Fortune Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

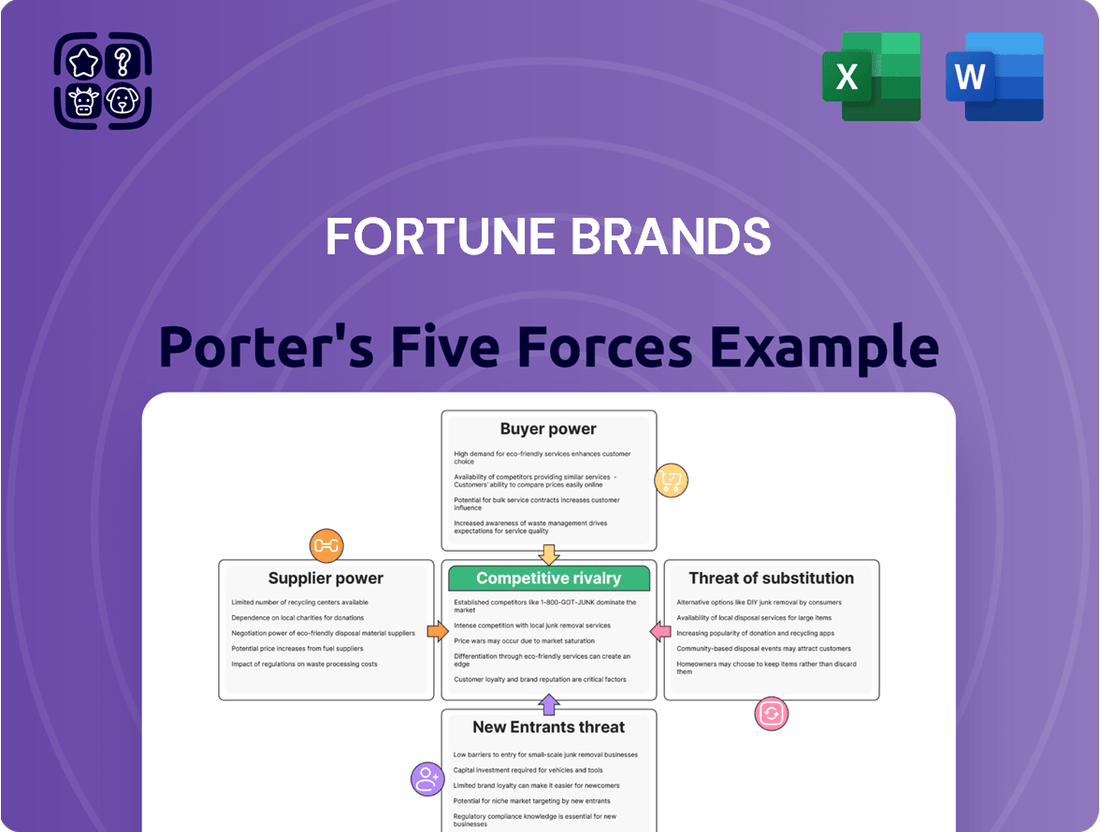

Fortune Brands faces moderate rivalry from established players and emerging brands in the home and security sectors. While buyer power is somewhat diffused across diverse customer segments, the threat of substitutes, particularly in security solutions, warrants careful consideration.

The complete report reveals the real forces shaping Fortune Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fortune Brands' reliance on key raw materials like metals, plastics, and wood, alongside manufactured components, directly impacts supplier bargaining power. For instance, if the price of copper, a critical metal for plumbing fixtures, surges due to global demand or limited mining output, suppliers of this raw material gain leverage. In 2023, the global copper market experienced price volatility, with average prices fluctuating significantly, directly affecting input costs for manufacturers like Fortune Brands.

The number of suppliers for critical inputs significantly influences bargaining power. If Fortune Brands relies on a few key suppliers for essential components, those suppliers gain leverage in setting prices and terms. For example, in 2024, the automotive supply chain experienced notable consolidation in certain specialized component sectors, leading to increased supplier leverage for manufacturers in those areas.

When suppliers offer unique or proprietary technology that is hard to find elsewhere, their bargaining power escalates. This situation can directly impact Fortune Brands' ability to innovate and manage its costs, as the company may have limited alternatives if a key supplier decides to alter its pricing or supply agreements.

Fortune Brands' suppliers can wield significant power if the costs for Fortune Brands to switch to alternative suppliers are high. These switching costs can include expenses related to retooling manufacturing processes to accommodate new materials or designs, the time and resources needed to requalify new suppliers and their products, and the potential disruption to production schedules. For example, in 2023, companies in the building products sector, where Fortune Brands operates, often face substantial investments in specialized machinery and quality control systems, making supplier changes a complex undertaking.

When these switching costs are substantial, Fortune Brands might find it difficult and expensive to move away from existing suppliers, even if current terms are not ideal. This reluctance to switch effectively strengthens the bargaining position of current suppliers. They can leverage this situation to potentially negotiate more favorable pricing or terms, knowing that Fortune Brands has limited immediate alternatives without incurring significant financial and operational penalties.

Threat of forward integration by suppliers

The threat of suppliers integrating forward into Fortune Brands' operations is a significant consideration. If suppliers possess the capability and the motivation, they could directly compete by manufacturing or distributing finished goods themselves. This scenario is more plausible if a supplier holds substantial market power, a recognizable brand, or unique technology that enables them to bypass Fortune Brands and connect directly with consumers.

For instance, a key component supplier to Fortune Brands' plumbing division might develop its own branded faucets or bathroom fixtures. In 2024, the global plumbing fixtures market was valued at over $100 billion, indicating a substantial opportunity for a supplier to capture a larger share of the value chain. If such a supplier were to invest in its own marketing and distribution networks, it could directly challenge Fortune Brands’ market position.

- Supplier Capability: Suppliers must have the financial resources, technical expertise, and operational capacity to undertake manufacturing and distribution.

- Market Power: Suppliers with significant leverage, perhaps due to exclusive technology or a dominant share of a critical input, are more likely to consider forward integration.

- Brand Recognition: A supplier with a strong existing brand can more easily transition to selling directly to consumers, leveraging that trust.

- Competitive Landscape: The intensity of competition within Fortune Brands' end markets can influence a supplier's decision to integrate forward, seeking higher margins.

Importance of Fortune Brands to suppliers

The bargaining power of suppliers to Fortune Brands is significantly influenced by how crucial Fortune Brands is as a customer to them. If a supplier relies heavily on Fortune Brands for a substantial portion of its sales, they are likely to be more accommodating with pricing and terms to maintain that valuable relationship. This dependence diminishes the supplier's leverage.

Conversely, if Fortune Brands constitutes only a small fraction of a supplier's overall business, that supplier holds considerably more power. They can more readily dictate terms, potentially leading to higher costs or less favorable conditions for Fortune Brands. This dynamic is a key consideration in supply chain management.

For example, in 2024, Fortune Brands' procurement strategy likely involves assessing the concentration of its supplier base. If a critical component is sourced from a single supplier that also serves many other large clients, that supplier's bargaining power would be elevated. Understanding these dependencies is vital for negotiating favorable supply agreements.

Key factors influencing supplier importance include:

- Revenue Dependence: The percentage of a supplier's total revenue derived from Fortune Brands.

- Customer Concentration: Whether Fortune Brands is one of many customers or a dominant one for the supplier.

- Switching Costs: The difficulty and expense for Fortune Brands to find and onboard alternative suppliers.

- Supplier's Market Position: A supplier's own strength and market share can amplify their bargaining power.

The bargaining power of suppliers to Fortune Brands is influenced by factors such as the availability of substitute inputs and the concentration of suppliers. If there are many suppliers offering similar materials or components, Fortune Brands can more easily switch, reducing supplier leverage. However, if specialized components or unique raw materials are required, and only a few suppliers can provide them, their bargaining power increases significantly.

The cost for Fortune Brands to switch suppliers is a critical determinant of supplier power. High switching costs, including investment in new equipment or retraining staff, can lock the company into existing relationships, giving suppliers more leverage. In 2023, the building products sector, where Fortune Brands operates, saw continued investment in advanced manufacturing, potentially increasing these switching costs for certain components.

Suppliers can gain leverage if they offer differentiated or proprietary products that are essential to Fortune Brands' offerings. This lack of readily available alternatives empowers these suppliers to command higher prices or more favorable terms. For example, a supplier of a unique, patented valve mechanism for plumbing fixtures would possess considerable bargaining power.

The threat of forward integration by suppliers also plays a role. If suppliers can credibly threaten to enter Fortune Brands' market by producing finished goods themselves, they can exert greater influence over pricing and supply agreements. This is particularly relevant in industries with strong brand recognition or efficient distribution networks.

| Factor | Impact on Fortune Brands | 2024 Market Context Example |

|---|---|---|

| Availability of Substitutes | Low availability increases supplier power. | Limited availability of certain sustainably sourced lumber impacted cabinet manufacturers. |

| Switching Costs | High costs empower suppliers. | Investments in specialized machinery for advanced composite materials can raise switching costs. |

| Supplier Differentiation | Unique products grant suppliers leverage. | Proprietary coatings for faucets or advanced water filtration technology. |

| Forward Integration Threat | Credible threat increases supplier leverage. | A large component supplier for kitchen sinks could potentially launch its own branded sink line. |

What is included in the product

Fortune Brands' Porter's Five Forces analysis reveals the intense competition within the home and security markets, the significant bargaining power of both suppliers and buyers, and the moderate threat of new entrants and substitutes.

Instantly identify and mitigate competitive threats by visualizing Fortune Brands' Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Fortune Brands caters to a wide array of customers, from individual homeowners buying through retail outlets to professionals such as builders and contractors. This broad customer base means the bargaining power isn't uniform across the board.

The leverage customers hold often correlates with their purchasing volume. For instance, major home builders or large retail partners who place substantial orders can negotiate more favorable pricing and terms. In 2023, Fortune Brands reported net sales of $2.9 billion, with a significant portion likely driven by these larger professional and retail accounts.

The bargaining power of customers is significantly influenced by the availability of alternatives. For Fortune Brands, operating in sectors like plumbing fixtures, cabinets, and security products, a wide array of competing brands means customers can easily switch if they're not satisfied with pricing or product offerings. This forces Fortune Brands to maintain competitive pricing and product innovation to retain its customer base.

Fortune Brands' customers, both consumers and professionals, exhibit varying degrees of price sensitivity in the home and security products market. This sensitivity directly impacts their bargaining power.

During economic slowdowns or periods of significant inflation, like those experienced in 2023 and projected for parts of 2024, consumers and businesses tend to become more budget-conscious. This heightened price awareness encourages them to actively seek out more affordable alternatives, thereby amplifying their collective leverage against suppliers like Fortune Brands.

Customer switching costs

Customer switching costs for Fortune Brands' products are generally low, meaning consumers face minimal hurdles in choosing an alternative brand or supplier. This ease of transition significantly bolsters customer bargaining power.

For many home improvement items, such as faucets or cabinetry, customers can readily opt for a competitor's product without incurring substantial financial penalties or undergoing complex processes. Similarly, contractors often have numerous distributors available, allowing them to switch suppliers with ease, further amplifying customer leverage.

For instance, in the broader home furnishings market, the average cost for a consumer to switch from one retailer to another for a significant purchase like furniture is often minimal, primarily involving time and research rather than direct financial outlay. This low barrier to switching reinforces the customer's ability to demand better pricing or terms.

- Low Switching Costs: Customers can easily change brands or suppliers with little effort or expense.

- Consumer Choice: For home improvement products, consumers can select from various brands readily available.

- Contractor Flexibility: Contractors can source materials from multiple distributors, increasing their options and bargaining power.

- Market Dynamics: The ease of switching in the home improvement sector empowers customers to negotiate favorable terms.

Customer information and market transparency

Customer information and market transparency significantly bolster buyer power. With readily available online access to product details, price comparisons, and customer reviews, consumers are better equipped to make informed choices. This heightened awareness allows them to leverage competitive pricing, putting pressure on companies like Fortune Brands to deliver strong value and maintain transparent pricing to secure their market position.

In 2024, the digital landscape continued to empower consumers. For instance, platforms like Houzz and Home Depot’s websites offer extensive product information and customer reviews for home improvement goods, a core market for Fortune Brands. This accessibility means customers can easily compare features and prices across different brands, directly impacting Fortune Brands' ability to command premium pricing without a clear differentiation.

- Increased Information Access: Online platforms provide consumers with unprecedented access to product specifications, pricing, and peer reviews.

- Price Sensitivity: Well-informed customers can easily compare prices, increasing price sensitivity and demanding better value.

- Competitive Pressure: This transparency forces companies like Fortune Brands to focus on value propositions and competitive pricing strategies.

- Impact on Margins: Higher customer bargaining power can lead to compressed profit margins if companies cannot effectively differentiate their offerings.

The bargaining power of Fortune Brands' customers is moderate to high, driven by low switching costs and the availability of numerous alternatives in the home and security products markets. Customers, from individual homeowners to large contractors, can easily compare prices and features across various brands, forcing Fortune Brands to maintain competitive pricing and focus on product differentiation to retain its market share.

In 2023, Fortune Brands generated $2.9 billion in net sales, with a significant portion coming from large professional and retail accounts that hold considerable negotiation leverage. The digital age further empowers customers, with online platforms providing easy access to price comparisons and reviews, intensifying pressure on Fortune Brands to offer compelling value propositions.

| Factor | Impact on Fortune Brands | Supporting Data/Observation |

|---|---|---|

| Switching Costs | Low | Customers can easily switch between brands of faucets, cabinets, or security systems without significant financial or procedural barriers. |

| Availability of Alternatives | High | The home improvement sector is highly competitive, with numerous brands offering similar products, giving customers ample choice. |

| Customer Information | High | Online platforms like Houzz and retailer websites provide extensive product details, pricing, and reviews, enabling informed customer decisions. |

| Price Sensitivity | Moderate to High | Economic conditions, such as inflation in 2023-2024, increase customer focus on affordability, amplifying their negotiation power. |

Full Version Awaits

Fortune Brands Porter's Five Forces Analysis

This preview displays the complete Fortune Brands Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring no discrepancies or missing information. This detailed analysis will equip you with critical insights into the industry's structure and Fortune Brands' competitive positioning, ready for immediate application.

Rivalry Among Competitors

The home and security products market is quite crowded, featuring a mix of big global companies and smaller, specialized firms. This means Fortune Brands faces competition across its various product lines, from faucets and sinks to cabinetry and smart home security systems.

This diversity of competitors, with players like Kohler, Masco, and Spectrum Brands, creates a highly competitive environment. For instance, in the kitchen and bath plumbing sector, established brands constantly innovate and market to capture consumer attention, making it challenging for any single player to dominate.

In 2024, the home improvement market saw continued activity, with companies investing in new product development and marketing to stand out. Fortune Brands, with its broad portfolio, must contend with rivals who are also actively seeking to grow their market share in these often mature segments.

The home and security products industry's growth rate directly impacts how fiercely companies compete. When the market is expanding rapidly, there's often enough business for everyone, which can temper aggressive rivalry. However, as growth slows or the market matures, companies tend to fight harder for every sale.

In 2024, the global smart home market, a key segment for Fortune Brands, was projected to grow at a compound annual growth rate (CAGR) of around 10-15%, according to various industry reports. This relatively healthy growth rate suggests that while competition exists, it may not be as cutthroat as in a stagnant market. Still, companies are vying for market share through innovation and marketing.

The ability to differentiate products significantly influences competitive rivalry within the home and security products sectors. Fortune Brands benefits from well-established brands like Moen, known for its faucet innovation, and Master Lock, a leader in security solutions. In 2023, Moen continued to invest in smart home technology, introducing new connected water control systems, which directly addresses the need for meaningful product differentiation.

However, the industry constantly pushes for innovation to avoid products becoming mere commodities. Intense price competition can quickly erode profit margins if differentiation efforts falter. For instance, in the smart home security market, rapid technological advancements mean that features introduced one year can become standard the next, necessitating ongoing research and development spending to maintain a competitive edge.

Exit barriers for competitors

High exit barriers can trap unprofitable competitors in the market, forcing them to continue aggressive actions. This situation, often seen in industries with specialized assets or substantial fixed costs, can lead to prolonged periods of intense rivalry and price pressure. For instance, in the building products sector where Fortune Brands operates, significant investments in manufacturing facilities and distribution networks can make it difficult and costly for companies to divest or shut down operations, even when facing losses.

These elevated exit barriers mean that even struggling players may persist, contributing to market overcapacity. This persistence fuels ongoing price competition as firms try to recover their sunk costs. Companies might be bound by long-term supply contracts or face substantial costs associated with decommissioning specialized machinery, making a swift exit unfeasible.

- Specialized Assets: Manufacturing plants designed for specific product lines in the building materials industry represent significant sunk costs, making them hard to repurpose or sell.

- Long-Term Contracts: Agreements with suppliers or distributors can obligate companies to continue operations, even if unprofitable, to avoid breach of contract penalties.

- High Fixed Costs: The substantial capital tied up in factories, equipment, and established distribution channels creates a strong incentive to keep operating rather than incur immediate closure costs.

Strategic stakes and brand loyalty

The home and security products market is strategically vital for numerous companies, and the presence of powerful, well-established brands, such as those within Fortune Brands' portfolio, significantly intensifies competitive rivalry. This market sees substantial investment in marketing and brand development aimed at cultivating deep customer loyalty.

Gaining market share from established competitors is therefore a difficult and expensive undertaking. Companies are compelled to allocate significant resources to differentiate their offerings and build lasting relationships with consumers. For instance, in 2024, the home improvement sector continued to see robust marketing spend as companies fought for consumer attention.

- High Brand Loyalty: Established brands like Moen and Master Lock, under the Fortune Brands umbrella, benefit from decades of consumer trust and recognition, making it harder for new entrants to capture significant market share.

- Marketing Investment: Companies in this space regularly invest millions in advertising, sponsorships, and digital marketing campaigns to maintain brand visibility and appeal. In 2023, for example, major players in the home goods sector collectively spent over $5 billion on advertising.

- Product Differentiation: While core functionality is similar, companies strive to differentiate through design, innovation, smart home integration, and warranty services, which requires ongoing R&D and marketing efforts.

- Customer Acquisition Cost: The combination of strong brands and aggressive marketing drives up the cost of acquiring new customers, as competitors vie for the same consumer base.

Competitive rivalry within Fortune Brands' home and security products sectors is intense, driven by a crowded market with both global giants and niche players. This dynamic is further fueled by significant marketing investments and the challenge of differentiating products in often mature segments.

In 2024, the home improvement market continued to see companies battling for market share through innovation and aggressive marketing. The global smart home market, a key area for Fortune Brands, experienced projected growth of 10-15% CAGR, indicating a competitive but expanding landscape where differentiation is crucial.

High exit barriers, such as specialized assets and substantial fixed costs in manufacturing, can keep less profitable competitors in the market, leading to sustained price competition. Established brands like Moen and Master Lock, part of Fortune Brands, benefit from strong brand loyalty, but companies must continually invest in R&D and marketing to maintain their edge against rivals.

| Factor | Impact on Fortune Brands | 2024 Data/Observation |

|---|---|---|

| Market Crowding | Intensifies competition across all product lines. | Mix of large global firms and smaller specialized competitors. |

| Product Differentiation | Essential for market share and profitability. | Moen's investment in smart water control systems highlights ongoing innovation efforts. |

| Marketing Spend | Crucial for brand loyalty and customer acquisition. | Companies collectively spent over $5 billion on advertising in the home goods sector in 2023. |

| Exit Barriers | Can lead to overcapacity and price pressure. | Specialized manufacturing assets and high fixed costs in building products sector. |

SSubstitutes Threaten

The threat of substitutes for Fortune Brands is significant, stemming from diverse product categories. For instance, in the home building and renovation sector, alternative materials like metal or composite shelving can replace traditional wood cabinetry, potentially impacting demand for Fortune Brands' cabinetry solutions. In 2024, the global market for shelving systems is projected to reach over $70 billion, with a growing segment focused on non-wood alternatives.

The relative price-performance of substitutes is a critical factor for Fortune Brands. If alternative products, like those from competitors in the plumbing or cabinets sectors, offer comparable or better quality for less money, customers will naturally gravitate towards them. For instance, if a competitor launches a new line of faucets with similar durability but priced 15% lower, this directly challenges Fortune Brands' market position and ability to maintain premium pricing.

Customer willingness to switch to alternatives hinges on how easy and risk-free it is to adopt them. For example, homeowners might choose to reface their existing cabinets instead of buying new ones, or tackle small repairs themselves rather than purchasing replacement parts, directly impacting demand for Fortune Brands' offerings.

Technological advancements enabling new substitutes

Rapid technological progress consistently introduces novel substitutes, potentially undermining established product categories. For instance, the burgeoning smart home ecosystem presents a significant threat, as integrated systems for security, water management, and even plumbing fixtures can diminish the demand for Fortune Brands' traditional standalone offerings. By 2024, the smart home market was valued at over $100 billion globally, with continued robust growth projected, indicating a substantial shift in consumer preferences towards connected solutions.

These technological shifts create substitutes that offer enhanced functionality or convenience, directly impacting consumer choice. Consider how smart water leak detectors and automated shut-off valves, increasingly common in new home constructions, directly compete with traditional plumbing components and water control systems. This trend is further evidenced by the fact that over 40% of new homes built in the US in 2024 incorporated some form of smart home technology, a figure expected to rise.

- Smart Home Integration: Advancements in IoT and AI are enabling seamless integration of home systems, making standalone products less appealing.

- Digital Disruption: New technologies can create entirely new product categories that bypass traditional market structures.

- Consumer Adoption: Increasing consumer comfort and demand for smart technology directly fuels the growth of substitute solutions.

Switching costs for customers to adopt substitutes

The ease and expense associated with customers switching to alternative products significantly influence the threat of substitutes. If the transition to a different option requires little financial outlay or minimal effort, customers are more inclined to explore and adopt substitutes. For instance, a homeowner undertaking a renovation who decides to opt for a different brand of faucet or toilet might find the switching costs to be quite low, making them more receptive to exploring alternatives beyond Fortune Brands' offerings.

For Fortune Brands, this means that products with lower switching costs present a greater substitution threat. Consider the plumbing fixtures market; if a consumer finds it just as easy and affordable to install a competitor's faucet as one from Moen or Kohler, the competitive pressure from substitutes intensifies. This low barrier to entry for customers considering alternatives directly impacts Fortune Brands' pricing power and market share.

In 2023, the home improvement sector saw continued consumer interest in DIY projects, potentially lowering the perceived effort of switching. While specific data on switching costs for individual plumbing fixtures isn't readily available, the general trend towards accessible installation guides and readily available tools suggests that for many basic fixtures, the hurdle for a customer to switch brands remains relatively low. This environment necessitates that Fortune Brands continually innovate and offer distinct value propositions to retain customer loyalty.

- Low Switching Costs: Many of Fortune Brands' core products, particularly in plumbing and hardware, can have relatively low switching costs for consumers.

- DIY Culture Impact: The rise in DIY projects means consumers are more comfortable with installation, potentially reducing the perceived effort and cost of switching to a substitute brand.

- Brand Loyalty vs. Price: While brand loyalty exists, a significant price difference or superior feature set in a substitute can easily sway price-sensitive consumers, especially for less differentiated products.

The threat of substitutes for Fortune Brands is substantial, particularly from integrated smart home solutions that offer enhanced functionality over standalone products. For instance, smart water leak detectors and automated shut-off valves are increasingly displacing traditional plumbing components. The smart home market, valued at over $100 billion globally in 2024, demonstrates a clear consumer shift towards connected living, directly impacting demand for conventional offerings.

Entrants Threaten

The home and security products manufacturing sector, where Fortune Brands operates, generally requires significant upfront capital. This includes substantial investments in production facilities, advanced machinery, ongoing research and development, and building out robust distribution channels to reach consumers effectively.

These considerable capital requirements serve as a formidable barrier to entry. New companies often find it challenging to amass the necessary funds to establish operations on a scale that can compete with established players like Fortune Brands, thereby limiting the threat of new entrants.

Fortune Brands' robust brand loyalty, exemplified by names like Moen and Master Lock, presents a significant barrier for new entrants. These established brands have cultivated trust and recognition over many years, making it difficult for newcomers to gain traction. For instance, in 2023, Moen continued to be a leading brand in the faucet market, a position built on decades of consumer confidence.

Access to distribution channels presents a significant barrier for new entrants in the home and security products market. Established companies like Fortune Brands have cultivated deep, long-standing relationships with key retailers such as Home Depot and Lowe's, as well as extensive networks of wholesalers and professional contractors. In 2023, Home Depot reported over $150 billion in net sales, highlighting the immense reach and importance of such partnerships.

Newcomers find it exceptionally challenging to secure comparable shelf space and market access. Fortune Brands' preferred supplier status with major distributors means that new products often face an uphill battle to even be considered, let alone prominently displayed. This existing infrastructure and trust are difficult and costly for new players to replicate, effectively limiting their ability to reach a broad customer base.

Economies of scale

Existing players like Fortune Brands leverage substantial economies of scale, particularly in manufacturing and procurement. For instance, in 2023, Fortune Brands Innovations reported net sales of $2.2 billion, indicating a significant operational footprint. This scale allows for lower per-unit production costs, presenting a formidable barrier for new entrants aiming to compete on price.

The cost advantage derived from these economies of scale makes it challenging for newcomers to match the pricing strategies of established firms. Fortune Brands' ability to negotiate bulk discounts on raw materials and optimize its supply chain further solidifies this advantage. This financial muscle translates into a more competitive market position, deterring potential new entrants who lack the capital and volume to achieve similar cost efficiencies.

- Significant Cost Advantage: Fortune Brands' large-scale operations in 2023, with $2.2 billion in net sales, enable lower per-unit production costs.

- Procurement Power: Bulk purchasing of materials leads to better pricing, a benefit new entrants struggle to replicate.

- Logistical Efficiency: Optimized supply chains reduce transportation and distribution expenses, contributing to overall cost competitiveness.

- Pricing Pressure: The cost efficiencies allow Fortune Brands to offer more attractive pricing, making it difficult for new companies to enter and gain market share.

Regulatory hurdles and intellectual property

The home and security products industry presents significant barriers to entry due to stringent regulatory requirements and complex building codes. New companies must invest heavily to ensure compliance with safety certifications and local regulations, a process that can be both time-consuming and costly. For instance, in 2024, navigating the varying environmental and safety standards across different U.S. states alone demanded substantial upfront resources for any new manufacturer.

Furthermore, established players like Fortune Brands possess a robust portfolio of intellectual property, including patents and trademarks. This IP acts as a formidable shield, making it difficult for newcomers to develop and market competing products without facing potential infringement claims. The cost of independent research and development to circumvent existing patents can be prohibitive, effectively limiting the competitive landscape for emerging businesses in key product segments.

- Regulatory compliance: Navigating diverse building codes and safety certifications requires significant upfront investment and expertise.

- Intellectual property: Fortune Brands' extensive patent portfolio deters new entrants from entering specific product categories without risking infringement.

- R&D costs: Developing unique products to avoid patent infringement necessitates substantial research and development expenditures for new companies.

- Market access: Meeting established quality and safety standards, often backed by patents, creates a high barrier to entry for new players.

The threat of new entrants for Fortune Brands is generally considered low. This is primarily due to the substantial capital investment required to establish manufacturing facilities, acquire advanced machinery, and build out effective distribution networks. For example, in 2023, Fortune Brands Innovations reported significant capital expenditures to support its operational growth and product development.

Existing brand loyalty, exemplified by brands like Moen, and established relationships with major retailers such as Home Depot, further solidify this low threat. Newcomers face challenges in replicating Fortune Brands' scale, procurement power, and logistical efficiencies, which contribute to a significant cost advantage. In 2023, Fortune Brands Innovations achieved net sales of $2.2 billion, underscoring its market presence and operational scale.

| Barrier to Entry | Impact on New Entrants | Fortune Brands' Position (2023 Data) |

|---|---|---|

| Capital Requirements | High upfront investment needed for facilities and machinery. | Significant operational scale and investment capacity. |

| Brand Loyalty & Reputation | Difficult for new brands to gain consumer trust and recognition. | Strong established brands like Moen and Master Lock with decades of consumer confidence. |

| Distribution Channels | Challenging to secure shelf space and access to retailers. | Long-standing partnerships with major retailers like Home Depot. |

| Economies of Scale | New entrants struggle to match cost efficiencies of large-scale production. | Net sales of $2.2 billion, enabling lower per-unit costs and bulk purchasing advantages. |

Porter's Five Forces Analysis Data Sources

Our Fortune Brands Porter's Five Forces analysis is built upon a foundation of robust data, incorporating insights from the company's annual reports, SEC filings, and investor presentations. We also leverage industry-specific market research reports and trade publications to capture a comprehensive view of the competitive landscape.