FIH Mobile PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FIH Mobile Bundle

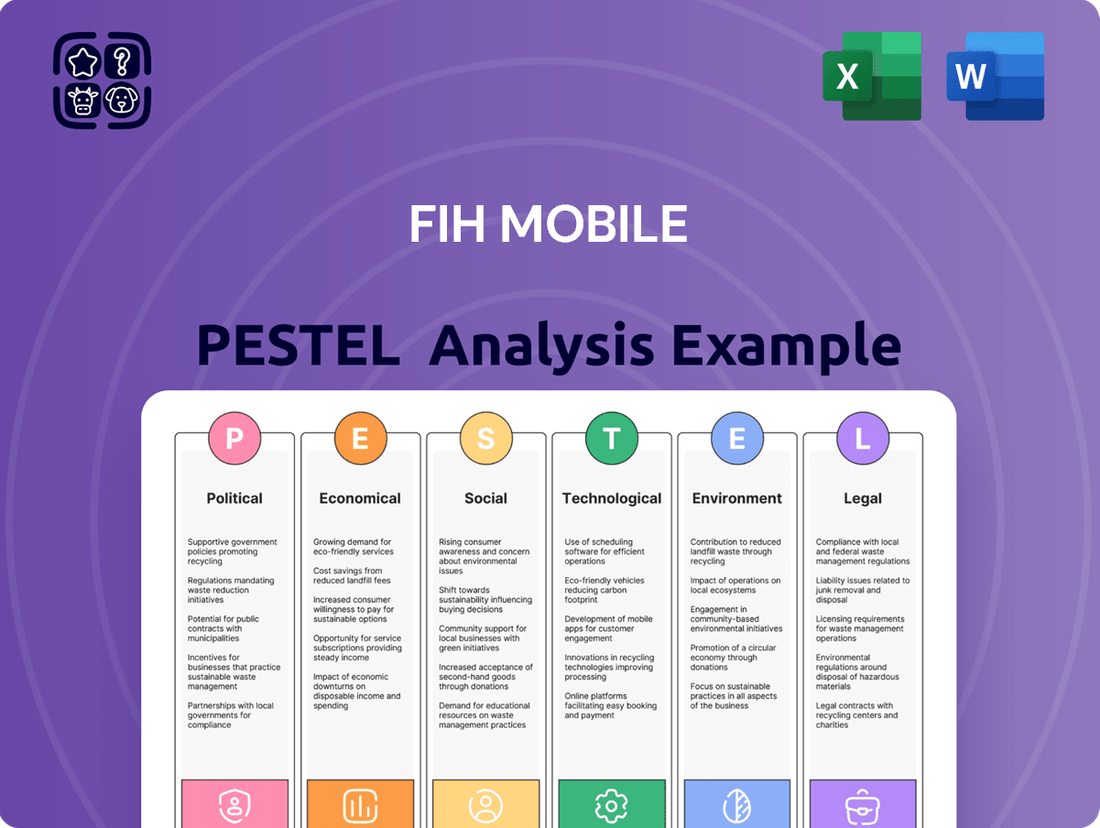

Unlock the critical external factors shaping FIH Mobile's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for a deeper dive into FIH Mobile's dynamic operating environment.

Political factors

Ongoing trade tensions, especially between the U.S. and China, continue to cast a long shadow over the global electronics supply chain. Tariffs on key components like integrated circuits and finished goods such as smartphones directly impact costs and availability, forcing companies like FIH Mobile to re-evaluate their sourcing strategies. For instance, in 2023, U.S. tariffs on Chinese goods reached significant levels, affecting billions of dollars in trade.

These geopolitical disputes underscore the critical need for supply chain diversification. Reducing reliance on single regions, particularly China, is a strategic imperative for resilience. Companies are increasingly exploring manufacturing bases in countries like Vietnam and India, aiming to spread risk and ensure continuity of operations amidst escalating trade friction.

Furthermore, broader geopolitical instability, including the China-Taiwan situation and recent disruptions in the Red Sea, poses direct threats to the seamless sourcing and delivery of electronic components. These events can trigger significant cost increases and delivery delays, as seen with rerouting of shipping lanes in the Red Sea impacting global logistics and raising freight costs by as much as 15-20% in early 2024.

Governments worldwide are actively promoting domestic manufacturing and technological advancements through subsidies and incentives. For example, China's substantial national subsidies, particularly those aimed at accelerating the Android market, significantly shape market dynamics and provide advantages to manufacturers within its borders. These initiatives are designed to strengthen local production capacities and decrease dependence on international supply chains, potentially creating both opportunities and competitive challenges for global players.

Governments worldwide are tightening export controls on critical emerging technologies, such as artificial intelligence and advanced semiconductors, aiming to protect national security and maintain a competitive edge. For instance, the US Bureau of Industry and Security (BIS) has expanded its Entity List, impacting companies dealing with advanced computing and semiconductor manufacturing equipment. This trend directly affects companies like FIH Mobile, potentially limiting their access to essential components or their ability to ship advanced products globally.

These evolving regulations necessitate robust compliance strategies for FIH Mobile to navigate the complex landscape of international trade. Failure to adhere to these controls can result in significant penalties, including fines and restrictions on market access, jeopardizing supply chains and sales channels. For example, in 2023, several tech firms faced scrutiny and operational disruptions due to new export restrictions, highlighting the critical need for proactive compliance measures.

Regulatory Pressure from International Bodies

International bodies and economic blocs, like the European Union, are stepping up regulations on major tech firms, which can function similarly to tariffs. For instance, the EU's Digital Markets Act (DMA) and the upcoming AI Act are designed to increase competition and manage risks, but they impose substantial compliance costs and potential financial penalties on companies like FIH Mobile if they fall under their scope. These measures can significantly impact global market access and necessitate adjustments to operational strategies to meet diverse regulatory landscapes.

These regulatory shifts can translate into direct financial impacts. For example, the DMA, which came into effect in March 2024, targets gatekeeper platforms, and while FIH Mobile might not be a direct target, its partners or the broader ecosystem it operates within could face new obligations. The potential for fines under such regulations, which can reach up to 10% of a company's total worldwide annual turnover, underscores the financial stakes involved in navigating this evolving regulatory environment.

- EU Digital Markets Act (DMA): Implemented March 2024, aiming to ensure fair competition in digital markets.

- EU Artificial Intelligence Act (AI Act): Expected full implementation by mid-2025, setting rules for AI systems.

- Potential Fines: Up to 10% of global annual turnover for non-compliance with DMA.

- Impact on Operations: Increased compliance costs and potential adjustments to market strategies.

Shifting Global Manufacturing Footprints

Global political dynamics are increasingly influencing manufacturing locations, with a notable trend towards reshoring and nearshoring. This strategic pivot is driven by a desire to bolster supply chain resilience and mitigate geopolitical risks. For instance, the U.S. reshoring initiative, supported by policies aimed at incentivizing domestic production, saw manufacturing employment grow by an estimated 1.5% in 2024 compared to 2023, according to preliminary data from the Bureau of Labor Statistics. This global movement could prompt FIH Mobile to re-evaluate its existing manufacturing hubs and consider investments in new, localized facilities to shorten lead times and reduce exposure to international trade disputes.

Companies are actively seeking to diversify their production bases, moving away from over-reliance on single regions. This diversification strategy aims to create more robust and adaptable supply chains. In 2024, several major electronics manufacturers announced plans to expand production capacity in Mexico and Vietnam, aiming to serve North American and Asian markets more efficiently. Such shifts could necessitate adjustments in FIH Mobile's operational strategy, potentially leading to increased capital expenditure in regions offering greater political stability and logistical advantages.

- Reshoring Initiatives: Governments worldwide are implementing policies to bring manufacturing back onshore, offering tax breaks and subsidies.

- Nearshoring Trends: Companies are establishing production closer to their primary markets to improve responsiveness and reduce transportation costs.

- Supply Chain Resilience: The focus is on building more robust supply chains less susceptible to global shocks, including pandemics and trade wars.

- Geopolitical Risk Mitigation: Diversifying manufacturing locations helps businesses avoid concentrated risks associated with specific political climates or international relations.

Geopolitical tensions, particularly between major economic powers, directly impact global supply chains and trade dynamics. For instance, ongoing trade disputes between the U.S. and China, which saw tariffs affecting billions in trade in 2023, force companies like FIH Mobile to reassess sourcing and manufacturing strategies to mitigate risks.

The trend towards reshoring and nearshoring, driven by a desire for supply chain resilience and reduced geopolitical risk, is reshaping global manufacturing footprints. Preliminary data from the U.S. Bureau of Labor Statistics indicated a 1.5% growth in manufacturing employment in 2024 due to reshoring initiatives, prompting companies to consider localized production.

Governments are increasingly implementing export controls on advanced technologies, such as semiconductors and AI, to protect national security. This directly affects companies like FIH Mobile by potentially limiting access to critical components or markets, as seen with expanded US Entity Lists impacting advanced computing equipment in 2023.

New regulations from international bodies, like the EU's Digital Markets Act (DMA) effective March 2024, impose significant compliance costs and potential fines, up to 10% of global annual turnover, on companies operating within their scope, necessitating strategic adjustments for market access.

| Factor | Description | Impact on FIH Mobile | Example/Data Point |

| Trade Tensions | Disputes between major economies | Increased costs, supply chain disruption | US tariffs on Chinese goods in 2023 |

| Reshoring/Nearshoring | Shifting production closer to home markets | Need to re-evaluate manufacturing locations | 1.5% US manufacturing job growth in 2024 |

| Export Controls | Restrictions on technology transfer | Limited access to components/markets | US BIS Entity List expansion |

| Regulatory Compliance | New laws affecting digital markets/AI | Increased operational costs, potential fines | EU DMA (March 2024), potential 10% turnover fines |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting FIH Mobile, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers a comprehensive understanding of the market landscape, highlighting key trends and potential challenges for strategic decision-making.

Provides a concise PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

The global smartphone market is showing signs of a strong rebound, with projections indicating continued growth through 2024 and 2025. After experiencing some dips, the market is expected to expand by 2.3% in 2025, reaching an impressive 1.26 billion units shipped.

This upward trend signifies a positive outlook for the mobile and wireless communications sector. For FIH Mobile, a major player in manufacturing, this overall market expansion translates into a significant opportunity to leverage increased demand and further solidify its position.

Foxconn Technology Group, FIH Mobile's parent, demonstrated robust financial performance in 2024, achieving an 11.3% year-on-year revenue increase and a 7.5% rise in net profit. This strong showing provides a stable financial foundation for its subsidiaries.

Looking ahead to 2025, Foxconn projects continued growth, fueled by high demand for AI servers and progress in smart manufacturing technologies. This positive outlook suggests potential for increased investment and support for FIH Mobile's operations and strategic initiatives.

The financial strength and strategic trajectory of Foxconn directly impact FIH Mobile by shaping the availability of capital, the allocation of resources, and the scope of strategic opportunities that can be pursued.

FIH Mobile's revenue saw a decrease in 2024, reaching US$5,702.9 million, an 11.5% drop from the previous year. This was a deliberate move, stemming from a strategic adjustment in its customer base aimed at boosting overall profitability.

Despite the revenue dip, the company demonstrated a strong comeback in profitability, narrowing its loss attributable to owners to US$20.3 million in 2024, a substantial improvement from the US$120.7 million loss recorded in 2023. This turnaround, particularly evident in the latter half of 2024, highlights effective cost management and a commitment to long-term financial health.

Consumer Purchasing Power and Demand

Consumer purchasing power is on the mend globally, with improving macroeconomic conditions fueling a stronger appetite for smartphones. This trend is particularly evident in emerging markets, where rising incomes translate directly into increased demand for new devices. For instance, in India, smartphone shipments reached an estimated 150-160 million units in 2024, a significant rebound from previous years, indicating robust consumer confidence and spending capacity.

This renewed consumer sentiment directly benefits companies like FIH Mobile, which manufactures smartphones for various brands. As consumers feel more financially secure, they are more likely to upgrade their existing devices or purchase new ones, including potentially higher-end models. This surge in demand, especially in growth regions such as Southeast Asia and Latin America, where smartphone penetration is still expanding, creates a favorable environment for FIH Mobile's production and sales volumes.

- Global Smartphone Shipments: Projections for 2024 indicate a global market recovery, with some analysts forecasting a modest year-over-year growth of 2-3% after a period of decline.

- Emerging Market Growth: Countries like India and Vietnam are expected to lead smartphone market growth in 2024-2025, driven by increasing disposable incomes and a young, tech-savvy population.

- Consumer Confidence Index: Improvements in consumer confidence indices across key markets correlate with increased spending on durable goods, including smartphones. For example, India's Consumer Confidence Index has shown a steady upward trend in early 2024.

- Demand for Premium Devices: A portion of the renewed purchasing power is being directed towards premium and 5G-enabled smartphones, signaling a willingness among consumers to invest in more advanced technology.

Fluctuating Component Costs and Supply Chain Efficiency

The electronics sector's supply chain remains susceptible to disruptions, with geopolitical tensions and potential shortages of key raw materials like rare earth elements contributing to volatile component costs. For instance, the average price of semiconductors, a critical input for mobile devices, saw significant fluctuations throughout 2024, driven by demand shifts and production bottlenecks. FIH Mobile's emphasis on operational improvements and automation is therefore paramount for cost control and sustaining competitive pricing in this environment.

Companies are increasingly leveraging digitalization and AI to refine supply chain management. These advanced systems allow for more accurate demand forecasting and quicker responses to market changes, which is crucial for mitigating the impact of fluctuating costs. By mid-2025, many leading electronics manufacturers are expected to have integrated AI solutions for at least 60% of their supply chain planning processes, aiming to bolster resilience and efficiency.

- Geopolitical Risk: Ongoing trade disputes and regional conflicts continue to pose a threat to the stability of component sourcing and pricing.

- Material Scarcity: Dependence on specific regions for critical materials like lithium and cobalt can lead to price spikes and supply interruptions.

- Operational Efficiency: FIH Mobile's investment in automation and lean manufacturing practices aims to offset rising input costs and maintain price competitiveness.

- Digital Transformation: The adoption of AI and advanced analytics in supply chain operations is projected to improve visibility and responsiveness by up to 25% by the end of 2025.

Economic factors present a mixed but generally positive landscape for FIH Mobile. The global smartphone market is rebounding, with projections for 2025 indicating a 2.3% increase in unit shipments to 1.26 billion. This growth is supported by improving consumer purchasing power, especially in emerging markets like India, which saw shipments between 150-160 million units in 2024. FIH Mobile's parent, Foxconn, also demonstrated financial strength in 2024, with an 11.3% revenue increase, suggesting continued investment potential for its subsidiaries.

| Metric | 2023 | 2024 (Est.) | 2025 (Proj.) |

|---|---|---|---|

| Global Smartphone Shipments (Bn Units) | 1.18 | 1.20 | 1.26 |

| Foxconn Revenue Growth | N/A | 11.3% | Continued Growth |

| FIH Mobile Net Loss Attributable to Owners | US$120.7M | US$20.3M | Improving Trend |

Preview the Actual Deliverable

FIH Mobile PESTLE Analysis

The preview you see here is the exact FIH Mobile PESTLE Analysis document you'll receive after purchase—fully formatted and ready to use.

You are viewing the actual, finished FIH Mobile PESTLE Analysis. What you see is exactly what you’ll be working with immediately after checkout.

This is a real screenshot of the FIH Mobile PESTLE Analysis you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Consumers are increasingly showing a preference for products that align with environmental and ethical values. A 2024 report indicated that over 60% of consumers globally consider sustainability a key factor when making purchasing decisions, with a notable portion willing to pay more for eco-friendly electronics.

This growing demand directly impacts manufacturers like FIH Mobile, pushing them to integrate sustainable practices across their operations, from responsible material sourcing to energy-efficient production processes and end-of-life product management. Companies that successfully adapt to these expectations can foster stronger brand loyalty and attract a segment of the market that prioritizes corporate responsibility.

By embracing sustainability, FIH Mobile has an opportunity to differentiate itself in a competitive market, potentially leading to increased market share and improved long-term financial performance as consumer awareness and expectations continue to evolve through 2025.

Consumers are increasingly extending the lifespan of their smartphones, with many now opting for three-year refresh cycles. This shift directly impacts the addressable market for new device sales, presenting a significant challenge for manufacturers like FIH Mobile.

This trend necessitates a strategic pivot for FIH Mobile, urging a focus on enhancing product durability, improving repairability, and consistently introducing genuinely innovative features. By doing so, the company can better incentivize earlier upgrades and maintain relevance in a market where consumers are less inclined to replace devices frequently.

Consumers are increasingly prioritizing devices that are built to last and can be easily repaired, a trend fueled by growing environmental awareness and a desire to reduce electronic waste. This shift is also being propelled by new regulations aimed at fostering a more sustainable technology sector. For instance, the European Union's Ecodesign for Sustainable Products Regulation, which came into effect in 2024, mandates stricter requirements for product durability and repairability, impacting manufacturers globally.

The push towards a circular economy is gaining significant momentum, with governments and consumers alike advocating for practices that emphasize repair, reuse, and refurbishment over outright replacement. This evolving landscape presents a clear opportunity for companies like FIH Mobile. By enhancing its after-sales services and focusing on product designs that facilitate easier repairs and upgrades, FIH Mobile can effectively tap into this burgeoning market segment.

Investing in robust repair and refurbishment programs not only addresses consumer demand but also aligns with broader sustainability goals, potentially reducing a company's environmental footprint. For example, a successful refurbishment program can extend the life of a device by several years, diverting it from landfills and conserving the resources needed for new production. This strategy can lead to improved customer loyalty and a stronger brand reputation in an increasingly eco-conscious market.

Impact of AI on User Experience and Personalization

Artificial intelligence is rapidly becoming a cornerstone of smartphone functionality, driving significant advancements in user experience and personalization. This trend is reshaping how consumers interact with their devices, with AI-powered features like intelligent cameras and voice assistants becoming increasingly sophisticated. For FIH Mobile, a key player in smartphone design and manufacturing, understanding and integrating these AI capabilities is crucial for staying ahead in a competitive market and meeting heightened consumer expectations.

The integration of AI allows for deeply personalized user experiences, from adaptive interfaces to predictive app suggestions. This personalization is a major driver of customer satisfaction and loyalty in the mobile industry. For instance, by mid-2024, reports indicated that over 70% of smartphone users actively utilize AI-driven features like voice assistants and personalized content feeds, highlighting a clear market demand for these innovations.

- AI-driven personalization enhances user engagement and device stickiness.

- Voice assistants are becoming primary interaction points for many users, demanding seamless AI integration.

- Intelligent camera systems, leveraging AI for image processing and scene recognition, are a key differentiator in the premium smartphone segment.

- FIH Mobile's ability to incorporate these AI advancements directly impacts its value proposition as a manufacturing partner.

Evolving Connectivity and Digital Lifestyle

The ongoing rollout of 5G, with 6G research well underway, is fundamentally reshaping how we connect and interact digitally. By mid-2024, global 5G subscriptions were projected to surpass 1.5 billion, a significant jump from previous years, highlighting this rapid expansion. This enhanced connectivity, alongside advancements in satellite internet like Starlink, is fostering new avenues for seamless communication and deeper digital integration into everyday routines. FIH Mobile, with its deep roots in mobile and wireless technology, is strategically positioned to leverage this trend, as consumers increasingly rely on sophisticated connectivity for an ever-growing array of digital services.

This evolution directly fuels the adoption of data-intensive applications and services. For instance, mobile payment systems are becoming more sophisticated and widespread, with global mobile payment transaction value expected to reach over $15 trillion by 2025. Furthermore, enhanced cloud-based experiences, from gaming to remote work, are becoming the norm, all dependent on robust and fast mobile networks. FIH Mobile's established capabilities in manufacturing and developing mobile devices and components are crucial for supporting this demand for advanced digital lifestyles.

- Global 5G subscriptions projected to exceed 1.5 billion by mid-2024.

- Mobile payment transaction value anticipated to surpass $15 trillion globally by 2025.

- Advancements in satellite connectivity are expanding internet access to previously underserved regions.

Societal shifts towards sustainability and ethical consumption are significantly influencing the electronics industry. By 2024, consumer demand for eco-friendly products had surged, with a notable percentage willing to pay a premium for sustainable electronics, directly pressuring manufacturers like FIH Mobile to adopt greener practices throughout their value chain.

Consumers are increasingly extending the lifespan of their devices, with many now opting for three-year refresh cycles. This trend, further amplified by regulations like the EU's Ecodesign for Sustainable Products Regulation enacted in 2024, emphasizes product durability and repairability, compelling companies like FIH Mobile to innovate in these areas.

The growing emphasis on a circular economy is driving demand for repair and refurbishment services. FIH Mobile can capitalize on this by enhancing its after-sales support and designing products for easier maintenance, aligning with both consumer preferences and sustainability goals.

Technological factors

The rollout of 5G is accelerating globally, with projections indicating over 1 billion 5G connections by the end of 2024, a significant leap from previous years. This enhanced connectivity offers speeds up to 100 times faster than 4G, enabling seamless integration of advanced technologies.

The development of 6G, expected to begin trials around 2028, promises even greater capabilities, including terabit-per-second speeds and sub-millisecond latency. This will unlock truly immersive experiences in augmented and virtual reality, alongside more sophisticated AI applications and widespread autonomous systems.

FIH Mobile's strategic focus on research and development for 5G and future 6G hardware is crucial. By investing in advanced antenna designs, miniaturized components, and robust materials, the company can ensure its products meet the demanding specifications of these next-generation networks, maintaining its competitive edge.

Artificial intelligence is fundamentally reshaping smartphone capabilities, powering everything from sophisticated camera features to deeply personalized user interfaces and more responsive voice assistants. This pervasive integration means devices are becoming inherently smarter, offering users more intuitive and seamless interactions.

FIH Mobile, as a key player in designing and engineering mobile devices, must actively incorporate these AI advancements to remain competitive and deliver truly cutting-edge products to its global clientele. For instance, by Q4 2024, over 85% of new smartphone models are expected to feature dedicated AI processing units, a trend FIH Mobile must leverage.

Foldable and rollable displays are rapidly transitioning from niche curiosities to a substantial segment of the mobile device market. These innovative screen technologies allow for larger viewing areas while maintaining pocket-friendly portability, a key consumer demand. By mid-2025, it's projected that foldable smartphones will capture a notable percentage of the premium smartphone market, with shipments expected to surpass 30 million units globally, a significant jump from previous years.

The increasing durability and functionality of these flexible screens are opening up new avenues for user interaction and device design. This evolution necessitates that manufacturers like FIH Mobile invest in and adapt their production lines. The manufacturing of these advanced displays requires specialized equipment and expertise in handling delicate, multi-layered components, impacting production costs and lead times.

Breakthroughs in Battery Technology

Advancements in battery technology, such as the development of solid-state batteries, are poised to significantly enhance mobile device power cells, offering extended lifespan, faster charging, and improved safety. AI-driven battery management systems are also contributing to better performance and efficiency. For FIH Mobile, integrating these cutting-edge battery solutions is vital to satisfy consumer expectations for devices that are both long-lasting and dependable.

These innovations are particularly relevant as the global demand for smartphones continues to grow. For instance, by the end of 2024, smartphone shipments were projected to reach over 1.17 billion units, highlighting the critical need for reliable power sources.

- Solid-state batteries promise higher energy density and faster charging times compared to current lithium-ion technology.

- AI battery management optimizes power consumption, extending device usage between charges.

- FIH Mobile's adoption of these technologies can directly address consumer pain points related to battery life and charging convenience.

Emergence of Smart Manufacturing and Automation

The manufacturing sector is increasingly adopting smart technologies, with automation and digital twins becoming central. This shift is driven by the need for greater efficiency and precision, impacting companies like FIH Mobile.

FIH Mobile is actively expanding into automotive electronics and robotics, areas experiencing robust growth. This diversification leverages their core strengths in communication technology to tap into these expanding markets.

This strategic pivot is designed to lessen dependence on the fluctuating smartphone market. By embracing advanced manufacturing and new technological frontiers, FIH Mobile aims for more stable revenue streams and future growth opportunities.

- Smart Manufacturing Growth: The global smart manufacturing market was valued at approximately $279.4 billion in 2023 and is projected to reach $717.5 billion by 2030, growing at a CAGR of 14.3%.

- Robotics Adoption: Industrial robot installations saw a significant increase, with estimates suggesting over 500,000 industrial robots were deployed globally in 2023.

- Automotive Electronics Market: The automotive electronics market is expected to grow substantially, with projections indicating it could reach over $500 billion by 2028, driven by trends like electric vehicles and autonomous driving.

The continued evolution of mobile network technology, particularly the widespread adoption of 5G and the nascent development of 6G, presents significant opportunities for FIH Mobile. These advancements in speed and latency directly influence the design and performance requirements of the mobile devices FIH Mobile manufactures.

The integration of Artificial Intelligence (AI) into smartphones is becoming standard, with over 85% of new models expected to feature dedicated AI processing units by the end of 2024. This trend demands that FIH Mobile embed sophisticated AI capabilities into its product designs to enhance user experience and maintain competitiveness.

Emerging display technologies like foldable and rollable screens are gaining market traction, with projections indicating significant growth in this segment by mid-2025. FIH Mobile must adapt its manufacturing processes to accommodate the specialized requirements of these innovative, flexible display components.

Advancements in battery technology, such as solid-state batteries and AI-driven management systems, are critical for meeting consumer demand for longer-lasting and more efficient mobile devices. The global smartphone market itself continues to expand, with shipments projected to exceed 1.17 billion units by the end of 2024, underscoring the importance of reliable power solutions.

| Technology Trend | Impact on FIH Mobile | Key Data Point (2024/2025) |

|---|---|---|

| 5G/6G Rollout | Drives demand for advanced hardware and network compatibility. | Over 1 billion 5G connections expected by end of 2024. |

| AI Integration | Requires embedding AI processing units for smarter devices. | Over 85% of new smartphones to have dedicated AI units by Q4 2024. |

| Foldable/Rollable Displays | Necessitates specialized manufacturing for flexible screen technology. | Foldable smartphone shipments projected to surpass 30 million units by mid-2025. |

| Battery Technology | Enhances device longevity and charging convenience. | Global smartphone shipments projected over 1.17 billion units in 2024. |

Legal factors

Many nations are implementing more rigorous e-waste recycling regulations, placing a greater onus on manufacturers to manage their products throughout their entire lifecycle. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, which saw revisions in 2023, continues to push for higher collection and recycling rates, with targets often exceeding 65% of average weight collected per year. FIH Mobile, as a significant player in the mobile device industry, must navigate these increasingly stringent Extended Producer Responsibility (EPR) schemes, which frequently necessitate the establishment of robust take-back programs and enhanced recycling infrastructure to ensure compliance and responsible end-of-life management for its devices.

Governments globally are increasingly focused on the responsible disposal of lithium-ion batteries, driven by the widespread use of portable electronics. New regulations are emerging that mandate safe disposal methods and robust recycling initiatives to combat environmental pollution and fire hazards. For instance, the European Union’s Battery Regulation, fully applicable from February 2024, imposes strict requirements on battery collection, treatment, and recycling, with targets for recovered materials.

FIH Mobile must proactively incorporate these battery-specific environmental mandates into its product lifecycle management, from design and manufacturing to end-of-life handling. This includes ensuring compliance with collection rates and recycling efficiency standards, potentially impacting operational costs and supply chain partnerships. The company's commitment to sustainability will be tested by its ability to adapt its processes to meet these evolving legal frameworks.

Governments globally are increasingly mandating a circular economy for electronics, compelling manufacturers like FIH Mobile to prioritize product longevity and recyclability. New regulations, such as the EU's Ecodesign for Sustainable Products Regulation, are pushing for products that are easier to repair, reuse, and recycle. This includes requirements for extended availability of spare parts and repair manuals, with some regions aiming for a 10-year availability by 2028.

These legal shifts mean FIH Mobile must integrate eco-design principles deeply into its product development and manufacturing. Failure to comply could lead to significant penalties and market access restrictions, impacting its ability to operate in key markets. For instance, the European Commission's proposed "right to repair" initiatives aim to boost consumer repairability, directly influencing product design choices.

Tightening E-Waste Export Restrictions

International agreements, such as the Basel Convention, are increasingly restricting the global movement of electronic waste. These regulations mandate explicit consent from importing nations for the transfer of even non-hazardous e-waste, impacting cross-border logistics for companies like FIH Mobile. In 2024, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive continued to emphasize extended producer responsibility, pushing manufacturers to manage end-of-life products more rigorously.

Many countries are implementing stricter national policies to prevent the dumping of e-waste in developing nations, aiming to curb unsafe recycling practices. This trend is driven by growing awareness of the environmental and health hazards associated with improper disposal. For instance, by the end of 2025, several African nations are expected to strengthen their import bans on used electronics, which often contain significant amounts of e-waste.

- Basel Convention: Governs the transboundary movement of hazardous wastes and their disposal, with ongoing efforts to include e-waste more comprehensively.

- EU WEEE Directive: Places greater responsibility on producers for the collection and recycling of their products, with targets for collection rates increasing annually.

- Regional Bans: Numerous developing countries are tightening or enforcing bans on e-waste imports to protect their environments and populations.

FIH Mobile must therefore develop robust, compliant, and ethical strategies for managing its electronic waste streams worldwide. This includes ensuring all disposal and recycling activities adhere to the evolving international and regional legal frameworks, potentially increasing operational costs but also fostering a more sustainable business model.

Increased Trade Compliance and Export Controls

The global trade landscape is increasingly intricate, marked by evolving export controls and heightened due diligence requirements. Governments are leveraging advanced technologies to detect and deter sanctions evasion, impacting companies like FIH Mobile. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continues to update its Entity List, which can restrict exports of certain technologies to listed companies, a factor FIH Mobile must actively monitor.

FIH Mobile needs robust compliance frameworks to navigate these complexities. Failure to adhere to stricter measures against sanctions evasion can lead to significant penalties. In 2024, companies globally faced increased scrutiny, with regulatory bodies imposing fines for compliance breaches. For example, the US Department of Justice reported significant enforcement actions related to export control violations.

- Evolving Export Controls: Governments are implementing new restrictions on the transfer of sensitive technologies, requiring businesses to stay updated on regulatory changes.

- Enhanced Due Diligence: Increased scrutiny on supply chains and business partners necessitates more thorough vetting processes to ensure compliance with international regulations.

- Technology-Driven Enforcement: The use of AI and data analytics by governments to flag suspicious trade activities means companies must have transparent and compliant operations.

- Risk of Penalties: Non-compliance can result in substantial fines, reputational damage, and restrictions on international trade activities.

Governments are increasingly focusing on data privacy and cybersecurity, enacting stricter laws that impact how companies handle user information. For instance, the EU's General Data Protection Regulation (GDPR), which has seen ongoing enforcement and interpretation updates through 2024, imposes significant obligations on data processing and breach notification.

FIH Mobile must ensure its operations, from product design to customer service, comply with these data protection mandates. This involves implementing robust security measures and transparent data handling policies to avoid substantial fines and maintain customer trust. The company's adherence to these regulations is crucial for its global market access and reputation.

Intellectual property rights are also a key legal consideration, with governments strengthening protections for patents, trademarks, and copyrights. In 2024, many jurisdictions continued to enhance enforcement mechanisms against infringement, including digital IP theft. FIH Mobile must safeguard its own innovations and respect the IP of others to prevent legal disputes and maintain competitive advantage.

Environmental factors

The global e-waste problem is escalating, with projections indicating a surge to 74 million metric tons by 2030, a significant jump from the 53.6 million metric tons recorded in 2019. This exponential growth, driven by rapid innovation and shorter device lifespans, presents critical environmental hurdles, particularly the management of toxic substances like lead and mercury. FIH Mobile, as a major electronics manufacturer, must navigate these challenges by investing in robust recycling programs and designing products for longevity and easier disassembly.

The mobile sector is increasingly adopting circular economy principles, prioritizing device longevity via repair, refurbishment, and recycling. This shift aims to slash manufacturing's carbon footprint and conserve natural resources.

For instance, the European Union's Ecodesign for Sustainable Products Regulation, coming into full effect in 2025, mandates extended product lifespans and repairability for many electronics, including smartphones. This regulation is expected to drive a significant increase in demand for refurbished devices and repair services.

FIH Mobile's existing after-sales support network and its product development strategies can be leveraged to bolster these circular economy efforts. By integrating repairability into device design and expanding refurbishment programs, FIH Mobile can align with these evolving environmental mandates and capitalize on the growing market for sustainable mobile solutions.

Consumers and regulators are increasingly pushing manufacturers towards eco-friendly operations. This translates to a greater need for recycled materials in electronics and a shift towards renewable energy in production. For instance, in 2024, the global consumer electronics market saw a notable rise in demand for products with a lower carbon footprint, with over 60% of consumers surveyed indicating a preference for brands demonstrating strong environmental commitments.

FIH Mobile's proactive approach to sustainable sourcing and manufacturing is crucial for its continued success. By embracing greener production methods and utilizing recycled components, the company can not only bolster its brand image but also align with stricter environmental regulations expected to be implemented globally by 2025.

Reducing Carbon Emissions and Climate Impact

Manufacturing new smartphones generates significant carbon emissions, a major contributor to a device's total lifecycle carbon footprint. The electronics industry is increasingly focused on ambitious goals to reduce these emissions and reach net-zero targets. For instance, many leading tech companies have pledged to achieve carbon neutrality by 2030 or 2040, impacting their supply chains.

FIH Mobile, as a key player within the Foxconn group, is under pressure to adopt robust decarbonization strategies and enhance energy efficiency across its manufacturing operations. This commitment is crucial for mitigating its environmental impact and aligning with global sustainability trends. Foxconn itself has committed to sourcing 100% renewable electricity for its global operations by 2028.

- Manufacturing Footprint: Smartphone production accounts for a substantial portion of a device's carbon emissions, primarily from energy-intensive processes and material sourcing.

- Industry Targets: The broader electronics sector is setting aggressive goals, with many aiming for net-zero emissions within the next decade, driving innovation in sustainable manufacturing.

- FIH Mobile's Role: As part of Foxconn, FIH Mobile must integrate energy efficiency measures and explore renewable energy sources to meet its environmental obligations and reduce its carbon output.

Water and Waste Management in Production

FIH Mobile, like many in the electronics sector, faces significant environmental scrutiny regarding its water and waste management. Effective handling of these resources is paramount for sustainable production, especially in large-scale manufacturing. The company must prioritize robust waste reduction strategies and comprehensive recycling initiatives to align with growing global environmental standards.

Responsible water usage is another key environmental factor. In 2023, the electronics manufacturing industry, as a whole, consumed billions of liters of water, highlighting the need for efficient water management systems. FIH Mobile's commitment to investing in advanced water treatment and recycling technologies is crucial for minimizing its operational impact and ensuring compliance with increasingly stringent environmental regulations. This focus on sustainability is not just about compliance but also about long-term operational resilience and corporate responsibility.

- Water Consumption: The electronics industry globally uses vast amounts of water, with some estimates placing it in the tens of billions of liters annually for manufacturing processes.

- Waste Generation: E-waste is a growing concern, and responsible management of manufacturing waste, including hazardous materials, is critical.

- Recycling Rates: Efforts to increase recycling rates for electronic components and manufacturing byproducts are ongoing, with targets often set by regulatory bodies and industry associations.

- Investment in Technology: Companies like FIH Mobile are investing in advanced wastewater treatment and waste-to-energy technologies to reduce their environmental footprint.

The escalating global e-waste crisis, projected to reach 74 million metric tons by 2030, demands proactive environmental strategies from manufacturers like FIH Mobile. The industry's increasing adoption of circular economy principles, emphasizing device longevity and repairability, is driven by regulations such as the EU's Ecodesign for Sustainable Products Regulation, fully effective in 2025. Furthermore, the significant carbon footprint of smartphone production, coupled with industry-wide net-zero commitments by 2030-2040, pressures FIH Mobile to enhance energy efficiency and explore renewable energy sources, aligning with Foxconn's goal of 100% renewable electricity by 2028.

FIH Mobile must also address substantial water consumption and waste generation in its manufacturing processes. With the electronics industry consuming billions of liters of water annually, investment in advanced water treatment and recycling technologies is crucial for compliance and operational resilience. The company's commitment to sustainable sourcing and utilizing recycled components is vital, especially as consumer demand for eco-friendly products grew significantly in 2024, with over 60% of consumers favoring brands with strong environmental commitments.

| Environmental Factor | Key Data/Trend (2024-2025) | Implication for FIH Mobile |

| E-Waste Volume | Projected 74 million metric tons by 2030 (up from 53.6 million in 2019) | Need for enhanced recycling programs and product design for longevity. |

| Circular Economy Adoption | EU's Ecodesign Regulation (full effect 2025) mandates extended lifespans and repairability. | Opportunity to leverage after-sales support and expand refurbishment services. |

| Carbon Emissions | Industry net-zero targets by 2030-2040; Foxconn's 100% renewable electricity by 2028. | Pressure to adopt decarbonization strategies and improve energy efficiency. |

| Water Consumption | Billions of liters annually in electronics manufacturing. | Investment in advanced water treatment and recycling technologies is essential. |

| Consumer Preference | Over 60% of consumers in 2024 preferred brands with strong environmental commitments. | Boosts brand image and market competitiveness through sustainable practices. |

PESTLE Analysis Data Sources

Our FIH Mobile PESTLE Analysis draws data from official government publications, reputable market research firms, and international economic bodies. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the mobile industry.