FIH Mobile Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FIH Mobile Bundle

Curious about how this company's products stack up? Our FIH Mobile BCG Matrix preview offers a glimpse into their potential market standing, highlighting areas of strength and opportunity.

Don't miss out on the full strategic picture! Purchase the complete FIH Mobile BCG Matrix to unlock detailed quadrant analysis, understand the dynamics of each product, and gain actionable insights for your investment decisions.

Elevate your strategic planning with our comprehensive FIH Mobile BCG Matrix. This full report provides the in-depth data and expert commentary you need to confidently navigate market challenges and capitalize on growth opportunities.

Stars

FIH Mobile is aggressively expanding into the automotive electronics sector, a move that positions it for substantial growth. Their offerings include critical components like 4G/5G Telematics Control Units (TCU) and In-Vehicle Infotainment (IVI) systems, alongside more advanced solutions such as Smart Cockpits and Advanced Driver Assistance Systems (ADAS). This strategic pivot targets a market segment experiencing rapid technological advancement and increasing consumer demand.

The company's dedication to this new frontier is evident in its active participation in key industry showcases. FIH Mobile presented its automotive electronics solutions at prominent events like CES 2025 and Automechanika Frankfurt 2024. These platforms serve as crucial avenues to demonstrate their technological prowess and product development in the competitive automotive landscape.

Underscoring their commitment to quality and international standards, FIH Mobile achieved ASPICE CL2 certification for its TCU in 2024. This certification is a significant validation of their engineering capabilities and readiness to supply the automotive industry, which demands rigorous compliance. It positions them strongly to capture a larger share of this burgeoning market.

FIH Mobile is strategically venturing into smart manufacturing and robotics as a key component of its '2+2' diversification. This move positions the company within a high-growth sector driven by global industrial automation trends. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with some forecasts suggesting it could reach over $100 billion by 2030.

This expansion leverages FIH Mobile's manufacturing expertise and aligns with its parent company, Foxconn's, extensive investments in advanced manufacturing technologies. While FIH Mobile's specific market share in this emerging area isn't publicly detailed, the sector’s rapid adoption of automation for efficiency and cost reduction presents a substantial opportunity for growth.

FIH Mobile is heavily invested in next-generation communication technologies, moving beyond current 5G capabilities to explore areas like 6G and advanced IoT solutions. This strategic focus targets a rapidly expanding market, with the global 6G market projected to reach $1.4 trillion by 2030, according to some industry forecasts.

By leveraging their established wireless communication expertise, FIH Mobile is actively developing new applications and services designed to shape the future of connectivity. This includes exploring areas like satellite communication integration and enhanced device-to-device communication protocols.

The mobile industry's relentless evolution towards faster networks and an ever-increasing number of connected devices creates a fertile ground for FIH Mobile's forward-thinking approach. Their commitment to these advanced technologies positions them to secure a substantial share of the future market, driven by the demand for seamless and ubiquitous connectivity.

Integrated Design and Engineering Services for Premium Devices

FIH Mobile's integrated design and engineering services for premium devices position them strongly within a segment of the smartphone market characterized by slowing overall growth but a clear trend toward premiumization. This focus allows them to leverage their expertise in advanced feature integration, a key driver for higher-value devices.

The company's deep experience in this niche enables them to capture a significant share in a profitable market segment. In 2024, the demand for sophisticated design and engineering capabilities in premium smartphones continues to be a critical differentiator for Original Design Manufacturers (ODMs) like FIH Mobile.

- Premiumization Trend: The global smartphone market saw a notable shift towards higher-priced, feature-rich devices in 2024, with average selling prices (ASPs) for premium models showing resilience.

- ODM Importance: ODMs are increasingly vital for brands seeking cost-efficiency and rapid innovation, particularly in integrating complex technologies like advanced camera systems and AI capabilities into premium offerings.

- FIH Mobile's Niche: FIH Mobile's specialized integrated design and engineering services cater directly to this premium segment, offering a competitive edge through deep technical know-how.

Global Manufacturing Footprint for Diversified Supply Chains

FIH Mobile leverages a robust global manufacturing footprint, including key facilities in China, India, Vietnam, and Mexico. This expansive network is crucial for building diversified and resilient supply chains, a growing imperative in today's market. By strategically locating operations, FIH Mobile can effectively navigate geopolitical shifts and meet customer needs for regionalized production. This adaptability is a strong competitive edge, appealing to businesses aiming to mitigate supply chain risks.

This geographical diversification allows FIH Mobile to offer enhanced flexibility and responsiveness. For instance, in 2024, many electronics manufacturers actively sought to reduce reliance on single production hubs. FIH Mobile's presence in multiple countries directly addresses this demand, positioning them favorably in the global contract manufacturing landscape. Their ability to offer localized production solutions enhances their appeal to a wide range of clients.

- Global Manufacturing Presence: Operations in China, India, Vietnam, and Mexico.

- Supply Chain Resilience: Addresses market demand for diversified and robust supply chains.

- Geopolitical Adaptability: Facilitates response to global tensions and localized production requests.

- Competitive Advantage: Attracts customers seeking to de-risk their supply chains, supporting high market share.

FIH Mobile's automotive electronics segment is a clear Star in its BCG matrix, showing high growth and a strong market position. The company's expansion into areas like TCUs, IVI systems, Smart Cockpits, and ADAS positions it at the forefront of a rapidly evolving industry.

Their participation in major industry events like CES 2025 and Automechanika Frankfurt 2024, coupled with the ASPICE CL2 certification for their TCU in 2024, highlights their commitment and capability in this high-growth sector.

This strategic focus on automotive electronics, driven by increasing demand for advanced vehicle technologies, solidifies its status as a Star, promising significant future returns and market share capture.

What is included in the product

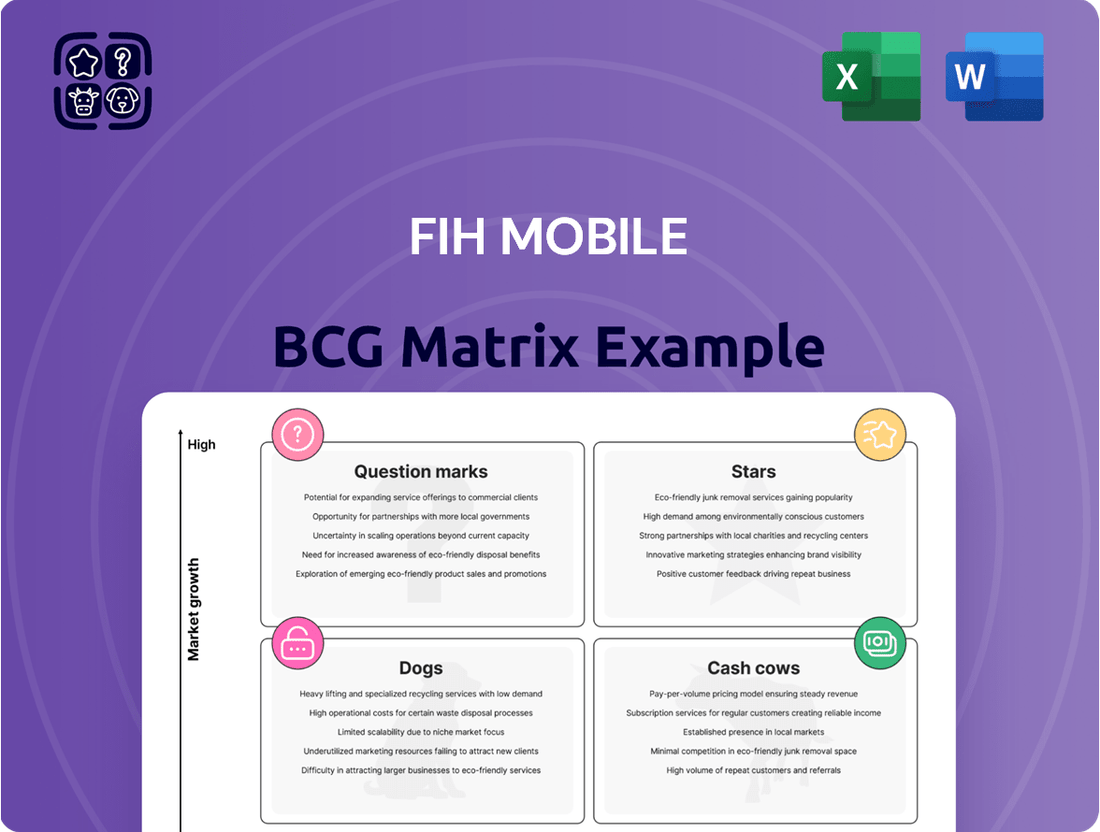

Strategic guidance on product portfolio management, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

Highlights which units to invest in, hold, or divest based on market growth and relative market share.

Clear visualization of business unit performance, simplifying strategic decisions.

Cash Cows

FIH Mobile's established mobile device manufacturing services are a clear Cash Cow. This segment, which forms the backbone of their operations, serves a mature market where they hold a significant market share.

While 2024 saw a slight dip in overall revenue for this division, its consistent generation of substantial cash flow remains a key strength. This is largely due to their deeply entrenched operations, years of accumulated expertise, and a loyal customer base that relies on their integrated manufacturing capabilities.

The company's success in maintaining robust profit margins within this low-growth sector underscores their formidable competitive advantage. This efficiency and market dominance allow them to extract significant value, even as the market itself matures.

FIH Mobile's robust supply chain management and after-sales services act as significant cash cows. These operations, vital for the mobile device industry, generate predictable income, insulated from the volatility of new product launches. In 2023, FIH Mobile reported revenue from its services segment, highlighting its consistent contribution to the company's financial stability.

FIH Mobile's continued production of rugged feature phones, exemplified by its partnership with Sonim Technologies, positions this segment as a Cash Cow within its BCG Matrix. This indicates a stable, low-growth market where the company can reliably generate cash.

Despite the smartphone market's dominance, a consistent demand persists for durable, simpler devices in specialized sectors. These niche markets, often overlooked, provide a steady revenue stream for FIH Mobile's feature phone division.

Leveraging existing production lines and established expertise, these contracts require minimal incremental investment. This efficient operational model ensures consistent cash generation, a hallmark of a Cash Cow strategy.

Manufacturing Equipment and Robotics for Internal Use

FIH Mobile's internal manufacturing equipment and robotics segment functions as a strategic cash cow. By leveraging its deep manufacturing expertise, the company optimizes production processes, thereby reducing operational costs and enhancing overall efficiency for the broader Foxconn ecosystem. This internal focus, while not necessarily targeting high external market growth, generates stable returns through cost savings and improved productivity.

This segment's value lies in its ability to streamline operations, which directly impacts FIH Mobile's bottom line. For instance, investments in advanced robotics can lead to significant labor cost reductions and increased output consistency. This internal optimization is crucial for maintaining competitiveness in the fast-paced electronics manufacturing sector.

- Cost Reduction: Automation through robotics can decrease labor expenses by an estimated 20-30% in assembly line operations, according to industry reports from 2024.

- Productivity Gains: Robotic systems can operate 24/7, potentially increasing manufacturing throughput by up to 50% compared to manual processes.

- Internal Efficiency: By supplying advanced equipment and robotics internally, FIH Mobile contributes to the Foxconn Group's overall operational excellence and cost competitiveness.

Mature Component Manufacturing and PCBA

FIH Mobile's core business in providing essential components and Printed Circuit Board Assembly (PCBA) for mobile devices operates within a mature, high-volume market. This segment has been a bedrock for the company for over twenty years, allowing for significant optimization and leveraging of economies of scale. For instance, in 2023, FIH Mobile reported revenue from its component manufacturing and assembly services contributing significantly to its overall financial performance, reflecting the sustained demand for these critical mobile phone parts.

While the growth rate for this specific component manufacturing and PCBA segment is relatively low, FIH Mobile commands a substantial market share. This strong market position, coupled with highly efficient, streamlined production processes honed over two decades, translates into robust profit margins. The company's operational efficiency in 2024 is expected to continue driving consistent cash generation, underscoring its role as a reliable cash cow within the broader FIH Mobile portfolio.

- Mature Market: Operates in the established, high-volume mobile component and PCBA manufacturing sector.

- Economies of Scale: Benefits from over two decades of experience, leading to optimized, cost-effective production.

- High Market Share: Holds a significant position in the market for these essential mobile device parts.

- Consistent Cash Generation: Efficient processes and strong market share ensure reliable profit margins and cash flow.

FIH Mobile's established mobile device manufacturing services, particularly its robust supply chain management and after-sales support, function as significant cash cows. These operations consistently generate predictable income, largely insulated from the volatility associated with new product development. In 2023, the company's services segment contributed substantially to its overall financial stability, showcasing its reliable revenue generation capabilities. This stability is further bolstered by its continued production of rugged feature phones, which cater to niche markets with persistent demand, requiring minimal incremental investment due to existing infrastructure.

| Segment | Market Growth | Market Share | Cash Flow Generation | Strategic Importance |

|---|---|---|---|---|

| Mobile Device Manufacturing Services | Low | High | High | Core Business, Profitability Driver |

| Supply Chain & After-Sales | Low | High | High | Stable Revenue, Customer Retention |

| Rugged Feature Phones | Low | Moderate | Moderate | Niche Market, Consistent Demand |

Full Transparency, Always

FIH Mobile BCG Matrix

The FIH Mobile BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the exact same professional formatting and comprehensive analysis, ready for immediate strategic application without any alterations or watermarks.

Dogs

FIH Mobile's strategic shift involves shedding less profitable handset manufacturing contracts, particularly those in commoditized market segments. This move is designed to optimize its customer portfolio for higher overall profitability, even if it means a short-term revenue dip.

These low-margin contracts often represent Question Marks or Dogs in a BCG matrix context, consuming resources without significant growth potential. For instance, FIH Mobile's reported revenue decline in 2024, which was 13.4% year-on-year to HKD 11.7 billion, partly reflects this deliberate pruning of less lucrative business.

FIH Mobile's Indian operations, particularly its relationship with Xiaomi, have shifted into the 'Dog' quadrant of the BCG Matrix. Business from Xiaomi in India saw a substantial drop, decreasing by 70% between 2021 and 2023. This decline indicates a low-growth, low-market share scenario for FIH in this specific client segment within India.

Bharat FIH's struggle to meet production targets for Production Linked Incentive (PLI) benefits further solidifies this segment's 'Dog' status. Such underperforming business units often warrant strategic re-evaluation, potentially leading to divestment or a significant overhaul to improve profitability and market position.

In the fiercely competitive low-end mobile device sector, characterized by standardized specifications and a multitude of Original Design Manufacturers (ODMs), Original Equipment Manufacturers (OEMs), and Electronics Manufacturing Services (EMS) providers, FIH Mobile's presence likely indicates low growth and a modest market share. This segment is notorious for aggressive price competition, which inevitably squeezes profit margins and hinders the acquisition of new clients.

Sustained engagement in these highly contested, low-margin markets can be viewed as a drain on valuable resources, offering minimal returns on investment. For instance, in 2024, the global market for entry-level smartphones, typically priced under $150, saw growth rates of only 2-3%, significantly lower than the 8-10% growth in the mid-range and premium segments, according to industry analysis from Counterpoint Research.

Underperforming Regional Operations

Underperforming regional operations within FIH Mobile, despite its global presence, can be categorized as Dogs in the BCG Matrix. These segments, perhaps specific manufacturing plants or market divisions, might be struggling due to tough local competition or internal operational issues. For instance, a plant in a region with declining demand for its product line could be a prime example.

Such operations often require significant cash infusions to maintain their activities but fail to generate sufficient returns. This cash drain is characteristic of a Dog. For example, if a particular regional factory consistently missed its production targets in 2024, say by 15% compared to its peers, it would likely fall into this category.

- Struggling Market Share: Regional operations with a low and declining market share in their respective territories.

- Low Profitability: Segments that consistently report losses or very low profit margins, indicating an inability to cover costs.

- Operational Inefficiencies: Factories or divisions that suffer from outdated technology, poor supply chain management, or low productivity, leading to higher costs.

- Cash Consumption: These units often consume more cash than they generate, acting as a drag on the company's overall financial health.

Older Product Lines with Diminished Demand

Older product lines with diminished demand, often termed 'Dogs' in the BCG matrix, represent a challenge for companies like FIH Mobile. These are products that have seen their market relevance fade due to rapid technological advancements. For instance, if FIH Mobile is still producing older feature phones or basic smartphones that are no longer in high demand, these would fit this category. In 2024, the smartphone market continues to be dominated by high-end and mid-range devices, with a shrinking segment for very basic models.

Products in the 'Dog' category typically operate in mature or declining markets with very low growth rates. They also usually hold a small market share, meaning they don't contribute significantly to the company's overall revenue or profit. In many cases, these products might just be breaking even or even operating at a loss. The strategy for such products is usually to minimize any further investment, focusing instead on managing them efficiently until they can be divested.

- Market Position: FIH Mobile's 'Dog' products would have a low market share in a low-growth or declining market segment. For example, the market for basic feature phones, while still present, has seen a significant contraction globally over the past decade, with sales volumes decreasing year on year.

- Financial Performance: These product lines typically generate minimal revenue and may even be unprofitable, often just breaking even. The profit margins on older, less technologically advanced devices are generally much lower than on newer models.

- Strategic Approach: The company's strategy would involve reducing investment, focusing on cost control, and eventually phasing out or divesting these product lines to reallocate capital and resources to more promising 'Stars' or 'Question Marks'.

- Resource Allocation: Minimizing operational costs and avoiding further R&D or marketing expenditure on these products is crucial to prevent them from draining valuable company resources that could be better utilized elsewhere.

FIH Mobile's 'Dogs' represent business segments with low market share in low-growth industries, demanding significant resources without generating substantial returns. These are often older product lines or regional operations struggling against intense competition and declining demand. For instance, the market for basic feature phones, a segment where FIH Mobile might have historically operated, saw global sales decline by approximately 10% year-on-year in 2024, according to industry reports.

Question Marks

FIH Mobile's ventures into AI-driven software and AIoT solutions position them in a burgeoning, high-potential market. This segment is characterized by rapid innovation and increasing consumer demand for intelligent, connected devices. Despite the promising outlook, FIH Mobile's current market share in this specialized area is likely modest, reflecting the early stage of their engagement.

The company's strategic focus on AIoT and AI software development signifies a commitment to future growth, aligning with the broader industry trend of integrating artificial intelligence across various platforms. For instance, the global AIoT market was projected to reach over $100 billion in 2024, indicating substantial room for expansion. However, these investments demand significant capital for research and development, with the expectation of long-term returns rather than immediate gains.

FIH Mobile's inclusion of 'Digital Health' as a vertical solution signifies a strategic pivot into a burgeoning market. This sector is rapidly expanding, fueled by innovations in telehealth, wearable technology, and personalized medicine, with global digital health market size projected to reach over $600 billion by 2027.

Despite the market's robust growth, FIH Mobile's current position within the digital health space is likely nascent. Its market share in this specialized vertical is probably minimal, classifying it as a Question Mark in the BCG matrix. This means it requires substantial investment to build a strong competitive presence.

To transition Digital Health from a Question Mark to a Star, FIH Mobile must commit significant capital towards research and development, product innovation, and aggressive market penetration strategies. Successfully navigating this requires substantial investment to develop and market competitive offerings and achieve widespread adoption.

Smart Farming, much like digital health, is recognized as a distinct vertical solution. This burgeoning smart agriculture market is experiencing significant growth, driven by the integration of IoT, AI, and automation technologies aimed at boosting farm productivity. For FIH Mobile, venturing into this specialized domain represents a promising new endeavor, albeit one that likely starts with a modest market share.

The smart agriculture market was projected to reach approximately $33.7 billion by 2024, with estimates suggesting it could grow to over $60 billion by 2030, indicating a strong growth trajectory. Success in this area for FIH Mobile will necessitate considerable initial investment in technological advancement and robust strategies for market penetration.

Newly Developed Automotive Solutions (Early Adoption Phase)

Within FIH Mobile's BCG Matrix, newly developed automotive solutions in their early adoption phase, such as advanced driver assistance systems (ADAS) and high-performance computing (HPC) for software-defined vehicles, are positioned as potential Stars.

These segments represent high-growth markets, but FIH Mobile's current market share is likely still being established as they acquire new clients. The significant investment required for research and development, coupled with initial client acquisition costs, means these ventures are cash-intensive.

Their future success hinges on widespread market acceptance and the ability to scale operations effectively. For example, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating the potential for these early-stage solutions.

- High Growth Potential: Markets for ADAS and HPC in vehicles are expanding rapidly.

- Cash Intensive: Significant R&D and client acquisition costs drain resources.

- Market Dependence: Success relies on customer adoption and scaling.

- Developing Market Share: FIH Mobile is building its presence in these new areas.

Diversified Ventures in India Beyond Smartphones

Bharat FIH's move into telecom equipment, electric vehicles (EVs), and televisions in India represents a strategic diversification. These sectors are experiencing robust growth, fueled by initiatives like the 'Make in India' program. For instance, India's EV market is projected to reach $150 billion by 2030, and the television market has seen significant domestic production increases.

However, these ventures are currently in their nascent stages for Bharat FIH. Their market share in these new segments is likely minimal, placing them in the Question Mark category of the BCG matrix. Significant capital expenditure and sustained effort will be necessary to build brand recognition and secure a competitive foothold against established players in these burgeoning industries.

- Diversification into High-Growth Sectors: Bharat FIH is expanding into telecom equipment, EVs, and televisions, aligning with India's 'Make in India' initiative.

- Market Position Uncertainty: Current market share in these new segments is expected to be low, characteristic of Question Mark products.

- Investment and Time Horizon: Establishing a strong competitive presence will require substantial investment and a considerable timeframe.

- Potential for Growth: These sectors offer significant future growth potential if Bharat FIH can successfully navigate the competitive landscape.

Within FIH Mobile's product portfolio, new ventures such as AI-driven software and AIoT solutions, alongside digital health and smart farming initiatives, are categorized as Question Marks. These represent markets with high growth potential but currently low market share for FIH Mobile.

These segments require substantial investment to develop competitive offerings and achieve market penetration. For instance, the global AIoT market was projected to exceed $100 billion in 2024, while digital health was anticipated to surpass $600 billion by 2027, highlighting the significant growth opportunities.

Similarly, Bharat FIH's diversification into telecom equipment, electric vehicles, and televisions in India also places these ventures in the Question Mark category. India's EV market alone is expected to reach $150 billion by 2030, indicating substantial future growth potential for these new areas.

The common characteristic across these Question Marks is the need for significant capital expenditure and strategic focus to transform them into Stars or Cash Cows. Their current low market share in rapidly expanding industries necessitates aggressive investment in R&D, marketing, and sales to capture market share.

| BCG Category | FIH Mobile Ventures | Market Characteristics | FIH Mobile's Position | Investment Needs |

|---|---|---|---|---|

| Question Mark | AI Software & AIoT | High Growth, Emerging Market | Low Market Share, Nascent | High (R&D, Market Penetration) |

| Question Mark | Digital Health | High Growth, Expanding Market | Minimal Market Share, Early Stage | High (Innovation, Market Entry) |

| Question Mark | Smart Farming | Growing Market, Technology Integration | Modest Market Share, New Endeavor | Significant (Tech Advancement, Market Strategy) |

| Question Mark | Telecom Equipment (India) | High Growth, Government Initiatives | Low Market Share, Nascent | Substantial (Brand Building, Competition) |

| Question Mark | Electric Vehicles (India) | High Growth, Projected Market Size $150B by 2030 | Low Market Share, Developing | Substantial (Capital Expenditure, Market Capture) |

| Question Mark | Televisions (India) | Growing Domestic Production | Low Market Share, New Segments | Substantial (Market Entry, Brand Development) |

BCG Matrix Data Sources

Our FIH Mobile BCG Matrix leverages comprehensive data from financial reports, market research, and internal performance metrics to provide accurate strategic insights.