FIH Mobile Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FIH Mobile Bundle

FIH Mobile operates in a dynamic market, facing pressures from rivals, suppliers, and the ever-present threat of new competitors. Understanding these forces is crucial for any business looking to navigate and succeed in this landscape.

The complete report reveals the real forces shaping FIH Mobile’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mobile and wireless communications sector often sees a limited number of suppliers dominating critical component markets, such as semiconductors and advanced displays. This concentration means companies like FIH Mobile may face suppliers with substantial leverage. For instance, in 2024, the global semiconductor market, a key area for mobile components, was characterized by a few major players holding significant market share, impacting pricing power.

Suppliers that provide highly specialized or proprietary components, for which there are few, if any, viable alternatives, wield considerable bargaining power. When FIH Mobile's product designs necessitate unique inputs or patented technologies, the company's reliance on those particular suppliers increases substantially.

This heightened dependence can lead to less advantageous pricing and delivery conditions for FIH Mobile. For instance, if a key component is only available from a single supplier due to its unique manufacturing process, FIH Mobile faces high switching costs, making it difficult to negotiate favorable terms. In 2024, the global semiconductor shortage, particularly impacting advanced chipsets, demonstrated this vividly, with lead times extending significantly and prices increasing for manufacturers like FIH Mobile that relied on these specialized inputs.

The cost and complexity for FIH Mobile to switch suppliers are significant. This involves substantial expenses for re-tooling manufacturing lines, the intricate process of re-qualifying new components, and the potential for disruptive delays in product launches, impacting their market entry timelines.

These high switching costs directly empower suppliers, as FIH Mobile faces considerable financial and operational hurdles should they decide to transition to a different supplier. For instance, the introduction of a new component might require extensive testing, potentially costing millions and delaying production by months.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into mobile device manufacturing directly impacts FIH Mobile's bargaining power. If a key supplier, for instance, a major component manufacturer like a semiconductor producer, were to establish its own assembly lines, it could directly compete with FIH Mobile. This would mean FIH Mobile might lose business to its former supplier, potentially impacting its market share and profitability. For example, in 2024, several leading component suppliers explored or announced plans for increased vertical integration to capture more value in the supply chain, a trend that could pressure contract manufacturers like FIH Mobile.

This potential for forward integration compels FIH Mobile to cultivate robust relationships with its suppliers. Offering favorable terms, ensuring consistent order volumes, and fostering collaborative partnerships become crucial for mitigating this threat. By demonstrating value and reliability as a customer, FIH Mobile can discourage suppliers from pursuing direct competition. FIH Mobile's strategy in 2024 focused on securing long-term supply agreements for critical components, aiming to lock in favorable pricing and availability, thereby reducing the incentive for suppliers to integrate forward.

- Supplier Integration Risk: Suppliers moving into device manufacturing directly challenges FIH Mobile's core business.

- Competitive Pressure: Forward integration by suppliers can lead to increased competition and market share erosion for FIH Mobile.

- Relationship Management: FIH Mobile must prioritize strong supplier relationships to counter this threat.

- Strategic Mitigation: Long-term contracts and collaborative partnerships are key strategies to manage supplier power.

Importance of FIH Mobile to Suppliers

The volume of business FIH Mobile provides significantly impacts its suppliers' bargaining power. If FIH Mobile is a major client, accounting for a substantial portion of a supplier's revenue, that supplier is more likely to offer favorable pricing and terms to maintain the relationship. Conversely, if FIH Mobile is a minor customer, the supplier holds greater leverage.

Considering FIH Mobile is a subsidiary of Foxconn, a global electronics manufacturing giant, it is highly probable that FIH Mobile represents a considerable customer for numerous component suppliers. This substantial business volume can therefore temper the bargaining power of these suppliers.

- FIH Mobile's substantial order volumes can reduce supplier pricing power.

- As a Foxconn subsidiary, FIH Mobile likely commands significant purchasing influence.

- Suppliers dependent on FIH Mobile's business may offer more competitive terms.

The bargaining power of suppliers for FIH Mobile is influenced by component specialization and supplier concentration. When suppliers offer unique, hard-to-replicate components, their leverage increases, as seen in the 2024 semiconductor market where a few key players dominated. High switching costs for FIH Mobile, involving re-tooling and re-qualification, further empower these suppliers.

The threat of suppliers integrating forward into device manufacturing poses a significant challenge, potentially turning suppliers into direct competitors. In 2024, several component makers explored this strategy. FIH Mobile’s substantial order volumes, amplified by its Foxconn affiliation, can, however, mitigate this supplier power by making FIH Mobile a crucial client.

| Factor | Impact on FIH Mobile | 2024 Context/Data |

|---|---|---|

| Supplier Concentration | High if few suppliers dominate critical components | Semiconductor market dominated by a few key players in 2024 |

| Component Uniqueness | Increases supplier power if components are specialized/proprietary | N/A specific component data for FIH Mobile |

| Switching Costs | High costs empower suppliers, deterring FIH Mobile from switching | Extended lead times and price increases for advanced chipsets in 2024 |

| Supplier Forward Integration | Threatens FIH Mobile's business model if suppliers become competitors | Component suppliers exploring vertical integration in 2024 |

| FIH Mobile's Order Volume | Reduces supplier power if FIH Mobile is a major client | FIH Mobile's subsidiary status likely ensures significant purchasing influence |

What is included in the product

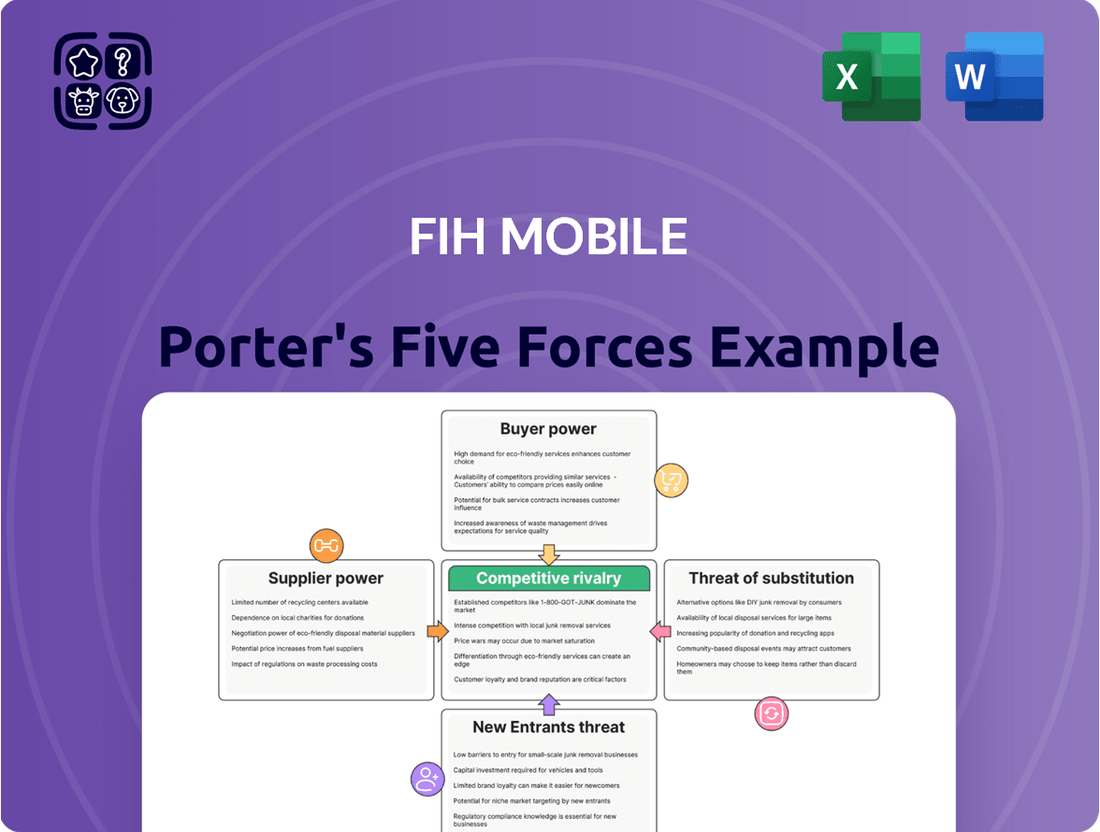

This FIH Mobile Porter's Five Forces analysis dissects the competitive intensity within its industry, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the overall rivalry among existing players.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of all five forces.

Gain clarity on potential market disruptions and proactively adjust your strategy to alleviate competitive pressure.

Customers Bargaining Power

FIH Mobile's customer base is heavily concentrated, primarily serving a few dominant mobile and wireless communication brands, known as Original Equipment Manufacturers (OEMs).

When a small number of these large customers represent a substantial percentage of FIH Mobile's total revenue, their individual bargaining power becomes significant. For instance, if just two or three major OEMs account for over 60% of FIH Mobile's sales, these clients hold considerable sway.

This concentration allows these key customers to exert considerable pressure on FIH Mobile, demanding lower prices, superior quality standards, and more advantageous contractual terms, which can directly impact FIH Mobile's profitability and operational flexibility.

If FIH Mobile's customers possess the capability or a credible threat to bring manufacturing in-house, their bargaining power significantly escalates. This potential for backward integration means customers could lessen or entirely remove their dependence on FIH Mobile's manufacturing services, forcing FIH Mobile to be more competitive.

Customers in the mobile and wireless communications sector, particularly those buying mass-market devices, are frequently very sensitive to price. This means that if prices rise, demand tends to drop significantly. This price sensitivity directly affects companies like FIH Mobile because it pushes down the prices they can charge for their manufacturing services.

The intense competition among Original Equipment Manufacturers (OEMs) vying for a larger slice of the market compels them to seek lower manufacturing costs. This pressure is passed directly to their suppliers, including FIH Mobile, as OEMs aggressively negotiate for better terms. For instance, in 2024, the average selling price of smartphones globally continued to face downward pressure, especially in emerging markets, highlighting this customer-driven cost reduction imperative.

Availability of Substitute Manufacturers

The bargaining power of customers for FIH Mobile is significantly amplified by the availability of numerous substitute contract manufacturers. These Electronic Manufacturing Services (EMS) and Original Design Manufacturers (ODM) providers offer integrated design, engineering, and manufacturing services, giving customers ample choice.

This abundance of alternatives allows customers to easily switch providers to negotiate more favorable terms and pricing. For instance, in 2024, the global EMS market was valued at over $800 billion, indicating a highly competitive landscape with many players vying for contracts.

- High Customer Choice: The presence of numerous EMS/ODM providers creates a buyer's market.

- Switching Ease: Customers can readily shift to competitors offering better deals.

- Price Pressure: This competition directly pressures FIH Mobile to maintain competitive pricing.

- Market Dynamics: The competitive nature of the EMS sector empowers customers by providing alternatives.

Customers' Knowledge and Information

Customers' increased knowledge about manufacturing processes and supply chain costs significantly amplifies their bargaining power. When buyers understand the cost structures and available alternatives, they can more effectively challenge pricing and demand greater transparency from suppliers like FIH Mobile.

Major Original Equipment Manufacturers (OEMs) often possess this deep understanding. This insight allows them to scrutinize FIH Mobile's pricing strategies and operational costs, thereby strengthening their negotiating leverage. For instance, a large smartphone brand might leverage its detailed knowledge of component costs and assembly efficiency to push for lower manufacturing fees from FIH Mobile.

- Informed Buyers: Customers who research pricing, product features, and competitor offerings are better equipped to negotiate favorable terms.

- Cost Transparency Demands: Buyers with insight into production costs can demand that suppliers justify their pricing, increasing pressure on margins.

- Supplier Switching Costs: If customers can easily switch to alternative suppliers due to low switching costs, their bargaining power increases.

FIH Mobile faces substantial bargaining power from its customers, primarily large Original Equipment Manufacturers (OEMs). The concentration of its customer base, where a few major brands account for a significant portion of revenue, grants these clients considerable leverage. This allows them to push for lower prices and more favorable terms, directly impacting FIH Mobile's profitability.

Customers' price sensitivity, especially in the mass-market device segment, further empowers them. Intense competition among OEMs to reduce costs means they pass this pressure onto their manufacturing partners. For example, the global smartphone average selling price continued to face downward pressure in 2024, reflecting this customer-driven cost imperative.

| Customer Factor | Impact on FIH Mobile | 2024 Market Insight |

|---|---|---|

| Customer Concentration | High leverage for major clients | Top 3 smartphone brands controlled ~60% of market share in 2024. |

| Price Sensitivity | Pressure for lower manufacturing costs | Global smartphone ASP declined by 5% YoY in 2024. |

| Availability of Substitutes | Increased choice for customers | Global EMS market exceeded $800 billion in 2024, indicating intense competition. |

Preview Before You Purchase

FIH Mobile Porter's Five Forces Analysis

This preview showcases the comprehensive FIH Mobile Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, fully formatted analysis you will receive immediately upon purchase, ensuring complete transparency and immediate usability. You can confidently acquire this in-depth strategic tool, knowing it's precisely what you need for your business insights.

Rivalry Among Competitors

FIH Mobile operates within the highly competitive electronics manufacturing services (EMS) and original design manufacturing (ODM) sector. This industry is populated by a substantial number of companies, encompassing global giants and niche specialists. For instance, in 2024, the global EMS market was valued at over $700 billion, with numerous players actively seeking contracts.

The sheer volume of competitors, coupled with the increasing importance of regional manufacturing hubs, creates a fragmented market. This fragmentation means companies like FIH Mobile must constantly innovate and offer competitive pricing to secure business. The rise of new manufacturing centers, particularly in Southeast Asia, has further amplified this competitive pressure.

The mobile and wireless communications industry has seen impressive growth, but it's now entering a more mature phase. Global smartphone shipments are projected for low single-digit growth in 2025, indicating a slowdown from previous years.

This slower growth environment naturally fuels more intense competition. Companies are compelled to battle harder for market share in a less expanding market, often resorting to price reductions and robust marketing campaigns to stand out.

In the contract manufacturing sector, differentiating services is inherently difficult, often leading to commoditization. While FIH Mobile does provide a suite of integrated services including design, engineering, and after-sales support, the fundamental manufacturing processes themselves are largely replicable by competitors.

This limited scope for product differentiation means that competition frequently centers on price. For instance, in 2023, the average gross profit margin for contract electronics manufacturers hovered around 10-15%, a figure that can be significantly pressured when price becomes the primary competitive lever.

Consequently, intense price-based competition can erode profit margins for FIH Mobile and amplify the overall rivalry within the industry, as companies vie for contracts based on cost efficiency rather than unique service offerings.

Exit Barriers

FIH Mobile, like many in the electronics manufacturing sector, faces significant exit barriers. These can include highly specialized, capital-intensive manufacturing equipment and long-term commitments to suppliers and customers. For instance, the cost of decommissioning or repurposing advanced SMT (Surface-Mount Technology) lines can be prohibitive.

These high exit barriers mean that even if a segment of the business becomes unprofitable, firms may be compelled to continue operations. This can lead to persistent overcapacity within the industry, as companies absorb losses rather than face the steep costs associated with exiting, thereby intensifying competitive pressures for all players.

- Specialized Assets: FIH Mobile operates advanced manufacturing facilities with specialized machinery for electronics assembly, making them difficult and costly to sell or redeploy.

- Long-Term Contracts: Existing contracts with clients for manufacturing services may stipulate penalties or significant financial obligations for early termination.

- Employee & Labor Commitments: Significant investments in workforce training and potential severance packages for a large manufacturing workforce can act as an exit impediment.

- Brand & Reputation: A sudden exit could damage FIH Mobile's reputation with remaining partners and the broader market, impacting future business opportunities.

Switching Costs for Customers

While customers in the mobile manufacturing sector do possess significant power, the ease with which they can switch contract manufacturers directly influences competitive rivalry. If it's straightforward and inexpensive for a brand to move production to another factory, competition among contract manufacturers intensifies as they vie for each new contract. This dynamic was evident in 2024, where the global contract electronics manufacturing market saw intense competition, with many brands leveraging flexible agreements to optimize costs and production capabilities.

Conversely, situations where switching is complex and incurs substantial costs can act as a moderating force on rivalry. These switching costs might include the expense of retooling, the loss of accumulated manufacturing expertise specific to a particular client's product, or the time required to qualify a new supplier. For instance, a brand deeply integrated with a contract manufacturer's proprietary processes might face higher barriers to switching, thus reducing the immediate pressure on the incumbent manufacturer.

- Low Switching Costs: Brands can easily change contract manufacturers, increasing rivalry as companies compete on price and service to win new business.

- High Switching Costs: Complex integration or specialized processes can make it difficult and expensive for brands to switch, thereby reducing rivalry.

- Impact on Rivalry: The degree of customer switching costs directly correlates with the intensity of competition among contract manufacturers.

FIH Mobile operates in a crowded EMS market with numerous global and regional competitors, making differentiation difficult and often leading to price wars. The industry's maturity, with projected low single-digit growth in smartphone shipments for 2025, intensifies this rivalry as companies fight for market share. This environment, coupled with high exit barriers like specialized equipment, means companies may continue operations even when unprofitable, exacerbating overcapacity and competitive pressure.

SSubstitutes Threaten

The primary threat of substitutes for FIH Mobile stems from companies choosing to develop their products entirely in-house, bypassing the need for integrated design, engineering, manufacturing, and after-sales support. This direct alternative allows clients to maintain complete control over their intellectual property and production processes, potentially reducing reliance on external partners.

Another significant substitute threat comes from specialized contract manufacturers. These firms may focus solely on Electronic Manufacturing Services (EMS) or Original Design Manufacturing (ODM), offering a piece of the integrated solution that FIH Mobile provides. For instance, a client might engage a separate design firm and then a specialized EMS provider, fragmenting the supply chain but potentially offering cost advantages or specific expertise.

In 2024, the trend towards supply chain diversification and reshoring has intensified. Many brands are exploring multiple manufacturing partners to mitigate geopolitical risks and ensure greater flexibility. This could lead to a greater adoption of specialized EMS providers, as companies seek to de-risk their operations by not relying solely on one integrated partner like FIH Mobile for their entire product lifecycle.

Advances in manufacturing technologies, like widespread adoption of 3D printing and increased automation, pose a threat by enabling Original Equipment Manufacturers (OEMs) to bring production in-house. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow significantly, potentially making localized production more viable for many companies.

If these technologies mature and become cost-effective at scale, they could directly substitute the services offered by large contract manufacturers such as FIH Mobile. This shift would reduce reliance on outsourced partners, impacting FIH Mobile's market share and revenue streams as OEMs opt for more agile, in-house manufacturing solutions.

Major customers like Apple and Samsung are actively diversifying their supply chains, moving production from China to places like India and Vietnam. This 'China +1' strategy is driven by geopolitical concerns. For example, in 2023, India's electronics manufacturing output saw significant growth, signaling this shift.

This strategic reorientation by Original Equipment Manufacturers (OEMs) could act as a substitute for FIH Mobile's services if it leads to a reduced reliance on large, established manufacturers in key regions. As OEMs build new manufacturing capabilities in alternative locations, they might bypass established players like FIH Mobile for certain production needs.

Changes in Product Lifecycles or Demand

A notable shift towards shorter product lifecycles in the mobile industry, driven by rapid technological advancements, presents a significant threat. This acceleration forces manufacturers like FIH Mobile to adapt quickly, potentially leading customers to explore alternative, more flexible manufacturing partners or even in-house production if the speed-to-market becomes paramount. For instance, the average smartphone replacement cycle has been trending downwards, with many consumers upgrading every 2-3 years, a pace that can strain traditional manufacturing models.

Conversely, a substantial decline in overall demand for mobile and wireless communication devices would also empower substitutes. If the market contracts, customers might seek out lower-cost manufacturing options or consolidate their supply chains, making FIH Mobile's established service model less attractive. The global smartphone market, while showing resilience, has experienced periods of demand contraction, with shipments sometimes declining year-over-year, underscoring this vulnerability.

The nature of demand also plays a crucial role. An increasing customer preference for highly complex, premium, or customized devices could, however, mitigate the threat of substitutes. Such specialized requirements often necessitate sophisticated manufacturing capabilities and established quality control processes, areas where FIH Mobile may hold a competitive advantage, thereby reducing the appeal of less specialized or lower-tier alternatives.

- Shortened Product Lifecycles: The increasing pace of innovation in mobile technology, leading to faster obsolescence and upgrade cycles, compels manufacturers to seek agile production partners.

- Demand Volatility: Fluctuations in global demand for mobile devices, including potential downturns, can drive customers to seek more cost-effective or adaptable manufacturing solutions.

- Shift to Premium/Complex Devices: A growing market for sophisticated, high-end smartphones may favor established manufacturers with advanced capabilities, thereby reducing the threat from less specialized substitutes.

Emergence of New Business Models

The threat of substitutes for traditional electronics manufacturing, like that undertaken by FIH Mobile, is growing with the rise of innovative business models. For instance, the concept of highly localized micro-factories is gaining traction, potentially offering a more agile and responsive alternative to large-scale contract manufacturing. These smaller, distributed facilities can significantly reduce lead times and transportation expenses.

Platform-based manufacturing services also present a viable substitute. These platforms connect businesses directly with a network of smaller, specialized manufacturers, enabling greater flexibility and customization. This can be particularly appealing for niche products or for companies seeking to avoid the high minimum order quantities often associated with established players.

By 2024, the global contract manufacturing market, while substantial, faces disruption from these emerging models. Customers are increasingly valuing speed and adaptability. For example, a company needing rapid prototyping or small-batch production might find a micro-factory or a manufacturing platform a more suitable and cost-effective option than engaging a large-scale manufacturer like FIH Mobile for a limited run.

- Localized Micro-factories: Offer reduced logistics costs and faster turnaround times for specific production needs.

- Platform-Based Manufacturing: Connect businesses with a network of specialized smaller manufacturers, enhancing flexibility.

- Customer Value Proposition: These substitutes appeal to customers prioritizing agility, customization, and potentially lower overhead for smaller projects.

- Market Impact: While FIH Mobile operates in a large market, these models can capture specific segments seeking alternatives to traditional, high-volume production.

The threat of substitutes for FIH Mobile is amplified by the rise of localized micro-factories and platform-based manufacturing services. These emerging models offer greater agility, reduced lead times, and lower logistics costs, appealing to customers prioritizing speed and customization over high-volume production.

For instance, the global market for additive manufacturing (3D printing), a key enabler of micro-factories, was valued at approximately $15.1 billion in 2023 and is expected to grow substantially. This technological advancement allows companies to bring production closer to their end markets, directly substituting the need for large, centralized manufacturing facilities.

Furthermore, platform-based services connect businesses with a network of specialized smaller manufacturers, providing flexibility that can be more attractive than the high minimum order quantities often associated with established players like FIH Mobile. This fragmentation of the manufacturing landscape presents a significant challenge.

The trend of supply chain diversification, with companies like Apple and Samsung actively moving production to locations such as India and Vietnam, also contributes to this threat. By building new capabilities in alternative regions, these Original Equipment Manufacturers (OEMs) may bypass established partners for certain production needs.

| Substitute Type | Key Characteristics | Customer Appeal | Market Impact on FIH Mobile |

|---|---|---|---|

| In-house Production | Full control over IP and processes | Reduced reliance on external partners | Loss of integrated service contracts |

| Specialized EMS/ODM Providers | Focus on specific manufacturing stages | Potential cost savings, specialized expertise | Fragmented supply chain, reduced scope |

| Micro-factories | Localized, agile production | Faster turnaround, reduced logistics | Competition for niche and rapid prototyping |

| Platform-Based Manufacturing | Network of smaller, specialized firms | Flexibility, customization, lower MOQs | Captures segments seeking alternatives to high-volume |

Entrants Threaten

Entering the integrated design, engineering, and manufacturing sector for mobile and wireless communications demands significant capital. Companies need to invest heavily in cutting-edge machinery, specialized facilities, and robust research and development to compete effectively. For instance, establishing a state-of-the-art semiconductor fabrication plant, a critical component for advanced mobile tech, can cost billions of dollars, creating a formidable barrier to entry.

Established players like FIH Mobile leverage significant economies of scale, enabling them to achieve lower per-unit production costs. For instance, in 2023, FIH Mobile's extensive manufacturing capacity allowed it to produce millions of devices, a volume that new entrants would find incredibly difficult and costly to replicate.

This cost advantage presents a substantial barrier for new companies entering the mobile manufacturing market. Without reaching similar production volumes, newcomers would struggle to compete on price against incumbents like FIH Mobile, whose operational efficiencies are a direct result of their scale.

FIH Mobile's deep integration of services points to a significant accumulation of proprietary technology and engineering expertise. New entrants would face substantial hurdles in replicating this, needing years and considerable capital for R&D and skilled personnel.

Access to Distribution Channels and Supply Chains

New entrants into the mobile device manufacturing sector, particularly those aiming to compete with established players like FIH Mobile, encounter significant hurdles in securing reliable supply chains. Building these intricate networks for components, from semiconductors to displays, requires substantial capital and established relationships, which are difficult for newcomers to replicate quickly. For context, the global semiconductor market alone was valued at approximately $600 billion in 2023, highlighting the scale of investment needed to secure critical inputs.

Gaining access to established distribution channels and the customer relationships that FIH Mobile, as a subsidiary of Foxconn, has cultivated over years presents another formidable barrier. These channels are often locked by existing agreements and brand loyalty. For instance, major mobile carriers often have exclusive or preferential distribution agreements with established manufacturers, limiting shelf space and visibility for new brands. The sheer scale of Foxconn’s operations, responsible for manufacturing a significant portion of the world's electronics, gives FIH Mobile unparalleled leverage in negotiating terms and securing prime distribution slots.

- Supply Chain Complexity: New entrants must establish robust relationships with component suppliers, a process that can take years and significant financial commitment, especially given the global demand for electronics components.

- Distribution Channel Access: Securing shelf space and partnerships with mobile carriers and retailers is challenging due to existing exclusive agreements and the established market presence of companies like FIH Mobile.

- Customer Relationships: Building brand loyalty and trust with consumers takes time and substantial marketing investment, areas where FIH Mobile benefits from the broader ecosystem of its parent company, Foxconn.

- Economies of Scale: FIH Mobile, as part of Foxconn, benefits from massive production volumes that allow for lower per-unit costs, a competitive advantage that new entrants struggle to match initially.

Government Policy and Regulation

Government policies can significantly influence the threat of new entrants in the mobile manufacturing sector. While governments often aim to support domestic industries, specific regulations can act as barriers. For instance, stringent environmental standards or complex labor laws can increase the initial investment and operational costs for newcomers, making it harder to enter the market. In 2024, many countries continued to refine their environmental, social, and governance (ESG) regulations, impacting manufacturing processes and supply chains.

Conversely, government incentives can lower entry barriers. Programs designed to promote local manufacturing, such as tax breaks or subsidies for setting up production facilities, can make it more attractive for new companies to establish a presence. India, for example, has actively pursued policies like the Production Linked Incentive (PLI) scheme to boost domestic mobile manufacturing, thereby potentially reducing the threat of new entrants by making local operations more financially viable.

- Environmental Regulations: Increased compliance costs for new entrants due to stricter emission standards and waste management rules.

- Labor Laws: New companies must navigate varying labor protection laws, impacting hiring and operational flexibility.

- Trade Tariffs: Tariffs on imported components or finished goods can raise the cost of market entry or production for new mobile manufacturers.

- Local Manufacturing Incentives: Government support, like India's PLI scheme, can reduce capital expenditure and operational hurdles for new domestic players.

The threat of new entrants for FIH Mobile is moderate, primarily due to the substantial capital investment required for advanced manufacturing facilities and R&D. While the mobile sector is dynamic, the sheer cost of establishing a competitive manufacturing operation, especially for high-end devices, acts as a significant deterrent. For instance, setting up a new semiconductor fabrication plant can easily cost tens of billions of dollars, a prohibitive sum for most aspiring entrants.

Economies of scale enjoyed by established players like FIH Mobile, which benefits from Foxconn's vast production capacity, create a considerable cost advantage. Newcomers struggle to match these per-unit efficiencies without achieving similar massive production volumes, making it difficult to compete on price. In 2023, FIH Mobile's operational scale allowed for millions of units to be produced, a benchmark new entrants would find challenging to meet initially.

Access to established distribution channels and customer relationships is another major hurdle. Existing partnerships with mobile carriers and retailers are often exclusive, limiting market entry for new brands. The brand loyalty and trust cultivated by companies like FIH Mobile, bolstered by its parent company's reputation, require significant time and marketing investment to replicate.

Government regulations and incentives also play a role. While stricter environmental or labor laws can increase entry costs, government support through schemes like India's Production Linked Incentive (PLI) can reduce barriers for domestic manufacturers. In 2024, evolving ESG regulations continue to shape the operational landscape for potential new entrants.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

| Capital Requirements | High cost of advanced manufacturing, R&D, and facilities. | Significant deterrent due to immense upfront investment. | Semiconductor fab costs can exceed $10 billion. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to compete on price without matching scale. | FIH Mobile's 2023 production volume of millions of devices. |

| Distribution Channels | Existing exclusive agreements with carriers and retailers. | Limited access to market and customer base for new brands. | Preferential deals with major mobile carriers. |

| Government Policies | Varying impact of regulations and incentives. | Can increase costs (e.g., ESG compliance) or reduce them (e.g., PLI schemes). | India's PLI scheme aims to boost local manufacturing. |

Porter's Five Forces Analysis Data Sources

Our FIH Mobile Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, industry-specific market research from firms like IDC and Counterpoint Research, and public financial databases such as Bloomberg and Refinitiv.

We leverage a comprehensive dataset including competitor financial statements, news articles from reputable business publications, and government regulatory filings to provide a thorough assessment of the competitive landscape.