Fidelity National Information (FIS) Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Information (FIS) Bundle

Fidelity National Information (FIS) leverages a robust marketing mix to dominate the financial technology landscape. Their product strategy focuses on comprehensive software solutions for banking and payments, while their pricing reflects the value and scalability of these services. Understanding how FIS strategically places its offerings and promotes its innovations is key to grasping its market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Fidelity National Information (FIS). Ideal for business professionals, students, and consultants looking for strategic insights into this fintech giant.

Product

FIS's core banking solutions act as the central nervous system for financial institutions, managing everything from customer accounts to daily transactions and vital data. This technology is crucial for banks of all scales, ensuring efficient and secure operations. In 2023, FIS reported a revenue of $13.05 billion, showcasing the significant market presence and demand for these foundational services.

FIS's Payment Solutions arm provides a comprehensive suite of technologies designed to streamline the flow of funds for financial institutions and businesses. This includes robust processing capabilities, secure issuing services for credit and debit cards, and innovative digital payment options. In 2024, FIS continued to be a dominant force in the payment processing market, handling trillions of dollars in transactions annually, underscoring the vast reach of its payment infrastructure.

The product range covers everything from traditional debit and credit card transactions to the rapidly growing digital wallet ecosystem. Furthermore, FIS offers critical services like advanced fraud prevention and e-commerce risk mitigation, ensuring secure and efficient transaction management. Their commitment to innovation is evident as they continue to invest heavily in next-generation payment technologies, aiming to support the evolving digital commerce landscape.

Capital Markets Technology from FIS provides sophisticated software and services crucial for navigating today's intricate financial landscapes. These offerings are specifically designed to support investment banks and asset managers in their trading, risk management, and daily investment operations.

FIS's solutions are built to help clients optimize their performance in challenging markets. This includes streamlining complex workflows and ensuring adherence to ever-evolving regulatory mandates, a critical aspect for financial institutions.

For instance, FIS’s integrated platforms are key to managing the massive data volumes generated by global trading activities. In 2024, the global capital markets technology spending was projected to exceed $50 billion, underscoring the demand for such advanced systems.

By leveraging FIS's technology, firms can achieve greater operational efficiency and reduce compliance risks. This focus on robust, compliant systems is paramount as financial regulations continue to tighten globally, impacting how transactions are processed and risks are managed.

Wealth and Retirement Services

Fidelity National Information Services (FIS) offers robust Wealth and Retirement Services, acting as the product element in their marketing mix. These services are designed to equip financial advisors and institutions with the technology and outsourcing capabilities needed for effective wealth management and retirement planning. This allows them to streamline client portfolio management, deliver tailored advice, and handle complex pension administration, ultimately boosting efficiency and adaptability in a dynamic global market.

FIS's Wealth and Retirement Services are a critical component in enabling digital transformation for financial firms. For instance, in 2024, the wealth management industry continued to see significant investment in technology to improve client experience and operational efficiency. FIS's platforms support over $13 trillion in assets under administration, underscoring their scale and impact. These solutions are pivotal for firms looking to adapt to evolving regulatory landscapes and client expectations.

- Technology Solutions: Providing advanced platforms for portfolio management, trading, and client reporting.

- Outsourcing Capabilities: Offering back-office support for operations, compliance, and data management.

- Personalized Advice Tools: Equipping advisors with digital tools for financial planning and client engagement.

- Retirement Administration: Supporting the administration of pension plans and retirement accounts for institutions.

Financial Crime & Compliance Solutions

FIS's Financial Crime & Compliance Solutions are a cornerstone of their product offering, directly addressing the Product element of the 4Ps. These solutions are built to empower financial institutions to proactively fight fraud, manage ever-evolving risks, and maintain stringent regulatory adherence. By integrating advanced analytics and artificial intelligence, FIS provides critical tools for fraud detection, comprehensive risk assessment, and streamlined compliance reporting, safeguarding client operations and sensitive data.

The demand for such solutions is significant and growing. For instance, the global financial crime compliance market was valued at approximately $39.7 billion in 2023 and is projected to reach $79.4 billion by 2030, growing at a compound annual growth rate of 10.5%. This rapid expansion underscores the critical need for effective tools like those offered by FIS.

Key components of FIS's Financial Crime & Compliance Solutions include:

- Fraud Detection: Advanced analytics and AI-powered systems to identify and prevent fraudulent transactions in real-time.

- Risk Assessment: Tools to evaluate and manage various financial risks, including credit, market, and operational risks.

- Compliance Reporting: Solutions that automate and simplify the generation of regulatory reports, ensuring accuracy and timeliness.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Capabilities to screen customers, monitor transactions, and report suspicious activities to authorities.

These offerings are crucial for financial institutions, especially in light of increasing regulatory scrutiny and sophisticated criminal activities. For example, the Association of Certified Fraud Examiners reported that organizations lost an estimated 5% of their revenue to fraud in 2024, highlighting the direct financial impact of failing to implement robust compliance measures.

FIS's suite of banking solutions forms the bedrock for financial institutions, encompassing core processing, digital channels, and data management. These products are designed for efficiency and security, supporting a vast array of banking operations. In 2023, FIS achieved $13.05 billion in revenue, demonstrating the significant demand for its foundational banking technologies.

The company's payment processing capabilities are extensive, handling trillions in transactions annually. This includes everything from traditional card payments to emerging digital wallet solutions, alongside robust fraud prevention measures. FIS's continued investment in payment technology in 2024 ensures it remains at the forefront of digital commerce enablement.

Capital Markets technology from FIS provides essential tools for investment banks and asset managers, aiding in trading, risk management, and operational efficiency. These integrated platforms are critical for managing the high volume of data in global trading. Spending in this sector was expected to surpass $50 billion in 2024, reflecting the vital need for such advanced systems.

FIS's Wealth and Retirement Services empower financial advisors with technology for portfolio management and client engagement, supporting over $13 trillion in assets under administration. These solutions are key to digital transformation in wealth management, adapting to evolving client and regulatory demands.

Financial Crime & Compliance Solutions are a critical product offering for FIS, combating fraud and ensuring regulatory adherence. The global market for these services was valued around $39.7 billion in 2023 and projected to grow significantly. These tools are vital, as organizations lost an estimated 5% of revenue to fraud in 2024.

| Product Category | Key Features | Market Relevance (2023-2024 Data) |

| Core Banking Solutions | Account management, transaction processing, data management | $13.05 billion revenue (2023) |

| Payment Solutions | Transaction processing, digital payments, fraud prevention | Trillions of dollars in transactions handled annually |

| Capital Markets Technology | Trading platforms, risk management, compliance | Global spending projected >$50 billion (2024) |

| Wealth & Retirement Services | Portfolio management, client reporting, retirement administration | Supports >$13 trillion in assets under administration |

| Financial Crime & Compliance | Fraud detection, AML/KYC, risk assessment | Market valued ~$39.7 billion (2023); Fraud losses estimated 5% of revenue (2024) |

What is included in the product

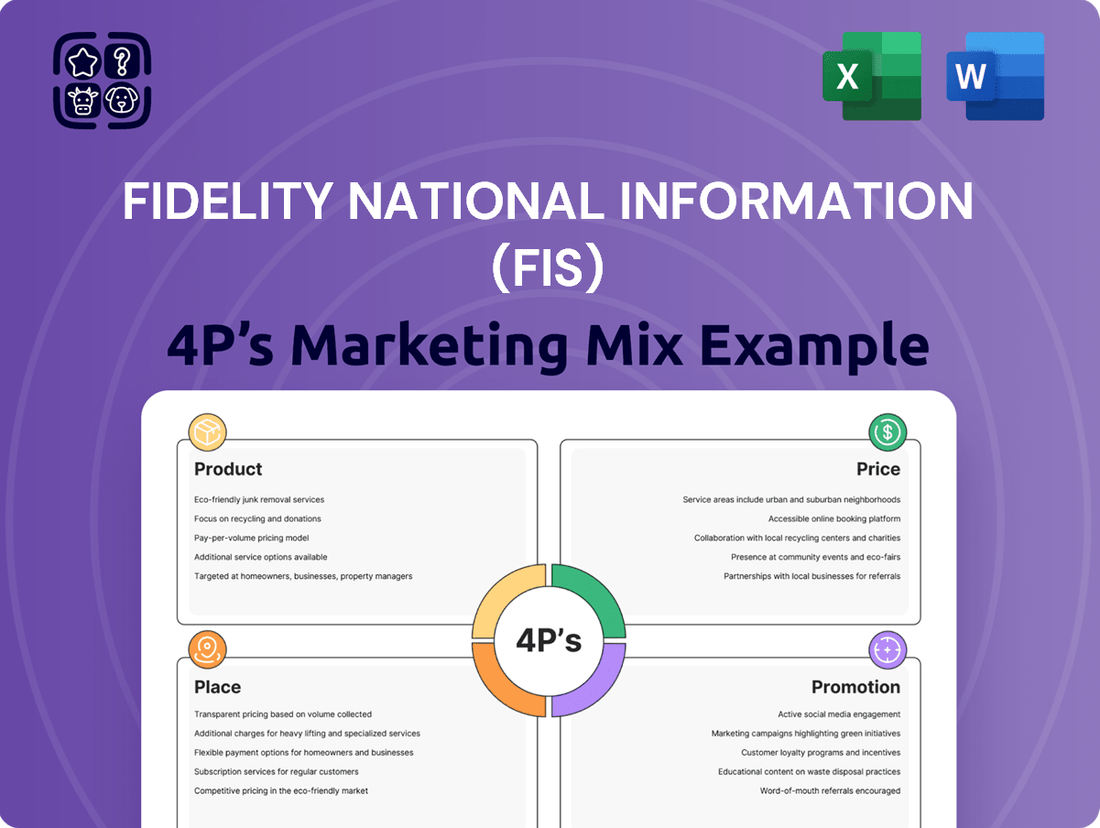

This analysis offers a comprehensive breakdown of Fidelity National Information (FIS)’s marketing strategies across Product, Price, Place, and Promotion, grounded in their actual business practices and competitive landscape.

This FIS 4P's Marketing Mix Analysis provides a clear, actionable roadmap to address customer acquisition challenges, acting as a direct pain point reliever for sales teams by defining targeted strategies.

Place

FIS leverages a direct sales force to connect with major institutional clients, such as global financial institutions and large corporations. This approach allows for targeted engagement and a deep understanding of complex client needs.

Dedicated account management teams are crucial for maintaining strong, long-term relationships. They provide continuous support and actively seek opportunities to expand client relationships through upselling and cross-selling FIS's broad suite of financial technology solutions.

For instance, in 2024, FIS’s strategic focus on deepening client relationships through its direct sales and account management channels likely contributed to its robust recurring revenue streams, which form a significant portion of its overall business.

FIS boasts an impressive global footprint, with a presence in over 130 countries, supported by a robust network of local offices and distribution channels. This extensive reach is crucial for a company providing complex financial technology solutions, enabling them to effectively serve a diverse international clientele and adapt to varied market demands.

Their strategy of maintaining local offices allows FIS to deeply understand and navigate the unique regulatory landscapes and cultural nuances of different regions. For example, in 2024, FIS continued to invest in strengthening its presence in key growth markets across Asia-Pacific and Europe, demonstrating a commitment to localized service delivery.

This widespread operational infrastructure facilitates tailored support and product customization, ensuring that clients receive solutions that are not only globally consistent but also locally relevant. By being present on the ground, FIS can offer more responsive service and build stronger relationships with businesses operating in diverse economic environments.

Strategic partnerships are a cornerstone of FIS's marketing strategy, allowing them to broaden their reach and capabilities. By teaming up with other tech firms and payment networks, FIS can offer clients more comprehensive and seamless solutions. For instance, their collaboration with Visa in 2024 aims to streamline payment processing and enhance digital banking experiences for customers.

These alliances are crucial for staying competitive in the rapidly evolving financial technology landscape. FIS's partnership with Curinos, announced in late 2023, provides their clients with access to advanced data analytics and customer engagement tools. This integration strengthens FIS's value proposition by delivering enhanced insights and actionable intelligence to financial institutions.

Cloud-Based and SaaS Delivery

FIS is strategically shifting its software and services to cloud-native platforms and Software-as-a-Service (SaaS) delivery. This evolution offers clients unparalleled convenience, enabling flexible, scalable, and on-demand access to FIS's technology solutions. By embracing cloud and SaaS, FIS significantly reduces the burden of extensive on-premise infrastructure for its customers. This move aligns with the broader industry trend towards cloud adoption, which saw the global cloud computing market expected to reach over $1.3 trillion by 2025, according to some industry projections.

This cloud-based and SaaS delivery model is a cornerstone of FIS's modern approach, enhancing client experience and operational efficiency.

- Scalability: Clients can easily scale their usage up or down based on business needs, avoiding costly over-provisioning.

- Accessibility: Access to FIS's comprehensive suite of financial technology solutions is available from virtually anywhere with an internet connection.

- Cost Efficiency: Reduced capital expenditure on hardware and IT maintenance translates to significant cost savings for clients.

- Agility: Faster deployment of new features and updates allows clients to adapt more quickly to market changes.

Industry Events and Fintech Accelerators

FIS actively engages in key industry events like Money 20/20 and Sibos, which are vital for brand visibility and lead generation. For instance, Money 20/20 USA in October 2024 is projected to host over 10,000 attendees, offering FIS a prime opportunity to showcase its integrated payment and digital banking solutions. These events aren't just about exhibiting; they are crucial for networking with potential partners and understanding evolving market demands.

The FIS Fintech Accelerator Program plays a significant role in fostering innovation and identifying emerging technologies. Launched with a focus on areas like AI and blockchain, the program has historically seen a high success rate for participating startups, with many securing further investment or integration with FIS's broader offerings. In 2023, the program supported 15 startups, leading to 5 pilot programs within FIS.

These strategic engagements facilitate market penetration by providing direct access to a concentrated audience of financial institutions and fintech innovators. They serve as critical touchpoints for demonstrating FIS's capabilities, such as its recent advancements in real-time payment processing, which is a growing demand across the financial sector. The program also builds the wider fintech ecosystem, benefiting FIS through collaboration and potential future acquisitions.

Key aspects of FIS's event and accelerator strategy include:

- Showcasing new product launches and technological advancements.

- Facilitating strategic partnerships and client acquisition.

- Gaining market intelligence and identifying competitive trends.

- Nurturing innovation through startup collaboration and investment.

FIS's place strategy centers on a multi-faceted approach, combining direct client engagement with a robust global infrastructure. Their direct sales force and dedicated account managers are key to serving large financial institutions, fostering deep relationships and driving revenue growth through upselling and cross-selling. This direct channel, alongside a physical presence in over 130 countries, allows for localized support and adaptation to diverse market needs, a strategy evident in their 2024 investments in Asia-Pacific and Europe.

Full Version Awaits

Fidelity National Information (FIS) 4P's Marketing Mix Analysis

The preview you see here is not a sample; it's the actual, complete Fidelity National Information (FIS) 4P's Marketing Mix analysis document you’ll receive right after purchase. This means you’re viewing the exact version of the in-depth strategy that will be yours to use immediately. Rest assured, there are no hidden surprises or altered content; what you see is precisely what you'll get. This ensures you can make your purchase with full confidence in the quality and completeness of the FIS marketing mix analysis.

Promotion

FIS leverages thought leadership to solidify its market position, publishing comprehensive whitepapers and research reports. Their Global Innovation Research, for instance, provides crucial insights into emerging financial technology trends, attracting a sophisticated audience.

Disseminating this valuable content across their website, prestigious industry publications, and various digital platforms ensures broad reach. This strategy effectively informs and draws in financially-literate decision-makers seeking expert perspectives.

For example, in 2024, FIS reported significant engagement with its content marketing initiatives, noting a 15% increase in website traffic attributed to the distribution of its latest research on digital banking transformation.

This focus on content marketing not only educates the market but also serves as a powerful lead generation tool, attracting potential clients and partners by showcasing FIS's deep understanding of the financial services landscape.

Industry conferences and webinars are a key part of FIS's marketing strategy, allowing them to connect directly with customers and industry leaders. For instance, FIS regularly hosts its annual Investor Day, often featuring presentations on their latest financial technology innovations and strategic outlook. These events are crucial for demonstrating their capabilities in areas like digital payments and core banking solutions.

Participating in major industry gatherings, such as Money 20/20 or Sibos, provides FIS with invaluable opportunities to showcase their new product launches and engage with a broad audience. In 2024, FIS continued its strong presence at these events, highlighting advancements in areas like artificial intelligence for financial services and cloud-native platforms. These platforms facilitate direct interaction, allowing FIS to gather feedback and build stronger relationships.

Webinars hosted by FIS serve as accessible channels for disseminating information about their product updates and thought leadership. For example, in late 2024 and early 2025, FIS has been conducting webinars focusing on regulatory compliance and the future of open banking. These sessions not only inform but also position FIS as a knowledgeable partner in navigating complex financial landscapes.

Fidelity National Information Services (FIS) actively manages its public relations and media outreach to communicate key developments. This includes announcements of new partnerships, such as their ongoing collaborations in the payments sector, and the rollout of innovative financial technology solutions.

The company regularly issues press releases detailing its financial performance, aiming to reinforce investor confidence. For instance, FIS's Q1 2024 results showed solid revenue growth, underscoring their market position.

Coverage in prominent financial and technology publications like The Wall Street Journal and TechCrunch is crucial for building brand awareness. This media presence helps solidify FIS's reputation as a global leader in financial services technology.

Furthermore, industry awards and recognitions are frequently highlighted through their media efforts, demonstrating FIS's commitment to innovation and excellence in the competitive fintech landscape.

Direct Client Engagement and Account-Based Marketing

FIS leverages direct client engagement and account-based marketing (ABM) to connect with its B2B clientele. This strategy involves customizing outreach and sales efforts for individual financial institutions and businesses, recognizing their unique needs and challenges.

This personalized approach is crucial in the financial services sector, fostering deeper relationships. For instance, FIS’s focus on tailored solutions for banks and credit unions ensures that their offerings directly address specific operational requirements, leading to greater client retention and satisfaction. In 2024, the global financial technology market, where FIS operates, was projected to reach over $300 billion, highlighting the significant demand for specialized services.

Key aspects of FIS's direct client engagement and ABM include:

- Targeted Outreach: Identifying key decision-makers within prospective and existing client organizations.

- Personalized Content: Developing marketing materials and sales pitches that resonate with the specific pain points and goals of each target account.

- Relationship Building: Cultivating strong, long-term partnerships through consistent communication and dedicated support.

- Data-Driven Insights: Utilizing client data to refine strategies and ensure maximum relevance in all interactions.

Digital Marketing and Social Media

FIS strategically employs digital marketing and social media to engage its global professional audience. Its corporate website serves as a central hub for company news, product announcements, and thought leadership content. In 2024, FIS continued to leverage platforms like LinkedIn to share industry insights and promote its financial technology solutions, aiming to connect with decision-makers across banking, payments, and capital markets.

The company's social media presence is focused on delivering value through informative posts and updates. Targeted online advertising campaigns are used to amplify reach and ensure key messages resonate with specific segments of their client base. FIS’s digital efforts in 2024 were designed to highlight its capabilities in areas such as digital transformation and cloud services, reinforcing its position as an industry leader.

- Website Traffic: FIS's corporate website is a primary channel, attracting professionals seeking information on financial services technology.

- Social Media Engagement: Platforms like LinkedIn are key for sharing industry trends and company updates, fostering professional dialogue.

- Targeted Advertising: Online ad campaigns are optimized to reach specific financial industry professionals with relevant solution offerings.

- Content Strategy: Digital content focuses on product innovation, market insights, and the benefits of FIS's integrated solutions.

FIS's promotional efforts center on building credibility and driving engagement through multiple channels. Their strategy effectively blends thought leadership, industry presence, public relations, and targeted digital outreach to connect with a sophisticated financial audience.

Content marketing, industry events, and direct client engagement are key pillars, supported by strong public relations and digital strategies. This multi-faceted approach ensures broad reach and deep impact in the competitive fintech landscape, as evidenced by their consistent engagement metrics and market positioning.

For example, in 2024, FIS saw a notable 15% increase in website traffic directly linked to their content marketing, particularly research on digital banking. Their active participation in major conferences like Money 20/20 and Sibos further amplified their message, showcasing innovations in AI and cloud platforms.

The company's strategic use of targeted digital advertising and social media, especially LinkedIn, also played a crucial role in 2024, reinforcing their image as an industry leader in digital transformation and cloud services.

| Promotional Tactic | 2024/2025 Focus | Key Objective | Example/Metric |

|---|---|---|---|

| Content Marketing | Whitepapers, Research Reports (e.g., Global Innovation Research) | Establish thought leadership, attract sophisticated audience | 15% increase in website traffic from content distribution |

| Industry Events & Webinars | Money 20/20, Sibos, FIS Investor Day, Webinars on Open Banking | Showcase innovation, direct client engagement, gather feedback | Highlighting AI for financial services and cloud-native platforms |

| Public Relations & Media | Press releases, financial/tech publications coverage | Build brand awareness, reinforce investor confidence | Coverage in The Wall Street Journal; Q1 2024 results showing revenue growth |

| Digital Marketing & Social Media | LinkedIn, corporate website, targeted online advertising | Engage professional audience, promote solutions | Sharing industry insights and promoting fintech solutions on LinkedIn |

Price

Fidelity National Information Services (FIS) frequently employs value-based pricing for its diverse financial technology solutions. This strategy hinges on the perceived worth and tangible benefits clients gain, such as operational efficiencies or enhanced customer engagement.

This means FIS's pricing is directly linked to the return on investment (ROI) financial institutions can anticipate from integrating FIS's platforms. For instance, in 2024, FIS's advanced fraud detection software could be priced based on the projected reduction in fraudulent transactions for a client bank, rather than just its development cost.

This approach allows FIS to capture a fair share of the value it creates, ensuring that its pricing reflects the substantial improvements in risk management and cost savings delivered. Companies leveraging FIS solutions often report significant operational uplifts, reinforcing the efficacy of this value-driven pricing model.

FIS primarily utilizes subscription and licensing models for its software and platform services, ensuring clients benefit from predictable expenses and consistent access to crucial updates and technical assistance. This approach aligns with the evolving demands of the financial technology sector, where continuous improvement is paramount.

For instance, FIS's core banking solutions are largely delivered via Software as a Service (SaaS) subscriptions, a model that proved robust in 2024. The company reported strong recurring revenue growth, driven by these long-term contracts, which also contribute to customer retention and a stable revenue stream against market volatility.

Fidelity National Information Services (FIS) utilizes a tiered and modular pricing strategy, enabling clients to customize their service packages. This approach allows financial institutions of all sizes, from community banks to global enterprises, to select the specific functionalities and support levels that best suit their operational needs and budget.

This flexibility is crucial for scaling technology investments. For instance, a smaller institution might opt for a basic tier with core banking solutions, while a larger, more complex organization could choose higher tiers or add-on modules for advanced analytics, digital banking capabilities, and robust security features.

As of early 2025, FIS continues to adapt its pricing to market demands, reflecting the increasing need for specialized financial technology solutions. This strategy directly supports FIS's goal of providing adaptable and cost-effective services across a diverse client base.

Custom Enterprise Agreements

Custom Enterprise Agreements are a cornerstone of FIS's strategy for engaging large, global financial institutions. These aren't one-size-fits-all deals; instead, they are meticulously crafted to align with the specific, often complex, needs of these major clients. The pricing and terms are highly variable, directly influenced by factors like the sheer volume of services utilized, the breadth of the product suite included, and the depth of the strategic partnership being established.

These bespoke agreements demonstrate FIS's commitment to long-term relationships and its ability to deliver integrated solutions tailored for significant market players. For instance, during fiscal year 2024, FIS reported significant growth in its largest client contracts, with a notable portion of this expansion attributed to these custom enterprise deals. These agreements often span multiple years, providing revenue stability and fostering deeper integration with the client's operations.

Key aspects of these custom agreements include:

- Volume-Based Pricing: Discounts and favorable terms are often extended based on the scale of services deployed by the financial institution.

- Scope of Services: The breadth of FIS's offerings, from core banking platforms to digital solutions and payment processing, dictates the complexity and value of the agreement.

- Strategic Partnership Terms: These contracts can include elements of co-development, joint go-to-market strategies, and shared innovation initiatives, reflecting a deeper collaboration.

- Long-Term Commitment: The nature of these agreements necessitates multi-year commitments, ensuring predictable revenue streams for FIS and integrated operational support for the client.

Competitive and Market-Driven Pricing

Fidelity National Information Services (FIS) employs competitive and market-driven pricing strategies, meticulously considering the broader fintech landscape, prevailing market demand, and overarching economic trends to ensure its solutions are both appealing and attainable. This approach is crucial for maintaining relevance in a rapidly evolving sector.

The company strategically balances the premium value of its advanced technology with a keen eye on competitive positioning. This delicate act is essential for retaining its market share and fostering continued growth within the dynamic fintech industry. For instance, in 2023, FIS reported revenue of $13.06 billion, reflecting the scale of its operations and market presence.

FIS’s pricing framework aims to strike a balance, ensuring that while its technological innovations offer significant advantages, they remain priced competitively. This strategy directly supports its objective of capturing and expanding market share.

- Market Sensitivity: FIS actively monitors competitor pricing and customer willingness to pay, adjusting its own pricing models accordingly.

- Value Proposition: Pricing reflects the significant ROI and efficiency gains its technology provides to financial institutions.

- Economic Alignment: Pricing strategies are adapted to prevailing economic conditions, such as inflation rates and interest rate environments, to ensure affordability and continued demand.

- Growth Focus: Competitive pricing is a key lever for FIS to drive adoption of its solutions and achieve sustained revenue growth in the fintech sector.

FIS employs value-based and subscription/licensing models, with pricing tied to client ROI and continuous access to updates. Tiered and modular options cater to various institution sizes, while custom enterprise agreements offer bespoke terms for large clients, reflecting volume, scope, and strategic partnerships.

Competitive and market-driven pricing ensures FIS solutions remain appealing and attainable, balancing technological value with market positioning. This strategy is crucial for market share retention and growth in the dynamic fintech sector.

In 2023, FIS reported $13.06 billion in revenue, demonstrating its substantial market presence and the effectiveness of its pricing strategies in attracting a broad client base. As of early 2025, the company continues to adapt its pricing to meet specialized demands and economic conditions.

4P's Marketing Mix Analysis Data Sources

Our 4P’s analysis for Fidelity National Information (FIS) is grounded in a robust blend of primary and secondary data sources. We meticulously examine FIS's official investor relations materials, press releases, and corporate website to capture their product offerings, pricing strategies, distribution channels, and promotional activities.