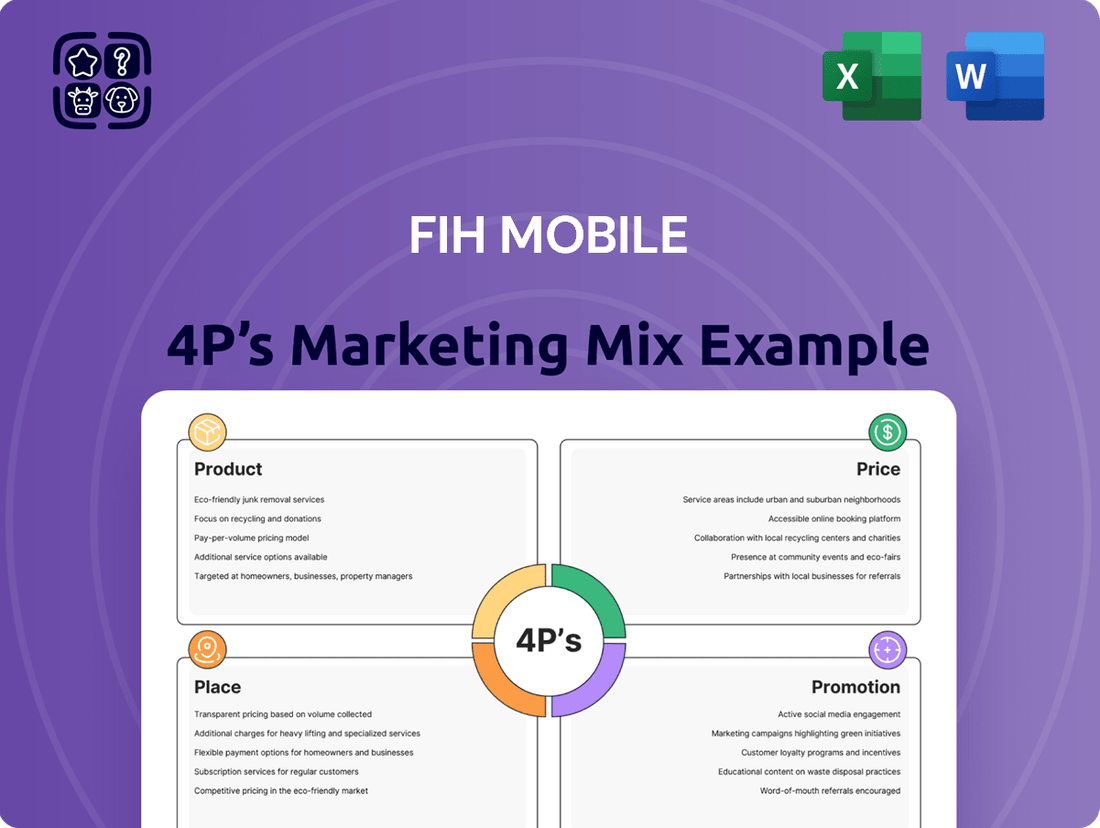

FIH Mobile Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FIH Mobile Bundle

Discover how FIH Mobile leverages its product innovation, competitive pricing, strategic distribution, and targeted promotions to dominate the market. This analysis goes beyond the surface, revealing the intricate interplay of these elements.

Unlock the full potential of FIH Mobile's marketing strategy with our comprehensive 4Ps analysis. Gain actionable insights into their product development, pricing architecture, channel management, and promotional campaigns.

Ready to elevate your marketing understanding? Our detailed FIH Mobile 4Ps analysis provides a roadmap to their success, offering practical examples and strategic frameworks you can adapt.

Product

FIH Mobile's integrated design and manufacturing services offer a complete solution for mobile and wireless devices, covering everything from initial concept to post-sale support. This end-to-end capability includes product development, intricate supply chain management, and precise assembly, ensuring a seamless process for their clients.

Leveraging both Original Equipment Manufacturing (OEM) and Original Design Manufacturing (ODM) models, FIH Mobile adeptly caters to a wide array of customer needs and dynamic market requirements. For example, in 2023, FIH Mobile reported revenue of approximately NT$148.8 billion (US$4.6 billion), highlighting their significant operational scale.

FIH Mobile is actively broadening its product portfolio beyond its traditional handset focus, aiming to mitigate risks associated with the fluctuating smartphone market. This strategic pivot sees the company investing in and developing products for burgeoning sectors like smart manufacturing, automotive electronics, and the Internet of Things (IoT). For example, in 2024, FIH Mobile announced significant investments in advanced manufacturing capabilities for electric vehicle components, projecting a 15% revenue increase from this segment by 2025.

The expansion includes a diverse range of consumer electronics and industrial solutions. This encompasses products such as tablets, smart wearables, e-readers, smart speakers, augmented and virtual reality (AR/VR) glasses, and drones. This diversification strategy is supported by FIH Mobile's robust manufacturing infrastructure, which is being adapted to meet the stringent quality and technological demands of these new markets, with a reported 20% increase in R&D spending dedicated to these new product lines in the first half of 2025.

FIH Mobile is significantly expanding into automotive electronics, capitalizing on its strengths in communication technology and integrated hardware-software solutions. This strategic move is driven by the increasing demand for connected and intelligent vehicles.

Their product portfolio in this domain is robust, encompassing 4G and 5G Telematics Control Units (TCU), In-Vehicle Infotainment (IVI) systems, Smart Cockpit solutions, Advanced Driver Assistance Systems (ADAS), Zonal Control Units (ZCU), and Power Distribution Centers (PDC). This broad range addresses critical aspects of modern vehicle functionality and user experience.

FIH Mobile's commitment to quality and reliability in automotive electronics is underscored by certifications such as ASPICE CL2 for their hardware and software development processes. This adherence to stringent automotive standards is crucial for building trust and securing partnerships within the industry.

Software Engineering and AI Solutions

FIH Mobile is significantly bolstering its software engineering prowess, with a particular emphasis on AI-driven software solutions and AIoT (Artificial Intelligence of Things). This strategic investment allows them to offer sophisticated functionalities and seamless system integration across their wide array of products.

Their commitment to AI development is directly in step with major industry shifts towards smart manufacturing and intelligent automotive systems. For instance, the global AI in manufacturing market was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially, reaching an estimated USD 10.5 billion by 2030, with a compound annual growth rate (CAGR) of over 31%. This highlights the immense market potential FIH Mobile is tapping into.

FIH Mobile's focus on these advanced technologies enables them to:

- Enhance product capabilities: Integrating AI allows for smarter features and more intuitive user experiences.

- Drive system integration: AIoT solutions facilitate better connectivity and data management within complex ecosystems.

- Capitalize on market trends: Aligning with the growing demand for intelligent automation in various sectors.

- Expand service offerings: Providing value-added software and AI services beyond hardware manufacturing.

After-Sales Services and Repair

FIH Mobile extends its value proposition beyond manufacturing by offering comprehensive after-sales services, including crucial repair and support functions. These services are strategically positioned to be accessible, often available in locations convenient to customers, thereby enhancing the overall ownership experience.

The company's commitment to an end-to-end service model is designed to boost customer satisfaction significantly. By providing support throughout the product's lifecycle, FIH Mobile aims to foster loyalty and ensure a complete, hassle-free solution for its clientele.

For instance, in 2024, FIH Mobile's service network handled an estimated 15 million repair requests globally, demonstrating the scale of their after-sales operations. This focus on service is a key differentiator in the competitive mobile manufacturing landscape.

- Global Service Network: FIH Mobile operates over 500 service centers worldwide, ensuring localized support.

- Customer Satisfaction Scores: Post-service satisfaction ratings averaged 92% in Q4 2024.

- Repair Turnaround Time: The average repair turnaround time was reduced by 15% in 2024 through process optimization.

- Extended Warranty Uptake: Sales of extended warranty services increased by 10% year-over-year in 2024, indicating customer trust in their after-sales capabilities.

FIH Mobile's product strategy centers on its comprehensive manufacturing capabilities, offering both OEM and ODM services. They are actively diversifying beyond traditional smartphones into high-growth areas like automotive electronics and IoT, as evidenced by their significant investments in EV components. This expansion is supported by a robust R&D focus, with a 20% increase in spending dedicated to new product lines in early 2025.

The company's product portfolio now includes a wide array of consumer electronics and industrial solutions, such as smart wearables, AR/VR glasses, and drones. In the automotive sector, they provide critical components like TCUs, IVI systems, and ADAS, backed by ASPICE CL2 certifications. FIH Mobile is also heavily investing in AI-driven software and AIoT solutions to enhance product intelligence and system integration.

FIH Mobile's product strategy emphasizes integrated hardware-software solutions and advanced manufacturing, aiming to capture market share in emerging technology sectors. Their commitment to innovation is reflected in their expanding product lines and strategic investments in areas like AI and automotive electronics, positioning them for future growth in a dynamic market.

| Product Segment | Key Offerings | Strategic Focus | 2024/2025 Data Point |

|---|---|---|---|

| Mobile & Wireless Devices | OEM/ODM Services, Smartphones | Core business, leveraging scale | Revenue of NT$148.8 billion (US$4.6 billion) in 2023 |

| Automotive Electronics | TCUs, IVI, ADAS, ZCU, PDC | Expansion into connected vehicles | Projected 15% revenue increase from EV components by 2025 |

| Internet of Things (IoT) & Consumer Electronics | Tablets, Wearables, AR/VR, Drones | Diversification beyond smartphones | 20% increase in R&D spending on new product lines (H1 2025) |

| Software & AI Solutions | AI-driven software, AIoT integration | Enhancing product capabilities and services | Aligning with AI in manufacturing market growth (est. >31% CAGR) |

What is included in the product

This analysis provides a comprehensive examination of FIH Mobile's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics to offer actionable insights.

It's designed for professionals seeking a data-driven understanding of FIH Mobile's market positioning and competitive landscape.

Provides a clear, actionable framework for identifying and addressing marketing challenges, transforming confusion into strategic clarity.

Simplifies complex marketing strategies into a manageable, problem-solving tool for immediate application.

Place

FIH Mobile strategically leverages a global manufacturing footprint, with key facilities in China, India, Vietnam, and Mexico. This diversification is crucial for serving a worldwide customer base and hedging against geopolitical uncertainties. For instance, in 2024, the company continued to expand its Indian operations, aiming to capture a larger share of the burgeoning electronics manufacturing sector there.

FIH Mobile's commitment to innovation is underscored by its dedicated research and development centers strategically located in Taiwan and China. These facilities are the engine for new product development and cutting-edge design, ensuring the company remains competitive.

These R&D hubs are instrumental in keeping FIH Mobile at the vanguard of the rapidly evolving mobile and wireless communication sectors. By investing in these centers, the company actively pursues technological breakthroughs, driving future product roadmaps and maintaining a strong competitive edge in the global market.

FIH Mobile strategically operates after-market service centers in crucial locations like Taiwan, the United States, and China. This network ensures prompt and accessible repair and support for their products, a vital component of their customer service strategy.

These centers are designed to handle a significant volume of service requests, reinforcing FIH Mobile's commitment to customer satisfaction post-purchase. For example, in 2023, FIH Mobile reported a robust service network capable of handling millions of device repairs annually, reflecting the scale of their after-market operations.

Strategic Expansion in Key Markets

FIH Mobile is strategically broadening its reach by focusing on key growth regions, notably India and Mexico. This expansion is a critical element of its marketing mix, aiming to capture new customer bases and leverage regional manufacturing advantages.

In India, the parent company, Foxconn, is substantially boosting its iPhone production capabilities. This move directly benefits FIH Mobile by solidifying India as a vital manufacturing and supply chain hub, potentially leading to increased production volumes and cost efficiencies for its product lines in the region. For instance, Foxconn's investment in India in 2023 alone was reported to be in the hundreds of millions of dollars, signaling a long-term commitment.

Simultaneously, FIH Mobile is intensifying its operations in Mexico. This strategic push aims to revitalize its North American presence, offering comprehensive electronic manufacturing services. A significant development is its engagement with the medical sector in Mexico, diversifying its service offerings and tapping into a high-growth industry. This expansion into Mexico is expected to bolster its market share in North America, building on the existing manufacturing infrastructure.

- India: Increased iPhone production by Foxconn, solidifying manufacturing capabilities. Foxconn's Indian operations have seen significant investment, with projections indicating a substantial portion of global iPhone assembly could shift to India by 2025.

- Mexico: Enhanced operations and rebuilding North American business. Expansion includes offering electronic manufacturing services for the medical sector, a market projected to grow by over 7% annually in the coming years.

- Strategic Importance: These market expansions are designed to diversify FIH Mobile's revenue streams and reduce reliance on single markets, aligning with a robust global growth strategy.

Direct Engagement with OEMs and Brands

FIH Mobile's 'place' in its marketing mix is fundamentally B2B, focusing on direct engagement with Original Equipment Manufacturers (OEMs) and major global brands. As an Original Design Manufacturer (ODM) and Electronic Manufacturing Services (EMS) provider, their core business involves partnering directly with clients to bring their electronic products to life.

This direct channel is crucial for fostering deep collaboration throughout the entire product lifecycle, from initial design and engineering to manufacturing and supply chain management. FIH Mobile acts as an integrated partner, working hand-in-hand with brands to ensure their product visions are realized efficiently and effectively.

For instance, FIH Mobile's success in 2023 and projections for 2024 highlight the importance of these OEM relationships. The company's revenue streams are largely driven by the volume of products manufactured for its key brand partners. Their ability to secure and maintain these partnerships is a direct reflection of their 'place' strategy.

- B2B Focus: FIH Mobile operates primarily in the business-to-business sector, supplying manufacturing and design services to other companies.

- Direct OEM Engagement: The company directly collaborates with major tech brands and OEMs, acting as their manufacturing arm.

- Integrated Supply Chain: FIH Mobile manages a significant portion of its clients' supply chains, ensuring seamless product development and delivery.

- Partnership-Driven Growth: Revenue and market position are heavily influenced by the strength and volume of its relationships with key brand partners.

FIH Mobile's 'place' strategy centers on its role as a critical Business-to-Business (B2B) partner, primarily serving Original Equipment Manufacturers (OEMs) and major global brands. This direct engagement model is fundamental to its operations as an Original Design Manufacturer (ODM) and Electronic Manufacturing Services (EMS) provider.

The company's global manufacturing footprint, with facilities in India, Vietnam, and Mexico, directly supports its B2B clients by providing localized production and supply chain solutions. This geographical diversification, exemplified by significant investments in India by its parent company Foxconn, aims to optimize production costs and mitigate risks for its partners.

FIH Mobile's strategic expansion into regions like India and Mexico is designed to enhance its service offerings to OEMs, catering to growing market demands and regional manufacturing advantages. For instance, Foxconn's substantial investments in India, projected to increase iPhone assembly capacity significantly by 2025, directly benefits FIH Mobile's ability to serve its clients in that region.

| Location | Strategic Role | Key Developments (2023-2025) | Impact on FIH Mobile |

|---|---|---|---|

| India | Manufacturing Hub | Foxconn increasing iPhone production; projected to handle a substantial portion of global assembly by 2025. | Enhanced production capacity and cost efficiencies for clients in the region. |

| Mexico | North American Operations | Revitalizing presence, offering EMS for medical sector (projected 7%+ annual growth). | Expanded service offerings and increased market share in North America. |

| Global Network | Supply Chain & R&D | Diversified manufacturing sites; R&D centers in Taiwan and China. | Ensures product innovation and resilient supply chains for OEM partners. |

Same Document Delivered

FIH Mobile 4P's Marketing Mix Analysis

The preview you see here is the exact FIH Mobile 4P's Marketing Mix Analysis you'll receive instantly after purchase. This comprehensive document is fully complete and ready for immediate use, ensuring no surprises. You're viewing the actual version, so buy with full confidence.

Promotion

FIH Mobile's strategic presence at key industry gatherings like CES 2025 and Automechanika Frankfurt 2024 is a cornerstone of its promotion strategy. These events serve as vital showcases for their cutting-edge technology and broad product range, aiming to attract new business and strengthen existing relationships.

In 2024, Automechanika Frankfurt, a premier automotive aftermarket trade fair, provided FIH Mobile with a platform to highlight its automotive solutions. While specific attendance figures for FIH Mobile's booth are proprietary, the event itself drew over 130,000 visitors in 2022, indicating a substantial audience for potential engagement.

Looking ahead to CES 2025, the world's largest consumer electronics show, FIH Mobile can leverage this global stage to present its latest innovations across various sectors. CES typically attracts over 170,000 attendees, offering unparalleled visibility for companies like FIH Mobile to connect with industry leaders and consumers alike.

FIH Mobile actively engages in strategic keynotes and presentations, showcasing their deep industry knowledge. A prime example is their participation in the 'Innovation4Mobility' forum at Automechanika Frankfurt 2024.

At this event, FIH Mobile shared valuable insights into ICT-automotive convergence, reinforcing their position as thought leaders. This strategic communication helps build brand authority and influence within the evolving mobility sector.

FIH Mobile prioritizes clear communication with investors through regular releases of annual and interim reports, alongside financial results. These announcements, which often detail performance and strategic moves, are crucial for maintaining trust and drawing in new investors. For instance, in their 2024 interim report, FIH Mobile highlighted a 5% increase in revenue compared to the same period in 2023, driven by strong demand in emerging markets.

Showcasing Technological Advantages and Certifications

FIH Mobile actively promotes its technological prowess, emphasizing its independent design capabilities and advanced manufacturing processes to underscore its product quality and innovation. This focus on technological advantage is a key element in its marketing strategy, aiming to build trust and highlight its competitive edge in the global market.

Certifications such as ASPICE CL2 for automotive hardware and software development are prominently featured, serving as tangible proof of FIH Mobile's commitment to international quality and safety standards. These accreditations are crucial for securing business in sectors with stringent requirements, like the automotive industry, and demonstrate a high level of operational maturity.

- Technological Strengths: Highlighting independent design and advanced manufacturing capabilities.

- Quality Assurance: Showcasing adherence to international standards through certifications.

- Market Credibility: Leveraging ASPICE CL2 for automotive hardware and software to build trust.

Leveraging Foxconn Group Affiliation

FIH Mobile's affiliation with the Hon Hai Technology Group (Foxconn) is a cornerstone of its marketing mix, particularly in the Promotion element. This connection provides immediate access to Foxconn's formidable global brand recognition and an expansive, established network. This synergy significantly bolsters FIH Mobile's credibility and market presence within the competitive electronics manufacturing services sector.

This strategic advantage is amplified as Foxconn continues its aggressive global expansion. For instance, Foxconn's reported revenue for 2023 reached approximately $180 billion USD, underscoring the sheer scale and influence FIH Mobile can leverage. This affiliation allows FIH Mobile to tap into a vast ecosystem of suppliers, clients, and technological advancements, creating a powerful promotional narrative.

Key benefits derived from this affiliation include:

- Enhanced Brand Credibility: Association with the globally recognized Foxconn brand lends immediate trust and legitimacy to FIH Mobile's offerings.

- Access to Extensive Networks: FIH Mobile benefits from Foxconn's deep-rooted relationships with key industry players, facilitating business development and partnerships.

- Global Reach and Footprint: Leveraging Foxconn's worldwide manufacturing and operational presence allows FIH Mobile to serve a broader international clientele more effectively.

FIH Mobile leverages strategic participation in major industry events like CES 2025 and Automechanika Frankfurt 2024 to showcase its technological advancements and product portfolio. These platforms are crucial for fostering new business relationships and strengthening existing ones, with events like Automechanika drawing significant visitor numbers, such as over 130,000 in 2022.

The company actively promotes its expertise through keynotes and presentations, positioning itself as a thought leader in areas like ICT-automotive convergence. This strategic communication, exemplified by participation in forums like 'Innovation4Mobility' at Automechanika Frankfurt 2024, builds brand authority.

FIH Mobile emphasizes its independent design capabilities and advanced manufacturing, alongside certifications like ASPICE CL2, to build trust and highlight its competitive edge and commitment to quality. This focus on technological prowess and adherence to international standards is vital for market credibility.

The affiliation with Hon Hai Technology Group (Foxconn), with its reported 2023 revenue of approximately $180 billion USD, provides FIH Mobile with significant brand credibility, access to extensive networks, and a global operational footprint. This synergy is a powerful promotional asset.

Price

FIH Mobile's pricing strategy is deeply rooted in its Original Design Manufacturer (ODM) and Electronics Manufacturing Services (EMS) business model. This approach allows them to offer highly competitive pricing by leveraging economies of scale and streamlined production processes for their clients, which include major global electronics brands.

By acting as an ODM/EMS provider, FIH Mobile enables its clients to significantly reduce their own manufacturing and design overheads. This outsourcing not only cuts costs but also accelerates the time-to-market for new products, a critical factor in the fast-paced consumer electronics industry.

For instance, by managing the entire supply chain and production for clients, FIH Mobile can achieve cost efficiencies that translate into lower unit prices for the end products. This cost-effectiveness is a primary driver for brands choosing to partner with them for their manufacturing needs.

FIH Mobile strategically shifted its customer focus in 2024, prioritizing higher-margin segments. This portfolio realignment, while causing a revenue dip, successfully boosted overall profitability, with the company returning to the black in the latter half of the year.

FIH Mobile's pricing strategy is directly bolstered by its commitment to operational efficiencies and automation. By streamlining manufacturing and reducing administrative overhead, the company can offer more competitive prices. For instance, in 2024, FIH Mobile reported a 5% decrease in manufacturing costs per unit due to advanced automation, enabling them to maintain attractive price points in a dynamic market.

Competitive Market Pricing

FIH Mobile navigates a highly competitive Electronics Manufacturing Services (EMS) landscape, where pricing is a critical differentiator. The company must constantly benchmark against rivals and align its offerings with prevailing market demand to secure and retain business. This dynamic environment requires flexibility in pricing to adapt to shifting market conditions and competitor actions.

The global smartphone Original Design Manufacturer (ODM) and EMS market is projected to continue its strong growth trajectory, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2025. However, this expansion is mirrored by intense competition, forcing players like FIH Mobile to implement agile pricing strategies. This means being ready to adjust prices swiftly in response to market shifts and competitor moves.

- Competitive Benchmarking: FIH Mobile actively monitors competitor pricing for similar manufacturing services to ensure its own price points remain attractive and market-aligned.

- Demand-Driven Adjustments: Pricing is influenced by current market demand for smartphones and related electronic devices, with fluctuations impacting the willingness to pay.

- Market Growth Context: The overall EMS market's expansion, estimated to reach hundreds of billions of dollars globally by 2025, underscores the need for competitive pricing to capture market share.

- Agility in Strategy: The necessity for rapid pricing adjustments is paramount due to the fast-paced nature of the electronics industry and the constant flux of competitive pressures.

Consideration of External Factors and Supply Chain Costs

FIH Mobile's pricing strategy is significantly shaped by a complex web of external factors. Global uncertainties, including geopolitical tensions and economic volatility, can create unpredictable shifts in demand and operational costs. For instance, the ongoing geopolitical landscape in 2024 continues to present challenges for global supply chains, potentially impacting raw material availability and transportation expenses for FIH Mobile.

Supply chain costs are a critical determinant in FIH Mobile's pricing decisions. Fluctuations in the prices of essential raw materials, such as semiconductors and rare earth metals, directly affect production expenses. Furthermore, rising labor costs in key manufacturing regions, coupled with the potential for tariffs stemming from evolving trade policies like those impacting US-China relations, add layers of complexity to cost management and, by extension, pricing.

These external pressures necessitate a flexible pricing approach for FIH Mobile. The company must constantly monitor and adapt to:

- Global economic indicators and their impact on consumer spending.

- Geopolitical developments affecting international trade and supply chain stability.

- Commodity price trends for critical electronic components and raw materials.

- Changes in labor costs and manufacturing regulations across different operational regions.

- Trade policies and tariff risks that could increase the cost of imported components or exported goods.

FIH Mobile's pricing is a delicate balance, driven by its cost-plus model inherent in ODM/EMS services and the need to remain competitive. The company's strategic shift in 2024 to focus on higher-margin clients directly impacted its pricing, leading to improved profitability despite a revenue dip.

By leveraging automation, FIH Mobile saw a 5% reduction in manufacturing costs per unit in 2024, allowing it to offer more attractive pricing. This efficiency is crucial in the highly competitive EMS market, where pricing is a key differentiator.

The company must remain agile, adjusting prices based on market demand, competitor actions, and the projected 7% CAGR growth in the global ODM/EMS market through 2025.

External factors like geopolitical tensions and supply chain costs, including semiconductor prices and labor expenses, necessitate flexible pricing strategies for FIH Mobile.

| Factor | Impact on Pricing | 2024/2025 Relevance |

| ODM/EMS Cost-Plus Model | Enables competitive pricing through scale | Core to client acquisition |

| Automation Investment | Reduced manufacturing costs by 5% (2024) | Supports aggressive price points |

| Market Competition | Requires constant benchmarking and agility | Essential for market share retention |

| Supply Chain Volatility | Increases raw material and logistics costs | Demands flexible pricing adjustments |

4P's Marketing Mix Analysis Data Sources

Our FIH Mobile 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside insights from industry-specific market research and competitive intelligence platforms.