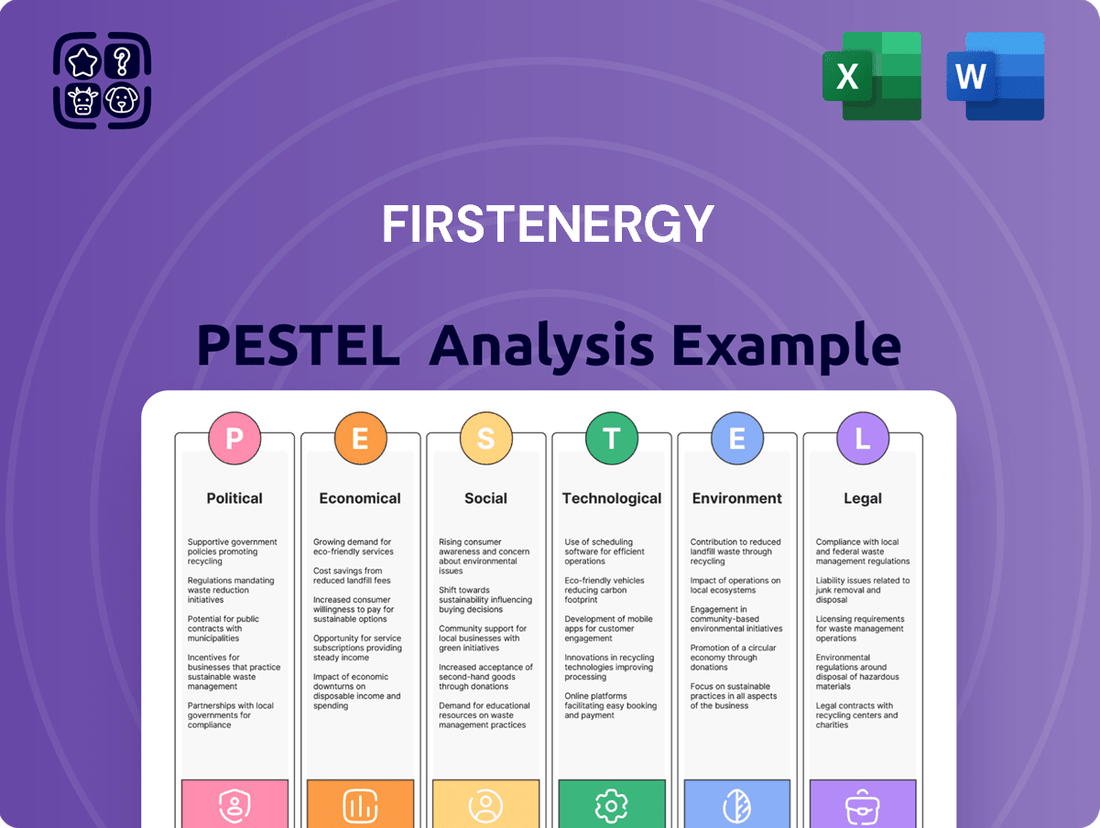

FirstEnergy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

Navigate the complex external forces shaping FirstEnergy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and strategic direction. Gain a competitive edge by leveraging these critical insights for your own market strategy. Download the full, actionable intelligence now.

Political factors

FirstEnergy navigates a heavily regulated landscape where government policies and regulatory bodies profoundly shape its operations and financial health. Rate cases are particularly vital, as they dictate the prices the company can charge customers, directly impacting revenue streams and the ability to recover investments. For instance, recent rate reviews in Pennsylvania, West Virginia, and New Jersey have secured base revenue increases, offering a degree of stability for service reliability and financial planning.

Government initiatives focused on grid modernization and the clean energy transition offer substantial opportunities for FirstEnergy. These programs are designed to upgrade aging infrastructure and incorporate renewable energy sources, areas where FirstEnergy is actively investing.

A key example of this support is the $50 million grant awarded to FirstEnergy in November 2024 from the U.S. Department of Energy's Grid Deployment Office. This funding is specifically earmarked for improving electric service reliability and advancing smart grid projects across its service territories.

This federal financial backing directly complements FirstEnergy's significant capital investment plans, such as the Energize365 initiative. Energize365 is a multi-year program aimed at reinforcing the electrical grid and facilitating the integration of advanced technologies, making these government grants particularly impactful.

FirstEnergy has been under significant political scrutiny, particularly following its involvement in the Ohio House Bill 6 bribery scandal. This situation led to a thorough review of the company's past actions and its relationship with political entities.

In response to this scrutiny, FirstEnergy has implemented substantial corporate governance reforms. These include a complete redesign of its operating model to enhance transparency and accountability, the establishment of a dedicated ethics and compliance office, and a comprehensive overhaul of its political activity and lobbying practices.

These governance changes are crucial for FirstEnergy to rebuild public trust and foster more constructive, compliant relationships with regulatory bodies and policymakers moving forward. The company's commitment to these reforms signals a strategic shift towards greater ethical conduct and regulatory adherence.

Energy Policy and Decarbonization Goals

FirstEnergy's strategic direction is significantly shaped by evolving energy policies at federal and state levels, especially those focused on decarbonization and renewable energy mandates. These policies directly influence the company's long-term investment and operational plans, pushing for a transition away from traditional energy sources.

The company has set a 2050 carbon neutrality goal for its Scope 1 emissions. However, achieving interim reduction targets presents a hurdle, partly due to its reliance on coal-fired power plants in West Virginia, which are crucial for the regional electricity supply. This reliance creates a complex balancing act between environmental goals and operational realities.

- Federal Influence: Biden administration's climate initiatives, including potential carbon pricing mechanisms or expanded clean energy tax credits, could accelerate FirstEnergy's transition.

- State-Level Mandates: States like Ohio and Pennsylvania are increasingly implementing Renewable Portfolio Standards (RPS) and clean energy goals, impacting FirstEnergy's generation mix and grid modernization investments. For instance, Ohio's Energy Portfolio Standards require utilities to source a growing percentage of their electricity from renewable sources.

- Decarbonization Challenges: FirstEnergy's 2023 ESG report highlighted that while aiming for carbon neutrality by 2050, the company's Scope 1 emissions were 15.3 million metric tons of CO2 equivalent in 2022.

- Operational Dependencies: The continued operation of its Pleasants and Mitchell power stations in West Virginia, which are coal-fired, complicates the company's ability to meet aggressive near-term emission reduction targets.

Infrastructure Investment Policies

Government policies that back critical infrastructure upgrades are a significant tailwind for FirstEnergy. These initiatives directly support the company's core business of enhancing transmission and distribution networks. For instance, programs like Energize365, with a substantial $28 billion earmarked for investments through 2029, demonstrate a clear commitment to modernizing the electric grid. This aligns perfectly with national goals to boost resilience and meet the increasing electricity demands from sectors like electric vehicles and data centers.

These infrastructure investment policies translate into tangible opportunities for FirstEnergy. The focus on grid modernization means increased demand for the company's services in upgrading and maintaining electrical infrastructure. Such government support can lead to more predictable revenue streams and a stable operating environment.

- $28 billion planned investment in Energize365 through 2029.

- National efforts to modernize the electric grid are ongoing.

- Increased demand for grid upgrades driven by EVs and data centers.

Government support for grid modernization is a major positive for FirstEnergy, with initiatives like the $50 million U.S. Department of Energy grant awarded in November 2024 directly fueling projects aimed at reliability and smart grid advancements. This aligns with the company's substantial Energize365 program, which plans $28 billion in investments through 2029 to upgrade infrastructure, anticipating increased demand from electric vehicles and data centers.

| Government Support | Grant Amount | Awarded By | Awarded Date | Purpose |

| Grid Modernization Grant | $50 million | U.S. Dept. of Energy | November 2024 | Reliability & Smart Grid |

| Energize365 Program | $28 billion | FirstEnergy | Through 2029 | Grid Infrastructure Upgrade |

What is included in the product

This FirstEnergy PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

A clear, actionable PESTLE analysis for FirstEnergy that highlights key external threats and opportunities, enabling proactive strategic adjustments and mitigating potential risks.

Economic factors

FirstEnergy's financial health is significantly bolstered by its ambitious capital investment programs, most notably Energize365. This initiative alone earmarks approximately $28 billion for investment through 2029, a substantial commitment to modernizing its infrastructure.

These extensive investments are strategically aimed at expanding FirstEnergy's rate base, which is the value of utility assets on which regulators allow the company to earn a return. The company is targeting a robust 9% compound annual growth rate for its rate base through 2029, demonstrating a clear path for revenue expansion.

This focus on regulated asset growth through consistent capital deployment offers a degree of financial stability and predictability. It allows FirstEnergy to generate reliable earnings, which is crucial for investor confidence and future funding capabilities.

Inflationary pressures are a significant economic headwind for FirstEnergy, impacting both day-to-day operating expenses and the substantial capital investments needed for grid modernization and clean energy transitions. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2023, averaging 4.1% over the year, which directly affects the cost of materials, labor, and services essential for utility operations. This environment underscores the critical need for robust cost management and operational discipline to shield financial performance and achieve earnings growth targets.

FirstEnergy is actively pursuing strategies to mitigate these rising costs. The company's objective is to maintain flat operations and maintenance (O&M) costs while simultaneously identifying and implementing further efficiencies across its diverse business segments. This focus on internal efficiency is vital for absorbing inflationary impacts and ensuring the affordability of energy services for customers, a key consideration in the current economic climate.

Fluctuations in the interest rate environment directly impact FirstEnergy's ability to finance its significant capital investments. While the company has made strides in strengthening its balance sheet and regaining investment-grade credit ratings, elevated borrowing costs can still put pressure on its financial performance.

For instance, lower financing costs were a contributing factor to FirstEnergy's improved core earnings reported in the first quarter of 2025. This highlights the sensitivity of the company's profitability to changes in the cost of capital.

Customer Demand and Economic Conditions

Customer demand for electricity is intrinsically linked to the health of the broader economy. During periods of recession or reduced industrial activity in FirstEnergy's service territories, electricity consumption naturally declines. Conversely, economic expansion often spurs increased demand.

FirstEnergy has observed a positive trend in customer demand, partly driven by weather-related electricity usage. Looking ahead, the company is strategically positioned to benefit from the surging demand from large industrial users, particularly data centers. This sector's growth is a significant tailwind for FirstEnergy's future revenue streams.

- Data Center Growth: The demand from data centers is projected to be a key driver of electricity consumption growth in the coming years.

- Economic Sensitivity: Fluctuations in industrial output and overall economic health directly impact electricity demand within FirstEnergy's operational footprint.

- Weather Impact: Extreme weather events can temporarily boost customer demand for electricity, as seen in recent periods.

Shareholder Returns and Investment Value

FirstEnergy is committed to enhancing shareholder returns by focusing on both dividend increases and projected earnings growth. This strategy aims to provide a compelling total return for investors.

The company's board demonstrated this commitment by approving a quarterly dividend increase in March 2025. This move signals strong confidence in FirstEnergy's financial roadmap and its ability to deliver consistent value.

- Dividend Growth: The March 2025 dividend increase underscores FirstEnergy's dedication to returning capital to shareholders.

- Earnings Growth Focus: The company's financial plan prioritizes earnings expansion to support long-term investment value.

- Competitive Returns: FirstEnergy aims to offer a competitive total annual shareholder return through this dual approach.

Inflationary pressures continue to be a key economic factor, impacting FirstEnergy's operational costs and capital expenditure plans. While the U.S. inflation rate showed signs of moderation in late 2024 and early 2025, the cost of materials and labor remains elevated compared to pre-pandemic levels. The company's strategy to maintain flat operations and maintenance costs through efficiency gains is crucial in navigating this environment.

Interest rates also play a significant role in FirstEnergy's financial strategy, particularly concerning its substantial capital investments. While the company has improved its credit standing, higher borrowing costs can still affect profitability. The ability to secure financing at favorable rates is vital for the success of initiatives like Energize365, which involves significant debt financing.

Customer electricity demand is closely tied to economic activity. FirstEnergy anticipates strong growth in demand, particularly from industrial sectors like data centers, which are expanding rapidly within its service territories. This trend, coupled with weather-related usage, provides a positive outlook for revenue generation.

| Economic Factor | Impact on FirstEnergy | Key Data/Trend (2024-2025) |

|---|---|---|

| Inflation | Increased operating and capital costs | Moderating but still elevated cost of materials and labor |

| Interest Rates | Financing costs for capital investments | Improved credit ratings but continued sensitivity to borrowing costs |

| Economic Growth & Demand | Electricity consumption and revenue | Strong projected growth from data centers and industrial users |

Preview Before You Purchase

FirstEnergy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of FirstEnergy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into regulatory changes, market trends, consumer behavior, technological advancements, legal frameworks, and environmental considerations relevant to FirstEnergy.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed report provides a robust understanding of the external forces shaping FirstEnergy's business landscape, enabling informed decision-making.

Sociological factors

Customers today demand consistent and reasonably priced electricity, particularly when extreme weather strikes or as their energy usage patterns shift. This expectation is a significant sociological factor influencing utility operations.

FirstEnergy's Energize365 initiative directly addresses this by aiming to boost system dependability and resilience without compromising affordability. For instance, in 2023, the company reported investing approximately $2.7 billion in its transmission and distribution infrastructure, a key component of meeting these customer expectations.

Through substantial investments in grid modernization, FirstEnergy is working to reduce the frequency and duration of power outages. These upgrades, such as replacing aging equipment and implementing advanced monitoring systems, are crucial for improving customer satisfaction and trust in the reliability of their service.

FirstEnergy actively demonstrates its commitment to community engagement and social responsibility through substantial investments and partnerships. In 2023, the company reported contributing over $10 million to various non-profit organizations and community initiatives, focusing on areas like education, environmental stewardship, and economic development. This proactive approach aims to strengthen the social fabric and economic vitality of the regions where it operates, fostering goodwill and long-term stakeholder relationships.

Societal shifts towards electrification, encompassing homes, businesses, and transportation, are significantly boosting electricity demand. For instance, the U.S. Department of Energy projects that by 2030, electric vehicles (EVs) could account for over 15% of new vehicle sales, a substantial increase from previous years. This trend directly impacts utilities like FirstEnergy, necessitating grid upgrades to handle the increased load.

FirstEnergy is actively addressing these demographic and technological shifts through strategic grid modernization and specific programs. Their EV Driven initiative in Maryland and New Jersey, for example, aims to facilitate EV adoption by offering charging infrastructure support and incentives, directly responding to growing consumer interest in cleaner transportation options and aligning with broader societal preferences for sustainable energy solutions.

Workforce Development and Safety Culture

FirstEnergy recognizes that its role as an essential service provider hinges on a robust, skilled workforce and an unwavering commitment to safety. The company has actively pursued the redesign of its operating model, fostering a high-performance culture that places paramount importance on safety, adaptability, and ongoing enhancement. This strategic focus is crucial for navigating the evolving economic landscape and its potential effects on the workforce.

In 2023, FirstEnergy continued its emphasis on safety training and development. While specific workforce numbers fluctuate, the company's commitment to operational excellence is underscored by its investments in employee programs designed to build a resilient and capable team. For instance, in the first quarter of 2024, FirstEnergy reported a focus on streamlining operations, which indirectly supports workforce efficiency and safety protocols.

- Safety First Culture: FirstEnergy's operational framework is built around a safety-first mentality, essential for utility work.

- Workforce Transformation: The company is engaged in redesigning its operating model to enhance agility and performance, directly impacting its workforce.

- Economic Adaptability: Addressing workforce impacts in a changing economic environment is a key consideration for long-term stability.

- Continuous Improvement: Fostering a culture of continuous improvement ensures the workforce remains skilled and operations remain efficient.

Public Perception and Trust

Public perception and trust are paramount for FirstEnergy, especially given past regulatory scrutiny. Rebuilding this trust hinges on demonstrable improvements in transparency and governance.

FirstEnergy's commitment to reliable service and community engagement is key to fostering positive public sentiment. For instance, in 2023, the company reported investing $2.5 billion in grid modernization and reliability projects, aiming to directly address customer concerns about service quality.

- Enhanced Transparency: FirstEnergy has implemented new reporting mechanisms and stakeholder outreach programs to provide clearer information on operations and regulatory compliance.

- Corporate Governance: Following past issues, the company has overhauled its board structure and executive compensation policies to align with stakeholder interests.

- Reliability Investment: Significant capital expenditures, such as the $2.5 billion in grid modernization in 2023, underscore a commitment to dependable service delivery.

- Community Well-being: FirstEnergy actively participates in local initiatives and environmental stewardship programs to demonstrate its dedication to the communities it serves.

Societal expectations for reliable and affordable energy are a constant pressure on FirstEnergy. Customers, especially during extreme weather, demand uninterrupted service, influencing the company's operational strategies and investment priorities.

The growing trend towards electrification, from electric vehicles to home heating, is significantly increasing electricity demand. FirstEnergy's investments, like the $2.7 billion in infrastructure upgrades in 2023, are crucial to meeting this rising demand and ensuring grid stability.

Public trust is a critical sociological factor, particularly after past regulatory challenges. FirstEnergy's focus on transparency, improved governance, and community engagement, including over $10 million in community contributions in 2023, aims to rebuild and maintain this trust.

A skilled and safe workforce is fundamental to FirstEnergy's operations. The company's commitment to safety training and operational model redesign in 2023 and early 2024 reflects an understanding of the importance of workforce adaptability in a dynamic economic environment.

| Sociological Factor | FirstEnergy Response/Data | Impact |

|---|---|---|

| Customer Expectations (Reliability & Affordability) | Energize365 initiative; $2.7 billion invested in T&D infrastructure (2023) | Drives grid modernization and resilience investments. |

| Electrification Trend | EV Driven initiative; U.S. DOE projects >15% EV sales by 2030 | Increases demand, necessitates grid upgrades. |

| Public Trust & Perception | Enhanced transparency; $2.5 billion in grid modernization (2023); $10M+ community contributions (2023) | Requires focus on governance, reliability, and community engagement. |

| Workforce & Safety | Operational model redesign; focus on safety training (2023/2024) | Ensures operational efficiency and safety compliance. |

Technological factors

FirstEnergy is channeling significant capital into grid modernization, notably through its ambitious Energize365 program. This initiative is designed to create a more intelligent, resilient, and secure electrical grid, a crucial step in adapting to evolving energy demands and technological advancements.

Key to Energize365 is the deployment of advanced distribution management systems (ADMS) and widespread automation. These technologies are vital for enhancing grid reliability by proactively identifying and addressing potential issues, thereby minimizing the duration and impact of power outages for customers.

By integrating emerging technologies, FirstEnergy aims to bolster its defenses against disruptions, including those caused by severe weather or cyber threats. This strategic investment underscores the company's commitment to ensuring a stable and dependable energy supply in the face of increasing complexity.

FirstEnergy is significantly advancing its technological capabilities through the widespread deployment of smart meters. The company aims to have these meters installed for roughly 86% of its customer base by 2028, a substantial undertaking that will reshape how energy is managed and delivered.

These smart meters offer dual benefits: empowering customers with better control over their energy consumption and associated costs, while simultaneously enhancing FirstEnergy's operational efficiency. The granular data provided by smart meters allows for more precise outage detection and faster restoration times, especially critical during severe weather events.

Technological leaps in solar and wind power, alongside advancements in battery storage, are significantly reshaping how FirstEnergy plans its electrical grid. These innovations allow for more decentralized energy generation, presenting both opportunities and challenges for grid stability and management.

FirstEnergy is actively investing in grid modernization to seamlessly incorporate these distributed energy resources. For instance, the company is exploring the use of energy storage systems not just for backup power, but as a valuable transmission asset. This strategy aims to enhance operational flexibility and reliability, especially as renewable energy penetration increases. By 2024, FirstEnergy's planned investments in grid modernization and integration of renewables are substantial, reflecting a commitment to adapting to these technological shifts.

Cybersecurity and Infrastructure Security

The increasing digitalization of the energy grid makes robust cybersecurity essential for FirstEnergy. Protecting critical infrastructure from cyber threats is paramount as the grid becomes more interconnected and digitally managed. FirstEnergy's Energize365 program, aiming for a more secure grid, inherently involves bolstering defenses against these evolving technological risks.

In 2024, the energy sector continued to face significant cyber threats. Reports from the Cybersecurity and Infrastructure Security Agency (CISA) highlighted a rise in ransomware attacks targeting utility companies. FirstEnergy's investment in grid modernization, part of its Energize365 initiative, includes substantial upgrades to its IT and OT (Operational Technology) systems, directly addressing these vulnerabilities. For instance, the company has been investing in advanced metering infrastructure and smart grid technologies, which, while enhancing efficiency, also expand the attack surface requiring heightened security protocols.

- Cyber Threat Landscape: The energy sector remains a prime target for nation-state actors and cybercriminals seeking to disrupt critical infrastructure.

- FirstEnergy's Defense Strategy: The Energize365 program allocates significant capital towards enhancing cybersecurity, including network segmentation and advanced threat detection systems.

- Infrastructure Security Investment: As of early 2025, FirstEnergy's ongoing grid modernization efforts are estimated to include over $1 billion in technology upgrades, with a substantial portion dedicated to cybersecurity enhancements.

Advanced Transmission and Distribution Systems

FirstEnergy is actively investing in modernizing its electrical grid, focusing on advanced transmission and distribution systems. This strategic upgrade is designed to bolster the resilience of its high-voltage transmission network and develop more sophisticated local distribution infrastructure. These enhancements are crucial for adapting to evolving energy demands and ensuring a stable power supply.

The company's efforts aim to significantly reduce long-term maintenance expenditures while simultaneously increasing operational flexibility. By implementing these technologically advanced systems, FirstEnergy empowers its grid operators with the agility to react promptly to fluctuating conditions, ultimately leading to improved overall system performance and a more reliable energy delivery for its customers.

Key aspects of these technological advancements include:

- Grid Modernization: Upgrading the high-voltage transmission system to enhance capacity and reliability.

- Smart Grid Technologies: Implementing advanced distribution systems for better monitoring and control.

- Resilience Improvement: Building infrastructure that can withstand and recover quickly from disruptions.

- Operational Efficiency: Reducing maintenance costs and increasing flexibility for grid operators.

FirstEnergy is heavily investing in technological upgrades, with its Energize365 program at the forefront, aiming for a smarter, more resilient grid. The company plans to install smart meters for approximately 86% of its customers by 2028, enhancing both customer control and operational efficiency through detailed data collection.

These technological advancements are critical for integrating distributed energy resources like solar and wind power, as well as battery storage, into the grid. FirstEnergy is exploring energy storage as a transmission asset to boost flexibility and reliability. Furthermore, the increasing digitalization necessitates robust cybersecurity measures, with significant capital allocated to protecting critical infrastructure from evolving cyber threats.

FirstEnergy's commitment to technological advancement is evident in its substantial investments in grid modernization. These upgrades focus on enhancing the transmission network's resilience and developing sophisticated distribution infrastructure, aiming to reduce long-term maintenance costs and increase operational flexibility for grid operators.

| Technological Factor | Description | Key Initiatives/Data |

| Grid Modernization | Upgrading transmission and distribution systems for enhanced reliability and capacity. | Energize365 program, focus on high-voltage transmission network resilience. |

| Smart Grid Technologies | Deployment of advanced systems for better grid monitoring and control. | Smart meter rollout targeting 86% of customers by 2028; deployment of ADMS and automation. |

| Distributed Energy Resources (DER) Integration | Incorporating renewable energy sources and storage into the grid. | Investment in battery storage as a transmission asset; adapting to decentralized generation. |

| Cybersecurity | Protecting critical infrastructure from cyber threats in an increasingly digital environment. | Significant capital allocation within Energize365 for IT/OT system upgrades; response to rising ransomware threats targeting utilities. |

Legal factors

FirstEnergy navigates a complex web of regulations, with state Public Utility Commissions (PUCs) and federal agencies like the Federal Energy Regulatory Commission (FERC) dictating operational standards. Compliance with these mandates, covering everything from rate structures to service quality, is paramount. For example, in Ohio, the company's Electric Security Plan filings detail significant investments in grid modernization and customer assistance programs, demonstrating a direct link between regulatory approval and capital deployment.

FirstEnergy has navigated substantial legal hurdles, including a significant $100 million settlement with the SEC in 2024 concerning the Ohio House Bill 6 bribery scandal. This settlement underscores the company's exposure to litigation risks.

The company continues to face ongoing legal and regulatory scrutiny. Potential fines for failing to meet reliability standards represent a material risk that could affect its financial health and public image.

FirstEnergy operates under a complex web of environmental statutes, encompassing air emissions, water quality, and waste disposal. For instance, the U.S. Environmental Protection Agency's (EPA) regulations, such as the Clean Air Act, directly influence power plant operations and emissions control investments.

Shifting environmental mandates, particularly those addressing climate change, pose significant financial and operational challenges. The U.S. aims for a 50-52% reduction in greenhouse gas emissions from 2005 levels by 2030, a target that impacts FirstEnergy's reliance on fossil fuels and necessitates substantial capital for cleaner energy transitions.

Corporate Governance and Shareholder Rights

Legal frameworks governing corporate governance are paramount for FirstEnergy, dictating requirements for board oversight, executive compensation structures, and the mechanisms for shareholder engagement. These legal stipulations ensure accountability and transparency in the company's operations.

FirstEnergy has proactively restructured its governance framework and revised policies, a direct response to historical challenges. This includes strengthening independent board oversight and refining executive compensation practices to better align with performance and shareholder interests. For instance, in 2023, the company continued to enhance its compliance programs and reporting, reflecting ongoing efforts to meet evolving legal and regulatory expectations.

Shareholder influence is also legally recognized, particularly concerning activities like lobbying. Shareholder proposals, such as those related to the disclosure and oversight of political expenditures and lobbying activities, are put to a vote, allowing investors to directly impact corporate policy in these sensitive areas. In 2024, several utility companies, including those in similar sectors to FirstEnergy, faced increased scrutiny and investor votes on their lobbying disclosures, highlighting a trend in heightened shareholder activism on these matters.

Key legal aspects impacting FirstEnergy's governance include:

- Board Independence: Adherence to regulations mandating a majority of independent directors to ensure objective decision-making.

- Executive Compensation Scrutiny: Compliance with laws and guidelines governing the structure and disclosure of executive pay packages.

- Shareholder Voting Rights: Upholding the legal right of shareholders to vote on significant corporate matters, including proposals on lobbying and political spending.

- Regulatory Compliance: Ensuring all governance practices align with federal and state laws applicable to public utility companies.

Data Privacy and Cybersecurity Laws

FirstEnergy faces a complex legal landscape regarding data privacy and cybersecurity, particularly with its expanding smart meter infrastructure and digitally managed grid. These regulations, like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), and similar frameworks emerging globally and at the state level, mandate stringent protections for customer data. Failure to comply can result in significant fines and reputational damage.

The company must invest heavily in robust cybersecurity measures to safeguard its operational technology (OT) systems, which are increasingly interconnected and vulnerable to cyber threats. In 2024, the U.S. Department of Energy continued to emphasize the importance of grid cybersecurity, with utilities reporting an average of $1 million in costs per cybersecurity incident in recent years, underscoring the financial imperative for compliance.

- Data Protection Compliance: Adherence to evolving privacy laws like CCPA/CPRA is crucial for managing customer data collected through smart meters.

- Cybersecurity Investment: Significant financial resources are required to protect critical operational technology systems from sophisticated cyberattacks.

- Regulatory Scrutiny: Increased government focus on energy sector cybersecurity means ongoing compliance and potential audits.

FirstEnergy's legal environment is heavily shaped by regulatory compliance, particularly from state Public Utility Commissions and federal bodies like FERC. The company's 2024 settlement of $100 million with the SEC, stemming from the Ohio HB6 scandal, highlights significant litigation risks and the potential for substantial financial penalties. Ongoing scrutiny over reliability standards also presents a material risk to the company's financial health and public perception.

Environmental factors

FirstEnergy is actively working towards a 2050 carbon neutrality goal for its Scope 1 emissions. This commitment reflects a broader industry shift and increasing pressure to address climate change.

However, the company's capacity to directly influence generation-based greenhouse gas (GHG) reductions is constrained in deregulated markets. Regulatory frameworks in these states restrict FirstEnergy's ownership of generation assets, thereby limiting its direct control over emissions from power production in the immediate future.

The global push for a low-carbon economy is a major environmental driver. FirstEnergy is actively investing in grid modernization to better integrate intermittent renewable sources like solar. For instance, the company is pursuing ownership of solar generation in West Virginia, a move that aligns with its strategy to adapt to evolving energy landscapes.

Climate change is increasing the frequency and intensity of extreme weather, directly impacting grid reliability. These events, from hurricanes to derechos, can cause widespread damage and prolonged outages, posing a substantial challenge to utility providers like FirstEnergy.

FirstEnergy's Energize365 initiative is a direct response to these environmental pressures, focusing on strengthening the grid's ability to withstand and quickly recover from severe weather. This program involves significant investments in infrastructure upgrades and advanced automation technologies, aiming to reduce the duration and impact of power interruptions for its customers.

For instance, in 2023, FirstEnergy reported investing $2.1 billion in grid modernization and resilience efforts, a substantial portion of which is allocated to projects designed to mitigate the effects of extreme weather. This proactive approach is crucial as the company operates in regions increasingly susceptible to these climate-driven disruptions.

Waste Management and Resource Efficiency

Environmental considerations for FirstEnergy significantly include waste management, covering the responsible disposal and recycling of materials generated from its operations. This focus is crucial for minimizing the company's ecological footprint and adhering to evolving environmental regulations.

FirstEnergy is actively pursuing improved resource efficiency, demonstrating a commitment to sustainability. A key initiative is their goal to recycle or beneficially reuse at least 50% of their wood poles by 2025. This target directly addresses the reduction of landfill waste, a significant environmental challenge for utility companies.

- Waste Management Focus: Responsible disposal and recycling of operational materials are central to FirstEnergy's environmental strategy.

- Resource Efficiency Goal: Aiming to recycle or beneficially reuse at least 50% of wood poles by 2025.

- Landfill Waste Reduction: This initiative directly contributes to decreasing the volume of waste sent to landfills.

- Sustainability Commitment: Demonstrates proactive engagement with environmental stewardship and circular economy principles.

Land Use and Biodiversity Impact

Large-scale infrastructure projects, such as transmission line construction and substation expansions, inherently impact land use and biodiversity. FirstEnergy's commitment to minimizing these effects is evident in its strategic approach to development. For instance, the Valley Link transmission project prioritizes the use of existing rights-of-way to reduce new land disturbance.

This focus on existing corridors helps mitigate habitat fragmentation and preserves ecological corridors. In 2024, FirstEnergy reported investing approximately $2.5 billion in transmission infrastructure upgrades, with environmental stewardship being a key consideration in project planning and execution.

- Land Use Minimization: Prioritizing existing rights-of-way for new transmission lines and facility expansions.

- Biodiversity Protection: Implementing measures to protect sensitive habitats and species during construction and operation.

- Investment in Upgrades: Approximately $2.5 billion allocated in 2024 for transmission infrastructure, with environmental impact assessments integral to these investments.

FirstEnergy is navigating a complex environmental landscape, driven by the global transition to a low-carbon economy and increasing regulatory scrutiny. Extreme weather events, exacerbated by climate change, directly challenge grid reliability, prompting significant investments in modernization and resilience. The company is also focusing on resource efficiency, aiming to reduce waste and minimize its ecological footprint.

FirstEnergy's commitment to sustainability is underscored by initiatives like Energize365, which received approximately $2.1 billion in investments in 2023 for grid modernization. A key goal is to recycle or beneficially reuse at least 50% of its wood poles by 2025, directly addressing landfill waste. Furthermore, in 2024, the company allocated around $2.5 billion to transmission infrastructure upgrades, with environmental considerations, such as minimizing land use and protecting biodiversity, integrated into project planning.

| Environmental Factor | FirstEnergy's Response/Initiative | Key Data/Target |

|---|---|---|

| Climate Change & Extreme Weather | Energize365 initiative for grid modernization and resilience | $2.1 billion invested in 2023 for grid modernization |

| Low-Carbon Economy Transition | Investing in grid modernization for renewable integration, pursuing solar ownership | Targeting carbon neutrality for Scope 1 emissions by 2050 |

| Waste Management & Resource Efficiency | Focus on responsible disposal and recycling of operational materials | Aim to recycle/reuse 50% of wood poles by 2025 |

| Land Use & Biodiversity | Prioritizing existing rights-of-way for infrastructure projects | Approx. $2.5 billion invested in transmission upgrades in 2024, with environmental impact assessments |

PESTLE Analysis Data Sources

Our FirstEnergy PESTLE Analysis is meticulously crafted using data from official government agencies, reputable industry associations, and leading financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the energy sector.