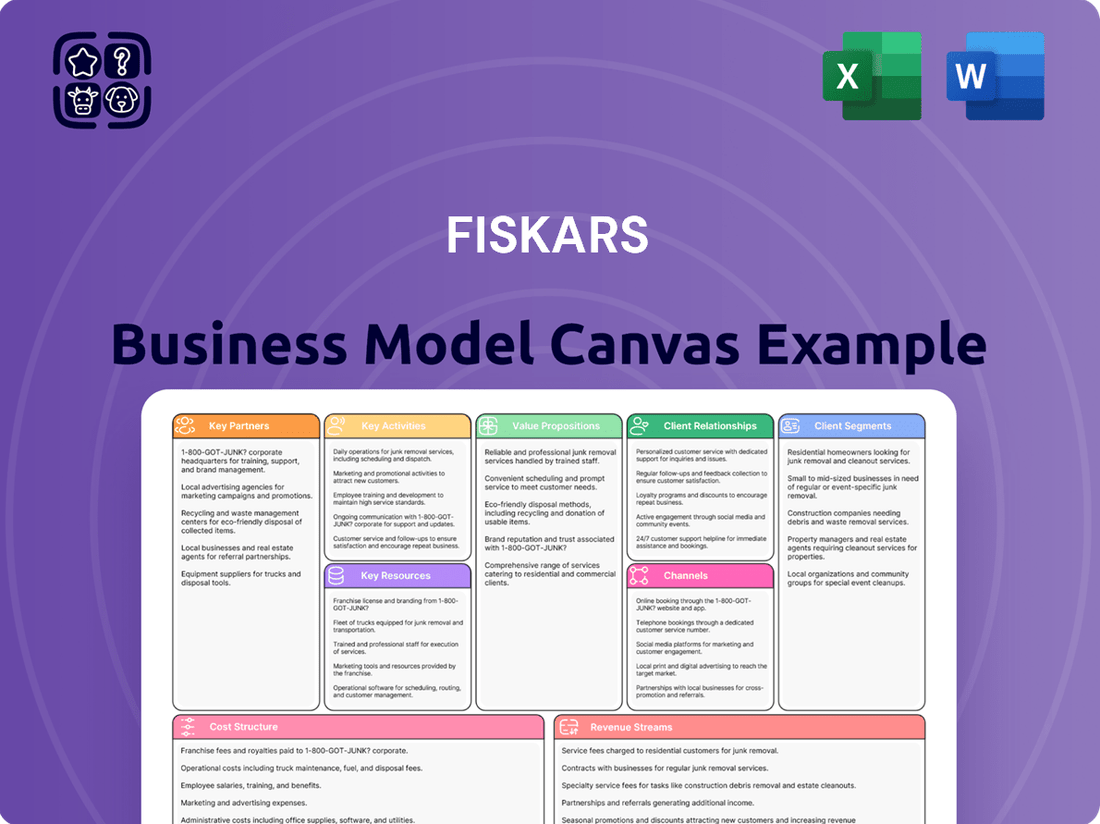

Fiskars Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Unlock the full strategic blueprint behind Fiskars's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fiskars Group's success is significantly bolstered by its extensive network of retail and distribution partners. Major players like Amazon, The Home Depot, Walmart, and Lowe's are critical channels, ensuring Fiskars' wide array of products reaches consumers globally. In 2024, these partnerships continue to be the backbone for market penetration and accessibility, making Fiskars' gardening tools, kitchenware, and home décor readily available to a broad customer base.

Fiskars Group relies on a global network of manufacturing and supply chain collaborators to ensure a consistent flow of high-quality goods. These partnerships are fundamental to their production efficiency, cost control, and overall product availability. For instance, in 2023, Fiskars continued to optimize its manufacturing footprint, with a significant portion of its production occurring in Europe and Asia to balance cost and proximity to markets.

Fiskars Group actively partners with e-commerce platform providers to bolster its direct-to-consumer (DTC) strategy. These collaborations are vital for optimizing both Fiskars' proprietary online stores and its presence on major online marketplaces, ensuring a robust digital sales channel.

These strategic alliances are instrumental in driving digital sales expansion, particularly in crucial markets such as the United States and China. For instance, in 2023, Fiskars reported a significant increase in its online sales, underscoring the importance of these platform partnerships in achieving its growth objectives.

Design and Innovation Ecosystem

Fiskars Group actively cultivates a vibrant design and innovation ecosystem, collaborating with external designers, material innovators, and technology providers. This strategic approach, central to their purpose of making everyday life extraordinary through pioneering design, fuels the creation of novel, user-centric, and environmentally conscious products. Such partnerships are crucial for maintaining Fiskars' leadership in product development and market appeal.

These collaborations are not just about product creation; they are about co-creation and shared learning. For instance, Fiskars’ ongoing work with design studios and material science companies ensures they are early adopters of cutting-edge techniques and sustainable materials. In 2024, Fiskars continued to emphasize sustainable sourcing, with a significant portion of their raw materials being evaluated for their environmental impact, reflecting a commitment to innovation that aligns with ecological responsibility.

- Ecosystem Engagement: Fiskars partners with independent designers and specialized firms to inject fresh perspectives into product development.

- Material and Technology Sourcing: Collaborations with material suppliers and tech companies enable the integration of advanced, sustainable solutions.

- Innovation Pipeline: These partnerships are vital for a consistent flow of new, high-quality, and user-friendly products that meet evolving consumer demands.

- Sustainability Focus: A key aspect of these partnerships involves sourcing and developing products with a reduced environmental footprint, a trend that gained further traction in 2024.

Strategic Alliances and Acquisitions

Fiskars Group actively cultivates key partnerships through strategic alliances and acquisitions, notably integrating Georg Jensen to broaden its brand portfolio and enhance market reach. This expansion strategy is designed to leverage complementary strengths and access new customer segments. For instance, the acquisition of Georg Jensen in 2022 was a significant step in this direction.

Furthermore, Fiskars is undergoing a significant structural change, planning to separate its Fiskars and Vita business areas into independent entities. This strategic separation, announced in early 2024, necessitates the formation of new operational and legal partnerships. These new structures are intended to allow each business area to pursue its growth objectives and optimize investment more effectively.

- Strategic Acquisitions: Integration of Georg Jensen in 2022 to expand luxury homeware offerings.

- Business Area Separation: Planned independence for Fiskars and Vita business areas in 2024 to foster focused growth.

- Partnership Evolution: Development of new operational and legal collaborations to support independent business strategies.

Fiskars Group's key partnerships extend to its supply chain and manufacturing operations, ensuring efficient production and product availability. These collaborations are vital for maintaining cost-effectiveness and quality control across its diverse product lines. In 2023, Fiskars continued to leverage its global manufacturing network, with a notable presence in Europe and Asia, to optimize its supply chain and meet market demands effectively.

| Partner Type | Examples/Focus | Strategic Importance | 2023/2024 Impact |

| Retail & Distribution | Amazon, The Home Depot, Walmart, Lowe's | Global market penetration, consumer access | Continued backbone for sales, enabling wide product availability. |

| E-commerce Platforms | Online marketplaces, DTC enablers | Digital sales channel optimization, DTC strategy | Drove significant online sales growth in key markets. |

| Design & Innovation | External designers, material innovators | Product development, sustainability integration | Fueled creation of user-centric, eco-conscious products; adoption of sustainable materials. |

| Strategic Acquisitions/Alliances | Georg Jensen (acquired 2022) | Brand portfolio expansion, new customer segments | Broadened luxury homeware offerings. |

| Business Area Separation | Internal restructuring for Fiskars & Vita | Focused growth, optimized investment | New operational and legal partnerships forming to support independent business strategies in 2024. |

What is included in the product

A detailed breakdown of Fiskars' strategy, outlining its customer segments, value propositions, and key activities to deliver quality tools and experiences.

Fiskars' Business Model Canvas offers a clear, one-page snapshot to quickly identify core components, streamlining the process of understanding their strategy and potential for innovation.

Activities

Fiskars Group's central activity revolves around relentless product design and innovation, focusing on enduring aesthetics, practical utility, and user comfort. This dedication to pioneering design seeks to address everyday challenges and elevate the user experience across their diverse product lines.

The company's significant investment in innovation drives the creation of premium, long-lasting tools. For example, in 2023, Fiskars Group reported a strong focus on developing new, sustainable materials and smart functionalities for their gardening and kitchenware, reflecting their commitment to both innovation and environmental responsibility.

Fiskars' manufacturing and production activities are central to its business, encompassing the creation of a wide array of consumer goods. These products span categories like kitchenware, garden tools, and outdoor equipment, serving diverse customer needs.

In 2024, the company continued to focus on optimizing its production processes and supply chain. This is crucial for managing global demand effectively and ensuring the high quality that consumers expect from brands like Fiskars, Wedgwood, and Waterford.

The efficiency of these operations directly impacts Fiskars' ability to deliver its product portfolio, which includes everything from premium tableware to essential gardening implements, to markets worldwide.

Fiskars Group's key activity is robust global brand management and marketing, nurturing its well-established brands like Fiskars, Gerber, Iittala, and Waterford. This ensures consistent brand recognition and desirability across diverse markets, reaching consumers in over 100 countries through targeted campaigns and strategic positioning.

Commercial excellence is central to these efforts, driving brand growth and market penetration. In 2023, Fiskars Group's net sales reached €3.4 billion, with a significant portion attributed to the strong performance and effective marketing of its core brands, demonstrating the impact of these activities.

Sales and Distribution Network Management

Fiskars Group actively manages a complex web of sales and distribution channels to ensure its products are accessible to consumers worldwide. This involves nurturing relationships with a vast network of retail partners, from large department stores to independent specialty shops. The company also prioritizes the development and optimization of its direct-to-consumer e-commerce platforms, providing a seamless online shopping experience. In 2023, Fiskars reported that its net sales reached €4.2 billion, with a significant portion attributed to its robust distribution strategies in key international markets.

The efficient operation of this distribution network is paramount to Fiskars' global reach and market penetration. This includes managing logistics, inventory, and supply chain operations to ensure timely delivery of products. For instance, the company's strategic focus on expanding its presence in markets like the United States and China relies heavily on the effectiveness of its sales and distribution infrastructure. This operational excellence underpins the company's ability to meet growing consumer demand and capitalize on market opportunities.

- Retail Channel Management: Overseeing relationships and sales performance with a diverse range of brick-and-mortar retailers globally.

- E-commerce Development: Investing in and enhancing online sales platforms to drive direct-to-consumer revenue.

- Direct Sales Operations: Managing any direct sales forces or initiatives to engage customers personally.

- Global Logistics and Supply Chain: Ensuring efficient product flow from manufacturing to end consumers across various regions.

Direct-to-Consumer (DTC) Channel Development

Fiskars Group is actively investing in building and growing its Direct-to-Consumer (DTC) channels, which include their physical stores and online shops. This is a key part of their strategy to connect more directly with customers, create a stronger brand presence, and foster organic sales growth.

This strategic push is showing positive results. For instance, in the first quarter of 2025, Fiskars reported a 9% increase in comparable DTC sales, highlighting the effectiveness of their efforts in this area.

- Expanding owned retail footprint.

- Enhancing e-commerce capabilities.

- Deepening customer engagement through DTC.

- Driving sales growth via direct channels.

Fiskars Group's core activities are deeply rooted in product design and innovation, with a strong emphasis on creating durable, aesthetically pleasing, and user-friendly items. This focus drives the development of premium goods that aim to solve everyday problems and enhance user experiences across their diverse product ranges.

The company's manufacturing and production efforts are crucial, encompassing the creation of a wide spectrum of consumer goods. These span categories such as kitchenware, gardening tools, and outdoor equipment, catering to a broad array of customer requirements. In 2024, Fiskars continued to optimize its production and supply chains to effectively manage global demand and uphold the high quality associated with its brands.

Fiskars also excels in global brand management and marketing, cultivating its renowned brands like Fiskars, Gerber, Iittala, and Waterford. This strategic approach ensures consistent brand recognition and appeal in various markets, reaching consumers in over 100 countries through well-executed campaigns. Commercial excellence underpins these efforts, fostering brand expansion and market penetration, as evidenced by their 2023 net sales of €3.4 billion.

The group actively manages a comprehensive network of sales and distribution channels to ensure product accessibility worldwide. This involves cultivating strong relationships with retail partners and enhancing direct-to-consumer e-commerce platforms. In 2023, Fiskars' net sales reached €4.2 billion, with a substantial portion stemming from their effective distribution strategies in key international markets.

| Key Activity | Description | 2023 Net Sales (EUR billion) | Key Focus Areas for 2024 |

|---|---|---|---|

| Product Design & Innovation | Creating durable, user-friendly, and aesthetically pleasing products. | 4.2 | Sustainable materials, smart functionalities. |

| Manufacturing & Production | Producing kitchenware, garden tools, outdoor equipment. | Process optimization, supply chain efficiency. | |

| Brand Management & Marketing | Nurturing brands like Fiskars, Gerber, Iittala, Waterford. | 3.4 | Targeted campaigns, strategic positioning. |

| Sales & Distribution | Managing retail partnerships and e-commerce channels. | N/A | Expanding DTC, optimizing logistics. |

Full Document Unlocks After Purchase

Business Model Canvas

The Fiskars Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You'll get the complete, ready-to-use Business Model Canvas, ensuring no surprises and full access to all its insights.

Resources

Fiskars Group's strength lies in its impressive stable of globally recognized brands, including Fiskars, Gerber, Iittala, Waterford, Royal Copenhagen, Georg Jensen, Moomin Arabia, and Wedgwood. This collection of brands is a cornerstone of the company's market presence and consumer connection, representing substantial intellectual property.

These brands are meticulously managed within two distinct business areas, Fiskars and Vita, to maximize their individual and collective impact. For instance, in 2023, Fiskars Group reported net sales of €3.4 billion, with a significant portion of this driven by the strong performance and consumer loyalty associated with these flagship brands.

Fiskars leverages its deep-rooted design and innovation heritage, which has cultivated significant intellectual property. This includes a portfolio of patents, distinctive product designs, and strong trademarks, all contributing to its unique market position.

This expertise in design is central to Fiskars' value proposition. It allows the company to consistently develop products that are not only visually appealing but also offer superior functionality, directly meeting consumer needs and expectations.

Fiskars' dedication to pioneering design serves as a critical competitive advantage. In 2023, the company continued to invest in R&D, with a focus on sustainable innovation and user-centric design, reinforcing its leadership in its core markets.

Fiskars Group operates a robust global manufacturing and supply chain network, essential for bringing its wide array of products to market. This infrastructure encompasses numerous production sites and a complex system for sourcing raw materials and components worldwide.

In 2024, Fiskars continued to emphasize supply chain resilience and efficiency. For instance, the company has invested in optimizing its logistics, aiming to reduce lead times and transportation costs. This focus is crucial given global trade dynamics and the need to ensure consistent product availability for consumers across its key markets.

The company's commitment to an efficient supply chain directly impacts its ability to manage costs effectively. By strategically locating production facilities and optimizing sourcing, Fiskars aims to maintain competitive pricing while ensuring high-quality products. This global reach allows them to tap into specialized manufacturing capabilities and diverse material sources.

Extensive Retail and E-commerce Network

Fiskars Group's extensive multi-channel distribution network is a cornerstone of its business model, encompassing both its own retail outlets and collaborations with a vast array of third-party retailers worldwide. This robust infrastructure ensures broad market penetration and accessibility for its product lines.

The company's commitment to digital channels is evident in its expanding e-commerce footprint, which includes dedicated online stores. This dual approach, blending physical and digital retail, is crucial for reaching a global customer base across more than 100 countries.

- Global Reach: Distribution in over 100 countries.

- Multi-channel Strategy: Own retail stores and third-party partnerships.

- E-commerce Growth: Significant investment in owned online platforms.

- Brand Accessibility: Ensuring products are available where consumers shop.

Skilled Workforce and Management

Fiskars' approximately 7,000 employees globally form a critical human capital asset. This diverse team includes specialized designers, engineers, marketing experts, and sales professionals, all contributing unique skills. Their collective knowledge is instrumental in driving product innovation and ensuring effective market penetration.

The expertise housed within Fiskars is directly linked to its success in product development and brand management. For instance, the company's ability to consistently launch well-received products in categories like kitchenware and gardening tools relies heavily on the skills of its R&D and design departments. This human capital is a key driver of operational efficiency and market responsiveness.

Furthermore, Fiskars' leadership team is a vital component of its business model. This group of experienced executives is responsible for charting the company's strategic direction, navigating complex market dynamics, and ensuring the effective execution of business plans. Their guidance is essential for adapting to evolving consumer demands and maintaining a competitive edge.

- Human Capital: Approximately 7,000 employees worldwide, encompassing design, engineering, marketing, and sales functions.

- Expertise: Crucial for product development, brand management, and market execution, driving innovation and efficiency.

- Leadership: The management team's strategic acumen is vital for navigating market challenges and executing the company's vision.

Fiskars Group's key resources are its strong portfolio of globally recognized brands, including Fiskars, Gerber, Iittala, and Waterford, representing significant intellectual property and consumer connection. This is complemented by a deep-rooted design and innovation heritage, evidenced by patents and unique product designs that provide a competitive edge. The company also boasts a robust global manufacturing and supply chain network, crucial for efficient product delivery and cost management, along with an extensive multi-channel distribution system that ensures broad market access.

Fiskars' human capital, comprising approximately 7,000 employees worldwide, is a vital asset, bringing specialized skills in design, engineering, and marketing that drive innovation and market responsiveness. The leadership team's strategic guidance is also critical for navigating market dynamics and executing the company's vision.

| Key Resource | Description | Impact/Data Point |

|---|---|---|

| Brand Portfolio | Globally recognized brands (Fiskars, Gerber, Iittala, Waterford, etc.) | Drove significant portion of €3.4 billion net sales in 2023. |

| Intellectual Property | Patents, product designs, trademarks from design heritage | Underpins unique market position and competitive advantage. |

| Manufacturing & Supply Chain | Global network of production sites and sourcing systems | Focus on resilience and efficiency in 2024 to reduce lead times and costs. |

| Distribution Network | Own retail, third-party retailers, and e-commerce platforms | Ensures product availability in over 100 countries. |

| Human Capital | ~7,000 employees with specialized skills | Essential for product innovation, brand management, and market execution. |

Value Propositions

Fiskars Group's value proposition centers on pioneering design and timeless beauty, creating products that are both functional and inspiring. This focus ensures their offerings are not just tools but enhancements to everyday life, reflecting a deep understanding of user needs and aesthetic appeal.

The company's dedication to design excellence is evident in its long heritage, stretching back to 1649, which informs its commitment to purposeful and beautiful creations. This historical foundation supports their continuous innovation in delivering products that are both enduring and highly effective for users.

In 2023, Fiskars Group reported net sales of €3.4 billion, a testament to the market's appreciation for their design-driven approach. Their investment in research and development, a key component of their design strategy, aims to maintain this leadership in creating aesthetically pleasing and highly functional products.

Fiskars' commitment to high-quality and durable products is a cornerstone of its business model. Their tools are engineered for longevity, undergoing stringent testing to ensure they withstand demanding use. This dedication to quality is further underscored by robust warranties, demonstrating Fiskars' confidence in the enduring performance of their offerings.

For consumers, this translates into a value proposition of reliability and reduced long-term cost. By investing in Fiskars products, customers benefit from tools that perform consistently over time, minimizing the need for frequent replacements. For example, Fiskars reported a 3.5% increase in net sales for its Functional segment in Q1 2024, a segment heavily reliant on its durable goods.

Fiskars Group places a strong emphasis on creating products that are not only functional but also incredibly easy for anyone to use. This means their garden tools feel natural in your hand, and their kitchenware makes cooking a breeze. Their commitment to user-centric design is evident in how they strive to solve everyday problems, making tasks more enjoyable and efficient for everyone.

Diverse Portfolio for Indoor and Outdoor Living

Fiskars Group offers a comprehensive range of products designed to enhance both indoor and outdoor living experiences. This diverse portfolio addresses a wide spectrum of consumer needs, from essential kitchen tools to sophisticated home décor and robust outdoor equipment.

The company's strength lies in its ability to cater to various lifestyles and activities through its well-established brands. These include Fiskars for gardening and crafting, Gerber for outdoor and tactical gear, and Iittala and Waterford for premium tableware and glassware.

This broad product offering allows Fiskars Group to capture market share across multiple segments. For instance, their garden segment is a significant contributor, with sales in this area often showing resilience. In 2023, Fiskars Group reported net sales of €4.2 billion, with their Living segment, which encompasses many indoor and outdoor products, playing a crucial role.

- Extensive Product Range: Covers kitchenware, garden tools, tableware, and outdoor gear.

- Brand Strength: Leverages well-known brands like Fiskars, Gerber, Iittala, and Waterford.

- Market Reach: Addresses diverse consumer needs for both indoor and outdoor activities.

- Financial Performance: Contributes significantly to overall company sales, with Fiskars Group reporting €4.2 billion in net sales for 2023.

Commitment to Sustainability and Circularity

Fiskars Group is deeply committed to sustainable development, actively integrating principles of a circular economy into its product design and operational strategies. The company focuses on creating durable, long-lasting products that minimize waste and encourage responsible consumption. This commitment is reflected in their ongoing efforts to innovate with more sustainable materials and manufacturing processes, aiming to offer consumers choices that support a healthier planet.

Fiskars' dedication to sustainability extends to promoting a circular economy, where resources are used efficiently and waste is minimized. They are actively exploring and implementing more eco-friendly methods throughout their value chain, from sourcing to product end-of-life. In 2023, Fiskars Group reported that 80% of its sales were generated from products that contribute to a more sustainable future, underscoring their strategic focus on this area.

- Responsible Design: Products are engineered for longevity and repairability.

- Circular Economy Focus: Efforts to reduce waste and maximize resource utilization.

- Sustainable Operations: Continuous improvement in manufacturing processes and material sourcing.

- Positive Impact: Products designed to contribute to a healthier future and promote conscious consumerism.

Fiskars Group's value proposition centers on providing high-quality, durable, and user-friendly products that enhance everyday life. Their commitment to timeless design, coupled with a focus on functionality and sustainability, creates offerings that are both beautiful and built to last.

This dedication translates into tangible benefits for consumers, offering reliability and long-term value. By investing in Fiskars products, customers gain tools that perform consistently, reducing the need for frequent replacements and contributing to more sustainable consumption patterns.

The company's extensive product range, spanning kitchenware, garden tools, and home décor, caters to diverse needs and lifestyles. This broad market appeal, supported by strong brand recognition, underpins their significant market presence and financial success, with net sales reaching €4.2 billion in 2023.

| Value Proposition Aspect | Description | Supporting Fact/Data |

|---|---|---|

| Design & Durability | Pioneering design and timeless beauty create functional, inspiring, and long-lasting products. | Fiskars' heritage dates back to 1649, informing its commitment to purposeful creations. |

| User-Centricity | Products are designed for ease of use, solving everyday problems and making tasks more enjoyable. | Fiskars reported a 3.5% increase in net sales for its Functional segment in Q1 2024. |

| Product Breadth | Comprehensive range enhances indoor and outdoor living, catering to various consumer needs. | Net sales were €4.2 billion in 2023, with a diverse portfolio contributing significantly. |

| Sustainability | Commitment to circular economy principles, durable products, and responsible consumption. | 80% of Fiskars Group's 2023 sales were from products contributing to a more sustainable future. |

Customer Relationships

Fiskars Group cultivates direct relationships with its customers through its own retail stores and robust e-commerce channels. This direct-to-consumer (DTC) strategy enables tailored customer experiences and facilitates the collection of crucial feedback, fostering stronger brand loyalty.

The effectiveness of this approach is evident in Fiskars Group's Q1 2025 performance, where comparable DTC sales saw a healthy increase of 9%. This growth underscores the value of direct engagement in building lasting customer connections and driving sales.

Fiskars fosters deep customer connections by nurturing brand-specific communities, weaving narratives around their storied pasts. This approach resonates with consumers drawn to the unique histories and design ethos of iconic brands like Iittala and Royal Copenhagen, fostering loyalty through shared heritage.

These communities are actively engaged through a mix of in-person events and rich digital content. For instance, Fiskars' commitment to heritage is evident in initiatives like the Iittala & Design Museum, which provides a physical space for customers to connect with the brand's legacy, reinforcing emotional bonds.

Fiskars Group enhances customer relationships through comprehensive service, offering product warranties and satisfaction guarantees. This approach builds trust, assuring customers of product quality and reliability. For instance, in 2023, Fiskars reported continued focus on customer experience initiatives, aiming to improve satisfaction scores.

Digital Interaction and Personalized Experiences

Fiskars Group actively leverages digital channels to forge deeper connections with its customer base. By utilizing data analytics, the company aims to deliver highly personalized experiences, from tailored marketing messages to product suggestions that align with individual preferences.

- Personalized Marketing: In 2024, Fiskars continued to refine its digital marketing strategies, focusing on segmenting audiences for more relevant outreach.

- Product Recommendations: The company’s e-commerce platforms feature sophisticated recommendation engines, aiming to increase average order value by suggesting complementary products.

- Engaging Online Content: Fiskars invests in creating valuable online content, such as DIY tutorials and product guides, to enhance customer engagement and brand loyalty.

- Responsive Customer Journey: Digital tools, including chatbots and streamlined online support, are employed to ensure a more immediate and satisfying customer interaction.

Retailer-Facilitated Relationships

While Fiskars Group is increasingly focused on direct-to-consumer (DTC) channels, it continues to cultivate robust customer relationships through its extensive network of retail partners. These retailers act as crucial touchpoints, offering direct consumer interaction, prominent product showcases, and localized sales assistance, all of which significantly enhance the overall customer journey.

This strategic multi-channel approach is vital for ensuring widespread product availability and consistent service delivery across diverse markets. For instance, in 2024, Fiskars Group reported that a substantial portion of its sales still transacted through third-party retailers, underscoring the ongoing importance of these partnerships in reaching a broad customer base.

- Retailer Interaction: Retail partners provide a physical presence for product discovery and immediate customer support.

- Brand Representation: Retailers effectively display and promote Fiskars products, reinforcing brand visibility.

- Sales Support: Localized sales teams within retail environments offer personalized assistance, driving conversion.

- Market Reach: The retail network ensures Fiskars products are accessible to a wider demographic beyond DTC efforts.

Fiskars Group builds strong customer relationships through a blend of direct engagement and strategic retail partnerships. Their direct-to-consumer (DTC) approach, including owned stores and e-commerce, allows for personalized experiences and valuable feedback, as seen in their 9% comparable DTC sales growth in Q1 2025. This is complemented by fostering brand communities and offering excellent service, including warranties, to build trust and loyalty.

| Customer Relationship Strategy | Key Activities | Supporting Data/Examples |

|---|---|---|

| Direct-to-Consumer (DTC) Engagement | Owned retail stores, E-commerce platforms, Personalized marketing, Engaging online content | 9% comparable DTC sales growth (Q1 2025), Focus on personalized marketing and product recommendations (2024) |

| Brand Community Building | Narrative weaving, Heritage focus, In-person events, Digital content | Iittala & Design Museum initiatives, Connecting with consumers through shared heritage |

| Customer Service & Trust | Product warranties, Satisfaction guarantees, Responsive customer support | Continued focus on customer experience initiatives (2023) |

| Retail Partnerships | Third-party retailers, Product showcases, Localized sales assistance | Substantial portion of sales through third-party retailers (2024), Ensuring broad market reach |

Channels

Fiskars Group leverages a significant global presence with approximately 450 owned retail stores. These locations serve as crucial direct-to-consumer touchpoints, offering consumers immersive brand experiences and access to the complete product portfolio.

For the Business Area Vita, these owned retail stores are particularly impactful, contributing 50% of its total net sales through direct channels. This direct engagement allows for effective product showcasing and a deeper connection with customers.

Fiskars leverages its owned e-commerce sites to foster direct-to-consumer (DTC) relationships and control the brand experience, driving significant online sales growth. In 2024, the company continued to prioritize its digital channels as a key avenue for market expansion and customer engagement.

By also participating in third-party marketplaces, Fiskars broadens its digital reach, tapping into established customer bases and increasing product visibility. This multi-channel strategy is crucial for maximizing online sales and adapting to evolving consumer purchasing habits.

Fiskars Group leverages a robust wholesale distribution network, partnering with a wide array of retail chains and independent stores globally. This strategy is crucial for ensuring widespread physical accessibility of its gardening tools, kitchenware, and home products across diverse consumer segments.

This traditional channel remains a cornerstone of Fiskars' market penetration. For instance, the company reported significant distribution gains for the Fiskars brand in key markets like the U.S. and Germany during 2024, underscoring the ongoing effectiveness of this approach in reaching a broad customer base.

Direct Sales and Corporate

Direct sales and corporate channels are crucial for Fiskars Group, extending beyond typical consumer retail. This involves catering to business clients through bulk orders, corporate gifting programs, and specialized distribution partnerships. For instance, in 2024, Fiskars' B2B segment likely saw continued growth as companies sought premium branded products for employee recognition or client appreciation.

These channels offer a unique opportunity for direct engagement, allowing Fiskars to understand and meet the specific needs of larger organizations. This direct interaction fosters stronger relationships and can lead to significant revenue streams, complementing their broader e-commerce and retail presence. The focus here is on providing tailored solutions rather than mass-market availability.

Key aspects of Fiskars' direct sales and corporate channels include:

- Corporate Gifting: Offering customized product bundles for businesses to use as gifts for employees or clients.

- Bulk Orders: Facilitating large-volume purchases for commercial clients, such as hospitality or property management.

- Specialized Distribution: Partnering with specific distributors that serve institutional or professional markets.

- Direct Engagement: Building relationships with key business accounts to understand and fulfill their unique procurement needs.

Global Market Presence

Fiskars boasts an extensive global footprint, with its products available in more than 100 countries spanning Europe, the Americas, and the Asia-Pacific region. This expansive reach is a testament to its robust distribution network.

The company leverages a dual strategy for market access, utilizing both its proprietary sales channels and cultivating strategic alliances with partners across various international markets. This approach ensures broad customer engagement.

- Global Reach: Products sold in over 100 countries.

- Distribution Strategy: Combination of owned channels and partnerships.

- Market Access: Facilitates broad customer engagement and sales volume.

Fiskars Group employs a multifaceted channel strategy, encompassing owned retail stores, e-commerce platforms, third-party marketplaces, and a robust wholesale network. This approach ensures broad accessibility and direct customer engagement across diverse segments. The company's commitment to digital channels, including its own e-commerce sites, continued to drive growth in 2024, expanding market reach and customer interaction.

Fiskars' owned retail stores, numbering around 450 globally, are pivotal for direct-to-consumer sales, particularly for the Vita business area, which saw 50% of its net sales from these direct channels. This strategy allows for immersive brand experiences and direct feedback, crucial for product development and customer loyalty.

The company's wholesale distribution network is vital for widespread product availability, reaching consumers through numerous retail chains and independent stores worldwide. This traditional channel saw significant distribution gains for the Fiskars brand in key markets like the U.S. and Germany during 2024, highlighting its continued effectiveness.

Beyond consumer channels, Fiskars actively engages in direct sales and corporate channels, catering to business clients through bulk orders, corporate gifting, and specialized distribution. This B2B segment, important for tailored solutions and client appreciation, likely experienced continued growth in 2024.

| Channel Type | Key Features | 2024 Focus/Impact |

|---|---|---|

| Owned Retail Stores | ~450 global locations, direct-to-consumer (DTC) experience | Crucial for brand immersion; Vita business area: 50% of net sales via direct channels. |

| Owned E-commerce Sites | DTC relationships, brand experience control | Prioritized for market expansion and customer engagement, driving online sales growth. |

| Third-Party Marketplaces | Broadened digital reach, access to established customer bases | Increased product visibility and adaptation to evolving consumer habits. |

| Wholesale Distribution | Partnerships with retail chains and independent stores | Ensured widespread physical accessibility; significant distribution gains in U.S. and Germany for Fiskars brand. |

| Direct Sales & Corporate Channels | Bulk orders, corporate gifting, specialized distribution for B2B clients | Catering to business needs, fostering relationships, and generating revenue streams through tailored solutions. |

Customer Segments

Home enthusiasts and decorators are a key customer segment for Fiskars, particularly those who appreciate premium brands like Iittala, Royal Copenhagen, Wedgwood, and Georg Jensen. These individuals invest in high-quality, design-forward items for their homes, from elegant tableware to sophisticated decor. Their purchasing decisions are driven by a desire for beauty, exceptional craftsmanship, and practical functionality in their everyday lives.

This segment actively seeks products that enhance their living spaces and culinary experiences. For instance, the global luxury goods market, which includes high-end home decor and tableware, saw significant growth, with reports indicating a substantial increase in consumer spending on premium lifestyle products leading into 2024. This trend underscores the strong demand for the type of meticulously crafted and aesthetically pleasing items offered by Fiskars' heritage brands.

This segment includes individuals passionate about gardening, yard maintenance, and enjoying the outdoors. They seek tools that are not only effective but also comfortable and built to last, whether they're tending to their flower beds or embarking on a wilderness adventure.

Fiskars and Gerber directly address these needs with a comprehensive product line. Think of their well-regarded gardening tools, designed for ease of use and superior cutting power, alongside robust outdoor gear and specialized cutting implements that are essential for any outdoor enthusiast. In 2024, Fiskars reported strong performance in its Garden segment, driven by innovation and demand for quality outdoor products.

These customers place a high value on performance, meaning tools that get the job done efficiently and with minimal effort. Ergonomics is also key; they appreciate tools that are comfortable to hold and use for extended periods, reducing strain. Reliability is paramount, as they depend on their equipment to perform consistently, season after season.

The Crafting and DIY Hobbyist segment represents a core customer base for Fiskars. These individuals are passionate about creating, whether it's through sewing, scrapbooking, or general home improvement projects. They rely on tools that offer both precision and ease of use to bring their visions to life.

Fiskars' reputation for quality is a significant draw for this group, with their scissors and crafting tools being particularly sought after. In 2024, the global arts and crafts market was valued at approximately $40 billion, with DIY activities showing continued strong growth, indicating a substantial and engaged market for Fiskars' offerings.

These hobbyists prioritize tools that are comfortable for extended use and built to last, ensuring reliability across numerous projects. They are willing to invest in durable, high-performance products that enhance their creative process and deliver professional-looking results.

Premium and Luxury Consumers

Fiskars Group's premium and luxury consumers represent a significant segment, particularly within its Business Area Vita. This group actively seeks high-end products in categories such as tableware, drinkware, jewelry, and home decor. Brands like Georg Jensen, Royal Copenhagen, and Waterford are specifically curated to attract this discerning clientele.

These consumers are driven by a desire for exclusivity, a rich brand heritage, and superior, high-end design. They are willing to invest in items that reflect quality and status. For instance, Georg Jensen's sterling silver hollowware and jewelry collections often command premium prices, appealing directly to this market's appreciation for craftsmanship and lasting value.

- Brand Loyalty: This segment often exhibits strong brand loyalty, prioritizing established names with a proven track record of quality and design excellence.

- Value Perception: For premium consumers, value is intrinsically linked to craftsmanship, material quality, brand prestige, and unique design elements rather than just price.

- Spending Habits: In 2024, the global luxury goods market continued its robust growth, with sectors like high-end homeware and decorative items showing particular strength, indicating a receptive market for Fiskars' premium offerings.

Urban Gardeners and Eco-Conscious Consumers

Fiskars Group is increasingly catering to urban gardeners, a segment that values tools designed for compact living and indoor environments. This includes innovative solutions for balcony gardening and vertical farming, reflecting a growing trend in metropolitan areas. For instance, a 2024 report indicated a 15% year-over-year increase in demand for compact gardening equipment in major European cities.

Eco-conscious consumers represent another key customer segment, actively seeking products that align with their sustainability values. They are drawn to Fiskars' commitment to circularity, durable design, and the use of recycled materials. This demographic is willing to invest in quality items that reduce waste and have a lower environmental impact, with surveys showing over 60% of consumers in this group prioritizing eco-friendly attributes when making purchasing decisions.

- Urban Gardeners: Demand for specialized tools for small-space cultivation is rising, with a notable 15% increase in urban gardening equipment sales in key European cities during 2024.

- Eco-Conscious Consumers: This segment prioritizes sustainability, with more than 60% of consumers indicating a preference for eco-friendly products, aligning with Fiskars' circular economy initiatives.

- Product Resonance: Fiskars' focus on durable, responsibly designed products, including those made with recycled content, strongly appeals to consumers seeking long-lasting and environmentally sound purchases.

Fiskars serves a diverse customer base, from home enthusiasts and passionate gardeners to crafting hobbyists and premium consumers. These groups value quality, durability, and design, whether for everyday use or specialized projects. For instance, the global arts and crafts market was valued at approximately $40 billion in 2024, highlighting the significant engagement of DIY hobbyists with Fiskars' product offerings.

Urban gardeners and eco-conscious consumers are increasingly important segments, seeking innovative solutions for small spaces and sustainable products. Fiskars' commitment to durable design and recycled materials resonates strongly with these environmentally aware individuals, with over 60% of them prioritizing eco-friendly attributes in 2024.

| Customer Segment | Key Motivations | 2024 Market Insight |

|---|---|---|

| Home Enthusiasts | Aesthetics, craftsmanship, functionality | Premium home decor market saw substantial growth |

| Gardeners & Outdoor Enthusiasts | Performance, ergonomics, reliability | Fiskars reported strong performance in Garden segment |

| Crafting & DIY Hobbyists | Precision, ease of use, durability | Global arts and crafts market valued at ~$40 billion |

| Premium Consumers | Exclusivity, brand heritage, high-end design | Luxury goods market, including homeware, showed robust growth |

| Urban Gardeners | Compact solutions, indoor gardening | 15% year-over-year increase in compact gardening equipment demand in European cities |

| Eco-Conscious Consumers | Sustainability, circularity, reduced environmental impact | Over 60% prioritize eco-friendly attributes |

Cost Structure

Fiskars Group's manufacturing and sourcing represent a substantial cost driver, encompassing raw materials, labor, and factory expenses for its wide array of products. In 2023, the company reported cost of sales at €2.5 billion, reflecting these significant operational expenditures. To manage these costs effectively, Fiskars strategically diversifies its sourcing channels, a crucial step to buffer against potential cost increases stemming from external factors like tariffs or supply chain disruptions.

Fiskars allocates significant resources to marketing and brand promotion, a key cost driver within its business model. These investments are spread across its diverse brand portfolio, encompassing everything from traditional advertising to cutting-edge digital campaigns and in-store activations. For example, in 2023, Fiskars reported marketing and advertising expenses of €176 million, demonstrating a clear commitment to maintaining and growing brand presence in a competitive global landscape.

Fiskars Group consistently invests in Research and Development (R&D) to foster innovation and refine its product lines. These crucial investments fuel the creation of new products, the enhancement of current offerings, and the incorporation of sustainable elements into their portfolio. For instance, in 2023, Fiskars Group reported R&D expenses of €40 million, underscoring their commitment to staying ahead in a dynamic market and meeting changing consumer demands.

Supply Chain and Logistics Costs

Fiskars faces substantial costs in its supply chain and logistics, a critical component for reaching customers in over 100 countries. These expenses encompass transportation, warehousing, and the intricate management of inventory across its global network. In 2023, Fiskars reported that its cost of goods sold, which includes many of these supply chain elements, amounted to €872.2 million, representing a significant portion of its overall revenue.

Optimizing these logistics is paramount for controlling operational expenditures and boosting profitability. The efficiency of moving goods from manufacturing to end-users directly impacts the bottom line. For instance, a streamlined distribution network can significantly reduce freight costs, which are a major variable in global operations.

- Global Reach: Managing logistics for distribution in over 100 countries incurs considerable transportation and warehousing expenses.

- Inventory Management: Holding and moving inventory efficiently is a key cost driver for Fiskars.

- Cost of Goods Sold: In 2023, Fiskars' cost of goods sold was €872.2 million, highlighting the scale of these supply chain expenditures.

- Efficiency Gains: Ongoing efforts to optimize logistics are crucial for reducing operational costs and improving profit margins.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses at Fiskars cover a broad range of operational costs. These include the expenses associated with maintaining a sales force, managing administrative functions, supporting IT infrastructure, and running retail operations. Key components within SG&A are salaries for employees, rent for both retail locations and corporate offices, and necessary investments in digital platforms to enhance customer engagement and operational efficiency.

Fiskars is actively implementing organizational changes aimed at achieving significant cost savings within its SG&A structure. These initiatives focus on streamlining operations and simplifying processes. As a result of these simplification actions, the company has projected an annual run-rate saving of approximately EUR 12 million. This strategic move is designed to improve overall profitability and resource allocation.

- Sales Force Costs: Salaries, commissions, and benefits for the sales team.

- Administrative Functions: Overhead for HR, finance, legal, and management.

- IT Infrastructure: Costs for software, hardware, cloud services, and cybersecurity.

- Retail Operations: Rent, utilities, store staffing, and visual merchandising.

- Digital Platforms: Investments in e-commerce, CRM, and marketing technology.

- Cost Savings Target: Approximately EUR 12 million annual run-rate saving from simplification.

Fiskars Group's cost structure is heavily influenced by its manufacturing and sourcing operations, which represent a significant portion of its expenses. The company's commitment to innovation is reflected in its R&D spending, while marketing and brand-building activities are crucial for maintaining its market position.

| Cost Category | 2023 Expense (EUR million) | Key Components |

| Cost of Sales | 872.2 | Raw materials, manufacturing labor, factory overhead |

| Marketing & Advertising | 176 | Brand promotion, digital campaigns, in-store activations |

| Research & Development | 40 | New product development, product enhancement, sustainability integration |

| Sales, General & Administrative (SG&A) | N/A (Simplification savings projected at EUR 12 million annually) | Sales force, administration, IT, retail operations, digital platforms |

Revenue Streams

Fiskars Group's home and kitchen products, encompassing items like cookware, knives, and tableware, represent a core revenue driver. Brands such as Fiskars and Iittala are central to this segment, serving consumers' daily needs. In 2023, this category was a significant contributor to the company's overall sales performance.

Revenue is also generated from selling a broad array of garden and outdoor activity products. This includes tools for everything from planting and pruning to general yard maintenance and even items for outdoor recreation.

The Fiskars and Gerber brands are key drivers in this segment, attracting a diverse customer base that includes both seasoned professionals and casual hobbyists. These brands are recognized for their quality and durability, contributing significantly to sales volume.

For Fiskars' Business Area, this particular category sees a pronounced increase in importance during the first half of the year. This seasonal demand highlights the cyclical nature of the gardening and outdoor goods market, with sales peaking in spring and early summer.

The Business Area Vita, encompassing esteemed brands like Georg Jensen, Royal Copenhagen, Wedgwood, and Waterford, drives revenue through the sale of premium and luxury tableware, elegant drinkware, sophisticated jewelry, and distinctive interior decor items. This segment is a powerhouse for Fiskars, accounting for a substantial 52% of the company's total net sales in 2024, highlighting the strong consumer demand for high-quality, design-led home and lifestyle products.

E-commerce Sales

Fiskars Group is experiencing robust growth in its e-commerce sales, a crucial and expanding revenue stream. This channel encompasses sales generated through Fiskars' proprietary online stores as well as various external online marketplaces.

The company has reported substantial increases in comparable e-commerce sales, underscoring the effectiveness of its digital strategy. For instance, in 2023, Fiskars Group’s net sales from e-commerce channels saw a notable uplift, contributing significantly to overall revenue.

This direct-to-consumer and global reach via e-commerce allows Fiskars to connect with a wider customer base and gain valuable insights into consumer behavior, further driving sales and brand engagement.

- E-commerce Growth: Fiskars Group has witnessed a significant increase in comparable e-commerce sales, demonstrating a successful pivot to digital channels.

- Direct Consumer Access: The e-commerce channel provides direct engagement with consumers, enhancing brand loyalty and understanding.

- Global Reach: Online platforms offer Fiskars an expansive global footprint, allowing for sales and market penetration beyond traditional retail limitations.

- 2023 Performance: E-commerce sales were a key contributor to Fiskars Group's overall net sales in 2023, reflecting the channel's growing importance.

Wholesale and Retail Partner Sales

Fiskars Group generates a significant portion of its revenue through wholesale partnerships with major retail chains and other distribution networks across the globe. These collaborations are vital for achieving widespread market penetration and accessing a broad customer base. For instance, in 2023, wholesale and retail partner sales formed the backbone of the company's distribution strategy, enabling them to reach consumers in numerous countries.

These established retail networks are crucial for Fiskars Group to effectively present its product portfolio, which spans gardening tools, kitchenware, and home products. By working with these partners, Fiskars can ensure its products are readily available to consumers, driving sales volume and brand visibility. The company often engages in co-marketing efforts with these retail partners to further boost product awareness and demand.

- Wholesale Agreements: A substantial revenue stream comes from agreements with large retail chains and distributors.

- Global Market Penetration: These partnerships enable Fiskars Group to reach customers across diverse international markets.

- Customer Reach: Sales through these channels are essential for accessing a wide spectrum of consumers globally.

- 2023 Performance: Wholesale and retail partner sales were a critical component of Fiskars Group's revenue generation in 2023.

Fiskars Group's revenue streams are diverse, encompassing sales from its Home and Kitchen division, which features popular brands like Fiskars and Iittala, and its Garden and Outdoor division, bolstered by brands such as Fiskars and Gerber. The premium segment, known as Vita, includes luxury brands like Georg Jensen and Royal Copenhagen, which significantly contributed to the company's financial performance. In 2024, the Vita business area alone accounted for 52% of Fiskars Group's total net sales, underscoring the strength of its premium offerings in the market.

| Revenue Stream | Key Brands | 2024 Contribution (Vita Segment) |

|---|---|---|

| Home and Kitchen | Fiskars, Iittala | N/A |

| Garden and Outdoor | Fiskars, Gerber | N/A |

| Premium (Vita) | Georg Jensen, Royal Copenhagen, Wedgwood, Waterford | 52% of Total Net Sales |

Business Model Canvas Data Sources

The Fiskars Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer goods and outdoor equipment, and strategic insights derived from competitive analysis and industry trend forecasting.