FirstEnergy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

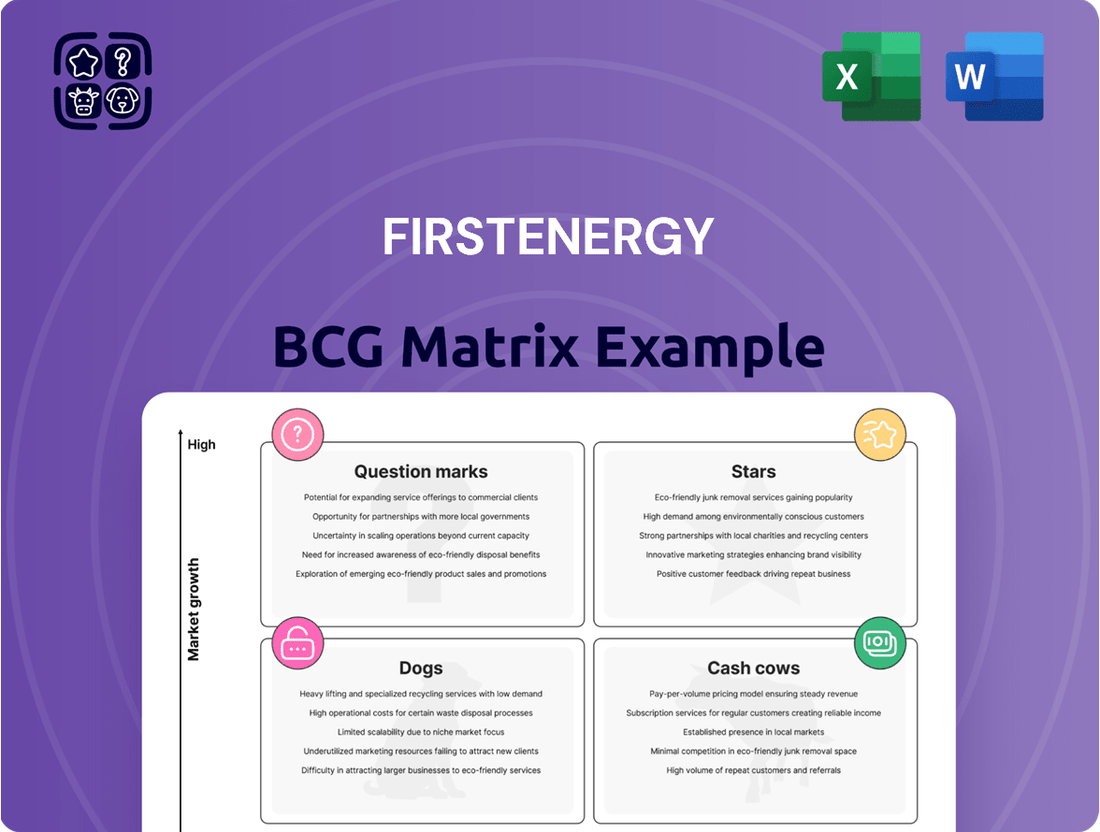

Curious about FirstEnergy's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings stack up in terms of market share and growth potential. Understand which segments are generating cash and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete FirstEnergy BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, equipping you with the insights needed for informed investment and resource allocation decisions.

Don't miss out on a detailed breakdown of FirstEnergy's market position. The full report provides actionable strategies and a clear roadmap to optimize their product portfolio for sustained success and competitive advantage.

Stars

FirstEnergy's Energize365 initiative positions its grid modernization and expansion efforts as a Star in its BCG Matrix. This program represents a significant commitment to upgrading infrastructure, aiming to boost reliability and security.

The company is channeling substantial capital into this endeavor, with plans to invest $28 billion through 2029. A notable portion, $5 billion, is earmarked for 2025 alone, underscoring the urgency and scale of these modernization projects.

These investments are designed to create a more intelligent and resilient grid, capable of meeting evolving energy demands and integrating new technologies. This forward-looking strategy is crucial for FirstEnergy's long-term growth and market position.

FirstEnergy's investment in transmission infrastructure development, exemplified by projects like the $3 billion Valley Link venture, positions it in a high-growth segment. This focus is critical for modernizing the grid, enabling the integration of renewable energy sources, and ensuring reliability for a growing customer base.

FirstEnergy is strategically leveraging the explosive growth in data center demand, boasting a contracted load pipeline of 2.6 gigawatts by 2029.

This aggressive expansion is exemplified by significant projects such as Meta's new data center in Toledo Edison territory, which is projected to contribute substantially to FirstEnergy's revenue.

This focus on data center infrastructure positions FirstEnergy favorably within a high-growth sector, promising consistent revenue streams and market leadership.

Strategic Partnerships for Clean Energy Integration

FirstEnergy actively pursues strategic partnerships to drive clean energy integration. Collaborations and joint proposals, like JCP&L's involvement in offshore wind farm connections in New Jersey, underscore this commitment. These efforts are crucial for meeting state clean energy mandates and positioning FirstEnergy for future growth in the dynamic energy sector.

These partnerships are more than just collaborations; they are vital for the practical implementation of clean energy projects. By working with developers and other stakeholders, FirstEnergy can leverage expertise and share risks, making complex projects like offshore wind connections more feasible. This approach not only supports environmental goals but also opens up new revenue streams and strengthens the company's market position.

- JCP&L's Offshore Wind Connection: FirstEnergy, through its subsidiary JCP&L, is a key partner in connecting offshore wind farms to the New Jersey grid.

- State Clean Energy Goals: These partnerships directly contribute to achieving ambitious clean energy targets set by states like New Jersey, which aims for significant renewable energy generation.

- Future Growth Avenues: Involvement in these projects positions FirstEnergy to benefit from the expanding renewable energy market, including transmission infrastructure development and grid modernization.

- Facilitating Integration: FirstEnergy's role is to provide the necessary grid infrastructure and expertise to seamlessly integrate intermittent renewable sources into the existing power system.

Advanced Smart Meter Deployment

FirstEnergy’s advanced smart meter deployment in Ohio represents a significant growth opportunity, aligning with its Grid Modernization II plan. This initiative aims to equip an additional 1.4 million customers with smart meter technology.

The benefits of this widespread smart meter adoption are multifaceted, enhancing grid efficiency and customer engagement. These devices are crucial for improving outage detection, ensuring accurate billing, and providing customers with greater insight and control over their energy consumption patterns.

- Grid Modernization II Plan: Ongoing deployment to 1.4 million Ohio customers.

- Enhanced Outage Management: Faster detection and restoration.

- Accurate Billing: Real-time data for precise energy charges.

- Customer Empowerment: Tools for better energy usage control.

FirstEnergy's strategic investments in grid modernization, data center expansion, and renewable energy integration clearly define its Stars. The Energize365 initiative, backed by a $28 billion investment through 2029, including $5 billion for 2025, highlights substantial capital allocation towards a more resilient and intelligent grid.

The company's aggressive pursuit of data center load, with a contracted pipeline of 2.6 gigawatts by 2029, and its critical role in connecting offshore wind farms, as seen with JCP&L in New Jersey, further solidify these areas as high-growth, high-investment opportunities.

The ongoing deployment of smart meters to 1.4 million Ohio customers under the Grid Modernization II plan also represents a key Star, enhancing operational efficiency and customer engagement.

FirstEnergy's commitment to transmission infrastructure, including the $3 billion Valley Link project, positions it to capitalize on the growing demand for reliable energy delivery and renewable energy integration.

| Initiative | Investment/Growth Area | Key Data/Facts | Strategic Importance |

|---|---|---|---|

| Energize365 | Grid Modernization & Expansion | $28 billion investment (through 2029), $5 billion in 2025 | Enhances reliability, security, and integrates new technologies |

| Data Center Expansion | High-Demand Sector Growth | 2.6 GW contracted load pipeline by 2029 | Secures consistent revenue streams and market leadership |

| Renewable Energy Integration | Offshore Wind Connections (JCP&L) | Partnerships to meet state clean energy mandates | Opens new revenue streams and strengthens market position |

| Smart Meter Deployment | Grid Modernization II Plan | 1.4 million Ohio customers targeted | Improves outage detection and customer energy control |

| Transmission Infrastructure | Modernizing Energy Delivery | $3 billion Valley Link project | Enables renewable integration and ensures reliability |

What is included in the product

This BCG Matrix overview analyzes FirstEnergy's business units, identifying which to invest in, hold, or divest based on market share and growth.

A clear, visual BCG Matrix helps FirstEnergy leadership quickly identify underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

FirstEnergy's regulated distribution operations are its bedrock, acting as reliable cash cows. These businesses, serving over six million customers across key states like Ohio, Pennsylvania, and New Jersey, operate in mature markets where the company holds a significant market share.

The essential nature of electricity distribution, coupled with regulated revenue streams, ensures a consistent and predictable cash flow for FirstEnergy. For instance, in 2023, FirstEnergy reported that its regulated utilities generated the vast majority of its earnings, highlighting the stability of these operations.

FirstEnergy's established transmission operations are a prime example of a cash cow within its business portfolio. The company boasts an extensive transmission system, spanning approximately 24,000 miles of lines, which forms the backbone of its reliable energy delivery.

These assets operate under FERC regulation, ensuring predictable revenue streams and consistent returns on investment. Significant past investments have bolstered this network, leading to stable growth in its rate base and solidifying its position as a dependable generator of cash flow for FirstEnergy.

FirstEnergy's Base Rate Case Orders and Formula Rate Programs function as significant cash cows, particularly through recent regulatory approvals. For instance, in Pennsylvania, West Virginia, and New Jersey, these mechanisms have resulted in net annual revenue increases, directly translating into real-time returns on capital expenditures.

A substantial portion of FirstEnergy's strategic investment plan, around 75%, is channeled through these recovery mechanisms. This focus ensures a stable and predictable generation of cash flow, a hallmark of a strong cash cow business segment.

Regulated Generation Assets (West Virginia)

FirstEnergy's regulated generation assets in West Virginia, totaling approximately 3,599 megawatts, represent a significant portion of its portfolio. These assets, which include coal, solar, and hydro facilities, are characterized by their stable, regulated revenue streams, a hallmark of the utility business model. The company's coal-fired plants, such as Fort Martin and Harrison, are key contributors to this predictable income, benefiting from cost recovery mechanisms inherent in regulated operations.

These assets are considered Cash Cows within the BCG Matrix framework due to their established market position and consistent cash generation. For instance, in 2024, regulated generation assets are expected to continue providing a substantial and reliable cash flow, underpinning FirstEnergy's overall financial stability. The predictable nature of their earnings allows for reinvestment in other business segments or shareholder returns.

- Asset Type: Regulated Coal, Solar, and Hydro

- Total Capacity: Approximately 3,599 MW

- Primary Location: West Virginia

- Key Benefit: Steady, predictable revenue stream from regulated utility model

Customer Base and Essential Service

FirstEnergy's utility operations are a classic example of a Cash Cow within the BCG Matrix. They serve millions of residential, commercial, and industrial customers, providing the essential service of electricity. This widespread and consistent demand is a key driver of their stability.

The necessity of electricity for everyday life creates a very stable and predictable revenue stream for FirstEnergy. This broad customer base, encompassing diverse sectors, ensures that demand remains robust, underpinning the strong cash flow generation from these utility assets.

- Millions of Customers: FirstEnergy serves over 6 million customers across its operating companies.

- Essential Service: Electricity is a non-discretionary utility, guaranteeing consistent demand.

- Stable Revenue: The regulated nature of utility operations provides predictable earnings and cash flow.

- Cash Generation: These factors combine to make the utility segment a significant generator of cash for the company.

FirstEnergy's regulated distribution and transmission segments are its core cash cows, generating consistent and predictable cash flow. These operations, serving millions of customers across multiple states, benefit from established market positions and regulatory frameworks that ensure stable returns. In 2023, FirstEnergy's regulated utilities were the primary drivers of its earnings, underscoring their role as dependable cash generators.

The company's transmission assets, spanning approximately 24,000 miles, operate under FERC regulation, providing predictable revenue streams. Significant prior investments have expanded the rate base, contributing to stable growth and solidifying these assets as consistent cash flow producers.

FirstEnergy's regulated generation facilities, especially those in West Virginia with a capacity of around 3,599 MW, also function as cash cows. These include coal, solar, and hydro plants, with coal facilities like Fort Martin and Harrison being key contributors to regulated income through cost recovery mechanisms. For 2024, these assets are projected to continue delivering substantial and reliable cash flow, bolstering FirstEnergy's financial health.

| Segment | Key Characteristic | Cash Flow Contribution | 2023/2024 Data Point |

| Regulated Distribution | Serves 6M+ customers, essential service | High, predictable | Majority of 2023 earnings |

| Regulated Transmission | 24,000 miles of lines, FERC regulated | Consistent, stable | Stable growth in rate base |

| Regulated Generation (WV) | 3,599 MW capacity (coal, solar, hydro) | Substantial, reliable | Projected strong cash flow in 2024 |

What You’re Viewing Is Included

FirstEnergy BCG Matrix

The FirstEnergy BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, is ready for immediate download and application within your business planning processes. You can confidently expect the same professional formatting and in-depth market evaluation that will empower your decision-making.

Dogs

FirstEnergy's aging infrastructure, notably in segments that have experienced repeated outages such as in Lakewood, Ohio, falls into the 'Dog' category of the BCG Matrix. These assets are characterized by low growth potential and demand substantial ongoing investment for maintenance. In 2023, FirstEnergy reported capital expenditures of $3.4 billion, with a significant portion allocated to grid modernization and reliability improvements, highlighting the ongoing costs associated with these older systems.

FirstEnergy's strategic shift towards a fully regulated utility model means its non-core or divested competitive generation assets are now classified as question marks or dogs in the BCG Matrix. These assets, no longer part of the company's primary operations, represent investments that have either been sold off or retired. For instance, the company completed the sale of its competitive generation fleet in 2023, a move that aligns with its stated strategy.

Underperforming legacy systems at FirstEnergy can be categorized as Dogs within the BCG Matrix. These are older operational models or technologies that are being phased out due to inefficiency or a lack of modern capabilities. For instance, the company's ongoing redesign of its operating model aims to boost accountability and streamline decision-making, directly addressing the obsolescence of less efficient, legacy structures.

Areas with Significant Regulatory Penalties and Fines

Areas with significant regulatory penalties and fines, such as those stemming from the Lakewood outages or past bribery investigations, act as cash drains for FirstEnergy. These issues consume valuable resources and management attention without generating proportionate returns, negatively impacting the company's financial health.

For instance, in 2023, FirstEnergy agreed to a $10 million settlement to resolve allegations of misleading investors regarding its role in a bribery scheme. This type of financial penalty directly impacts profitability and can deter future investment.

- Lakewood Outages: Past incidents have led to significant fines and require ongoing investment in infrastructure upgrades and compliance measures.

- Bribery Investigations: Settlements and legal costs associated with investigations drain financial resources.

- Environmental Compliance: Failure to meet environmental regulations can result in substantial fines and remediation expenses.

Initiatives with Limited Growth Potential and High Maintenance

Within FirstEnergy's portfolio, initiatives categorized as Dogs are those characterized by limited growth prospects coupled with significant ongoing operational demands. These often represent older, less efficient assets or smaller-scale projects that consume resources without contributing meaningfully to the company's future expansion or market position.

For instance, certain legacy power generation units or aging distribution infrastructure might fit this description. These assets require substantial capital for maintenance and upgrades to remain compliant and operational, yet their technological limitations or market saturation prevent significant revenue or market share growth. In 2023, FirstEnergy reported significant capital expenditures on maintaining its existing infrastructure, a portion of which would be allocated to these less productive assets.

- Legacy Infrastructure: Aging transmission lines or substations requiring frequent repairs and upgrades with minimal capacity for increased load.

- Underutilized Assets: Older power generation facilities with low efficiency and limited demand, incurring high operating and maintenance costs.

- Small-Scale, Non-Strategic Projects: Minor initiatives or pilot programs that have not demonstrated scalability or significant market impact.

FirstEnergy's legacy infrastructure, such as aging transmission lines and substations that require continuous repairs and upgrades without significant capacity for growth, are prime examples of Dogs in the BCG Matrix. These assets are costly to maintain and offer limited future returns. In 2023, the company's capital expenditures, totaling $3.4 billion, included substantial investments in maintaining these existing, less productive systems.

Underperforming legacy systems and non-core competitive generation assets, which have either been divested or retired as part of FirstEnergy's strategic shift to a fully regulated model, also fall into the Dog category. These assets consume resources without contributing to the company's core growth strategy. The sale of its competitive generation fleet in 2023 exemplifies this divestment approach.

Areas facing regulatory penalties, like those from past bribery investigations or compliance failures, act as significant cash drains. For instance, a 2023 settlement of $10 million for misleading investors highlights how these issues consume valuable financial resources and management attention, negatively impacting overall profitability and deterring new investments.

| Category | Description | FirstEnergy Examples | Financial Impact |

| Dogs | Low market share, low growth potential. Require significant investment to maintain but offer little return. | Aging transmission infrastructure, legacy generation units, divested competitive assets. | High maintenance costs, regulatory fines, cash drains, reduced profitability. |

Question Marks

FirstEnergy is actively evaluating energy storage, particularly battery storage, as a critical transmission asset and a component of distributed energy resources. This strategic assessment acknowledges the burgeoning market for these technologies.

While the energy storage sector is experiencing significant growth, FirstEnergy's current market share and profitability within this segment remain modest. This positions energy storage as a question mark within the BCG matrix, demanding substantial investment to unlock its future potential and competitive advantage.

FirstEnergy's new energy efficiency programs are designed to assist customers in lowering their electricity consumption and overall demand. These initiatives tap into a growing market focused on sustainable energy practices.

While these programs show promise in a developing market for sustainable energy, their direct contribution to FirstEnergy's revenue and market share is still in its early stages. Significant investment may be needed to expand their reach and impact, potentially positioning them as a question mark in the BCG matrix as their future growth trajectory is still being determined.

FirstEnergy's early-stage EV infrastructure programs, such as EV Driven in Maryland and New Jersey, are designed to foster electric vehicle adoption. These initiatives are crucial for building a presence in a rapidly expanding market where FirstEnergy's current share in charging infrastructure is likely nascent, requiring significant investment.

Uncertain Future of Remaining Coal-Fired Generation

FirstEnergy operates regulated coal plants, but the long-term viability of coal generation faces intense decarbonization pressures. While these plants are currently necessary for grid stability, their future is uncertain as the market shifts towards cleaner energy sources.

FirstEnergy's stated commitment to achieving carbon neutrality for Scope 1 emissions by 2050 places these coal assets in a precarious position. This commitment, coupled with the ongoing operation of these plants in the near term, designates their future as a Question Mark within the BCG matrix.

- Decarbonization Pressure: Global and national policies are increasingly targeting coal power, impacting its long-term economic and regulatory feasibility.

- FirstEnergy's Carbon Goals: The company's 2050 carbon neutrality target creates a clear conflict with continued reliance on coal generation.

- Near-Term Necessity vs. Long-Term Strategy: Balancing current energy needs with future sustainability goals makes the strategic direction for these assets a key question.

- Regulatory Environment: Evolving regulations and potential carbon pricing mechanisms could further challenge the profitability and operational lifespan of coal-fired generation.

Pilot Programs for Advanced Technologies (e.g., ADMS)

FirstEnergy's investment in pilot programs for advanced technologies like Advanced Distribution Management Systems (ADMS) falls into the question mark category of the BCG matrix. These initiatives are crucial for modernizing the grid and are considered high-growth areas within the utility sector. However, the company's current market share in terms of fully realized benefits from these early-stage deployments is low, necessitating ongoing strategic investment and scaling efforts.

The focus here is on the potential for future growth, acknowledging the current limited impact. For instance, while specific 2024 figures for FirstEnergy's ADMS market share are not publicly detailed, the broader utility industry saw significant investment in grid modernization. In 2023, for example, U.S. utilities were projected to spend billions on smart grid technologies, a trend expected to continue and accelerate through 2024 and beyond, indicating the strategic importance of these pilot programs for FirstEnergy's long-term competitive positioning.

- High Growth Potential: ADMS and smart grid technologies represent a rapidly expanding market segment for utilities.

- Low Current Market Share: Initial deployments and integration mean FirstEnergy has a limited realized market share in these advanced systems.

- Strategic Investment Required: Continued capital allocation is essential to scale these technologies and capture future market growth.

- Focus on Future Benefits: The question mark classification highlights the need to nurture these investments for future market leadership.

FirstEnergy's investment in energy storage, new energy efficiency programs, and early-stage EV infrastructure initiatives all represent potential growth areas. However, their current market share and profitability in these segments are still developing, requiring substantial investment to realize their full potential. This positions them as Question Marks in the BCG matrix, where their future success hinges on strategic capital allocation and market development.

| Initiative | BCG Category | Rationale | 2024 Outlook/Data Point |

| Energy Storage | Question Mark | Growing market, but FirstEnergy's current share and profitability are modest. Requires investment to build competitive advantage. | The U.S. energy storage market is projected to grow significantly, with utility-scale battery storage capacity expected to increase substantially through 2024 and beyond. |

| Energy Efficiency Programs | Question Mark | Developing market for sustainable practices; direct revenue contribution is early stage. Needs expansion for greater impact. | Customer demand for energy efficiency solutions continues to rise, driven by cost savings and environmental concerns. |

| EV Infrastructure Programs | Question Mark | Rapidly expanding market for EV charging; FirstEnergy's current share is nascent. Significant investment needed to establish a strong presence. | The adoption of electric vehicles is accelerating, leading to increased demand for charging infrastructure development. |

| Regulated Coal Plants | Question Mark | Facing decarbonization pressures and conflicting with FirstEnergy's carbon neutrality goals. Future viability is uncertain. | Regulatory bodies and market forces are increasingly pushing for the retirement of coal-fired power plants in favor of cleaner alternatives. |

BCG Matrix Data Sources

Our FirstEnergy BCG Matrix is built on verified market intelligence, combining financial data from SEC filings, industry research from leading energy analysts, and official company reports to ensure reliable, high-impact insights.