FinecoBank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FinecoBank Bundle

FinecoBank operates in a dynamic financial services landscape, where understanding the intensity of competitive rivalry and the power of buyers is crucial. The threat of new entrants and the availability of substitutes also significantly shape its strategic positioning.

The complete report reveals the real forces shaping FinecoBank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FinecoBank's reliance on specialized technology for its digital operations, including core banking and cybersecurity, means providers of these advanced solutions can wield considerable influence. The intricate nature and unique integration of these systems can make switching difficult for FinecoBank, potentially driving up costs or dictating less favorable contract terms.

For example, in 2023, the global financial technology market was valued at over $11.5 trillion, with a significant portion dedicated to core banking and cybersecurity solutions. This high demand for specialized fintech services underscores the potential bargaining power of key providers.

While FinecoBank faces this concentration, the rapidly evolving fintech landscape offers a counterbalancing force. The emergence of diverse and innovative solutions across the ecosystem provides FinecoBank with opportunities to diversify its technology partners, thereby enhancing its negotiation leverage and mitigating the risk of over-reliance on any single provider.

FinecoBank relies on a robust network of over 3,000 Personal Financial Advisors (PFAs) as of December 31, 2024, who are instrumental in client engagement and wealth management. The high demand for skilled and reputable financial advisors in Italy means these professionals can exert significant influence over their terms of employment and the bank's retention efforts.

FinecoBank, operating as a direct bank, relies heavily on access to robust liquidity and capital markets to fuel its lending, investment, and operational activities. Suppliers here encompass a range of entities, from interbank lenders to institutional investors participating in bond issuances, and crucially, central bank facilities that provide essential funding. The availability and cost of these capital sources are directly influenced by broader economic conditions and evolving regulatory landscapes, which can significantly shift the bargaining power of these financial suppliers.

In 2024, the European Central Bank's (ECB) monetary policy, including its interest rate decisions, directly impacts the cost of borrowing for banks like FinecoBank. For instance, the ECB's decision to maintain a certain interest rate level in early 2024 would have made interbank lending more or less expensive, directly affecting FinecoBank's funding costs. Furthermore, the success of FinecoBank's bond issuances in 2024, measured by oversubscription rates and yield spreads compared to benchmark rates, would indicate the appetite of institutional investors and thus their relative bargaining power.

Data and Information Providers

FinecoBank's operations, particularly its trading platforms and investment services, rely heavily on timely market data, financial news, and analytical tools. Providers of these essential services, like Bloomberg or Refinitiv, are critical for the bank's brokerage and investment divisions. The specialized nature of some financial data and the absolute requirement for accuracy and speed can grant these suppliers a degree of leverage.

The bargaining power of data and information providers for FinecoBank is generally considered moderate. This is because while FinecoBank requires a constant stream of high-quality data, the market for financial data providers, though concentrated, does offer some alternatives. For example, in 2024, the global financial data market was valued at over $30 billion, indicating a substantial but also competitive landscape. The cost of switching data providers can be significant due to integration complexities and potential disruptions to trading operations, which adds to the suppliers' power.

- Reliance on Specialized Data: FinecoBank's trading platforms depend on real-time, accurate data feeds for equities, bonds, and derivatives, which are often proprietary or require specialized infrastructure.

- Market Concentration: A few major players dominate the financial data provision market, limiting the number of viable alternative suppliers for FinecoBank.

- Switching Costs: The expense and operational disruption involved in changing data providers can deter FinecoBank from seeking new suppliers, thereby strengthening existing provider relationships.

- Data Quality and Reliability: The critical need for high-fidelity data to support investment decisions and regulatory compliance means FinecoBank cannot compromise on the quality offered by its providers.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, such as specialized legal and audit firms, hold significant bargaining power over banks like FinecoBank. The Italian banking sector is subject to stringent and evolving regulations, including those for anti-money laundering and data privacy. For instance, in 2023, Italy's banking sector faced increased scrutiny regarding compliance with EU directives, leading to higher demand for expert advisory services.

These external consultants offer niche expertise essential for navigating complex legal frameworks. The substantial financial penalties and reputational damage associated with non-compliance empower these suppliers. FinecoBank, like other financial institutions, relies heavily on these firms to ensure adherence to directives such as the GDPR and various anti-financial crime legislation, making their services indispensable.

- High Cost of Non-Compliance: Banks face significant fines and operational disruptions if they fail to meet regulatory standards.

- Specialized Expertise: Compliance service providers possess unique knowledge of intricate and frequently updated banking regulations.

- Dependence on External Advisors: The complexity of financial regulations necessitates reliance on external legal and audit professionals.

FinecoBank's reliance on specialized technology for its digital operations, including core banking and cybersecurity, means providers of these advanced solutions can wield considerable influence. The intricate nature and unique integration of these systems can make switching difficult for FinecoBank, potentially driving up costs or dictating less favorable contract terms.

For example, in 2023, the global financial technology market was valued at over $11.5 trillion, with a significant portion dedicated to core banking and cybersecurity solutions. This high demand for specialized fintech services underscores the potential bargaining power of key providers.

While FinecoBank faces this concentration, the rapidly evolving fintech landscape offers a counterbalancing force. The emergence of diverse and innovative solutions across the ecosystem provides FinecoBank with opportunities to diversify its technology partners, thereby enhancing its negotiation leverage and mitigating the risk of over-reliance on any single provider.

What is included in the product

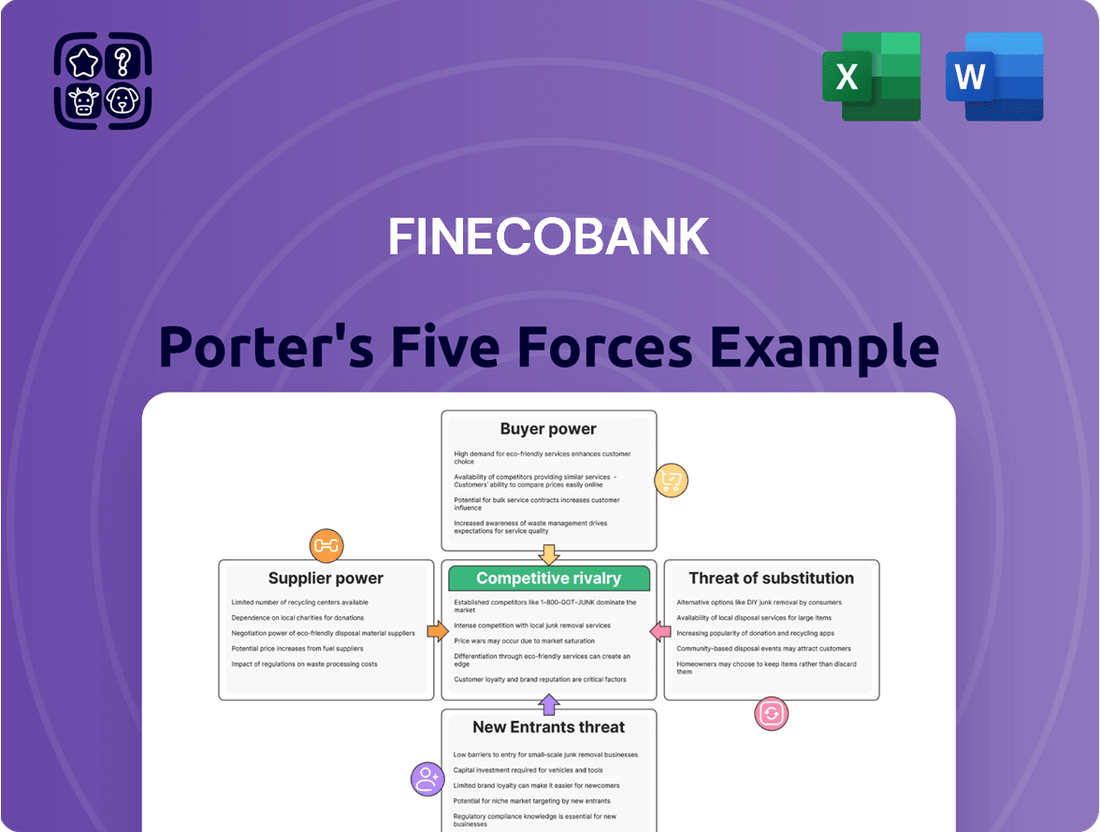

Tailored exclusively for FinecoBank, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly assess competitive pressures with a visual breakdown of FinecoBank's industry landscape, making strategic adjustments effortless.

Customers Bargaining Power

Customers in digital banking, including those interacting with FinecoBank, experience significantly lower switching costs. This is largely due to streamlined account opening procedures and the increasing portability of financial information. For instance, in 2024, many neobanks and digital platforms reported customer onboarding times measured in minutes rather than days, a stark contrast to traditional institutions.

This ease of transition directly enhances customer bargaining power. They can readily compare offerings from various providers based on critical factors like fees, available features, and interest rates. A study in early 2025 indicated that over 60% of digital banking users actively monitor competitor offerings, a testament to this heightened influence.

Consequently, FinecoBank faces the imperative to consistently innovate and deliver superior value to its customers. Maintaining a competitive edge through enhanced services, attractive rates, and user-friendly digital experiences is crucial for customer retention in this dynamic market.

Retail clients, especially for everyday banking, are very sensitive to price. They look for lower fees on things like checking accounts, credit cards, and simple transactions. This means FinecoBank needs to keep its pricing competitive across its banking, brokerage, and investment offerings, as customers can easily switch if they find better rates or lower commissions elsewhere.

The digital revolution has dramatically boosted customer access to information about financial products. Online reviews, financial aggregators, and fintech comparison platforms now allow consumers to easily research and compare offerings from various institutions, including FinecoBank. This heightened transparency empowers customers, enabling them to make more informed choices and negotiate for better value, thereby increasing their bargaining power.

Diversified Service Needs

FinecoBank serves a wide array of clients, offering everything from simple banking to complex trading and wealth management. This broad offering, while designed to attract more customers, also means clients can easily find niche providers for specific financial services, lessening their dependence on FinecoBank for every requirement. This can lead to a more fragmented customer loyalty.

For instance, a customer primarily interested in advanced algorithmic trading might find a specialized platform more appealing than FinecoBank's integrated offering. Similarly, a client focused solely on long-term, conservative wealth preservation might opt for a boutique wealth management firm. This ability for customers to "cherry-pick" services from different providers directly impacts FinecoBank's ability to lock in clients across its entire product suite.

- Customer Specialization: Clients can seek out providers excelling in specific financial areas, reducing reliance on a single institution.

- Fragmented Loyalty: The availability of specialized services can dilute customer commitment to a full-service bank like FinecoBank.

- Reduced Switching Costs: For specific services, the effort to switch providers is minimal, empowering customers.

Customer Base Growth and Engagement

FinecoBank's customer base growth, reaching 1.66 million clients by adding over 152,000 new customers in 2024, highlights its appeal. However, this expansion also amplifies the bargaining power of its customers. A larger, more engaged customer base has a greater capacity to collectively influence terms if they perceive a decline in service quality or value.

This growing customer base means FinecoBank must focus on maintaining high satisfaction and engagement levels. If customers feel undervalued or if competitors offer superior terms, this large group could potentially shift their business, thereby increasing their bargaining power.

- Customer Acquisition: FinecoBank added over 152,000 new customers in 2024.

- Total Client Reach: The bank now serves 1.66 million clients.

- Potential for Collective Action: A large, engaged customer base can exert significant bargaining power if dissatisfied.

- Retention Imperative: Sustained high satisfaction is crucial to mitigate churn and customer leverage.

FinecoBank's customers benefit from low switching costs, as digital banking makes it easy to move accounts. In 2024, many digital platforms offered onboarding in minutes, a significant advantage for consumers. This ease of transition allows customers to readily compare offerings, with a 2025 study showing over 60% of digital banking users actively monitoring competitors, thus increasing their bargaining power.

| Metric | 2024 Data | Implication for Bargaining Power |

|---|---|---|

| Customer Onboarding Time | Minutes (for many digital platforms) | Lowers switching costs, increasing customer power. |

| Customer Monitoring of Competitors | Over 60% (early 2025 study) | Heightens transparency and empowers informed choices. |

| New Customers Acquired | 152,000+ | Larger base amplifies potential collective influence. |

| Total Clients | 1.66 million | Significant reach means customer dissatisfaction can have a larger impact. |

What You See Is What You Get

FinecoBank Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for FinecoBank, offering a detailed examination of competitive forces within the banking and financial services sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

FinecoBank faces significant competition from deeply entrenched traditional Italian banks. Giants like Intesa Sanpaolo, with its substantial €1.1 trillion in assets under management as of the end of 2023, and Banco BPM, which reported €208 billion in total assets in the same period, command vast physical branch networks and loyal customer relationships built over decades.

These established players are not standing still; they are actively pursuing digital transformation initiatives to enhance their online offerings and customer experience. This means they are increasingly able to compete with digital-first banks like FinecoBank on service and accessibility, not just traditional strengths.

While FinecoBank differentiates through its integrated banking, investing, and insurance model, the sheer scale and ongoing digital investment by incumbents like UniCredit, which reported €836 billion in total assets at year-end 2023, create a formidable competitive landscape for market share.

The Italian banking landscape is increasingly shaped by digital-only banks and neobanks like Revolut, N26, and Isybank. These players provide slick, app-driven services, often at lower price points, directly challenging FinecoBank's digitally focused approach, especially with younger, cost-conscious customers.

FinecoBank's core brokerage and investment services operate in a fiercely competitive landscape. It faces significant rivalry from nimble online brokers, established asset management firms, and a growing number of wealth management platforms, all vying for investor attention and assets.

This intense competition is fueled by a constant drive for innovation in trading tools, aggressive pricing strategies with competitive commission structures, and the expansion of diverse investment product offerings. For instance, in 2024, the European online brokerage sector saw commission rates for basic trades often fall below 0.10%, pushing incumbents like FinecoBank to enhance value through superior technology and personalized advice to maintain market share.

Consolidation in the Italian Banking Sector

The Italian banking sector is experiencing significant consolidation. This trend, driven by the pursuit of scale and efficiency, means larger, stronger banks are emerging. For FinecoBank, this translates to increased competitive pressure from these enlarged entities with greater financial muscle and wider market penetration.

This consolidation is not just theoretical; it's actively reshaping the competitive landscape. For instance, in 2023, the Italian banking sector saw notable M&A activity, with several smaller institutions being absorbed by larger players. This strategic realignment aims to create more robust financial groups capable of competing more effectively both domestically and internationally.

- Mergers and acquisitions are actively reducing the number of independent Italian banks.

- Consolidation aims to improve profitability and operational efficiency through economies of scale.

- Larger consolidated entities possess greater financial resources for investment and expansion.

- This trend intensifies competition, potentially impacting market share and pricing for all players, including FinecoBank.

Product and Service Differentiation

FinecoBank distinguishes itself through a unique multi-channel strategy, blending robust online banking and brokerage services with a network of dedicated financial advisors. This approach provides customers with both digital convenience and personalized human guidance. For instance, in 2024, FinecoBank continued to invest heavily in its digital platform, aiming to enhance user experience and streamline access to its diverse financial product offerings.

The bank offers a comprehensive suite of integrated services, encompassing banking, brokerage, and investment management, all accessible through a single platform. This holistic offering simplifies financial management for its clients. FinecoBank's commitment to innovation in its digital user experience and advisory services is crucial for maintaining its competitive edge in the dynamic financial services landscape.

- Multi-channel approach: Online accessibility combined with a network of financial advisors.

- Comprehensive services: Integrated banking, brokerage, and investment solutions.

- Digital enhancement: Continuous investment in user experience and advisory capabilities.

- Market standing: Vital for differentiation in a competitive and evolving market.

FinecoBank faces intense rivalry from both established Italian banking giants and agile digital-only competitors. Traditional banks like Intesa Sanpaolo, with €1.1 trillion in assets as of year-end 2023, and UniCredit, holding €836 billion, leverage extensive branch networks and deep customer loyalty, while simultaneously bolstering their digital offerings. This forces FinecoBank to continually innovate its integrated banking, investing, and insurance model to stand out.

The rise of neobanks and fintech disruptors such as Revolut and N26 presents a direct challenge, particularly for younger demographics attracted by lower costs and slick app interfaces. FinecoBank's brokerage services also encounter fierce competition from online brokers and wealth management platforms, where aggressive pricing, exemplified by commission rates often below 0.10% in 2024 for basic trades, necessitates a focus on superior technology and advisory services to retain clients.

| Competitor Type | Key Strengths | FinecoBank's Response |

|---|---|---|

| Traditional Banks (e.g., Intesa Sanpaolo, UniCredit) | Large asset base (€1.1T and €836B respectively, YE 2023), extensive branch networks, established customer relationships | Integrated multi-channel strategy, digital platform enhancement, focus on advisory services |

| Digital Banks/Neobanks (e.g., Revolut, N26) | Low-cost digital-first offerings, user-friendly apps, appeal to younger demographics | Enhancing digital user experience, offering comprehensive integrated services |

| Online Brokers/Wealth Platforms | Competitive pricing (e.g., <0.10% commissions in 2024), diverse investment products | Differentiating through superior technology, personalized advice, and integrated platform |

SSubstitutes Threaten

Traditional banks, with their extensive physical branch networks, offer a tangible alternative for customers who value in-person service and advice, especially for complex financial needs. This segment of the market, though shrinking, still represents a viable substitute for digital-first or direct banking models like FinecoBank’s. For instance, in 2023, while digital transactions surged, a significant portion of retail banking revenue in the Eurozone still stemmed from services heavily reliant on branch interactions.

The growing Italian fintech scene presents many specialized alternatives for FinecoBank's individual offerings. For example, payment apps like Satispay, peer-to-peer lending services, and robo-advisors such as Moneyfarm provide customers with different ways to handle specific financial requirements outside of a full-service bank.

Customers increasingly have the option to bypass traditional intermediaries like FinecoBank by directly engaging with financial markets. This can involve utilizing global trading platforms that offer access to a wide array of securities, or even purchasing government bonds and other debt instruments directly from issuers.

The appeal of direct investment, particularly in government bonds offering positive yields, presents a significant threat. For instance, in early 2024, many government bond markets saw yields rise, making them an attractive alternative to lower-yielding bank deposits or managed investment products, thereby diverting potential capital away from FinecoBank's core offerings.

Alternative Lending and Crowdfunding Platforms

Alternative lending and crowdfunding platforms present a significant threat to traditional financial institutions like FinecoBank. These platforms, often leveraging technology, provide accessible and sometimes faster routes to capital for both individuals and businesses, directly competing with FinecoBank's core lending operations.

The appeal of these substitutes lies in their often streamlined application processes and a wider array of funding structures compared to conventional bank loans. For instance, peer-to-peer lending platforms connect borrowers directly with investors, bypassing some of the traditional banking overhead. In 2024, the global alternative lending market continued its robust growth, with projections indicating further expansion as more consumers and businesses seek flexible financing solutions.

- Agility: Alternative platforms frequently offer quicker loan approvals and funding disbursements than traditional banks.

- Diversification: Crowdfunding, in particular, allows for capital raising from a broad base of smaller investors, offering an alternative to single-source bank financing.

- Market Share: The increasing adoption of these platforms signifies a potential erosion of market share for established lenders in specific segments.

Cryptocurrencies and Digital Assets

The rise of cryptocurrencies and digital assets presents a growing threat of substitutes for traditional financial services offered by institutions like FinecoBank. These digital assets are increasingly seen as alternative stores of value and investment vehicles, potentially drawing capital away from conventional banking and brokerage accounts.

The volatility of cryptocurrencies is a key factor, but their appeal lies in offering different avenues for wealth accumulation and storage. This emerging market is not just a niche interest; it's gaining traction globally and within specific regions like Italy.

In Italy, the digital assets market is anticipated to see substantial growth by 2025. This expansion signifies a tangible shift in investor behavior, where digital currencies could begin to substitute for traditional investment portfolios and even aspects of currency usage.

- Growing Investor Interest: A significant portion of the global population, including in Europe, is exploring or actively investing in digital assets.

- Alternative Wealth Storage: Cryptocurrencies offer a decentralized alternative to traditional savings and investment accounts.

- Market Projections: The Italian digital asset market is on a projected growth trajectory, indicating a potential diversion of funds from traditional financial institutions.

- Technological Disruption: The underlying blockchain technology also has the potential to disrupt traditional financial intermediaries.

The threat of substitutes for FinecoBank is significant, encompassing traditional banking, fintech innovations, direct market access, alternative lending, and digital assets. Customers can opt for physical branches for personalized service or specialized fintech apps for specific needs like payments or investments. Direct engagement with global markets or purchasing government bonds, especially those with attractive yields as seen in early 2024, offers an alternative to managed products.

Alternative lending and crowdfunding platforms provide faster, more flexible capital access, directly competing with FinecoBank's lending services. The global alternative lending market saw robust growth in 2024, with platforms offering streamlined processes and diverse funding structures. Cryptocurrencies and digital assets also pose a threat, offering alternative stores of value and investment vehicles, with the Italian digital asset market projected for substantial growth by 2025.

| Substitute Category | Examples | Key Appeal | 2024/2025 Relevance |

|---|---|---|---|

| Traditional Banks | Physical branches | In-person service, complex needs advice | Still significant revenue source in Eurozone retail banking |

| Fintech Innovations | Payment apps, robo-advisors | Specialized, convenient services | Growing Italian fintech scene |

| Direct Market Access | Global trading platforms, direct bond purchases | Bypassing intermediaries, potentially higher yields | Rising government bond yields in early 2024 |

| Alternative Lending | P2P lending, crowdfunding | Agility, diversification, faster funding | Robust global growth in alternative lending |

| Digital Assets | Cryptocurrencies | Alternative store of value, investment | Projected substantial growth in Italian digital asset market by 2025 |

Entrants Threaten

Entering the Italian banking sector presents substantial hurdles due to rigorous regulatory and licensing requirements. Potential new players must contend with complex approval processes mandated by entities such as the Bank of Italy and the European Central Bank.

These stringent requirements, encompassing significant capital adequacy ratios and demanding compliance standards, effectively deter many prospective entrants, thereby reinforcing the position of established firms like FinecoBank.

Launching a new banking operation, even a digital one, requires immense upfront capital. Think about the costs for cutting-edge technology, setting up operations, and meeting strict regulatory capital requirements. For instance, in 2024, many new fintechs have struggled to secure the hundreds of millions, sometimes even billions, needed to become fully licensed and operational banks.

This significant financial hurdle acts as a powerful deterrent, effectively keeping out many aspiring new players who lack substantial financial backing. It’s not just about having a good idea; it’s about having the deep pockets to bring it to life in a heavily regulated industry.

FinecoBank, established in 1999, has cultivated a robust brand and earned significant customer trust through years of operation. New competitors entering the financial services sector must overcome the considerable hurdle of building credibility and a loyal customer base, a process that typically demands substantial time and marketing expenditure to rival established entities.

Economies of Scale and Cost Advantages of Incumbents

Existing players like FinecoBank leverage significant economies of scale, particularly in technology development, marketing reach, and operational efficiency, stemming from their substantial customer base and mature infrastructure. This allows them to spread fixed costs over a larger volume, leading to lower per-unit costs.

New entrants face a considerable hurdle in matching these cost advantages. They often lack the established customer base and scale to achieve comparable efficiencies in their initial stages, making it challenging to compete effectively on price or offer a full suite of services without incurring higher costs.

- Economies of Scale: FinecoBank's large operational footprint allows for cost efficiencies in areas like IT infrastructure and regulatory compliance, which are difficult for startups to replicate.

- Cost Advantages: Incumbents benefit from established brand recognition and customer loyalty, reducing customer acquisition costs compared to new entrants.

- Barriers to Entry: The high initial investment required for technology platforms and marketing campaigns creates a significant barrier for potential new competitors.

Access to Distribution Channels and Talent

FinecoBank's established multi-channel distribution, combining a robust online platform with a network of financial advisors, presents a significant barrier for new entrants. Developing comparable reach and customer engagement requires substantial investment and time. For instance, as of Q1 2024, FinecoBank reported a strong growth in its customer base, underscoring the effectiveness of its distribution strategy.

New players face the challenge of replicating FinecoBank's ability to attract and retain top talent in both finance and technology. The competition for skilled professionals is intense, particularly in areas like digital banking and wealth management. This talent acquisition hurdle can slow down innovation and operational scaling for emerging firms.

- Multi-channel distribution FinecoBank utilizes both online platforms and a physical network of advisors.

- Costly channel development New entrants must invest heavily to build comparable distribution networks.

- Talent acquisition challenges Securing and retaining skilled financial and tech professionals is a competitive hurdle.

The threat of new entrants for FinecoBank is generally low due to significant barriers. High capital requirements, stringent regulatory approvals from bodies like the Bank of Italy and the European Central Bank, and the need for substantial upfront investment in technology and operations deter many potential competitors. For example, in 2024, securing the necessary funding for a new banking license remained a major obstacle for fintech startups.

Established players like FinecoBank benefit from strong brand recognition, customer loyalty built over years, and significant economies of scale, particularly in IT and marketing. New entrants must overcome the considerable challenge of building trust and matching the cost efficiencies derived from an existing large customer base. This makes it difficult for them to compete on price or service breadth initially.

FinecoBank's established multi-channel distribution network, combining digital platforms with financial advisors, and its ability to attract top talent in finance and technology also present competitive hurdles. Replicating this reach and expertise requires significant investment and time, further limiting the immediate threat from new market entrants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Requirements | Strict licensing, capital adequacy, and compliance standards | High; requires extensive time, resources, and legal expertise |

| Capital Investment | Significant upfront costs for technology, operations, and licensing | High; deters firms without substantial financial backing |

| Economies of Scale | Cost advantages from large customer base and infrastructure | High; new entrants struggle to match cost efficiencies |

| Brand Loyalty & Trust | Established reputation and customer relationships | High; difficult and costly for new players to build |

| Distribution Channels | Integrated online and physical advisor networks | High; costly and time-consuming to replicate |

| Talent Acquisition | Competition for skilled financial and tech professionals | Moderate to High; impacts speed of innovation and scaling |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FinecoBank is built upon a foundation of robust data, drawing from FinecoBank's official annual reports, investor relations disclosures, and regulatory filings. We also incorporate insights from reputable financial news outlets and industry-specific market research reports.