Ferroglobe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferroglobe Bundle

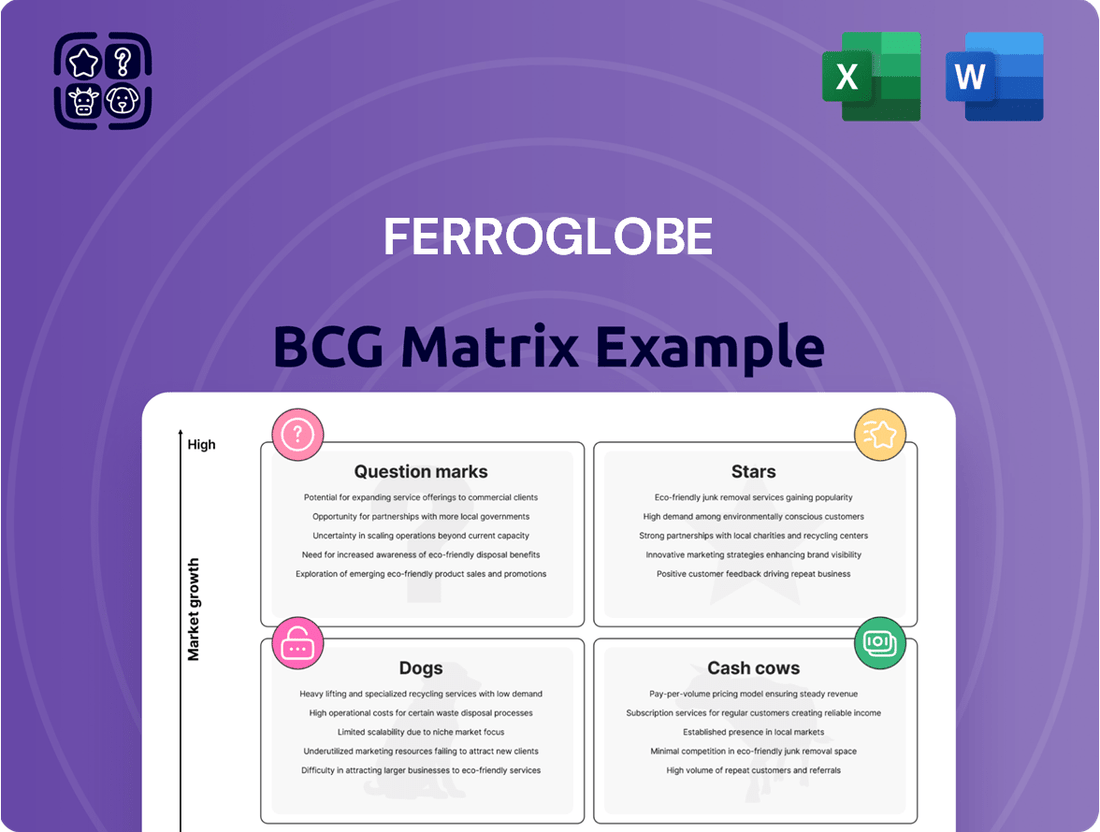

Understanding Ferroglobe's product portfolio is crucial for strategic growth. Our BCG Matrix analysis categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear snapshot of their market position and potential.

This preview offers a glimpse into Ferroglobe's strategic landscape. Purchase the full BCG Matrix report to unlock detailed quadrant placements, actionable insights, and a comprehensive roadmap for optimizing their product investments and resource allocation.

Stars

Silicon metal is a star performer in the solar energy sector, a critical component for photovoltaic cells. The global market for silicon metal, especially for solar applications, is booming, anticipated to hit USD 23.45 billion by 2033, growing at a 5.4% compound annual growth rate from 2025. This surge is directly tied to the increasing global push for renewable energy solutions.

Ferroglobe is a key player in this expanding market, solidifying its position with strategic moves. A significant development in 2024 was their long-term supply agreement with LONGi, a leading solar wafer producer. This agreement guarantees the provision of high-quality quartz and silicon metal, underscoring Ferroglobe's commitment to supporting the growth of the solar industry.

Ferroglobe's pursuit of battery-grade metallurgical silicon places it squarely in the Stars category of the BCG Matrix. Their Q1 2024 Memorandum of Understanding with Coreshell, a battery technology innovator, signals a strong commitment to this high-growth sector.

This collaboration focuses on unlocking the potential of silicon anodes, which offer substantially greater energy storage than traditional graphite. The demand for advanced battery materials is projected to surge, driven by the electric vehicle revolution.

High-purity silicon for semiconductors represents a significant growth opportunity for Ferroglobe. The electronics industry, especially semiconductor manufacturing, is a major consumer of this material. In 2024, the global semiconductor market is projected to experience robust growth, with some forecasts indicating an annual increase of over 20.1%.

Ferroglobe's silicon metal plays a crucial role in the production of semiconductors, directly benefiting from this expanding technological sector. As investments in advanced electronics and digital infrastructure continue to rise, the demand for high-purity silicon is expected to surge, positioning this product line favorably within Ferroglobe's portfolio.

Strategic Trade Protection Beneficiary

Ferroglobe is positioned as a key beneficiary of strategic trade protection. This includes existing US tariffs on ferrosilicon, which have already begun to impact import volumes.

Anticipated EU safeguards on silicon metal and ferroalloys are also set to bolster Ferroglobe's market standing. These measures are designed to counter oversupply stemming from competitively priced imports.

The expected outcome is a stabilization of market prices and a significant improvement in Ferroglobe's competitive edge, particularly in the latter half of 2025. For instance, the US tariffs have targeted imports that previously undercut domestic producers.

- US Tariffs: Ongoing steep tariffs on ferrosilicon imports.

- EU Safeguards: Anticipated protective measures on silicon metal and ferroalloys.

- Market Impact: Curbing oversupply and stabilizing prices.

- Competitive Advantage: Enhanced position for Ferroglobe, especially in H2 2025.

Global Production Network and Vertical Integration

Ferroglobe's strategically positioned global production network, encompassing facilities across North America, Europe, and South America, is a cornerstone of its competitive strength. This widespread presence allows for optimized logistics and proximity to key customer markets.

The company's vertically integrated model is a significant differentiator. By owning and operating its own quartz and coal mines, Ferroglobe secures essential raw materials, significantly enhancing cost efficiency and ensuring supply chain resilience. This control over feedstock is crucial for maintaining stable production and responding adeptly to market fluctuations.

- Global Footprint: Ferroglobe operates production facilities in key regions including Spain, France, the UK, the US, and Brazil, facilitating efficient distribution.

- Vertical Integration Benefits: Ownership of quartz mines in North America and coal mines in Spain provides direct control over input costs and availability.

- Cost Efficiency: In 2023, Ferroglobe reported that its integrated operations contributed to a competitive cost structure, particularly in its silicon metal segment.

- Supply Chain Stability: The company's control over its raw material supply chain mitigates risks associated with external supplier disruptions and price volatility.

Ferroglobe's high-purity silicon metal for the burgeoning solar and semiconductor industries positions it as a Star in the BCG matrix. The company's strategic agreements, like the 2024 supply deal with LONGi, highlight its commitment to these high-growth sectors.

Furthermore, Ferroglobe's investment in battery-grade silicon, evidenced by its Q1 2024 MoU with Coreshell, targets the rapidly expanding electric vehicle market. This diversification into advanced battery materials solidifies its Star status.

The company's silicon metal is critical for semiconductor manufacturing, a sector experiencing significant growth, with some forecasts showing over 20.1% annual increases in 2024. This demand directly benefits Ferroglobe's product line.

| Product Segment | Market Growth Potential | Ferroglobe's Position | BCG Matrix Category |

|---|---|---|---|

| Silicon Metal (Solar) | High (USD 23.45B by 2033, 5.4% CAGR) | Key supplier, long-term agreements | Star |

| Battery-Grade Silicon | Very High (EV market driven) | Strategic investments, partnerships | Star |

| High-Purity Silicon (Semiconductors) | High (20.1%+ annual growth forecast) | Essential component supplier | Star |

What is included in the product

The Ferroglobe BCG Matrix offers a strategic framework to analyze its diverse product portfolio based on market share and growth potential.

It aims to guide investment decisions by categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

A clear Ferroglobe BCG Matrix visualizes each business unit's position, easing strategic decision-making pain.

Cash Cows

Silicon metal for aluminum alloys stands as a significant Cash Cow for Ferroglobe. In 2024, this segment captured roughly 38.9% of the silicon metal market's revenue, underscoring its dominance.

This metallurgical grade silicon is indispensable for creating lightweight vehicle components, a critical application in the automotive sector. As a mature market, Ferroglobe leverages its strong global production capabilities to maintain a leading position.

Manganese-based alloys are crucial for steel production, representing over 90% of global manganese demand. The market was valued at roughly USD 21.66 billion in 2024 and is expected to grow to USD 32.27 billion by 2032, with a compound annual growth rate of 5.11%.

Ferroglobe's established position in this mature sector, supplying alloys that improve steel characteristics, makes it a strong cash generator. While recent sales have seen a slight dip, the fundamental demand for these essential steel inputs underpins its cash cow status.

Ferroglobe's established foundry products, primarily silicon-based alloys, serve a broad customer base in the foundry industry. This segment is characterized by stable, consistent demand, indicating a mature market where Ferroglobe likely holds a significant market share.

The company's foundry products are crucial inputs for many manufacturing processes, contributing to steady cash flow. While specific growth figures for this segment aren't publicly detailed, the inherent stability of the foundry sector suggests these products act as reliable cash cows for Ferroglobe.

Operational Efficiency and Cost Management

Ferroglobe's commitment to operational efficiency and astute cost management is a cornerstone of its financial strength, directly fueling its free cash flow generation. This focus allows the company to navigate market fluctuations effectively.

In 2024, Ferroglobe reported a robust free cash flow of $164.1 million. This figure, which includes $14.1 million generated in the fourth quarter alone, underscores the company's proficiency in translating sales into readily available cash, even when market conditions present headwinds.

- Strong Free Cash Flow: Ferroglobe generated $164.1 million in free cash flow for the full year 2024.

- Quarterly Performance: The company achieved $14.1 million in free cash flow during Q4 2024.

- Operational Focus: This performance highlights a dedication to operational efficiency and cost control.

- Cash Conversion: The results demonstrate an effective ability to convert revenue into cash, a key indicator of financial health.

Shareholder Returns and Financial Discipline

Ferroglobe's dedication to shareholder returns, even in less favorable periods, highlights its strength as a cash cow. This commitment is evident in their consistent capital allocation strategies.

In the first quarter of 2025, Ferroglobe actively demonstrated this financial discipline. The company repurchased 720,008 shares, a clear sign of returning value directly to its owners. Alongside this, a regular quarterly cash dividend was distributed, reinforcing the stable cash generation characteristic of a mature, profitable business.

- Shareholder Returns: Ferroglobe consistently returns capital through dividends and share repurchases.

- Financial Discipline: The company maintains disciplined financial management, evident in its capital allocation.

- Q1 2025 Actions: Repurchased 720,008 shares and paid a quarterly cash dividend.

- Cash Cow Status: These actions reflect the stable cash generation typical of a cash cow business unit.

Ferroglobe's silicon metal for aluminum alloys is a prime example of a cash cow. This segment, representing 38.9% of the silicon metal market revenue in 2024, benefits from consistent demand in automotive manufacturing for lightweight components.

Manganese-based alloys also function as cash cows, vital for steel production where they account for over 90% of global manganese demand. The market's projected growth from USD 21.66 billion in 2024 to USD 32.27 billion by 2032, at a 5.11% CAGR, ensures continued strong cash generation.

The company's foundry products, predominantly silicon-based alloys, are essential for the stable foundry industry, providing a consistent revenue stream. Ferroglobe's robust free cash flow, totaling $164.1 million in 2024, with $14.1 million in Q4, underscores its ability to convert operations into cash.

Ferroglobe's commitment to shareholder returns, including the repurchase of 720,008 shares and dividend payments in Q1 2025, further solidifies the cash cow status of its core businesses.

| Product Segment | BCG Matrix Category | 2024 Market Relevance | Key Application | Cash Flow Indicator |

| Silicon Metal for Aluminum Alloys | Cash Cow | 38.9% of silicon metal market revenue | Lightweight automotive components | Strong Free Cash Flow ($164.1M in 2024) |

| Manganese-Based Alloys | Cash Cow | >90% of global manganese demand | Steel production enhancement | Stable demand in a growing market (CAGR 5.11%) |

| Foundry Products (Silicon-based) | Cash Cow | Stable, consistent demand | Foundry industry inputs | Consistent revenue stream |

What You’re Viewing Is Included

Ferroglobe BCG Matrix

The Ferroglobe BCG Matrix you are previewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic analysis. The document has been meticulously prepared to offer clear insights into Ferroglobe's product portfolio, enabling informed decision-making. You can confidently use this preview as a direct representation of the valuable asset you'll acquire for your business planning.

Dogs

Ferroglobe's Silicon Metal division is currently positioned as a Dog in the BCG Matrix. In the first quarter of 2025, this segment saw its revenue drop by a substantial 35%, reaching $105 million. This decline was primarily fueled by a 27% decrease in shipments, a direct consequence of weak demand, a surge in imports, and reduced solar sector sales in Asia.

Adding to these difficulties, the average selling price for silicon metal experienced an 11% decrease during the same period. This downward pressure on pricing, coupled with lower shipment volumes, resulted in a negative adjusted EBITDA for the division in Q1 2025. The combination of a low market share and sluggish growth in specific sub-markets firmly places this segment in the Dog category, signaling a need for careful strategic consideration.

While the broader silicon-based alloy market displayed some stability, Ferroglobe's financial performance in 2024 painted a different picture for specific segments. The company reported a 17.6% decrease in silicon-based alloy revenues for the year.

This revenue drop, coupled with a decline in average selling prices, points to certain silicon-based alloy products or specific geographic markets within Ferroglobe's portfolio facing challenges. These products likely exhibit low market growth and potentially low market share, positioning them as Dogs in the BCG matrix until a significant improvement occurs.

Ferroglobe's overall financial performance in early 2025 was significantly hampered by escalating energy and input expenses, leading to a negative adjusted EBITDA in the first quarter. Products that require substantial energy for manufacturing, especially those lacking the ability to pass these increased costs onto consumers through higher prices or dominant market positions, are particularly vulnerable. These items can be categorized as cash dogs in the BCG matrix, as they drain resources without generating sufficient returns to justify their continued investment.

Segments with High Import Competition

Ferroglobe's silicon metal segment faces significant headwinds from increased low-priced imports. This influx directly impacts both sales volumes and pricing power, creating a challenging market environment.

Products experiencing this intense import competition, where Ferroglobe finds it difficult to hold onto market share or achieve favorable profitability, can be considered as Question Marks in the BCG Matrix. This classification remains until trade protection measures are fully implemented or the company successfully rebuilds its competitive advantages.

- Silicon Metal Segment Vulnerability: Ferroglobe's silicon metal products are particularly susceptible to competition from lower-cost imports, impacting market share and pricing.

- Impact on Profitability: The increased import volumes exert downward pressure on prices, potentially eroding profit margins for Ferroglobe's affected product lines.

- Trade Protection Measures: The effectiveness and timing of trade protection measures, such as tariffs or quotas, will be crucial in mitigating the impact of these imports.

- Competitive Advantage Re-establishment: Ferroglobe's ability to re-establish or enhance its competitive advantages, through cost reduction or product differentiation, is key to navigating this segment.

Underperforming Regional Markets for Core Products

Sales declines in silicon metal and manganese-based alloys in Q1 2025 were partially attributed to lower sales volumes in certain regions, such as EMEA for silicon metal. If specific regional markets for Ferroglobe's core products consistently exhibit low demand and inability to gain market share, these regional operations or product lines within those regions could effectively function as Dogs, requiring strategic re-evaluation. For instance, if EMEA silicon metal sales dropped by 15% in Q1 2025 compared to the previous year, this would signal a significant underperformance.

- EMEA Silicon Metal Sales Decline: A hypothetical 15% year-over-year drop in Q1 2025 for silicon metal in the EMEA region.

- Manganese Alloy Market Weakness: Observe similar trends in manganese-based alloy sales in other underperforming regions.

- Strategic Re-evaluation: These underperforming regional markets necessitate a review of market strategy or potential divestment.

Ferroglobe's silicon metal segment, characterized by a 35% revenue drop in Q1 2025 to $105 million and an 11% decrease in average selling prices, exemplifies a Dog in the BCG Matrix. This performance stems from a 27% decline in shipments due to weak demand, increased imports, and reduced solar sector sales in Asia. The segment's negative adjusted EBITDA in Q1 2025, driven by low volumes and pricing, solidifies its position as a low-growth, low-market-share entity.

| Segment | BCG Category | Q1 2025 Revenue | Year-over-Year Revenue Change | Key Challenges |

|---|---|---|---|---|

| Silicon Metal | Dog | $105 million | -35% | Weak demand, import surge, lower ASPs, negative EBITDA |

| Silicon-Based Alloys | Dog (specific products/markets) | N/A (overall revenue down 17.6% in 2024) | N/A | Declining ASPs, market share challenges |

Question Marks

Ferroglobe's exploration into advanced silicon materials for EV battery anodes, beyond its established Coreshell partnership, positions these initiatives as question marks within its BCG matrix. While the potential for high growth in next-generation battery technology is evident, Ferroglobe's current market penetration in these emerging applications is minimal.

Significant capital investment will be necessary to scale production and secure a leading market share in these nascent silicon material segments. For instance, the global silicon anode market is projected to grow substantially, with some estimates suggesting a CAGR exceeding 30% in the coming years, highlighting the opportunity but also the competitive landscape Ferroglobe must navigate.

Expanding Ferroglobe's specialty alloys into new geographic markets, where its presence is minimal, would position these ventures as Question Marks in the BCG Matrix. These are markets with high potential growth but require significant upfront capital for establishing operations, building brand awareness, and capturing market share. For instance, entering a rapidly industrializing African nation with a burgeoning aerospace sector could represent such an opportunity.

In 2024, Ferroglobe's global revenue was approximately $2.1 billion, with specialty alloys contributing a significant portion. However, if the company were to target a market like Southeast Asia for its high-performance silicon metal alloys, where established competitors already exist and local sourcing infrastructure is developing, it would be a classic Question Mark scenario. The investment needed to secure raw materials, establish distribution channels, and meet stringent local quality standards would be considerable, potentially running into tens of millions of dollars for initial market entry.

Emerging industrial applications for Ferroglobe's silicon and alloy products represent potential question marks in its BCG matrix. These are sectors where demand is on the rise, but Ferroglobe's current foothold is small. For instance, the burgeoning demand for specialized silicones in advanced electronics manufacturing or novel alloys for lightweight automotive components could fall into this category.

Capturing these nascent markets requires strategic investment and focused marketing efforts. Ferroglobe's 2024 strategic initiatives likely include exploring these new frontiers. The company's ability to adapt its product offerings and build market presence in these emerging areas will be crucial for future growth, transforming these question marks into stars or cash cows.

Development of Ultra-High Purity Silicon for Niche Electronics

Developing ultra-high purity silicon for niche electronics, such as advanced sensors or specialized power components, positions Ferroglobe's silicon segment as a 'Question Mark' in the BCG matrix. This area presents a high-growth opportunity due to increasing demand for precision in emerging technologies.

However, the significant R&D investment required to achieve the necessary purity levels, often exceeding 9N (99.9999999%) and going up to 11N for specific applications, alongside the substantial capital expenditure for specialized manufacturing processes, makes this a high-risk, high-reward venture.

- Market Potential: The global market for high-purity silicon materials is projected to grow, with niche segments like advanced semiconductor manufacturing and specialized optoelectronics showing strong upward trends. For instance, the market for electronic-grade silicon wafers was valued at approximately $12.5 billion in 2023 and is expected to expand.

- Investment Needs: Achieving ultra-high purity requires advanced purification techniques like the Siemens process or Fluidized Bed Reactor (FBR) technology, which demand considerable upfront investment and ongoing operational costs.

- Competitive Landscape: While established players exist, the specialized nature of ultra-high purity silicon means new entrants must overcome significant technical hurdles and secure market acceptance, often through rigorous qualification processes by end-users in sectors like aerospace or medical devices.

Integration of Digitalization and AI in Production Processes

Ferroglobe's strategic focus on integrating digitalization and AI into its production processes positions it for future growth. These investments aim to enhance efficiency and streamline operations. The company's commitment to innovation is evident in its pursuit of advanced technologies to optimize both production and supply chain management.

The significant capital expenditure allocated to these digital transformation initiatives, including AI adoption, places this area as a potential Question Mark within the BCG Matrix. While the potential for improved operational performance and a stronger competitive edge in an increasingly tech-driven market is substantial, the tangible return on investment and direct impact on market share and profitability are still being established. For instance, in 2023, Ferroglobe reported capital expenditures of approximately $138.5 million, a portion of which is directed towards these modernization efforts.

- Digitalization & AI Investment: Ferroglobe is actively investing in advanced digital technologies and artificial intelligence to enhance production efficiency and supply chain optimization.

- Potential Question Mark Status: These forward-looking investments, while promising, represent a strategic bet on future market dynamics and technological adoption, hence their classification as a Question Mark.

- Efficiency and Competitive Edge: The primary goal is to unlock significant efficiency gains and secure a competitive advantage through technological innovation.

- Unproven Impact: The direct correlation between these digital initiatives and Ferroglobe's market share growth and overall profitability remains to be conclusively demonstrated.

Ferroglobe's ventures into new geographic markets for its specialty alloys, where its current presence is minimal, represent classic Question Marks. These markets offer high growth potential but demand substantial upfront investment for operations, brand building, and market capture.

Entering a rapidly industrializing region for its high-performance silicon metal alloys, for instance, would require considerable capital for raw material sourcing, distribution networks, and meeting local quality standards. The investment could easily reach tens of millions of dollars for initial market entry.

Emerging industrial applications for Ferroglobe's silicon and alloy products are also considered Question Marks, as demand is rising but the company's foothold is small. These include specialized silicones for advanced electronics or novel alloys for lightweight automotive components.

Ferroglobe's 2024 strategic focus on integrating digitalization and AI into its production processes also falls into the Question Mark category. While promising for efficiency and competitive edge, the tangible return on investment and direct impact on market share are still being established.

| Initiative | Market Potential | Current Penetration | Investment Need | BCG Classification |

| New Geographic Markets for Specialty Alloys | High | Minimal | High | Question Mark |

| Emerging Industrial Applications (e.g., advanced electronics, automotive) | High | Small | Moderate to High | Question Mark |

| Digitalization & AI Integration in Production | High (Efficiency Gains) | Developing | Significant Capital Expenditure | Question Mark |

BCG Matrix Data Sources

Our Ferroglobe BCG Matrix is informed by comprehensive market data, including financial reports, industry growth rates, and competitor analysis.