Fidelity National Information (FIS) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Fidelity National Information (FIS). Discover how political stability, economic fluctuations, and evolving social trends are shaping the company’s future. Use these insights to strengthen your own market strategy and anticipate challenges. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Financial technology firms like Fidelity National Information Services (FIS) face intense regulatory scrutiny. Governments globally are tightening rules around data privacy, anti-money laundering efforts, and safeguarding consumers. For instance, the ongoing enforcement of GDPR in Europe and CCPA in California necessitates continuous adaptation of FIS's technologies and business practices, potentially influencing their product roadmaps and ability to enter new markets.

Global operations inherently expose Fidelity National Information Services (FIS) to geopolitical instability and evolving trade policies. For instance, heightened tensions in regions where FIS has significant client bases or operational footprints can directly impact the demand for its financial technology solutions. The company's reliance on global talent and technology infrastructure means that disruptions in international trade agreements, such as tariffs or sanctions, could increase operational costs or affect the accessibility of critical components.

In 2024, the landscape of international trade continues to be shaped by shifting geopolitical alliances and protectionist sentiments in various economies. FIS, with its extensive reach across North America, Europe, and Asia, must remain agile. A significant disruption in a major trading bloc, for example, could have ripple effects on cross-border financial transactions and the adoption of new payment technologies, areas where FIS is a key player. The company's robust risk management frameworks are crucial for navigating these volatile conditions.

Government investment in digital infrastructure presents a significant tailwind for Fidelity National Information (FIS). Initiatives aimed at modernizing networks and fostering digital economies, such as the US Department of Commerce's Broadband Equity, Access, and Deployment (BEAD) program, which allocated $42.45 billion in 2024 to expand high-speed internet access, directly support the ecosystem FIS operates within. Enhanced digital connectivity and secure data frameworks are crucial for the expansion of fintech services and digital payment solutions that FIS provides.

These government-backed upgrades create a more robust environment for FIS to deliver and expand its financial technology offerings. For instance, the push for digital identity frameworks can streamline customer onboarding and transaction security, areas where FIS offers critical solutions. As governments worldwide continue to prioritize digital transformation, FIS is well-positioned to capitalize on these trends, potentially seeing increased demand for its core services in areas like payment processing and banking technology. In 2024, global government spending on digital transformation across all sectors was projected to reach over $600 billion, indicating a broad commitment to digital infrastructure development.

Political Support for Fintech Innovation

Government initiatives worldwide are increasingly focused on fostering fintech growth, which directly benefits companies like FIS. Policies such as regulatory sandboxes, which allow for controlled testing of new financial technologies, are being adopted by numerous countries. For instance, the UK's Financial Conduct Authority launched its sandbox in 2016, and by 2023, it had facilitated over 200 firms through its various cohorts, many of whom are developing innovative payment and lending solutions.

Tax incentives for research and development in technology are also a significant political factor. In 2024, the United States continued to offer tax credits for R&D, encouraging significant private sector investment in technological advancements. Similarly, countries like Singapore have implemented grants and tax breaks specifically for fintech firms, aiming to position themselves as global hubs for financial innovation. These measures reduce the cost of innovation for FIS, allowing for faster development and deployment of new services.

- Regulatory Sandboxes: Many nations, including the UK, Singapore, and Australia, have established regulatory sandboxes, creating safe environments for fintech testing.

- Tax Incentives: Governments offer R&D tax credits and grants, as seen in the US and parts of Asia, lowering the financial burden of technological development for companies like FIS.

- National Fintech Strategies: Countries are actively developing national strategies to promote their financial sectors, often including specific support for digital transformation and innovation in financial services.

- Open Banking Initiatives: Mandates for open banking, like PSD2 in Europe, encourage data sharing and competition, driving innovation that FIS can leverage.

Cybersecurity Policy and National Security

As financial systems increasingly rely on interconnectedness, government policies concerning cybersecurity and national security are directly shaping Fidelity National Information Services (FIS) operational landscape. These regulations are not just guidelines; they are critical for maintaining the integrity of financial transactions and safeguarding sensitive customer data. For FIS, this means a constant need to adapt and fortify its systems against evolving cyber threats, which are a significant national security concern.

Strict requirements for data protection, ensuring the resilience of critical financial infrastructure, and mandated reporting of cyber incidents are paramount. For instance, the US Cybersecurity and Infrastructure Security Agency (CISA) actively promotes frameworks like the Cybersecurity Performance Goals (CPGs) for critical infrastructure, which directly influence how companies like FIS must operate. Failure to comply can result in substantial penalties and reputational damage.

FIS must therefore continuously align its robust security protocols with evolving national cybersecurity strategies. This alignment ensures not only regulatory compliance but also fosters trust among its clients and stakeholders. In 2024, the global cybersecurity market is projected to reach over $200 billion, highlighting the immense importance and investment in this sector, and FIS's commitment is crucial to navigating this complex environment.

- Data Protection Mandates: FIS must adhere to stringent data privacy laws, such as GDPR and CCPA, which dictate how customer information is collected, stored, and processed.

- Critical Infrastructure Resilience: National security policies often classify financial systems as critical infrastructure, requiring FIS to implement advanced measures to prevent disruptions from cyberattacks.

- Cyber Incident Reporting: Governments are increasingly enforcing mandatory breach notification laws, compelling FIS to report cyber incidents within specific timeframes to relevant authorities.

- National Cybersecurity Strategies: FIS's security architecture and investments are influenced by national strategies aimed at improving overall cyber defense capabilities and information sharing.

Government initiatives to foster fintech growth, such as regulatory sandboxes and tax incentives for R&D, directly benefit FIS. For example, the UK's FCA sandbox has facilitated hundreds of firms, many developing payment solutions, underscoring the supportive environment created by such policies. These measures reduce innovation costs, accelerating FIS's development of new services.

Furthermore, government investment in digital infrastructure, like the $42.45 billion allocated in 2024 for the US BEAD program to expand broadband, bolsters the ecosystem FIS operates in. Enhanced digital connectivity and secure data frameworks are vital for the expansion of fintech services and digital payment solutions that FIS provides.

The political landscape also necessitates adherence to evolving cybersecurity regulations and data protection mandates. FIS must continuously align its security protocols with national strategies, such as CISA's Cybersecurity Performance Goals, to maintain integrity and customer trust, especially as the global cybersecurity market is projected to exceed $200 billion in 2024.

What is included in the product

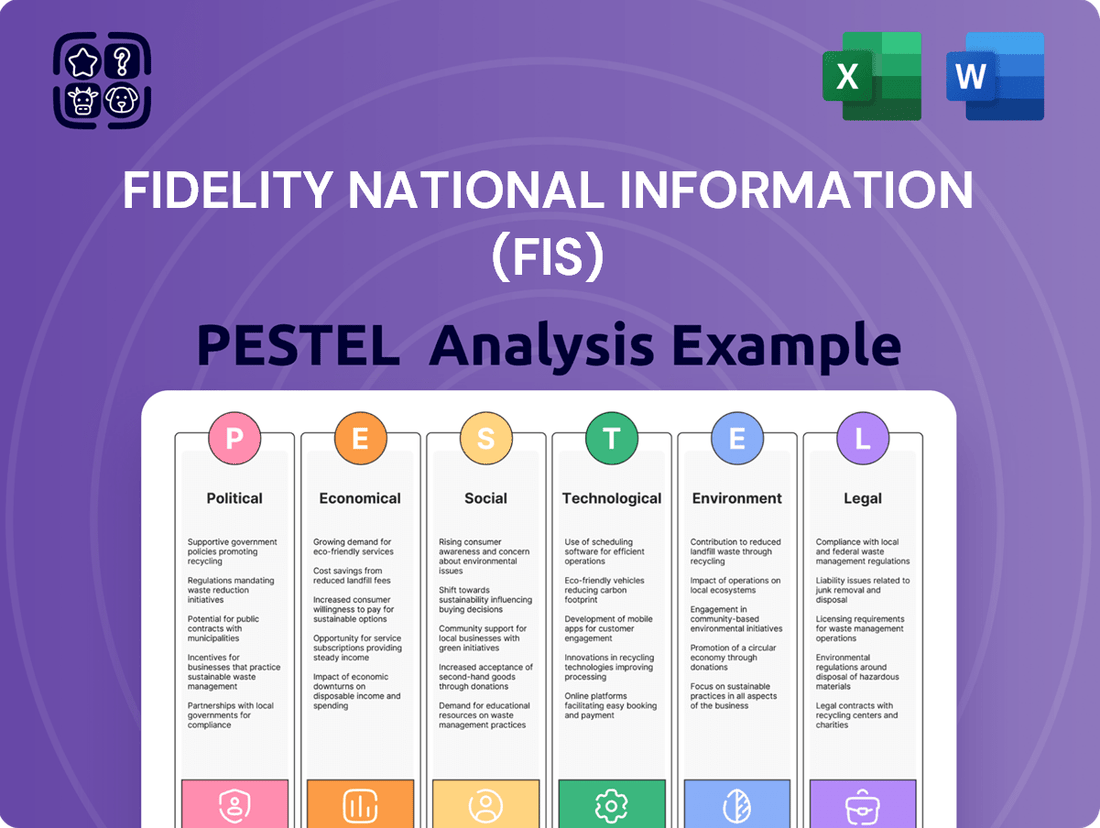

This PESTLE analysis examines how external macro-environmental factors influence Fidelity National Information (FIS) across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides data-backed insights into current trends and regulatory dynamics to equip stakeholders with actionable intelligence for strategic planning and identifying opportunities.

Our PESTLE analysis for Fidelity National Information Services (FIS) offers a concise, easily digestible overview of external factors, serving as a valuable tool to proactively address potential market challenges and optimize strategic planning.

Economic factors

The global economic outlook significantly impacts IT spending by financial institutions, a key client base for FIS. Strong economic growth encourages greater investment in technology solutions by banks and businesses. Conversely, economic slowdowns or recessionary pressures typically lead to tighter IT budgets and a more cautious approach to adopting new services, directly affecting FIS's revenue streams.

For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, down from 3.5% in 2023, signaling a less robust environment. This moderation suggests financial institutions may exercise more discretion in their technology investments, potentially impacting demand for FIS's offerings.

Fluctuations in interest rates, largely driven by central bank policies, significantly impact the profitability of financial institutions like those that are FIS's clients. For instance, if the Federal Reserve raises its benchmark rate, it can lead to higher borrowing costs for banks, potentially squeezing their net interest margins.

When interest rates rise, FIS's clients, often banks and other financial services firms, may face increased operating costs. This can lead to a natural inclination to cut back on discretionary spending, particularly on technology investments and new projects. A report from Accenture in late 2023 indicated that a substantial percentage of financial institutions were reviewing their technology budgets in anticipation of a more challenging economic environment.

Consequently, a rising interest rate environment could translate into slower sales growth for FIS as clients prioritize cost containment. This might manifest as delays in new contract signings or a more cautious approach to renewing existing agreements, as businesses look to reduce expenses wherever possible to navigate tighter financial conditions.

Rising inflation in 2024 and projected into 2025 directly impacts FIS's operating expenses. Costs for essential resources like electricity to power its data centers, talent acquisition and retention in a competitive labor market, and ongoing software development are all experiencing upward pressure. For instance, the U.S. Consumer Price Index (CPI) saw significant increases throughout 2023, a trend analysts expect to persist, albeit at a potentially moderating pace, into 2025.

FIS faces the challenge of passing these increased operational costs onto its clients. The fintech landscape is highly competitive, with numerous providers offering similar services. This environment can restrict FIS's pricing power, making it difficult to fully offset higher expenses. Consequently, profit margins could be squeezed if cost increases outpace revenue growth from price adjustments.

Effective management of these inflationary cost pressures is therefore a critical strategic imperative for FIS. Strategies such as optimizing energy consumption in data centers, enhancing operational efficiencies through automation, and carefully evaluating pricing structures in client contracts will be vital to maintaining financial health and profitability amidst these economic headwinds.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for global companies like Fidelity National Information Services (FIS). As FIS operates and transacts in numerous countries, its revenue and expenses are naturally denominated in various currencies. When these exchange rates fluctuate, the reported financial performance of FIS can be impacted. This means that profits and cash flows can appear higher or lower simply due to the conversion back to FIS's primary reporting currency, the U.S. dollar.

For instance, if the U.S. dollar strengthens against a major currency like the Euro, revenue earned in Euros would translate to fewer dollars, potentially reducing reported profits. Conversely, a weaker dollar could boost reported earnings. This dynamic underscores the importance of managing foreign currency exposure. In 2023, FIS reported that its net earnings were impacted by foreign currency translation adjustments, highlighting the real-world effects of this volatility.

To counter these effects, FIS employs hedging strategies. These financial tools, such as forward contracts or currency options, are designed to lock in exchange rates for future transactions. This helps to stabilize the company's financial results and provides greater predictability for investors and stakeholders. The effectiveness of these hedging programs is crucial for mitigating the risks associated with currency fluctuations.

- Global Operations: FIS generates revenue and incurs expenses in multiple currencies across its international operations.

- Impact on Financials: Fluctuations in exchange rates directly affect the translation of foreign currency earnings and expenses, influencing reported profitability and cash flow.

- Hedging Imperative: Robust hedging strategies are essential for FIS to mitigate the financial risks arising from currency exchange rate volatility.

- 2023 Impact: Foreign currency translation adjustments had a noticeable effect on FIS's net earnings in the 2023 fiscal year.

Consumer Spending and Business Investment Trends

Consumer spending is a major driver for FIS, as increased spending often translates to higher transaction volumes. In the first quarter of 2024, U.S. consumer spending rose at a 2.0% annualized rate, indicating continued, albeit moderated, demand for financial services and payment solutions. This trend directly supports FIS's revenue streams tied to transaction processing and digital payment adoption.

Business investment also plays a critical role, influencing the demand for FIS's core banking and payment technologies. As businesses expand and invest in new infrastructure, they often upgrade their payment systems and seek advanced processing capabilities. For example, a projected 5.2% growth in U.S. business investment in equipment for 2024 suggests a positive environment for FIS's enterprise solutions.

The ongoing shift towards digital transactions is a significant tailwind for FIS. Consumers and businesses alike are increasingly opting for digital payment methods, which directly benefits companies like FIS that provide the underlying technology. By the end of 2024, it's estimated that over 70% of all retail transactions will be digital in many developed markets, underscoring the growing need for FIS's payment processing and digital banking platforms.

Conversely, economic slowdowns or a contraction in consumer and business spending can negatively impact FIS. Reduced transaction volumes and a hesitancy in business investment can lead to lower fee-based revenues. For instance, if consumer spending growth were to significantly decelerate or turn negative in late 2024 or early 2025, it would likely put pressure on FIS's transaction-dependent revenue segments.

- Consumer spending in Q1 2024 increased by 2.0% annually.

- U.S. business investment in equipment is projected to grow 5.2% in 2024.

- Over 70% of retail transactions are expected to be digital by year-end 2024 in developed markets.

- Slowdowns in spending can reduce transaction-based revenues for FIS.

Global economic growth forecasts for 2024, such as the IMF's projection of 3.2%, influence IT spending by FIS's financial institution clients. Rising inflation, with the U.S. CPI showing significant increases in 2023 and expected to continue into 2025, pressures FIS's operating costs. Currency exchange rate volatility also impacts FIS's reported earnings, as seen with foreign currency translation adjustments affecting net earnings in 2023.

| Economic Factor | 2024/2025 Projection/Data | Impact on FIS |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Moderates IT spending by clients |

| Inflation (U.S. CPI) | Increased in 2023, expected to persist into 2025 | Raises FIS's operating expenses |

| Currency Exchange Rates | Volatile, impacting 2023 net earnings | Affects reported profitability and cash flow |

Same Document Delivered

Fidelity National Information (FIS) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fidelity National Information (FIS) delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides critical insights into the external forces shaping FIS's strategic landscape and operational environment. Understand the macro-level influences affecting this global financial technology provider.

Sociological factors

Consumers today expect their financial interactions to be as effortless as their online shopping or social media use. This demand for digital-first experiences means banks and payment providers need robust, user-friendly platforms. For instance, by the end of 2024, it's projected that over 80% of global banking customers will actively use mobile banking apps, highlighting the critical need for institutions to upgrade their digital infrastructure.

This societal shift directly fuels the need for companies like Fidelity National Information (FIS) to provide the underlying technology. As financial institutions scramble to meet these evolving customer expectations, their investment in modernizing digital channels, including mobile banking and online payment solutions, directly translates into increased demand for FIS's software and services.

Demographic shifts are reshaping the financial landscape for FIS. Globally, populations are aging, meaning a larger segment of the population will require retirement planning and wealth management solutions, a key area for FIS's offerings. Simultaneously, the ascendancy of digital-native generations like Gen Z, who are entering the workforce and financial markets, demands intuitive, mobile-first platforms and innovative payment solutions. By 2025, it’s projected that over 70% of the global population will be smartphone users, underscoring the need for FIS to prioritize digital accessibility.

Furthermore, there's a significant global push towards financial inclusion, aiming to bring previously unbanked and underbanked populations into the formal financial system. FIS has an opportunity to develop technologies that facilitate easier account opening, lower transaction costs, and accessible credit for these communities. Efforts to expand financial literacy and digital banking access in emerging markets represent a substantial growth avenue, potentially reaching billions of new users by the end of 2024 and into 2025.

Societal concerns regarding data privacy and cybersecurity are paramount in the financial services sector. As a key technology provider, FIS's ability to safeguard sensitive financial information is crucial for maintaining public trust. In 2024, reports indicated a significant increase in cyberattacks targeting financial institutions, with data breaches costing an average of $5.04 million globally.

FIS must uphold rigorous security protocols and transparency to build and keep client confidence. A single security lapse can severely damage its reputation and client relationships, impacting its business operations. For example, a major financial data breach in late 2023 led to a significant drop in customer retention for the affected company.

Talent Availability and Workforce Expectations

The fintech industry, including companies like FIS, relies heavily on a specialized talent pool. Expertise in cutting-edge fields such as artificial intelligence (AI), robust cybersecurity measures, and advanced cloud computing is paramount for innovation and operational security. The demand for these skills continues to escalate, creating a competitive landscape for talent acquisition.

Societal shifts are significantly impacting workforce dynamics. Growing preferences for remote or hybrid work arrangements, coupled with an increasing emphasis on work-life balance, are reshaping employee expectations. These trends directly influence not only the availability of skilled professionals but also the overall cost associated with attracting and retaining them in the competitive financial technology sector.

FIS, to maintain its edge, must proactively adjust its talent management strategies. This includes refining recruitment approaches to effectively reach and engage top-tier tech talent. Furthermore, fostering an environment that supports professional development and offers competitive compensation and benefits is crucial for nurturing and retaining these highly sought-after employees.

- High Demand Skills: 2024 reports indicate a persistent shortage of cybersecurity professionals, with global demand estimated to be over 4 million, and AI specialists are also highly sought after.

- Remote Work Impact: Surveys from late 2023 and early 2024 show that over 70% of employees prefer hybrid or fully remote work options, impacting recruitment reach and talent pool accessibility.

- Work-Life Balance: A significant percentage of the workforce, particularly younger generations entering the job market, prioritizes work-life balance and flexible working conditions when choosing employers.

- Talent Acquisition Costs: The competitive market for tech talent has driven up average salaries and recruitment expenses, with specialized roles seeing year-over-year increases of 10-15% in compensation packages.

Growing Emphasis on Financial Wellness

Societal focus on financial wellness is booming, with more people actively seeking ways to manage their money better and understand responsible lending practices. This trend presents a clear opportunity for FIS to innovate.

FIS can capitalize on this by developing and offering sophisticated tools designed to aid both individuals and businesses in their financial management journeys. These solutions could empower users to make smarter decisions, ultimately boosting their overall financial health and security, directly addressing these growing consumer demands.

- Increased Demand for Financial Education: Surveys indicate a significant portion of the population feels inadequately prepared for financial planning, creating a market for accessible educational resources.

- Rise of FinTech Solutions: The fintech sector is seeing substantial investment, with a growing number of platforms offering budgeting, investment, and debt management tools. For example, the global fintech market was valued at over $2.4 trillion in 2024 and is projected to grow significantly.

- Focus on Responsible Lending: Consumers and regulators alike are emphasizing responsible lending. FIS can offer services that facilitate transparent and ethical lending processes, enhancing trust and compliance.

- Personalization in Financial Services: Consumers expect personalized financial advice and tools. FIS's ability to leverage data analytics to offer tailored solutions will be key to meeting this expectation.

Societal expectations for seamless digital financial experiences continue to grow, driving demand for user-friendly platforms. By the close of 2024, over 80% of global banking customers are anticipated to utilize mobile banking applications, underscoring the critical need for financial institutions to enhance their digital infrastructure, which directly benefits technology providers like FIS.

Demographic shifts, including an aging global population needing retirement solutions and digital-native generations entering the market, necessitate intuitive, mobile-first financial tools. With smartphone penetration projected to exceed 70% globally by 2025, FIS must prioritize digital accessibility to cater to these evolving user bases and the growing emphasis on financial inclusion in emerging markets.

Concerns about data privacy and cybersecurity are paramount, with financial data breaches costing an average of $5.04 million globally in 2024. FIS's ability to maintain robust security protocols is essential for client trust and business continuity, as evidenced by a late 2023 breach that negatively impacted customer retention for an affected firm.

The increasing demand for financial wellness and education creates opportunities for FIS to develop tools that empower individuals and businesses in managing their finances effectively. The global fintech market, valued at over $2.4 trillion in 2024, highlights the significant growth potential for platforms offering personalized budgeting, investment, and responsible lending solutions.

Technological factors

Fidelity National Information Services (FIS) operates in a landscape rapidly reshaped by artificial intelligence (AI), machine learning (ML), and blockchain. These technological forces are not just evolving but accelerating, fundamentally altering how financial services are delivered and consumed.

To remain competitive, FIS must prioritize robust research and development (R&D) for integrating AI and ML. Think about fraud detection; AI-powered systems are becoming crucial. For instance, in 2024, financial institutions are increasingly adopting AI for real-time fraud monitoring, a trend FIS needs to support with cutting-edge solutions.

Furthermore, personalized financial advice, powered by ML algorithms, is a growing expectation from consumers. FIS can leverage these advancements to offer tailored investment strategies and financial planning tools, potentially increasing customer engagement and retention in a crowded market.

Blockchain technology presents opportunities for FIS in enhancing transaction processing efficiency and security. While adoption is still maturing, the potential for faster, more transparent, and cost-effective cross-border payments and settlements is significant, driving FIS to explore and implement blockchain-based solutions.

The ever-growing complexity of cyber threats is a significant technological hurdle for companies like FIS, which handle sensitive financial data. These threats range from ransomware attacks to sophisticated data breaches, demanding continuous adaptation and robust defense mechanisms.

As a provider of critical financial infrastructure, FIS must invest heavily in state-of-the-art cybersecurity. This involves deploying advanced encryption technologies, implementing real-time threat monitoring systems, and building resilient IT infrastructure to safeguard its operations and client information.

For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial and reputational risks at stake. FIS's commitment to cybersecurity is crucial for maintaining client trust and ensuring uninterrupted service delivery in this evolving digital landscape.

Open banking, fueled by regulatory mandates and technological advancements like APIs, is dramatically altering the financial services sector. This shift encourages greater data sharing and collaboration. For Fidelity National Information Services (FIS), it means a significant opportunity to integrate its offerings more broadly.

FIS must proactively develop and promote its own open API platforms. This strategic move will allow for seamless integration with a growing ecosystem of fintech innovators and third-party service providers. By doing so, FIS can unlock new revenue streams and deliver more compelling, connected customer experiences, a crucial element in the competitive 2024-2025 landscape.

Cloud Computing Adoption and Infrastructure Modernization

The increasing adoption of cloud computing is a significant technological factor for Fidelity National Information (FIS). This shift provides financial institutions with enhanced scalability, improved cost efficiency, and greater operational agility. FIS itself is actively focusing on developing and delivering cloud-native solutions, directly supporting its clients through their cloud migration journeys.

Modernizing core banking and payment infrastructures is a key component of this technological transition. By embracing cloud technologies, FIS aims to equip its clients with more flexible and future-ready systems. This strategic direction is vital for FIS's continued growth and its ability to adapt to evolving market demands in the financial services sector.

The benefits of cloud adoption for financial services are substantial:

- Enhanced Scalability: Cloud platforms allow financial institutions to easily scale their IT resources up or down based on demand, a critical advantage during peak transaction periods.

- Cost Efficiencies: Moving to the cloud often reduces capital expenditure on physical infrastructure and can lead to more predictable operational costs.

- Increased Agility: Cloud-native solutions enable faster deployment of new products and services, improving responsiveness to market changes and customer needs.

- Infrastructure Modernization: FIS's focus on cloud migration helps clients update legacy systems, reducing technical debt and improving overall system performance and security.

Competition from New Fintech Startups and Challenger Banks

The financial technology sector is a rapidly evolving arena. New fintech startups and challenger banks are consistently appearing, bringing fresh, often specialized, solutions to the market. For example, in 2024, venture capital funding for fintechs remained robust, with significant investments pouring into areas like embedded finance and digital banking platforms.

FIS needs to maintain a relentless pace of innovation and adjust its services to stay ahead. Its substantial scale and extensive experience in the financial services industry are key advantages. These strengths enable FIS to counter disruptive forces and preserve its prominent market position against agile newcomers.

- Fintech Funding Surge: Global fintech funding reached over $150 billion in 2024, indicating intense competition and innovation.

- Challenger Bank Growth: Several challenger banks, like Revolut and N26, reported significant user base expansions in early 2025, exceeding tens of millions of customers.

- FIS Competitive Edge: FIS's broad portfolio, serving over 20,000 financial institutions, provides a strong foundation to adapt to new market demands.

- Innovation Investment: FIS continues to invest heavily in research and development, allocating billions annually to enhance its digital offerings and cloud-based solutions.

Technological advancements, particularly in AI and cloud computing, are reshaping how FIS operates and serves its clients. The company is prioritizing R&D to integrate AI for fraud detection and personalized financial advice, recognizing consumer demand for such solutions in 2024-2025.

Blockchain offers FIS opportunities to improve transaction efficiency and security, which is crucial given the projected global cost of cybercrime reaching $10.5 trillion annually by 2025. FIS must also leverage open banking via APIs to foster collaboration with fintech innovators.

The firm's focus on cloud-native solutions enhances scalability and cost-efficiency for clients, supporting core banking modernization. This strategic direction is vital as fintech funding in 2024 exceeded $150 billion, underscoring the intense innovation FIS must navigate.

FIS's extensive client base and ongoing investment in digital and cloud offerings position it to adapt to the dynamic fintech landscape, where challenger banks are rapidly expanding their user bases.

Legal factors

Global data privacy rules like GDPR and CCPA are critical for FIS. These regulations dictate how customer data can be handled, impacting everything from data collection to international transfers. Fines for non-compliance can be substantial; for instance, GDPR allows for penalties up to 4% of global annual turnover or €20 million, whichever is higher.

Adhering to these stringent laws necessitates strong data governance, clear consent mechanisms, and secure data management. This has a direct effect on FIS's product development, requiring built-in privacy features, and complicates international business operations due to varying legal landscapes.

Financial institutions, including those relying on technology providers like FIS, operate under rigorous anti-money laundering (AML) and know your customer (KYC) laws designed to thwart illegal financial transactions. These regulations are critical for maintaining financial system integrity. For example, the Financial Crimes Enforcement Network (FinCEN) in the US reported over 300,000 suspicious activity reports (SARs) in 2023, highlighting the scale of compliance efforts.

To assist its clients in meeting these essential legal mandates, FIS's technology offerings must integrate sophisticated compliance functionalities. This includes robust identity verification processes, real-time transaction monitoring to detect anomalies, and streamlined systems for reporting suspicious activities to regulatory bodies.

Fidelity National Information Services (FIS) relies heavily on safeguarding its intellectual property, particularly its extensive software, intricate algorithms, and proprietary technological advancements. This protection is paramount to maintaining its competitive edge in the fast-evolving financial technology sector. For example, in 2023, FIS reported significant investments in research and development, underscoring the value it places on innovation and the need for robust IP protection.

The legal landscape, encompassing patents, copyrights, and trade secrets, provides the essential framework for FIS to shield its innovations. These legal mechanisms are critical for preventing infringement and preserving FIS's market leadership. Global IP protection is a complex but vital aspect of FIS's strategy, ensuring its unique solutions remain secure against unauthorized replication.

Antitrust and Competition Laws

As a significant entity in the financial technology landscape, Fidelity National Information Services (FIS) operates under a strict framework of antitrust and competition laws across numerous global markets. These regulations are designed to prevent market dominance and ensure a level playing field for all participants. For instance, in 2024, regulatory bodies continued to closely examine large-scale mergers and acquisitions within the tech sector, impacting companies like FIS.

FIS's strategic growth through acquisitions, such as the recent integration of Demica and Dragonfly, necessitates meticulous adherence to these competition mandates. The company must ensure its market practices do not stifle innovation or disadvantage smaller competitors. Failure to comply can result in substantial fines and operational restrictions.

- Merger Scrutiny: Acquisitions by FIS, like Demica in 2023, undergo review by antitrust authorities to assess potential impacts on market competition.

- Market Practices: FIS's business models and pricing strategies are subject to scrutiny to prevent anti-competitive behavior.

- Global Compliance: Adherence to varying antitrust regulations in North America, Europe, and Asia is critical for FIS's international operations.

Cross-Border Transaction and Payment Regulations

FIS, operating across numerous countries, must contend with a complex tapestry of international regulations for cross-border payments. These rules, which differ significantly by jurisdiction, affect everything from currency exchange mechanics to capital movement restrictions.

For instance, the European Union’s Payment Services Directive 2 (PSD2), which came into full effect in 2018 and continues to evolve, mandates open banking principles, impacting how FIS can offer payment services and integrate with third-party providers across member states. Similarly, differing foreign exchange controls in countries like China or India can directly influence the feasibility and cost-effectiveness of international payment solutions FIS offers, potentially slowing market expansion.

- Regulatory Variance: FIS must adapt its payment solutions to comply with diverse international rules on foreign exchange, remittances, and capital controls.

- Market Access Impact: Varying national regulations can dictate the design of FIS's payment technologies and influence its strategies for entering new global markets.

- Compliance Costs: Navigating these cross-border regulations incurs significant compliance and operational costs for a global financial technology provider like FIS.

- Evolving Landscape: The dynamic nature of international financial regulations requires continuous monitoring and adaptation by FIS to maintain compliance and competitive advantage.

FIS must navigate a complex global regulatory environment, including data privacy laws like GDPR and CCPA, which impose strict rules on customer data handling. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching 4% of global annual turnover. Adherence requires robust data governance and secure management practices.

Anti-money laundering (AML) and know your customer (KYC) regulations are paramount for FIS and its clients, aiming to prevent illicit financial activities. FinCEN reported over 300,000 suspicious activity reports (SARs) in 2023, underscoring the scale of compliance efforts. FIS's solutions must incorporate advanced compliance features like transaction monitoring.

Protecting intellectual property (IP), including software and algorithms, is crucial for FIS's competitive edge in the fintech sector. In 2023, FIS demonstrated its commitment to innovation through significant R&D investments, necessitating strong IP protection via patents and copyrights to prevent infringement.

Antitrust and competition laws govern FIS's market practices and growth strategies, particularly its acquisitions. Regulatory bodies in 2024 continued to scrutinize tech sector M&A, impacting companies like FIS which must ensure its market actions do not stifle competition.

Environmental factors

FIS faces increasing pressure from investors, clients, and regulators to showcase robust Environmental, Social, and Governance (ESG) performance. This trend is accelerating, with global sustainable investment assets projected to reach $50 trillion by 2025, underscoring the financial implications of ESG integration.

To navigate this landscape, FIS must embed sustainability across its operations and product development. This includes implementing transparent ESG reporting mechanisms, such as detailing carbon emissions reduction targets and social impact metrics.

Furthermore, FIS has an opportunity to develop and offer solutions that directly support its clients’ sustainable finance initiatives. This could involve providing data analytics for ESG compliance or platforms that facilitate green bond issuance, aligning with the growing demand for financial products that prioritize environmental and social outcomes.

The operation of large-scale data centers, which are crucial for Fidelity National Information Services (FIS) to deliver its financial technology solutions, demands substantial energy. In 2023, global data center energy consumption reached an estimated 1.5% of total electricity demand, a figure expected to rise with increasing digital services. This significant energy draw places FIS within a sector facing intense scrutiny regarding its carbon footprint.

Consequently, FIS is under growing pressure to enhance the energy efficiency of its IT infrastructure and transition towards renewable energy sources. This push is driven by the need to mitigate environmental impact and align with evolving sustainability targets, with many companies aiming for 100% renewable energy by 2030. For instance, major tech companies have already committed to these goals, setting a precedent for the financial services industry.

Climate change presents significant physical risks to FIS. Extreme weather events, like the increasing frequency and intensity of hurricanes and floods, directly threaten the operational resilience of its data centers and critical IT infrastructure. For instance, a severe storm impacting a key data center could disrupt services for financial institutions relying on FIS.

To counter these environmental threats, FIS must prioritize robust disaster recovery and business continuity planning. Geographically diversifying its operational footprint, including data center locations, is essential. This diversification helps ensure that a single weather event does not cripple its entire service delivery capability, a strategy increasingly vital as climate-related disruptions become more common.

Regulatory Push for Climate Risk Disclosure

Financial regulators worldwide are intensifying their focus on climate risk disclosure for financial institutions. This regulatory push is creating a significant demand for sophisticated technology solutions capable of assessing, modeling, and reporting on these evolving environmental factors. For Fidelity National Information Services (FIS), this presents a clear opportunity to expand its offerings in climate risk management technology.

The expectation is for financial firms to integrate climate considerations into their risk frameworks, mirroring established practices for credit or market risk. This means FIS can leverage its expertise to develop and market platforms that assist clients in navigating these new disclosure requirements and understanding their potential financial exposures stemming from climate change. By 2025, it's anticipated that a substantial portion of global financial assets will be subject to some form of climate-related financial disclosure mandates.

- Mandatory Disclosures: Leading economies are implementing regulations requiring financial entities to report on climate-related financial risks, similar to existing financial reporting standards.

- Technology Demand: This regulatory environment directly fuels the need for advanced analytics and data management tools to quantify and report on climate vulnerabilities.

- FIS Opportunity: FIS is well-positioned to provide these specialized technology solutions, assisting clients in compliance and risk mitigation.

- Market Growth: The market for climate risk analytics and reporting solutions for the financial sector is projected for substantial growth through 2025 and beyond.

Resource Scarcity and Circular Economy Principles

The growing global emphasis on resource scarcity and the adoption of circular economy principles directly impacts Fidelity National Information Services (FIS) by necessitating a re-evaluation of its supply chain and operational strategies. This shift encourages a focus on the entire lifecycle of hardware, from initial sourcing to eventual disposal, pushing for waste reduction and the responsible procurement of materials essential for its technological infrastructure.

FIS's commitment to these principles can yield significant benefits, including enhanced corporate reputation among environmentally conscious stakeholders and improved operational efficiency through optimized resource utilization. For instance, a 2024 report by the Ellen MacArthur Foundation highlighted that adopting circular economy models could unlock $4.5 trillion in economic value globally by 2030, a trend FIS is positioned to leverage.

- Hardware Lifecycle Management: FIS is increasingly exploring longer-term hardware leasing and refurbishment programs to extend product lifespans and minimize electronic waste, a critical component of circularity.

- Responsible Sourcing: The company is scrutinizing its supplier network to ensure materials used in its data centers and client-facing technology adhere to ethical and sustainable sourcing standards.

- Waste Reduction Initiatives: Implementing robust recycling programs for electronic components and packaging materials is a key focus area, aiming to divert significant volumes from landfills.

- Energy Efficiency: Investing in energy-efficient hardware and data center operations aligns with resource conservation, reducing both environmental impact and operational costs.

FIS is navigating a landscape where environmental concerns are paramount, influencing investor sentiment and regulatory expectations. The company's significant energy consumption from data centers, estimated at 1.5% of global electricity demand in 2023, places it under scrutiny for its carbon footprint.

To address this, FIS is pressured to enhance IT infrastructure energy efficiency and adopt renewable energy sources, with many aiming for 100% renewables by 2030.

Climate change also poses physical risks, such as extreme weather events impacting data center operations, necessitating robust disaster recovery and geographic diversification strategies.

Moreover, regulatory shifts are mandating climate risk disclosure, creating a demand for FIS's technology solutions in climate risk management and analytics, with substantial market growth projected through 2025.

The company is also adapting to circular economy principles, focusing on hardware lifecycle management and responsible sourcing to reduce waste and enhance efficiency.

PESTLE Analysis Data Sources

Our PESTLE analysis for Fidelity National Information (FIS) is meticulously constructed using a blend of official government publications, reputable financial news outlets, and expert industry analysis. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting FIS.