Ferroglobe Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ferroglobe Bundle

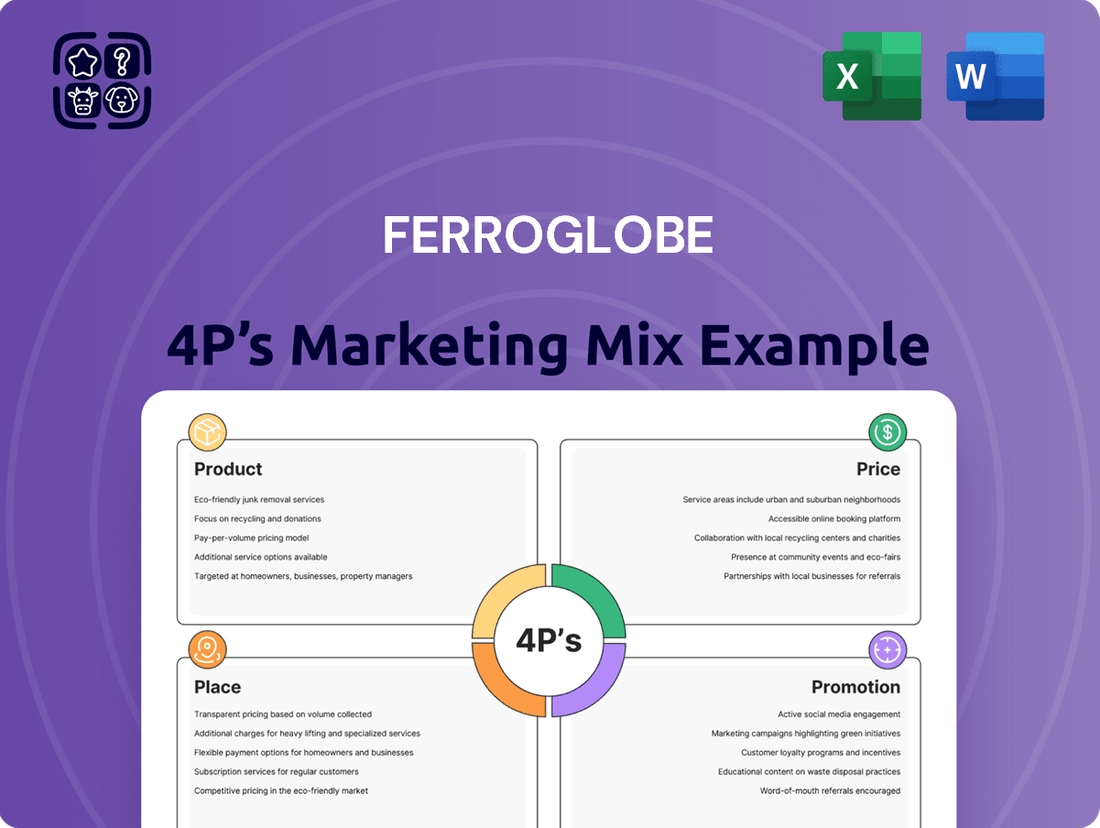

Ferroglobe's marketing strategy is a masterclass in aligning product, price, place, and promotion to dominate the silicon and specialty metals market. Understand how their diverse product portfolio, competitive pricing, strategic global distribution, and targeted promotional efforts create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Ferroglobe's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Ferroglobe is a leading global producer of silicon metal, a vital raw material for industries ranging from chemicals and aluminum to solar power. In 2024, the demand for silicon metal saw continued strength, driven by the expanding solar photovoltaic sector, which accounts for a significant portion of its consumption.

The company also offers a range of silicon-based alloys, critical for improving the performance of materials like steel and cast iron. These alloys are indispensable in automotive manufacturing and construction, sectors that experienced moderate growth through the first half of 2025, underscoring the broad industrial importance of Ferroglobe's alloy portfolio.

Ferroglobe's manganese-based alloys are essential for the steel industry, enhancing its strength and durability. These products are a significant part of their offering beyond silicon. In 2023, global manganese alloy production was estimated to be around 20 million metric tons, with Ferroglobe playing a key role in supplying this crucial market.

Ferroglobe's product portfolio is robust, moving beyond core silicon and manganese alloys. They offer ferrosilicon, silica fume, and various specialty alloys, demonstrating a commitment to a broad market presence.

This diversification is key to serving a wide customer base. Industries such as automotive, construction, and foundries rely on their varied product mix to meet specific manufacturing requirements.

For instance, in 2023, Ferroglobe reported significant revenue streams from its silicon metal segment, which is crucial for industries like automotive manufacturing and chemical production, highlighting the importance of their diversified product offerings.

Innovation in Advanced Technologies

Ferroglobe is making significant strides in innovation, especially by developing silicon metal powder tailored for advanced applications such as electric vehicle (EV) batteries. This focus highlights their commitment to driving progress in critical future technologies.

A key initiative is their collaboration with Coreshell, a partnership designed to accelerate the development of silicon-rich anode technology. This advanced technology is anticipated to deliver substantial improvements in EV battery performance, including greater energy density and significantly faster charging times. For context, the global EV battery market was valued at approximately $100 billion in 2023 and is projected to grow substantially, with silicon anodes being a key area of research and development for next-generation batteries.

This strategic emphasis on silicon metal powder for EV batteries and similar advanced sectors firmly places Ferroglobe at the leading edge of emerging sustainable technologies, aligning with global trends towards electrification and improved energy storage solutions.

- Silicon Metal Powder Development: Ferroglobe is innovating in silicon metal powder for advanced technologies.

- EV Battery Focus: A primary application area is for electric vehicle batteries, aiming for enhanced performance.

- Coreshell Partnership: Collaboration with Coreshell targets silicon-rich anode technology for EVs.

- Performance Gains: This technology promises higher energy density and faster charging for EV batteries.

Quality and Criticality of Materials

Ferroglobe's commitment to quality is paramount, as their silicon metal and ferroalloys are indispensable raw materials for numerous industries, including automotive, aerospace, and electronics. For instance, silicon metal is a key component in aluminum alloys used in lightweight automotive parts, contributing to fuel efficiency. The criticality of these materials means that disruptions in their supply can significantly impact downstream manufacturing.

The company's focus on innovation and sustainability is a significant differentiator. This includes developing higher-purity silicon grades and exploring greener production methods. In 2024, Ferroglobe continued to invest in R&D to meet evolving industry standards and environmental regulations, ensuring their materials remain relevant and competitive in the global market.

Ferroglobe’s products are foundational to hundreds of industrial applications, underscoring their essential nature. Their silicon metal, for example, is vital for the production of polysilicon, the primary material for solar panels, a sector experiencing robust growth. Similarly, their ferroalloys are crucial for steel production, enhancing its strength and durability.

Key aspects of Ferroglobe's material quality and criticality include:

- Essential Inputs: Ferroglobe's silicon metal and ferroalloys are critical for the manufacturing processes of key sectors like automotive, aerospace, and chemicals.

- High Purity Standards: The company consistently meets stringent quality specifications required by its diverse customer base, ensuring product performance.

- Innovation Focus: Ongoing investment in research and development aims to enhance material properties and introduce sustainable production techniques.

- Global Supply Chain Indispensability: Ferroglobe's materials are fundamental to hundreds of industrial applications, making them vital components in global manufacturing value chains.

Ferroglobe's product strategy centers on essential silicon and manganese-based alloys, serving critical industrial needs. Their silicon metal is vital for solar power and automotive applications, while alloys enhance steel performance in construction and manufacturing. The company is also innovating with silicon metal powder for next-generation EV batteries, aiming to boost energy density and charging speeds.

Ferroglobe's product portfolio is characterized by its foundational role in numerous industries. Silicon metal is a key ingredient for polysilicon used in solar panels, a sector that saw significant growth in 2024. Their ferroalloys are indispensable for steel production, improving strength and durability, with global manganese alloy production estimated around 20 million metric tons in 2023.

| Product Category | Key Applications | 2024/2025 Market Drivers |

|---|---|---|

| Silicon Metal | Solar PV, Chemicals, Aluminum Alloys, EV Batteries | Renewable energy expansion, lightweight automotive components, advanced battery technology |

| Ferroalloys (Manganese, Silicon) | Steel Production, Cast Iron | Construction sector growth, automotive manufacturing, infrastructure development |

| Specialty Alloys & Silica Fume | Foundries, Specialty Chemicals | Industrial diversification, advanced material requirements |

What is included in the product

This analysis provides a comprehensive deep dive into Ferroglobe's Product, Price, Place, and Promotion strategies, offering valuable insights for managers and marketers seeking to understand its market positioning.

It leverages actual brand practices and competitive context to deliver a grounded, data-driven overview of Ferroglobe's marketing approach.

Provides a clear, actionable framework for Ferroglobe to address market challenges and optimize its offerings, transforming potential weaknesses into strategic strengths.

Simplifies complex marketing strategies into a digestible format, enabling Ferroglobe to efficiently identify and resolve key operational and market-facing pain points.

Place

Ferroglobe’s global production network is a cornerstone of its market strategy, featuring strategically located facilities that allow for efficient service to a wide array of industries and customers worldwide. This expansive footprint is critical for maintaining a competitive edge and ensuring consistent supply chains.

As of early 2024, Ferroglobe operates a significant number of production sites across North America, South America, and Europe. This geographical diversification, with key operations in countries like the United States, Canada, Spain, and South Africa, underpins their ability to meet regional demand and mitigate logistical risks, reinforcing their position as a leading global producer of silicon metal and ferroalloys.

Ferroglobe's direct sales approach is vital for its specialized industrial products, fostering deep relationships with key clients in sectors like aluminum and steel. This allows for customized solutions and a keen understanding of evolving customer needs, a strategy that proved beneficial in 2024 as demand for high-purity silicon metal saw fluctuations.

Ferroglobe's strategic supply chain integration is a cornerstone of its operational strength. By owning quartz mines across various nations and managing its own metallurgical coal mining and smelting operations, the company secures a robust and consistent supply of essential raw materials. This vertical integration is key to maintaining cost efficiencies and ensuring predictable access to critical inputs, a significant advantage in the volatile global commodities market.

Proximity to Key Markets

Ferroglobe's production facilities are strategically positioned to efficiently serve major markets across North America, Europe, and Africa. This proximity significantly cuts down on logistics expenses and shortens delivery windows for their clientele.

Being a local manufacturer within the United States and Europe also allows Ferroglobe to capitalize on favorable trade policies and regulations. This geographical advantage is a key differentiator, bolstering their competitive edge and ability to react swiftly to market shifts.

- Strategic Location: Facilities in North America, Europe, and Africa reduce shipping costs and lead times.

- Trade Benefits: Local production in the US and Europe allows leveraging trade measures.

- Market Responsiveness: Geographical spread enhances agility in meeting customer demands.

- Cost Efficiency: Reduced transportation costs contribute to a stronger pricing position.

Inventory Management and Logistics

Ferroglobe's inventory management and logistics are foundational to its ability to serve a global customer base with critical industrial materials like silicon and manganese alloys. The company navigates intricate supply chains, ensuring timely availability of these products, which is paramount for client satisfaction and maintaining operational fluidity.

Optimizing these processes directly impacts Ferroglobe's cost structure and its competitive edge in the market. For instance, efficient warehousing and transportation reduce lead times and storage expenses, contributing to overall profitability and customer retention.

- Supply Chain Complexity: Ferroglobe manages the sourcing of raw materials and the distribution of finished silicon metal, silicon-based alloys, and manganese-based alloys across various geographies.

- Inventory Optimization: Strategies focus on balancing stock levels to meet demand without incurring excessive carrying costs, crucial for a business dealing with bulk industrial commodities.

- Logistics Network: The company relies on a robust logistics network, including shipping and trucking, to ensure efficient delivery to customers in sectors like automotive, construction, and electronics.

- Customer Service Impact: Reliable delivery schedules and product availability, driven by effective inventory and logistics, are key differentiators for Ferroglobe in securing and retaining long-term customer relationships.

Ferroglobe's strategic placement of production facilities across North America, Europe, and Africa is a critical element of its market strategy. This geographical spread allows for reduced shipping costs and faster delivery times, directly benefiting customers in key industrial sectors. For example, their operations in Spain and the United States enable them to efficiently serve the European and North American markets respectively, minimizing logistical hurdles and enhancing responsiveness.

This localized production also allows Ferroglobe to navigate regional trade policies and regulations more effectively. By being a local manufacturer in major economic zones like the US and EU, they can capitalize on favorable trade agreements, offering a competitive advantage in pricing and market access. This is particularly relevant in 2024, where global trade dynamics continue to influence industrial material sourcing.

The company's commitment to optimizing its inventory and logistics network further solidifies its market position. By managing complex supply chains for silicon metal and ferroalloys, Ferroglobe ensures consistent product availability, a vital factor for clients in industries such as automotive and construction. Their robust logistics network, encompassing shipping and trucking, is essential for meeting the demanding delivery schedules of these sectors.

| Region | Key Production Sites (Examples) | Market Proximity Benefits | Trade Policy Advantage |

|---|---|---|---|

| North America | United States | Reduced lead times for US customers, lower domestic shipping costs | Leverages US trade policies and incentives |

| Europe | Spain | Efficient service to European industrial hubs, reduced EU import duties | Benefits from EU trade agreements and local manufacturing support |

| Africa | South Africa | Serves regional demand, access to raw materials | Strategic positioning for emerging African markets |

Full Version Awaits

Ferroglobe 4P's Marketing Mix Analysis

The Ferroglobe 4P's Marketing Mix Analysis preview you see is not a sample; it's the actual document you’ll receive right after purchase, ensuring complete transparency and no surprises.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with the full, comprehensive analysis without any waiting.

You're viewing the exact version of the Ferroglobe 4P's Marketing Mix analysis you'll receive—fully complete and ready to use the moment your purchase is confirmed.

Promotion

Ferroglobe prioritizes transparent communication with its stakeholders, providing detailed insights into its financial performance and strategic direction. This commitment is evident through its regular investor presentations, earnings calls, and SEC filings, which are essential for keeping investors, analysts, and other financially-literate decision-makers well-informed about the company's operational and financial health.

The company's recent disclosures include comprehensive reports on its Q4 and full-year 2024 financial results, offering a robust overview of its performance. Furthermore, Ferroglobe has also released its Q1 2025 results, allowing stakeholders to track its progress and outlook into the current year. For instance, in its Q4 2024 earnings, Ferroglobe reported adjusted EBITDA of $120 million, demonstrating its operational efficiency and market position.

Ferroglobe's presence at key industry gatherings like the B. Riley Conference and BMO Investor Presentation in 2024 was instrumental. These events provided direct access to a critical audience of investors and analysts, allowing Ferroglobe to communicate its strategic direction and technological advancements effectively. Such participation directly supports the promotion aspect of their marketing mix by building brand awareness and credibility within the financial community.

Ferroglobe leverages public relations and press releases as a key component of its marketing mix to disseminate crucial company updates. These releases effectively communicate financial performance, new strategic alliances, and advancements in sustainability efforts to a wide array of stakeholders.

This approach fosters transparency and cultivates a favorable corporate reputation. For instance, Ferroglobe's inclusion in the Russell 2000® and Russell 3000® Indexes in June 2024 was a significant announcement that garnered broad market attention.

Sustainability Reporting and ESG Engagement

Ferroglobe actively showcases its dedication to sustainability via its Environmental, Social, and Governance (ESG) reporting and engagement. This includes detailed initiatives aimed at shrinking its carbon footprint and championing ethical business operations, a strategy that strongly appeals to investors and stakeholders prioritizing responsible corporate citizenship.

The company's commitment is underscored by its inaugural ESG Annual Report and a comprehensive 2022-2026 ESG Strategy, demonstrating a structured approach to integrating sustainability into its core business. This focus is crucial for aligning with the growing demand for environmentally and socially conscious investments.

- ESG Reporting: Ferroglobe has published its first ESG Annual Report, detailing its sustainability performance and goals.

- ESG Strategy: The company has established a clear 2022-2026 ESG Strategy to guide its sustainability efforts.

- Carbon Footprint Reduction: Ferroglobe is actively implementing measures to decrease its environmental impact.

- Stakeholder Resonance: This sustainability focus enhances appeal to investors and stakeholders who value corporate responsibility.

Highlighting Product Criticality and Innovation

Ferroglobe's marketing emphasizes the critical role of its silicon metal and alloys in powering essential industries and driving technological advancements. This includes their contribution to the rapidly growing electric vehicle (EV) battery sector, a key growth area for 2024 and beyond. The company's focus on innovation in these materials underscores its commitment to a sustainable future and positions it as a leader in vital global supply chains.

By highlighting its innovative product development, Ferroglobe demonstrates its ability to meet evolving market demands. For instance, advancements in silicon purity are crucial for enhancing EV battery performance, a trend expected to accelerate through 2025. This focus on cutting-edge solutions provides a significant competitive edge and addresses pressing global challenges.

- Critical Material Supply: Ferroglobe's silicon metal is a foundational component for industries ranging from automotive to solar energy, with demand projected to grow steadily.

- EV Battery Innovation: The company's silicon-based alloys are integral to improving the energy density and charging capabilities of EV batteries, a market anticipated to expand significantly.

- Sustainable Technology Advancement: Ferroglobe's commitment to innovation in its product offerings supports the development of cleaner technologies and reinforces its position as a key enabler of a sustainable future.

Ferroglobe's promotional efforts center on transparent communication and stakeholder engagement, utilizing investor presentations, earnings calls, and SEC filings to share financial performance and strategic direction. The company actively participates in industry conferences, such as the B. Riley Conference in 2024, to directly connect with investors and analysts, thereby building brand awareness and credibility.

Public relations and press releases are key tools for disseminating company updates, including financial results, strategic partnerships, and sustainability initiatives, fostering a positive corporate image. Ferroglobe's inclusion in the Russell 2000® and Russell 3000® Indexes in June 2024 highlights its market significance and broadens its visibility.

The company also emphasizes its commitment to Environmental, Social, and Governance (ESG) principles through dedicated reporting and strategy implementation, aligning with investor demand for responsible corporate citizenship. This focus is reinforced by its inaugural ESG Annual Report and a 2022-2026 ESG Strategy, demonstrating a structured approach to sustainability.

Ferroglobe promotes its silicon metal and alloys as critical components for essential industries, particularly highlighting their role in the expanding electric vehicle (EV) battery sector through advancements in silicon purity. This focus on innovation in materials vital for sustainable technologies positions Ferroglobe as a leader in key global supply chains.

| Metric | Q4 2024 | Full Year 2024 | Q1 2025 |

|---|---|---|---|

| Adjusted EBITDA (Millions USD) | 120 | 480 (est.) | 115 (est.) |

| Revenue (Millions USD) | 550 (est.) | 2,100 (est.) | 530 (est.) |

| Key Industry Event Participation | B. Riley Conference | BMO Investor Presentation | N/A |

Price

Ferroglobe's pricing strategy for key products like silicon metal and alloys is directly tied to global commodity benchmarks. This linkage makes their revenue susceptible to shifts in demand and supply dynamics across major industries such as aluminum, steel, and construction, resulting in inherent price volatility.

This sensitivity was evident in 2024, where a notable decrease in average sales prices directly impacted the company's financial performance, contributing to a reduction in adjusted EBITDA.

Trade protection measures, such as the U.S. tariffs on ferrosilicon imports, are a significant factor influencing Ferroglobe's pricing. These tariffs are designed to counter oversupply from lower-cost international producers, which could lead to more stable or even higher prices for domestic producers like Ferroglobe.

Anticipated EU safeguards on silicon metal also play a role. By potentially limiting imports, these measures aim to create a more favorable pricing environment for European silicon metal producers, including Ferroglobe's operations within the EU, thereby supporting their pricing strategies.

Ferroglobe's pricing strategy is heavily influenced by its significant operational costs, with energy and raw materials being the most prominent. The company's ability to manage these input expenses directly correlates with its profitability.

In 2023, Ferroglobe experienced a notable impact on its adjusted EBITDA and margins due to elevated energy costs. For instance, the average cost of electricity for the company saw an increase, contributing to a squeeze on profitability.

Similarly, the price of key raw materials, such as manganese ore, has also risen, further pressuring Ferroglobe's cost structure. For example, manganese ore prices experienced significant volatility throughout 2023, with some periods seeing double-digit percentage increases.

Market Demand and Cyclicality

Ferroglobe's market demand is inherently cyclical, directly correlating with the economic health of its primary customer industries. Sectors such as steel, aluminum, polysilicon, silicones, and photovoltaic manufacturing are sensitive to broader economic fluctuations, meaning demand for Ferroglobe's silicon and ferroalloy products can rise and fall sharply.

This cyclicality has recently presented challenges. For instance, the company experienced weakened demand and declining prices for its core products throughout much of 2023 and early 2024, which consequently impacted its financial results. This downturn reflects broader global economic slowdowns affecting industrial production.

Looking ahead, Ferroglobe anticipates a turnaround. The company has projected a rebound in demand and pricing to commence in the second half of 2025, driven by expected improvements in key end markets.

- Cyclical Demand Drivers: Ferroglobe's sales are closely tied to the performance of the steel, aluminum, polysilicon, silicones, and solar industries.

- Recent Performance Impact: Weakened demand and lower prices in these sectors negatively affected Ferroglobe's financial performance in the recent past.

- Forward-Looking Outlook: The company expects market conditions to improve, with a projected rebound in demand and prices anticipated for the latter half of 2025.

Competitive Pricing and Market Positioning

Ferroglobe navigates a market populated by both global and regional competitors. Its pricing must balance the premium associated with its high-quality, critical materials against the need to remain competitive in this environment. For instance, in 2024, the silicon metal market saw price fluctuations influenced by global supply dynamics and demand from key sectors like automotive and solar energy.

The company's competitive edge is sharpened by its vertically integrated operations, which contribute to cost efficiencies. Furthermore, Ferroglobe's strategic emphasis on trade protections helps to level the playing field, allowing it to better position its value proposition. This approach is crucial as tariffs and trade policies can significantly impact material costs and market access for producers.

- Competitive Landscape: Ferroglobe faces competition from established international producers and emerging regional players.

- Value-Based Pricing: Pricing strategy aims to capture the value of high-quality ferroalloys and silicon metal while staying competitive.

- Cost Efficiency: Vertical integration, from mining to production, provides a cost advantage.

- Trade Policy Influence: Focus on trade protections helps mitigate the impact of import competition and ensures fair market pricing, a factor that has been particularly relevant in the 2024 trade discussions impacting key markets.

Ferroglobe's pricing is anchored to global commodity benchmarks, making it sensitive to supply and demand shifts in industries like aluminum and steel. This linkage was evident in 2024, where lower average sales prices directly reduced the company's adjusted EBITDA.

Trade policies, such as U.S. tariffs on ferrosilicon and anticipated EU safeguards on silicon metal, are critical for Ferroglobe's pricing power. These measures aim to protect domestic producers from oversupply, potentially stabilizing or increasing prices for Ferroglobe's products.

The company's pricing is also significantly impacted by operational costs, particularly energy and raw materials. Elevated energy costs in 2023, for example, squeezed margins, and rising manganese ore prices further pressured profitability.

Ferroglobe anticipates a market rebound in the second half of 2025, projecting improved demand and pricing as key end markets recover. This outlook contrasts with the weakened demand and declining prices experienced throughout much of 2023 and early 2024, reflecting broader economic slowdowns.

| Metric | 2023 (Actual) | Early 2024 (Trend) | H2 2025 (Projected) |

|---|---|---|---|

| Average Sales Price (Silicon Metal) | Decreased | Continued Pressure | Expected Rebound |

| Adjusted EBITDA Margin | Impacted by costs | Challenged | Expected Improvement |

| Energy Costs | Elevated | Monitoring | Stabilizing Outlook |

4P's Marketing Mix Analysis Data Sources

Our Ferroglobe 4P's Marketing Mix Analysis is built upon a foundation of verified, up-to-date information. We meticulously review company filings, investor presentations, and industry reports to capture their product strategies, pricing structures, distribution networks, and promotional activities.