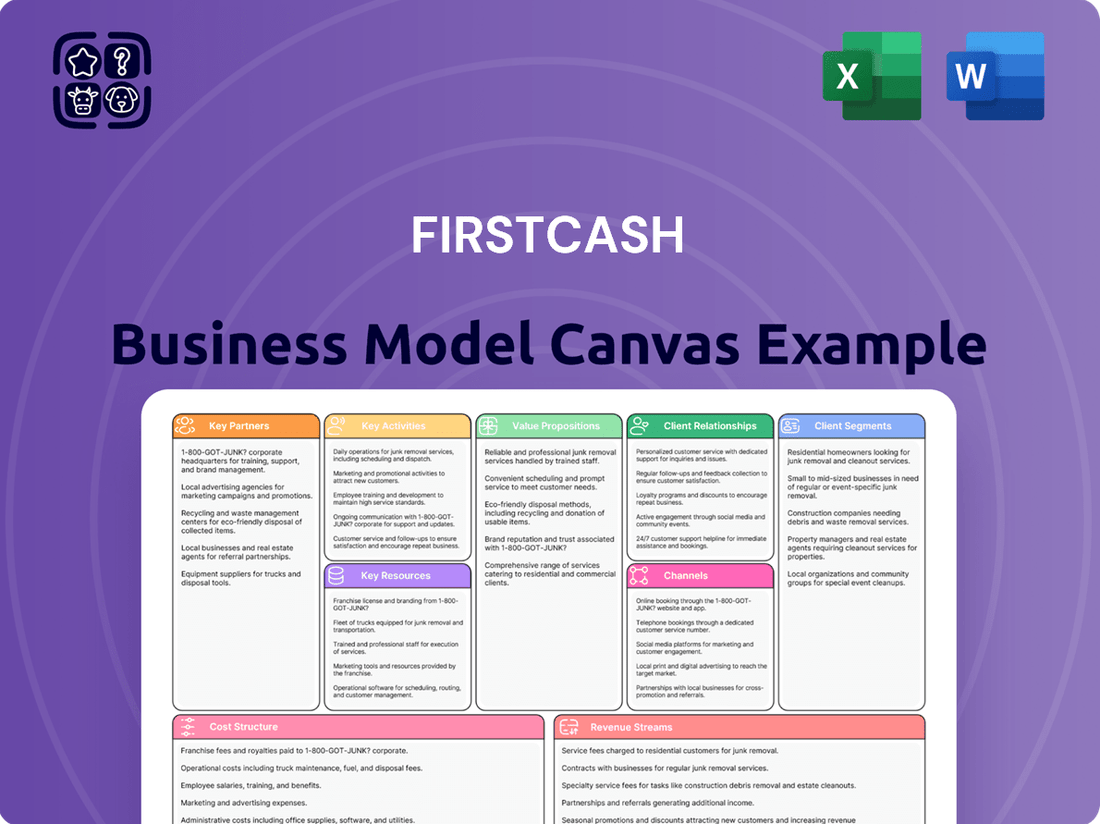

FirstCash Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

Unlock the core strategies behind FirstCash's thriving business model. This Business Model Canvas dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success. It's an essential tool for anyone aiming to understand or replicate their market dominance.

Discover how FirstCash effectively manages its key resources and activities to deliver unparalleled value. The complete Business Model Canvas provides a detailed look at their cost structure and key partnerships, crucial for strategic planning and competitive analysis.

Want to truly grasp FirstCash's operational genius? Our full Business Model Canvas breaks down every essential component, from channels to customer relationships, offering actionable insights for your own ventures.

Elevate your business acumen by exploring the complete FirstCash Business Model Canvas. This comprehensive document is your key to understanding their competitive advantages and growth strategies. Get it now to gain a significant strategic edge.

Partnerships

The American First Finance (AFF) segment relies on a vast network of retail merchants, critical for its point-of-sale financing. FirstCash partners with over 12,000 small and medium-sized businesses as of early 2024, spanning sectors like furniture, appliances, and automotive repair. This collaboration enables merchants to offer flexible financing solutions to customers. By providing the necessary technology and capital, FirstCash empowers these partners to boost their sales volume and reach a broader consumer base.

FirstCash collaborates with specialized technology vendors for its core pawn operations software, security systems, and digital platforms, streamlining processes across its 2,800+ locations as of early 2024. For the company's point-of-sale (POS) finance segment, partnerships with POS system integrators and data analytics firms are vital. These collaborations enhance underwriting precision, improve fraud detection capabilities, and ensure a seamless customer application experience. Such technology partnerships significantly bolster operational efficiency and strengthen risk management across FirstCash's diverse service offerings.

Maintaining a cooperative relationship with local law enforcement and regulators is crucial for FirstCash, ensuring compliance across its 2,800+ locations as of Q1 2024. This partnership involves strict adherence to reporting pawned items, a key measure to prevent the trade of stolen goods and support public safety efforts. Strong regulatory relationships are vital for navigating the diverse legal frameworks governing pawn and consumer lending in the U.S. and Latin America, where the company operates. This proactive engagement helps FirstCash uphold its operational integrity and meet all legal obligations in the dynamic 2024 regulatory landscape.

Logistics and Shipping Companies

For its expanding online retail segment, FirstCash strategically partners with major national and international logistics providers such as UPS, FedEx, and USPS. These collaborations are crucial for efficiently fulfilling the growing volume of e-commerce orders, particularly for forfeited collateral and other pre-owned merchandise sold online. Efficient logistics operations are paramount to ensuring a positive customer experience and supporting the scalability of FirstCash’s digital sales channels, which continue to see increased activity in 2024.

- FirstCash leverages these partnerships to manage thousands of online transactions annually.

- Reliable shipping directly impacts customer satisfaction and repeat business for online sales.

- Partnerships enable reach across the United States and internationally for merchandise sales.

- The ability to scale logistics supports FirstCash's e-commerce growth strategy for 2024 and beyond.

Precious Metal Refiners

FirstCash cultivates partnerships with specialized precious metal refiners and smelters to process unsaleable or scrap jewelry, including gold, silver, and platinum. These collaborations are crucial for converting raw materials into commodity-grade bullion, enabling efficient inventory liquidation. This process significantly contributes to FirstCash’s revenue, with net scrap sales reaching approximately $140 million in 2024, a vital component of its business model.

- Refiners convert scrap gold, silver, and platinum into high-value bullion.

- This partnership facilitates efficient liquidation of pawned jewelry.

- Scrap sales are a critical revenue stream for FirstCash.

- FirstCash reported significant net scrap sales in 2024.

FirstCash cultivates a broad network of key partnerships essential for its diverse operations and growth. These include over 12,000 retail merchants for point-of-sale financing, and technology vendors streamlining processes across 2,800+ pawn locations as of early 2024. Strategic alliances with logistics providers support its expanding e-commerce segment, while precious metal refiners contribute significantly to revenue, with net scrap sales reaching approximately $140 million in 2024. These collaborations are vital for operational efficiency, compliance, and maximizing returns across all business lines.

| Partnership Type | Key Role | 2024 Data/Impact |

|---|---|---|

| Retail Merchants | Point-of-Sale Financing | Over 12,000 partners (early 2024) |

| Technology Vendors | Operational Efficiency, Risk Management | 2,800+ locations, enhanced underwriting |

| Logistics Providers | E-commerce Fulfillment | Growing online sales activity in 2024 |

| Precious Metal Refiners | Scrap Metal Liquidation | Approx. $140 million net scrap sales (2024) |

What is included in the product

FirstCash's business model focuses on providing pawn loans and retail sales of pre-owned merchandise to underserved customer segments, leveraging a widespread network of physical locations and efficient inventory management.

This model emphasizes a low-overhead, high-volume approach, with a strong emphasis on customer service and compliance within its target markets.

FirstCash's Business Model Canvas effectively addresses the pain point of financial exclusion by clearly outlining how they provide accessible credit solutions to underserved populations.

Activities

The core activity involves providing collateralized, non-recourse loans to customers, typically short-term. This process demands accurately appraising a wide array of personal assets, from fine jewelry to modern electronics, to determine the appropriate loan amounts. Expertise in appraisal is fundamental to managing risk, as loan-to-value ratios are critical for FirstCash's profitability. As of early 2024, FirstCash continued to manage a substantial pawn loan portfolio, emphasizing the continuous need for precise valuations across its network of over 3,000 retail locations globally.

FirstCash's retail merchandising and sales activity is centered on managing, pricing, and selling forfeited pawn collateral alongside goods purchased directly from customers. This involves a meticulous process of cleaning, testing, and attractively displaying merchandise across their physical stores and growing online platforms. Effective inventory management, coupled with dynamic pricing strategies, is crucial for maximizing retail sales margins. For example, in Q1 2024, FirstCash reported merchandise sales revenue of $169.8 million, highlighting the segment's significant contribution to their overall business performance.

A primary activity for FirstCash is the origination and servicing of lease-to-own and retail financing through its American First Finance (AFF) segment at partner merchant locations. This involves real-time underwriting of consumer applications utilizing proprietary algorithms. The focus is on offering credit solutions to customers who may not qualify for traditional financing, expanding access to goods and services. In Q1 2024, AFF's gross merchandise value (GMV) increased by 19% to $198 million, showcasing robust market penetration. This strategic activity addresses a significant underserved consumer segment.

Regulatory Compliance and Reporting

FirstCash operates within a highly regulated environment, making stringent compliance a core daily activity across its operations. This encompasses strict adherence to diverse consumer lending laws and robust anti-money laundering (AML) regulations, crucial for a financial services provider. The company also manages extensive pawn-specific reporting requirements to local and federal law enforcement agencies, ensuring full transparency. Proactive and continuous compliance management significantly mitigates potential legal and financial risks, especially given its broad footprint across 2,800 retail locations as of early 2024. This diligent approach is vital for maintaining operational integrity and public trust.

- Adherence to consumer lending laws, including state-specific interest rate caps.

- Rigorous anti-money laundering (AML) protocols and suspicious activity reporting (SARs).

- Pawn transaction reporting to law enforcement databases like LeadsOnline.

- Compliance with data privacy regulations for customer information.

Store Operations and Management

FirstCash’s store operations and management are central to its business model, encompassing all activities for running its extensive network of physical locations. This includes vital tasks like staffing, rigorous training, robust security measures, precise cash management, and attentive customer service. Standardizing operational procedures across approximately 2,900 locations as of Q1 2024 is crucial for maintaining brand consistency and efficiency. This activity forms the backbone of the company’s primary customer interface, ensuring a uniform experience.

- Global footprint: FirstCash operated roughly 2,900 stores across 26 countries and territories as of March 31, 2024.

- Operational consistency: Standardized procedures are key to managing this vast network efficiently.

- Core services: Daily activities include securing assets and managing customer interactions.

- Human capital: Staffing and training are ongoing priorities for effective store performance.

FirstCash's core activities center on providing collateralized pawn loans, leveraging expert asset appraisal across its global network of over 3,000 locations. They also drive substantial revenue through retail merchandise sales of forfeited items and purchased goods, reporting $169.8 million in Q1 2024. The American First Finance segment provides crucial lease-to-own and retail financing solutions, with Q1 2024 GMV at $198 million. These operations are underpinned by stringent regulatory compliance and efficient store management across its approximately 2,900 international locations.

| Key Activity | 2024 Data Point | Impact |

|---|---|---|

| Pawn Lending | Over 3,000 global locations | Broad market reach for credit access. |

| Retail Sales | Q1 2024 merchandise sales: $169.8M | Significant revenue contribution. |

| AFF Financing | Q1 2024 GMV: $198M (+19% YoY) | Expands underserved consumer credit. |

Full Version Awaits

Business Model Canvas

The FirstCash Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot from the complete, ready-to-use file. Upon completing your order, you will gain full access to this identical, professionally structured document, allowing you to immediately leverage its insights for your business strategy.

Resources

FirstCash boasts an extensive physical store network, comprising 2,946 retail pawn and buy/sell locations across the U.S. and Latin America as of Q1 2024. This vast footprint serves as a primary strategic asset, offering unparalleled market penetration. These stores are the main channel for customer acquisition and direct service delivery, ensuring broad accessibility. The sheer scale of this physical presence creates a significant barrier to entry for potential competitors, solidifying FirstCash's market position.

FirstCash relies on significant access to liquid capital and credit facilities, a critical resource for funding its substantial pawn loan portfolio and AFF financing receivables. A strong balance sheet, exemplified by its $509 million in total available liquidity as of March 31, 2024, provides the necessary cash flow. This includes $156 million in cash and $353 million available from its revolving credit facility. This robust financial strength ensures the company can meet customer loan demand and strategically acquire new stores, fostering operational continuity. Such financial stability is essential for sustained growth in the pawn and retail sectors.

Strong, established brands like FirstCash, Cash America, and Cash Converters in Latin America represent valuable intangible assets for the company. This brand equity, cultivated over decades, builds essential trust among a customer base often wary of traditional financial institutions. For instance, FirstCash's extensive network, boasting over 2,900 locations globally as of early 2024, reinforces its widespread recognition. This trust is paramount for attracting and retaining both pawn and retail customers, underpinning their sustained market presence.

Proprietary Data and Underwriting Models

FirstCash leverages an extensive trove of proprietary data encompassing millions of pawn transactions, precise collateral valuations, and detailed customer behavior patterns. This deep data asset, continually updated from over 2,900 retail pawn locations as of early 2024, is crucial. The company's American First Finance AFF segment specifically employs sophisticated, data-driven underwriting algorithms that analyze this information to assess risk and approve financing for underserved consumers, contributing to a total loan portfolio of approximately $1.5 billion as of March 31, 2024. These robust data assets provide a significant competitive advantage, enabling FirstCash to accurately price risk and maximize profitability across its diverse financial services. This internal data intelligence minimizes defaults and optimizes loan performance, strengthening their market position.

- Proprietary data from 2,900+ locations as of early 2024.

- Underwriting algorithms for $1.5 billion loan portfolio as of Q1 2024.

- Enhanced risk pricing and profitability maximization.

- Competitive edge in underserved consumer financing.

Experienced Personnel and Appraisal Expertise

FirstCash relies on its skilled workforce, especially experienced store managers and appraisers. Their precise ability to value diverse merchandise like jewelry and electronics is critical for the pawn lending model's success. This human capital mitigates loan losses and enhances the resale value of inventory, directly impacting profitability. For instance, in Q1 2024, FirstCash reported strong pawn loan balances, underscoring the effectiveness of their appraisal expertise in managing asset quality.

- FirstCash operates over 2,800 retail locations, each relying on trained staff.

- Accurate appraisals minimize risk and maximize returns on pawned items.

- The company's 2024 financial health reflects the strength of its appraisal processes.

- Skilled personnel are vital for maintaining low loan loss rates within the pawn portfolio.

FirstCash's key resources include its extensive physical network of 2,946 stores and substantial liquid capital, totaling $509 million as of Q1 2024. Proprietary data and advanced underwriting algorithms efficiently manage a $1.5 billion loan portfolio. Strong brand equity, alongside skilled appraisers, further enhances market position and profitability. These assets underpin its robust financial services model.

| Resource | 2024 Data | Impact |

|---|---|---|

| Store Network | 2,946 locations | Market reach |

| Liquid Capital | $509M (Q1) | Loan funding |

| Loan Portfolio | $1.5B (Q1) | Revenue driver |

Value Propositions

FirstCash offers immediate access to regulated, non-recourse credit, primarily through pawn loans, serving individuals underserved by traditional banking. This provides crucial liquidity, allowing customers to access small-dollar, short-term cash loans quickly. A key benefit is the non-recourse nature; if a customer cannot repay, their credit score remains unaffected, unlike other subprime credit options. In 2024, FirstCash continued to expand its pawn segment, which accounted for a significant portion of its revenue, providing essential financial lifelines without long-term credit risks.

FirstCash offers customers a vast array of quality, pre-owned merchandise, including jewelry, electronics, and tools, at prices significantly below new items. This compelling value proposition attracts budget-conscious consumers seeking affordable alternatives. The dynamic inventory creates a unique treasure-hunt shopping experience, driving repeat visits. In Q1 2024, FirstCash reported retail merchandise sales of 145.4 million, underscoring the segment's significant contribution to revenue and its appeal to a broad customer base.

For its retail merchant partners, FirstCash's American First Finance (AFF) segment delivers a crucial value proposition by enabling them to offer financing to customers who might otherwise be declined for traditional credit. This service directly expands the merchant's potential customer base, contributing to higher sales conversion rates and an increase in average transaction sizes. FirstCash effectively manages the underlying credit risk associated with these loans, allowing merchants to concentrate solely on their core sales activities. The growth in the AFF segment continued into 2024, demonstrating its sustained positive impact on merchant sales volumes and customer reach.

A Quick and Dignified Way to Sell Goods

FirstCash provides a secure, immediate, and transparent option for individuals to sell personal items they no longer need, bypassing the uncertainty of online marketplaces. Customers receive instant cash payment in a professional retail environment, often within minutes, offering a dignified solution for quick liquidity. This service caters to a significant portion of the population seeking immediate financial solutions, with pawn transactions remaining a vital economic resource for many. The company’s extensive store network, which included 1,179 pawn stores in the U.S. as of 2024, ensures widespread accessibility for these transactions.

- Immediate cash payment for personal items.

- Secure and transparent transaction environment.

- Alternative to online sales for quick liquidity.

- Access to 1,179 U.S. FirstCash pawn stores as of 2024.

Accessible Financing at the Point of Sale

FirstCash, through American First Finance (AFF), offers accessible point-of-sale financing, empowering end-consumers to secure funds for significant purchases like furniture or auto repairs directly at retail locations. This proposition caters specifically to customers who might lack access to traditional credit cards or bank loans. The streamlined, technology-driven application process ensures a quick decision, facilitating immediate purchases. In 2024, AFF continues to expand its merchant network, enhancing financial inclusion.

- AFF's total gross transaction volume reached approximately $1.1 billion in 2023.

- The segment primarily serves underserved consumers.

- Decisions are often provided in minutes via their digital platform.

- FirstCash aims for continued growth in this segment throughout 2024.

FirstCash delivers immediate, non-recourse pawn loans and instant cash for personal items, serving individuals outside traditional banking. They provide affordable, quality pre-owned merchandise, attracting budget-conscious consumers. Through American First Finance, FirstCash enables accessible point-of-sale financing for both merchants and underserved consumers, expanding market reach and sales opportunities.

| Value Prop. | Key Metric (2024) | Data Point |

|---|---|---|

| Pawn Loans | US Pawn Stores | 1,179 |

| Retail Sales | Q1 2024 Merchandise Sales | $145.4 Million |

| AFF Volume | 2023 Gross Transaction Volume | ~$1.1 Billion |

Customer Relationships

FirstCash primarily builds customer relationships in its pawn segment through direct, in-person interactions at its extensive network of 3,465 retail pawn locations reported in Q1 2024. These relationships are often transactional, focusing on specific pawn loans or retail purchases. However, professional, respectful, and efficient service during these face-to-face encounters is paramount. This direct engagement fosters trust, which is key to encouraging repeat business and driving the high-frequency transactions that underpin their financial model.

For FirstCash, building customer relationships centers on trust and familiarity, especially for its core pawn customers who frequently need short-term credit. Providing friendly and fair service encourages customers to return to the same store, transforming a single transaction into a loyal connection. This repeat business is critical, with FirstCash reporting a significant percentage of its pawn loans are renewed or repaid by existing customers. This loyalty is a primary driver of recurring revenue, underpinning the stability of their financial performance.

In the American First Finance (AFF) segment, FirstCash primarily establishes customer relationships indirectly, with the initial engagement originating through their network of partner merchants. Post-sale, FirstCash diligently maintains these relationships by providing comprehensive servicing, billing, and customer support through user-friendly digital portals and dedicated call centers. This approach ensures a seamless and positive financing experience for customers, which in turn reflects favorably on the merchant partners. As of March 31, 2024, the total lease and finance receivables for the AFF segment stood at approximately $450 million, highlighting the scale and effectiveness of this indirect relationship model.

Digital Self-Service and Support

FirstCash is significantly enhancing customer relationships by leveraging digital self-service channels, enabling customers to manage pawn loans and Advantageous Financial Solutions (AFF) accounts conveniently online. This digital shift caters to the evolving preferences of modern consumers, with online payments for pawn loans and AFF accounts growing as of early 2024. The company also utilizes its e-commerce platforms, such as e-pawn.com, to build strong relationships with online retail shoppers, expanding its reach beyond physical stores. These streamlined digital interactions offer convenience and accessibility, fostering loyalty and driving engagement in a competitive market.

- Online payment portals for pawn loans and AFF accounts provide 24/7 accessibility for customers.

- E-commerce sites facilitate direct sales and build relationships with online retail consumers.

- Digital channels reduce in-store traffic, improving operational efficiency and customer satisfaction.

- Increased digital adoption reflects a strategic adaptation to evolving customer service expectations.

Community-Based Engagement

Pawn stores like FirstCash often serve as essential community financial hubs, fostering relationships through their consistent local presence and familiarity. Store managers and employees become recognizable figures in neighborhoods, cultivating a sense of trust and reliability. This grassroots connection is a subtle yet powerful element of their customer relationship model, reflecting the direct engagement seen across their extensive network.

- FirstCash operates over 2,900 locations globally, with a significant portion in local communities.

- Their localized approach helps build consistent customer visits, often weekly or monthly.

- Customer retention is bolstered by familiar faces and accessible services.

- This model supports their role as a neighborhood resource for immediate financial needs.

FirstCash builds customer relationships primarily through direct, in-person service at its extensive network of 3,465 pawn locations as of Q1 2024, fostering trust and repeat business. For its American First Finance (AFF) segment, relationships are managed indirectly via partner merchants, supported by digital portals and call centers, with AFF receivables at $450 million as of March 31, 2024. The company also enhances engagement through digital self-service channels and e-commerce platforms, offering convenience and accessibility for all customers. This multi-faceted approach ensures consistent customer loyalty and drives recurring revenue.

| Relationship Type | Primary Channel | 2024 Data Point |

|---|---|---|

| Pawn Customers | In-person (Retail Stores) | 3,465 locations (Q1 2024) |

| AFF Customers | Indirect (Partner Merchants) | $450M receivables (Mar 31, 2024) |

| All Customers | Digital (Online Portals/E-commerce) | Growing online payments (early 2024) |

Channels

The extensive network of brick-and-mortar pawn stores serves as the primary channel for FirstCash, delivering all core services like pawn lending, retail sales, and buying goods from the public. These locations, numbering approximately 2,900 retail storefronts across 25 countries and territories as of Q1 2024, are strategically placed in high-traffic areas. This maximizes visibility and accessibility for their target customer base. This physical presence remains the absolute foundation of FirstCash's entire business model.

The American First Finance (AFF) segment utilizes an indirect channel through its extensive retail merchant partner network. These thousands of third-party store locations serve as crucial points for originating point-of-sale financing and lease-to-own agreements. This B2B2C channel strategy allows FirstCash to rapidly expand its financing business without the capital expenditure of building its own retail outlets. By early 2024, AFF had expanded its reach to over 10,000 active merchant locations, significantly boosting its market penetration and customer acquisition capabilities.

FirstCash strategically utilizes its branded e-commerce websites and prominent third-party online marketplaces like eBay to sell a curated selection of higher-value retail merchandise. This digital presence significantly broadens their customer reach beyond the immediate vicinity of their 1,400+ US retail stores. By leveraging online channels, FirstCash optimizes inventory turnover and maximizes the recovery value on items, a crucial aspect of their business model. This approach enhances liquidity, contributing to efficient asset management for the company.

Corporate Websites and Digital Portals

FirstCash leverages corporate websites like firstcash.com and dedicated customer portals as essential digital channels. These platforms enable customers to conveniently manage their accounts, make payments on various loan or financing agreements, and explore available retail inventory directly online. For investors and strategic partners, the corporate website serves as the primary hub for accessing critical financial reporting and company announcements. In 2024, digital engagement continues to be a key focus, complementing the company's extensive physical footprint of over 2,800 retail locations across the U.S., Mexico, and Latin America.

- Customers utilize portals for account management and payments.

- Retail inventory is browsable online, enhancing customer choice.

- Investors access financial reports and company updates digitally.

- Digital channels support 2,800+ physical locations as of 2024.

Local Marketing and Advertising

FirstCash leverages localized marketing, including digital advertisements and local print media, to effectively drive foot traffic to its nearly 3,300 retail locations worldwide as of Q1 2024. This targeted strategy communicates specific offerings like pawn loans and retail merchandise, reinforcing the brand's presence within the communities it serves.

In-store promotions further enhance this crucial channel for customer acquisition at the store level, directly contributing to local market penetration and engagement.

- FirstCash operated 3,293 stores globally as of March 31, 2024.

- Local marketing spend directly supports customer acquisition for these physical locations.

- Digital ad spend for localized targeting is a growing component of their strategy.

- Community engagement through local channels fosters repeat business.

FirstCash's core channels are nearly 3,300 global brick-and-mortar pawn stores (Q1 2024) and the American First Finance network of over 10,000 merchant partners (early 2024). Digital channels, including e-commerce and customer portals, broaden reach and facilitate account management. Localized marketing drives traffic to physical locations.

| Channel Type | Reach (2024) | Primary Function |

|---|---|---|

| Pawn Stores | ~3,300 global | Lending, Retail Sales |

| AFF Merchant Network | 10,000+ locations | Point-of-Sale Financing |

| Digital Platforms | Global Access | E-commerce, Account Mgmt. |

Customer Segments

The unbanked and underbanked are FirstCash's core customer segment for pawn services, comprising individuals lacking access to traditional banking or credit. These consumers often seek small, short-term loans, typically under $500, to manage immediate cash flow needs or unexpected expenses. They prioritize the speed and accessibility of pawn loans, valuing their non-recourse nature where collateral, not credit history, secures the transaction. As of 2024, a significant portion of the U.S. population remains underbanked, with millions relying on alternative financial services.

Value-conscious retail shoppers are a core segment for FirstCash, seeking significant discounts on pre-owned goods. These bargain hunters prioritize acquiring quality items like jewelry, electronics, and tools at prices well below new market value. This diverse customer base, spanning various income levels, is drawn to the substantial savings offered. In Q1 2024, FirstCash reported strong retail merchandise sales, underscoring this segment's consistent demand for affordable, pre-owned products across their extensive store network.

Small and Medium-Sized Retail Merchants represent a crucial B2B customer segment for FirstCash’s American First Finance (AFF) division. These partners include retailers specializing in furniture, mattresses, electronics, and automotive repair, seeking to offer flexible financing solutions to their customers. By collaborating with AFF, these merchants, numbering over 12,000 active locations as of March 2024, can significantly increase their sales and approve a broader base of customers. This partnership allows them to expand their business without incurring the typical credit risk associated with in-house financing, enhancing their operational efficiency. AFF’s gross merchandise volume (GMV) reached $302.2 million in Q1 2024, demonstrating the program's impact.

Credit-Challenged Consumers (POS Financing)

This segment focuses on consumers making purchases at AFF's partner merchants, who often face challenges securing traditional financing due to their credit history. They critically need alternative financing solutions like lease-to-own or retail installment contracts to complete desired purchases. This clientele highly values immediate access to credit directly at the point of sale, enabling them to acquire essential goods despite credit limitations. In 2024, FirstCash, through its AFF segment, continued to address this significant market need.

- AFF's gross merchandise value (GMV) for Q1 2024 was $228.4 million, demonstrating continued demand.

- These consumers typically have FICO scores below 650.

- The segment prioritizes convenience and rapid approval at the point of sale.

- Alternative financing options bridge the gap for approximately 40% of US consumers with subprime credit in 2024.

Individuals Selling Personal Goods

Individuals selling personal goods represent a key customer segment for FirstCash, seeking immediate liquidity from items they no longer need.

These customers prioritize a quick, secure, and hassle-free transaction over achieving the absolute highest price, unlike slower online marketplaces. FirstCash's direct buy/sell services, like those offered at their 2,800+ stores as of Q1 2024, directly cater to this need for rapid access to cash.

- FirstCash reported over 3.2 million buy/sell transactions in 2023 across its U.S. and Latin American operations.

- The average buy/sell transaction value often ranges from $50-$200, reflecting smaller, immediate cash needs.

- Approximately 70% of individuals selling goods to pawn stores cite immediate financial needs as their primary motivation.

- FirstCash's merchandise sales, driven by these buy transactions, generated over $850 million in revenue in 2023.

FirstCash primarily serves the unbanked and underbanked seeking pawn loans, and value-conscious retail shoppers. Its American First Finance (AFF) division caters to over 12,000 small and medium retail merchants and consumers needing alternative financing, with AFF's Q1 2024 gross merchandise value at $228.4 million. Additionally, individuals selling goods contribute to over 3.2 million buy/sell transactions annually.

| Segment | Key Need | 2024 Data Point |

|---|---|---|

| Unbanked/Underbanked | Immediate cash liquidity | Millions underbanked in 2024 |

| AFF Consumers | Alternative financing | Q1 2024 GMV: $228.4M |

| Retail Shoppers | Discounted goods | Strong Q1 2024 retail sales |

Cost Structure

The Cost of Goods Sold (COGS) for FirstCash is a significant expenditure, predominantly representing the principal amount of pawn loans for items forfeited by customers and subsequently moved into retail inventory. This also encompasses the cost of merchandise directly purchased from the public for resale. For 2024, managing this cost through precise item appraisals remains crucial for optimizing FirstCash's gross margin performance on retail merchandise sales. Efficient inventory management directly influences profitability in the company's pawn operations.

Store-level operating expenses are a significant cost for FirstCash, encompassing the daily functioning of its extensive physical store network. These costs primarily include payroll for store employees, rent for over 2,800 retail locations as of early 2024, utilities, security services, and property taxes. These expenses, largely fixed to semi-variable, are crucial for operational efficiency. In 2023, FirstCash reported total operating expenses exceeding $1.4 billion, with store-level costs representing a substantial portion of this figure.

Salaries, General & Administrative (SG&A) expenses for FirstCash encompass essential corporate overhead, including executive salaries and the costs for finance, legal, IT, and human resources functions. This category also covers significant expenses related to managing the American First Finance segment, such as technology infrastructure and centralized support staff. These costs are critical for supporting the company's extensive scale and ensuring compliance with regulatory requirements. For instance, FirstCash reported SG&A expenses of approximately $107.6 million in the first quarter of 2024, reflecting the ongoing investment in these vital operational areas.

Provision for Loan Losses

The provision for loan losses is a key operating expense for FirstCash, particularly within its American First Finance segment. This cost accounts for the estimated losses anticipated from customer defaults on their consumer financing portfolios. The effectiveness of the company's underwriting models directly impacts the size of this provision, as robust models mitigate potential losses. For instance, in Q1 2024, FirstCash reported a provision for losses on finance receivables of $31.8 million, reflecting ongoing portfolio management.

- The provision for loan losses is a significant operating expense for FirstCash's American First Finance segment.

- It covers estimated losses from customer defaults on consumer financing.

- The size of this provision is directly influenced by the effectiveness of underwriting models.

- In Q1 2024, FirstCash reported a $31.8 million provision for finance receivables losses.

Interest Expense

FirstCash's business model heavily relies on debt to finance its extensive loan and receivables portfolios, making interest expense a significant cost. This includes interest paid on various borrowings such as corporate bonds and credit facilities. Efficiently managing these borrowing costs and maintaining a strong credit profile are essential for the company's profitability and financial stability, especially with total debt around $1.7 billion as of March 2024. For the first quarter of 2024, FirstCash reported interest expense of approximately $33.6 million, underscoring its impact.

- Q1 2024 Interest Expense: Approximately $33.6 million.

- Total Debt (March 2024): Around $1.7 billion.

- Primary Debt Uses: Financing loan and receivables portfolios.

- Key Management Focus: Controlling borrowing costs and credit health.

FirstCash's cost structure is dominated by Cost of Goods Sold for pawn inventory and significant store-level operating expenses across its 2,800+ locations. Salaries, General & Administrative costs support corporate functions and the American First Finance segment. Additionally, the provision for loan losses and substantial interest expenses on its debt finance portfolio are key cost drivers, impacting 2024 profitability.

| Cost Category | Key Driver | 2024 Data Point |

|---|---|---|

| Store Operations | Rent, Payroll | Over 2,800 locations (early 2024) |

| SG&A Expenses | Corporate Overhead | $107.6M (Q1 2024) |

| Loan Losses | Finance Receivables | $31.8M (Q1 2024) |

| Interest Expense | Debt Portfolio | $33.6M (Q1 2024) |

Revenue Streams

FirstCash primarily generates its most substantial revenue from pawn service fees and interest charged on loans. Customers pay these fees to redeem their collateralized items, forming the core of the business model. This high-margin, recurring revenue stream acts as the financial engine for the company's pawn operations. For instance, in the first quarter of 2024, FirstCash reported $205.1 million in pawn service charges, highlighting its significant contribution to overall revenue. This consistent income underscores the stability and profitability of their lending services.

FirstCash generates a significant portion of its revenue from the retail sale of forfeited pawn collateral and merchandise purchased directly from the public. For 2024, this segment remains crucial, with revenue reflecting the full sale price of each item. Profitability stems from the margin over the initial loan amount or acquisition cost. This revenue stream effectively diversifies FirstCash’s income and monetizes its core lending activities.

The American First Finance (AFF) segment generates substantial revenue through fees, interest, and lease payments from its portfolio of retail financing and lease-to-own agreements. Consumers utilize AFF's financing solutions to make purchases at partner merchant stores. This segment’s lease and finance receivables reached $384.8 million as of March 31, 2024, reflecting its significant portfolio. AFF revenue increased 12% in the first quarter of 2024, solidifying its position as a major growth area. It represents a key source of revenue diversification for FirstCash.

Scrap Jewelry Sales

FirstCash generates revenue from selling damaged, out-of-style, or low-value gold and other precious metal jewelry to refiners. This jewelry is sold at its melt value, directly tied to current commodity prices like gold. This stream provides an efficient method to liquidate non-retail-worthy inventory, contributing consistently to overall revenue. For instance, in Q1 2024, FirstCash reported strong retail sales, which includes the liquidation of such items, reflecting this consistent contribution.

- Jewelry sold at melt value to refiners.

- Efficiently liquidates non-retail inventory.

- Consistent revenue contributor.

- Revenue tied to commodity prices.

Ancillary Financial Services

FirstCash generates additional revenue through ancillary financial services in some locations. These offerings, while not primary, include essential conveniences like check cashing, money orders, and money transfers. These services enhance customer loyalty and contribute incrementally to store profitability. For instance, in 2023, FirstCash reported total revenues of $2.9 billion, with these supplementary services playing a role in the overall financial ecosystem.

- Check cashing services offer immediate liquidity for customers.

- Money orders provide a secure method for payments.

- Money transfers facilitate convenient remittance options.

- These services contribute to customer traffic and incremental revenue.

FirstCash primarily generates robust revenue from pawn service fees and interest, alongside the retail sale of forfeited collateral. Its American First Finance (AFF) segment significantly contributes through consumer financing and lease-to-own agreements. Ancillary services like check cashing and the sale of precious metals further diversify income streams.

| Revenue Stream | Q1 2024 Contribution | Key Metric (2024) |

|---|---|---|

| Pawn Service Charges | $205.1 million | Core recurring income |

| AFF Segment Revenue | 12% increase (Q1 2024) | Lease & Finance Receivables: $384.8 million (March 31, 2024) |

| Retail Sales (Pawned Merchandise) | Significant portion of total retail sales | Profitability from margin over loan/cost |

| Precious Metal Sales | Consistent contribution within retail sales | Tied to commodity prices |

| Ancillary Financial Services | Incremental revenue (part of $2.9B total 2023 revenue) | Enhances customer loyalty |

Business Model Canvas Data Sources

The FirstCash Business Model Canvas is built using a combination of internal financial reports, customer transaction data, and operational performance metrics. These sources provide a comprehensive view of FirstCash's current business operations and financial health.