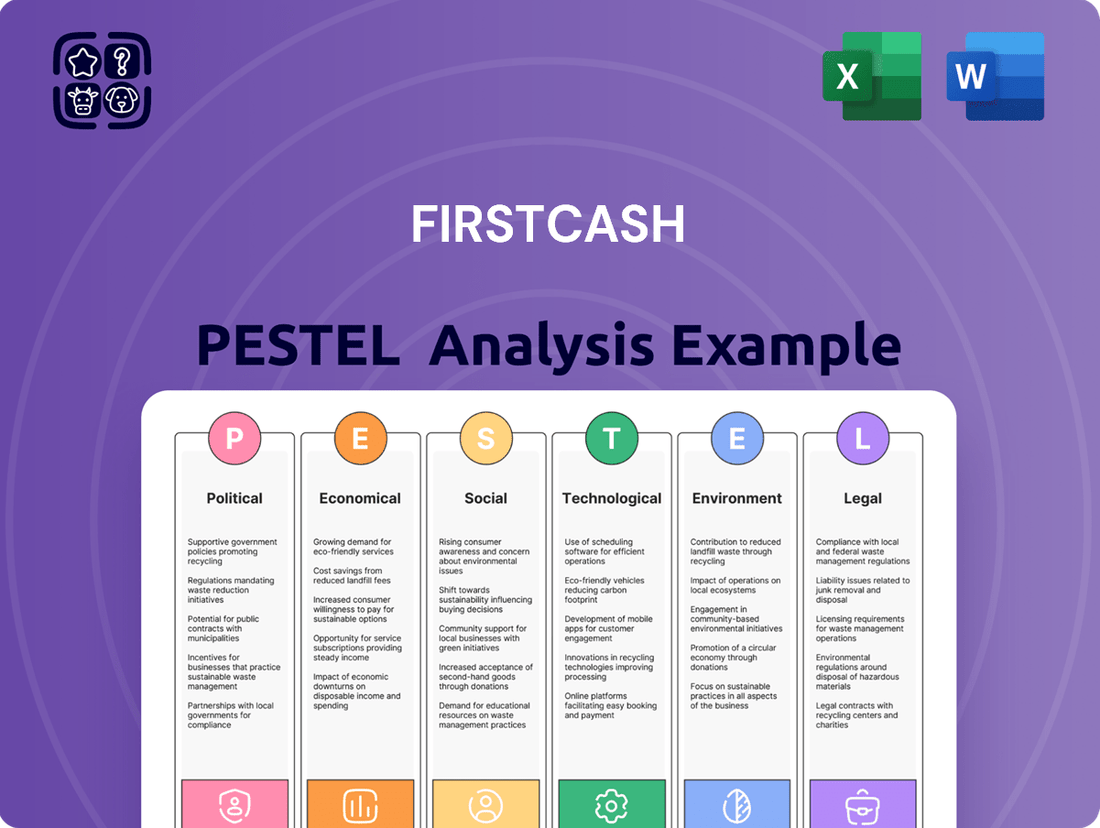

FirstCash PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping FirstCash's future. This comprehensive PESTLE analysis provides a deep dive into the external forces impacting the company's operations and strategic direction. Gain a competitive edge by understanding these crucial market dynamics and anticipating potential challenges and opportunities.

Arm yourself with actionable intelligence to make informed decisions. Our expertly crafted PESTLE analysis is designed for investors, strategists, and business leaders seeking a clear understanding of the broader market landscape. Don't miss out on vital insights that could redefine your approach to the pawn and lending industry.

Ready to elevate your strategic planning? Download the full PESTLE analysis of FirstCash today and unlock a wealth of data-driven insights. Equip yourself with the knowledge needed to navigate complex external environments and drive sustainable growth.

Political factors

FirstCash navigates a highly regulated landscape, subject to extensive federal, state, and local laws. In the U.S., agencies like the Consumer Financial Protection Bureau (CFPB) maintain significant oversight, with 2024 enforcement actions continuing to target consumer lending practices. Shifts in government or political stability across its Latin American markets, such as Mexico where it has over 1,500 stores, could introduce new compliance challenges. Regulatory adjustments, like potential changes to interest rate caps or licensing requirements in 2025, could also increase operational costs and impact profitability.

Governments in the U.S. and Latin America hold the power to impose caps on interest rates and fees for pawn loans and other consumer finance products, directly impacting FirstCash's profitability. For instance, some states in the U.S. already enforce varying rate limits, while countries like Mexico have seen discussions around stricter consumer lending oversight. This regulatory environment creates uncertainty for FirstCash's revenue streams, as potential legislative changes in 2024-2025 could compress margins on its core lending operations. The political climate significantly influences the likelihood and severity of such regulations.

FirstCash faces notable risks from international relations and trade policies, especially given its extensive Latin American operations, including over 1,300 stores in Mexico as of early 2024. Political tensions or shifts in trade agreements, like potential re-negotiations of the USMCA, can significantly impact currency exchange rates. For instance, the Mexican peso's volatility in 2024, influenced by geopolitical sentiment, directly affects the dollar value of FirstCash's international earnings. Such changes also influence the economic stability and disposable income of its customer base in these markets, potentially impacting demand for financial services.

Consumer Protection Legislation

Consumer protection legislation remains a significant political factor for FirstCash, given its focus on underserved communities. Ongoing legislative efforts, particularly in 2024 and 2025, aim to increase transparency in lending and strengthen debt collection practices. This continuous scrutiny can lead to higher compliance costs and necessitate operational adjustments for companies like FirstCash, impacting profitability. For instance, the Military Lending Act (MLA) already caps interest rates for service members, directly affecting eligible loan products.

- Regulatory shifts in 2024-2025 could introduce new caps on fees or interest rates, similar to the MLA's 36% APR limit for military personnel.

- Increased enforcement by agencies like the CFPB, which issued $1.4 billion in consumer relief in 2023, signals a strict regulatory environment.

- New disclosure requirements might increase operational complexity and compliance expenses for FirstCash's diverse product offerings.

Political Stability in Latin American Markets

FirstCash's significant growth trajectory hinges on its expansion in Latin American markets, particularly Mexico, Guatemala, Colombia, and El Salvador. Political instability, including shifts in government policy and social unrest, presents a notable challenge. For instance, Mexico's 2024 presidential election introduces potential regulatory changes that could impact financial services. These factors can disrupt store operations and consumer confidence, directly affecting revenue and asset safety in FirstCash's over 1,700 Latin American locations.

- Mexico's 2024 political landscape could influence consumer lending regulations.

- Guatemala and El Salvador face ongoing security concerns impacting business continuity.

- Colombia's social dynamics continue to shape the operating environment for financial services.

FirstCash faces significant political risks from evolving regulations, including potential new interest rate caps and increased enforcement by agencies like the CFPB in 2024-2025. Political instability and elections in key Latin American markets, such as Mexico's 2024 presidential election, could lead to adverse policy shifts. International trade policies and currency volatility, exemplified by the Mexican peso in 2024, also directly impact foreign earnings. These factors collectively threaten operational costs and profitability across its 2,800+ global locations.

| Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| Regulatory Risk | Compliance costs, profit margins | CFPB enforcement continues; potential 2025 rate caps |

| Political Stability | Operational disruption, policy changes | Mexico's 2024 election; ongoing unrest in Guatemala |

| Trade Policy | Currency volatility, economic stability | Mexican peso volatility in 2024 due to geopolitical sentiment |

What is included in the product

This PESTLE analysis provides a comprehensive review of the external macro-environmental factors impacting FirstCash, examining Political, Economic, Social, Technological, Environmental, and Legal influences to inform strategic decision-making.

A concise PESTLE analysis for FirstCash offers a clear understanding of external factors, effectively relieving the pain point of navigating complex market dynamics during strategic planning.

By presenting FirstCash's PESTLE factors in an easily digestible format, this analysis serves as a powerful tool to quickly identify and address potential market challenges, thereby alleviating the burden of extensive research.

Economic factors

Inflationary pressures, with the US CPI rising to 3.3% year-over-year in May 2024, create a dual effect for FirstCash. While rising costs for essentials strain lower-income consumers, increasing demand for pawn loans, it also curtails discretionary spending, impacting the retail sales of merchandise. FirstCash's business model is often counter-cyclical, thriving as traditional credit access tightens for consumers, evident in their Q1 2024 pawn loan balances growing to $1.2 billion.

Changes in benchmark interest rates, such as the Federal Funds Rate currently targeted between 5.25-5.50% by early 2025, directly impact FirstCash's cost of capital and its ability to borrow for operations. While pawn loan rates are often capped by state statutes, broader economic rate trends influence the financial stability of FirstCash customers, affecting their need for short-term credit. Economic forecasts for 2025 suggest potential rate reductions, possibly seeing the Fed Funds rate decline, which could spur increased lending demand and improve FirstCash's financing terms. Lower rates typically encourage consumer spending and borrowing, potentially benefiting FirstCash's various lending segments.

The employment landscape directly impacts FirstCash’s target demographic, with the US unemployment rate holding around 3.9% in early 2024. Despite a generally robust job market, sustained inflation, hovering near 3.5% annually in Q1 2024, can still pressure household budgets. While median wage growth, at approximately 4.2% annualized in early 2024, might reduce the need for short-term credit, economic volatility can increase the demand for pawn services. Therefore, any future increase in unemployment or significant real wage stagnation would likely drive higher pawn loan volumes.

Precious Metals and Commodity Prices

The price of gold and other precious metals significantly impacts FirstCash's pawn operations. Higher gold prices, exceeding 2,300 USD per ounce in mid-2024, directly increase the value of a major collateral category, allowing for larger loan amounts. This also boosts retail margins on forfeited jewelry, enhancing profitability. Such elevated commodity values provide a strong hedge against broader economic uncertainties, stabilizing revenue streams.

- Gold prices surpassed 2,300 USD per ounce in May 2024, influencing collateral values.

- Higher precious metal prices directly increase loan sizes and retail margins for FirstCash.

Performance of the Retail Sector

The health of the broader retail sector significantly impacts FirstCash, especially for partners within its American First Finance (AFF) segment. Bankruptcies or poor performance among retail partners, particularly in the furniture vertical, can directly constrain revenue and growth for their point-of-sale payment solutions. FirstCash's outlook for 2025 reflects a strategic effort to diversify the AFF segment beyond furniture, aiming to mitigate risks from sector-specific downturns. For instance, while US retail sales showed a modest 0.1% increase in April 2024, furniture and home furnishings sales specifically decreased by 0.5% in the same period, highlighting the need for diversification.

- US retail sales increased by a modest 0.1% in April 2024, indicating a cautious consumer spending environment.

- Furniture and home furnishings store sales saw a 0.5% decrease in April 2024, affecting key AFF partners.

- FirstCash aims to diversify AFF's merchant base beyond furniture in 2025 to reduce reliance on specific retail segments.

Overall economic growth, with US GDP expanding 1.3% annualized in Q1 2024, directly influences consumer financial stability. Slower growth or recession risks, as some forecasts suggest for late 2024 or early 2025, could increase demand for FirstCash's short-term lending products. Conversely, sustained economic expansion reduces reliance on alternative credit, impacting loan volumes. FirstCash's counter-cyclical model often sees increased activity during economic contractions, reflecting heightened consumer need for liquidity.

| Economic Indicator | Q1 2024 Data | 2025 Outlook |

|---|---|---|

| US GDP Growth | 1.3% (Annualized) | 1.5-2.0% (Projected) |

| Consumer Spending | Modest increase | Dependent on inflation/wages |

| Demand for Pawn Loans | Increased with inflation | Potentially higher if GDP slows |

What You See Is What You Get

FirstCash PESTLE Analysis

This is the exact, finished FirstCash PESTLE Analysis you’ll own after checkout.

The content and structure shown in the preview is the same document you’ll download after payment.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a comprehensive look at the external factors impacting FirstCash.

No placeholders, no teasers—this is the real, ready-to-use FirstCash PESTLE Analysis you’ll get upon purchase, providing actionable insights.

Sociological factors

FirstCash plays a crucial role for millions of underbanked individuals who lack access to traditional financial services. This demographic, often needing immediate cash, relies on pawn shops, making FirstCash a vital community financial resource. As of late 2023, while global unbanked figures have improved, a significant portion of the adult population, still exceeding 1.4 billion, remains without a bank account. This highlights a sustained and substantial customer base for FirstCash, particularly in emerging markets where financial inclusion remains a key challenge.

Consumer attitudes are shifting, with a notable increase in preference for secondhand retail driven by value consciousness and sustainability. This trend is highly beneficial for FirstCash, as it stands as one of the largest global resellers of recycled consumer products. Projections indicate the secondhand market could reach over $350 billion by 2027, amplifying FirstCash's merchandise sales. This societal shift effectively destigmatizes pawn shop retail, broadening the customer base beyond traditional demographics for asset-backed loans and quality merchandise.

Modern consumers increasingly seek digital convenience for financial services, expecting features like online appraisals and remote loan management. While the pawn industry has historically relied on physical locations, a significant shift towards digitization is underway to meet these demands. FirstCash is actively investing in technology, with its e-commerce sales increasing by 15% in Q1 2024, highlighting this strategic pivot. This focus on omnichannel capabilities, including its growing online presence, is vital for FirstCash to attract and retain a broader customer base in the evolving financial landscape.

Demographic Shifts in Latin America

FirstCash's significant presence and growth strategy in Latin America are strongly supported by favorable demographic trends. The region boasts a large, young population, with approximately 30% of its populace under 25 years old in 2024, driving a continuous need for accessible credit solutions. FirstCash's ongoing success hinges on its ability to tailor its financial services to the diverse cultural and economic contexts across these markets.

- Latin America's working-age population is projected to remain robust through 2025, ensuring sustained demand for credit.

- Urbanization rates nearing 82% by 2025 in countries like Mexico and Colombia expand the addressable market for pawn and retail services.

- FirstCash reported over 1,300 stores in Latin America by early 2024, demonstrating its deep market penetration.

Consumer Debt and Financial Literacy

Societal levels of consumer debt directly impact the demand for FirstCash's services, as high debt often pushes individuals toward accessible credit options like pawn loans. Conversely, an increase in financial literacy among consumers, evidenced by initiatives like the 2024 national financial literacy campaigns, could lead them to explore alternative, more traditional financial management solutions. However, FirstCash's non-recourse pawn loans, which do not affect a customer's credit score, remain a distinct advantage for those needing immediate cash without impacting their financial reputation. This unique value proposition caters to a segment seeking discrete and rapid liquidity, especially given the average US household debt reaching over $100,000 in early 2025.

- US consumer debt reached over $17.5 trillion by Q1 2025.

- Financial literacy programs saw a 15% increase in participant enrollment in 2024.

- FirstCash's non-recourse loans differentiate it from traditional credit providers.

- Demand for short-term liquidity solutions remains strong amid economic shifts.

Societal shifts, like the increasing acceptance of secondhand retail, driven by value and sustainability, significantly boost FirstCash's merchandise sales, projected to reach over $350 billion by 2027. The persistent global underbanked population, still exceeding 1.4 billion as of late 2023, ensures a consistent demand for accessible credit. Furthermore, high consumer debt, reaching over $17.5 trillion in the US by Q1 2025, compels many to seek non-traditional financial solutions like FirstCash's non-recourse pawn loans.

| Sociological Factor | Trend/Impact (2024/2025) | FirstCash Relevance |

|---|---|---|

| Secondhand Market Growth | Projected over $350B by 2027 | Boosts merchandise sales & broadens customer base. |

| Underbanked Population | 1.4B+ globally (late 2023) | Sustained core customer base for accessible credit. |

| Consumer Debt Levels | US consumer debt >$17.5T (Q1 2025) | Drives demand for non-recourse short-term loans. |

Technological factors

The financial services sector is rapidly shifting towards digital and mobile-first solutions, a trend that presents both opportunities and challenges for FirstCash. The global digital lending market is projected to reach approximately $19.3 billion in 2024, emphasizing this significant transformation. FirstCash is actively integrating digital platforms for enhanced loan management and customer interactions, aiming to modernize its service delivery. However, the rise of online-only fintech competitors, which capture a growing share of the non-bank lending market, poses a direct threat to traditional models. This dynamic environment necessitates continuous technological adaptation for sustained growth.

Artificial intelligence and machine learning are transforming financial services, with global AI in finance market size projected to reach $22.6 billion by 2025, up from $10.1 billion in 2022. FirstCash can deploy these advanced technologies to significantly enhance the accuracy of item appraisals, moving beyond manual processes to data-driven valuations. This also allows for personalized customer offers, potentially boosting engagement and revenue, and improving operational efficiency by automating routine tasks. Leveraging AI for credit scoring and fraud detection, which can reduce fraud losses by up to 25% by 2025 according to industry estimates, strengthens risk management and streamlines the customer experience across its 2,900+ retail locations.

As FirstCash expands its digital footprint, it faces increasing risks related to cybersecurity and the protection of sensitive customer data. A significant data breach could result in financial losses, with the average cost per breach in financial services projected to exceed $6 million by late 2024. Regulatory penalties, such as those under the California Consumer Privacy Act (CCPA) or similar state laws, could also apply. Investing in robust cybersecurity infrastructure is essential to mitigate these risks and maintain customer trust, crucial for sustained growth into 2025. This focus helps protect the company's reputation and avoid severe operational disruptions.

Point-of-Sale (POS) Payment Technology

The American First Finance (AFF) segment of FirstCash relies entirely on modern point-of-sale (POS) technology integrated with its retail partners for transaction processing. The rapid evolution of payment systems, including the growth of buy now, pay later (BNPL) options and other digital payment solutions, necessitates continuous investment and adaptation. Staying current with these technological advancements is crucial for the sustained growth and competitiveness of this business segment. For instance, the global BNPL market is projected to reach over $680 billion by 2025, underscoring the need for robust POS integration and innovation.

- AFF's reliance on integrated POS systems ensures seamless transaction processing for its retail partners.

- The BNPL market's projected growth to over $680 billion by 2025 highlights the necessity for advanced payment capabilities.

- Continuous investment in POS technology is vital for FirstCash to capture market share in evolving digital payment landscapes.

E-commerce and Online Retail Platforms

The rise of e-commerce offers FirstCash a significant opportunity to expand its retail sales beyond its extensive network of over 2,900 physical stores. Developing a user-friendly online marketplace for its diverse array of pre-owned merchandise, which historically contributes a substantial portion of its revenue, can attract a broader customer base, especially as global e-commerce sales are projected to reach over $7 trillion by 2025. This expansion necessitates strategic investment in efficient logistics, secure online payment systems, and targeted digital marketing campaigns to effectively compete with established online retailers.

- Online retail platforms allow FirstCash to reach customers beyond their physical store footprint.

- Investment in digital infrastructure is crucial to process online transactions securely.

- Targeted digital marketing is essential to compete with other online merchandise sellers.

- Expanding online sales diversifies revenue streams beyond traditional pawn and lending services.

FirstCash is rapidly adapting to the digital shift in financial services, integrating platforms while leveraging AI and machine learning to enhance operations and risk management. Cybersecurity investments are critical to mitigate rising data breach costs, projected to exceed $6 million per incident by late 2024. Expanding e-commerce and modernizing POS systems, crucial as the BNPL market grows to $680 billion by 2025, are vital for sustained growth and competitiveness.

| Technological Factor | Market Projection (2024/2025) | Impact for FirstCash |

|---|---|---|

| Digital Lending Market | ~$19.3 billion (2024) | Drives digital platform integration and competition. |

| AI in Finance Market | $22.6 billion (2025) | Enhances appraisals, fraud detection, and efficiency. |

| Cybersecurity Breach Cost | >$6 million (late 2024) | Necessitates robust security investment. |

| BNPL Market | >$680 billion (2025) | Requires advanced POS and payment system adaptation. |

| Global E-commerce Sales | >$7 trillion (2025) | Presents significant online retail expansion opportunity. |

Legal factors

The Consumer Financial Protection Bureau significantly influences FirstCash, wielding broad authority over consumer financial products and services in the U.S. This includes enacting rules, conducting examinations, and initiating enforcement actions for unfair, deceptive, or abusive acts or practices. For instance, a 2021 CFPB lawsuit alleged FirstCash violated the Military Lending Act, highlighting ongoing compliance risks. As of early 2025, the CFPB remains active, with potential new rules on overdraft fees and data privacy impacting the financial sector, necessitating FirstCash’s continuous adherence to evolving regulatory landscapes.

The pawn industry, including FirstCash, navigates a complex web of state and local regulations governing allowable interest rates, loan terms, and stringent record-keeping. Ensuring compliance across hundreds of jurisdictions in the U.S. and Latin America, which include roughly 2,900 stores as of early 2025, presents a continuous operational and financial challenge. Changes in these localized laws, such as new caps on interest or fees, directly impact store-level profitability and necessitate adaptive operating procedures. For instance, a single state's new lending ordinance could require significant system updates and staff training, affecting FirstCash's 2024-2025 financial outlook.

FirstCash's lending operations are heavily regulated by federal laws, including the Truth in Lending Act (TILA) and the Military Lending Act (MLA).

TILA mandates clear disclosure of credit terms, while the MLA imposes strict interest rate caps and other protections for active-duty service members and their dependents, typically at a 36% Military Annual Percentage Rate (MAPR).

Non-compliance carries substantial risks, such as fines, customer refunds, and legal actions from bodies like the CFPB, which has levied millions in penalties for similar violations in recent years.

Anti-Money Laundering (AML) and Data Security Laws

As a regulated financial institution, FirstCash must rigorously comply with Anti-Money Laundering (AML) regulations, necessitating diligent monitoring and reporting of suspicious transactions to authorities like FinCEN. Furthermore, the company navigates a complex landscape of data security and privacy laws, including the California Consumer Privacy Act (CCPA) and various state-level data breach notification statutes, safeguarding vast amounts of customer information. Non-compliance with these stringent legal frameworks can trigger substantial penalties, such as potential fines reaching millions of dollars, and inflict severe reputational damage, eroding customer trust and market standing. Maintaining robust compliance programs is critical, especially with evolving regulations expected through 2025.

- FinCEN reported over 5.4 million Bank Secrecy Act (BSA) filings in the 2023 fiscal year, underscoring the volume of compliance required.

- The average cost of a data breach in the financial sector exceeded $5.9 million in 2023, highlighting the financial risk of non-compliance.

- FirstCash's operational integrity relies heavily on its adherence to these evolving regulatory standards.

Acquisition and International Law

FirstCash's strategic growth heavily relies on acquisitions, exemplified by its planned 2025 acquisition of H&T Group in the UK. Such international transactions necessitate rigorous compliance with both UK and US regulatory approvals, including competition laws. Navigating these complex legal frameworks is paramount for successful market expansion and avoiding significant delays or penalties.

- The H&T Group acquisition requires approval from UK financial regulators.

- Cross-border M&A faces scrutiny under international competition laws.

- Legal due diligence is critical for foreign market entry.

- Compliance ensures smooth integration and operational continuity.

FirstCash navigates a complex legal landscape, facing strict oversight from the CFPB and adherence to federal lending laws like TILA and MLA, which includes a 36% MAPR for military loans. Compliance with diverse state and local regulations across its nearly 2,900 stores, governing loan terms and interest rates, is crucial. Additionally, rigorous AML and data privacy compliance, coupled with international M&A regulatory approvals for deals like the H&T Group acquisition, are paramount to avoid substantial fines and reputational damage.

| Legal Factor | Impact on FirstCash (2024-2025) | Risk/Opportunity |

|---|---|---|

| CFPB/Federal Laws (MLA, TILA) | Ongoing scrutiny; potential new rules on overdrafts. | Compliance costs; fines (e.g., MLA settlements). |

| State/Local Regulations | Varying loan terms across ~2,900 stores. | Operational complexity; profit margin variability. |

| AML/Data Privacy (CCPA) | Mandatory FinCEN reporting; data breach prevention. | High fines; reputational damage (e.g., average $5.9M data breach cost). |

Environmental factors

FirstCash's business model inherently supports the circular economy by extending the lifespan of goods. By buying and reselling pre-owned items, the company significantly reduces the demand for new manufacturing and minimizes waste. This approach, handling a substantial volume of merchandise annually, directly contributes to resource conservation. For instance, their network facilitates the reuse of millions of items, aligning with global sustainability goals for 2024 and 2025.

FirstCash currently does not publicly disclose its carbon emissions data or formal climate targets, a stance increasingly scrutinized by stakeholders. Investor and consumer focus on corporate sustainability has intensified significantly by 2024, with many funds prioritizing ESG metrics. This lack of transparency could pose a notable reputational risk, potentially impacting investor sentiment and consumer trust as environmental disclosure standards evolve.

With FirstCash operating over 3,000 retail locations, the energy consumption for lighting, heating, and cooling represents a significant environmental impact. Implementing energy-efficient technologies across its extensive network, such as LED lighting upgrades or optimized HVAC systems, could substantially reduce its operational carbon footprint by 2025. This presents a clear opportunity for notable cost savings, potentially millions annually, while simultaneously enhancing the company's environmental performance.

Waste Management and Product End-of-Life

FirstCash, while promoting product reuse through its pawn and retail operations, faces environmental considerations regarding waste management and product end-of-life. Developing comprehensive recycling programs for unsellable electronics, which often contain hazardous materials like lead and cadmium, is crucial. This also extends to packaging and other operational waste generated across its 2,800+ global locations as of Q1 2024. Responsible disposal ensures compliance with evolving environmental regulations and minimizes ecological impact.

- Electronic waste (e-waste) from unsold items requires specialized recycling, with global e-waste generation projected to reach 74.7 million metric tons by 2030, highlighting the growing challenge.

- Implementing robust collection and disposal protocols for hazardous materials in electronics, such as mercury and brominated flame retardants, mitigates environmental contamination risks.

- Efficient waste segregation and partnerships with certified recyclers can reduce landfill contributions and improve FirstCash’s environmental footprint.

- Packaging waste reduction initiatives, aligning with broader industry trends towards sustainable materials, are also a key focus for operational efficiency and environmental stewardship.

Climate Change Risks to Operations

FirstCash, operating over 2,800 retail locations, faces significant operational risks from climate change, particularly due to its extensive physical footprint. Extreme weather events like hurricanes, floods, or wildfires could directly damage stores, disrupt supply chains, and impact customer access, especially in vulnerable regions across the U.S. and Latin America. Developing robust climate resilience strategies is increasingly crucial to mitigate these potential financial and operational disruptions. For instance, the company's Q1 2025 results, while strong, don't explicitly detail climate-related operational costs, but such events could impact future performance.

- Physical risks include damage to over 2,800 stores globally.

- Supply chain disruptions from severe weather can impact inventory flow.

- Increased frequency of extreme events necessitates adaptive business continuity plans.

- Regions in Latin America and the U.S. are particularly susceptible to climate impacts.

FirstCash promotes circularity by reusing millions of items, reducing waste and new manufacturing demand. However, the company faces scrutiny for lacking carbon emissions data and managing significant energy consumption across its 3,000+ stores. E-waste from unsold electronics, projected to reach 74.7 million metric tons globally by 2030, and broader operational waste require robust management. Physical climate risks like extreme weather also threaten its extensive retail footprint.

| Environmental Factor | Impact/Risk | Data Point (2024/2025) |

|---|---|---|

| Circular Economy | Reduced demand for new goods | Millions of items reused annually |

| Energy Consumption | Operational carbon footprint | 3,000+ retail locations |

| E-Waste Management | Hazardous material disposal | Global e-waste: 74.7M metric tons by 2030 |

PESTLE Analysis Data Sources

Our FirstCash PESTLE Analysis is informed by a comprehensive blend of official government data, international financial institution reports, and reputable market research firms. This approach ensures a robust understanding of political stability, economic trends, social demographics, and technological advancements impacting the pawn industry.