FirstEnergy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

FirstEnergy's recent performance showcases a complex interplay of robust infrastructure and evolving regulatory landscapes. While their established service territories offer stability, navigating the transition to cleaner energy presents both opportunities and challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within the utility sector.

Want the full story behind FirstEnergy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FirstEnergy's core strength lies in its regulated utility operations, which provide a bedrock of stability. By serving millions of customers across states like Ohio, Pennsylvania, and New Jersey, the company benefits from predictable revenue streams. These revenues are largely insulated from the wild swings of the open market because rates are determined by public utility commissions.

This regulatory framework ensures FirstEnergy's essential services are always in demand, fostering a consistent customer base. For instance, in 2023, FirstEnergy reported operating revenues of $12.0 billion, a testament to the steady demand for its regulated electricity distribution and transmission services.

FirstEnergy's Energize365 program represents a significant strength, with a planned capital investment of $28 billion through 2029. This includes a substantial $5 billion earmarked for 2025 alone.

These investments are strategically directed towards bolstering the company's grid infrastructure, aiming to improve reliability, resilience against outages, and overall security.

The Energize365 initiative is projected to be a key driver for rate base growth, which directly contributes to the company's financial performance and is expected to enhance the customer experience through more dependable service.

FirstEnergy's geographic diversity is a significant strength, with operations spanning six states including Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. This broad operational footprint, serving over 6 million customers, effectively reduces reliance on any single market, thereby buffering against localized economic fluctuations or adverse regulatory shifts.

Focus on Grid Modernization and Technology Adoption

FirstEnergy is making significant strides in grid modernization, a key strength that positions it well for the evolving energy landscape. The company is actively investing in advanced technologies, including the rollout of smart meters across its service territories.

These investments are crucial for enhancing operational efficiency and bolstering grid reliability. By adopting smart grid technologies, FirstEnergy is better equipped to manage the complexities of integrating renewable energy sources and supporting the increasing demand from sectors like data centers. For instance, in 2024, the company continued its deployment of smart meters, aiming to improve real-time data collection and outage management.

- Smart Meter Deployment: Continued expansion of smart meter technology to enhance grid visibility and customer engagement.

- Efficiency Gains: Modernization efforts are projected to yield operational efficiencies, reducing costs and improving service quality.

- Renewable Integration: The upgraded grid infrastructure is designed to seamlessly accommodate and manage distributed energy resources, including solar and wind power.

- Future-Proofing: Investments prepare the grid for increased electrification and the demands of emerging technologies and industries.

Improved Financial Profile and Shareholder Returns

FirstEnergy has demonstrated a robust improvement in its financial standing, evidenced by its projected 6-8% compound annual growth rate for core earnings through 2029. This growth trajectory signals enhanced operational efficiency and strategic execution.

The company's commitment to shareholder value is further underscored by its consistent increases in quarterly dividends. For instance, FirstEnergy raised its quarterly common stock dividend to $0.4125 per share in 2024, reflecting a strong belief in its sustained financial health and future cash flow generation.

- Improved Earnings: Targeting 6-8% CAGR for core earnings through 2029.

- Shareholder Returns: Increased quarterly dividend to $0.4125 per share in 2024.

- Financial Confidence: Dividend increases signal management's positive outlook on financial stability.

FirstEnergy's regulated utility model provides a stable foundation, generating predictable revenue streams from millions of customers across six states. Its Energize365 program, with $28 billion in planned capital investments through 2029, including $5 billion for 2025, is a key strength aimed at modernizing its grid and enhancing reliability. The company's ongoing smart meter deployment is improving operational efficiency and preparing the grid for future demands.

| Metric | Value (2023/2024/2025 Projection) | Significance |

|---|---|---|

| Operating Revenues | $12.0 billion (2023) | Demonstrates consistent demand for services. |

| Energize365 Investment | $5 billion (2025 Projection) | Drives grid modernization and reliability. |

| Core Earnings CAGR | 6-8% (Through 2029 Projection) | Indicates strong financial performance and growth potential. |

| Quarterly Dividend | $0.4125 per share (2024) | Signals confidence in financial stability and shareholder returns. |

What is included in the product

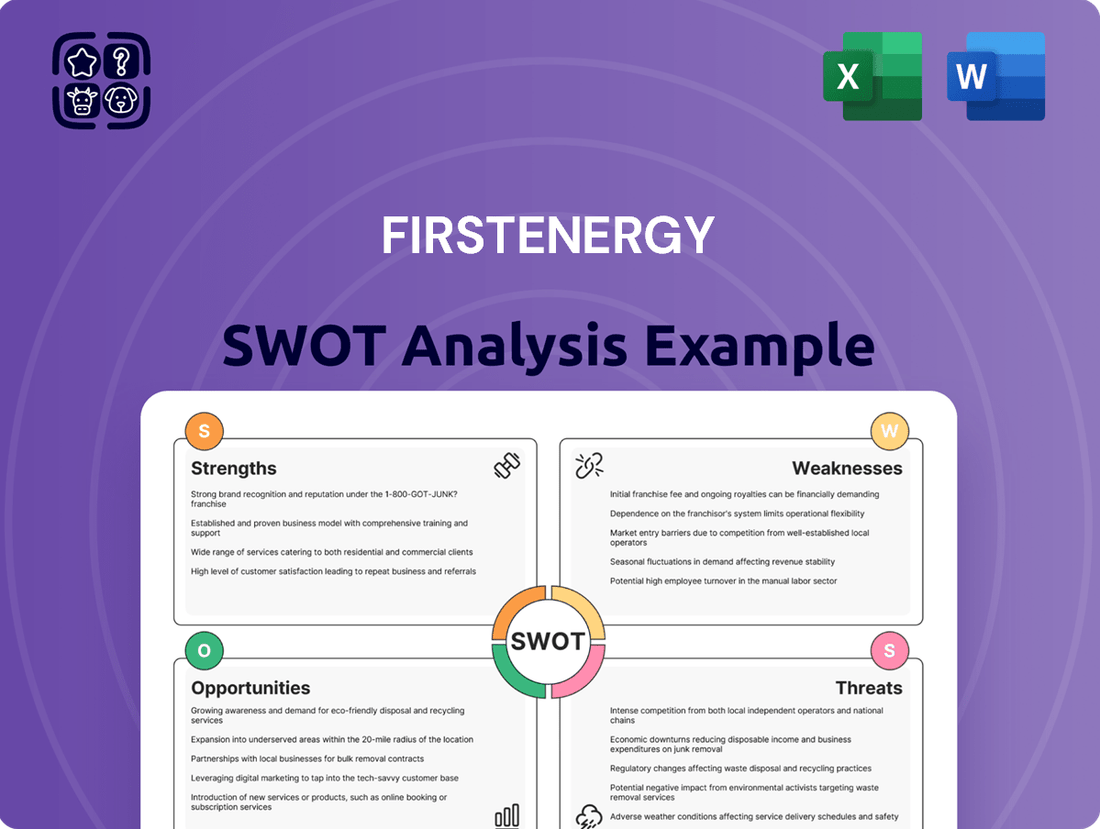

Analyzes FirstEnergy’s competitive position through key internal and external factors, including its robust regulated utility base and the opportunities presented by grid modernization and clean energy transition, while also addressing threats from regulatory changes and competition.

Identifies critical internal weaknesses and external threats for proactive risk mitigation.

Weaknesses

Despite substantial investments, FirstEnergy continues to grapple with the persistent challenge of an aging infrastructure. This is directly impacting reliability, as evidenced by recurring service disruptions and power outages in various service territories. For instance, areas like Lakewood, Ohio, have experienced repeated issues, highlighting the strain on older systems.

These infrastructure deficiencies not only inconvenience customers but also invite significant regulatory attention. Public dissatisfaction and the potential for substantial fines are direct consequences, underscoring the urgent need for more aggressive and widespread infrastructure modernization efforts to ensure consistent service delivery.

FirstEnergy faces significant weaknesses stemming from past regulatory and legal entanglements, notably concerning the Ohio House Bill 6 bribery scandal. This has resulted in ongoing investigations and potential for substantial financial penalties, impacting its bottom line. For instance, in 2023, the company agreed to a $17 million settlement with the Securities and Exchange Commission (SEC) related to its disclosures concerning the HB6 scandal, underscoring the financial ramifications of these legacy issues.

FirstEnergy's financial structure presents a notable weakness with its debt-to-equity ratio, which has been reported as significantly higher than the industry average. For instance, as of the first quarter of 2024, its debt-to-equity ratio stood at approximately 1.8, compared to an industry average closer to 1.2, indicating a greater reliance on borrowed funds and thus increased financial risk.

Furthermore, the company's profitability metrics also raise concerns. In 2023, FirstEnergy's net profit margin was around 6.5%, lagging behind the industry median of 8.2%. Similarly, its return on assets (ROA) for the same period was approximately 2.1%, falling short of the industry average of 3.5%, which suggests challenges in generating profits from its asset base.

Exposure to Regulatory Decisions on Rate Increases

FirstEnergy's regulated utility operations, while providing a stable base, are inherently tied to the decisions of public utility commissions regarding rate increases. This reliance creates a significant weakness, as delays or unfavorable rulings can directly hinder the company's ability to recover capital investments and achieve projected profitability.

For instance, the ongoing rate cases in various jurisdictions, such as Ohio, highlight this vulnerability. Unfavorable outcomes in these proceedings can compress margins and impact revenue growth, as the company’s earnings are directly influenced by the approved rate structures. This regulatory dependency introduces an element of uncertainty into financial planning and performance forecasting.

- Regulatory Dependence: Profitability hinges on approvals for rate increases from public utility commissions.

- Impact of Unfavorable Decisions: Delays or denials in rate cases can negatively affect revenue and investment recovery.

- Ongoing Rate Case Challenges: Current proceedings in states like Ohio demonstrate the continuous pressure from regulatory scrutiny.

Abandonment of Short-Term Carbon Reduction Goals

FirstEnergy’s decision to abandon its interim 2030 carbon emissions reduction goal in favor of a net-zero target by 2050 has raised concerns. This shift, while explained by the company as a response to tightening power supplies, could be perceived negatively by investors prioritizing environmental, social, and governance (ESG) factors. It may also invite criticism regarding the company's dedication to climate action.

This strategic pivot could impact FirstEnergy's standing with environmentally conscious stakeholders. For instance, as of early 2024, many utilities are facing increased scrutiny on their decarbonization timelines. The abandonment of a concrete short-term target may lead to a reassessment of FirstEnergy’s commitment by those who track progress against established climate goals.

- Shift in Climate Goals: Abandoned 2030 interim carbon reduction target for a 2050 net-neutral goal.

- Investor Perception: Potential negative impact on ESG-focused investors and stakeholders.

- Reputational Risk: Exposure to criticism regarding commitment to climate change initiatives.

- Market Context: Occurs amidst increasing investor and regulatory pressure on utility decarbonization efforts.

FirstEnergy's substantial debt-to-equity ratio, reported at approximately 1.8 in Q1 2024, significantly exceeds the industry average of 1.2, indicating elevated financial risk due to higher leverage.

The company's profitability metrics also lag, with a 2023 net profit margin of 6.5% and an ROA of 2.1%, both below industry medians of 8.2% and 3.5% respectively, suggesting challenges in efficient profit generation.

FirstEnergy's reliance on public utility commissions for rate increase approvals creates a significant weakness, as unfavorable or delayed rulings, such as those seen in ongoing Ohio rate cases, directly impede revenue growth and investment recovery.

| Metric | FirstEnergy (Q1 2024/2023) | Industry Average |

|---|---|---|

| Debt-to-Equity Ratio | ~1.8 | ~1.2 |

| Net Profit Margin (2023) | 6.5% | 8.2% |

| Return on Assets (ROA) (2023) | 2.1% | 3.5% |

Preview the Actual Deliverable

FirstEnergy SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The preview you see here offers a genuine glimpse into the comprehensive FirstEnergy SWOT analysis. Upon purchase, you'll gain access to the complete, professionally structured report.

You’re viewing a live preview of the actual SWOT analysis file for FirstEnergy. The complete version, offering in-depth insights, becomes available immediately after checkout.

Opportunities

FirstEnergy has a substantial opportunity to leverage ongoing investments in grid modernization and smart grid technologies. This includes the deployment of smart meters, distribution automation systems, and advanced analytics platforms.

These technological upgrades are projected to boost operational efficiency and reliability across FirstEnergy's service territories. For instance, by 2024, the company had already installed millions of smart meters, providing real-time data that aids in faster outage detection and restoration.

Furthermore, these advancements enable more effective demand management strategies and smoother integration of renewable energy sources, such as rooftop solar, contributing to a more resilient and adaptable energy infrastructure.

FirstEnergy is strategically positioned to benefit from the significant increase in electricity demand driven by data center construction within its operational areas. The company has secured substantial contracted load from these developments, which is projected to fuel consistent revenue increases and expand its rate base.

As of early 2024, FirstEnergy reported a robust pipeline of data center projects, with many anticipating significant power requirements in the coming years. This trend is particularly strong in regions with favorable energy costs and available land, areas where FirstEnergy has a strong presence.

FirstEnergy sees significant opportunities in the burgeoning renewable energy sector, particularly in states like West Virginia where it's actively exploring investments in solar and wind projects. This strategic pivot aligns with a nationwide push towards cleaner energy, driven by both regulatory tailwinds and increasing consumer demand for sustainable power solutions. By integrating these cleaner sources, FirstEnergy aims to modernize its grid and capture growth in a rapidly evolving energy landscape.

Leveraging Favorable Regulatory Frameworks (Formula Rates)

FirstEnergy's ability to leverage favorable regulatory frameworks, particularly formula rates, presents a significant opportunity. These mechanisms allow for the recovery of a substantial portion of planned capital expenditures, estimated to be around $17 billion through 2027, directly through customer rates. This predictability in earnings insulates the company from lengthy and uncertain traditional rate case proceedings, fostering more stable and consistent financial performance.

This regulatory structure directly supports FirstEnergy's ongoing investments in grid modernization and clean energy initiatives. By ensuring a predictable return on these significant capital outlays, formula rates provide the financial certainty needed to undertake large-scale projects that are crucial for future growth and operational efficiency. For instance, in 2023, FirstEnergy reported that approximately 70% of its rate base was subject to formula rate mechanisms.

- Predictable Capital Recovery: Formula rates allow for the automatic recovery of approved capital investments, reducing regulatory lag and uncertainty.

- Enhanced Earnings Stability: These mechanisms provide a predictable return on investment, leading to more consistent earnings streams for the company.

- Support for Infrastructure Investment: The predictable returns encourage significant capital expenditures in areas like grid modernization and renewable energy integration.

- Reduced Regulatory Risk: By minimizing the need for contentious traditional rate cases, formula rates lower the company's exposure to prolonged regulatory battles.

Potential for Economic Development and Load Growth in Service Territories

FirstEnergy's commitment to reliable infrastructure and strategic investments positions it to capitalize on economic development opportunities. By fostering a stable energy environment, the company can attract new businesses to its service territories, thereby stimulating local economies and creating jobs. This proactive approach to economic growth directly translates into increased electricity demand.

The growth of industrial, commercial, and residential sectors within FirstEnergy's operational footprint is a key driver for load growth. For instance, in 2024, FirstEnergy projected capital expenditures of approximately $3.9 billion, with a significant portion dedicated to grid modernization and reliability projects. These investments are designed to support increased energy needs as businesses expand and new communities develop. Higher electricity consumption by these expanding sectors directly contributes to revenue growth for the company.

- Attracting New Businesses: FirstEnergy's investments in grid modernization, totaling billions in capital expenditures through 2027, enhance service reliability, making its territories more attractive for new industrial and commercial enterprises.

- Supporting Economic Expansion: Reliable and affordable energy is crucial for business operations; FirstEnergy's infrastructure improvements directly support the expansion of existing businesses and the establishment of new ones.

- Driving Load Growth: Increased economic activity, from manufacturing to data centers, naturally leads to higher electricity consumption, boosting FirstEnergy's overall energy sales and revenue.

- Residential Growth Impact: As service territories experience population growth, the demand for residential electricity also rises, further contributing to a diversified and growing customer base.

FirstEnergy is well-positioned to benefit from increased electricity demand driven by the construction of data centers within its service territories. The company has secured substantial contracted load from these developments, which is projected to fuel consistent revenue increases and expand its rate base.

The company also sees significant opportunities in the renewable energy sector, actively exploring investments in solar and wind projects to modernize its grid and capture growth in a rapidly evolving energy landscape.

Favorable regulatory frameworks, particularly formula rates, allow for the predictable recovery of substantial capital expenditures, estimated at around $17 billion through 2027, directly through customer rates, fostering stable financial performance.

FirstEnergy's investments in grid modernization, totaling billions in capital expenditures, enhance service reliability, making its territories more attractive for new industrial and commercial enterprises, thereby driving load growth.

| Opportunity Area | Key Driver | FirstEnergy's Position/Action | Projected Impact |

| Data Center Growth | Increased demand for power | Secured substantial contracted load | Consistent revenue increases, expanded rate base |

| Renewable Energy Integration | Nationwide push for cleaner energy | Exploring investments in solar and wind | Grid modernization, growth in sustainable power |

| Favorable Regulatory Frameworks (Formula Rates) | Predictable capital recovery | ~70% of rate base subject to formula rates (2023) | Enhanced earnings stability, support for infrastructure investment |

| Economic Development | Attracting new businesses and supporting expansion | Billions in capital expenditures for grid modernization | Increased electricity demand, revenue growth |

Threats

FirstEnergy faces intensified regulatory scrutiny, notably from the Public Utilities Commission of Ohio (PUCO) and the Securities and Exchange Commission (SEC). These ongoing investigations into past practices, including the House Bill 6 scandal, create significant uncertainty and risk.

The potential for substantial fines and penalties stemming from these regulatory actions presents a direct threat to FirstEnergy's financial health. For instance, the company has already agreed to a $175 million settlement with the SEC in October 2023 related to the HB6 matter, impacting its earnings and cash flow.

Such penalties could negatively affect FirstEnergy's financial performance, potentially leading to reduced profitability and impacting its credit ratings. This heightened regulatory environment necessitates significant compliance investments and could constrain future strategic initiatives.

Inflation and ongoing supply chain issues in 2024 are significantly increasing FirstEnergy's operational and capital expenditure costs. This could impact the company's ability to execute planned projects on schedule and affect overall profitability. For instance, the cost of materials like copper and steel, crucial for grid upgrades, saw substantial increases throughout 2023 and into early 2024.

While FirstEnergy is committed to maintaining affordable energy prices, these rising costs present a challenge. Any attempts to pass these increases on to customers through higher rates in 2024 or 2025 could encounter significant pushback from state regulators and consumer advocacy groups, potentially leading to protracted rate case proceedings.

The utility sector, including FirstEnergy, is under immense pressure to decarbonize, driven by stricter environmental regulations and growing societal demands for cleaner energy. This shift is not just about compliance; it's also about staying competitive.

While FirstEnergy has set a 2050 net-carbon-neutral target, the path to achieving this involves substantial investment and potential operational changes. Competition from renewable energy sources, such as solar and wind power, is intensifying, offering consumers and businesses alternatives that are increasingly cost-effective and environmentally friendly.

Moreover, evolving emissions standards could force FirstEnergy to accelerate its transition away from fossil fuels, potentially incurring significant capital expenditures. For instance, in 2023, FirstEnergy reported that approximately 30% of its generation capacity was from nuclear and renewables, with a stated goal to further reduce its carbon footprint.

Cybersecurity Risks and Physical Security

As a critical infrastructure provider, FirstEnergy faces significant cybersecurity and physical security threats. These vulnerabilities could lead to operational disruptions, data breaches affecting millions of customers, and substantial financial penalties. For instance, the U.S. Department of Energy has emphasized the growing threat of state-sponsored cyberattacks on the energy sector, highlighting the need for continuous vigilance.

FirstEnergy's commitment to mitigating these risks is demonstrated through ongoing investments in advanced security technologies and robust protocols. The company reported capital expenditures of $3.4 billion in 2023, a portion of which is allocated to enhancing grid modernization and security measures. These efforts are crucial to protect against potential breaches that could compromise sensitive customer information and disrupt essential services.

- Cybersecurity Vulnerabilities: Essential infrastructure is a prime target for cyberattacks, potentially leading to widespread service outages.

- Data Breach Risks: Compromised customer data can result in identity theft and significant reputational damage for FirstEnergy.

- Financial Impact: Security incidents can incur substantial costs from operational downtime, regulatory fines, and system restoration efforts.

- Erosion of Public Trust: A major security failure could severely damage customer confidence and FirstEnergy's standing in the communities it serves.

Adverse Weather Events and Climate Change Impacts

FirstEnergy faces significant threats from changing weather patterns and the escalating impacts of climate change. More frequent and intense storms, heatwaves, and other extreme weather events directly threaten the reliability of its extensive power grid. For instance, the company experienced substantial disruptions during severe weather events in 2023, leading to increased capital expenditures for infrastructure hardening and restoration efforts.

These climate-related challenges translate into higher operational costs and potential revenue loss due to prolonged service interruptions. The company's 2024 capital expenditure plan includes significant investments aimed at improving grid resilience against these adverse events, recognizing the growing financial implications.

The increasing severity of natural disasters poses a direct risk to FirstEnergy's infrastructure, potentially causing widespread outages and requiring costly repairs. This was evident in the aftermath of severe storms impacting its service territories in late 2023 and early 2024, which led to millions in restoration expenses.

- Increased Outage Frequency: Extreme weather events in 2023 led to a notable rise in customer outage minutes across FirstEnergy's service areas.

- Higher Restoration Costs: The company allocated an additional $150 million in 2023 for storm response and infrastructure resilience upgrades, a direct consequence of adverse weather.

- Infrastructure Vulnerability: Aging infrastructure, when combined with more intense weather, heightens the risk of equipment damage and prolonged service disruptions.

- Regulatory Scrutiny: Performance during major outages can lead to increased regulatory oversight and potential penalties, impacting financial performance.

FirstEnergy faces ongoing regulatory challenges, including investigations into past practices like the House Bill 6 scandal, which could lead to substantial fines. For example, a $175 million SEC settlement was agreed upon in October 2023. Additionally, rising inflation and supply chain issues in 2024 are increasing operational costs, potentially impacting project execution and profitability, with material costs for grid upgrades seeing significant hikes.

The company is also under pressure to decarbonize due to stricter environmental regulations and competition from renewables, necessitating significant investments in cleaner energy sources. Evolving emissions standards might force accelerated transitions away from fossil fuels, potentially leading to higher capital expenditures. In 2023, FirstEnergy reported approximately 30% of its generation was from nuclear and renewables.

Cybersecurity threats pose a significant risk to FirstEnergy's operations and customer data, with potential for widespread outages and financial penalties. The U.S. Department of Energy has highlighted the growing threat of state-sponsored cyberattacks on the energy sector. FirstEnergy reported capital expenditures of $3.4 billion in 2023, with a portion dedicated to enhancing security measures.

FirstEnergy's infrastructure is vulnerable to climate change impacts, including more frequent and intense storms, leading to increased operational costs and potential revenue loss. The company allocated an additional $150 million in 2023 for storm response and infrastructure resilience upgrades, reflecting the growing financial implications of extreme weather events.

| Threat Category | Specific Threat | Impact | 2023/2024 Data/Context |

| Regulatory | SEC/PUCO Investigations & Fines | Financial penalties, uncertainty, compliance costs | $175 million SEC settlement (Oct 2023) |

| Economic | Inflation & Supply Chain Disruptions | Increased operational/capital costs, project delays | Rising costs for materials like copper and steel |

| Environmental | Decarbonization Pressure & Competition | Capital expenditure for transition, potential stranded assets | 30% generation from nuclear/renewables (2023) |

| Security | Cybersecurity & Physical Threats | Service outages, data breaches, reputational damage | $3.4 billion capital expenditures (2023) for grid modernization/security |

| Climate Change | Extreme Weather Events | Infrastructure damage, increased restoration costs, outages | $150 million additional allocation for storm response/resilience (2023) |

SWOT Analysis Data Sources

This FirstEnergy SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry forecasts to provide a well-rounded strategic overview.