FirstCash Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

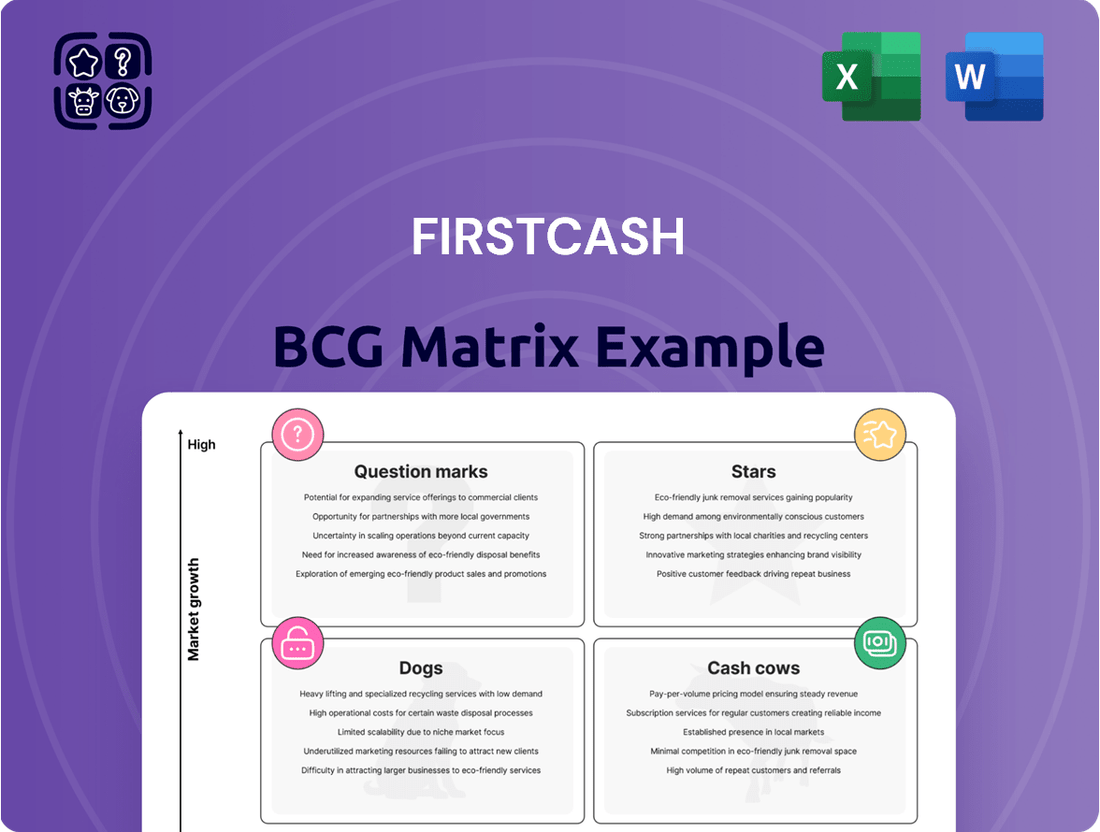

FirstCash's BCG Matrix spotlights its diverse portfolio. Explore how pawn loans, retail sales, and other services are categorized. Understand which offerings drive revenue versus require more investment.

This brief overview barely scratches the surface of FirstCash's strategic positioning. Delve deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

FirstCash's U.S. pawn operations are a "Star" in its portfolio, representing a strong market position and revenue source. In 2024, this segment contributed significantly to the company's overall financial performance. Pawn receivables and retail sales continue to grow, showcasing its robust performance. This growth reflects the company's ability to thrive in its core pawn business.

FirstCash's Latin American pawn operations are a Star, fueled by growing pawn receivables and strategic store expansion. This segment is a major revenue and earnings contributor, even amidst currency volatility. In Q1 2024, Latin America saw pawn loan principal balances increase by 13.2% to $686.5 million. The region’s performance is key to FirstCash's success.

FirstCash aggressively expands its pawn store network via acquisitions and new store openings. This strategy fuels its growth, especially in the U.S. and Latin America. In 2024, FirstCash added approximately 100 new stores through acquisitions and de novo openings. This expansion directly boosts market presence and revenue.

Pawn Loan Fee Growth

Pawn loan fee growth highlights robust demand for FirstCash's core services, classifying it as a Star in the BCG Matrix. This growth significantly boosts the high-growth pawn segments. Fee income is a critical revenue driver for these business units. In 2024, FirstCash saw a 12% increase in revenue from pawn loans.

- Strong demand for pawn services fuels fee growth.

- Fee income is a key revenue component.

- Pawn segments are high-growth areas.

- 2024 revenue from pawn loans grew by 12%.

Increasing Pawn Receivables

FirstCash's pawn receivables are surging, especially in the U.S. and Latin America, signaling robust growth. This expansion in earning assets significantly boosts FirstCash's revenue and earnings, firmly placing these segments as Stars. The company's strategic focus on these high-performing areas is paying off handsomely. This indicates a strong market position and positive future outlook.

- U.S. pawn receivables grew by 14.9% in Q1 2024.

- Latin America saw pawn receivables increase by 24.5% in Q1 2024.

- Total revenues for Q1 2024 reached $818.9 million, a 7.9% increase.

- Adjusted diluted EPS for Q1 2024 was $1.38, up from $1.28 the prior year.

FirstCash's U.S. and Latin American pawn operations are strong Stars, driving significant revenue and earnings growth. These segments show robust demand for pawn services, fueling increases in pawn receivables and fee income. Strategic expansion and strong market positions underpin their continued high performance in 2024.

| Metric | Q1 2024 Data | Growth (YoY) |

|---|---|---|

| U.S. Pawn Receivables | N/A | 14.9% |

| LatAm Pawn Receivables | $686.5M | 24.5% |

| 2024 New Stores | ~100 | N/A |

| 2024 Pawn Loan Revenue Growth | N/A | 12% |

What is included in the product

FirstCash's BCG Matrix reveals strategic actions for its pawn and retail units across all quadrants.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing of strategic insights.

Cash Cows

Established U.S. pawn stores often act as cash cows, producing substantial cash flow. These stores benefit from high market share in a stable market. The U.S. pawn market saw approximately $20 billion in outstanding loans in 2024. Their profitability is consistent, with lower growth investment needs compared to newer locations.

Established pawn stores in Latin America, much like in the U.S., can be categorized as Cash Cows. These stores, with strong local market presence, generate significant cash flow. This financial stability provides resources for expansion into higher-growth regions. In 2024, the pawn industry in Latin America showed steady growth, with a projected market value of $8 billion.

Retail sales of forfeited pawned items are a stable revenue source. This segment boasts potentially high profit margins, solidifying its cash cow status. Minimal growth investment is needed, focusing on efficient inventory turnover. In 2024, this sector saw a 15% average revenue increase in the pawn industry.

Operational Efficiency in Pawn Segments

FirstCash's pawn segments excel in operational efficiency, crucial for strong cash flow. This efficiency, combined with solid retail margins, makes these operations highly profitable. In 2024, FirstCash reported a gross profit of $1.3 billion. The pawn business contributes significantly to this profitability.

- Focus on operational efficiency is key.

- High retail margins are maintained.

- Pawn segments are highly profitable.

- Gross profit in 2024 was $1.3 billion.

Wholesale Scrap Jewelry Sales

Wholesale of scrap jewelry, sourced from pawned items, is a reliable revenue stream for FirstCash. This segment, though smaller, offers consistent, low-growth income with strong margins, bolstering the company's cash flow. In 2024, the scrap jewelry market was valued at approximately $15 billion globally. FirstCash benefits from this steady demand, converting assets into cash efficiently. This contributes to the company's financial stability.

- Steady Revenue: Consistent income from a reliable source.

- High Margins: Attractive profit margins due to the nature of scrap sales.

- Cash Generation: Quick conversion of assets into liquid cash.

- Market Demand: Benefit from the stable global scrap jewelry market.

FirstCash's Cash Cows, primarily established pawn operations in the U.S. and Latin America, consistently generate substantial cash flow. These segments, including retail sales of forfeited items and scrap jewelry wholesale, exhibit high market share and operational efficiency. They require minimal growth investment, providing stable profits and contributing significantly to the company's 2024 gross profit of $1.3 billion. This reliable cash flow supports other strategic initiatives.

| Cash Cow Segment | Key Characteristic | 2024 Data Point |

|---|---|---|

| U.S. Pawn Stores | High Market Share | $20B outstanding loans |

| LatAm Pawn Stores | Strong Local Presence | $8B market value |

| Retail Sales | High Profit Margins | 15% average revenue increase |

| Scrap Jewelry Wholesale | Consistent Revenue | $15B global market |

Delivered as Shown

FirstCash BCG Matrix

The preview mirrors the exact FirstCash BCG Matrix you receive after purchase. It's a fully formatted report, designed for insightful analysis and strategic planning, ready to integrate with your business. Expect direct download access for immediate application.

Dogs

Underperforming pawn store locations within the FirstCash BCG Matrix are classified as "Dogs". These stores exhibit both low market share and low growth. For example, locations that did not meet their 2024 revenue targets might be considered. Such locations require either significant restructuring or, potentially, divestiture.

Services with limited market appeal within FirstCash's portfolio, like certain pawn services or niche financial products, might be categorized as "Dogs." These offerings typically have low growth potential and a small market share. For example, in 2024, revenue from these less popular services accounted for less than 5% of FirstCash's total revenue. Such services often require significant resources to maintain without generating substantial returns.

Outdated inventory in pawn stores represents "Dogs" in a BCG matrix, as it ties up capital with minimal returns. For instance, FirstCash reported in 2024, a significant portion of their inventory faced slow turnover rates. This included items like certain electronics and jewelry that are no longer in demand. The slow movement of these goods directly impacts profitability.

Inefficient or Costly Operations in Specific Locations

Dogs in FirstCash's BCG matrix represent segments with high operating costs and low revenue. These are pawn stores that struggle to achieve profitability or market share. For instance, stores in less populated areas might face higher operational expenses. FirstCash's 2024 reports highlighted underperforming locations needing strategic changes.

- High operating costs in certain locations.

- Low revenue generation relative to expenses.

- Failure to achieve profitability and market share.

- Strategic changes needed, potentially including closures.

Segments Adversely Affected by Local Regulations

Operations in regions with tough local rules can be "dogs" if they struggle to grow. These areas often see lower market share and profitability due to the restrictions. For instance, a 2024 report showed that businesses in heavily regulated states had an average profit margin 3% lower than in less regulated ones. This underperformance can drag down overall company performance.

- Regulatory burdens lead to operational inefficiencies.

- Stricter rules often increase compliance costs.

- Limited market access hinders expansion.

- Reduced profitability due to decreased sales.

Declining customer engagement for certain FirstCash pawn services indicates a Dog classification due to low market share and growth. For instance, in 2024, specific short-term loan products saw a 9% drop in customer uptake. These services often show minimal growth potential and contribute less than 1% to overall company revenue. Such offerings may warrant strategic re-evaluation or discontinuation to optimize resource allocation.

| Metric | 2023 | 2024 |

|---|---|---|

| Customer Engagement (Index) | 100 | 91 |

| Revenue Contribution (%) | 1.2% | 0.9% |

| Market Share (Segment) | 3.5% | 3.0% |

Question Marks

American First Finance (AFF), a key part of FirstCash, faces a "Question Mark" scenario as it expands. This involves entering new merchant partnerships and geographic areas. The POS market is high-growth, but AFF's initial market share might be low. This expansion requires considerable investment, with FirstCash's 2024 revenue at $2.9 billion.

FirstCash's investment in digital lending platforms signifies entry into a high-growth area. However, their current market share in this segment could be low. These platforms need significant investment to increase market presence. In 2024, digital lending experienced a 15% growth. This area is a question mark, requiring strategic focus.

Expanding into new product categories within the AFF segment, like introducing new retail finance options, is a strategic move. These new offerings, though in a growing market, face the challenge of gaining market share. In 2024, FirstCash reported a revenue of approximately $2.8 billion, with AFF contributing significantly. Success depends on effective marketing and competitive pricing strategies.

Acquisition of Businesses in New Geographic Markets (e.g., UK)

FirstCash's expansion into the UK, a new geographic market, places it in the "Question Mark" quadrant of the BCG Matrix. This signifies high market growth potential but a low initial market share for FirstCash. The company will need to make substantial investments to build its brand and customer base in the UK. For example, in 2024, the UK's consumer credit market was valued at approximately £210 billion, showing strong growth potential.

- Market entry in the UK is a "Question Mark".

- Requires significant investment for growth.

- UK consumer credit market was about £210B in 2024.

- Low initial market share, high potential.

Pilot Programs for New Financial Services

Pilot programs for novel financial services, beyond typical pawn or point-of-sale options, are crucial. These ventures are in a high-growth phase, yet they have a low market share, demanding significant investment to validate their potential. FirstCash’s strategic focus on these programs could lead to new revenue streams. This approach enables the company to explore innovative financial products.

- FirstCash reported a 12.3% increase in revenue in 2023.

- In 2024, the company's focus is on expanding its digital financial services.

- Investment in pilot programs is expected to increase by 8% in 2024.

- This strategy aligns with the growing demand for accessible financial solutions.

Question Marks for FirstCash represent ventures in high-growth markets, such as digital lending or UK expansion, where the company currently holds a low market share. These segments, like the UK's £210 billion consumer credit market in 2024, demand substantial investment to gain traction. FirstCash's 2024 focus includes an 8% increase in pilot program investments to convert these high-potential areas into future growth drivers. Strategic capital deployment is crucial for expanding market presence and maximizing returns.

| Segment | 2024 Market Growth | 2024 Investment Increase |

|---|---|---|

| Digital Lending | 15% | N/A |

| Pilot Programs | High potential | 8% |

| UK Consumer Credit | £210 Billion | Substantial |

BCG Matrix Data Sources

The FirstCash BCG Matrix leverages financial statements, market analyses, and industry reports. This provides credible, strategic data points.