FirstEnergy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstEnergy Bundle

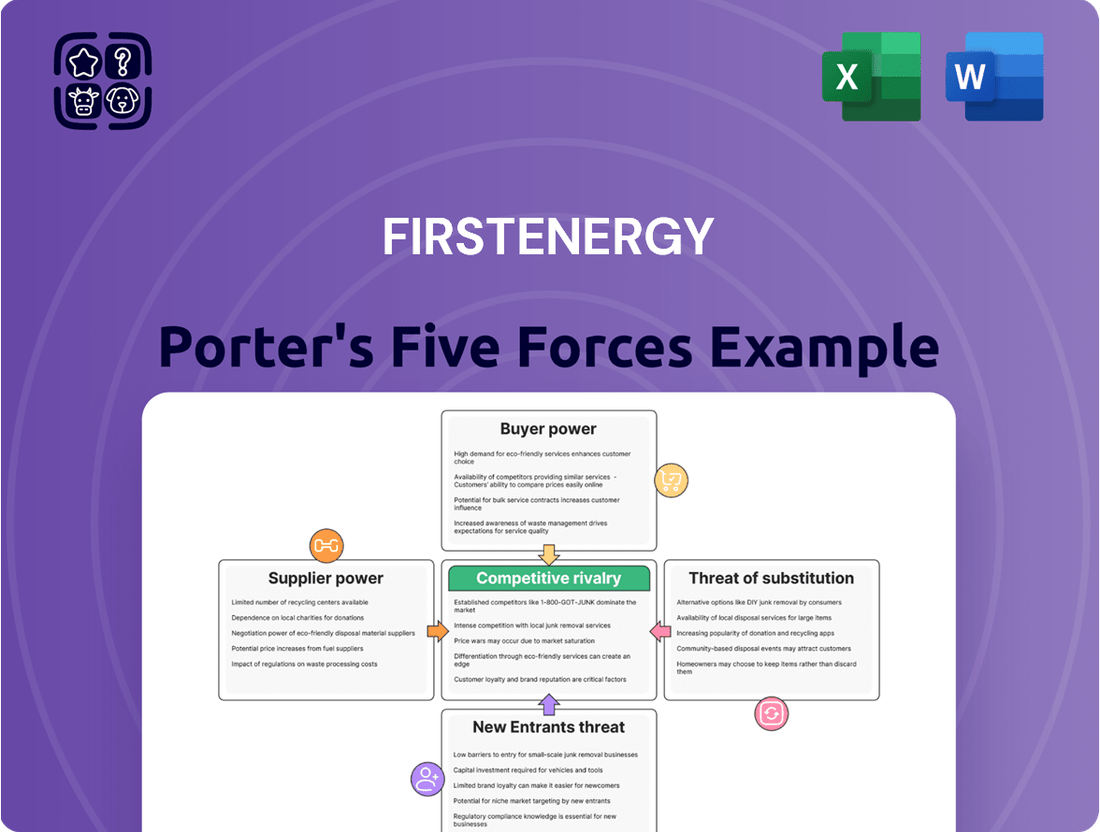

FirstEnergy navigates a complex utility landscape shaped by intense rivalry and significant buyer power. Understanding the threat of substitutes and the influence of suppliers is crucial for any strategic outlook. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FirstEnergy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

FirstEnergy, as a regulated utility, faces limited supplier power for its core energy inputs. The company's substantial purchasing volume for fuels like natural gas and coal, and increasingly renewable energy components, provides a degree of leverage. However, global market volatility for these commodities, as seen in the fluctuating natural gas prices throughout 2024, can still exert upward pressure on FirstEnergy's input costs.

FirstEnergy's substantial capital investment plans, like the $28 billion Energize365 program extending to 2029, highlight a critical dependence on suppliers for specialized equipment such as transformers and smart meters. This reliance on advanced grid technologies means suppliers of these essential components can wield significant bargaining power.

The proprietary nature of certain technologies used in grid modernization further strengthens the hand of these specialized providers. This can lead to less favorable pricing or terms for FirstEnergy, as alternative suppliers may not offer equivalent or readily available solutions.

Labor unions can significantly influence FirstEnergy's bargaining power as suppliers. In 2024, the utility sector, like many others, continues to grapple with the impact of unionized workforces. Collective bargaining agreements can dictate wages, benefits, and working conditions, directly affecting FirstEnergy's operational costs and its ability to adapt staffing levels or implement new work practices efficiently.

The demand for specialized skills within the utility industry further bolsters the bargaining power of the workforce. Managing complex grid infrastructure, integrating renewable energy sources, and navigating cybersecurity threats all require highly trained and certified personnel. This scarcity of specialized talent, particularly in areas like advanced grid operations and electrical engineering, grants skilled laborers considerable leverage when negotiating terms with employers like FirstEnergy.

Regulatory Influence on Supplier Costs

In a regulated utility like FirstEnergy, the power of suppliers is somewhat tempered by the ability to pass approved costs onto customers. This regulatory oversight means that while suppliers might try to increase prices, FirstEnergy’s ability to recoup those increases is subject to approval by regulatory bodies. For instance, in 2024, utilities often navigate complex rate case proceedings where the reasonableness of all operating expenses, including those from suppliers, is thoroughly examined.

However, this regulatory shield isn't absolute. Regulatory commissions actively scrutinize supplier contracts and pricing to ensure that FirstEnergy is not overpaying, thereby protecting consumers. This means that suppliers cannot simply dictate higher prices without justification, as regulators will analyze the necessity and market fairness of those costs.

- Regulatory Approval: FirstEnergy’s ability to pass supplier costs to customers is contingent on regulatory approval, limiting unchecked price increases.

- Cost Scrutiny: Regulatory bodies, such as Public Utility Commissions, meticulously review all operational expenses, including supplier invoices, to ensure they are prudent and reasonable.

- Rate Case Impact: In 2024, utilities like FirstEnergy faced ongoing rate case reviews where the justification of supplier-related costs was a key component in determining future customer rates.

Emerging Renewable Energy Supply Chains

FirstEnergy's reliance on renewable energy components, such as solar panels and wind turbines, is growing. This increasing dependence can shift bargaining power towards specialized suppliers in these expanding, yet sometimes constrained, supply chains. For instance, in 2024, global solar panel manufacturing capacity is projected to exceed demand, potentially softening supplier power in that segment, but critical battery storage components may still offer leverage to a few key providers.

- Increasing Demand for Renewables: FirstEnergy's strategic shift towards renewables means greater reliance on a new set of suppliers.

- Evolving Technology & Constraints: The rapid evolution of renewable technologies and potential supply chain bottlenecks can empower specialized suppliers.

- Market Dynamics: While the overall market is growing, concentrated manufacturing for specific components, like advanced battery chemistries, can give certain suppliers significant leverage in 2024.

FirstEnergy's bargaining power with suppliers is a mixed bag, influenced by its regulated status and evolving energy landscape. While its sheer size offers some leverage, the specialized nature of grid modernization equipment and the tight labor market for skilled utility workers grant significant power to certain suppliers and labor groups. The company's ongoing investments, such as the $28 billion Energize365 program, underscore this dependence.

The bargaining power of suppliers for FirstEnergy is moderately high, particularly for specialized grid modernization components and in the labor market. The company's reliance on advanced technologies, often with limited alternative providers, allows these suppliers to command better terms. Furthermore, the demand for skilled labor in areas like electrical engineering and cybersecurity, exacerbated by unionized workforces, strengthens the position of employees and their representatives.

| Supplier Type | Bargaining Power Factor | Impact on FirstEnergy | Example (2024) |

|---|---|---|---|

| Grid Modernization Equipment (Transformers, Smart Meters) | Proprietary technology, limited alternatives | High; can dictate pricing and terms | Suppliers of advanced substation automation systems |

| Renewable Energy Components (Solar Panels, Batteries) | Growing demand, supply chain concentration | Moderate to High; depends on specific component | Key battery storage manufacturers |

| Fuel Suppliers (Natural Gas, Coal) | Global commodity markets, purchasing volume | Moderate; subject to market volatility | Natural gas producers during periods of high demand |

| Skilled Labor (Engineers, Technicians) | Specialized skills, unionization | High; influences wages and working conditions | Unionized line workers negotiating new contracts |

What is included in the product

This analysis unpacks the competitive forces shaping FirstEnergy's operating environment, examining supplier power, buyer bargaining, new entrant threats, substitute service risks, and the intensity of rivalry within the utility sector.

Quickly identify and address the most significant competitive pressures impacting FirstEnergy's profitability and strategic options.

Customers Bargaining Power

Customers, from homes to businesses, rely heavily on electricity as a fundamental necessity, meaning they have very few viable alternatives for basic power provision. This inherent dependency, often characterized by inelastic demand, naturally curtails their individual ability to negotiate terms with FirstEnergy.

FirstEnergy's rates are under the watchful eye of state public utility commissions. These commissions act on behalf of customers, striving to keep services affordable while allowing the company to remain profitable. This oversight significantly limits FirstEnergy's power to raise prices without justification and offers a direct avenue for customer feedback and complaints.

Customers of FirstEnergy generally face a limited choice for electricity distribution and transmission within their service areas. This lack of alternative providers creates a natural monopoly for FirstEnergy, significantly diminishing the bargaining power of individual customers. In 2024, FirstEnergy served approximately 6 million customers across its regulated utility operations.

Increasing Customer Awareness and Demand for Modernization

While individual residential customers typically hold minimal sway, their collective voice, amplified by growing awareness of grid modernization, clean energy alternatives, and smart home integration, can significantly impact regulatory policy and utility investment priorities. This heightened customer consciousness translates into a tangible bargaining force.

FirstEnergy's strategic initiatives, such as the ongoing 'Energize365' program which includes the widespread deployment of smart meters, directly address these evolving customer expectations for enhanced reliability and advanced energy management capabilities. This program represents a proactive adaptation to customer demand.

- Smart Meter Deployment: As of early 2024, FirstEnergy has been actively installing smart meters across its service territories, enabling more granular data for customers and improved grid management for the utility.

- Customer Engagement: The company actively engages with customers on topics like grid reliability improvements and the integration of renewable energy sources, reflecting a response to increased customer interest and demand for cleaner options.

- Regulatory Influence: Collective customer advocacy on issues like rate structures and service quality can influence Public Utility Commission decisions, indirectly impacting FirstEnergy's operational and investment strategies.

Potential for Distributed Generation and Energy Efficiency

Customers' ability to generate their own power or use energy more efficiently can shift their bargaining power. For instance, if a significant portion of FirstEnergy's customer base adopts rooftop solar, their demand for utility-supplied electricity decreases. This can lead to a slight reduction in FirstEnergy's revenue per customer, giving those customers more leverage.

The increasing accessibility of distributed generation technologies, like solar panels, directly impacts customer reliance on traditional utilities. By 2024, the U.S. solar market continued its growth trajectory, with residential solar installations remaining a key driver. This trend empowers customers to become more independent energy producers, thereby influencing their relationship with providers like FirstEnergy.

- Distributed Generation Adoption: As more homes and businesses install solar panels, their dependence on FirstEnergy for electricity diminishes.

- Energy Efficiency Measures: Investments in energy-saving appliances and building insulation reduce overall electricity consumption, lessening the impact of utility pricing on customers.

- Customer Leverage: The potential for self-generation and reduced consumption gives customers a degree of indirect bargaining power, as they can opt for alternatives to utility-provided power.

While FirstEnergy's regulated status and the essential nature of electricity limit individual customer bargaining power, collective action and the rise of distributed generation are increasing customer leverage. The company's proactive smart meter deployment and customer engagement initiatives in 2024 reflect an adaptation to these evolving dynamics. This growing customer consciousness, coupled with regulatory oversight, shapes FirstEnergy's pricing and service strategies.

| Factor | Impact on FirstEnergy | Supporting Data (2024) |

| Limited Alternatives | Low bargaining power for individual customers due to essential service. | FirstEnergy served ~6 million customers across regulated utilities. |

| Regulatory Oversight | Public Utility Commissions limit pricing power and provide customer advocacy. | State-level PUCs set rates and approve major capital investments. |

| Distributed Generation | Increasing customer leverage through self-generation (e.g., solar). | Continued growth in U.S. residential solar installations. |

| Customer Engagement | Growing customer awareness influences utility investment and policy. | FirstEnergy's 'Energize365' program includes smart meter rollout. |

What You See Is What You Get

FirstEnergy Porter's Five Forces Analysis

This preview showcases the complete FirstEnergy Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or missing sections. You can trust that this professionally formatted analysis is ready for your immediate use and application.

Rivalry Among Competitors

FirstEnergy's regulated utility model grants it exclusive rights for electricity transmission and distribution across its vast service territories, spanning Ohio, Pennsylvania, and New Jersey. This inherent geographic monopoly in infrastructure severely curtails direct competition in these crucial segments of the energy value chain.

While FirstEnergy primarily operates as a regulated utility, historically, some segments of the electricity generation market have been open to competition from independent power producers. This means that in those specific, deregulated areas, FirstEnergy might face rivals who generate power. However, the company's current strategic direction emphasizes regulated transmission and distribution, which inherently limits direct competition in generation.

FirstEnergy faces indirect competition from alternative energy sources. For instance, natural gas remains a significant competitor in the heating market, impacting electricity demand. In 2024, residential natural gas prices saw fluctuations, influencing consumer choices for heating solutions.

Furthermore, the rise of self-generation technologies, such as rooftop solar panels, directly reduces the need for electricity purchased from utilities like FirstEnergy. This trend is accelerating, with solar installations continuing to grow year-over-year, particularly in residential and commercial sectors, thereby diminishing the utility's customer base and revenue potential.

Regulatory Environment and Rate Cases

The intense competition among utilities like FirstEnergy is significantly influenced by the regulatory landscape. State public utility commissions hold considerable power, approving rate cases and crucial investment plans that dictate how companies can recover costs and fund essential system upgrades.

This regulatory dependency creates a unique competitive dynamic. Utilities actively vie for regulatory approval, seeking favorable outcomes that enable them to invest in modernization and maintain reliable service, which directly impacts their financial health and competitive standing.

- Regulatory Approval Dependency: Utilities compete to secure approvals for rate increases and capital investment plans from state commissions, directly impacting their ability to fund infrastructure improvements and recover costs.

- Rate Case Outcomes: The success or failure in rate cases can significantly alter a utility's financial performance and competitive position relative to peers.

- Investment Plan Competition: Companies present competing proposals for system upgrades and modernization, seeking regulatory endorsement for their strategic vision and cost recovery mechanisms.

Focus on Reliability and Customer Service

In the utility sector, particularly within regulated markets like FirstEnergy's, direct competition is often constrained. Consequently, the rivalry among established players intensifies around operational excellence. This means focusing heavily on delivering reliable power, providing exceptional customer service, and investing in modernizing the grid infrastructure. These efforts are crucial not only for customer satisfaction but also for meeting stringent regulatory requirements and maintaining public confidence.

Recent events underscore the critical nature of these competitive factors. For instance, outages experienced in Lakewood serve as a stark reminder of the scrutiny FirstEnergy faces regarding its reliability. Such incidents can directly impact customer perception and regulatory oversight, making consistent, dependable service a key differentiator.

- Reliability Metrics: FirstEnergy reported an SAIDI (System Average Interruption Duration Index) of 1.2 hours in 2023, aiming to reduce this by 5% by 2025 through grid investments.

- Customer Satisfaction Scores: In 2023, FirstEnergy's customer satisfaction surveys showed an average rating of 7.5 out of 10, with a strategic goal to improve this to 8.0 by the end of 2024.

- Grid Modernization Investment: The company allocated $800 million in 2024 towards grid modernization projects, including smart meter deployment and substation upgrades, to enhance service reliability and efficiency.

FirstEnergy's competitive rivalry is primarily shaped by its regulated operational environment, where direct competition is limited due to exclusive service territories. Rivalry intensifies through efforts to secure favorable regulatory approvals for rate increases and capital investments, influencing financial health and competitive positioning.

The focus is on operational excellence, including grid modernization and customer service, to differentiate from peers and meet regulatory demands. For example, FirstEnergy's 2024 grid modernization investment of $800 million aims to improve reliability, a key competitive factor.

Reliability metrics, such as the 2023 SAIDI of 1.2 hours, and customer satisfaction scores, with a 2023 average of 7.5 out of 10, are crucial battlegrounds. Improving these metrics is essential for maintaining customer loyalty and regulatory favor.

Indirect competition from distributed generation, like rooftop solar, also pressures utilities. This trend, growing year-over-year, forces companies like FirstEnergy to adapt and invest in smart grid technologies to retain customers.

| Competitive Factor | FirstEnergy's 2023/2024 Data | Impact on Rivalry |

| Grid Modernization Investment | $800 million in 2024 | Enhances reliability, a key differentiator |

| SAIDI (System Average Interruption Duration Index) | 1.2 hours in 2023 | Drives focus on operational excellence |

| Customer Satisfaction Score | 7.5/10 in 2023 | Highlights importance of service quality |

SSubstitutes Threaten

The threat of substitutes for FirstEnergy is significant, primarily stemming from advancements in energy efficiency and conservation. These measures directly reduce the demand for electricity, impacting the company's sales volumes. For instance, widespread adoption of smart home technology and enhanced building insulation can lead to a considerable decrease in the amount of power customers need to purchase.

In 2024, the drive for energy savings continues to accelerate. Many utilities, including those served by FirstEnergy, are actively promoting demand-side management programs. These programs incentivize customers to adopt more efficient appliances and behaviors, directly substituting away from traditional electricity consumption. The increasing availability and affordability of these technologies pose a persistent challenge to maintaining consistent sales growth.

The growing trend of customer-sited renewable generation, particularly rooftop solar, poses a significant threat of substitution for FirstEnergy. As more customers install solar panels, they reduce their demand for electricity purchased from the utility, directly impacting FirstEnergy's revenue streams. In 2023, the U.S. saw a record 6.4 gigawatts of new solar capacity installed, with residential solar leading the charge, indicating a substantial and ongoing shift.

The threat of substitutes for electric heating and cooling is a significant factor for FirstEnergy. Alternatives like natural gas, propane, and fuel oil are readily available in many regions and can be more cost-effective, directly impacting electricity demand for these essential services. For instance, in 2024, regions with robust natural gas infrastructure often see lower residential electricity consumption for heating compared to areas reliant solely on electricity.

Technological Advancements in Energy Storage

Technological advancements in energy storage present a significant threat of substitutes for FirstEnergy. Innovations in battery technology, particularly at the utility scale and for individual consumers, are making energy independence more attainable. This reduces the necessity for traditional grid-supplied electricity, a core offering of FirstEnergy.

By 2024, the global energy storage market is projected to see substantial growth, with battery storage technologies leading the charge. For instance, advancements in lithium-ion and emerging solid-state batteries are driving down costs and increasing efficiency. This trend is expected to continue, making distributed energy resources and microgrids more economically viable alternatives to centralized power generation.

The increasing adoption of rooftop solar coupled with battery storage systems empowers individual customers to generate and store their own power. This directly competes with the electricity FirstEnergy provides. As these technologies become more affordable and accessible, the reliance on utility-provided power diminishes, creating a tangible substitute threat.

- Falling Battery Costs: The cost of lithium-ion battery packs for energy storage has seen a dramatic decline, falling by over 90% in the decade leading up to 2023.

- Utility-Scale Deployments: Major utilities are increasingly investing in large-scale battery storage projects to manage grid stability and integrate renewable energy sources, signaling a shift in the energy landscape.

- Residential Adoption: In 2023, residential solar plus storage installations saw continued strong growth, with many homeowners seeking to reduce their electricity bills and increase resilience.

- Emerging Technologies: Research and development into next-generation storage solutions, such as flow batteries and advanced solid-state batteries, promise even greater cost reductions and performance improvements in the coming years.

Fuel Switching by Industrial and Commercial Customers

Large industrial and commercial clients of FirstEnergy possess the capability to switch to alternative energy sources or even self-generate electricity. This threat is particularly pronounced if electricity prices rise significantly or if service reliability falters.

For instance, in 2023, industrial customers accounted for approximately 30% of FirstEnergy’s total retail electricity sales. These large consumers often have the capital and technical expertise to explore options like on-site solar installations or backup generators fueled by natural gas, especially when faced with escalating operational costs.

- Fuel Switching Potential: Industrial and commercial customers can opt for natural gas, coal, or renewable sources if electricity becomes too expensive.

- Self-Generation: Businesses might invest in on-site power generation to ensure a stable supply and potentially lower costs.

- Price Sensitivity: A significant portion of these customers' operating budgets is tied to energy expenses, making them highly responsive to price fluctuations.

- Reliability Concerns: Any perceived decrease in the reliability of the grid could accelerate the adoption of backup or alternative power solutions.

The threat of substitutes for FirstEnergy is multifaceted, encompassing energy efficiency, distributed generation, and alternative fuels. As energy efficiency technologies improve and become more accessible, customer demand for grid-supplied electricity naturally decreases. This trend is amplified by government incentives and growing consumer awareness regarding energy conservation.

In 2024, the continued growth of rooftop solar installations, often paired with battery storage, represents a direct substitute for traditional utility services. These distributed energy resources allow consumers to generate and store their own power, reducing reliance on FirstEnergy. The U.S. residential solar market alone added a significant capacity in recent years, demonstrating this ongoing shift.

Furthermore, alternative energy sources like natural gas continue to pose a substitution threat, particularly for heating and cooling needs. The availability and cost-effectiveness of these fuels in certain regions can divert demand away from electricity. Industrial and commercial customers, who represent a substantial portion of FirstEnergy's revenue, are particularly adept at exploring and adopting these alternative energy solutions to manage costs and ensure reliability.

| Substitute Category | Key Drivers | Impact on FirstEnergy | 2024 Data/Trend |

|---|---|---|---|

| Energy Efficiency & Conservation | Smart home tech, building insulation, demand-side management programs | Reduced electricity consumption, lower sales volumes | Accelerated adoption of efficiency measures by utilities and consumers |

| Distributed Generation (Solar + Storage) | Falling battery costs, residential solar growth, microgrids | Decreased reliance on grid power, revenue erosion | Record residential solar installations continue; battery costs declining over 90% since 2013 |

| Alternative Fuels (Natural Gas, Propane) | Cost-effectiveness for heating/cooling, existing infrastructure | Lower electricity demand for specific applications | Regions with strong natural gas infrastructure show lower residential electricity use for heating |

| Industrial/Commercial Self-Generation | On-site solar, backup generators, price sensitivity | Loss of large customer load, revenue impact | Industrial customers accounted for ~30% of FirstEnergy's retail sales in 2023, with potential to switch |

Entrants Threaten

The electric utility sector, especially in transmission and distribution, demands substantial capital for building and maintaining essential infrastructure. This high cost acts as a significant deterrent for any new companies looking to enter the market. For instance, FirstEnergy has outlined a substantial capital investment plan of $28 billion through 2029, underscoring the immense financial commitment required.

The electric utility sector is deeply entrenched in a web of regulations, demanding strict adherence to licensing, environmental, and safety standards. This highly regulated environment acts as a significant deterrent for potential new entrants, making it exceptionally difficult to establish a foothold.

Gaining the necessary approvals from both state and federal regulatory bodies is a protracted and intricate undertaking. For instance, in 2024, the average time for obtaining a major utility construction permit could extend over several years, involving extensive environmental impact studies and public hearings, adding substantial cost and uncertainty.

FirstEnergy's significant advantage lies in its deeply entrenched grid infrastructure, spanning Ohio, Pennsylvania, and New Jersey. Replicating this vast network, which includes thousands of miles of transmission and distribution lines, represents an immense capital undertaking for any potential new competitor. This established infrastructure alone acts as a formidable barrier.

Furthermore, FirstEnergy benefits from powerful network effects. As more customers connect to its grid, the value of that grid increases for all users, creating a self-reinforcing cycle of customer loyalty and operational efficiency. In 2023, FirstEnergy served approximately 6 million customers, a testament to its extensive reach and the inherent value of its established network.

Economies of Scale and Scope

FirstEnergy's vast operational footprint, serving millions across multiple states, creates substantial economies of scale. This means the company can spread its high fixed costs, like maintaining extensive transmission and distribution networks, over a larger customer base, leading to lower per-unit costs. For instance, in 2023, FirstEnergy reported revenues of $11.7 billion, underscoring its significant market presence.

These economies of scale present a formidable barrier to entry for potential competitors. New entrants would struggle to match FirstEnergy's cost efficiency in areas such as power generation, grid management, and customer service, making it difficult to offer competitive pricing. The capital required to build comparable infrastructure is immense, further deterring new players.

Furthermore, economies of scope allow FirstEnergy to leverage its existing infrastructure and expertise across different business segments, such as regulated utility operations and competitive generation. This diversification enables cost synergies and a broader service offering, which new, more specialized entrants would find hard to replicate. The company's integrated approach, from generation to delivery, solidifies its cost advantage.

- Economies of Scale: FirstEnergy's large customer base and extensive infrastructure allow for lower per-unit operating costs in generation, transmission, and distribution.

- Economies of Scope: Diversification across different energy segments enables cost synergies and a wider service portfolio, creating a competitive edge.

- Capital Investment Barrier: The immense capital required to build competing infrastructure makes it prohibitively expensive for new entrants.

- Cost Efficiency: FirstEnergy's scale allows it to negotiate better terms with suppliers and operate more efficiently, translating to cost advantages over smaller rivals.

Public Service Obligation and Reliability Expectations

The threat of new entrants into the electric utility sector, specifically for a company like FirstEnergy, is significantly mitigated by the inherent public service obligation and the stringent reliability expectations placed upon such entities. New players would need to demonstrate an immediate and unwavering commitment to maintaining consistent power delivery, a benchmark established and refined by incumbent utilities over many years. This high bar for operational excellence presents a substantial barrier.

New entrants face immense pressure to immediately meet these high reliability standards, often built over decades by incumbent utilities. For instance, in 2024, major utility companies like FirstEnergy consistently aim for reliability metrics such as System Average Interruption Duration Index (SAIDI) and System Average Interruption Frequency Index (SAIFI) that are measured in minutes and occurrences per customer per year, respectively. Achieving these levels requires massive, long-term investment in infrastructure and sophisticated grid management systems.

- Public Service Obligation: Electric utilities are legally mandated to provide continuous and reliable service to all customers within their service territory, regardless of profitability of individual customer segments.

- Reliability Standards: New entrants must meet or exceed established reliability benchmarks, often dictated by regulatory bodies, which require substantial upfront investment in resilient infrastructure.

- Capital Intensity: Building out a new, reliable electric grid comparable to those of established players like FirstEnergy involves billions of dollars in capital expenditure for generation, transmission, and distribution assets.

- Regulatory Hurdles: Obtaining the necessary permits, licenses, and approvals to operate as a utility is a complex and time-consuming process, further deterring potential new entrants.

The threat of new entrants for FirstEnergy is considerably low due to immense capital requirements, stringent regulatory hurdles, and established infrastructure. The electric utility sector demands billions in investment for grid development and maintenance, a cost that new companies find difficult to absorb. For example, FirstEnergy's planned capital expenditures through 2029 total $28 billion, highlighting the scale of investment needed.

Existing regulatory frameworks and the need to meet high reliability standards further deter new players. Obtaining necessary permits can take years, and replicating FirstEnergy's extensive network, serving millions across multiple states, is an enormous undertaking. In 2023, FirstEnergy reported revenues of $11.7 billion, showcasing its significant market presence and economies of scale that new entrants would struggle to match.

| Barrier Type | Description | Example Metric/Data |

| Capital Investment | Extremely high costs to build and maintain utility infrastructure. | FirstEnergy's $28 billion capital plan through 2029. |

| Regulatory Hurdles | Complex and lengthy approval processes for licensing and operations. | Permit acquisition can take several years in 2024. |

| Infrastructure Scale | Vast, established transmission and distribution networks. | FirstEnergy serves approximately 6 million customers. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | FirstEnergy's 2023 revenue of $11.7 billion. |

Porter's Five Forces Analysis Data Sources

Our FirstEnergy Porter's Five Forces analysis is built upon a foundation of publicly available information, including FirstEnergy's annual reports (10-K filings), investor presentations, and regulatory filings with the SEC. We also incorporate industry-specific data from reputable sources like the Edison Electric Institute and energy market research reports to provide a comprehensive view of the competitive landscape.