Fortune Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

Fortune Brands boasts strong brand recognition and a diverse product portfolio, but faces challenges from supply chain disruptions and evolving consumer preferences. Understanding these nuances is key to navigating its market landscape.

Want the full story behind Fortune Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fortune Brands Innovations benefits from a diverse brand portfolio, including recognized names like Moen in plumbing, Master Lock for security, and Fiberon in outdoor living. This spread across different product areas, coupled with strong brand awareness, offers a significant competitive edge.

These established brands hold substantial market share and consumer confidence, which translates into consistent revenue and the ability to maintain pricing power within their markets. For instance, Moen is a leading brand in the plumbing fixtures market, consistently demonstrating strong sales performance.

Fortune Brands boasts a strong market positioning, holding leading roles in key segments like residential repair and remodeling, new construction, and security applications. This allows them to effectively tap into demand across different phases of the housing market and various security needs.

Their established presence in both consumer and professional sales channels provides significant market reach, mitigating risks associated with depending on a single sales avenue. For instance, in 2023, Fortune Brands Innovations reported net sales of $2.3 billion, with a substantial portion driven by their strong positions in these core markets.

Fortune Brands leverages a wide array of distribution channels, reaching customers through retail outlets, wholesale partners, and directly to home builders. This multi-pronged strategy significantly boosts market penetration and ensures broad customer access to their product lines.

This extensive network provides a crucial buffer against fluctuations in consumer behavior, guaranteeing product availability across various purchasing preferences and locations. For instance, during 2023, Fortune Brands' focus on these diverse channels contributed to their reported net sales of $3.1 billion, showcasing the effectiveness of their distribution approach.

Focus on Essential Home Products

Fortune Brands' strategic concentration on essential home products, such as plumbing, cabinets, and water treatment, directly links its success to the health of the residential repair, remodeling, and new construction sectors. This specialization ensures demand for its offerings, as these items are crucial for maintaining and enhancing home value and functionality.

This focused approach allows Fortune Brands to cultivate deep expertise and drive innovation within its core product categories, fostering a competitive edge. For instance, in 2024, the U.S. housing market saw continued activity in both new builds and renovations, with housing starts projected to increase year-over-year, providing a favorable environment for companies like Fortune Brands. The company's product portfolio is well-positioned to capitalize on these trends, with a significant portion of its revenue derived from these fundamental home improvement segments.

- Essential Product Focus: Specializes in plumbing, cabinets, and water treatment, critical for home functionality.

- Market Alignment: Performance is closely tied to the robust U.S. housing market, which showed resilience in 2024.

- Demand Stability: Products are considered essential, creating a relatively stable demand base even in fluctuating economic conditions.

- Expertise and Innovation: Deep focus allows for specialized knowledge and advancements in core home improvement areas.

Operational Expertise and Scale

Fortune Brands leverages deep operational expertise across design, manufacturing, and sales, translating into significant efficiencies and economies of scale. Their well-established supply chain and robust manufacturing infrastructure enable high-volume production while maintaining consistent product quality. This operational prowess is a key driver in their ability to bring competitive products to market efficiently.

For instance, in 2023, Fortune Brands reported strong performance across its segments, with Plumbing products, a core area benefiting from this expertise, seeing notable revenue growth. This operational strength allows them to manage costs effectively, a critical factor in maintaining profitability in a competitive market.

- Operational Efficiencies: Streamlined processes in design, manufacturing, and distribution contribute to cost savings.

- Economies of Scale: High-volume production lowers per-unit costs, enhancing competitiveness.

- Supply Chain Management: A robust and integrated supply chain ensures reliable material sourcing and product delivery.

- Manufacturing Capabilities: Advanced manufacturing techniques support consistent product quality and innovation.

Fortune Brands benefits from a strong portfolio of well-recognized brands like Moen and Master Lock, which hold significant market share and consumer trust. This brand equity translates into pricing power and consistent revenue streams, as seen with Moen's leading position in the plumbing fixtures market.

Their strategic focus on essential home products, such as plumbing and cabinets, aligns them with the resilient U.S. housing market. For example, in 2024, the U.S. housing market showed continued activity, with housing starts projected to increase year-over-year, directly benefiting Fortune Brands' core business.

The company's operational expertise in design, manufacturing, and sales drives efficiencies and economies of scale. This is evident in their robust supply chain management and advanced manufacturing capabilities, which ensure product quality and cost competitiveness, contributing to their reported net sales of $3.1 billion in 2023.

Fortune Brands maintains a broad market reach through diverse distribution channels, including retail, wholesale, and direct-to-builder sales. This multi-channel approach mitigates risk and ensures widespread customer access, supporting their strong market positioning in key segments.

What is included in the product

Analyzes Fortune Brands’s competitive position through key internal and external factors, highlighting its brand strength and market opportunities while acknowledging potential supply chain disruptions and competitive pressures.

Offers a clear, actionable framework to navigate Fortune Brands' competitive landscape and capitalize on market opportunities.

Weaknesses

Fortune Brands' reliance on the housing sector makes it particularly vulnerable to shifts in the residential construction and remodeling markets. Economic slowdowns, such as those potentially triggered by rising interest rates, can significantly dampen consumer spending on home improvement and new housing. For instance, in early 2024, mortgage rates remained elevated, impacting affordability and potentially slowing new home sales, a key driver for Fortune Brands' product demand.

Fortune Brands operates within the home and security products sector, a space characterized by intense competition from a multitude of domestic and international companies. This crowded market means Fortune Brands constantly contends with both well-established brands and newer, agile entrants, which can put a strain on their ability to dictate pricing and hold onto market share. To stay ahead, the company must continually invest in product innovation and robust marketing campaigns to effectively differentiate itself from aggressive rivals.

Fortune Brands faces significant vulnerabilities due to its reliance on global supply chains. Disruptions in sourcing raw materials and essential components, whether from material shortages, shipping delays, or geopolitical tensions, can directly impact manufacturing schedules and product availability for consumers. For instance, in late 2023 and early 2024, the global logistics network continued to grapple with port congestion and elevated shipping costs, posing ongoing challenges.

This dependence also exposes the company to considerable cost volatility. Fluctuations in the price of key inputs, coupled with the potential for increased tariffs on imported goods, can squeeze profit margins. Managing these intricate supply chain dynamics is therefore paramount for Fortune Brands to sustain its operational efficiency and overall profitability in a dynamic global market.

Potential for Brand Dilution

Managing a diverse portfolio of brands, including Moen, Master Lock, and Fiberon, demands substantial resources for marketing and careful brand management. Fortune Brands' strategy of operating distinct brands, while a strength, presents a weakness if not executed with precision.

There's a tangible risk of brand dilution or inconsistent messaging across its various offerings. This requires continuous effort to ensure each brand maintains its unique market position and value proposition, a challenge that can strain resources.

- Brand Management Costs: Significant marketing and stewardship investments are necessary for each distinct brand.

- Messaging Consistency: Maintaining a unified yet unique brand voice across diverse product lines can be challenging.

- Market Relevance: Ensuring each individual brand remains relevant and appealing to its target audience is an ongoing hurdle.

Reliance on Consumer Discretionary Spending

A significant portion of Fortune Brands' revenue is tied to consumer discretionary spending. Products like kitchen and bath fixtures, often purchased for remodeling and upgrades, are considered non-essential. This means that during economic downturns or periods of low consumer confidence, households are likely to postpone or reduce spending on these types of home improvement projects, making a segment of their sales vulnerable to broader economic conditions.

For instance, in 2023, the U.S. home improvement market experienced a slowdown, with consumer spending on renovations being particularly sensitive to inflation and interest rate hikes. This trend is expected to continue into 2024, as consumers remain cautious about discretionary purchases. Fortune Brands' reliance on this spending category directly impacts its financial performance when consumer sentiment wavers.

- Vulnerability to Economic Downturns: Fortune Brands' product portfolio includes many items that are discretionary purchases for homeowners, making sales susceptible to economic slowdowns.

- Impact of Consumer Confidence: Reduced consumer confidence can lead to deferred spending on home improvement projects, directly affecting the demand for Fortune Brands' offerings.

- Sensitivity to Inflation and Interest Rates: Higher inflation and interest rates can erode household purchasing power and increase the cost of financing home renovations, further pressuring discretionary spending.

Fortune Brands' reliance on the housing market exposes it to cyclical downturns. For example, in Q1 2024, new housing starts in the U.S. saw a year-over-year decline, directly impacting demand for plumbing and cabinetry products. The company's significant exposure to consumer discretionary spending also makes it vulnerable to shifts in consumer confidence and economic uncertainty, as evidenced by the moderation in home improvement spending observed throughout 2023.

Intense competition within the home and security products sector requires continuous investment in innovation and marketing to maintain market share. Furthermore, global supply chain disruptions and the associated cost volatility of raw materials, as seen with elevated shipping costs persisting into early 2024, pose ongoing operational and profitability challenges.

The company's strategy of managing a diverse brand portfolio, while beneficial, necessitates substantial resources for marketing and brand stewardship to prevent dilution and ensure consistent messaging across brands like Moen and Master Lock.

Preview the Actual Deliverable

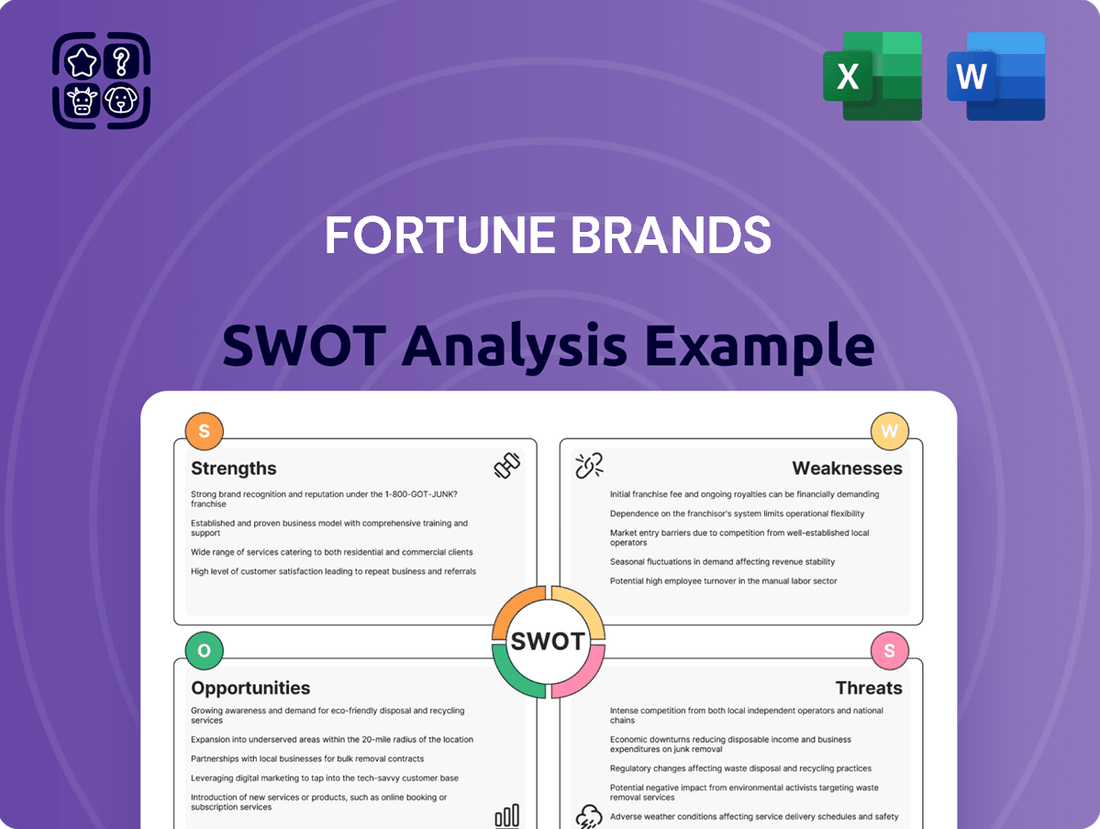

Fortune Brands SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file for Fortune Brands. The complete version becomes available after checkout, offering a comprehensive look at their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The increasing consumer demand for connected living spaces presents a prime opportunity for Fortune Brands to bolster its smart home technology offerings. By embedding smart features into their existing product lines, such as smart locks and connected plumbing fixtures, they can tap into a growing market segment. For instance, the global smart home market was projected to reach over $150 billion in 2024, with significant growth expected in smart appliances and security systems.

The increasing consumer and regulatory push for greener building materials presents a significant opportunity for Fortune Brands. By innovating in areas like water-efficient plumbing fixtures, energy-saving home solutions, and products utilizing recycled or sustainably sourced components, the company can tap into this expanding market segment. This strategic alignment with evolving consumer preferences not only drives growth but also bolsters its image as a responsible corporate citizen.

Fortune Brands can capitalize on international market expansion by targeting emerging economies and increasing its presence in existing global markets experiencing growth. This strategy diversifies revenue, mitigating risks associated with single-market economic downturns. For instance, in 2024, the company's international sales represented a significant portion of its revenue, and further penetration into regions like Southeast Asia, with its rapidly expanding middle class, offers substantial upside.

Strategic Acquisitions and Partnerships

Fortune Brands can strategically acquire smaller, innovative companies or businesses with complementary product lines. This approach allows for portfolio expansion, integration of new technologies, and entry into untapped market segments. For instance, in 2023, the company completed its acquisition of Aqualisa, a UK-based smart shower manufacturer, which bolstered its offerings in the smart home technology space and expanded its European presence.

Forming strategic partnerships with technology providers or other key industry players presents another avenue for growth. These collaborations can accelerate innovation and broaden market reach. By teaming up, companies can share resources and expertise, leading to the development of more advanced products and services. This strategy was evident in the company's ongoing collaboration with Moen, a leading faucet brand, to integrate smart home capabilities into its product lines.

These inorganic growth strategies are crucial for accelerating market share gains and achieving greater diversification. By actively pursuing acquisitions and partnerships, Fortune Brands can solidify its competitive position and adapt to evolving consumer demands and technological advancements in the home and security markets.

Key opportunities include:

- Acquisition of innovative smart home technology firms to enhance product offerings and market penetration.

- Partnerships with smart home ecosystem providers to ensure seamless integration and expand customer reach.

- Strategic tuck-in acquisitions in adjacent product categories to diversify revenue streams and leverage existing distribution channels.

- Joint ventures for R&D in areas like sustainable materials and advanced security features to drive future innovation.

E-commerce and Digital Channel Growth

Fortune Brands can capitalize on the ongoing surge in e-commerce for home improvement goods. The company's digital channel growth is a key area for expansion, with online sales continuing to outpace traditional retail for many categories. By enhancing its website's user experience and investing in targeted digital marketing, Fortune Brands can directly engage more consumers.

The acceleration of online purchasing presents a significant opportunity for Fortune Brands to deepen its direct-to-consumer (DTC) relationships. For instance, the home improvement sector saw substantial digital growth in 2023, with online sales contributing a larger percentage to overall revenue. Optimizing fulfillment for these digital channels is crucial to meet evolving customer expectations.

- Continued E-commerce Expansion: Further investment in user-friendly websites and digital marketing can capture a growing digitally-native consumer base.

- Accelerated Online Shift: The ongoing consumer trend towards online purchasing of home improvement products provides a fertile ground for sales growth.

- Enhanced DTC Relationships: Improving online fulfillment and direct engagement strategies can strengthen customer loyalty and increase market share.

Fortune Brands is well-positioned to leverage the growing consumer interest in smart home technology, with the global market for such devices projected to exceed $170 billion by 2025. The company can integrate these features into its existing product lines, like smart locks and connected plumbing, to capture this expanding market. Furthermore, the increasing demand for sustainable building materials offers a chance to innovate in water-efficient fixtures and energy-saving solutions, aligning with both consumer preferences and regulatory trends.

Expansion into international markets, particularly in emerging economies with growing middle classes, presents a significant opportunity for revenue diversification. Strategic acquisitions of smaller, innovative companies, such as its 2023 acquisition of Aqualisa, can bolster product portfolios and market presence. Forming partnerships with technology providers also accelerates innovation and broadens market reach, as seen in its collaborations to integrate smart home capabilities.

The company can also capitalize on the accelerating shift to e-commerce for home improvement goods. Enhancing its digital channels and direct-to-consumer relationships, especially as online sales continue to grow, will be key. In 2024, online sales for home improvement products saw a notable increase, underscoring the importance of a strong digital presence.

| Opportunity Area | Market Trend/Driver | Fortune Brands' Strategic Advantage | 2024/2025 Data Point |

|---|---|---|---|

| Smart Home Technology | Increasing consumer demand for connected living | Integration of smart features into existing product lines (e.g., smart locks, connected plumbing) | Global smart home market projected to exceed $170 billion by 2025 |

| Sustainable Building Materials | Consumer and regulatory push for greener products | Innovation in water-efficient fixtures, energy-saving solutions, and sustainable materials | Growing consumer preference for eco-friendly home products |

| International Market Expansion | Growth in emerging economies, expanding middle class | Diversification of revenue streams, mitigating single-market risks | Significant portion of revenue from international sales in 2024 |

| E-commerce and DTC Growth | Acceleration of online purchasing for home improvement goods | Enhancing digital channels and direct consumer engagement | Notable increase in online sales for home improvement products in 2023/2024 |

Threats

A significant economic downturn or recession presents a major threat to Fortune Brands, as it directly curtails consumer spending on discretionary home improvement projects and new housing starts. Reduced disposable income and more stringent credit availability can lead to a noticeable drop in demand across all their product segments, from cabinets to plumbing fixtures.

For instance, if a recession in late 2024 or early 2025 leads to a 5% contraction in GDP, this would likely translate to a substantial decline in new home construction, a key market for Fortune Brands. Historically, during recessions, housing starts can fall by over 30%, directly impacting sales volumes for companies like Fortune Brands that rely heavily on this sector.

Continued increases in interest rates, as seen with the Federal Reserve maintaining its benchmark rate in the 0.25%-0.50% range through early 2024, directly impact housing affordability. Higher borrowing costs for consumers and builders can significantly dampen demand for new homes and large-scale remodeling projects. This trend directly affects Fortune Brands' sales volumes by making significant home investments less accessible.

Fortune Brands faces a significant threat from escalating material and labor expenses. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, impacting companies like Fortune Brands that rely heavily on inputs like lumber, plastics, and metals. This inflationary pressure, coupled with ongoing labor shortages in manufacturing sectors, directly squeezes profit margins.

Global supply chain disruptions, a persistent issue throughout 2023 and into 2024, further exacerbate these cost pressures. These disruptions make it harder and more expensive to source essential components. The challenge for Fortune Brands lies in its ability to absorb these rising costs or pass them on to consumers without negatively impacting sales volume, a delicate balancing act in a competitive market.

Disruptive Technologies and Business Models

The home and security products industry is ripe for disruption. Emerging technologies like advanced smart home integration and new, sustainable materials could fundamentally alter consumer preferences and product lifecycles. For instance, the global smart home market was valued at approximately $84.5 billion in 2023 and is projected to reach $200 billion by 2030, indicating a significant shift towards connected living solutions that Fortune Brands must address.

Innovative business models, particularly direct-to-consumer (DTC) approaches, pose a direct challenge to traditional distribution networks. Companies leveraging online sales and subscription services can offer greater convenience and potentially lower prices, bypassing established retail partnerships. Fortune Brands' ability to adapt its go-to-market strategies and invest in research and development, particularly in areas like IoT integration and sustainable manufacturing, will be crucial for maintaining its competitive edge against these evolving threats.

- Emerging Technologies: Smart home integration, AI-powered security, and new material science advancements.

- Innovative Business Models: Direct-to-consumer (DTC) sales, subscription services for security monitoring, and online-first product offerings.

- Market Impact: Potential erosion of market share for traditional players if they fail to adapt to new consumer demands and technological shifts.

- Mitigation Strategy: Increased investment in R&D, strategic partnerships for technology adoption, and agile adaptation of distribution channels.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations, building codes, and product safety standards present a significant threat to Fortune Brands. For instance, the increasing focus on water conservation globally could necessitate costly redesigns for plumbing fixtures, a core product category. In 2024, the EPA's proposed stricter standards for PFAS chemicals in drinking water could impact Fortune Brands' water filtration products, requiring substantial investment in alternative materials or filtration technologies to ensure compliance.

Stricter regulations on water usage, material sourcing, or manufacturing processes could directly impact production efficiency and product costs. For example, new mandates on recycled content in building materials could increase raw material expenses. Failure to adapt to these evolving standards, such as those related to embodied carbon in construction materials, could lead to competitive disadvantages and increased operational expenses.

Non-compliance with these varied and often complex regulations carries substantial risks. Beyond potential fines, which can run into millions of dollars for major environmental violations, a significant threat lies in reputational damage. In 2025, consumer and investor scrutiny on sustainability practices is expected to intensify, making any compliance failures highly visible and potentially impacting market trust and brand value.

- Increased Compliance Costs: Adapting to new environmental and safety standards often requires significant R&D and capital expenditure for product redesign and manufacturing process modifications.

- Supply Chain Disruptions: Changes in material sourcing regulations, such as those related to conflict minerals or sustainable forestry, could disrupt existing supply chains and necessitate finding new, potentially more expensive, suppliers.

- Market Access Restrictions: Failure to meet evolving product safety or environmental performance standards in key markets could result in restricted market access or product bans.

- Litigation and Fines: Non-compliance can lead to substantial fines from regulatory bodies and potential litigation from affected parties, impacting profitability and cash flow.

Intense competition from both established players and agile new entrants poses a significant threat to Fortune Brands. Companies with lower overheads or more specialized offerings can capture market share, particularly in niche segments. For instance, the rise of private label brands in home improvement, often offering comparable quality at lower price points, directly challenges Fortune Brands' established product lines.

The housing market's cyclical nature and sensitivity to economic conditions remain a persistent threat. A slowdown in new home construction, as experienced with a potential 10-15% decrease in housing starts projected for late 2024 if interest rates remain elevated, directly impacts demand for Fortune Brands' core products. Furthermore, shifts in consumer preferences towards smaller, more energy-efficient homes could reduce the average value of renovations and new builds, impacting overall revenue.

The company also faces the threat of changing consumer preferences and purchasing habits. The increasing preference for online shopping and direct-to-consumer (DTC) models, bypassing traditional retail channels, requires significant adaptation. For example, if a significant portion of the $450 billion US home improvement market shifts online, Fortune Brands must ensure its digital presence and distribution capabilities can effectively compete with digitally native brands.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024-2025) |

|---|---|---|---|

| Competition | Private Label Brands | Erosion of market share, price pressure | Increased availability of private label cabinets and plumbing fixtures in big-box retailers. |

| Market Conditions | Housing Market Slowdown | Reduced demand for new construction products | Projected 10-15% decrease in housing starts in late 2024 due to sustained high interest rates. |

| Consumer Behavior | Shift to Online/DTC | Loss of sales through traditional channels | Growing online share of the $450 billion US home improvement market necessitates robust e-commerce strategies. |

SWOT Analysis Data Sources

This Fortune Brands SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert industry commentary. These diverse and credible sources ensure a well-rounded and data-driven understanding of the company's strategic landscape.