FinecoBank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FinecoBank Bundle

Curious about FinecoBank's innovative approach to financial services? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

FinecoBank collaborates with leading technology and software providers to build and maintain its sophisticated digital banking and investment platforms. These partnerships are essential for delivering a seamless user experience, offering advanced trading functionalities, and ensuring the security of client data. For instance, in 2024, FinecoBank continued to invest heavily in its IT infrastructure, leveraging partnerships to enhance its AI-driven advisory services and real-time market analysis tools, which are critical for its competitive edge.

FinecoBank's collaboration with major payment networks like Visa and Mastercard is critical for its card issuing business, allowing it to offer a wide range of credit and debit products. These partnerships ensure that FinecoBank's clients can transact globally with ease and acceptance. In 2024, the continued growth in digital payments underscores the importance of these foundational relationships for facilitating billions of transactions annually.

FinecoBank's brokerage services rely heavily on partnerships with liquidity providers and direct connections to numerous stock, bond, and derivatives exchanges. These crucial relationships enable the bank to offer a vast array of tradable instruments, from equities to complex derivatives, ensuring clients have access to diverse investment opportunities.

In 2024, FinecoBank continued to leverage these partnerships to facilitate efficient order execution. The bank's platform connects to major European exchanges like Borsa Italiana, Euronext, and Xetra, as well as key international markets, providing deep liquidity and competitive pricing for its clients' trades.

Insurance Underwriters

FinecoBank collaborates with insurance underwriters to offer a wider array of financial solutions to its customers. These partnerships are crucial for expanding their product portfolio beyond core banking and investment services, thereby catering to a broader client need for risk management and wealth protection.

These strategic alliances enable FinecoBank to integrate insurance products seamlessly into their existing banking and investment platforms. For instance, in 2024, FinecoBank continued to leverage these relationships to provide life insurance, protection plans, and other insurance-linked investment products, enhancing customer loyalty and generating new revenue streams.

- Partnership with leading insurance providers

- Expansion of product offerings to include life and protection insurance

- Integration of insurance solutions into digital banking platforms

Regulatory Bodies and Compliance Partners

FinecoBank’s commitment to operating within stringent legal frameworks necessitates robust relationships with regulatory bodies. While not traditional commercial partners, these entities are crucial for maintaining the bank's license to operate and ensuring customer trust.

To navigate the complex landscape of financial regulations, FinecoBank may collaborate with specialized compliance technology providers and expert consultants. These partnerships are vital for staying ahead of evolving legal requirements and implementing effective risk management strategies.

- Regulatory Adherence: FinecoBank's operations are guided by directives from the Bank of Italy and the European Central Bank, ensuring compliance with EU-wide financial regulations.

- Compliance Technology: The bank leverages advanced RegTech solutions to automate compliance processes, reducing operational risk and improving efficiency.

- Consultancy Engagement: External legal and compliance consultants are engaged to provide specialized advice on new regulations and to conduct independent audits, reinforcing the bank's commitment to integrity.

FinecoBank's strategic alliances with technology providers enhance its digital platform, offering advanced AI-driven advisory and real-time market analysis. These partnerships are crucial for maintaining its competitive edge in 2024, driving seamless user experiences and robust security measures.

Collaborations with payment networks like Visa and Mastercard are fundamental to FinecoBank's card business, facilitating billions of global transactions in 2024 and ensuring widespread acceptance of its credit and debit products.

Partnerships with liquidity providers and direct exchange memberships are vital for FinecoBank's brokerage services, enabling access to a vast array of financial instruments and efficient order execution across major European and international markets in 2024.

FinecoBank partners with insurance underwriters to integrate a broader range of financial solutions, including life and protection insurance, into its digital platforms. This strategy, actively pursued in 2024, aims to enhance customer loyalty and diversify revenue streams.

| Partner Type | Purpose | 2024 Impact/Focus |

|---|---|---|

| Technology & Software Providers | Platform development, AI advisory, security | Enhanced user experience, advanced analytics |

| Payment Networks (Visa, Mastercard) | Card issuing, global transactions | Facilitation of billions of transactions, broad acceptance |

| Liquidity Providers & Exchanges | Brokerage services, trading access | Deep liquidity, competitive pricing, efficient execution |

| Insurance Underwriters | Product expansion, risk management | Integration of insurance-linked products, revenue diversification |

What is included in the product

A comprehensive, pre-written business model tailored to FinecoBank's strategy, detailing its integrated offering of banking, investing, and insurance services for retail and professional clients.

Covers customer segments, channels, and value propositions in full detail, highlighting FinecoBank's digital-first approach and focus on personalized client relationships.

FinecoBank's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of its integrated banking, brokerage, and financial advisory services, simplifying complex offerings for clients.

This structured approach within the canvas helps FinecoBank address customer pain points related to fragmented financial management by presenting a cohesive solution for all their needs.

Activities

FinecoBank's digital platform development and maintenance is a crucial activity, focusing on enhancing its online banking, trading, and investment services. This involves a constant drive to improve user experience, bolster security measures, and seamlessly integrate innovative features that cater to the dynamic demands of its clientele.

In 2024, FinecoBank continued to invest heavily in its digital infrastructure, aiming to provide a robust and intuitive user interface. This commitment is reflected in its ongoing efforts to refine its mobile app and web platform, ensuring clients can manage their finances and investments efficiently and securely.

FinecoBank's core operations revolve around managing and empowering its extensive network of financial advisors. This involves providing them with comprehensive training, robust performance management systems, and cutting-edge tools designed to enhance client service and advisory capabilities.

These advisors are instrumental in fostering direct client relationships, offering tailored financial guidance and solutions. Their ability to connect personally with clients is a significant driver of customer loyalty and business growth for FinecoBank.

In 2024, FinecoBank continued to invest in its advisor network, aiming to solidify its position as a leading digital bank with a strong human touch. The bank's strategy emphasizes the synergy between advanced digital platforms and the personalized advice delivered by its advisors.

FinecoBank's key activities heavily revolve around the meticulous daily management of customer accounts, ensuring every current account operates seamlessly. This involves handling deposits, withdrawals, and account inquiries with speed and accuracy, forming the bedrock of customer trust.

The bank actively processes a high volume of credit and debit card transactions, facilitating everyday commerce for its clients. In 2024, FinecoBank reported a significant increase in digital transaction volumes, underscoring the efficiency and security of its payment processing infrastructure.

Furthermore, a crucial operational activity is the origination and servicing of mortgages and personal loans. This requires robust underwriting processes and diligent management of loan portfolios to ensure financial stability and customer satisfaction.

Ensuring the smooth and secure flow of funds across all banking channels is paramount. This operational backbone supports all other activities, from card payments to loan disbursements, and is critical for maintaining the bank's reputation for reliability.

Investment and Brokerage Services Management

FinecoBank actively manages its sophisticated trading platforms, facilitating transactions across stocks, bonds, and derivatives. This core activity also encompasses the provision of robust wealth management services and a diverse array of mutual funds, catering to a broad spectrum of investor needs.

The management of these investment and brokerage services is underpinned by continuous market analysis, rigorous product selection processes, and diligent risk management. These actions are crucial for ensuring the competitiveness and safety of FinecoBank’s investment offerings.

- Platform Management: Overseeing the functionality and user experience of trading platforms for equities, fixed income, and derivatives.

- Wealth Solutions: Offering tailored wealth management strategies and a curated selection of mutual funds.

- Market Intelligence: Conducting ongoing analysis to identify investment opportunities and manage market-related risks.

Marketing and Customer Acquisition

FinecoBank focuses on attracting new retail clients through a multi-faceted marketing approach. Digital channels are key, with significant investment in online advertising and content marketing to showcase its integrated banking, investing, and trading platform. The bank emphasizes its ability to provide a seamless customer experience across all touchpoints.

Brand building efforts aim to position FinecoBank as a reliable and innovative financial partner. This includes highlighting its competitive fee structures and the breadth of investment products offered. The bank actively promotes its unique value proposition to differentiate itself in a crowded market.

In 2024, FinecoBank continued to see strong growth in its client base. For instance, the bank reported an increase in net new clients, reaching over 500,000 new clients in the first half of 2024. This growth underscores the effectiveness of their marketing and customer acquisition strategies.

- Digital Marketing Focus: Significant investment in online advertising, social media campaigns, and search engine optimization to reach a broad audience.

- Brand Awareness Initiatives: Campaigns designed to build trust and highlight FinecoBank's comprehensive financial solutions.

- Client Growth Metrics: In H1 2024, FinecoBank added over 500,000 new clients, demonstrating successful customer acquisition.

- Promoting Integrated Services: Marketing efforts emphasize the benefits of the bank's all-in-one platform for banking, investing, and trading.

FinecoBank's key activities center on managing its advanced digital platform, which integrates banking, investing, and trading services. This involves continuous innovation to enhance user experience and security, ensuring clients have seamless access to financial tools.

The bank also prioritizes the management and support of its extensive network of financial advisors. These advisors play a critical role in building direct client relationships and delivering personalized financial guidance, a cornerstone of FinecoBank's client-centric approach.

Operational excellence is maintained through the efficient daily management of customer accounts and the processing of a high volume of transactions, including credit and debit card payments. In 2024, the bank saw a notable rise in digital transaction volumes, highlighting its robust payment infrastructure.

Furthermore, FinecoBank actively engages in the origination and servicing of mortgages and personal loans, alongside managing sophisticated trading platforms for various financial instruments. This includes offering comprehensive wealth management solutions and a diverse range of mutual funds, all supported by rigorous market analysis and risk management practices.

| Key Activity Area | Description | 2024 Data/Focus |

|---|---|---|

| Digital Platform Enhancement | Improving user experience, security, and feature integration for online banking, trading, and investment services. | Continued investment in mobile app and web platform refinement. |

| Financial Advisor Network Management | Training, performance management, and tool provision for advisors to enhance client service. | Emphasis on synergy between digital platforms and personalized advice. |

| Transaction Processing | Efficient and secure management of customer accounts, deposits, withdrawals, and card transactions. | Significant increase in digital transaction volumes reported. |

| Investment and Wealth Management | Operating trading platforms, offering wealth solutions, and managing mutual fund portfolios. | Ongoing market analysis and risk management for investment offerings. |

Preview Before You Purchase

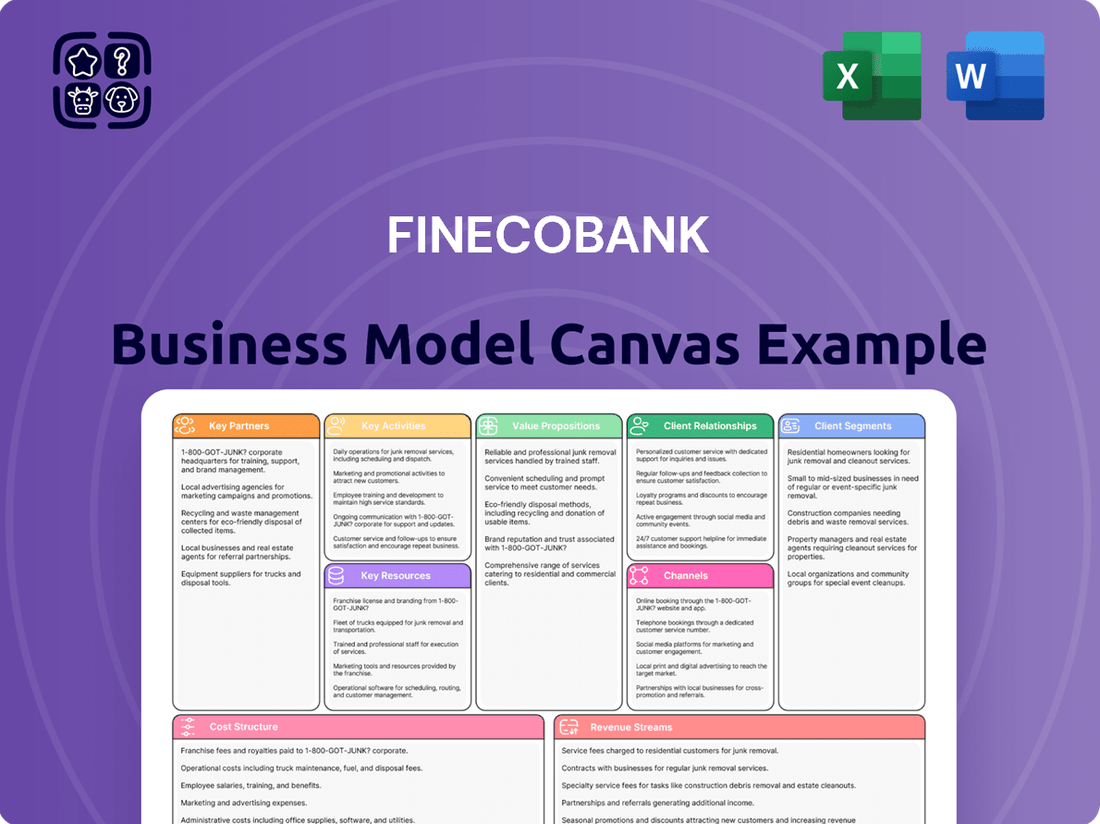

Business Model Canvas

The FinecoBank Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency and no surprises. Once your order is complete, you'll gain full access to this comprehensive canvas, ready for your strategic analysis.

Resources

FinecoBank's proprietary digital banking and trading platforms are its core technological infrastructure, seamlessly integrating direct banking, brokerage, and investment services. These advanced online and mobile interfaces are fundamental to the bank's strategy of providing unparalleled digital accessibility and a comprehensive suite of financial solutions to its clients.

In 2024, FinecoBank continued to emphasize the development and enhancement of these platforms, aiming to solidify its position as a leader in digital financial services. The bank's commitment to innovation in this area is reflected in its ongoing investment in technology to ensure a user-friendly and robust experience for its diverse customer base, facilitating efficient transactions and informed investment decisions.

FinecoBank's network of experienced financial advisors is a crucial asset, representing significant human capital. These professionals offer tailored advice and dedicated support, enhancing the bank's digital offerings and cultivating stronger customer bonds.

In 2024, FinecoBank's financial advisors played a vital role in client engagement. The bank reported a substantial increase in assets under management, with a significant portion attributed to the personalized guidance provided by its advisory network, underscoring the value of human interaction in financial planning.

FinecoBank's brand reputation as a leading multi-channel direct bank, emphasizing digital innovation and a full spectrum of financial services, is a cornerstone of its business model. This established trust is a critical intangible asset, directly impacting its ability to attract and retain customers in the competitive financial landscape.

In the financial industry, customer trust and a strong brand reputation are not just beneficial; they are essential for growth. FinecoBank's commitment to transparency and reliable service underpins this trust, which is vital for acquiring new clients and ensuring the loyalty of existing ones.

As of the first quarter of 2024, FinecoBank reported a robust customer base, with its strong brand and digital-first approach contributing to a significant portion of its new client acquisitions. The bank's focus on providing a seamless and integrated banking, investing, and trading experience continues to solidify its market position.

Customer Data and Analytics Capabilities

FinecoBank leverages extensive customer data, meticulously gathered and analyzed, to foster a deep understanding of client behavior. This allows for the precise tailoring of product offerings and the delivery of highly personalized services, strengthening the direct relationship model.

The bank's robust analytics capabilities are central to its strategy, enabling data-driven decision-making across all operations. This approach not only refines existing services but also informs the development of new solutions designed to meet evolving customer needs.

- Data-Driven Personalization: FinecoBank utilizes customer data to offer bespoke investment advice and financial products, increasing client engagement and satisfaction.

- Enhanced Customer Insights: Advanced analytics provide granular insights into transaction patterns, product preferences, and life events, allowing for proactive service delivery.

- Strategic Decision Support: The insights derived from customer data analytics directly inform strategic planning, product development, and marketing campaigns, ensuring alignment with market demands.

Financial Capital and Liquidity

Financial capital and liquidity are the bedrock of FinecoBank's operations, enabling it to underwrite loans, manage risk, and comply with stringent banking regulations. These vital resources directly support the bank's ability to offer its full suite of financial services and maintain its overall stability in the market.

As of the first quarter of 2024, FinecoBank reported a Common Equity Tier 1 (CET1) ratio of 21.7%, significantly exceeding regulatory requirements. This robust capital position underscores the bank's financial strength and its capacity to absorb potential shocks.

- Capital Adequacy: FinecoBank maintains a strong CET1 ratio, a key indicator of its financial resilience and ability to support its business activities.

- Liquidity Management: The bank actively manages its liquidity to ensure it can meet its short-term obligations and fund its lending activities effectively.

- Regulatory Compliance: Sufficient financial capital and liquidity are crucial for adhering to banking regulations and maintaining customer trust.

FinecoBank's proprietary digital platforms are its engine, integrating banking, brokerage, and investment services. These platforms are key to its accessible, comprehensive digital strategy.

In 2024, FinecoBank continued investing in these platforms to maintain its leadership in digital finance, ensuring a user-friendly and robust experience for all clients.

The bank's network of experienced financial advisors provides essential human capital, offering personalized advice that complements its digital offerings and fosters client relationships.

In 2024, these advisors significantly contributed to increased assets under management, highlighting the value of their tailored guidance.

FinecoBank's strong brand reputation as a leading digital bank is a critical intangible asset, building trust and attracting customers.

This trust, built on transparency and reliable service, is vital for growth and customer loyalty in the competitive financial sector.

As of Q1 2024, FinecoBank's brand and digital approach fueled new client acquisitions, reinforcing its market position.

FinecoBank uses extensive customer data for deep client understanding, enabling personalized product offerings and services.

Advanced analytics drive strategic decisions, refining services and informing new solution development to meet customer needs.

FinecoBank leverages customer data for personalized advice and products, boosting client engagement.

Enhanced analytics offer deep insights into customer behavior, allowing for proactive service.

Customer data insights directly support strategic planning and product development.

Financial capital and liquidity are fundamental to FinecoBank's operations, enabling it to offer its full suite of services and maintain market stability.

As of Q1 2024, FinecoBank's CET1 ratio stood at 21.7%, well above regulatory minimums, demonstrating its financial strength.

FinecoBank maintains strong capital adequacy, crucial for its business activities and financial resilience.

Effective liquidity management ensures the bank meets its obligations and funds its operations.

Sufficient capital and liquidity are essential for regulatory compliance and maintaining customer trust.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Digital Platforms | Proprietary integrated banking and trading systems. | Core to digital accessibility and comprehensive service delivery. |

| Financial Advisors | Network of experienced professionals. | Provide personalized advice, enhancing digital offerings and client relationships. |

| Brand Reputation | Established trust as a leading digital bank. | Attracts and retains customers, crucial for market position. |

| Customer Data & Analytics | Extensive, analyzed client information. | Enables personalization and data-driven strategic decisions. |

| Financial Capital & Liquidity | Strong capital base and liquid assets. | Supports operations, regulatory compliance, and financial stability. |

Value Propositions

FinecoBank provides clients with seamless access to banking, brokerage, and investment services through sophisticated digital platforms and dedicated financial advisors. This dual approach ensures clients can manage their finances and investments conveniently, whether through their online portal or mobile app, or by engaging directly with a professional.

In 2024, FinecoBank reported a significant increase in digital client engagement, with over 90% of transactions conducted via their online and mobile channels. This highlights the effectiveness of their multi-channel strategy in meeting diverse customer interaction preferences.

FinecoBank's integrated banking, trading, and investment solutions offer clients a comprehensive financial hub. This single ecosystem consolidates current accounts, credit cards, loans, advanced trading platforms, and personalized wealth management services, creating a truly holistic financial management experience.

This seamless integration simplifies intricate financial needs for a diverse clientele, from individual investors to seasoned professionals. For instance, in 2024, FinecoBank reported a significant increase in its active clients leveraging these combined services, highlighting the demand for such streamlined financial management.

FinecoBank prioritizes a seamless and intuitive digital experience, making its online and mobile platforms exceptionally accessible. This commitment ensures clients can effortlessly manage their finances, fostering independence and convenience.

In 2024, FinecoBank reported that over 90% of its customer interactions occurred through digital channels, highlighting the success of its user-centric design. This digital-first approach empowers users to conduct transactions, access investment tools, and receive support 24/7, directly from their devices.

Direct Relationship and Personalized Advice

FinecoBank fosters a direct connection with its customers, ensuring they feel supported and understood. This approach is strengthened by the availability of specialized financial advisors who offer tailored recommendations.

This blend of digital convenience and personal guidance is crucial. It effectively serves individuals across the financial literacy spectrum, from those just starting out to seasoned investors needing sophisticated strategies.

In 2024, FinecoBank reported a significant portion of its clients actively engaging with their dedicated advisors, highlighting the value placed on personalized financial planning. This direct relationship model contributed to a notable increase in client retention rates.

- Direct Client Engagement: Clients can interact directly with the bank through its digital platform.

- Personalized Financial Advice: Access to dedicated financial advisors for tailored guidance.

- Catering to Diverse Needs: Supports varying levels of financial literacy and client requirements.

- Enhanced Client Retention: The direct relationship model is linked to improved client loyalty.

Competitive Pricing and Transparency

FinecoBank champions competitive pricing across its banking, brokerage, and investment offerings. This strategy is designed to attract and retain clients by ensuring cost-effectiveness. For instance, in 2024, FinecoBank continued to offer zero commission on many equity trades within the EU, a significant draw for active investors.

A cornerstone of FinecoBank's approach is its commitment to transparency in its fee structure. Clients benefit from clear, upfront information regarding all charges, fostering trust and enabling informed decision-making. This clarity is crucial in the financial services industry, where hidden fees can erode client confidence.

- Competitive Fees: FinecoBank aims to be among the most cost-effective providers in the European market for banking and investment services.

- Zero Commission Trades: In 2024, the bank maintained its policy of zero commissions on many European stock trades, a key differentiator.

- Transparent Structure: All fees and charges are clearly communicated, ensuring clients understand the cost of services.

FinecoBank's value proposition centers on a unified financial ecosystem, seamlessly blending banking, trading, and investment services. This integration simplifies complex financial management for a broad client base, from beginners to sophisticated investors.

The bank prioritizes an exceptional digital experience, ensuring its platforms are intuitive and accessible. This digital-first strategy empowers clients with 24/7 control over their finances and investments.

Furthermore, FinecoBank fosters strong client relationships through personalized advice from dedicated financial advisors. This human touch complements digital convenience, enhancing client satisfaction and retention.

Competitive and transparent pricing, including zero commissions on many European stock trades in 2024, underpins its appeal, making sophisticated financial tools accessible and cost-effective.

| Value Proposition Element | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Financial Hub | Consolidated banking, trading, and investment services in one platform. | High client adoption of combined services, driving engagement. |

| Superior Digital Experience | Intuitive and accessible online and mobile platforms. | Over 90% of transactions conducted digitally, showcasing user preference. |

| Personalized Advisory Services | Dedicated financial advisors offering tailored guidance. | Significant client engagement with advisors, boosting retention. |

| Cost-Effectiveness & Transparency | Competitive fees and clear pricing structures. | Zero commission on many EU equity trades, attracting active traders. |

Customer Relationships

FinecoBank champions customer relationships through robust digital self-service and automation. Its intuitive online and mobile platforms empower clients to independently manage accounts, execute trades, and access financial insights, fostering a sense of control and efficiency. This digital-first approach resonates particularly well with a growing segment of digitally native customers.

FinecoBank balances its digital-first approach with a vital human element, employing a network of financial advisors. These professionals offer personalized advice, fostering deeper client relationships for those seeking expert guidance.

This hybrid model is a cornerstone of their customer relationships, allowing for tailored support that resonates with clients. In 2024, FinecoBank continued to emphasize this blend, with a significant portion of its client base engaging with advisory services alongside digital platforms.

FinecoBank fosters client loyalty through proactive communication, delivering account statements, market insights, and educational content primarily via its digital platform. This approach ensures clients are consistently informed about their financial standing and potential investment avenues.

In 2024, FinecoBank continued to leverage digital channels to disseminate a wealth of information, including personalized market updates and accessible educational resources. This strategy is crucial for maintaining client engagement and empowering them to make informed financial decisions.

Dedicated Customer Support Channels

FinecoBank offers robust customer support through multiple avenues, including live online chat, dedicated phone lines, and email for prompt assistance. This multi-channel approach ensures clients can reach out through their preferred method, fostering accessibility and quick resolution of queries. In 2023, FinecoBank reported a significant increase in customer satisfaction scores directly linked to the efficiency of its support services, highlighting the importance of these channels in a direct banking environment.

The bank prioritizes swift issue resolution and client inquiry management across all its support platforms. This commitment to efficient service is crucial for building and maintaining the trust essential in a direct banking model where face-to-face interaction is limited. By investing in responsive customer care, FinecoBank strengthens its client relationships and encourages loyalty.

- Online Chat: Provides immediate, text-based assistance for quick questions.

- Phone Support: Offers direct, real-time verbal communication for complex issues.

- Email Support: Allows for detailed inquiries and documentation sharing.

- Customer Satisfaction: Directly correlates with the responsiveness and effectiveness of these support channels, a key differentiator in digital banking.

Community Building and Educational Resources

FinecoBank actively cultivates a vibrant community for its users, offering a wealth of educational resources. These resources cover essential topics in banking, trading, and investing, aiming to equip clients with the knowledge needed to make informed financial decisions. This focus on empowerment significantly enhances client engagement and fosters long-term loyalty to the platform.

- Community Engagement: FinecoBank's platform facilitates user interaction, creating a supportive environment for learning and sharing financial insights.

- Educational Content: Access to webinars, articles, and tutorials on market trends and investment strategies is provided to enhance financial literacy.

- Client Empowerment: By offering robust educational tools, FinecoBank aims to build confidence and independence in its user base.

- Loyalty Building: The combination of community and education directly contributes to increased user retention and a stronger brand connection.

FinecoBank's customer relationships are built on a foundation of digital self-service complemented by personalized advisory. This hybrid model, which saw continued emphasis in 2024, caters to diverse client needs, from independent digital users to those seeking expert financial guidance.

The bank actively nurtures loyalty through consistent, proactive communication, primarily via its digital channels, delivering account updates, market insights, and educational materials. This strategy ensures clients remain informed and engaged, reinforcing their connection with the bank.

FinecoBank's commitment to responsive, multi-channel customer support, including online chat, phone, and email, directly impacts client satisfaction and trust. In 2023, this efficiency was a key driver of increased customer satisfaction scores, vital for a direct banking model.

By fostering a community and providing extensive educational resources, FinecoBank empowers its clients, enhancing financial literacy and building long-term loyalty. This dual approach of support and education is central to their relationship-building strategy.

| Customer Relationship Strategy | Key Channels | 2024 Focus | Impact |

|---|---|---|---|

| Digital Self-Service & Automation | Online platform, Mobile app | Enhanced user experience, intuitive navigation | Empowers clients, fosters efficiency |

| Personalized Advisory | Financial advisors | Continued integration with digital platforms | Deeper client engagement, tailored guidance |

| Proactive Communication | Digital channels (email, app notifications) | Personalized market insights, educational content | Client retention, informed decision-making |

| Multi-Channel Support | Online chat, Phone, Email | Swift issue resolution, accessibility | Increased customer satisfaction, trust building |

| Community & Education | Webinars, Articles, Tutorials, User forums | Financial literacy enhancement | Client empowerment, long-term loyalty |

Channels

FinecoBank's primary channel is its sophisticated online banking platform, available through web browsers. This digital hub seamlessly integrates all banking, brokerage, and investment services, offering unparalleled convenience to its users.

In 2024, FinecoBank continued to see strong engagement on its platform, with a significant portion of its customer base actively managing their finances and investments online. This digital-first approach is central to their strategy for customer acquisition and retention.

FinecoBank's mobile applications are central to its customer engagement strategy, offering seamless on-the-go access to a comprehensive suite of banking, trading, and investment services. These platforms are designed to cater to the needs of digitally-savvy users, providing intuitive interfaces for managing finances and executing trades. In 2024, FinecoBank reported a significant portion of its transactions and customer interactions occurring through its mobile channels, reflecting the growing importance of digital accessibility.

FinecoBank's extensive network of personal financial advisors is a cornerstone of its client engagement strategy. These advisors offer a crucial human element, providing localized and personalized financial guidance that complements the bank's robust digital platforms. This direct interaction fosters trust and allows for in-depth consultations tailored to individual client needs.

In 2024, FinecoBank continued to leverage its advisor network to deepen client relationships and drive business growth. The bank reported a significant portion of its new client acquisitions and asset growth originating through its advisor channel, highlighting the enduring value of personalized financial advice in an increasingly digital world. This hybrid approach ensures clients receive both the convenience of online services and the expert support of a dedicated advisor.

Direct Mail and Email Communication

FinecoBank leverages direct mail and email as crucial channels for its business model, primarily for official communications, targeted marketing campaigns, and the secure delivery of account statements and critical updates to its diverse client base. These methods are foundational for maintaining client relationships and ensuring regulatory compliance. In 2024, the financial sector continued to see a strong reliance on these channels for customer engagement, with email marketing proving particularly cost-effective for reaching a wide audience.

These channels are integral to FinecoBank’s customer relationship management strategy. Email, in particular, offers a dynamic way to share personalized offers and financial insights, driving engagement and cross-selling opportunities. Direct mail, while perhaps less frequent, retains impact for high-value communications or specific demographic segments where digital fatigue might be a concern.

- Official Communications: Secure delivery of account statements, transaction confirmations, and policy updates.

- Marketing Campaigns: Targeted promotions, new product announcements, and personalized financial advice.

- Client Engagement: Maintaining regular contact and providing value-added content to foster loyalty.

- Regulatory Compliance: Ensuring official notifications meet stringent industry standards for delivery and record-keeping.

Social Media and Digital Marketing

FinecoBank leverages social media and digital marketing to connect with its audience, driving customer acquisition and brand loyalty. In 2024, the bank actively uses platforms like LinkedIn, X (formerly Twitter), and Instagram to share financial insights and product updates. This digital presence is vital for reaching a broad customer base and fostering engagement.

The bank’s digital marketing strategy focuses on targeted campaigns and content creation to highlight its innovative banking solutions. These efforts are designed to build brand awareness and attract new clients in a competitive market. By staying active across various digital channels, FinecoBank aims to maintain a strong connection with its customers.

- Customer Engagement: FinecoBank utilizes social media to interact directly with customers, addressing inquiries and fostering a community around its services.

- Brand Awareness: Digital marketing campaigns are deployed to increase the bank's visibility and promote its comprehensive financial offerings.

- Service Promotion: Key financial products and advisory services are highlighted through engaging digital content, driving interest and potential adoption.

- Data-Driven Insights: The bank analyzes digital channel performance to refine its marketing strategies and improve customer outreach effectiveness.

FinecoBank's multichannel approach effectively combines digital platforms with personalized human interaction. Its online and mobile banking services offer customers convenient, on-the-go financial management, which in 2024 saw a significant portion of transactions and customer engagement. Complementing this, a network of financial advisors provides tailored guidance, fostering deeper client relationships and driving new client acquisition.

Direct mail and email remain crucial for official communications and targeted marketing, ensuring regulatory compliance and client retention. In 2024, the bank continued to leverage social media and digital marketing to enhance brand awareness and promote its innovative financial solutions, reaching a broad audience.

| Channel | Key Function | 2024 Data/Trend |

|---|---|---|

| Online Banking Platform | Integrated banking, brokerage, investment | High customer engagement, central to acquisition/retention |

| Mobile Applications | On-the-go access to all services | Significant portion of transactions/interactions |

| Financial Advisors | Personalized financial guidance | Key driver of new client acquisition and asset growth |

| Direct Mail & Email | Official comms, marketing, statements | Continued reliance for engagement and compliance |

| Social Media & Digital Marketing | Customer acquisition, brand loyalty, insights | Active use on platforms like LinkedIn, X, Instagram |

Customer Segments

Digitally Savvy Retail Clients represent a growing segment that prioritizes seamless online and mobile experiences for all their financial needs. These individuals, comfortable with technology, expect intuitive platforms for banking, trading, and investment management, valuing speed and self-sufficiency. In 2024, a significant portion of retail investors, estimated to be over 70% in many developed markets, actively utilize digital channels for their investment activities, reflecting a strong preference for convenience and accessibility.

FinecoBank serves individual investors who are actively engaged in the markets, from day traders to those with a longer-term outlook. They provide robust trading platforms that allow access to a wide array of asset classes, including stocks, bonds, and derivatives.

This customer segment prioritizes sophisticated trading tools, extensive market reach, and cost-effective brokerage services. For instance, as of early 2024, FinecoBank’s trading volumes have shown consistent growth, reflecting the demand for their comprehensive offering among active participants.

Wealth Management Seekers are individuals and families who need expert help to grow and protect their assets. They're looking for more than just a place to park their money; they want tailored advice on investments, retirement planning, and estate management. In 2024, a significant portion of high-net-worth individuals (HNWIs) continued to prioritize personalized financial guidance, with many actively seeking out hybrid models that blend digital convenience with human advisor interaction.

Mortgage and Loan Applicants

Mortgage and loan applicants represent a core customer base for financial institutions like FinecoBank. This segment includes individuals looking to finance property purchases through mortgages or seeking personal loans for diverse needs such as education, vehicle acquisition, or home improvements. In 2024, the demand for accessible credit remains strong, with many consumers prioritizing ease of application and speed of approval.

These customers are highly sensitive to interest rates and often compare offers from multiple lenders. They value a transparent and efficient application process, seeking to minimize the time and effort required to secure financing. For instance, in early 2024, average mortgage rates in many developed economies hovered around 6-7%, making competitive pricing a significant differentiator.

- Competitive Rates: Applicants actively seek the lowest possible interest rates to reduce the overall cost of their borrowing.

- Streamlined Application: A simple, digital-first application process that minimizes paperwork and manual intervention is highly valued.

- Fast Approval Times: Customers expect quick decisions on their loan or mortgage applications, often within days rather than weeks.

- Personalized Advice: While efficiency is key, many also appreciate access to financial advisors for guidance on loan products and repayment strategies.

Existing Bank Account Holders Seeking Integrated Services

Existing FinecoBank account holders represent a significant customer segment, often starting with core banking needs like current accounts and cards. These individuals value the streamlined experience of consolidating their financial lives with a single provider, making them prime candidates for upselling.

This segment is characterized by a willingness to explore more sophisticated financial products once a foundational relationship is established. They see the benefit of integrated services, reducing the complexity of managing multiple financial institutions.

In 2024, FinecoBank continued to leverage its integrated platform to deepen relationships with its existing customer base. Data from early 2024 indicated that customers utilizing both banking and investment services demonstrated a higher retention rate and a greater propensity to increase their assets under management.

- Convenience: Customers appreciate managing everyday banking alongside investment and wealth management from a single platform.

- Trust: A pre-existing relationship with FinecoBank fosters trust, making customers more receptive to additional product offerings.

- Cross-selling Opportunity: FinecoBank can effectively cross-sell investment products, insurance, and advisory services to this engaged user base.

FinecoBank caters to a diverse range of customers, from digitally adept retail investors seeking advanced trading tools to individuals requiring personalized wealth management and financing solutions. The bank also serves its existing account holders, leveraging established trust to offer a broader suite of integrated financial services.

Cost Structure

FinecoBank dedicates a substantial portion of its expenses to its sophisticated technology infrastructure. This includes the ongoing development, maintenance, and enhancement of its core banking platforms, trading systems, and customer-facing applications. In 2023, the bank reported operating expenses of €1.35 billion, with a significant component attributed to technology and personnel.

FinecoBank's cost structure heavily features personnel expenses, encompassing salaries, benefits, and performance-based commissions for its vast team of financial advisors and internal employees. In 2024, these human capital costs are a significant outlay, reflecting the bank's commitment to a robust advisory network and operational staff.

A substantial portion of these personnel costs is dedicated to the training, development, and ongoing support of its financial advisor network. This investment ensures advisors are equipped with the latest market knowledge and tools, directly impacting client service and revenue generation.

FinecoBank dedicates significant resources to marketing and customer acquisition, employing a multi-channel approach that includes targeted digital advertising, extensive brand promotion, and strategic partnerships to attract new clients. These investments are fundamental to its growth strategy, ensuring a continuous inflow of customers in the highly competitive European financial services market.

In 2024, FinecoBank continued to emphasize digital channels for customer acquisition, recognizing the efficiency and reach of online platforms. While specific figures for marketing spend are proprietary, the bank's consistent growth in active clients, which reached approximately 1.7 million by the end of 2023, underscores the effectiveness of these expenditures in expanding its market footprint.

Regulatory Compliance and Legal Costs

FinecoBank, like all financial institutions, navigates a complex regulatory landscape, which translates into significant operational expenses. These costs are not merely overhead; they are fundamental to maintaining trust and stability in the financial markets.

Adhering to stringent financial regulations, including those from European authorities like the European Central Bank (ECB) and national bodies, requires substantial investment. This includes ongoing monitoring, reporting, and the implementation of robust compliance frameworks. For instance, in 2023, the financial services sector globally saw increased spending on compliance, driven by evolving anti-money laundering (AML) and know-your-customer (KYC) regulations.

Legal services are another critical component of this cost structure. FinecoBank engages legal experts to ensure all operations, product offerings, and client interactions meet legal standards. This proactive approach helps mitigate risks and potential litigation, safeguarding the bank's reputation and financial health.

- Regulatory Compliance: Costs associated with adhering to banking directives, capital requirements (e.g., Basel III/IV), and consumer protection laws.

- Legal Services: Expenses for legal counsel, contract reviews, dispute resolution, and advisory on new financial products and services.

- Reporting and Auditing: Costs for generating detailed financial reports for regulatory bodies and undergoing regular external audits to ensure transparency and accuracy.

- Compliance Technology: Investment in software and systems to automate compliance processes, monitor transactions, and manage regulatory data.

Operational and Administrative Overheads

FinecoBank's operational and administrative overheads are crucial for supporting its extensive advisor network and back-office functions. These costs encompass essential elements like office rentals, utilities, and the salaries of administrative staff who ensure the bank's smooth day-to-day operations.

In 2024, FinecoBank continued to invest in its infrastructure to support its growing business. While specific figures for operational and administrative overheads are part of their detailed financial reports, these costs are fundamental to maintaining the quality of service for both advisors and clients.

- Office Rentals: Costs associated with physical office spaces, including those supporting the advisor network.

- Utilities: Expenses for electricity, water, and other services necessary for business operations.

- Back-Office Operations: Costs related to processing transactions, customer service, and IT infrastructure.

- Administrative Staff Salaries: Compensation for personnel managing general administrative functions.

FinecoBank's cost structure is significantly influenced by its investment in technology, personnel, marketing, and regulatory compliance. These elements are crucial for maintaining its competitive edge and operational efficiency. In 2023, the bank reported total operating expenses of €1.35 billion, with technology and human capital forming substantial parts of this figure.

| Cost Category | Description | Estimated 2024 Impact |

|---|---|---|

| Technology Infrastructure | Development, maintenance, and enhancement of banking platforms and trading systems. | Continued significant investment to support digital growth and innovation. |

| Personnel Expenses | Salaries, benefits, and commissions for financial advisors and staff. | A major outlay reflecting the bank's extensive advisory network and operational teams. |

| Marketing & Customer Acquisition | Digital advertising, brand promotion, and partnerships. | Essential for client growth, with a focus on efficient digital channel acquisition. |

| Regulatory Compliance & Legal | Adherence to banking directives, reporting, and legal counsel. | Ongoing expense to ensure operational integrity and mitigate risks in a regulated environment. |

| Operational & Administrative Overheads | Office rentals, utilities, and back-office support. | Fundamental costs for supporting daily operations and the advisor network. |

Revenue Streams

FinecoBank's core revenue generation heavily relies on brokerage commissions and trading fees. These are levied on a vast array of financial instruments, including stocks, bonds, and derivatives, executed through their sophisticated trading platforms. In 2024, this segment remained a significant contributor, reflecting the ongoing demand for efficient trade execution and access to diverse markets.

FinecoBank generates significant revenue through a variety of banking service fees. These include charges on current accounts, the provision of credit and debit card services, and fees for international money transfers. These transactional fees form a crucial part of the bank's operational income, reflecting the everyday use of its core banking services.

FinecoBank generates a substantial portion of its revenue through interest earned on the mortgages and personal loans it extends to its diverse customer base. This core banking activity is fundamental to its business model.

The bank's net interest income, a key profitability driver, is largely determined by the spread between the interest rates it charges on loans and the rates it pays to depositors. For instance, in 2024, FinecoBank's net interest income reflected the prevailing interest rate environment, demonstrating its ability to manage this crucial spread effectively.

Investment Management and Advisory Fees

FinecoBank generates significant revenue through investment management and advisory fees. These fees are primarily linked to the wealth management solutions, mutual funds, and the expert advice offered by its extensive network of financial advisors.

The fee structure is typically calculated as a percentage of the assets managed (Assets Under Management or AUM) or through specific charges for particular services rendered. This model ensures a recurring revenue stream as clients continue to utilize FinecoBank's investment products and advisory capabilities.

- Wealth Management Fees: Revenue from managing client portfolios and providing tailored financial planning.

- Mutual Fund Fees: Income generated from the sale and ongoing management of various mutual fund products.

- Advisory Service Charges: Fees for the personalized guidance and recommendations provided by financial advisors.

As of the first quarter of 2024, FinecoBank reported a substantial increase in net fees and commissions, reflecting the growing demand for its wealth management services. This segment is a cornerstone of their business model, demonstrating strong client trust and engagement.

Insurance Product Sales Commissions

FinecoBank generates revenue through commissions earned from selling insurance products. These products are made available via its integrated platform, thanks to strategic alliances with various insurance underwriters. This stream diversifies the bank's income beyond traditional interest-based activities, contributing to its non-interest income portfolio.

In 2024, FinecoBank continued to leverage its extensive client base to offer a range of insurance solutions. While specific commission figures for insurance product sales are often embedded within broader fee and commission income disclosures, the trend for Italian banks in 2024 indicated a steady reliance on such ancillary services to bolster profitability. For instance, Italian banks, on average, saw their commission income from insurance and investment products remain a significant contributor to their overall revenue, often making up 20-30% of total income, depending on the institution's specific product mix and distribution strategy.

- Partnerships with Insurers: FinecoBank collaborates with leading insurance companies to provide a diverse selection of policies to its customers.

- Platform Integration: Insurance offerings are seamlessly integrated into FinecoBank's digital banking and investment platform, enhancing customer convenience and accessibility.

- Revenue Diversification: Commissions from insurance sales represent a key component of FinecoBank's strategy to diversify revenue streams and reduce reliance on net interest income.

- Growth Potential: The increasing demand for financial protection products among FinecoBank's digitally-savvy customer base presents ongoing opportunities for commission growth in this segment.

FinecoBank also generates revenue through foreign exchange services, offering competitive rates for currency conversions and international payments. This service caters to both retail and corporate clients, facilitating cross-border transactions and contributing to the bank's fee-based income. The bank's robust digital infrastructure ensures efficient and transparent FX operations.

The bank's revenue diversification strategy includes income from credit card services, encompassing interchange fees from transactions and potential interest income from revolving credit facilities. These services are integral to the daily financial activities of its customers, providing a consistent revenue stream.

FinecoBank's revenue streams are robust and diversified, with a significant portion derived from brokerage and trading fees, banking service charges, and interest income from loans. Wealth management and advisory services, along with insurance commissions, further bolster its income, demonstrating a comprehensive financial services offering. As of early 2024, net fees and commissions showed strong growth, highlighting the success of its wealth management segment.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Brokerage & Trading Fees | Commissions on financial instrument transactions. | Significant contributor, reflecting strong trading volumes. |

| Banking Service Fees | Charges on accounts, cards, and transfers. | Core income from everyday banking activities. |

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | Key profitability driver, influenced by interest rate environment. |

| Wealth Management & Advisory | Fees from managing assets and providing financial advice. | Strong growth reported in Q1 2024, indicating client trust. |

| Insurance Commissions | Revenue from selling insurance products via partnerships. | Diversifies income, with Italian banks typically seeing 20-30% of income from such products. |

Business Model Canvas Data Sources

The FinecoBank Business Model Canvas is informed by a blend of internal financial data, extensive market research, and strategic insights derived from industry analysis. These sources ensure each component of the canvas accurately reflects the bank's current operations and future potential.