FirstCash Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

FirstCash operates in a unique niche, facing distinct pressures across Porter's Five Forces. Understanding the bargaining power of their diverse customer base and the relatively low threat of substitutes is crucial for grasping their market position. However, the landscape is not without its challenges.

The competitive rivalry within the pawn and lending industry, though fragmented, presents significant hurdles, and the threat of new entrants, while currently moderate, demands careful consideration. Furthermore, the influence of suppliers, particularly in securing merchandise, can impact profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FirstCash’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

FirstCash’s primary suppliers are millions of individual customers offering personal goods for pawn loans or direct sale, creating an inherently fragmented base. This vast fragmentation means no single supplier holds significant leverage, a highly favorable dynamic for FirstCash. For example, in 2024, FirstCash reported serving a massive customer base across its thousands of stores, underscoring the diffused nature of its supplier network. This broad base ensures the company is not dependent on any individual, greatly diminishing supplier bargaining power.

The bargaining power of suppliers for FirstCash is notably low, primarily because there is no concentration among the individuals supplying pre-owned merchandise to pawn stores. These suppliers are a diffuse group seeking immediate cash, which prevents any organized influence on the prices FirstCash pays for goods. FirstCash's expansive network, encompassing over 3,000 stores globally as of 2024, further dilutes the power of any single supplier. This widespread presence ensures a continuous and diverse influx of items, consistently favoring FirstCash in price negotiations.

For FirstCash, the goods provided by individual suppliers, such as jewelry, electronics, and tools, are largely commodities. Their values are primarily determined by established secondary markets rather than by the individual suppliers themselves. There is minimal differentiation in the items offered by one supplier versus another, as a 1-ounce gold coin from one individual is identical to another. This inherent lack of unique input means that individual suppliers have very limited leverage and cannot command premium prices for their items, as FirstCash can easily source similar goods from numerous other individuals. In 2024, the market for pre-owned goods continued to reflect these commodity-like valuations, ensuring consistent pricing dynamics.

FirstCash's Role as a Price-Setter

FirstCash holds significant power in setting purchase prices due to suppliers' urgent need for immediate liquidity and the limited alternative buyers offering instant cash. The company's deep expertise in appraising a wide array of goods, ranging from jewelry to electronics, further solidifies its position. This allows FirstCash to effectively manage its cost of goods sold and maintain optimal loan-to-value ratios. For example, in 2024, FirstCash continued to leverage its appraisal capabilities across its extensive network of over 2,900 stores, ensuring consistent valuation.

- FirstCash's appraisal expertise directly impacts its ability to control inventory acquisition costs.

- The immediate cash need of sellers provides FirstCash with leverage in price negotiations.

- In 2024, FirstCash maintained a strong negotiating position in the pawn and retail sectors.

Minimal Threat of Forward Integration

FirstCash faces virtually no threat of forward integration from its individual consumer suppliers. The significant barriers to entry, including stringent state and local licensing requirements, substantial capital investment for inventory, and specialized operational expertise, deter any such move. Suppliers are primarily seeking immediate liquidity for their assets, not aiming to establish competing pawn or retail finance operations. For instance, as of Q1 2024, FirstCash operated over 1,100 pawn locations in the U.S. alone, highlighting the scale and infrastructure required.

- Licensing and regulatory hurdles for new pawn operations are extensive, requiring significant compliance efforts.

- The capital required for inventory acquisition and store infrastructure represents a substantial barrier.

- Operational expertise in asset valuation, compliance, and customer service is specialized.

- Individual consumers prioritize quick cash, not establishing complex retail finance businesses.

FirstCash benefits from a highly fragmented supplier base of individual customers, which inherently limits their bargaining power. These suppliers offer commoditized goods and seek immediate liquidity, providing FirstCash with significant leverage in price setting. As of 2024, FirstCash’s expansive network and appraisal expertise further solidify its control over acquisition costs. Critically, there is no threat of forward integration from these suppliers due to substantial operational and regulatory barriers.

| Supplier Characteristic | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Fragmented Base | Very Low | Millions of customers globally |

| Goods Type | Commoditized | Valued by secondary markets |

| Liquidity Needs | High Urgency | Drives immediate cash transactions |

What is included in the product

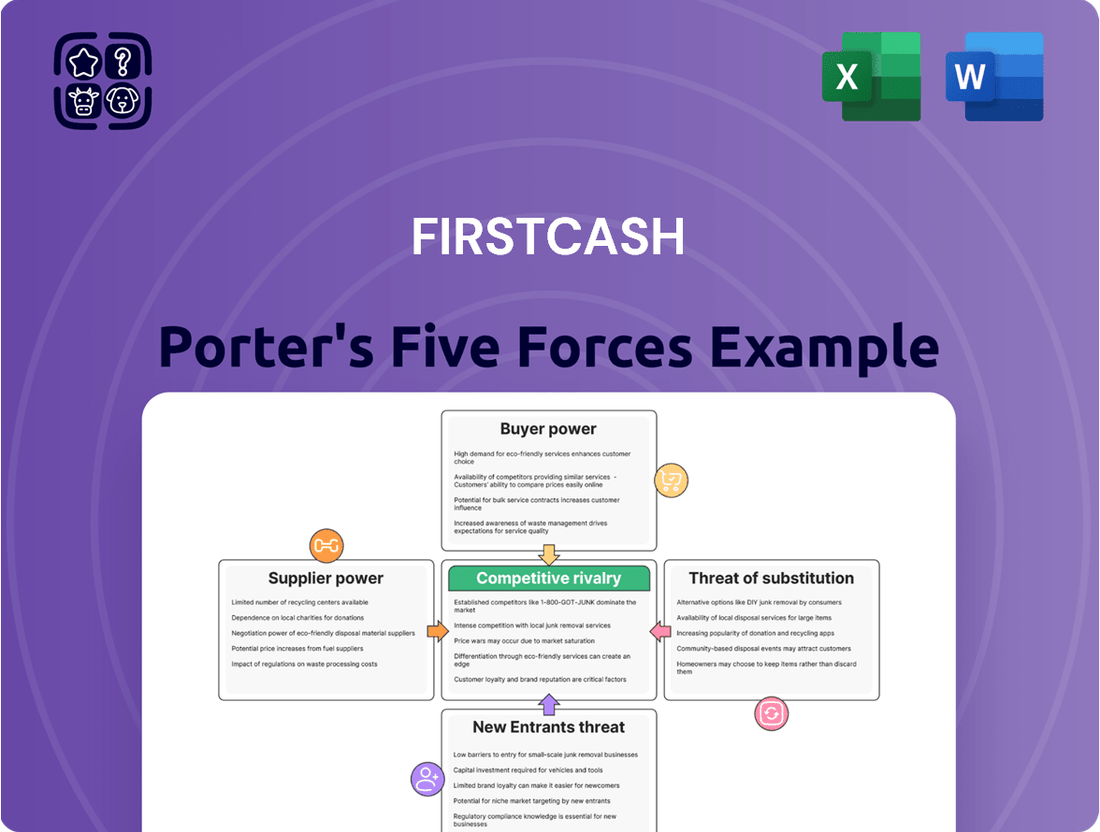

This analysis meticulously examines the competitive landscape for FirstCash, dissecting the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Visualize competitive intensity with a dynamic, interactive dashboard, making complex market pressures readily apparent.

Customers Bargaining Power

FirstCash serves a vast and fragmented customer base, primarily unbanked or underbanked individuals seeking small, immediate financial solutions. This high fragmentation significantly limits an individual customer's bargaining power regarding loan terms or interest rates. Given FirstCash's extensive network of over 2,800 retail locations as of early 2024, the departure of any single customer has a negligible impact on their overall revenue or operational stability. This widespread customer base ensures that no individual client can exert meaningful pressure on FirstCash's business model.

The typical transaction size at FirstCash, whether for a pawn loan or a retail purchase, remains relatively small in 2024. Individual customers do not engage in volumes large enough to exert significant pricing pressure on the company. For instance, the average pawn loan balance was around $150-$200 in recent periods, reflecting these low-value transactions. This holds true for both the pawn lending and the retail sales segments, limiting customer bargaining power.

For FirstCash's core demographic seeking immediate, non-recourse small-dollar loans, viable alternatives remain significantly limited. Traditional banks typically do not cater to this segment, which often includes underbanked individuals. While payday loans exist, they often present different repayment structures or more stringent qualification criteria, reducing their appeal. This scarcity of attractive options, evidenced by the consistent demand for pawn services, significantly diminishes the bargaining power of FirstCash customers. Annually, FirstCash facilitates millions of such transactions, underscoring the constrained choices available.

Price Sensitivity on Retail Side

On FirstCash's retail side, where pre-owned merchandise is sold, customers are notably price-sensitive, holding significant bargaining power. They actively compare prices with other secondhand retailers, including online platforms like eBay or local competitors, before making a purchase. This broad market access empowers buyers to seek the best value.

However, the diverse and often unique inventory found in pawn shops, ranging from electronics to jewelry, can somewhat lessen this power. For instance, a specific, rare item might not have direct price comparisons. FirstCash reported retail merchandise sales of $124.9 million in Q1 2024, demonstrating the scale of their retail operations.

- Customers exhibit high price sensitivity when purchasing pre-owned goods.

- Access to online marketplaces enhances buyer comparison capabilities.

- Unique pawn shop inventory can mitigate direct price competition.

- FirstCash's Q1 2024 retail merchandise sales reached $124.9 million.

Regulatory Influence on Customer Power

Government regulations, such as caps on interest rates, significantly increase customer power by setting legal limits on the terms FirstCash can offer. While customers do not directly negotiate these limits, regulatory bodies act on their behalf, influencing the overall cost of pawn services. This external force provides a crucial baseline of customer protection, ensuring fair practices in 2024.

- Many U.S. states cap pawn interest rates, often around 24% annually, plus fees.

- Texas, a major FirstCash market, has specific usury laws influencing pawn charges.

- Regulations in Mexico and Latin America also impose varying limits on lending terms.

- These rules indirectly empower customers by limiting FirstCash's pricing flexibility.

FirstCash's loan customers have limited bargaining power due to their fragmented base, small average loan sizes like $150-$200 in 2024, and few alternative options for immediate cash. However, retail customers exhibit higher power, actively comparing prices for pre-owned goods, especially online. Government regulations, such as state-imposed interest rate caps, indirectly empower customers by setting limits on loan terms in 2024, impacting FirstCash's pricing flexibility.

Full Version Awaits

FirstCash Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for FirstCash, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your immediate use. It thoroughly examines the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. No mockups, no samples—the FirstCash Porter's Five Forces Analysis you see here is exactly what you’ll be able to download after payment, providing actionable insights into its market dynamics.

Rivalry Among Competitors

FirstCash primarily navigates a landscape of fragmented local competition, where numerous small, independent pawn shops pose the main rivalry. Despite FirstCash operating over 1,100 stores in the U.S. and over 2,800 worldwide as of late 2023, each market segment remains highly localized. This intense rivalry centers on convenient store locations, personalized customer service, and the perceived fairness of loan values and retail prices. Local operators often leverage community ties, competing directly for customers seeking immediate financial solutions.

FirstCash faces significant competition from a diverse array of alternative financial service providers, including numerous independent and chain payday lenders, title loan companies, and installment loan providers. These firms collectively target the same segment of cash- and credit-constrained consumers who seek immediate financial solutions. The intensity of this rivalry is greatly influenced by the specific financial products offered and the evolving regulatory environment across different states and countries. For instance, the shift towards installment loans, which represented a growing portion of the non-bank consumer lending market in 2024, intensifies direct competition for FirstCash's core offerings.

The rise of fintech companies and online lending platforms presents a significant competitive threat to FirstCash. These digital-native companies, like those offering instant loans, provide convenient online short-term loan products that directly appeal to FirstCash's core customer base. For instance, the US online lending market is projected to reach over $190 billion in 2024, indicating a strong shift towards digital financial services. This increasing adoption of digital platforms intensifies rivalry, pushing traditional pawn and short-term lenders to innovate or lose market share to more accessible online alternatives.

Retail Competition

FirstCash faces significant retail competition from various secondhand sellers, including local thrift stores, consignment shops, and large online marketplaces like eBay and Facebook Marketplace. This rivalry largely centers on competitive pricing, product selection, and the overall quality of goods available to consumers. FirstCash leverages its pawn operations to uniquely acquire a diverse inventory, offering an edge in this crowded market. In 2024, the secondhand market continues its robust growth, intensifying this rivalry.

- FirstCash reported total retail sales of $219.7 million in Q1 2024, indicating substantial engagement in the secondhand market.

- The global secondhand market is projected to reach $350 billion by 2027, highlighting the vast competitive landscape.

- Online resale platforms, a key competitor, saw a 24% increase in user base in 2023, attracting more budget-conscious consumers.

- FirstCash's ability to source items directly from pawned collateral provides a steady and unique supply chain compared to traditional retailers.

Industry Consolidation and Scale Advantage

As the largest pawn operator, FirstCash benefits from significant economies of scale in technology, marketing, and regulatory compliance, capabilities smaller competitors cannot match. The company’s ongoing strategy of acquiring smaller pawn chains, like its 2024 purchases further consolidating the market, solidifies its competitive position. This scale provides a considerable advantage in the fragmented industry. For instance, FirstCash reported over 1,200 US stores in early 2024, reflecting its vast operational footprint.

- FirstCash leverages scale for cost efficiencies in technology and marketing.

- Smaller competitors face challenges in matching FirstCash's operational scope.

- Strategic acquisitions in 2024 enhance market consolidation for FirstCash.

- The company's extensive network, exceeding 1,200 US stores, bolsters its market dominance.

FirstCash navigates intense competitive rivalry from fragmented local pawn shops and diverse alternative financial service providers, including a growing online lending sector. The US online lending market is projected to exceed $190 billion in 2024, intensifying digital competition. Additionally, the robust secondhand market, with FirstCash reporting $219.7 million in Q1 2024 retail sales, adds significant retail rivalry. Despite this, FirstCash's scale and strategic 2024 acquisitions, expanding its US store count to over 1,200, bolster its market position.

| Metric | 2024 Data | Impact on Rivalry |

|---|---|---|

| US Online Lending Market | >$190 Billion (Projected) | Increases digital competition for short-term loans. |

| FirstCash Q1 2024 Retail Sales | $219.7 Million | Highlights engagement in highly competitive secondhand market. |

| FirstCash US Store Count | >1,200 (Early 2024) | Demonstrates scale advantage against smaller competitors. |

SSubstitutes Threaten

Traditional banks and credit unions represent a potential substitute, yet they typically do not serve the unbanked or underbanked demographic central to FirstCash's operations. For instance, in 2023, approximately 4.5% of U.S. households remained unbanked, a segment often reliant on alternative financial services. For customers possessing strong credit profiles, personal loans from these mainstream institutions offer a compelling substitute due to significantly lower interest rates. However, for a substantial portion of FirstCash's clientele, securing such conventional financing remains an unviable option, reinforcing their reliance on non-traditional providers.

Other alternative credit products like payday loans, auto title loans, and installment loans pose a direct threat as substitutes for FirstCash services. These options provide immediate cash, often requiring proof of income or a vehicle title as collateral, differentiating their terms. For instance, in 2024, the average annual percentage rate for a typical payday loan can exceed 300%, significantly higher than pawn loan rates. Customers weigh these options based on their specific financial needs and available assets, influencing their choice among these high-cost credit alternatives.

Online peer-to-peer (P2P) lending platforms and personal crowdfunding sites are emerging substitutes for traditional pawn and payday services like FirstCash. These platforms enable individuals to borrow directly from other individuals, often offering more competitive interest rates than short-term lenders. While P2P lending represented a global market size of approximately $200 billion in 2023 and is projected to grow, its increasing accessibility and ease of use pose a long-term threat to FirstCash's business model. The growing digital finance landscape, particularly with services becoming more mainstream in 2024, allows consumers to bypass traditional credit options.

'Buy Now, Pay Later' (BNPL) Services

Buy Now, Pay Later services present a significant substitute threat to FirstCash, particularly for its AFF segment and small consumer loans. These fintech-driven options offer immediate, often interest-free installment payments at the point of sale, directly competing with traditional retail financing. As of 2024, BNPL continues its rapid expansion, with global transaction values projected to reach over $600 billion, providing consumers with highly accessible alternatives for retail purchases without needing a traditional loan.

- BNPL allows immediate, interest-free installment payments for retail goods.

- It directly competes with FirstCash's POS payment solutions and small loans.

- Global BNPL transaction values are projected to exceed $600 billion in 2024.

- This widespread accessibility offers consumers a strong alternative to FirstCash's offerings.

Selling Personal Assets Directly

The threat of individuals selling personal assets directly through online platforms presents a notable substitute to FirstCash pawn loans. Instead of obtaining a quick loan, customers might opt for sites like Facebook Marketplace, eBay, or Craigslist, which often yield a higher sale price for items. However, this method lacks the immediate cash access and the secure buy-back option inherent to pawn services. It also demands significant effort from the seller, including listing, communication, and shipping arrangements, unlike the instant process at a pawn shop.

- eBay reported over 130 million active buyers globally in the first quarter of 2024.

- Facebook Marketplace facilitates billions in transactions annually, indicating widespread direct selling activity.

- Craigslist remains a prominent local selling platform for various goods.

- The convenience and speed of pawn loans (often minutes) contrast sharply with the days or weeks direct sales can take.

FirstCash faces a substantial threat from various substitutes, including traditional banks for credit-worthy individuals and other high-cost alternative lenders like payday loans, where APRs can exceed 300% in 2024. Emerging digital solutions such as online peer-to-peer lending and Buy Now, Pay Later services, projected to reach over $600 billion in global transaction values in 2024, offer convenient, often interest-free alternatives. Additionally, direct online selling platforms like eBay, with over 130 million active buyers in Q1 2024, provide a substitute for pawn loans, despite lacking the immediate cash and buy-back options.

| Substitute Category | Key Characteristic | 2024/Recent Data |

|---|---|---|

| Traditional/Alt Loans | Varying rates, accessibility | 4.5% US unbanked (2023); Payday APR > 300% |

| Digital Finance | Convenient, accessible credit | BNPL > $600B projected global transactions (2024) |

| Direct Online Selling | Higher potential sale price | eBay > 130M active buyers (Q1 2024) |

Entrants Threaten

The pawn industry, where FirstCash operates, is heavily regulated across local, state, and federal levels, creating a complex operating environment.

These regulations encompass strict rules on interest rate caps, customer identification protocols, and mandatory reporting to law enforcement agencies concerning transactions.

For instance, in 2024, state-specific usury laws often cap annual percentage rates on pawn loans, making compliance a significant hurdle.

Navigating this intricate and ever-evolving regulatory landscape, including anti-money laundering requirements, presents a substantial and costly barrier for any potential new entrant.

Establishing a pawn shop like FirstCash requires substantial capital for physical locations, diverse inventory, and ample cash reserves to fund loans. Building customer trust is paramount, as individuals entrust valuable personal property to the lender. New entrants face significant hurdles replicating FirstCash's extensive network of over 2,800 stores globally and its strong brand recognition, which has been built over decades. FirstCash's financial stability, evidenced by its market capitalization of approximately $3.5 billion in early 2024, further solidifies its competitive advantage. This makes it difficult for new, less-capitalized players to penetrate the market effectively.

FirstCash, as a large incumbent, benefits significantly from economies of scale, making new entry challenging. With a vast network, including over 2,800 retail locations across 25 countries as of early 2024, FirstCash can achieve substantial cost efficiencies in technology, security infrastructure, and employee training. This scale enables them to invest heavily in advanced systems and compliance, like robust anti-money laundering protocols. A new entrant, lacking this widespread operational footprint, would face considerably higher per-unit costs for similar investments. This cost disparity makes it difficult for new players to compete effectively on pricing or service quality against FirstCash's established advantages.

Specialized Knowledge and Expertise

Running a successful pawn operation, like FirstCash, demands deep specialized expertise in appraising a vast array of items, from intricate jewelry to diverse electronics and tools. This nuanced knowledge, vital for accurate valuations, is accumulated over years and presents a significant barrier for new entrants. Inaccurate appraisals can directly impact profitability; for instance, FirstCash reported over $2.1 billion in merchandise sales in 2023, underscoring the scale where appraisal precision is critical. New competitors would struggle to quickly replicate this institutional knowledge base, risking substantial losses from over-lending or missed opportunities.

- FirstCash's extensive product categories, including jewelry and electronics, require specific appraisal skills.

- Developing accurate valuation expertise takes considerable time and practical experience.

- Imprecise appraisals can lead to direct financial losses and reduced operational efficiency.

- The complexity of appraising diverse inventory acts as a strong deterrent for potential new market participants.

Limited Access to Distribution Channels

New entrants face substantial barriers due to FirstCash's established distribution. The company boasts over 3,000 physical stores across the U.S. and Latin America, a vast network that is incredibly costly and time-consuming for any newcomer to replicate. This extensive footprint offers a significant competitive advantage in terms of customer reach and trust. While online-only pawn platforms have emerged, they struggle with logistics and building the same level of customer confidence without a tangible physical presence. As of 2024, FirstCash continues to leverage its store density to maintain market dominance.

- FirstCash operates over 3,000 stores, primarily in the U.S. and Latin America.

- Replicating this physical footprint is a major capital and time barrier for new competitors.

- Online pawn platforms face inherent challenges in logistics and building customer trust.

- FirstCash's established physical presence provides a significant competitive moat as of 2024.

New entrants face low threats due to FirstCash's extensive physical footprint, encompassing over 3,000 stores primarily in the U.S. and Latin America as of 2024.

Replicating this vast network demands immense capital and time, creating a significant barrier.

While online pawn platforms exist, they struggle to match the trust and logistical efficiency of FirstCash's established brick-and-mortar presence.

This widespread physical distribution solidifies FirstCash's competitive advantage, making market penetration difficult for newcomers.

| Barrier Type | FirstCash Strength | New Entrant Challenge |

|---|---|---|

| Physical Presence | 3,000+ stores (2024) | High capital, time to replicate |

| Customer Trust | Decades of operation | Building confidence without physical touchpoints |

| Logistics | Established in-store processes | Complex for online-only models |

Porter's Five Forces Analysis Data Sources

Our FirstCash Porter's Five Forces analysis is built upon a foundation of publicly available financial data from SEC filings, investor relations reports, and industry-specific market research from firms like IBISWorld. We also incorporate insights from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.