Fortune Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

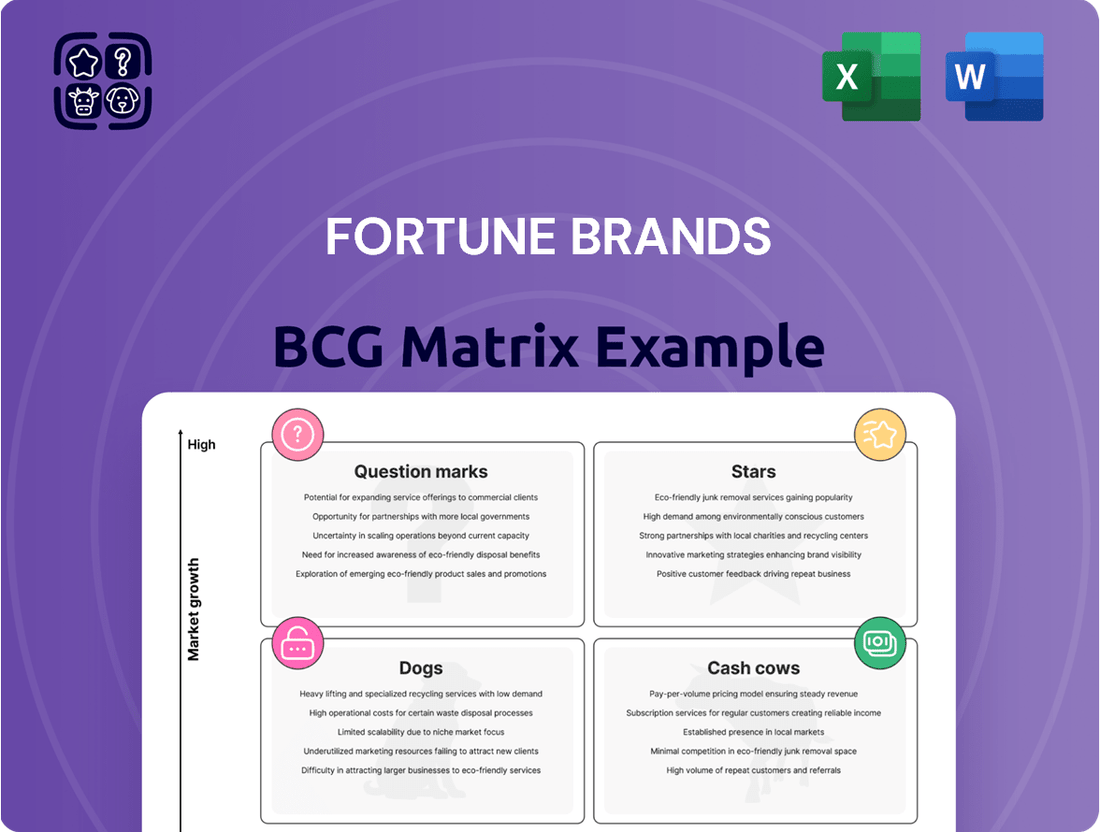

Fortune Brands' BCG Matrix offers a crucial snapshot of its diverse product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understanding these placements is key to unlocking strategic growth and optimizing resource allocation.

Don't miss out on the complete analysis; purchase the full BCG Matrix report to gain detailed quadrant insights, data-driven recommendations, and a clear roadmap for your investment and product decisions.

Stars

Flo by Moen is a shining example of a Star within Fortune Brands Innovations' portfolio. Its position is solidified by its impressive performance in the booming smart home sector. The company saw a remarkable 180% surge in Flo sales during the first quarter of 2024, a clear indicator of both strong product demand and a rapidly growing market.

This growth trajectory aligns perfectly with Fortune Brands' strategic focus on digital expansion. The company has set an ambitious goal of achieving $300 million in sales from its digital initiatives by 2025, underscoring the importance of products like Flo by Moen to its future success.

Fiberon is categorized as a Star in the BCG Matrix due to its strong performance in the expanding composite decking sector. This market is anticipated to experience a compound annual growth rate (CAGR) between 6% and 10.7% in the near future.

The brand's emphasis on sustainability, including the use of recycled materials, resonates with the robust growth in green building materials, a market projected to grow at a CAGR of 9.9% to 12.5% between 2029 and 2034.

Fiberon's strategic product line expansions and dedication to enhancing durability and aesthetics further solidify its competitive position, supporting its Star status.

Yale Residential, a key player in Fortune Brands' security segment, is well-positioned to capitalize on the booming smart lock market. This sector is anticipated to expand at a compound annual growth rate (CAGR) of 12.7% to 19.7% starting in 2025, showcasing significant upward momentum.

This growth trajectory for smart locks aligns perfectly with the broader smart home security market, which is projected to see a CAGR of 14.3% to 16.9% between 2025 and 2029. Yale's strategic emphasis on incorporating advanced smart technology into its products directly supports its ambition for increased market share in this dynamic and expanding industry.

House of Rohl (Luxury Water Innovations)

House of Rohl, a key brand within Fortune Brands Innovations' Water Innovations segment, is positioned as a potential star in the BCG matrix. Despite a broader market slowdown in Q1 2025, House of Rohl has shown resilience by outperforming in the luxury consumer segment. This indicates a strong foothold in a high-value niche where demand for premium home fixtures remains robust.

The luxury market segment that House of Rohl serves is characterized by consumers who are less impacted by economic downturns and continue to prioritize quality and design in their home renovations. This sustained investment in premium products allows House of Rohl to maintain a significant market share within this growing category.

- Brand Strength: House of Rohl maintains a strong market share in the luxury faucet and fixture segment.

- Market Growth: The luxury home goods market continues to show resilience and growth, even amidst broader economic fluctuations.

- Competitive Advantage: Less price sensitivity among luxury consumers allows for sustained revenue and profitability.

- Future Potential: Continued innovation and brand focus are likely to cement its star status.

Strategic Digital & Connected Product Initiatives

Fortune Brands Innovations is actively pouring resources into enhancing its digital capabilities and integrating connected product features across its diverse brands. This strategic push is designed to position the company at the forefront of smart home technology, anticipating substantial revenue growth and market leadership.

These initiatives are not just about adding technology; they represent a fundamental shift towards creating more integrated and intelligent living spaces. For instance, in 2023, the company highlighted its commitment to innovation, with a significant portion of its R&D budget allocated to digital and connected solutions, aiming to capture a larger share of the rapidly expanding smart home market.

- Digital Transformation Investment: Fortune Brands is channeling significant capital into digital infrastructure and software development to support its connected product ecosystem.

- Connected Product Portfolio Expansion: The company is focused on launching new smart home devices and upgrading existing product lines with enhanced connectivity and user experiences.

- Market Growth Expectations: Fortune Brands anticipates these digital and connected product strategies will be key drivers of future sales growth and market share gains, aligning with broader consumer trends towards smart home integration.

Stars in Fortune Brands' BCG Matrix represent products or brands with high market share in high-growth industries. These are the company's current and future growth engines, demanding significant investment to maintain their leading positions and capitalize on market expansion. The focus is on nurturing these brands to ensure they continue to dominate their respective, rapidly expanding sectors.

Flo by Moen exemplifies a Star, driven by an 180% surge in sales in Q1 2024 within the booming smart home market. Fiberon also shines as a Star, benefiting from the composite decking sector's projected 6% to 10.7% CAGR. Yale Residential is another Star, poised to grow with the smart lock market's anticipated 12.7% to 19.7% CAGR from 2025.

| Brand | Category | Market Growth Rate (CAGR) | Fortune Brands' Strategic Focus |

|---|---|---|---|

| Flo by Moen | Smart Home Water Security | High (Smart Home Sector) | Digital expansion, connected product features |

| Fiberon | Composite Decking | 6% - 10.7% (Near Future) | Sustainability, product innovation, green building |

| Yale Residential | Smart Locks | 12.7% - 19.7% (From 2025) | Advanced smart technology integration |

| House of Rohl | Luxury Home Fixtures | Resilient Growth (Luxury Segment) | Premium product focus, brand strength in niche |

What is included in the product

Highlights which Fortune Brands units to invest in, hold, or divest based on market share and growth.

Fortune Brands BCG Matrix: A clear visual roadmap to strategically allocate resources, relieving the pain of uncertainty in portfolio management.

Cash Cows

Moen, a stalwart in the plumbing fixture industry, stands as a prime example of a cash cow for Fortune Brands. Its global recognition and extensive product range, from traditional faucets to sophisticated plumbing systems, have cemented its position as a market leader.

Despite fluctuations in the broader Water Innovations segment, Moen's consistent demand and strong brand loyalty translate into significant and reliable cash flow. In 2024, the plumbing products sector, which Moen heavily influences, continued to show resilience, with consumer spending on home improvement and maintenance remaining a key driver.

Master Lock, a cornerstone of Fortune Brands, operates within the mature but stable traditional security hardware market, especially recognized for its padlocks. The company commands a significant market share in this segment, contributing reliably to Fortune Brands' overall financial health.

While the broader locks market is projected to grow at a moderate 6.9% between 2025 and 2034, Master Lock's dominant position ensures consistent cash flow. This steady revenue stream from its established product lines makes it a classic cash cow within the BCG matrix.

Therma-Tru, a prominent player in entry door systems, operates within the mature residential construction and remodeling market. Its strong brand recognition and commitment to quality have secured a substantial market share, enabling consistent profit generation.

This steady performance translates into a reliable cash flow for Fortune Brands. In 2024, the housing market experienced a moderate recovery, with new housing starts projected to reach around 1.4 million units, indicating continued demand for essential components like entry doors.

Larson (Storm & Screen Doors)

Larson, much like Therma-Tru, holds a significant position in the storm and screen door market for Fortune Brands. This sector experiences steady demand, fueled by ongoing home upkeep and improvement projects.

The consistent demand for storm and screen doors ensures a reliable revenue stream, even without explosive growth. In 2024, the home renovation market continued to show resilience, with spending on maintenance and repair estimated to remain robust, supporting brands like Larson.

Larson's established market share within this stable category is a key contributor to Fortune Brands' overall cash flow generation. This strong performance in a mature market solidifies its role as a cash cow.

- Brand Strength: Larson is a leading name in storm and screen doors.

- Market Stability: The segment benefits from consistent demand due to home maintenance.

- Cash Generation: Strong market share translates to reliable cash flow for Fortune Brands.

- 2024 Outlook: Home renovation spending provided a stable environment for Larson's performance.

Established Core Residential Repair & Remodel Products

Established core residential repair and remodel products represent a significant portion of Fortune Brands Innovations' business, acting as its cash cows. These mature product lines leverage strong brand recognition and extensive distribution networks to consistently generate substantial cash flow. Despite facing some headwinds in the broader market, the company demonstrated resilience, reporting robust margin expansion and healthy cash flow generation throughout 2024, underscoring the dependable performance of these core segments.

- Market Dominance: Fortune Brands Innovations holds a strong position in the residential repair and remodeling sector.

- Brand Loyalty and Distribution: Established brands and wide-reaching distribution channels contribute to consistent sales.

- Financial Performance: In 2024, the company achieved solid margin progress and strong cash flow, despite market challenges.

- Cash Generation: These core offerings are the primary drivers of cash for the company.

Fortune Brands' cash cows are its established brands in the residential repair and remodeling market, which consistently generate significant cash flow due to strong brand recognition and extensive distribution. These segments benefit from steady demand, making them reliable contributors to the company's financial health.

In 2024, Fortune Brands Innovations demonstrated this strength, reporting healthy cash flow generation and margin expansion despite varying market conditions. The company's focus on these mature, high-performing product lines solidifies their role as key cash generators.

| Brand | Segment | Market Position | 2024 Cash Flow Contribution |

|---|---|---|---|

| Moen | Plumbing Fixtures | Market Leader | Significant & Reliable |

| Master Lock | Security Hardware | Dominant Share | Consistent Revenue Stream |

| Therma-Tru | Entry Door Systems | Substantial Market Share | Steady Profit Generation |

| Larson | Storm/Screen Doors | Significant Position | Reliable Revenue Stream |

Full Transparency, Always

Fortune Brands BCG Matrix

The Fortune Brands BCG Matrix preview you're viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content; you'll get the complete, analysis-ready BCG Matrix report, meticulously crafted for strategic decision-making.

Dogs

Within Fortune Brands' vast product lines, such as those offered by Moen or Master Lock, certain older or less innovative stock-keeping units (SKUs) are likely experiencing declining consumer demand and market relevance. These legacy products often contribute minimal revenue and profit, consuming valuable resources without a significant return, making them prime candidates for discontinuation.

For instance, in 2023, while Fortune Brands reported strong overall performance, specific product categories might have shown slower growth, indicating potential underperforming legacy SKUs. Companies like Fortune Brands often review their portfolios to identify these items, which may represent less than 5% of total revenue but still require inventory management and marketing support.

Certain product lines within Fortune Brands, particularly those heavily reliant on components imported from countries facing potential tariffs, could be classified as 'dogs' in a BCG matrix analysis. If the projected tariff impacts of $200 million in 2025 and an annualized $525 million in 2026 are not effectively managed, these product categories are at risk.

For instance, if supply chain diversification efforts or cost-saving initiatives fall short of fully absorbing these increased costs, the profitability and market standing of these exposed products will likely decline. This could lead to a situation where their market share stagnates or shrinks, while their growth prospects dim significantly, fitting the 'dog' quadrant.

Fortune Brands might still have a few niche product lines where demand is consistently shrinking. This is often because consumers are moving towards newer technologies or different styles, making older products less appealing. For instance, if a company sold traditional rotary phones, demand would naturally decline as smartphones became the norm.

These types of products, while perhaps once successful, now contribute very little to Fortune Brands' total revenue. In 2023, for example, while the company reported overall strong performance in its core segments like water and cabinets, any such declining niche products would represent a small fraction of that overall success, potentially less than 1% of total sales.

Because they bring in minimal revenue and may even incur costs to maintain, these products are candidates for being phased out or sold off. This allows the company to focus resources on more promising areas of its business, like its growing water management solutions which saw significant growth in 2024.

Commoditized Product Segments with Low Differentiation

In the home and security sector, Fortune Brands faces challenges in segments where products are largely indistinguishable and price wars dominate. This commoditization can lead to thinner profit margins and slower expansion for certain offerings.

For instance, basic door hardware or standard window components often compete primarily on cost. In 2024, the U.S. housing market, while showing some resilience, still experienced fluctuating demand, putting pressure on builders and manufacturers of these less differentiated products. Fortune Brands' performance in these areas is directly tied to overall construction activity and consumer spending on renovations.

- Market Share Pressure: Intense price competition in commoditized segments makes it difficult to capture and hold significant market share.

- Low Profitability: Without unique features or branding, these product lines often yield lower profit margins.

- Limited Growth Potential: Slow market growth and high competition restrict the expansion opportunities for commoditized offerings.

- 2024 Data Context: The U.S. housing starts in early 2024 saw a year-over-year increase, but regional variations and interest rate sensitivity continue to impact demand for basic building materials.

Non-Strategic or Underperforming Acquired Assets

Fortune Brands' strategic portfolio management means some acquired assets might not perform as anticipated. If smaller, non-core acquisitions struggle with integration or fail to meet financial targets, they could be categorized as 'dogs' in the BCG Matrix. These underperformers can drain capital and management attention, hindering the growth of more promising business units.

For instance, while Fortune Brands divested its Cabinets business in 2022, the principle applies to any smaller, less successful acquisitions that remain. These 'dog' assets might represent a drag on overall company performance, requiring careful evaluation for potential turnaround strategies or divestment.

- Underperforming Acquisitions: Assets that haven't integrated well or met projected financial returns.

- Resource Drain: These units can consume valuable capital and management focus without significant contribution.

- Strategic Misfit: They may no longer align with Fortune Brands' core strategic objectives or growth areas.

- Potential Divestment: Such assets are candidates for sale or closure to reallocate resources effectively.

Products classified as 'dogs' within Fortune Brands' portfolio are those with low market share and low growth prospects. These are often legacy items or those in highly commoditized markets where differentiation is minimal, leading to weak profitability and limited expansion opportunities.

For example, basic door hardware or older plumbing fixtures that face intense price competition could be considered dogs. In 2024, the U.S. housing market's performance, while showing some positive signs like increased housing starts in early 2024, still presented challenges for less differentiated products due to fluctuating demand and consumer price sensitivity.

These underperforming assets, whether they are older SKUs or less successful acquisitions, represent a drain on resources. Fortune Brands' strategy often involves identifying these products for potential divestment or discontinuation to reallocate capital towards higher-growth segments, such as its water management solutions which saw notable growth in 2024.

The company's portfolio management actively seeks to prune these 'dog' categories to improve overall efficiency and focus on areas with stronger future potential, ensuring resources are directed towards innovation and market leadership.

Question Marks

Fortune Brands is strategically expanding its smart home presence beyond core water and lock systems, venturing into new connected product categories. This proactive approach targets high-growth segments within the smart home market, which is projected to see a compound annual growth rate of 23.5% from 2025 to 2029.

These newer integrations, while currently holding a smaller market share, represent significant potential. For instance, the company might be exploring smart kitchen appliances or advanced home environmental controls. Success in these nascent areas will necessitate substantial investment to transition them from question marks to star performers in the BCG matrix.

Emerging sustainable and eco-friendly material innovations represent a significant growth area. The global sustainable construction materials market is expected to see a compound annual growth rate (CAGR) between 9.9% and 12.5% from 2025 onwards. Fortune Brands' investment in these nascent, high-potential but currently low-market-share eco-friendly materials would position them as Question Marks within the BCG Matrix, reflecting their potential for future market leadership.

Aggressive international market expansion into untapped regions, like Fortune Brands' potential ventures into Southeast Asia or parts of Africa, would classify these initiatives as Stars or Question Marks within the BCG Matrix, depending on their current growth rate and market share. These ambitious moves demand substantial capital for establishing distribution networks, marketing campaigns, and localized product development to gain traction. For example, entering a market with a projected compound annual growth rate (CAGR) of 7% for home improvement products, as seen in some emerging economies, requires a long-term commitment.

Advanced Security Solutions (e.g., AI-powered surveillance)

Advanced security solutions, such as AI-powered surveillance, would likely be categorized as Stars or Question Marks within Fortune Brands' BCG Matrix, depending on their current market penetration and growth potential. The smart home security market is experiencing robust growth, projected to reach over $70 billion globally by 2026, driven by increasing consumer demand for integrated IoT and AI features. Fortune Brands' investment in these areas, potentially through new product development or strategic acquisitions, positions them to capitalize on this trend.

For AI-powered surveillance and next-generation access control, these represent significant growth opportunities. However, they also demand substantial research and development and marketing expenditure. Given the rapidly evolving landscape and the need to establish a strong market presence, these initiatives would require careful strategic planning to transition from Question Marks to Stars, where they can generate substantial returns.

- Market Growth: The global smart home security market is projected to grow significantly, with AI and IoT integration being key drivers.

- Investment Needs: Developing and marketing advanced security solutions like AI-powered surveillance requires considerable R&D and marketing investment.

- Strategic Positioning: These advanced solutions could be Stars or Question Marks, depending on their current market share and future growth prospects for Fortune Brands.

- Competitive Landscape: The market is dynamic, necessitating continuous innovation to maintain a competitive edge.

Pilot Programs for Disruptive Technologies

Pilot programs for disruptive technologies, such as those exploring machine learning and AI applications in the home and security sectors, would be classified as Stars within the Fortune Brands BCG Matrix. These initiatives represent significant long-term growth potential, aligning with Fortune Brands' commitment to innovation.

These early-stage ventures, despite their current limited market share and substantial investment requirements, are positioned to become market leaders. For instance, Fortune Brands' ongoing investment in AI-driven predictive maintenance for smart home devices showcases this strategic focus.

- Star Classification: Pilot programs for disruptive technologies like AI in home security are considered Stars due to high growth potential.

- Early Stage Investment: These programs require significant investment but are crucial for future market leadership.

- Fortune Brands' Commitment: The company actively pursues innovation through AI and machine learning in its product development.

- Example: AI-powered predictive maintenance for smart home devices exemplifies these Star initiatives.

Question Marks within Fortune Brands' BCG Matrix represent new ventures with high growth potential but currently low market share, demanding significant investment to develop. These could include emerging smart home categories or innovative sustainable materials, mirroring the projected 9.9% to 12.5% CAGR for sustainable construction materials. Success hinges on strategic resource allocation to transform these into future Stars.

| BCG Category | Fortune Brands Examples | Market Growth Potential | Investment Requirement | Strategic Focus |

|---|---|---|---|---|

| Question Marks | New smart home categories (e.g., smart kitchen appliances), sustainable materials | High (e.g., smart home market CAGR 23.5% 2025-2029) | High (R&D, market entry) | Develop to become Stars |

BCG Matrix Data Sources

Our Fortune Brands BCG Matrix leverages comprehensive data from company financial reports, internal sales figures, and market research to accurately assess product performance and market share.