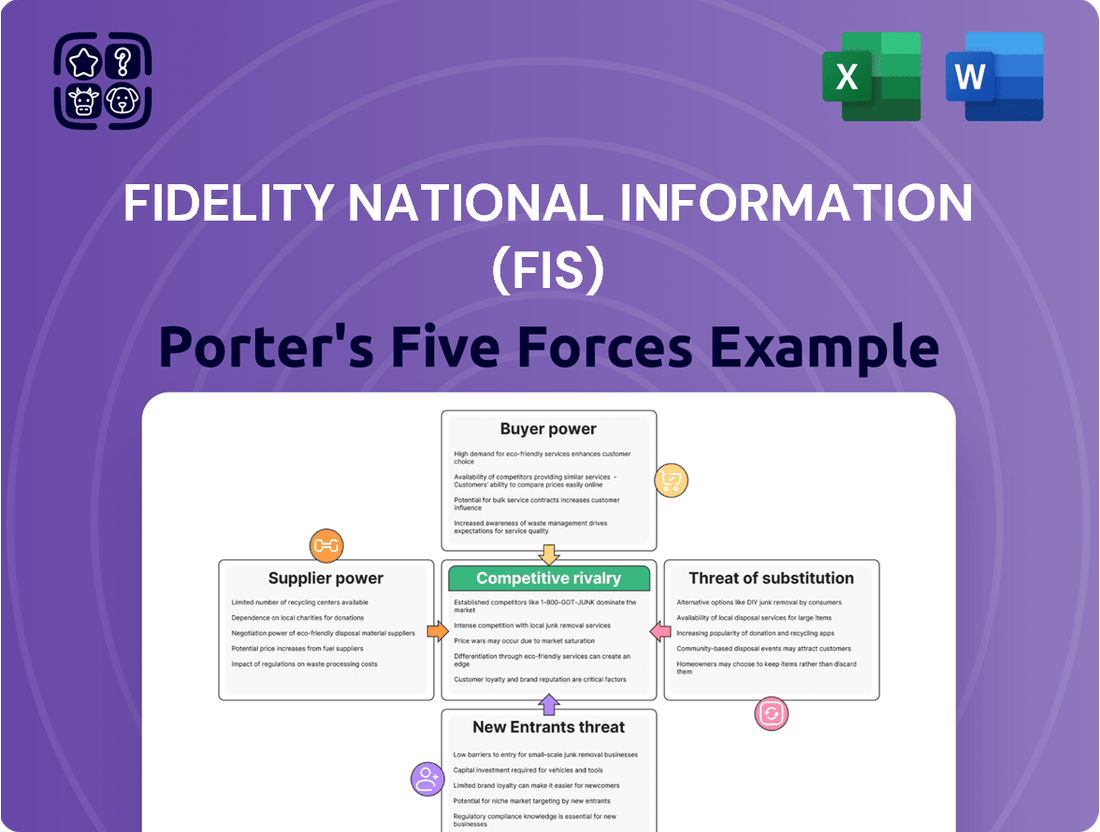

Fidelity National Information (FIS) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Fidelity National Information (FIS) operates in a dynamic financial technology landscape where buyer power can be significant due to consolidation and the availability of alternative solutions. The threat of new entrants is moderate, as high capital requirements and regulatory hurdles exist, but innovative startups can still disrupt the market. Intense rivalry among established players like Fiserv and Global Payments shapes pricing and service offerings, impacting FIS's profitability.

Supplier power for FIS is relatively low, as the company often has multiple options for sourcing technology and data. However, the threat of substitutes is a growing concern, with cloud-based solutions and fintech innovations offering alternative ways for financial institutions to manage operations. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Fidelity National Information (FIS)’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fidelity National Information Services (FIS) operates within an ecosystem heavily reliant on specialized technology. The concentration of key technology providers, offering essential software, hardware, and cloud infrastructure, significantly influences supplier bargaining power. When these suppliers are few and highly dominant in their niche, their leverage over companies like FIS escalates, potentially driving up costs or dictating less favorable contract terms.

Consider the global blockchain technology market, a sector crucial for many financial services innovations. This market is characterized by a limited number of major, highly specialized providers. For FIS, this means that sourcing advanced blockchain solutions or related infrastructure could involve negotiating with a small pool of influential entities, thereby concentrating their bargaining power.

The uniqueness and switching costs associated with a supplier's offerings significantly bolster their bargaining power against Fidelity National Information (FIS). When suppliers provide highly specialized or proprietary technology, like advanced data processing units or unique cybersecurity solutions, FIS faces greater difficulty in finding viable alternatives. This is especially true if these components are critical to FIS's service delivery.

For FIS, the transition away from an existing core technology supplier can be a complex and expensive undertaking. These high switching costs, encompassing data migration, system integration, and retraining, effectively lock FIS into relationships with established vendors, thereby enhancing the suppliers' leverage. For instance, the cost of migrating from a specialized mainframe system to a new cloud-based infrastructure can run into millions of dollars, making the decision to switch a significant hurdle.

The bargaining power of suppliers is a key factor for Fidelity National Information Services (FIS). If a supplier's input is critical to FIS's core operations and lacks readily available substitutes, that supplier gains considerable leverage. For example, essential cloud computing vendors play a vital role in FIS's service delivery, granting them significant influence over the company.

FIS heavily relies on major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These providers are indispensable for FIS's ability to offer its financial technology solutions and maintain its operational infrastructure.

The dependence on these specific cloud providers means FIS has limited options if they decide to change terms or pricing. This reliance, especially for core services, directly translates into increased bargaining power for these suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into FIS's core business is generally low. While some niche software providers might aim to offer broader solutions to financial institutions, the significant investment and expertise required to replicate FIS's comprehensive suite of financial technology services create a substantial barrier to entry. This complexity deters many suppliers from making the leap into direct competition.

However, it's not entirely absent. In specific, specialized segments of the financial technology market, a supplier with a highly sought-after component or data set could potentially develop an adjacent service that directly competes with a particular FIS offering. For instance, a provider of advanced fraud detection algorithms might evolve to offer a more complete anti-fraud platform, challenging FIS's existing solutions in that niche. Such a move would likely target a specific, high-margin area rather than attempting to replace FIS's entire product portfolio.

For FIS, this threat would manifest as increased competitive pressure in particular product lines, potentially impacting pricing and market share within those segments. Companies like FIS, with their broad service offerings and established client relationships, are better positioned to absorb or counter such niche competitive threats compared to smaller players in the industry. The overall complexity and regulatory environment of financial services technology remain key deterrents for broad-scale forward integration by most suppliers.

- Low Likelihood: The high capital expenditure and deep domain expertise needed to compete across FIS's broad financial technology landscape make widespread supplier forward integration unlikely.

- Niche Vulnerabilities: Specific software or data providers with unique capabilities could pose a threat by expanding into adjacent, high-value FIS service areas.

- Barrier to Entry: The intricate nature of financial services technology and its regulatory landscape act as significant deterrents for potential supplier competitors.

- Strategic Focus: Any forward integration by suppliers would likely be targeted at specific, profitable segments rather than a complete market takeover.

Availability of Substitute Inputs

The bargaining power of suppliers for Fidelity National Information Services (FIS) is significantly influenced by the availability of substitute inputs. If FIS can readily find alternative suppliers offering comparable components or services, or if they possess the capability to develop these inputs internally, the leverage held by any single supplier is reduced. This ease of substitution is a critical factor in moderating supplier power.

Furthermore, the presence of readily available substitute technologies for the inputs FIS requires directly curtails supplier influence. For instance, if FIS can switch to different software platforms or hardware providers without substantial disruption or increased cost, suppliers are less able to dictate terms. In 2024, the ongoing digital transformation across industries means that many core technology components used by FIS, such as cloud computing services and data analytics platforms, have multiple providers, increasing the pool of potential substitutes.

- Substitute Inputs: The ease with which FIS can find alternative sources for its necessary components and services directly weakens supplier bargaining power.

- Technological Substitutes: The availability of different technologies that can fulfill the same function as current inputs also diminishes supplier leverage.

- In-house Development: FIS's capacity to develop critical inputs internally, rather than relying on external suppliers, further reduces supplier power.

- Automation and Software: Tools like supply chain management software and automation solutions can help FIS identify and switch to alternative suppliers more efficiently, thereby mitigating supplier influence.

The bargaining power of suppliers for Fidelity National Information Services (FIS) is shaped by several key factors, including supplier concentration, the uniqueness of their offerings, switching costs, and the availability of substitutes. When suppliers are few, possess highly specialized or proprietary technology, and incur high switching costs for FIS, their leverage increases, potentially impacting FIS's operational costs and contract terms.

For example, in 2024, FIS's reliance on major cloud infrastructure providers like Amazon Web Services (AWS) and Microsoft Azure gives these suppliers considerable power due to the critical nature of their services and the significant costs associated with migrating away. While direct forward integration by suppliers into FIS's core business is generally low due to high barriers to entry, niche players with unique capabilities could target specific, profitable segments.

The availability of substitute inputs and technologies is crucial in moderating supplier power. In 2024, the widespread availability of multiple providers for core components like cloud services and data analytics platforms enhances FIS's ability to switch suppliers, thereby reducing individual supplier leverage.

| Factor | Impact on FIS Supplier Bargaining Power | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High if few dominant providers exist. | Limited providers for highly specialized financial APIs or core banking software modules. |

| Uniqueness of Offering | High if inputs are proprietary and critical. | Unique fraud detection algorithms or advanced data processing hardware. |

| Switching Costs | High if migration is complex and expensive. | Transitioning from a legacy core processing system to a new platform. |

| Availability of Substitutes | Low if many alternatives exist. | Multiple cloud service providers (AWS, Azure, Google Cloud) for general computing needs. |

| Threat of Forward Integration | Low overall, but possible in niche segments. | A specialized cybersecurity solution provider offering a broader managed security service. |

What is included in the product

Tailored exclusively for Fidelity National Information (FIS), this analysis unpacks the intense rivalry, significant buyer power, and moderate threat of substitutes impacting the financial technology sector.

FIS's Porter's Five Forces analysis provides a clear, actionable framework to navigate competitive pressures, offering a structured approach to strategic planning and risk mitigation.

Customers Bargaining Power

FIS serves a vast array of financial institutions worldwide, encompassing everything from everyday retail banks to complex capital markets operations. This broad reach is a key strength, but it also presents a dynamic where certain clients hold considerable sway.

While FIS boasts a large overall customer base, the concentration among its largest clients means these major financial institutions can wield significant bargaining power. Their substantial business volumes give them leverage in negotiations, making them crucial partners whose needs must be carefully managed.

For instance, a significant portion of FIS's revenue can be tied to a relatively small number of very large financial services firms. Losing even one or two of these key clients, perhaps due to competitive offerings or strategic shifts on their part, could indeed have a material impact on FIS's financial performance and market position.

The switching costs for financial institutions to move away from core processing, payment, or banking technology providers like Fidelity National Information (FIS) are exceptionally high. These costs aren't just monetary; they involve the immense complexity of data migration, integrating new systems with existing infrastructure, and the significant effort required to retrain personnel on different platforms. For example, a large bank might spend tens of millions of dollars and several years to transition its core banking system. This substantial investment and disruption create a strong lock-in effect for FIS's current clients, effectively diminishing their immediate bargaining power.

Large financial institutions possess the inherent capability to develop and manage their technology solutions internally. This presents a potential challenge for FIS, as these clients could opt for in-house development rather than relying on external vendors. For instance, major banks and credit unions often have substantial IT budgets and skilled personnel, enabling them to build custom platforms.

However, the significant investment required for such endeavors, coupled with lengthy development timelines and the intricate web of regulatory compliance, often renders in-house development a less attractive proposition. The sheer cost of building and maintaining sophisticated financial technology, including cybersecurity and ongoing updates, can be prohibitive. In 2024, the average cost for a large enterprise to develop a custom financial software solution could easily run into millions of dollars, not to mention the ongoing operational expenses.

Price Sensitivity of Customers

Financial institutions, facing intense competition and a rapidly changing landscape, are highly attuned to the pricing of technology solutions. They require sophisticated capabilities but also need cost-effective options, especially for standardized services. This creates significant pressure on providers like FIS to offer competitive pricing. In 2024, many banks and credit unions were actively seeking to optimize their technology spend, with a focus on solutions that offered clear ROI and reduced operational overhead. This price sensitivity is amplified by broader economic conditions and the ongoing drive for greater operational efficiency within these institutions.

The demand for cost-effectiveness is particularly acute for commoditized services where differentiation is less pronounced. For instance, core banking system upgrades or payment processing solutions, while critical, are also areas where clients can more readily compare pricing across multiple vendors. FIS's ability to demonstrate value beyond just the price point, through superior service, integration capabilities, and innovation, becomes crucial in these segments. Reports from industry analysts in late 2023 and early 2024 indicated that technology budgets for financial services firms were being scrutinized more closely than in previous years, underscoring this customer price sensitivity.

- Price Sensitivity: Financial institutions actively seek cost-effective technology solutions, especially for commoditized services, impacting FIS's pricing power.

- Market Competition: A competitive market compels financial institutions to be price-conscious, driving demand for value-for-money offerings.

- Economic Influence: Economic conditions and the pursuit of operational efficiency further heighten customers' sensitivity to the pricing of technology investments.

- 2024 Trends: In 2024, financial firms intensified scrutiny of technology spending, prioritizing solutions with demonstrable ROI and cost reduction.

Availability of Alternative Solutions or Competitors

Fidelity National Information Services (FIS) faces significant customer bargaining power due to the availability of numerous alternative solutions. Customers are not limited to FIS, as the market is populated by other major FinTech players like Fiserv and Global Payments, each offering comparable services and technology. This competitive landscape empowers buyers to negotiate terms and pricing more effectively, as switching costs, while present, are manageable for many. For instance, in 2024, the FinTech sector continued its robust growth, with reports indicating a 15% increase in the number of new vendors entering the market, providing an even wider array of choices for financial institutions. This proliferation of options directly impacts FIS's ability to command premium pricing or dictate contract terms.

The increasing diversity within the FinTech market further amplifies customer leverage. Beyond large competitors, smaller, specialized vendors offer niche solutions that can address specific customer needs, often at competitive price points. Furthermore, the rise of open-source technologies for certain functionalities allows some customers to develop in-house or leverage community-supported alternatives, reducing reliance on proprietary FIS solutions.

- Broad Competition: FIS competes with giants like Fiserv and Global Payments, offering customers direct alternatives.

- Market Growth: The FinTech market saw a 15% rise in new vendors in 2024, increasing customer choice.

- Specialized Solutions: Smaller vendors provide niche offerings, fragmenting the market and empowering buyers.

- Open-Source Alternatives: For certain functions, open-source options reduce dependence on providers like FIS.

The bargaining power of customers for FIS is substantial, driven by price sensitivity and the availability of numerous alternatives in the competitive FinTech landscape. While high switching costs exist for core systems, customers can still exert pressure, especially for commoditized services. In 2024, financial institutions intensified their scrutiny of technology spending, prioritizing clear ROI and cost reduction, which directly impacts FIS's pricing flexibility.

The market is characterized by strong competition from major players like Fiserv and Global Payments, alongside a growing number of specialized vendors. In 2024, the FinTech sector saw a 15% increase in new entrants, further fragmenting the market and enhancing customer choice. This environment compels FIS to offer competitive pricing and demonstrate significant value beyond cost, as customers can readily explore diverse solutions, including open-source alternatives for certain functionalities.

| Factor | Impact on FIS | 2024 Context |

|---|---|---|

| Customer Concentration (Large Clients) | Significant leverage for major financial institutions. | Key clients' strategic shifts can materially affect FIS. |

| Switching Costs | High for core systems, creating lock-in. | Mitigates immediate customer bargaining power for core services. |

| In-house Development Capability | Potential for clients to build their own solutions. | High development costs and compliance needs often make this less attractive. |

| Price Sensitivity | Customers seek cost-effective, high-ROI solutions. | Intensified scrutiny of tech spending, prioritizing efficiency and cost reduction. |

| Market Competition | Numerous alternative vendors provide choice. | 15% rise in FinTech vendors in 2024 increased customer options. |

Preview the Actual Deliverable

Fidelity National Information (FIS) Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, offering a deep dive into Fidelity National Information Services (FIS) through Porter's Five Forces. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the financial technology sector. This comprehensive analysis will equip you with a strategic understanding of FIS's competitive landscape, ready for immediate application.

Rivalry Among Competitors

The financial technology landscape is incredibly competitive, with a mix of long-standing companies and agile new FinTech startups. FIS faces rivals ranging from established technology giants to specialized payment processors and innovative digital platforms. For instance, in 2024, the global FinTech market was projected to reach over $2.5 trillion, highlighting the sheer scale and number of participants vying for market share.

The FinTech sector is booming, with projections indicating it will hit USD 394.88 billion by 2025 and expand at a compound annual growth rate of 16.2% until 2032. This rapid expansion, while potentially easing competitive pressure by increasing market size, simultaneously acts as a magnet for new entrants. The very growth that promises opportunity also fuels intense competition as existing players and newcomers alike deploy aggressive tactics to secure a larger slice of this expanding pie.

Competitive rivalry within the financial technology sector, where FIS operates, is intensely fueled by the continuous drive to offer innovative, secure, and all-encompassing solutions. This necessitates substantial and ongoing investment in research and development to stay ahead.

FIS itself leverages its extensive product portfolio, significant global reach, and a steadfast commitment to R&D, notably in areas like artificial intelligence and open banking, as key differentiators. These investments are crucial for maintaining a competitive edge in a rapidly evolving market.

Rival firms are not standing still; many are carving out success by specializing in particular market niches or by rapidly adopting emerging technologies. For instance, the growth of embedded finance and the widespread adoption of real-time payment systems represent significant areas where competitors are actively innovating and challenging established players.

Switching Costs for Customers

Fidelity National Information Services (FIS) benefits from significant customer switching costs within the financial technology sector. These costs, often tied to data integration, training, and contractual obligations, lock in existing clients. For instance, integrating a new core banking system can take years and millions of dollars, making a switch a substantial undertaking for financial institutions. This high barrier to exit means that once FIS secures a client, retaining them becomes more achievable, bolstering recurring revenue streams.

However, these high switching costs also fuel intense competition for new customer acquisition. Competitors must invest heavily in sales and marketing to persuade clients to undertake the disruptive process of switching. FIS likely spends considerable resources to win over customers from rivals, creating a costly battleground for market share. For example, in 2024, the global fintech market continued its robust growth, with increased M&A activity indicating a fight for dominance and customer bases.

- High customer switching costs in fintech, often involving complex data migration and system integration, create a sticky customer base for providers like FIS.

- These integration complexities mean financial institutions face substantial financial and operational hurdles when considering a change in their core technology providers.

- The initial acquisition of new clients is therefore a fiercely contested and expensive process, as competitors vie to overcome these high switching barriers.

- Despite the acquisition costs, once a client is onboarded, the entrenched nature of FIS's solutions aids in long-term customer retention and predictable revenue.

Strategic Stakes and Exit Barriers

The financial services technology sector, where Fidelity National Information (FIS) operates, carries immense strategic stakes due to its foundational role in the global economy. This means companies like FIS are deeply invested in maintaining and expanding their market positions, often viewing divestiture as a last resort.

High exit barriers further intensify this rivalry. These barriers are erected by substantial fixed costs associated with specialized technology and infrastructure, alongside the critical importance of market share in demonstrating capability and attracting further business. Even during economic slowdowns, these factors compel companies to remain active competitors rather than withdrawing.

- High Strategic Stakes: Companies are committed to market presence due to the sector's critical global economic role.

- High Exit Barriers: Significant fixed costs, specialized assets, and the pursuit of market share lock companies into the industry.

- Sustained Rivalry: These conditions foster intense competition, even when economic conditions are challenging.

Competitive rivalry in the financial technology sector is intense, driven by numerous players and rapid innovation. FIS contends with a wide array of competitors, from established tech giants to nimble startups, all seeking to capture market share in a rapidly expanding industry. For instance, in 2024, the global FinTech market was valued at over $2.5 trillion, underscoring the scale of competition.

The market's projected growth, with the FinTech sector expected to reach USD 394.88 billion by 2025 and grow at a 16.2% CAGR until 2032, attracts both existing players and new entrants. This dynamic environment means companies like FIS must continuously invest in R&D, particularly in areas like AI and open banking, to maintain their edge and differentiate their offerings from a growing field of specialized or rapidly adopting rivals.

High customer switching costs, often involving complex data integration and training, provide some customer stickiness for FIS. However, these same costs make acquiring new customers a costly endeavor, fueling fierce competition for market share. The ongoing M&A activity in the fintech space in 2024 further highlights this aggressive pursuit of dominance.

| Metric | 2024 Value (Est.) | Trend | Impact on Rivalry |

|---|---|---|---|

| Global FinTech Market Size | > $2.5 Trillion | Growing | Attracts more competitors, intensifies competition. |

| FinTech CAGR (until 2032) | 16.2% | Strong Growth | Fuels new entrants and aggressive strategies from existing players. |

| R&D Investment (Industry Average) | Significant % of Revenue | Increasing | Necessitates substantial investment to keep pace with innovation. |

SSubstitutes Threaten

Financial institutions, particularly major players, increasingly have the capital and technical know-how to build their own core processing and payment infrastructures. This internal development acts as a direct substitute for services like those offered by FIS. For instance, many large banks have invested significantly in their digital transformation, aiming for greater control and customization, which could reduce reliance on third-party vendors.

While the option exists, the substantial upfront investment, ongoing maintenance costs, and the sheer complexity of modern financial systems often make in-house development a less appealing choice compared to leveraging specialized providers. The time-to-market for new features can also be considerably longer when developing from scratch, a crucial factor in the fast-paced financial technology landscape.

The rise of open-source financial technology presents a significant threat of substitutes for proprietary solutions like those offered by Fidelity National Information Services (FIS). As these platforms mature, they provide viable alternatives for institutions seeking greater flexibility and potentially reduced licensing fees. For example, the global open-source software market was valued at over $20 billion in 2023 and is projected for substantial growth.

While adopting open-source requires considerable in-house expertise for development and ongoing maintenance, the appeal of customization and avoiding vendor lock-in is growing. This can lead some financial institutions to build their own systems or leverage community-driven projects instead of purchasing off-the-shelf solutions from companies like FIS, thereby fragmenting the market for traditional providers.

The rise of specialized FinTechs presents a significant threat of substitutes for Fidelity National Information Services (FIS). These nimble companies often focus on specific financial functions, offering modular and API-driven services. For instance, a FinTech specializing solely in real-time fraud detection or a niche payment processing solution can directly compete with or replace parts of FIS’s broader suite of services.

Financial institutions are increasingly exploring an ‘unbundling’ strategy. This means they might choose to source best-of-breed solutions from multiple specialized providers rather than relying on a single, comprehensive vendor like FIS. This trend is fueled by the desire for greater flexibility and the ability to integrate cutting-edge technology more rapidly. Reports from 2024 indicate a growing willingness among banks to adopt multi-vendor strategies, potentially fragmenting the market for traditional financial infrastructure providers.

Alternative Financial Service Models (e.g., Big Tech, Neo-banks)

The threat of substitutes for Fidelity National Information Services (FIS) comes from non-traditional players entering the financial services arena. Big tech companies, like Apple and Google, are increasingly offering payment solutions and other financial services, directly challenging incumbent institutions and their technology partners. For instance, by mid-2024, a significant percentage of consumers were actively using mobile payment platforms, indicating a shift in behavior that bypasses traditional banking infrastructure.

Challenger banks, or neo-banks, also represent a growing substitute threat. These digital-first institutions often provide streamlined, user-friendly services at lower costs, attracting customers who might otherwise rely on traditional banks and, by extension, the technology providers supporting them. This trend accelerated in 2024, with neo-banks reporting substantial user growth and expanding their service portfolios.

These alternative models can act as indirect substitutes by fundamentally altering consumer expectations and habits regarding financial transactions. As more users adopt these newer, often more convenient, platforms, the demand for the underlying technologies and services provided by firms like FIS could be impacted.

- Big Tech Entry: Companies like Apple Pay and Google Pay are integrating deeper into financial ecosystems, offering a range of services beyond simple payments.

- Neo-bank Growth: Challenger banks continue to gain traction, attracting a younger demographic with digital-native banking experiences.

- Consumer Behavior Shift: Increased adoption of digital wallets and mobile banking services signals a move away from traditional financial touchpoints.

- Service Disintermediation: These new entrants can offer end-to-end financial solutions, potentially disintermediating traditional providers and their technology partners.

Regulatory Changes Promoting Open Banking and Data Sharing

Regulatory shifts favoring open banking and data sharing significantly bolster the threat of substitutes for financial service providers like Fidelity National Information Services (FIS). These regulations, by mandating easier access to financial data for third parties, effectively lower the hurdles for new entrants offering alternative solutions. For instance, the European Union's Revised Payment Services Directive (PSD2) has been a key driver, enabling fintech companies to build innovative payment initiation and account information services that directly challenge traditional banking functions.

The proliferation of these new services, powered by accessible data, means consumers and businesses have more choices beyond established FIS offerings. This increased competition can lead to price pressure and necessitate continuous innovation from incumbent players. In 2024, the global open banking market was projected to reach over $50 billion, a testament to the growing influence of these regulatory frameworks.

- Increased Competition: Open banking regulations directly enable fintechs and other third-party providers to offer services that compete with or complement traditional financial infrastructure, potentially eroding FIS's market share in areas like payment processing and account management.

- Data Commoditization: As financial data becomes more accessible through APIs, its value as a proprietary asset diminishes, making it harder for companies reliant on data exclusivity to maintain a competitive edge.

- Innovation Acceleration: The ease of data access spurs rapid development of new financial products and services, forcing established players to adapt quickly or risk obsolescence.

- Customer Empowerment: Consumers gain more control over their financial data, allowing them to easily switch providers or consolidate services with new, often more agile, digital platforms.

The threat of substitutes for FIS is significant, stemming from various sources that offer alternative ways to achieve financial processing and payment goals. These substitutes range from in-house development by large financial institutions to the burgeoning ecosystem of specialized FinTechs and the disruptive influence of big tech companies and neo-banks.

Furthermore, regulatory changes like open banking actively lower barriers to entry, enabling new players to offer competitive services. This landscape necessitates continuous adaptation and innovation from FIS to maintain its market position against these diversifying threats.

The global open-source software market, valued at over $20 billion in 2023, highlights the growing appeal of alternatives to proprietary solutions. By mid-2024, a notable percentage of consumers were actively using mobile payment platforms, signaling a shift in how transactions are handled.

| Substitute Source | Key Characteristics | Impact on FIS |

| In-house Development | Control, customization, potential cost savings | Reduced reliance on third-party vendors |

| Open-Source Software | Flexibility, reduced licensing fees, customization | Market fragmentation, pricing pressure |

| Specialized FinTechs | Niche focus, modularity, API-driven services | ‘Unbundling’ of services, multi-vendor strategies |

| Big Tech & Neo-banks | Convenience, digital-native experience, lower costs | Shifting consumer expectations, disintermediation |

| Open Banking Regulations | Data accessibility, enabling new entrants | Increased competition, innovation acceleration |

Entrants Threaten

Entering the financial services technology sector, like the one FIS operates in, demands significant upfront capital. This isn't just about basic software; it includes hefty investments in cutting-edge technology development, robust IT infrastructure, and stringent cybersecurity measures. For instance, in 2024, companies in the fintech space often spend hundreds of millions of dollars on R&D and infrastructure to remain competitive and secure.

These considerable financial barriers act as a strong deterrent for potential new entrants. Building a scalable and reliable platform that can handle the complex needs of financial institutions requires deep pockets, making it exceptionally difficult for smaller or less-funded players to enter and compete effectively. The sheer cost of establishing a credible and secure presence can easily run into the billions.

The financial services sector, where Fidelity National Information (FIS) operates, is a heavily regulated arena. New companies entering this space must contend with a complex web of compliance requirements, licensing procedures, and rigorous security standards. For instance, in 2024, the global financial services sector continued to see increased regulatory scrutiny, particularly around data privacy and cybersecurity, with fines for non-compliance often reaching millions of dollars.

Navigating this intricate regulatory landscape across various jurisdictions presents a substantial barrier to entry. These compliance burdens, which can include Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, demand significant investment in legal expertise, technology, and operational processes. This complexity effectively deters many potential new entrants who may lack the resources or experience to meet these stringent demands.

For established giants like Fidelity National Information Services (FIS), the need for brand recognition and trust is paramount, acting as a significant barrier to new entrants. Building a reputation and earning the confidence of large financial institutions typically takes decades, a period during which existing players have cultivated deep, reliable relationships. For instance, FIS, with its long history, has demonstrably proven its reliability and capabilities to its client base, making it challenging for newcomers to quickly penetrate the market and gain acceptance.

New entrants face a substantial hurdle in replicating the established trust and brand loyalty that companies like FIS have cultivated over many years. The financial services industry, in particular, demands a high degree of security and proven performance, making institutions hesitant to switch to unproven providers. This entrenched trust means new competitors must not only offer superior technology or pricing but also overcome a significant psychological and operational barrier to entry.

Access to Distribution Channels and Customer Relationships

New entrants face a significant hurdle in accessing the established distribution channels and forging the deep customer relationships that incumbent firms like Fidelity National Information Services (FIS) have cultivated with financial institutions. These deeply embedded networks are not easily penetrated, often demanding substantial investment and time to even begin establishing a foothold.

Consider the vast client base FIS serves, which includes a significant portion of the world's largest banks and credit unions. For a new competitor, replicating this level of trust and integration with financial institutions, especially for core processing and payment systems, is a monumental task. This barrier is particularly high in the financial technology sector where regulatory compliance and proven reliability are paramount.

- Established Relationships: FIS benefits from decades of experience and trust built with major financial players, making it difficult for newcomers to displace existing partnerships.

- Distribution Network Control: Incumbents often have exclusive or preferred agreements with key distribution channels within the financial services industry.

- Switching Costs: Financial institutions face considerable costs and operational disruptions when changing core technology providers, further solidifying the positions of established vendors like FIS.

- Brand Reputation: FIS's long-standing reputation for reliability and innovation acts as a significant deterrent to new entrants attempting to gain market share.

Economies of Scale and Scope

Fidelity National Information Services (FIS) enjoys substantial advantages from economies of scale and scope. Its extensive portfolio of financial technology solutions, spanning payments, banking, and capital markets, allows for cost efficiencies in development, marketing, and operations. For instance, FIS's 2023 revenue was approximately $14.5 billion, reflecting its massive operational footprint.

New entrants often begin by targeting specific segments of the financial services market, which inherently limits their ability to match the cost structures or service breadth of established giants like FIS. This disparity makes it difficult for newcomers to achieve comparable pricing or offer the integrated, end-to-end solutions that FIS provides to its diverse client base.

- Economies of Scale: FIS's vast customer base and transaction volumes enable lower per-unit costs in areas like data processing and software development.

- Economies of Scope: Offering a wide array of integrated services allows FIS to cross-sell and bundle solutions, creating greater value for clients and reducing the need for separate vendor relationships.

- Barriers to Entry: The significant capital investment required to build comparable infrastructure and develop a comprehensive service suite acts as a formidable barrier for potential new competitors.

The threat of new entrants into the financial services technology sector, where FIS operates, is significantly low. This is primarily due to the immense capital requirements for developing advanced technology, robust infrastructure, and stringent cybersecurity. For example, in 2024, fintech companies routinely invest hundreds of millions in R&D and infrastructure to stay competitive and secure, a cost that deters smaller players.

Furthermore, the highly regulated nature of financial services, with complex compliance, licensing, and security standards, presents a substantial barrier. Navigating this intricate landscape, including adhering to KYC and AML regulations, demands considerable investment in legal, technological, and operational resources, making it difficult for new entrants to comply effectively.

Established players like FIS benefit from deeply ingrained trust and brand loyalty, cultivated over decades. Financial institutions prioritize security and proven performance, making them reluctant to switch from trusted providers to unproven newcomers. This entrenched trust, combined with high switching costs for clients, further solidifies the market position of incumbents.

Economies of scale and scope also play a crucial role. FIS's broad portfolio of services, from payments to capital markets, allows for cost efficiencies in development and operations, evidenced by its 2023 revenue of approximately $14.5 billion. New entrants, often focusing on niche segments, struggle to match the cost structures and integrated solutions offered by established giants.

| Barrier Type | Description | Example for FIS (2024 context) |

|---|---|---|

| Capital Requirements | High upfront investment in technology, infrastructure, and security. | Hundreds of millions in R&D and cybersecurity annually. |

| Regulatory Compliance | Navigating complex licensing, data privacy, and security standards. | Meeting stringent KYC/AML requirements and potential fines for non-compliance. |

| Brand Loyalty & Trust | Decades of building reputation and relationships with financial institutions. | Long-standing partnerships with major global banks and credit unions. |

| Switching Costs | Operational disruption and financial expense for clients changing core providers. | High costs associated with migrating core banking or payment systems. |

| Economies of Scale & Scope | Cost efficiencies from large customer base and broad service offerings. | Leveraging $14.5 billion 2023 revenue to offer competitive pricing and integrated solutions. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fidelity National Information (FIS) is built upon a foundation of comprehensive data, including FIS's own annual reports and SEC filings, alongside industry-specific market research from firms like Gartner and Forrester. This blend of internal and external data allows for a robust assessment of competitive pressures.