Ferroglobe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferroglobe Bundle

Ferroglobe operates in a market characterized by moderate buyer power and significant supplier leverage, particularly for key raw materials. The threat of new entrants is somewhat limited due to capital intensity and established relationships. Understanding these dynamics is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Ferroglobe’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ferroglobe's silicon metal and ferroalloy production demands substantial energy, leaving the company vulnerable to energy price swings. This dependency directly impacts its bottom line.

The reality of this vulnerability was starkly illustrated in the first quarter of 2025. During this period, elevated energy expenses directly contributed to a negative adjusted EBITDA, underscoring the considerable leverage energy suppliers hold over Ferroglobe's profitability.

To bolster its financial health, Ferroglobe must prioritize stabilizing its energy expenditures. This could involve securing more advantageous long-term energy supply agreements, which would provide greater predictability and potentially lower costs.

Ferroglobe's reliance on external suppliers for critical raw materials like silicon coal, electrodes, charcoal, and petroleum coke, alongside manganese ore, highlights a significant aspect of supplier bargaining power. While the company has some captive sources, such as its quartz mines and metallurgical coal operations, the need for these external inputs means that supplier pricing and availability directly influence Ferroglobe's cost structure and operational efficiency.

The pricing of these essential materials, particularly silicon coal, experienced a general decline throughout 2024. This downward trend offered Ferroglobe some cost relief. However, the impact on profitability was somewhat tempered as overall silicon prices fell at a faster rate, eroding some of the benefits from lower raw material costs.

Further illustrating the challenges, delays in the supply of manganese ore during the first quarter of 2025 had a tangible negative effect on the company's manganese segment volumes, underscoring the direct impact that supplier performance can have on operational output and financial results.

Ferroglobe's strategic vertical integration, encompassing ownership of quartz mines in Spain, the U.S., Canada, and South Africa, alongside in-house metallurgical coal mining, significantly curtails supplier power. This control over crucial raw materials ensures a more stable and potentially cost-effective supply chain for these essential inputs.

Limited substitutes for primary raw materials

For Ferroglobe's core operations, which involve producing silicon metal and ferroalloys, the primary raw materials such as silica, carbon-based reducing agents, and specific ores have very few direct substitutes. This scarcity of alternatives significantly strengthens the negotiating position of suppliers who can provide these essential inputs, particularly for the high-quality or specialized grades that Ferroglobe requires.

This situation directly translates into increased costs for Ferroglobe. For instance, in 2024, the global price of metallurgical-grade silicon, a key input, saw fluctuations driven by supply chain constraints and demand from various industries. Suppliers of high-purity silica, crucial for advanced silicon production, often command premium pricing due to limited availability of deposits meeting stringent quality standards.

- Limited Substitutes: The fundamental inputs for silicon metal and ferroalloy production, like specific grades of silica and carbon, lack readily available alternatives.

- Supplier Power: This lack of substitutes grants specialized raw material providers considerable leverage in price negotiations.

- Cost Impact: Ferroglobe faces potential cost increases as suppliers can charge more for essential, hard-to-replace materials.

- Quality Dependence: The reliance on specific material grades further concentrates power among suppliers capable of meeting these precise requirements.

Geopolitical factors influencing supply chains

Geopolitical tensions and evolving trade policies significantly disrupt global supply chains, impacting raw material availability and cost for companies like Ferroglobe. These external pressures can indirectly bolster supplier power, particularly for those in regions less affected by conflict or with strategically vital resources.

The ferroalloys industry, a key sector for Ferroglobe, has indeed experienced notable disruptions due to geopolitical events and raw material supply chain issues. For instance, trade disputes and sanctions in various regions have led to increased volatility in the pricing and accessibility of essential inputs like manganese ore and silicon metal.

- Geopolitical Tensions: Recent years have seen heightened geopolitical instability, impacting key mining regions and transportation routes crucial for raw material sourcing.

- Trade Policies: Tariffs and trade barriers implemented by major economies can alter the cost-effectiveness of sourcing from different countries, favoring suppliers in unaffected or strategically aligned nations.

- Supply Chain Resilience: Companies are increasingly focusing on supply chain resilience, which can lead to diversification of sourcing, potentially increasing the bargaining power of alternative suppliers.

- Raw Material Volatility: The global ferroalloys market, for example, experienced significant price swings in 2023 and early 2024, partly driven by supply concerns linked to geopolitical events.

Ferroglobe's reliance on specialized raw materials with few substitutes, like high-purity silica and carbon reductants, significantly amplifies supplier bargaining power. This dependence means suppliers of these critical inputs can dictate terms and prices, directly impacting Ferroglobe's cost structure and operational efficiency. The limited availability of high-quality deposits further concentrates this power among a select group of providers.

The company's efforts to mitigate this include vertical integration, such as owning quartz mines, which reduces reliance on external suppliers for certain key inputs. However, for materials where this integration is not complete, like specific grades of manganese ore, supplier performance and pricing remain critical factors influencing Ferroglobe's output and financial results, as seen with Q1 2025 manganese segment volume impacts.

Geopolitical events and evolving trade policies also play a crucial role, indirectly strengthening supplier power by disrupting global supply chains and creating price volatility. For instance, trade disputes in 2023 and early 2024 impacted the accessibility and pricing of inputs like manganese ore, highlighting how external factors can exacerbate supplier leverage.

| Raw Material | Supplier Bargaining Power Factor | Impact on Ferroglobe | 2024 Price Trend (General) |

|---|---|---|---|

| High-Purity Silica | Limited Substitutes, Quality Dependence | Increased input costs, potential production constraints | Fluctuating, premium for high-quality |

| Carbon Reductants (e.g., Charcoal, Petroleum Coke) | Limited Substitutes, Specialized Grades | Higher operating expenses, negotiation leverage for suppliers | Varied, some downward pressure |

| Manganese Ore | Geopolitical Sensitivity, Supply Chain Disruptions | Volume impacts, price volatility, operational disruptions | Volatile, influenced by global events |

What is included in the product

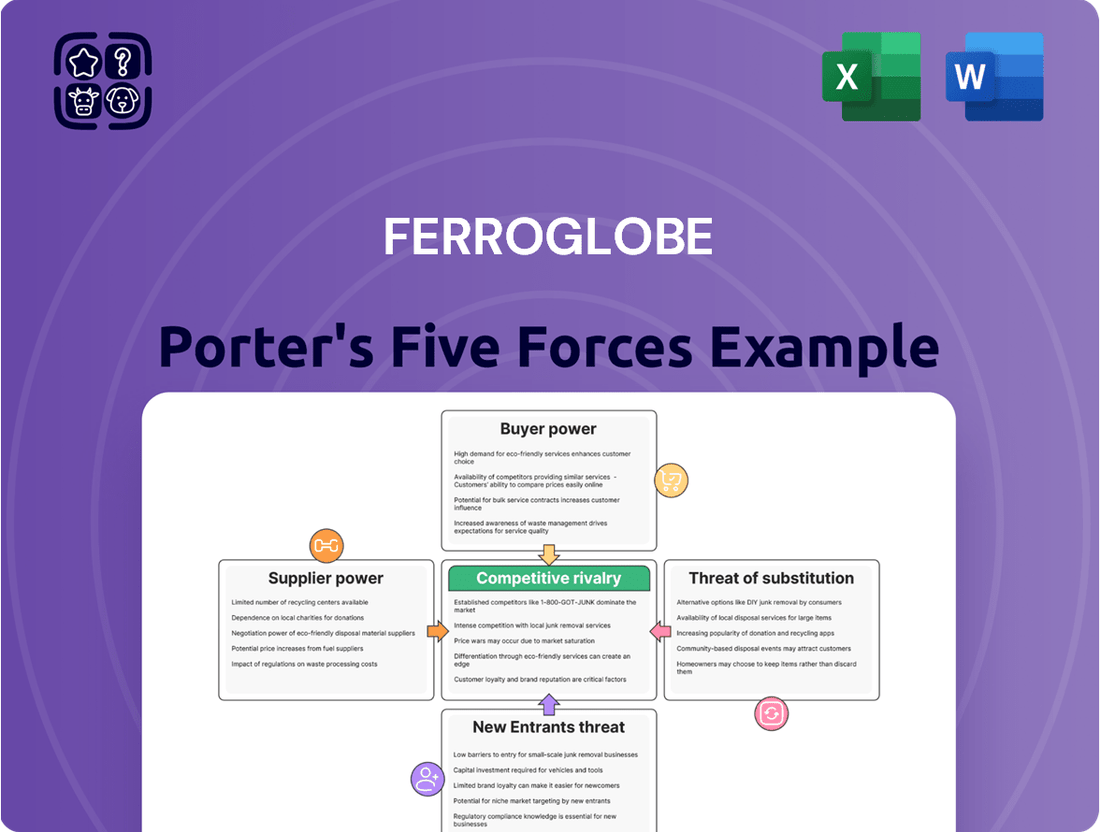

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ferroglobe's position in the silicon metal and ferroalloys industry.

Quickly identify competitive pressures with a visual breakdown of Ferroglobe's industry landscape, streamlining strategic planning.

Customers Bargaining Power

Ferroglobe's diverse customer base, spanning industries like chemical products, aluminum, steel, solar energy, automotive, and foundries, significantly dilutes the bargaining power of individual customers. This broad distribution means that no single client represents an overwhelmingly large percentage of Ferroglobe's total revenue, thereby limiting the leverage any one customer can exert.

The commodity nature of silicon metal and ferroalloys significantly amplifies customer price sensitivity. When products are largely undifferentiated, buyers naturally focus on price as the primary decision-making factor.

Ferroglobe's Q1 2025 performance clearly illustrates this. The company reported substantial drops in realized prices and weak demand, which directly translated into lower revenue and negative adjusted EBITDA. This financial outcome highlights how keenly customers react to price changes in a market where switching costs are low.

The global silicon metal and ferroalloys markets are characterized by a wide array of producers, with China standing out as a particularly dominant force. This abundance of suppliers means that buyers frequently have several choices for obtaining these essential materials.

This competitive landscape directly translates into enhanced bargaining power for customers. They are empowered to negotiate for more favorable pricing and improved terms of trade, as they can readily switch to alternative suppliers if their demands are not met.

In 2023, China's share in global silicon metal production was estimated to be over 70%, underscoring the significant leverage customers have when sourcing from this region. This concentration of supply, paradoxically, fuels customer power due to the sheer volume of available options.

Demand fluctuations in key end-user industries impact sales

Ferroglobe's revenue is significantly influenced by demand shifts in crucial sectors like aluminum, steel, and construction. When these industries experience a slowdown, it directly impacts Ferroglobe's sales volumes and pricing power.

For instance, a downturn in construction activity can lead to reduced demand for silicon metal, a key component in many building materials. This weaker demand environment allows customers to negotiate more favorable terms, thus increasing their bargaining power.

- Demand Sensitivity: Ferroglobe's sales are closely tied to the performance of the aluminum, steel, and construction industries.

- Impact of Weak Demand: Reduced demand in these end-user markets, as observed in early 2025, leads to lower shipment volumes and price concessions.

- Customer Leverage: During periods of weak demand, customers gain increased leverage to negotiate better prices and terms from Ferroglobe.

Trade measures may stabilize pricing for Ferroglobe

Recent regulatory actions, like anti-dumping and countervailing duties implemented in the U.S. market, are designed to limit the influx of unfairly priced imports into the silicon metal sector. These measures, alongside potential safeguard actions being considered in Europe, aim to create a more stable pricing environment.

If these trade interventions prove effective, they are anticipated to bolster Ferroglobe's market standing by mitigating the pressure from low-cost competitors. This stabilization could lead to improved pricing power for Ferroglobe, consequently diminishing the leverage that customers currently hold in price negotiations.

- U.S. Trade Measures: The U.S. International Trade Commission (USITC) has initiated investigations into silicon metal imports from various countries, with preliminary determinations in some cases finding material injury to the domestic industry.

- European Union Considerations: The European Commission has been reviewing the silicon metal market, with industry stakeholders advocating for protective measures against subsidized imports that depress local prices.

- Impact on Pricing: Stabilization of import prices due to these duties could allow Ferroglobe to maintain more consistent and potentially higher selling prices for its silicon metal products.

- Customer Leverage: A reduction in the availability of significantly cheaper imported silicon metal would lessen customers' ability to demand lower prices, thereby strengthening Ferroglobe's bargaining position.

Ferroglobe's diverse customer base across industries like aluminum, steel, and solar energy limits the power of any single buyer. However, the commodity nature of its products, particularly silicon metal, makes customers highly sensitive to price. This sensitivity was evident in early 2025, with significant price drops and weak demand impacting Ferroglobe's financial performance, underscoring customers' ability to leverage market conditions.

The global market's oversupply, especially from China which accounted for over 70% of silicon metal production in 2023, further empowers customers. They can easily switch suppliers, demanding more favorable terms. Recent U.S. anti-dumping investigations and potential EU safeguard actions aim to stabilize prices by curbing low-cost imports, which could reduce customer leverage by creating a more predictable pricing environment.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

| Customer Diversification | Lowers individual customer power | Broad customer base across multiple industries |

| Product Commoditization | Increases price sensitivity | Silicon metal and ferroalloys are largely undifferentiated |

| Market Supply Dynamics | Increases customer power | China's >70% share of 2023 silicon metal production |

| Demand Fluctuations | Increases customer power during downturns | Q1 2025 saw significant price drops and weak demand |

| Trade Regulations | Potential to decrease customer power | U.S. anti-dumping investigations, EU safeguard considerations |

What You See Is What You Get

Ferroglobe Porter's Five Forces Analysis

This preview showcases the complete Ferroglobe Porter's Five Forces Analysis, detailing the competitive landscape of the silicon and specialty metals industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors within this sector. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

Ferroglobe operates within a highly fragmented global market for ferroalloys and silicon metal. This means there are many companies competing, from large international corporations to smaller, local producers. This sheer number of players significantly ramps up the intensity of competition as everyone battles to capture a piece of the market.

Key rivals for Ferroglobe include established names like Elkem, Mississippi Silicon, Rusal, Hoshine Silicon Industry, and Tata Steel. In 2023, the global silicon metal market alone was valued at approximately $7.5 billion, showcasing the scale of this competitive arena. This intense rivalry often leads to price pressures and a constant need for innovation and efficiency to maintain market position.

The silicon metal and ferroalloy markets are characterized by a high degree of commoditization, meaning products are largely undifferentiated. Consequently, competition frequently centers on price, leading to aggressive price wars, particularly when demand falters or supply outstrips needs. This dynamic can significantly squeeze profit margins across the industry, as evidenced by Ferroglobe's reported margin compression in early 2025.

The global ferroalloy industry, including silicon metal, is grappling with significant overcapacity, largely driven by China's substantial production. This excess supply creates a challenging environment for companies like Ferroglobe, as it fuels a steady stream of low-priced imports. These imports directly impact pricing power and sales volumes in Ferroglobe's core markets, intensifying competitive pressures.

Trade protectionism and regulatory measures

Increasing protectionist measures, such as anti-dumping and countervailing duties in the U.S., are actively shaping the competitive landscape for silicon metal producers. These trade policies are designed to address unfair trade practices, potentially leading to more stable pricing and offering a competitive advantage to domestic manufacturers like Ferroglobe by mitigating the impact of subsidized imports.

Potential safeguard rulings in Europe also contribute to this evolving trade environment. By leveling the playing field, these regulatory actions can reduce the intensity of competition from foreign producers, thereby benefiting companies that adhere to fair trade principles.

- U.S. Imports of Silicon Metal: In 2023, the U.S. imported approximately 200,000 metric tons of silicon metal, with significant volumes originating from countries facing scrutiny for trade practices.

- European Commission Investigations: As of early 2024, the European Commission was reviewing several trade defense measures concerning silicon metal imports, indicating a proactive stance on ensuring fair market competition.

- Impact on Pricing: The implementation of duties can lead to an increase in the landed cost of imported silicon metal, which historically has benefited domestic producers by allowing for more competitive pricing strategies.

Demand growth in key sectors drives competition

The silicon metal and ferroalloys markets are poised for significant expansion, fueled by escalating demand from burgeoning sectors like electric vehicles (EVs), renewable energy infrastructure, and global infrastructure projects. For instance, the global silicon metal market was valued at approximately $8.5 billion in 2023 and is projected to reach over $13 billion by 2030, demonstrating robust compound annual growth. This robust growth trajectory, while creating substantial opportunities, simultaneously sharpens competitive pressures. Existing market participants are actively scaling up their operations to capitalize on this demand, while the attractive market outlook also entices new entrants, further intensifying the rivalry.

This heightened competition manifests in several ways:

- Price Wars: Increased supply as companies expand capacity can lead to price competition as players vie for market share.

- Innovation Race: Companies are investing in R&D to develop more efficient production methods and higher-grade products to differentiate themselves.

- Strategic Alliances: To secure raw materials and market access, companies may form partnerships or joint ventures.

- Mergers and Acquisitions: Consolidation is likely as larger players acquire smaller ones to gain scale and market dominance in response to growing demand.

Ferroglobe faces intense competition from numerous global players in the fragmented ferroalloy and silicon metal markets. Key rivals like Elkem and Mississippi Silicon contribute to this rivalry, which is often driven by price due to the commoditized nature of the products. Overcapacity, particularly from China, further intensifies price pressures and impacts sales volumes.

Trade policies, such as U.S. anti-dumping duties and potential European safeguard measures, are reshaping the competitive landscape. These actions aim to level the playing field, potentially benefiting domestic producers like Ferroglobe by mitigating the impact of unfairly priced imports.

The growing demand from sectors like EVs and renewable energy, with the silicon metal market projected to exceed $13 billion by 2030, fuels this competition. Companies are responding by expanding capacity, investing in innovation, and pursuing strategic alliances or acquisitions to gain market share.

| Competitor | Key Products | 2023 Market Share (Est.) | Key Strengths |

|---|---|---|---|

| Elkem | Silicon metal, ferrosilicon, foundry alloys | 5-7% | Global presence, integrated operations |

| Mississippi Silicon | Silicon metal | 3-5% | North American focus, strategic location |

| Rusal | Ferroalloys, aluminum | 2-4% | Large-scale production, diversified portfolio |

| Hoshine Silicon Industry | Silicon metal, polysilicon | 8-10% | Dominant Chinese producer, cost leadership |

SSubstitutes Threaten

In some metallurgical uses, materials like aluminum, silicon carbide, and silicomanganese can step in for ferrosilicon. This means customers have choices to get similar material characteristics, which can affect how much of certain ferroalloy products are needed.

While Ferroglobe itself makes some silicon-based alloys, the existence of these substitutes presents a challenge. For example, the global market for aluminum, a key substitute, was valued at approximately $240 billion in 2023, indicating a significant alternative for manufacturers.

The semiconductor industry faces a growing threat from alternative materials challenging silicon's dominance. As silicon nears its physical performance boundaries, compounds like Gallium Nitride (GaN) and Silicon Carbide (SiC) are gaining traction for their superior capabilities in high-frequency and high-power applications. For instance, GaN-based power devices are projected to capture a significant share of the power semiconductor market, estimated to grow substantially in the coming years, impacting traditional silicon demand.

Technological advancements in end-user industries present a significant threat of substitutes for Ferroglobe. Innovations in sectors like automotive or aerospace, where Ferroglobe's silicon and ferroalloys are crucial, can lead to the development of new materials or manufacturing processes that reduce the need for these traditional inputs. For instance, the push for lighter and stronger materials in electric vehicles might favor advanced composites or novel metal alloys over conventional steel components, thereby impacting demand for ferroalloys.

Furthermore, shifts in battery technology, particularly the exploration of silicon-dominant anodes for electric vehicle batteries, could reshape demand. While this presents an opportunity for higher-purity silicon, it also signifies a potential substitution away from traditional silicon metal applications if battery performance significantly improves and market adoption accelerates. In 2024, the global electric vehicle market continued its rapid expansion, with projections indicating a substantial increase in battery production, underscoring the critical nature of these material innovations.

Cost-performance trade-offs of substitutes

The appeal of substitutes for silicon hinges on their cost-performance ratio. While new materials might boast enhanced technical capabilities, their elevated production expenses or nascent manufacturing processes can hinder their ability to replace silicon broadly in the short to medium term.

For instance, while advanced ceramics offer higher temperature resistance than silicon carbide, their significantly higher unit costs, often several times that of silicon carbide, limit their application to niche, high-value sectors. This cost premium means silicon-based materials remain the more economically viable choice for the vast majority of applications.

- Cost-Performance Trade-off: Substitutes are only viable if their performance benefits justify their cost compared to silicon.

- Emerging Material Costs: New materials like advanced ceramics or certain composites often carry higher production costs due to complex manufacturing or raw material sourcing.

- Scalability Challenges: Limited scalable manufacturing for substitutes can keep their supply low and prices high, making them less competitive against established silicon production.

- Silicon's Cost Advantage: Silicon's mature and highly scaled production infrastructure allows for competitive pricing, making it difficult for most substitutes to gain significant market share based on cost alone.

Regulatory and environmental drivers for new materials

The increasing global emphasis on sustainability and environmental responsibility is a significant factor influencing the threat of substitutes for silicon-based products. As regulations tighten and consumer demand for eco-friendly options grows, materials offering a lower carbon footprint or enhanced energy efficiency become more attractive.

For instance, advancements in alternative materials for solar cells, such as perovskites, are gaining traction. While silicon remains dominant, the potential for perovskites to offer higher efficiencies and lower manufacturing costs, coupled with their reduced environmental impact during production, presents a growing competitive pressure. Some studies suggest perovskite solar cells could achieve efficiencies exceeding 30%, a notable increase over the typical 20-22% for silicon.

The push for greener manufacturing processes also plays a role. If substitutes can be produced with less energy-intensive methods or utilize more readily available, sustainable raw materials, they can directly challenge the market position of traditional silicon. This trend is further amplified by government incentives and policies aimed at promoting renewable energy and reducing industrial emissions, which can accelerate the adoption of these emerging alternatives.

- Growing demand for sustainable materials: Consumer and industry preference is shifting towards products with a lower environmental impact.

- Perovskite solar cell advancements: Research indicates potential for higher efficiencies and lower production costs compared to silicon.

- Regulatory incentives for green technologies: Government policies are encouraging the adoption of environmentally friendly materials and processes.

- Reduced carbon footprint: Alternatives that offer significant reductions in greenhouse gas emissions during manufacturing and use are increasingly competitive.

The threat of substitutes for Ferroglobe's products, particularly silicon and ferroalloys, is multifaceted, driven by material innovation, cost-effectiveness, and sustainability trends. While silicon remains a dominant material, emerging alternatives in sectors like semiconductors and renewable energy pose a growing challenge.

Technological advancements are introducing new materials that can perform similar functions, sometimes with superior characteristics. For instance, in the semiconductor industry, Gallium Nitride (GaN) and Silicon Carbide (SiC) are increasingly used in high-power and high-frequency applications, potentially reducing reliance on traditional silicon. Similarly, in automotive, advanced composites might displace some metal alloys, impacting ferroalloy demand. The global electric vehicle market's rapid expansion in 2024 highlights the importance of battery material innovation, which could shift demand patterns for silicon.

The cost-performance ratio is a critical determinant for substitute viability. While novel materials may offer enhanced capabilities, their higher production costs, often due to complex manufacturing or raw material sourcing, can limit their widespread adoption. For example, advanced ceramics, while offering superior temperature resistance, are significantly more expensive than silicon carbide, restricting their use to niche applications. Silicon's established, scaled production infrastructure provides a cost advantage that many substitutes struggle to overcome.

Sustainability is also a key driver. Growing demand for eco-friendly materials and stricter environmental regulations favor alternatives with lower carbon footprints or improved energy efficiency. Perovskite solar cells, for instance, are gaining traction due to their potential for higher efficiencies and lower environmental impact during production compared to silicon solar cells, which typically achieve 20-22% efficiency. Government incentives for green technologies further accelerate the adoption of these emerging alternatives.

| Substitute Material | End-Use Industry | Key Advantage | Cost Factor | Market Trend |

|---|---|---|---|---|

| Gallium Nitride (GaN) | Semiconductors | High-frequency, high-power applications | Higher production cost than silicon | Growing adoption in power electronics |

| Silicon Carbide (SiC) | Semiconductors, Automotive | High-temperature resistance, power efficiency | Higher than silicon | Increasing use in EVs and power grids |

| Advanced Composites | Automotive, Aerospace | Lightweight, high strength | Varies, can be higher than metals | Demand driven by fuel efficiency and performance |

| Perovskite Solar Cells | Renewable Energy | Potential for higher efficiency, lower manufacturing cost | Potentially lower than silicon | Rapid research and development, emerging market |

Entrants Threaten

The production of silicon metal and ferroalloys, key products for companies like Ferroglobe, demands massive upfront investment in specialized furnaces and extensive infrastructure. This capital intensity creates a significant hurdle for any new competitor looking to enter the market.

Furthermore, the energy-intensive nature of these processes, often relying on electricity for smelting, adds another layer of complexity and cost. For instance, the global silicon metal market was valued at approximately USD 6.5 billion in 2023 and is projected to grow, but this growth is tempered by the sheer cost of establishing energy-efficient production facilities.

Manufacturing high-quality silicon metal and ferroalloys requires significant, specialized technical expertise. Companies like Ferroglobe invest heavily in proprietary processes and ongoing research and development to maintain their edge. This deep technical know-how acts as a substantial barrier for potential new entrants.

New players entering the silicon metal and ferroalloy market would face the daunting task of acquiring or developing this specialized knowledge. This is not a quick or inexpensive process, often involving years of dedicated R&D and operational experience. The substantial time and capital investment needed to bridge this expertise gap significantly deters new competition.

Securing reliable and cost-effective access to essential raw materials, such as high-purity quartz and specific carbon reductants, presents a significant barrier for new entrants in the silicon metal and ferroalloys industry. Established companies like Ferroglobe have cultivated long-standing relationships with key suppliers, ensuring consistent material flow and favorable pricing. This deep integration into the supply chain, sometimes extending to vertical ownership of mining assets, provides a substantial competitive advantage that is challenging for newcomers to replicate.

Regulatory hurdles and trade protection measures

Regulatory hurdles and trade protection measures present a significant barrier to new entrants in the ferrosilicon and silicon metal industry. The sector is heavily regulated, with environmental standards becoming increasingly stringent. For instance, in 2024, many regions are focusing on carbon emissions, requiring substantial investment in cleaner production technologies for any new facility.

Trade protection measures, such as anti-dumping duties and safeguards, further complicate market entry. These can dramatically increase the cost of imported raw materials or finished goods, making it difficult for new players to compete on price. In 2023, for example, several countries reviewed or imposed new tariffs on silicon metal imports, impacting global supply chains and pricing dynamics.

- Environmental Regulations: Compliance with emissions standards and waste management protocols requires significant capital investment, often in the tens of millions of dollars for a new plant.

- Trade Tariffs: Anti-dumping duties can range from 10% to over 50%, as seen in various investigations concluded in late 2023 and early 2024, directly inflating import costs.

- Permitting Processes: Obtaining necessary operating permits can be a lengthy and complex process, sometimes taking several years and involving multiple government agencies.

- Market Access: Navigating these trade policies can restrict access to key markets, forcing new entrants to either absorb higher costs or seek production facilities in multiple jurisdictions.

Economies of scale and global distribution networks

Existing global producers like Ferroglobe leverage significant economies of scale. In 2024, Ferroglobe's substantial production capacity, for instance, allows for lower per-unit manufacturing costs compared to smaller operations. This scale is difficult for new players to replicate quickly.

Furthermore, established companies possess extensive global distribution networks. Ferroglobe's established logistics and supply chain infrastructure, optimized over years, provides a competitive edge in reaching diverse markets efficiently. New entrants would face substantial investment and time hurdles to build comparable reach.

These factors create a high barrier to entry:

- Economies of Scale: Large production volumes lead to lower per-unit costs, a significant advantage for incumbents.

- Global Distribution Networks: Established logistics and market access are costly and time-consuming for new entrants to build.

- Cost Efficiencies: Incumbents can offer more competitive pricing due to their scale and established supply chains.

The threat of new entrants in the silicon metal and ferroalloy market remains moderate, primarily due to substantial capital requirements and established industry expertise. Significant upfront investment in specialized production facilities and the need for deep technical knowledge create considerable barriers for newcomers. For instance, the global silicon metal market, valued at approximately USD 6.5 billion in 2023, demands high energy costs and intricate manufacturing processes that deter easy entry.

| Barrier Category | Specific Barrier | Impact on New Entrants | Supporting Data/Example (2023-2024) |

| Capital Intensity | Specialized Furnaces & Infrastructure | High upfront investment required, making entry costly. | New plants can cost tens to hundreds of millions of dollars. |

| Technical Expertise | Proprietary Processes & R&D | Requires years of development and specialized knowledge. | Companies invest heavily in ongoing R&D to maintain competitive edge. |

| Raw Material Access | Securing High-Purity Quartz & Carbon Reductants | Established relationships and vertical integration offer advantages. | Long-term supplier contracts are crucial for consistent material flow. |

| Regulatory & Trade | Environmental Standards & Tariffs | Compliance costs and trade protection measures increase complexity. | Environmental regulations and anti-dumping duties (10-50%) impact market entry. |

| Economies of Scale | Large Production Volumes | Incumbents benefit from lower per-unit costs. | Ferroglobe's substantial capacity in 2024 allows for cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Ferroglobe Porter's Five Forces analysis is built upon a foundation of robust data, including annual reports, investor presentations, industry-specific market research from firms like CRU and Wood Mackenzie, and global trade statistics.