Ferroglobe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferroglobe Bundle

Understand the critical political, economic, social, technological, environmental, and legal forces shaping Ferroglobe's operations. This comprehensive PESTLE analysis reveals key trends and potential impacts, offering invaluable foresight for strategic planning. Gain a competitive advantage by downloading the full report for actionable intelligence.

Political factors

Ferroglobe's operations are highly sensitive to governmental trade policies, particularly tariffs and duties. Petitions filed by U.S. silicon metal producers, including Ferroglobe USA, are seeking to address unfairly traded imports from nations such as Angola, Australia, Laos, Norway, and Thailand. Similar trade actions are also underway in Europe, demonstrating a global trend towards scrutinizing import practices.

The outcomes of these trade investigations are critical for Ferroglobe's market position and pricing power. For instance, the preliminary EU safeguard decision is anticipated by June 2025, while final determinations regarding U.S. ferrosilicon imports are expected by May 2025. These decisions have the potential to significantly influence import volumes and pricing, thereby impacting Ferroglobe's ability to stabilize prices and grow its market share.

Global geopolitical tensions and the increasing emphasis on supply chain resilience are key political considerations. Ferroglobe, a significant producer of silicon metal, stands to gain from government programs designed to bolster domestic production of critical materials. For instance, the U.S. Department of Commerce's designation of silicon metal as a critical material underscores the strategic importance of such resources.

The U.S. administration's commitment to reshoring manufacturing and lessening reliance on imports for essential mineral alloys directly influences Ferroglobe's market position and future expansion opportunities. This policy shift, evident in initiatives like the Inflation Reduction Act, which incentivizes domestic production of clean energy components often reliant on silicon, provides a favorable environment for Ferroglobe's growth.

Government policies play a significant role in shaping Ferroglobe's operational landscape, particularly through incentives aimed at bolstering manufacturing. These can include tax breaks for production, grants for investing in new technologies, and support for research and development initiatives. Such measures are crucial for fostering a competitive environment and encouraging growth within the sector.

The restart of Ferroglobe's silicon metal plant in Selma, Alabama, serves as a prime example of how state and local incentives can directly influence operational decisions. This restart, supported by various governmental programs, not only brought the facility back online but also led to significant job creation, highlighting the tangible economic benefits of public support.

These governmental interventions are designed to stimulate economic expansion and drive technological innovation. By encouraging investment and production, they help to ensure the long-term viability and advancement of the manufacturing industry, which directly benefits companies like Ferroglobe.

Regulatory Environment and Compliance

Ferroglobe's operations are significantly shaped by the regulatory environment, particularly concerning adherence to U.S. and international securities laws. As a publicly traded entity, the company faces stringent reporting obligations, impacting its financial disclosures and corporate governance.

A critical political factor for Ferroglobe is its classification as a foreign private issuer. Should Ferroglobe lose this status, it would likely trigger more demanding U.S. securities law compliance, potentially increasing operational costs and altering its governance structure. For instance, a change in status could necessitate more frequent and detailed SEC filings, impacting the resources allocated to compliance departments.

- Regulatory Compliance: Ferroglobe must navigate a complex web of U.S. and global regulations, including those governing publicly traded companies.

- Foreign Private Issuer Status: Maintaining this status is crucial for managing compliance burdens; a change could lead to higher costs and altered governance.

- Impact of Regulatory Changes: Shifts in regulatory requirements can directly affect operational expenditures and strategic decision-making processes.

Carbon Border Adjustment Mechanisms (CBAM)

The European Union's Carbon Border Adjustment Mechanism (CBAM), set to fully implement in 2026, represents a significant political factor for Ferroglobe. This mechanism imposes a carbon price on imports of certain goods, including ferromanganese, into the EU. While ferromanganese is explicitly covered, the exclusion of silicomanganese creates a complex landscape, potentially impacting regional pricing dynamics and the competitive positioning of Ferroglobe's various operations.

CBAM's core objective is to prevent carbon leakage by encouraging decarbonization efforts both within the EU and in exporting countries. For Ferroglobe, this could translate into increased production costs for its European facilities if they do not meet stringent emissions standards, or potentially higher input costs if imported materials are subject to the levy. The uncertainty surrounding the precise impact on silicomanganese trade flows adds another layer of complexity to strategic planning.

- EU CBAM Implementation: Full implementation is slated for 2026, impacting carbon-intensive imports.

- Ferromanganese Coverage: Ferroglobe's ferromanganese production is directly affected by the CBAM.

- Silicomanganese Uncertainty: The exclusion of silicomanganese creates uneven competitive pressures.

- Decarbonization Incentives: Measures aim to drive emissions reductions across supply chains.

Governmental trade policies, particularly tariffs and duties, are a major political influence on Ferroglobe. For example, U.S. silicon metal producers, including Ferroglobe USA, have filed petitions seeking to address unfairly traded imports from countries like Angola, Australia, Laos, Norway, and Thailand, with final determinations expected by May 2025. Similar trade actions are also occurring in Europe, with a preliminary EU safeguard decision anticipated by June 2025, impacting import volumes and pricing.

What is included in the product

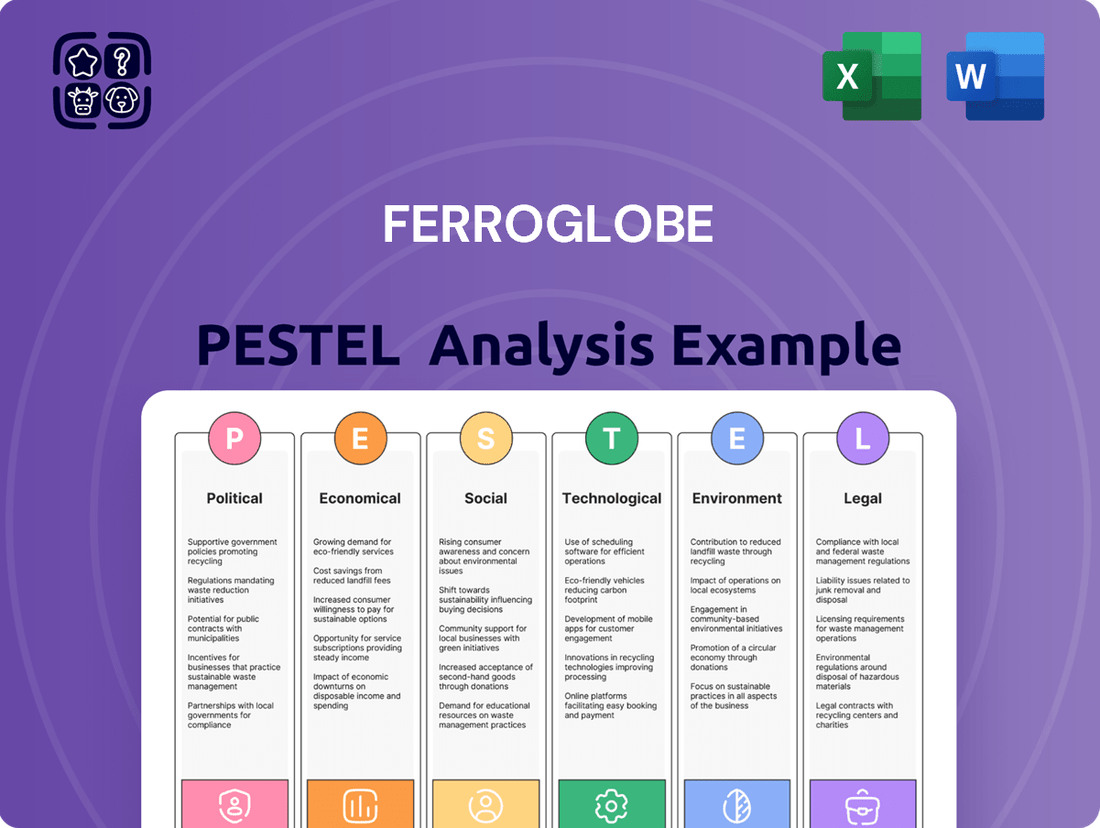

This PESTLE analysis examines the external macro-environmental factors influencing Ferroglobe, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It provides actionable insights into how these forces create both challenges and opportunities for the company.

Provides a concise version of Ferroglobe's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of the political, economic, social, technological, environmental, and legal factors impacting Ferroglobe.

Economic factors

Ferroglobe's financial performance is intrinsically linked to global commodity prices, particularly for silicon metal and silicon and manganese-based alloys. These price swings directly impact the company's revenue streams, creating a significant sensitivity in its business model.

For instance, the company reported a downturn in silicon metal revenue during the fourth quarter of 2024 and the first quarter of 2025, a trend attributed to both declining prices and lower sales volumes. This illustrates the immediate impact of market price movements on Ferroglobe's top line.

The inherent volatility of these key commodity markets, coupled with Ferroglobe's high operating leverage, means that even moderate price changes can translate into substantial swings in the company's profitability. This dynamic underscores the importance of closely monitoring global commodity market trends for investors and strategists alike.

Ferroglobe's product demand is significantly influenced by key sectors such as chemical production, aluminum manufacturing, steelmaking, and the rapidly expanding solar energy industry. The automotive sector, particularly with the surge in electric vehicles, also plays a crucial role.

The burgeoning demand for electric vehicles and the accelerated deployment of renewable energy, especially solar power, are poised to be major growth catalysts for the silicon metal market. Analysts project the global solar power capacity to reach over 3,000 GW by 2030, a substantial increase that will directly benefit silicon producers.

Furthermore, a projected cyclical recovery in industrial activity, anticipated to gain momentum in the latter half of 2025, is expected to bolster sales volumes for Ferroglobe. This recovery is likely to be driven by renewed investment in infrastructure and manufacturing.

Ferroglobe's operations, particularly the production of silicon metal and ferroalloys, are heavily reliant on energy, making energy costs a substantial portion of their overall expenses. In 2024, the company specifically cited elevated energy and input costs as key contributors to operational challenges.

The volatility of electricity prices directly influences Ferroglobe's production expenses, consequently impacting their profitability and the strategies they employ for pricing their products.

Impact of Trade Measures on Market Conditions

The effectiveness of current trade protection measures, like U.S. tariffs on ferrosilicon imports, is a key factor in stabilizing market conditions. These actions aim to curb oversupply from imports priced unfairly, which in turn is expected to support price stabilization. This stabilization could lead to better demand and higher prices for producers like Ferroglobe.

Anticipated EU safeguards on silicon metal also play a significant role. By potentially reducing the influx of lower-priced imports, these measures could create a more favorable environment for domestic producers. This could translate into improved market share and profitability for companies positioned to benefit from these policy shifts, especially as we approach the latter half of 2025.

- U.S. Tariffs: The U.S. has implemented tariffs on ferrosilicon imports, impacting global supply dynamics.

- EU Safeguards: The European Union is considering safeguards on silicon metal, which could affect import volumes.

- Market Stabilization: These measures are designed to reduce oversupply and support price stability in the market.

- Potential Benefits: Expected outcomes include improved demand, higher prices, and increased market share for domestic producers in 2025.

Global Economic Outlook and Industrialization

The global economic landscape is a key driver for Ferroglobe, as its products are essential for various industrial applications. A robust economic recovery typically translates to increased demand for silicon metal and ferroalloys, the core offerings of Ferroglobe. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, indicating a cautiously optimistic recovery. This recovery directly impacts sectors like construction and manufacturing, which are major consumers of Ferroglobe's materials.

Industrialization and urbanization trends worldwide are critical for Ferroglobe's long-term growth prospects. As developing economies continue to expand and modernize, the demand for materials used in infrastructure, renewable energy, and consumer goods rises. For example, the United Nations anticipates that by 2050, 68% of the world's population will reside in urban areas, a trend that fuels demand for aluminum, a key component in construction and transportation, where silicon metal is used in alloys.

Conversely, a faltering global economic recovery poses a risk to Ferroglobe's demand forecasts. If economic growth falters, industrial output could slow, directly impacting the consumption of silicon metal and ferroalloys. For example, if global GDP growth were to significantly miss the IMF's 2024 projection, it could lead to a noticeable slowdown in key end-markets for Ferroglobe.

Looking ahead, sustained global industrialization, coupled with advancements in energy storage solutions and the increasing integration of electric vehicles (EVs) in the automotive sector, are expected to be significant tailwinds for the silicon metal market. The EV sector, in particular, relies heavily on aluminum alloys, which incorporate silicon metal, for lightweighting and battery components. Industry analysts project the global silicon metal market to grow at a compound annual growth rate (CAGR) of approximately 5-6% through 2030, driven by these technological shifts and ongoing industrial expansion.

Ferroglobe's financial health is closely tied to global economic trends, with industrialization and urbanization driving demand for its core products like silicon metal and ferroalloys. The IMF's projection of 3.2% global growth for 2024 suggests a cautiously optimistic recovery, directly benefiting sectors such as construction and manufacturing that rely on Ferroglobe's materials.

The company's performance is also sensitive to energy costs, which constitute a significant portion of its operational expenses. In 2024, elevated energy prices presented a notable challenge, impacting production costs and influencing pricing strategies. This highlights the critical need for effective energy management and cost control measures.

Trade policies, such as U.S. tariffs on ferrosilicon imports and potential EU safeguards on silicon metal, are actively shaping market dynamics. These measures aim to curb oversupply and support price stabilization, which could lead to improved demand and higher prices for domestic producers like Ferroglobe in 2025.

Key growth catalysts for Ferroglobe include the expanding solar energy industry and the surge in electric vehicle production. The projected growth in solar power capacity and the increasing use of aluminum alloys with silicon metal in EVs are expected to drive demand for silicon metal. Analysts forecast the global silicon metal market to grow at a CAGR of 5-6% through 2030.

| Economic Factor | 2024 Projection/Status | Impact on Ferroglobe | Outlook for 2025 |

|---|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Supports demand for industrial materials | Continued recovery expected to boost sales |

| Energy Costs | Elevated in 2024 | Increased operational expenses | Volatility remains a key factor |

| Industrialization/Urbanization | Ongoing global trends | Drives demand for alloys and metals | Sustained long-term demand growth |

| Electric Vehicle (EV) Market | Rapid expansion | Increased demand for silicon in alloys | Significant growth driver |

Preview Before You Purchase

Ferroglobe PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ferroglobe PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential risks and opportunities relevant to Ferroglobe's global business.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of the external forces shaping Ferroglobe's industry, enabling informed decision-making.

Sociological factors

Ferroglobe's global footprint encompasses around 3,400 employees spread across nine countries, underscoring the sociological impact of its operations on diverse communities. The company's stated aim to foster and expand well-compensated employment, especially within the United States, resonates with societal priorities for robust job markets and economic resilience.

The strategic decision to reactivate production sites, such as the Selma plant in Alabama, directly injects new employment opportunities into the local economy, reflecting a commitment to community development and workforce growth.

Ferroglobe's global operations directly influence the economic vitality of its host communities, fostering local employment and supporting regional economies through its procurement practices. For example, in 2024, the company continued to emphasize local sourcing, with a significant portion of its operational expenditures directed towards regional suppliers, bolstering community economic development.

The company's commitment extends to managing the social footprint of its manufacturing sites, which includes addressing community concerns and contributing to local social infrastructure. This engagement is crucial for maintaining a positive social license to operate, especially as Ferroglobe navigates evolving societal expectations regarding corporate responsibility and environmental stewardship.

Ferroglobe's commitment to employee and community well-being is a key sociological consideration. The company's robust corporate policies on environmental health and safety (EHS) are implemented across all its global facilities, complementing adherence to local regulations. This focus is vital for maintaining a positive public image, ensuring operational stability, and fostering a motivated workforce.

In 2023, Ferroglobe reported a Total Recordable Incident Rate (TRIR) of 0.78, significantly below the industry average, underscoring their dedication to safety. This proactive approach not only protects their employees but also strengthens community relations, which is crucial for maintaining their social license to operate in diverse geographical locations.

Ethical Labor Practices and Human Rights

Ferroglobe places a strong emphasis on ethical labor practices and human rights across its global operations and supply chain. This commitment is demonstrated through robust policies designed to safeguard employee well-being and ensure fair treatment. In 2023, the company reported that 99% of its employees had undergone training on its Code of Conduct, which includes detailed provisions on human rights and ethical labor. This proactive approach aligns with increasing societal pressure on corporations to uphold these fundamental principles.

Employees are explicitly empowered to report any irregularities or unlawful behavior, including potential human rights breaches, without fear of reprisal. This internal reporting mechanism is a cornerstone of Ferroglobe's commitment to transparency and accountability. The company's focus on these areas reflects a broader societal expectation that businesses operate responsibly and ethically, contributing positively to the communities in which they function.

- Employee Training: In 2023, 99% of Ferroglobe employees received training on the company's Code of Conduct, emphasizing ethical labor and human rights.

- Reporting Mechanisms: Ferroglobe maintains channels for employees to report human rights violations and other unlawful activities.

- Supply Chain Scrutiny: The company actively works to ensure its supply chain partners adhere to similar ethical labor and human rights standards.

- Societal Expectations: Ferroglobe's policies are designed to meet and exceed growing public demand for corporate social responsibility.

Consumer Trends and Product Applications

Consumer preferences are increasingly leaning towards sustainability and advanced technology, which indirectly impacts Ferroglobe. For instance, the growing popularity of electric vehicles (EVs) and solar power systems, both heavily reliant on silicon metal, highlights a societal shift towards greener solutions. This trend directly boosts demand for Ferroglobe's core products.

The global EV market is projected to continue its rapid expansion. By 2024, EV sales are expected to reach over 10 million units worldwide, a significant jump from previous years. Similarly, solar energy installations are on the rise, with global capacity additions in 2024 anticipated to exceed 400 GW. These burgeoning sectors are key drivers for silicon metal consumption.

- Growing EV Adoption: The demand for silicon metal in EV battery components and lightweight body structures is a significant growth area.

- Solar Energy Expansion: Silicon metal is a fundamental material in photovoltaic cells, directly benefiting from the global push for renewable energy.

- Sustainable Materials: Consumers are showing a preference for products made with recycled or sustainably sourced materials, influencing manufacturing processes that may incorporate silicon-based compounds.

- Technological Advancements: Innovations in electronics and manufacturing often require specialized silicon alloys, aligning with consumer interest in cutting-edge products.

Ferroglobe's operations directly impact communities by providing employment, as seen with its 3,400 employees across nine countries. The company's focus on reactivating sites like the Selma plant in Alabama demonstrates a commitment to local economic development and job creation, a key societal priority. In 2024, Ferroglobe continued to emphasize local sourcing, channeling a significant portion of its operational expenditures to regional suppliers, thereby bolstering community economic growth.

The company's dedication to employee safety is evident in its 2023 Total Recordable Incident Rate (TRIR) of 0.78, which is substantially lower than the industry average. This commitment extends to ethical labor practices, with 99% of employees trained on its Code of Conduct in 2023, reinforcing fair treatment and human rights across its operations.

Societal demand for sustainable products directly benefits Ferroglobe, particularly through the growth of electric vehicles (EVs) and solar power. Global EV sales were projected to exceed 10 million units in 2024, while solar capacity additions were expected to surpass 400 GW the same year, both driving increased demand for silicon metal.

| Sociological Factor | Ferroglobe's Action/Impact | Relevant Data (2023-2024) |

| Employment Creation | Global workforce of approximately 3,400 employees across nine countries; reactivation of production sites like Selma, Alabama. | Continued emphasis on local sourcing in 2024, directing significant operational expenditures to regional suppliers. |

| Employee Well-being & Safety | Robust Environmental Health and Safety (EHS) policies implemented globally. | 2023 Total Recordable Incident Rate (TRIR) of 0.78, well below industry average. |

| Ethical Labor & Human Rights | Comprehensive Code of Conduct with provisions on human rights and fair treatment; employee reporting mechanisms. | 99% of employees trained on Code of Conduct in 2023; active scrutiny of supply chain partners for ethical standards. |

| Consumer Preferences (Sustainability) | Products are essential for growing sectors like EVs and solar energy. | Projected global EV sales over 10 million units in 2024; expected global solar capacity additions exceeding 400 GW in 2024. |

Technological factors

Technological innovation is reshaping the silicon metal industry, with companies like Ferroglobe investing in advancements to stay competitive. These innovations focus on improving energy efficiency in production, a crucial factor given silicon's energy-intensive manufacturing. For instance, Ferroglobe is exploring technologies that reduce electricity consumption per ton of silicon produced, aiming to lower operational costs and environmental impact.

Enhanced metal purity is another significant technological driver, as higher purity silicon is essential for growing sectors like solar energy and advanced electronics. Ferroglobe's commitment to research and development includes refining smelting processes to achieve purer silicon grades. This focus on quality supports its strategy to cater to high-value, specialized markets.

Furthermore, the development of specialized silicon metal alloys tailored for specific industrial applications is a key area of technological advancement. Ferroglobe is actively engaged in creating these custom alloys, which can offer unique properties for industries ranging from automotive to aerospace. This diversification through technological application allows Ferroglobe to tap into emerging demand and solidify its market position.

Ferroglobe is strategically investing in silicon metal for battery applications, recognizing its potential for future growth. This includes a partnership with Coreshell Technologies to develop battery-ready metallurgical silicon for electric vehicle (EV) batteries.

This collaboration specifically targets the creation of low-cost, high-range EV batteries by enabling silicon to replace graphite in anodes. Such an advancement could dramatically boost the demand for silicon metal, a key component in Ferroglobe's product portfolio.

The increasing global push towards renewable energy, especially solar power, is a major technological factor influencing Ferroglobe. Silicon metal is a fundamental material for photovoltaic cells, the core of solar energy technology. As solar installations grow, so does the demand for high-purity silicon, directly benefiting Ferroglobe.

Globally, solar power capacity saw substantial growth, with an estimated addition of over 300 GW in 2023, pushing total installed capacity past 1.3 TW. This expansion directly translates to increased demand for silicon metal. For instance, the solar industry is projected to consume a significant portion of global silicon metal output in the coming years, underscoring its importance for Ferroglobe's market.

Developments in Semiconductor Industry

The semiconductor industry's rapid technological evolution, particularly in areas like artificial intelligence and advanced computing, significantly drives demand for high-purity silicon metal. Ferroglobe's silicon metal is a foundational component for this sector, essential for producing the wafers that power these innovations.

Government initiatives globally, focused on bolstering domestic semiconductor manufacturing and promoting clean energy technologies, indirectly fuel the market for silicon metal. For instance, the US CHIPS and Science Act, with its substantial investment in semiconductor research and production, is expected to create a more robust demand environment. Similarly, European efforts to onshore chip production are contributing to market expansion.

Ferroglobe's ability to supply the high-purity silicon metal required for advanced semiconductor applications positions it to benefit from these trends. The increasing complexity and miniaturization of semiconductor components necessitate increasingly pure raw materials, a niche where Ferroglobe operates.

- Semiconductor Market Growth: The global semiconductor market is projected to reach over $1 trillion by 2030, driven by AI, IoT, and 5G technologies.

- Silicon Metal Demand: The demand for high-purity silicon metal in semiconductors is expected to see consistent growth, correlating with chip production volumes.

- Government Support: Significant government funding, such as the $52 billion allocated by the US CHIPS Act, aims to reshore semiconductor manufacturing, boosting demand for critical inputs like silicon.

- Ferroglobe's Role: Ferroglobe is a key supplier of silicon metal, a vital ingredient for the photovoltaic and semiconductor industries, which are experiencing strong tailwinds.

Recycling and Circular Economy Initiatives

Technological advancements are increasingly focusing on energy efficiency and the incorporation of recycled materials within the silicon industry. This shift towards a circular economy aims to minimize environmental impact by reducing reliance on virgin resources and lowering energy consumption in production processes.

While specific data for Ferroglobe regarding recycled silicon adoption isn't publicly detailed, the global trend is significant. For instance, the European Union's Circular Economy Action Plan, updated in 2020, sets ambitious targets for waste reduction and increased recycling rates across various sectors, which will likely influence supply chains and manufacturing practices for companies like Ferroglobe.

The drive for sustainability is pushing technological innovation in silicon production. This includes developing more efficient smelting techniques and exploring advanced methods for purifying and reusing silicon scrap. Such innovations are crucial for companies aiming to align with environmental regulations and meet growing consumer demand for eco-friendly products.

Key technological factors influencing the silicon industry, including Ferroglobe, include:

- Development of advanced recycling technologies for silicon-containing waste streams.

- Implementation of energy-saving technologies in silicon smelting and refining processes.

- Research into novel methods for purifying and reusing secondary silicon materials.

- Integration of digital technologies for optimizing resource management and waste reduction in production.

Technological advancements are a critical driver for Ferroglobe, particularly in improving energy efficiency and achieving higher silicon purity for key markets. Innovations in smelting processes aim to reduce electricity consumption, a significant cost factor in silicon production. For example, Ferroglobe is exploring new technologies to lower the energy needed per ton of silicon, directly impacting operational costs and environmental footprint.

The demand for high-purity silicon is escalating due to growth in sectors like solar energy and advanced electronics. Ferroglobe's R&D efforts are focused on refining its production methods to yield purer silicon grades, catering to these high-value markets. This commitment to quality is essential for its competitive edge.

Ferroglobe is also investing in silicon for battery applications, notably through a partnership with Coreshell Technologies to develop silicon for electric vehicle batteries. This strategic move targets the potential for silicon to replace graphite in anodes, a development that could significantly boost demand for silicon metal.

The solar industry's expansion is a major technological influence, as silicon metal is a fundamental component of photovoltaic cells. With global solar capacity exceeding 1.3 TW by the end of 2023, the demand for high-purity silicon is directly benefiting companies like Ferroglobe. The semiconductor industry's growth, spurred by AI and advanced computing, also relies heavily on high-purity silicon for wafer production.

| Key Technological Factors | Impact on Ferroglobe | Supporting Data |

| Energy Efficiency in Production | Lower operational costs, reduced environmental impact | Silicon production is energy-intensive; improvements directly affect profitability. |

| High-Purity Silicon Demand | Growth opportunities in solar and electronics | Global solar capacity over 1.3 TW (end of 2023); semiconductor market projected to exceed $1 trillion by 2030. |

| Battery Technology Advancements | New market potential for silicon metal | Partnership with Coreshell Technologies for EV battery silicon. |

| Recycling and Circular Economy | Sustainability focus, potential for resource optimization | EU Circular Economy Action Plan promotes waste reduction and recycling. |

Legal factors

Ferroglobe actively navigates anti-dumping and countervailing duty laws, a crucial aspect of its legal environment. The company has a history of filing petitions, notably concerning silicon metal and ferrosilicon imports, to combat unfair trade practices.

These legal mechanisms are vital for maintaining a level playing field, preventing market distortion caused by artificially low-priced imports. For instance, in 2023, the U.S. International Trade Commission continued investigations into certain silicon metal imports, a process that directly affects companies like Ferroglobe.

The success or failure of these trade remedy cases has a tangible impact on Ferroglobe's market position and its ability to price its products competitively. In 2024, the ongoing trade landscape continues to present both challenges and opportunities stemming from these regulations.

Ferroglobe navigates a complex web of environmental regulations, particularly concerning greenhouse gas emissions and waste disposal. For instance, the European Union's Emissions Trading System (EU ETS) directly impacts the cost of operations for its European facilities. The company's 2023 sustainability report highlighted ongoing efforts to reduce its carbon footprint, a direct response to increasingly stringent global environmental policies.

These evolving environmental mandates are compelling Ferroglobe to re-evaluate its production processes and allocate capital towards developing and implementing cleaner technologies. This strategic shift is crucial not only for meeting compliance requirements but also for maintaining its social license to operate and safeguarding its corporate reputation in an environmentally conscious market.

Ferroglobe, as a global entity, navigates a complex web of labor laws across its operating regions, ensuring fair employment practices, safe working conditions, and respect for employee rights. These regulations, which can vary significantly by country, impact everything from hiring and compensation to termination and collective bargaining.

The company's commitment to ethical operations is underscored by its compliance with legislation like the Norwegian Transparency Act. This act mandates due diligence and reporting on human rights and decent working conditions within supply chains, reflecting a growing global emphasis on corporate accountability in these areas.

Corporate Governance and Securities Laws

Ferroglobe operates under stringent corporate governance and securities laws due to its listing on Nasdaq and oversight by the SEC. This mandates adherence to rigorous periodic disclosure and reporting obligations, ensuring transparency for investors. For instance, in their 2023 annual report, Ferroglobe detailed its compliance with these regulations.

Changes in its classification, such as its foreign private issuer status, could trigger more demanding compliance and corporate governance frameworks. This means adapting to potentially stricter rules regarding financial reporting and board composition, impacting operational procedures.

- Nasdaq Listing Requirements: Ferroglobe must maintain compliance with Nasdaq's listing rules, including those related to corporate governance and timely financial disclosures.

- SEC Reporting Obligations: As a publicly traded entity, the company is subject to the Securities and Exchange Commission's reporting requirements, such as filing annual (10-K) and quarterly (10-Q) reports.

- Foreign Private Issuer Status: Any shifts in Ferroglobe's foreign private issuer status could necessitate significant adjustments to its corporate governance practices and disclosure procedures to align with evolving regulatory expectations.

Trade Agreements and Safeguard Measures

International trade agreements and safeguard measures directly impact Ferroglobe's operations. For instance, the European Commission's investigations into imports of certain ferroalloys have significant legal ramifications.

These investigations can result in provisional and final rulings that alter import volumes and market dynamics. Such changes directly influence Ferroglobe's sales performance and pricing strategies in affected European markets.

For example, in late 2023 and early 2024, the EU continued to review anti-dumping and anti-subsidy measures on various ferroalloys, which could affect trade flows and competitiveness for producers like Ferroglobe.

- Trade Policy Impact: EU safeguard measures on ferroalloys can restrict imports, potentially benefiting domestic producers like Ferroglobe by reducing competition.

- Market Dynamics: Rulings on safeguard measures influence pricing and availability of key raw materials and finished products, impacting Ferroglobe's cost structure and revenue.

- Legal Compliance: Ferroglobe must navigate complex trade regulations and potential legal challenges arising from these safeguard measures and trade investigations.

Ferroglobe's legal landscape is significantly shaped by trade regulations, particularly anti-dumping and countervailing duties. The company actively engages in trade remedy cases to ensure fair competition, as seen in its petitions against silicon metal and ferrosilicon imports. These legal actions directly influence market access and pricing for Ferroglobe's products in key regions like the United States.

Environmental regulations, especially those concerning emissions like the EU Emissions Trading System, impose direct operational costs on Ferroglobe. The company's 2023 sustainability efforts demonstrate a proactive approach to complying with increasingly stringent global environmental policies, aiming to reduce its carbon footprint.

Labor laws across Ferroglobe's operating countries dictate fair employment practices and workplace safety. Compliance with legislation like Norway's Transparency Act highlights the company's commitment to human rights and ethical supply chain management, reflecting a broader trend in corporate accountability.

As a Nasdaq-listed entity, Ferroglobe is bound by SEC reporting obligations and corporate governance standards. Maintaining its foreign private issuer status is crucial, as any change could trigger more demanding compliance frameworks, impacting financial reporting and board structures.

| Legal Factor | Impact on Ferroglobe | Recent/Relevant Data (2023-2024) |

|---|---|---|

| Trade Remedies (Anti-dumping/CVD) | Protects against unfair import pricing, influences market competitiveness. | Continued investigations into silicon metal imports in the US (2023). EU review of anti-dumping measures on ferroalloys (late 2023/early 2024). |

| Environmental Regulations | Increases operational costs (e.g., emissions), drives investment in cleaner technologies. | EU Emissions Trading System (EU ETS) impacts European facilities. Ferroglobe's 2023 report details carbon footprint reduction efforts. |

| Labor Laws | Ensures fair employment, safe conditions, and respect for employee rights across global operations. | Compliance with Norwegian Transparency Act regarding supply chain due diligence on human rights. |

| Corporate Governance & Securities Law | Mandates transparency, timely financial disclosures, and adherence to listing requirements. | Ferroglobe's 2023 annual report details SEC compliance. Nasdaq listing requires ongoing adherence to governance rules. |

Environmental factors

Ferroglobe's core business, producing silicon metal and ferroalloys, is inherently energy-intensive, contributing significantly to its carbon footprint. This reliance on energy makes the company particularly susceptible to fluctuations in energy prices, a trend observed throughout 2024 and projected to continue into 2025, directly impacting operational costs and profitability.

Consequently, Ferroglobe is prioritizing enhanced energy efficiency across its production facilities. This focus is not merely about cost reduction; it's a strategic imperative to align with global decarbonization mandates and investor expectations for environmental stewardship. The company's commitment to the green transition is evident in its ongoing investments in cleaner energy solutions and process optimization.

Ferroglobe's production heavily depends on raw materials like metallurgical coke and quartz. The environmental footprint associated with extracting and transporting these resources is a significant consideration. For instance, mining operations can impact land use and water quality, necessitating careful management.

The company's strategy of vertical integration, which includes owning some of its raw material sources, offers a degree of control over sourcing practices. This can potentially lead to more predictable supply chains and opportunities to implement more sustainable extraction and processing methods compared to relying solely on third-party suppliers.

Ferroglobe's industrial processes, like many in manufacturing, inherently produce waste and emissions. This necessitates strict adherence to environmental regulations concerning waste management and pollution control, a critical operational factor. For instance, in 2024, the European Union continued to enforce stringent directives like the Industrial Emissions Directive, pushing companies to invest in advanced abatement technologies.

Stricter environmental protection policies, particularly those targeting high energy consumption and high pollution capacity industries, can significantly reshape market dynamics. Such policies may lead to the withdrawal of less efficient producers, thereby impacting supply. This trend is likely to drive Ferroglobe and its competitors to accelerate investments in cleaner, more energy-efficient technologies to maintain market access and competitiveness.

Climate Change and Renewable Energy Transition

The global push towards renewable energy, particularly solar power, is a major environmental trend directly benefiting Ferroglobe. The company's silicon metal is a key component in photovoltaic cells, meaning this energy transition fuels significant demand for their products. For instance, global solar power capacity is projected to reach over 3,000 GW by 2030, a substantial increase from the approximately 1,200 GW installed by the end of 2023.

This growing market for solar technology presents a clear opportunity for Ferroglobe. However, it also underscores the importance of the company adopting sustainable practices within its own manufacturing processes. As environmental regulations tighten and investor focus on ESG (Environmental, Social, and Governance) factors intensifies, demonstrating a commitment to reduced emissions and responsible resource management will be critical for long-term success.

- Growing Demand: Increased solar installations globally directly translate to higher demand for Ferroglobe's silicon metal.

- Market Growth: The renewable energy sector is expanding rapidly, with solar power capacity expected to more than double between 2023 and 2030.

- Sustainability Imperative: Ferroglobe must align its production with environmental standards to meet market expectations and regulatory requirements.

- Competitive Advantage: Companies demonstrating strong environmental stewardship are increasingly favored by investors and customers in the renewable energy supply chain.

Environmental Sustainability Initiatives

Ferroglobe is actively pursuing environmental sustainability, focusing on innovation to minimize its ecological footprint. This commitment is crucial as stakeholders, including investors and regulators, increasingly demand evidence of corporate environmental responsibility. For instance, in 2023, the company reported a reduction in its greenhouse gas emissions intensity by 5% compared to the previous year, demonstrating tangible progress in its sustainability efforts.

The company's strategic direction emphasizes creating long-term value through technologies that inherently reduce environmental impact. This includes investing in processes that use less energy and generate fewer byproducts. Ferroglobe's sustainability report for the first half of 2024 highlighted a 7% decrease in water consumption per ton of product manufactured across its key operations.

- Focus on reducing greenhouse gas emissions: Ferroglobe aims to cut its carbon intensity, with a 5% reduction reported in 2023.

- Water conservation efforts: The company achieved a 7% decrease in water usage per ton of product in early 2024.

- Investment in eco-friendly technologies: Ferroglobe is prioritizing process innovations that lessen environmental impact.

- Stakeholder pressure for ESG performance: Increasing scrutiny from investors and the public drives the company's sustainability agenda.

Ferroglobe's operations are heavily influenced by environmental regulations and the global push for sustainability. The company's energy-intensive production of silicon metal and ferroalloys means it's closely monitored for emissions and resource consumption. For example, the European Union's stringent environmental directives, like the Industrial Emissions Directive, continue to shape operational requirements, pushing for investments in cleaner technologies and waste management. This regulatory landscape directly impacts production costs and necessitates ongoing adaptation.

The growing demand for renewable energy, particularly solar power, presents a significant environmental tailwind for Ferroglobe. Silicon metal is a critical component in photovoltaic cells, and the rapid expansion of solar capacity globally, projected to exceed 3,000 GW by 2030, directly fuels demand for Ferroglobe's products. This trend underscores the importance of the company's commitment to reducing its own environmental footprint to align with the values of its key customer base and the broader energy transition.

Ferroglobe is actively investing in sustainability initiatives. In 2023, the company reported a 5% reduction in greenhouse gas emissions intensity, and by the first half of 2024, it achieved a 7% decrease in water consumption per ton of product. These efforts reflect a strategic focus on eco-friendly technologies and responsible resource management, driven by both regulatory pressures and increasing investor and stakeholder scrutiny on ESG performance.

| Environmental Factor | Impact on Ferroglobe | Key Data/Trend |

|---|---|---|

| Energy Intensity & Emissions | High operational costs, regulatory compliance needs | EU Industrial Emissions Directive enforcement |

| Renewable Energy Demand | Increased demand for silicon metal | Global solar capacity to exceed 3,000 GW by 2030 |

| Sustainability Initiatives | Enhanced brand reputation, investor appeal | 5% GHG emission intensity reduction (2023), 7% water use reduction (H1 2024) |

PESTLE Analysis Data Sources

Our Ferroglobe PESTLE analysis is built upon a robust foundation of data from official government publications, leading financial institutions, and reputable industry-specific market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the ferroalloy sector.