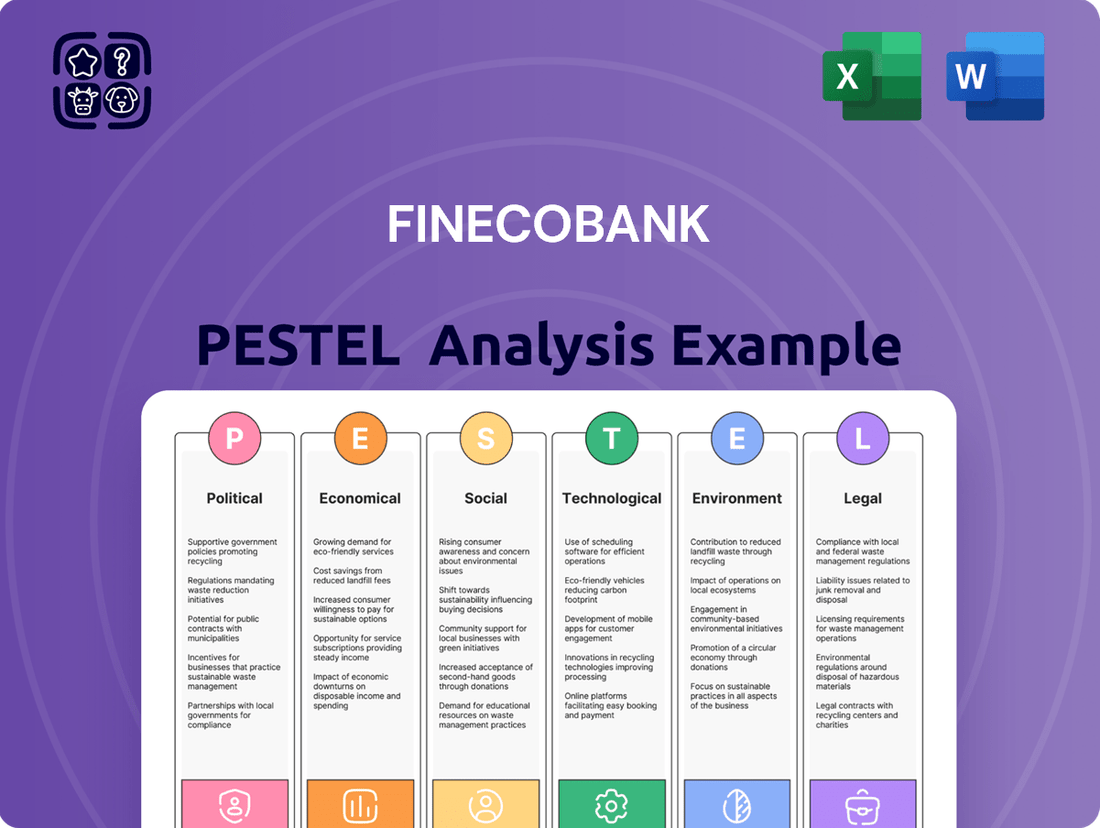

FinecoBank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FinecoBank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping FinecoBank's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Purchase the full version now for actionable intelligence that will empower your decision-making.

Political factors

Italy's political landscape is a key consideration for FinecoBank. A stable government, which has seen coalition governments remain in power for extended periods in recent years, fosters a more predictable environment for economic policies and banking regulations. For instance, the Italian government's approach to fiscal stimulus and public debt management directly impacts the broader economic climate in which FinecoBank operates.

As an Italian bank, FinecoBank operates within the EU Banking Union, meaning it adheres to directives from the European Central Bank (ECB) and the European Banking Authority (EBA). This framework significantly shapes its operational landscape.

The ongoing harmonization of banking rules across the European Union directly affects FinecoBank. For instance, the ECB's prudential requirements, such as the Common Equity Tier 1 (CET1) ratio, are critical. As of Q4 2023, the average CET1 ratio for significant institutions under ECB supervision was around 15.5%, providing a benchmark for FinecoBank's own capital adequacy. These regulations influence compliance costs and the ease with which FinecoBank can conduct business across member states.

Changes in Italian corporate tax rates, such as the Imposta sul Reddito delle Società (IRES), directly impact FinecoBank's net earnings. For instance, if IRES were to increase from its current rate, FinecoBank's profitability would likely see a reduction.

Furthermore, the introduction of new financial transaction taxes at the EU level could add to operational costs. The EU's ongoing discussions regarding potential financial transaction taxes demonstrate a political willingness to explore such measures, which could affect trading volumes and revenue streams for banks like FinecoBank.

Government incentives for digital banking or specific investment products can also shape FinecoBank's strategic direction. For example, Italian government initiatives promoting financial inclusion through digital platforms could encourage FinecoBank to further invest in its online services, potentially boosting customer acquisition and engagement.

Geopolitical Risks and Trade Wars

Broader geopolitical tensions and the specter of trade wars significantly influence investor confidence and capital flows across Europe, directly impacting economic stability. For FinecoBank, this instability translates to increased market volatility, which can affect its brokerage and investment services, potentially impacting client asset values and trading volumes.

The ongoing geopolitical landscape, including conflicts and shifting international alliances, creates an environment of uncertainty. For instance, the European Union's trade balance, a key indicator of economic health, saw a surplus of €23.3 billion in April 2024, but this can be rapidly altered by trade disputes or disruptions. Such shifts can lead to:

- Increased market volatility impacting FinecoBank's trading platforms.

- Reduced cross-border investment affecting capital flows into European markets.

- Potential currency fluctuations creating challenges for international transactions.

- Heightened regulatory scrutiny on financial institutions operating in sensitive regions.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Policies

Governments worldwide are intensifying their efforts to combat financial crime, leading to increasingly robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) policies. This means financial institutions like FinecoBank must navigate a complex and evolving regulatory landscape.

Adherence to these stringent national and international regulations necessitates substantial investment. FinecoBank is required to allocate resources towards sophisticated compliance systems, cutting-edge technology for transaction monitoring, and comprehensive staff training programs. These investments are crucial not only for mitigating legal and financial risks, such as hefty penalties, but also for safeguarding the bank's reputation and maintaining customer trust.

- Increased Regulatory Scrutiny: Financial Action Task Force (FATF) recommendations continue to shape global AML/CTF standards, impacting reporting requirements and due diligence processes.

- Technological Investment: Banks are investing heavily in AI and machine learning for transaction monitoring, with global spending on AML solutions projected to reach over $10 billion by 2025.

- Penalties for Non-Compliance: In 2023, financial institutions faced billions in fines for AML/CTF violations, underscoring the financial consequences of inadequate compliance.

- Reputational Risk Management: A strong AML/CTF framework is vital for maintaining public confidence and avoiding reputational damage that can significantly impact market share.

Political stability and government policies significantly influence FinecoBank's operational environment. Italy's commitment to EU banking regulations, such as capital adequacy ratios like CET1, which averaged around 15.5% for significant institutions in Q4 2023, directly impacts compliance and strategy.

Government fiscal policies, including corporate tax rates like IRES, and potential new financial transaction taxes at the EU level, directly affect FinecoBank's profitability and operational costs.

Furthermore, geopolitical tensions can lead to market volatility, impacting FinecoBank's trading and investment services, while evolving AML/CTF regulations necessitate ongoing investment in compliance technology, with global spending on AML solutions projected to exceed $10 billion by 2025.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting FinecoBank, covering political stability, economic conditions, social trends, technological advancements, environmental concerns, and legal frameworks. It provides actionable insights to identify strategic opportunities and mitigate potential risks.

A clear, actionable summary of FinecoBank's PESTLE factors, designed to quickly identify and address external challenges, thereby alleviating strategic planning pain points.

Economic factors

The European Central Bank's (ECB) monetary policy is a key driver for FinecoBank. As of late 2024, the ECB has maintained a cautious approach, with key interest rates hovering around 4.50%. This environment, while potentially boosting net interest margins on loans, also presents challenges for deposit profitability and can temper demand for credit, especially in sectors like mortgages.

Sustained higher interest rates, as seen in 2024, can improve FinecoBank's net interest margin (NIM) by increasing the yield on its loan portfolio. For instance, a 0.25% increase in the ECB's main refinancing operations rate typically translates to higher lending costs for customers. However, this also means higher funding costs for deposits, potentially squeezing profitability if deposit rates rise faster than lending rates.

Conversely, a prolonged period of low interest rates, a scenario that has characterized much of the preceding decade and could re-emerge, significantly challenges traditional banking income streams for FinecoBank. Lower rates compress NIMs, making it harder to generate substantial profits from the spread between what banks earn on loans and pay on deposits, pushing the bank to diversify revenue.

High inflation significantly impacts consumer purchasing power. For instance, if inflation hovers around 5% in 2024, a consumer's €1000 will effectively buy less than it did previously, reducing the amount available for discretionary spending and investment. This erosion of disposable income could lead to decreased demand for FinecoBank's asset management and investment services as individuals prioritize essential spending.

However, elevated inflation also presents opportunities. It can spur client interest in inflation-hedging financial products, such as inflation-linked bonds or certain commodities, potentially boosting demand for FinecoBank's wealth management solutions. Clients may actively seek expert advice on strategies to preserve their capital's real value amidst rising prices.

Italy's GDP growth is a key indicator of its economic health. In the first quarter of 2024, Italy's GDP grew by 0.3% compared to the previous quarter, and by 0.7% year-on-year, reflecting a moderate but positive economic trajectory. This growth, while steady, is closely watched by FinecoBank as it impacts consumer spending and business investment, directly influencing demand for financial services.

The broader Eurozone economy also plays a significant role. For 2024, the European Commission projected a GDP growth of 0.9% for the Eurozone, a slight upward revision from earlier forecasts. This regional economic performance influences cross-border investment and trade, indirectly affecting FinecoBank's operations and client activity, particularly for those with international exposure.

Unemployment rates and consumer confidence are vital components of economic health. In Italy, the unemployment rate stood at 7.2% in April 2024, a slight decrease from the previous month, signaling improving labor market conditions. Enhanced consumer confidence, often linked to lower unemployment and wage growth, typically translates into increased demand for credit and investment products, benefiting banks like FinecoBank.

Competition in Financial Services

FinecoBank navigates a fiercely competitive financial services landscape, facing off against established traditional banks, agile challenger banks, and disruptive fintech innovators. This intense rivalry, particularly in the digital banking and investment sectors, exerts downward pressure on fees and profit margins. For instance, the European digital banking market saw significant growth, with neobanks like N26 and Revolut expanding their customer bases rapidly throughout 2024, forcing incumbents and established players like FinecoBank to constantly adapt.

To maintain its edge, FinecoBank must prioritize continuous innovation and clear differentiation of its products and services. This is crucial for both retaining its existing client base and attracting new customers in a crowded marketplace. The ongoing digital transformation across the industry means that customer expectations for seamless, integrated, and value-added financial solutions are higher than ever.

- Digital Banking Growth: By the end of 2024, it's estimated that over 50% of European banking customers utilized digital channels for most of their transactions, highlighting the critical importance of a strong online and mobile presence.

- Fintech Investment Surge: Venture capital investment in European fintech companies remained robust in early 2025, with significant funding rounds announced for platforms specializing in wealth management and digital lending, intensifying competition in these areas.

- Fee Compression: Average transaction fees for online brokerage services in Europe have seen a decline of approximately 15-20% year-over-year leading into 2025, directly impacting revenue streams for all players, including FinecoBank.

Financial Market Volatility

Financial market volatility significantly impacts FinecoBank, a key player in brokerage and investment services. High volatility often translates to increased trading volumes and a greater need for expert advisory, which can boost revenue. For instance, during periods of heightened market uncertainty in late 2023 and early 2024, many European financial services firms saw a surge in client activity and demand for hedging strategies.

However, this same volatility also heightens client risk. If clients experience substantial losses, it can erode their confidence in FinecoBank's services and lead to a decrease in assets under management (AUM). The European banking sector, in general, experienced a notable shift in AUM in 2023, with some institutions reporting modest declines due to market fluctuations, even as trading revenues held steady.

- Increased Trading Volumes: Volatile markets often spur more frequent trading.

- Demand for Advisory: Clients seek guidance during uncertain times.

- Risk Exposure: Higher volatility means greater potential for client losses.

- Impact on AUM: Significant market downturns can reduce the value of assets managed.

Economic factors significantly shape FinecoBank's operating environment. The European Central Bank's monetary policy, with key rates around 4.50% in late 2024, influences lending and deposit profitability, while inflation impacts consumer spending and demand for hedging products. Italy's GDP growth, projected at 0.3% quarterly in early 2024, and the broader Eurozone's 0.9% growth forecast for 2024, indicate a steady but moderate economic expansion that affects overall demand for financial services.

Unemployment rates, with Italy's at 7.2% in April 2024, and consumer confidence are key indicators. Improved labor markets generally boost consumer confidence, leading to increased demand for credit and investment products. FinecoBank must adapt to these macroeconomic shifts, leveraging opportunities presented by inflation-hedging needs while mitigating risks from potential economic slowdowns.

| Economic Indicator | Value/Projection | Period | Implication for FinecoBank |

|---|---|---|---|

| ECB Key Interest Rate | ~4.50% | Late 2024 | Impacts NIM; potential for higher lending yields but also increased funding costs. |

| Italian GDP Growth | +0.3% (QoQ) | Q1 2024 | Moderate growth supports consumer spending and business investment, influencing service demand. |

| Eurozone GDP Growth | +0.9% (Projected) | 2024 | Regional economic health affects cross-border activity and client investment strategies. |

| Italian Unemployment Rate | 7.2% | April 2024 | Lower rates generally correlate with higher consumer confidence and demand for financial products. |

Preview the Actual Deliverable

FinecoBank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive FinecoBank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape with this detailed report.

Sociological factors

The growing comfort with digital platforms is a significant tailwind for FinecoBank. In 2024, a substantial portion of the Italian population, estimated to be over 70%, regularly uses online services, with mobile banking adoption continuing its upward trajectory. This societal shift towards digital engagement directly aligns with FinecoBank's established direct, multi-channel approach, making its services readily accessible and appealing to a broad customer base.

FinecoBank's strategy hinges on further capitalizing on this digital adoption by enhancing user experience and providing robust educational resources. By simplifying digital interfaces and offering clear guidance on its financial products and online tools, the bank can attract new customers and deepen existing relationships. This focus on digital enablement is key to expanding its market reach and fostering greater client interaction and loyalty.

Consumers now demand digital banking experiences that are as smooth and personalized as their favorite online retailers. This shift means banks must offer instant access, tailored advice, and effortless service.

FinecoBank's commitment to digital innovation and direct client engagement is crucial. By 2024, over 80% of banking interactions were projected to occur digitally, underscoring the need for FinecoBank to continuously enhance its platform to meet these evolving expectations for speed and personalization.

Italy's demographic landscape is characterized by a significant aging population, a trend that directly influences the demand for specialized financial services. As the proportion of older citizens grows, there's a heightened need for wealth management, robust pension planning solutions, and efficient inheritance services. This shift presents both challenges and opportunities for financial institutions like FinecoBank.

FinecoBank must strategically adapt its product portfolio and advisory approach to meet the varied requirements across different age demographics. For instance, younger, digitally-savvy clients are increasingly looking for sophisticated online trading platforms and investment tools. Conversely, older clients often require comprehensive wealth management strategies that address retirement income, capital preservation, and estate planning. By understanding these distinct needs, FinecoBank can better position itself to serve a broader client base effectively.

In 2023, Italy's median age was reported to be around 46.5 years, one of the highest in Europe, with the over-65 population constituting approximately 24% of the total. This demographic reality underscores the growing market for retirement-focused financial products. FinecoBank’s ability to innovate in areas like digital pension management and personalized wealth advisory for seniors will be crucial for sustained growth.

Trust and Brand Reputation

Public trust is paramount for financial institutions, directly impacting FinecoBank's ability to attract and keep clients. A strong brand reputation built on reliability and security is essential in the competitive financial landscape.

FinecoBank's commitment to transparency, particularly in its digital platforms and advisory services, underpins client confidence. As of Q1 2024, FinecoBank reported a Net Promoter Score (NPS) of 56, indicating a high level of customer satisfaction and trust.

- FinecoBank's NPS of 56 in Q1 2024 highlights strong customer trust.

- Reputation for security and transparency is key in the financial sector.

- Digital operations and financial advisory services are critical for client confidence.

ESG (Environmental, Social, Governance) Awareness

Societal awareness of Environmental, Social, and Governance (ESG) factors is rapidly increasing, directly impacting how clients make investment decisions and how businesses operate. This growing demand for ethically aligned investments means that financial institutions like FinecoBank must adapt to meet these evolving client preferences.

FinecoBank's commitment to ESG principles is becoming a significant differentiator. By offering sustainable investment products and embedding ESG considerations into its core operations, the bank can attract ethically minded investors. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance, highlighting the substantial financial implications of ESG integration.

- Growing Demand: Investors increasingly seek portfolios that align with their values, pushing for greater transparency and impact.

- ESG Integration: FinecoBank's ability to incorporate ESG criteria into its investment strategies and advisory services enhances client trust.

- Corporate Social Responsibility: Demonstrating strong CSR initiatives, such as community engagement and ethical labor practices, bolsters brand reputation.

- Market Growth: The significant expansion of the sustainable investment market underscores the financial opportunity for institutions prioritizing ESG.

Societal trust in financial institutions is a bedrock for FinecoBank's operations, directly influencing client acquisition and retention. A strong reputation for security and transparency is not just beneficial but essential in today's competitive financial landscape. As of Q1 2024, FinecoBank's Net Promoter Score (NPS) of 56 indicates a high level of customer satisfaction and trust, underscoring the effectiveness of its digital platforms and advisory services in building client confidence.

Technological factors

FinecoBank's business thrives on its advanced digital and mobile banking infrastructure, forming the bedrock of its direct client engagement. The bank reported that in the first half of 2024, its mobile app saw a significant increase in daily active users, reflecting the growing preference for digital channels. This focus on user-friendly interfaces and sophisticated mobile tools is crucial for staying ahead in a market where digital savviness is paramount.

The bank's commitment to digital innovation is evident in its ongoing development of new features and services accessible through its online platforms. By continuously enhancing its digital offerings, FinecoBank aims to meet the expectations of an increasingly tech-savvy customer base. This strategy is vital for retaining existing clients and attracting new ones who prioritize convenience and efficiency in their banking experiences.

Cybersecurity and data protection are paramount for FinecoBank, especially as digital transactions surge. In 2024, the financial sector experienced a significant uptick in sophisticated cyberattacks, with data breaches costing companies an average of $4.45 million globally. FinecoBank's commitment to robust security, including advanced encryption and AI-powered fraud detection, is crucial for safeguarding customer data and maintaining regulatory compliance with frameworks like GDPR, which mandates strict data privacy standards.

FinecoBank's integration of AI and ML is a key technological driver, promising enhanced personalized financial advice and automated customer support through advanced chatbots. This technological leap is expected to significantly boost operational efficiency and elevate the client experience by offering more tailored and responsive services.

The bank is leveraging AI for sophisticated fraud detection systems, aiming to reduce financial losses and bolster security for its customers. Furthermore, predictive analytics powered by ML are being employed to refine investment strategies, potentially leading to improved returns and more informed decision-making for clients.

Open Banking APIs and Fintech Collaboration

The push towards open banking, significantly influenced by regulations such as PSD2, is accelerating the adoption of Application Programming Interfaces (APIs). This technology is key for secure data sharing and seamless integration with external fintech companies, fostering a more connected financial landscape.

FinecoBank is well-positioned to capitalize on this trend. By embracing open APIs, the bank can unlock opportunities to introduce novel services and forge strategic partnerships with fintech innovators. This collaboration can enrich its service offerings, creating a more robust and integrated financial ecosystem for its customers.

- API Growth: The number of APIs available through open banking initiatives is projected to grow substantially, with some estimates suggesting a doubling in usage by 2025.

- Fintech Investment: Global investment in fintech reached over $150 billion in 2023, highlighting the sector's dynamism and potential for collaboration.

- Customer Demand: A significant percentage of consumers, upwards of 70% in some European markets, express willingness to use third-party financial apps if offered through their primary bank.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape financial services. These technologies offer significant improvements in security, transparency, and efficiency for transactions, settlements, and managing assets. For instance, the global blockchain in banking market was valued at approximately USD 1.3 billion in 2023 and is projected to grow substantially, reaching an estimated USD 7.5 billion by 2028, indicating a compound annual growth rate (CAGR) of around 41.5% during this period.

FinecoBank can leverage these advancements to optimize its internal processes, cutting down on operational expenses. The bank might also introduce innovative digital asset offerings or entirely new services built upon blockchain infrastructure, tapping into a rapidly expanding market. By 2024, the adoption of DLT in financial institutions is expected to accelerate, with many exploring its use for cross-border payments and trade finance, areas where FinecoBank can find significant operational benefits.

- Enhanced Security: Blockchain's cryptographic nature makes transactions highly secure and tamper-proof.

- Increased Transparency: All participants on a distributed ledger can view verified transactions, fostering trust.

- Improved Efficiency: DLT can automate processes like settlements, reducing time and manual intervention.

- New Digital Assets: The technology enables the creation and management of tokenized assets, opening new investment avenues.

Technological advancements are central to FinecoBank's strategy, with a strong emphasis on its digital and mobile platforms. The bank reported a notable increase in daily active users on its mobile app during the first half of 2024, highlighting the growing importance of digital channels. FinecoBank's continuous development of user-friendly interfaces and advanced mobile tools is crucial for maintaining its competitive edge in a market that increasingly values digital proficiency.

The bank's investment in AI and machine learning is driving innovations in personalized financial advice and automated customer support, enhancing both efficiency and client experience. Furthermore, FinecoBank is bolstering its cybersecurity measures, a critical aspect given the rise in sophisticated cyberattacks affecting the financial sector, with global data breach costs averaging $4.45 million in 2024.

Embracing open banking, facilitated by technologies like APIs, allows FinecoBank to integrate seamlessly with fintech partners and introduce novel services. Global fintech investment exceeded $150 billion in 2023, underscoring the potential for such collaborations. Blockchain and DLT are also being explored for their ability to enhance transaction security and efficiency, with the blockchain in banking market projected to reach $7.5 billion by 2028.

| Technology Area | Key Development/Impact | FinecoBank Relevance/Action | Supporting Data (2023-2025 Projection) |

|---|---|---|---|

| Digital & Mobile Banking | Increased user engagement via apps | Focus on user-friendly interfaces, enhanced mobile tools | H1 2024: Significant rise in mobile app daily active users |

| AI & Machine Learning | Personalized advice, automated support, fraud detection | Leveraging AI for improved client experience and security | AI adoption in financial services growing rapidly |

| Cybersecurity | Protection against sophisticated cyberattacks | Robust security measures, advanced encryption, AI fraud detection | 2024: Avg. data breach cost $4.45 million globally |

| Open Banking (APIs) | Seamless integration with fintechs, new service offerings | Strategic partnerships with fintech innovators | API usage projected to double by 2025; Fintech investment >$150B in 2023 |

| Blockchain & DLT | Enhanced security, transparency, efficiency in transactions | Optimizing internal processes, exploring digital asset offerings | Blockchain in banking market projected to reach $7.5B by 2028 (CAGR ~41.5%) |

Legal factors

FinecoBank operates under stringent European banking regulations. The Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD) mandate specific capital ratios, such as a Common Equity Tier 1 (CET1) ratio, which for major European banks averaged around 15.5% as of late 2023, ensuring robust financial health.

Furthermore, Markets in Financial Instruments Directive II (MiFID II) profoundly impacts FinecoBank's investment services by enhancing transparency, investor protection, and market integrity. This includes detailed reporting requirements and rules on best execution, crucial for maintaining client trust and regulatory compliance.

Consumer protection laws, a significant legal factor for FinecoBank, are robust at both national and European Union levels. These regulations govern everything from how financial products are advertised and sold to how services are delivered to individual customers. For instance, the EU's Consumer Credit Directive ensures clear information about borrowing costs and rights, impacting how FinecoBank structures its loan products and presents them to clients.

To maintain compliance, FinecoBank must prioritize transparency in its product disclosures and ensure that all contract terms are fair and easily understood by retail clients. This includes having effective procedures for handling customer complaints, as mandated by regulations like the EU's Alternative Dispute Resolution (ADR) framework, which aims to provide accessible and efficient out-of-court dispute resolution. Failure to adhere can result in significant penalties and reputational damage.

As a digital-first bank, FinecoBank's operations are heavily reliant on the secure and compliant handling of customer data, making adherence to the General Data Protection Regulation (GDPR) a critical legal factor. Failure to comply with GDPR's stringent rules on data collection, storage, processing, and consent can result in substantial fines, with penalties potentially reaching up to €20 million or 4% of global annual turnover, whichever is higher. Maintaining robust data privacy practices is therefore essential not only for legal compliance but also for preserving client trust and safeguarding the bank's reputation in the digital age.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Legislation

FinecoBank navigates a complex web of anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, demanding constant vigilance and adaptation. These laws, including directives from bodies like the Financial Action Task Force (FATF), necessitate rigorous customer due diligence, transaction monitoring, and the reporting of suspicious activities to authorities. For instance, in 2024, the European Banking Authority (EBA) continued to emphasize the need for enhanced AML/CTF frameworks across the EU, impacting institutions like FinecoBank.

Non-compliance carries severe repercussions. Penalties can range from substantial financial sanctions, such as the multi-million euro fines levied against various European banks in recent years for AML breaches, to significant reputational harm and even criminal prosecution for individuals involved. These legal obligations underscore the critical importance of robust internal controls and ongoing training for FinecoBank's staff to ensure adherence to evolving international and national standards.

- Enhanced Due Diligence: Implementing stringent Know Your Customer (KYC) procedures to verify client identities and understand the nature of their business.

- Suspicious Activity Reporting: Establishing clear protocols for identifying and reporting potentially illicit transactions to national financial intelligence units.

- Transaction Monitoring: Utilizing advanced systems to detect and flag unusual or high-risk transaction patterns.

- Regulatory Updates: Continuously monitoring and incorporating changes in AML/CTF legislation and guidance from supervisory bodies.

Digital Services and E-commerce Regulations

FinecoBank's reliance on digital platforms means it must navigate a complex web of digital services and e-commerce regulations. These rules, covering aspects like electronic signatures, online contract validity, and secure transaction protocols, are crucial for maintaining customer trust and operational integrity. For instance, the EU's eIDAS regulation, which came into full effect in 2016 and continues to be updated, provides a framework for electronic identification and trust services for electronic transactions, directly impacting how FinecoBank verifies customer identities and secures digital agreements.

The evolving landscape of data privacy, particularly with regulations like the GDPR (General Data Protection Regulation), significantly impacts how FinecoBank handles customer data within its digital operations. Compliance requires robust data protection measures, transparent data usage policies, and secure data storage. In 2023, fines for GDPR violations continued to be substantial, with companies facing penalties for breaches and non-compliance, underscoring the financial risks associated with inadequate data governance in the digital space.

- Electronic Signatures: Compliance with regulations ensuring the legal validity of electronic signatures is paramount for contract execution.

- Online Contract Formation: Adherence to rules governing the formation and enforceability of contracts initiated online is essential.

- Secure Transactions: Maintaining secure electronic transaction processes is mandated by regulations to protect customer funds and data.

- Data Privacy: Strict adherence to data privacy laws, such as GDPR, is critical for handling customer information in digital channels.

Legal frameworks governing financial services are extensive and constantly evolving, directly shaping FinecoBank's operational landscape. Compliance with directives like MiFID II, which emphasizes investor protection and market transparency, necessitates rigorous adherence to reporting and best execution standards. The bank must also navigate stringent consumer protection laws at both national and EU levels, ensuring fair practices in product advertising and service delivery, as exemplified by the EU's Consumer Credit Directive.

Data privacy is a paramount legal concern, especially for a digital-first entity like FinecoBank. Adherence to GDPR is non-negotiable, with potential fines reaching up to 4% of global annual turnover for non-compliance, making robust data governance essential for maintaining trust and avoiding significant financial penalties. Similarly, the bank must strictly follow anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, including those from the Financial Action Task Force (FATF), to prevent illicit activities and avoid substantial sanctions, as highlighted by the European Banking Authority's focus on enhanced AML frameworks in 2024.

| Regulation/Area | Impact on FinecoBank | Key Compliance Aspects | Potential Consequences of Non-Compliance |

|---|---|---|---|

| MiFID II | Enhances transparency and investor protection in investment services. | Best execution rules, detailed reporting, market integrity. | Reputational damage, regulatory fines. |

| Consumer Protection Laws (e.g., EU Consumer Credit Directive) | Governs product advertising, sales, and service delivery to individuals. | Clear information on borrowing costs, fair contract terms, complaint handling. | Customer dissatisfaction, legal disputes, fines. |

| GDPR | Mandates secure and compliant handling of customer data. | Data protection measures, transparent policies, secure storage, consent management. | Fines up to €20 million or 4% of global annual turnover, loss of trust. |

| AML/CTF Regulations (e.g., FATF, EBA guidance) | Requires vigilance against money laundering and terrorist financing. | Customer due diligence (KYC), transaction monitoring, suspicious activity reporting. | Significant financial penalties, reputational harm, criminal prosecution. |

Environmental factors

Client demand for investments that prioritize Environmental, Social, and Governance (ESG) factors is rapidly increasing. Surveys from 2024 indicate that over 70% of investors are considering ESG criteria in their portfolio decisions, a significant jump from previous years.

FinecoBank must actively broaden its range of sustainable investment options, including green bonds and socially responsible portfolios. This strategic move is crucial to capture the growing segment of environmentally conscious investors and meet evolving market expectations.

The global sustainable investment market is projected to reach $50 trillion by 2025, highlighting a substantial opportunity for financial institutions like FinecoBank to cater to this expanding client base and enhance their competitive edge.

FinecoBank, like other financial institutions, faces growing pressure to actively manage climate-related financial risks. This includes evaluating physical risks, such as the impact of extreme weather events on collateral and loan portfolios, and transition risks, stemming from shifts in policy, technology, and market sentiment towards lower-carbon economies. For instance, the European Central Bank's 2024 climate stress test highlighted significant potential losses for banks exposed to carbon-intensive sectors, a factor FinecoBank must integrate into its risk assessment frameworks.

The bank's lending and investment strategies need to incorporate climate considerations, ensuring that portfolios are resilient to both physical and transition impacts. This also extends to enhancing disclosure practices, providing stakeholders with transparent information on how climate risks are being identified, measured, and managed. As of early 2025, regulatory bodies worldwide are intensifying scrutiny on climate-related financial disclosures, making robust reporting a critical component of operational integrity for institutions like FinecoBank.

Regulators globally are intensifying their focus on green finance, compelling institutions like FinecoBank to adopt more transparent and environmentally conscious practices. This includes the implementation of green finance taxonomies and stricter disclosure requirements, aiming to channel capital towards sustainable activities.

FinecoBank can anticipate growing mandates to report on its environmental footprint and actively participate in sustainable finance initiatives. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to disclose sustainability-related information, impacting product labeling and reporting for firms operating within or serving the EU market.

Operational Environmental Footprint

FinecoBank, despite its digital nature, acknowledges its operational environmental footprint. This primarily stems from the energy consumption of its data centers, physical office spaces, and essential employee travel. For instance, in 2023, the banking sector globally saw increased scrutiny on energy efficiency in IT infrastructure, a trend directly impacting digital banks like FinecoBank.

The bank is actively engaged in initiatives to mitigate this impact. These include focused efforts on reducing overall energy usage, implementing comprehensive waste minimization programs, and prioritizing sustainable procurement practices across its operations. These actions are crucial for demonstrating its commitment to environmental responsibility.

Specific areas of focus for environmental responsibility in 2024 and 2025 include:

- Energy Efficiency: Investing in more energy-efficient data center technologies and optimizing office energy consumption.

- Waste Reduction: Implementing robust recycling programs and minimizing paper usage through digital workflows.

- Sustainable Procurement: Favoring suppliers with strong environmental credentials for IT equipment and office supplies.

- Carbon Footprint Measurement: Continuously monitoring and reporting on its carbon emissions to identify further reduction opportunities.

Corporate Social Responsibility (CSR) and Reputation

FinecoBank's commitment to Corporate Social Responsibility (CSR) extends beyond environmental considerations, encompassing community engagement and ethical operations, which significantly shape its public image and stakeholder trust. A strong CSR profile can bolster brand reputation, attracting environmentally and socially aware customers and top-tier talent.

In 2024, FinecoBank continued its focus on responsible business practices. For instance, its ongoing efforts in financial education programs, aimed at improving financial literacy across various demographics, underscore its dedication to societal well-being. Such initiatives are crucial for building long-term relationships and fostering a positive brand perception.

- Community Investment: FinecoBank actively supports local communities through various programs, aiming to create shared value.

- Ethical Governance: Adherence to stringent ethical standards in all business dealings is a cornerstone of its CSR strategy.

- Talent Attraction: A robust CSR framework is increasingly a deciding factor for professionals seeking employment with purpose-driven organizations.

- Customer Loyalty: Demonstrating social responsibility enhances customer loyalty, particularly among younger demographics who prioritize values in their banking choices.

Growing investor demand for ESG-aligned products is a significant environmental factor, with over 70% of investors considering ESG in 2024. FinecoBank must expand its sustainable investment offerings to meet this trend. The global sustainable investment market is projected to reach $50 trillion by 2025, presenting a substantial growth opportunity.

PESTLE Analysis Data Sources

Our PESTLE analysis for FinecoBank is grounded in data from official financial regulatory bodies, economic forecasting agencies, and reputable market research firms. We integrate insights from Italian and European Union legislation, technological adoption trends, and socio-economic reports to provide a comprehensive view.