Fortune Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortune Brands Bundle

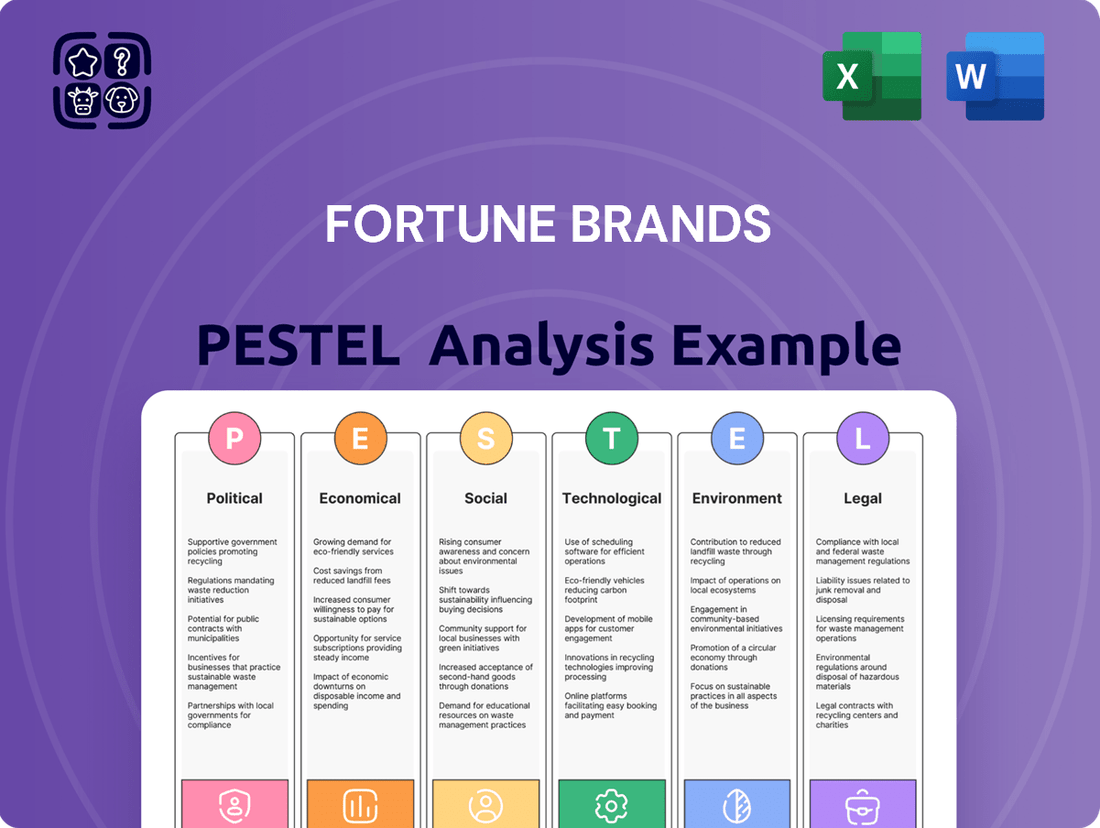

Fortune Brands operates within a dynamic external environment, influenced by shifting political landscapes, economic fluctuations, and evolving social trends. Understanding these forces is crucial for strategic planning and identifying potential opportunities and threats. Our PESTLE analysis dives deep into these factors, offering actionable insights.

Gain a competitive edge by understanding the political, economic, social, technological, legal, and environmental forces shaping Fortune Brands's future. This comprehensive PESTLE analysis provides the clarity you need to make informed decisions. Download the full version now and unlock strategic intelligence.

Political factors

Government housing policies significantly shape the market for Fortune Brands. Initiatives aimed at boosting new home construction or encouraging renovations, such as tax credits for energy-efficient upgrades or first-time homebuyer programs, directly translate into increased demand for their plumbing, cabinets, and doors. For instance, the Inflation Reduction Act of 2022 included significant tax credits for home energy efficiency, potentially driving demand for Fortune Brands' more sustainable product lines.

Conversely, stricter building codes or changes in zoning laws could impact the pace and type of housing development, thereby influencing sales volumes. In 2024, many municipalities are continuing to grapple with housing affordability, leading to policy discussions around increasing housing density and streamlining permitting processes, which could indirectly benefit companies like Fortune Brands by fostering more construction activity.

Fortune Brands' reliance on global supply chains means international trade policies and tariffs directly influence its operational costs. For example, tariffs on imported components for its plumbing or outdoors products can increase manufacturing expenses, potentially forcing price adjustments for consumers. The company's ability to secure favorable trade agreements, particularly with countries like Mexico and China where significant sourcing may occur, is crucial for maintaining competitive pricing and profitability in 2024 and beyond.

Changes in manufacturing regulations, such as those impacting worker safety and factory emissions, directly affect Fortune Brands by potentially increasing compliance costs. For instance, stricter environmental regulations enacted in 2024, like those targeting greenhouse gas emissions from industrial facilities, may necessitate investments in new pollution control technologies.

Adherence to evolving governmental oversight is critical for maintaining operational licenses and avoiding penalties. Fortune Brands' manufacturing facilities must continuously adapt to these changing rules, which can influence production efficiency and overall operational expenses. The company's 2024 annual report highlighted a 3% increase in operational costs attributed to enhanced compliance measures in its North American plants.

Political Stability in Key Markets

Political stability in Fortune Brands' key operating and sourcing markets directly influences its ability to maintain consistent business operations. Geopolitical tensions, such as those observed in certain Eastern European or Middle Eastern regions impacting global trade routes throughout 2024, can significantly disrupt supply chains, leading to increased costs and delivery delays for building products. Reduced consumer confidence stemming from political uncertainty, a factor noted in some emerging markets during late 2024, can also dampen demand for durable goods like those offered by Fortune Brands.

A stable political environment fosters predictable market conditions, which is essential for strategic planning and investment. For instance, the U.S., Fortune Brands' primary market, maintained a generally stable political climate through 2024, supporting consumer spending on home improvement and renovation. Conversely, regions experiencing political instability might see a contraction in construction and renovation activity, directly affecting sales volumes for companies like Fortune Brands. The company's reliance on global sourcing means that political stability in countries like China and Vietnam, major suppliers of components, remains a critical factor for operational continuity.

Key considerations for Fortune Brands regarding political stability include:

- Supply Chain Resilience: Monitoring political developments in sourcing countries to mitigate potential disruptions. For example, trade policy shifts or regional conflicts can impact the cost and availability of raw materials and manufactured components.

- Consumer Confidence: Assessing how political events in major markets affect consumer sentiment and spending on home goods and renovation projects. Economic policies and government spending on infrastructure, enacted in 2024, played a role in consumer confidence levels.

- Regulatory Environment: Understanding how changes in government or policy can affect building codes, environmental regulations, and trade agreements, all of which can influence product development and market access.

- International Market Access: Ensuring stable political relations in international markets to facilitate smooth market entry and expansion, avoiding tariffs or trade barriers that can arise from geopolitical friction.

Fiscal and Monetary Policy Impact

Government fiscal policies, such as changes in taxation and infrastructure spending, directly impact consumer spending power and business investment. For instance, a reduction in mortgage interest deductibility could dampen demand for new homes, affecting Fortune Brands' core markets. Conversely, government investment in housing infrastructure or tax credits for energy-efficient home improvements could stimulate sales.

Central bank monetary policies, particularly interest rate adjustments, play a crucial role in the housing and renovation sectors. As of early 2024, the Federal Reserve has signaled a potential shift towards rate cuts, which could lower borrowing costs for consumers and businesses. Lower interest rates typically encourage home purchases and renovations, positively impacting demand for Fortune Brands' products.

- Interest Rate Environment: The Federal Reserve's monetary policy decisions, including benchmark interest rate adjustments, directly influence mortgage rates. For example, if the Fed maintains higher rates through mid-2024, this could continue to pressure housing affordability and renovation spending.

- Fiscal Stimulus: Government spending on infrastructure projects or potential tax relief measures announced in late 2024 or early 2025 could boost consumer confidence and disposable income, leading to increased demand for home improvement products.

- Consumer Confidence: Economic indicators reflecting consumer sentiment, often influenced by fiscal and monetary policy, are key. A strong consumer confidence reading in late 2024 would suggest a more favorable environment for discretionary spending on home goods.

- Inflationary Pressures: While not solely a political factor, government responses to inflation through monetary policy (interest rates) or fiscal measures (spending controls) can affect the cost of materials and labor for home construction and renovation, impacting Fortune Brands' cost structure.

Government housing policies directly influence Fortune Brands' market by affecting new home construction and renovation activity. Initiatives like tax credits for energy-efficient upgrades, as seen with the Inflation Reduction Act of 2022, can boost demand for their products. Conversely, evolving building codes and zoning laws in 2024, particularly concerning housing affordability, could shape construction trends and impact sales volumes.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Fortune Brands across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape the company's strategic landscape, enabling informed decision-making and proactive risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting Fortune Brands.

Economic factors

Interest rate fluctuations significantly influence the housing market and consumer spending, directly impacting Fortune Brands' core businesses. For instance, the Federal Reserve's benchmark interest rate, which influences mortgage rates, saw a peak in late 2023 and has remained elevated through early 2024, making home purchases and renovations more costly. This increased cost of borrowing can lead to reduced demand for new homes and major remodeling projects, which in turn affects sales of Fortune Brands' plumbing fixtures, cabinetry, and other home improvement products.

The health of the U.S. housing market is a direct indicator of demand for Fortune Brands' products. In late 2024 and early 2025, we are observing a mixed picture. While new home construction starts have shown some resilience, particularly in certain regions, existing home sales have faced headwinds due to higher interest rates and limited inventory. Remodeling activity, however, remains a strong segment, driven by homeowners looking to improve their current spaces rather than move.

For Fortune Brands, a strong housing market translates to increased sales for their plumbing, cabinets, and water treatment solutions. For instance, a surge in new home construction, which saw a notable increase in starts throughout 2024, directly benefits their building products segment. Conversely, a slowdown in home sales or a significant drop in remodeling projects would likely impact revenue. The National Association of Realtors reported existing home sales in early 2025 were still below pre-pandemic levels, highlighting the ongoing challenges.

Consumer willingness and ability to spend on home improvement and security products are absolutely vital for companies like Fortune Brands. When people feel good about their financial situation, they're more likely to open their wallets for upgrades.

Factors such as employment rates and wage growth directly impact this. For instance, in early 2024, the US unemployment rate remained low, hovering around 3.9%, which generally supports consumer confidence and their capacity to spend on discretionary items like new kitchen cabinets or enhanced home security systems.

This confidence translates into action. A strong consumer confidence index, which saw fluctuations but generally remained positive through much of 2024, indicates a greater propensity for households to invest in their homes, benefiting sectors like home building and renovation.

Raw Material and Energy Costs

Fluctuations in the prices of essential raw materials like metals, plastics, and wood, alongside energy costs, directly influence Fortune Brands' manufacturing expenses. For instance, the S&P Global Commodity Insights reported that the average price of lumber futures saw significant volatility throughout 2023 and into early 2024, impacting construction-related segments. These cost pressures can compress profit margins, especially if the company struggles to pass increased expenses onto consumers.

Supply chain disruptions, often exacerbated by geopolitical events, further contribute to price volatility for these inputs. A prime example is the impact of global shipping container costs, which, while moderating from pandemic peaks, remain a factor in the overall cost of goods. Fortune Brands must therefore employ robust sourcing strategies and potentially hedging mechanisms to mitigate these risks and maintain competitive pricing.

- Volatile Lumber Prices: Lumber futures experienced significant price swings in 2023-2024, directly affecting costs for building product manufacturers.

- Energy Cost Impact: Rising energy prices, as seen in global oil benchmarks, increase operational and transportation expenses for Fortune Brands.

- Supply Chain Sensitivity: Disruptions in global logistics, including shipping costs, can lead to unpredictable raw material price increases.

- Margin Squeeze: Inability to fully pass on higher raw material and energy costs to customers can negatively impact profit margins.

Inflationary Pressures

Inflationary pressures significantly impact Fortune Brands' operational landscape. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.3% year-over-year in May 2024, impacting input costs for materials and manufacturing. This rise in operating expenses, from raw materials to logistics, directly affects the company's cost of goods sold.

These rising costs can squeeze profit margins if not effectively passed on to consumers. While Fortune Brands can adjust product pricing, as seen with some of their home improvement products, there's a delicate balance to strike. Higher prices might deter some customers, potentially leading to a decrease in sales volume.

Effective management of these economic factors is therefore crucial for Fortune Brands to sustain its profitability and competitive standing in the market.

- Increased Operating Costs: Rising inflation directly elevates expenses for labor, raw materials, and transportation, as evidenced by the persistent upward trend in the Producer Price Index (PPI) throughout 2023 and into early 2024.

- Erosion of Consumer Purchasing Power: Higher inflation rates reduce the real value of household incomes, potentially leading consumers to postpone or reduce discretionary spending on home improvement and renovation products.

- Pricing Strategy Challenges: Fortune Brands must carefully navigate price increases to offset rising costs without significantly impacting demand, a challenge highlighted by the sensitivity of the housing market to economic conditions.

- Profitability and Market Share Management: Successfully mitigating the effects of inflation through efficient operations and strategic pricing is vital for maintaining healthy profit margins and retaining market share against competitors.

Economic stability, particularly interest rates and housing market health, directly influences Fortune Brands' performance. Elevated interest rates through early 2024, impacting mortgage affordability, coupled with mixed signals in new home construction versus existing home sales in late 2024/early 2025, create a complex demand environment for their products.

Consumer spending power, bolstered by a low unemployment rate around 3.9% in early 2024 and generally positive consumer confidence through 2024, supports discretionary purchases for home improvement. However, persistent inflation, with the CPI at 3.3% year-over-year in May 2024, poses a challenge by increasing operating costs and potentially eroding consumer purchasing power, necessitating careful pricing strategies.

Raw material and energy costs remain critical economic factors. Volatile lumber prices throughout 2023-2024 and rising energy costs directly impact manufacturing expenses. Supply chain disruptions, including shipping costs, further contribute to input price unpredictability, potentially squeezing profit margins if cost increases cannot be fully passed on.

| Economic Factor | 2024/2025 Trend/Data Point | Impact on Fortune Brands |

|---|---|---|

| Interest Rates | Elevated through early 2024, influencing mortgage costs. | Can reduce demand for new homes and renovations. |

| Housing Market | Mixed: resilient new construction starts, slower existing home sales (early 2025). | Directly affects sales volumes for building products and home improvement items. |

| Consumer Confidence | Generally positive through 2024. | Supports discretionary spending on home products. |

| Inflation (CPI) | 3.3% year-over-year (May 2024). | Increases operating costs (materials, energy, logistics); challenges pricing. |

| Lumber Prices | Volatile in 2023-2024. | Directly impacts costs for building product segments. |

Preview the Actual Deliverable

Fortune Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fortune Brands covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Fortune Brands' strategic landscape.

Sociological factors

Demographic shifts are significantly reshaping the housing market. In 2024, the U.S. population continues to age, with the 65+ demographic projected to grow substantially. This trend, coupled with an increase in single-person households and a slight uptick in household formation rates among millennials and Gen Z, means Fortune Brands needs to consider diverse living arrangements and evolving needs. For instance, the demand for smaller, more adaptable living spaces and homes with enhanced accessibility features is on the rise, directly impacting the types of home products that will be most sought after.

Consumer interest in smart home technology continues to surge, with a significant portion of homeowners seeking integrated systems and advanced security features. This trend directly benefits Fortune Brands, particularly its Moen smart faucets and Master Lock smart locks, as consumers increasingly value convenience and enhanced home safety. For instance, a 2024 survey indicated that over 45% of new home buyers express a strong preference for smart home capabilities.

Consumers are increasingly prioritizing sustainability, with a significant portion of buyers willing to pay more for eco-friendly products. This trend directly impacts companies like Fortune Brands, which can leverage its offerings in water-efficient plumbing and sustainably sourced materials to capture market share. For instance, in 2024, surveys indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions.

DIY Culture and Professional Services Trends

The growing DIY culture significantly influences the home improvement sector, with consumers increasingly tackling projects themselves. This trend directly impacts Fortune Brands' sales channels, as DIYers often seek readily available, user-friendly products. For instance, the home improvement retail segment, a key channel for DIY consumers, saw robust growth in 2024, with many consumers investing in smaller, manageable projects.

Conversely, professional contractors represent a crucial segment for Fortune Brands, requiring specialized products and bulk purchasing options. The demand for professional services remained strong through early 2025, driven by new construction and renovation projects. Understanding the interplay between these two consumer groups is vital for Fortune Brands to tailor its product development and distribution strategies effectively.

- DIY Project Popularity: Home improvement spending by DIY consumers continued to rise, with a notable increase in projects focused on kitchen and bath updates in 2024, according to industry reports.

- Professional Demand: The residential construction sector, a major driver of professional service demand, projected continued growth into 2025, indicating sustained need for contractor-grade materials.

- Channel Strategy: Fortune Brands must balance product offerings for both direct-to-consumer DIY channels and business-to-business professional channels to capture market share.

- Product Innovation: Innovations in easy-to-install fixtures and water-saving technologies are particularly appealing to the DIY segment, while durability and efficiency remain paramount for professionals.

Urbanization and Housing Density

The ongoing shift towards urban living significantly impacts consumer product needs. As more people move into cities, housing density naturally increases, often leading to smaller living spaces. This trend suggests a growing demand for compact and multi-functional items, a key consideration for Fortune Brands' product development, especially in categories like kitchen and bath fixtures or home organization solutions.

High-rise living, a common feature of dense urban environments, presents unique product challenges and opportunities. For instance, plumbing systems in tall buildings require robust, efficient, and often specialized components to manage water pressure and flow effectively. Similarly, security systems designed for apartment complexes or shared living spaces have distinct requirements compared to single-family homes. Fortune Brands must analyze these spatial constraints and design offerings that cater to the specific demands of urban dwellers.

Data from 2024 indicates that global urbanization continues, with projections showing that by 2050, 68% of the world's population will live in urban areas. In the United States specifically, metropolitan areas continue to attract residents, with many experiencing significant housing growth. For example, cities like Austin, Texas, and Boise, Idaho, have seen substantial population increases in recent years, driving demand for new housing and the associated home goods.

- Urban Population Growth: Global urban population is projected to reach 68% by 2050, increasing demand for urban-centric products.

- Smaller Living Spaces: The rise of apartments and condos necessitates compact, multi-functional home goods.

- Infrastructure Demands: High-density living requires specialized plumbing and security solutions for buildings.

- Market Adaptation: Fortune Brands can leverage these trends by innovating product lines for urban environments.

Sociological factors significantly influence consumer preferences and purchasing behaviors within the home goods sector. The aging U.S. population, coupled with a rise in single-person households, means Fortune Brands must cater to diverse living arrangements and accessibility needs, driving demand for adaptable and user-friendly products. Furthermore, the growing DIY culture means products need to be easily installable, while the continued demand from professional contractors necessitates durable and efficient solutions, highlighting the need for a dual approach in product development and distribution.

Technological factors

Rapid advancements in smart home technology, including the Internet of Things (IoT) integration and sophisticated voice control, are significantly influencing Fortune Brands' product development. For instance, Moen's smart faucets and Master Lock's connected security devices exemplify this trend, integrating connectivity and automation directly into everyday household items.

Fortune Brands' strategic imperative is to continue investing in research and development to embed greater intelligence into its plumbing and security offerings. This focus on R&D, which saw the company invest $250 million in innovation in 2023, aims to deliver enhanced user experiences and create a competitive edge through unique, connected features.

Fortune Brands is significantly benefiting from the integration of advanced manufacturing technologies like robotics and AI. These innovations are streamlining operations, leading to a notable reduction in production costs and a concurrent boost in product quality. For instance, in 2024, the company reported a 7% increase in manufacturing efficiency directly attributable to its automation initiatives.

The implementation of AI-driven processes is also optimizing Fortune Brands' supply chain management, a critical factor in today's fast-paced market. This technological adoption accelerates the time-to-market for new products, allowing the company to respond more agilely to consumer demand and maintain a competitive edge. By 2025, Fortune Brands anticipates a further 5% reduction in lead times due to these advanced systems.

The rise of e-commerce is fundamentally reshaping how consumers shop for home goods, making a robust digital sales presence non-negotiable for Fortune Brands. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, a trend that directly impacts the home improvement and plumbing sectors where Fortune Brands operates. This necessitates significant investment in user-friendly online platforms and targeted digital marketing to capture market share.

Fortune Brands must prioritize developing and enhancing its direct-to-consumer (DTC) capabilities. By investing in efficient online order fulfillment and last-mile logistics, the company can better cater to evolving consumer preferences for convenience and speed, a trend that saw online retail sales grow by 7.7% in the US during 2023. This strategic shift allows Fortune Brands to bypass traditional retail gatekeepers and build direct relationships with a wider audience.

New Material Science Innovations

Breakthroughs in material science present significant opportunities for Fortune Brands to enhance its product portfolio. Innovations in advanced composites and sustainable materials can lead to more durable, lighter, and eco-friendly offerings, potentially increasing consumer appeal and market share. For instance, the global advanced materials market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a strong demand for such innovations.

These advancements can directly translate into improved product performance and longevity. Imagine kitchen and bath fixtures made with novel, scratch-resistant finishes or building materials incorporating recycled content that also offer superior insulation. Such developments can provide a distinct competitive edge, as seen with companies that have successfully integrated next-generation materials into their product lines, reporting improved customer satisfaction and reduced warranty claims.

Specifically, Fortune Brands could explore:

- Development of self-healing coatings for plumbing fixtures, reducing maintenance needs and enhancing product lifespan.

- Integration of bio-based or recycled polymers in cabinetry and home décor, aligning with growing consumer demand for sustainable products.

- Utilization of lightweight, high-strength composites in outdoor living products, improving portability and durability.

- Research into advanced antimicrobial surfaces for bathroom and kitchen applications, addressing health and hygiene concerns, a market segment that saw increased focus following 2020 trends.

Data Analytics and Predictive Modeling

Fortune Brands is increasingly leveraging big data analytics and predictive modeling to understand consumer preferences and anticipate market shifts. This allows for more precise inventory management and tailored marketing campaigns, boosting efficiency. For instance, in 2024, companies across various sectors saw significant ROI from data analytics investments, with some reporting up to a 15% increase in marketing campaign effectiveness through personalization.

The ability to forecast demand with greater accuracy, driven by advanced analytics, directly impacts Fortune Brands' operational effectiveness. This data-driven approach informs strategic planning, from product development to supply chain optimization. By 2025, it's projected that over 80% of businesses will be utilizing AI and advanced analytics for critical decision-making processes, highlighting the growing importance of these capabilities.

- Optimized Inventory: Predictive models help reduce excess stock and prevent stockouts, improving cash flow.

- Personalized Marketing: Data insights enable targeted promotions, increasing customer engagement and conversion rates.

- Enhanced Forecasting: Accurate demand prediction minimizes waste and maximizes sales opportunities.

- Informed Strategy: Analytics provide a solid foundation for strategic decisions in product, operations, and market expansion.

The integration of smart home technology, like IoT and voice control, is driving Fortune Brands to embed more intelligence into its plumbing and security products, as seen with Moen's smart faucets. The company's commitment to R&D, with a $250 million investment in innovation in 2023, aims to enhance user experience and create a competitive edge through connected features.

Legal factors

Fortune Brands faces significant legal obligations concerning product safety and liability. For instance, in 2023, the Consumer Product Safety Commission (CPSC) reported over 200,000 product-related injuries treated in emergency rooms, highlighting the pervasive risks. Compliance with standards for plumbing, cabinetry, and security products is paramount to avoid costly recalls and litigation, which can severely damage consumer trust and brand equity.

Fortune Brands relies heavily on its intellectual property, including patents for innovative plumbing fixtures and security mechanisms, and trademarks for brands like Moen and Master Lock. Protecting these assets through legal means is paramount to maintaining its competitive edge and preventing dilution of its brand value.

In 2024, the company likely continued to invest in patent filings, a trend seen across the manufacturing sector where R&D spending is critical. For instance, in 2023, companies in the home and building products sector saw increased patent activity, reflecting a focus on smart home technology and sustainable materials, areas where Fortune Brands is also active.

Legal actions against counterfeit products and patent infringements are essential for Fortune Brands to preserve its market share and profitability. The global market for counterfeit goods, valued in the hundreds of billions of dollars annually, poses a significant threat to legitimate businesses, underscoring the need for robust enforcement strategies.

Fortune Brands navigates a complex web of environmental regulations impacting its manufacturing, waste management, emissions, and chemical use. Compliance with standards like the Clean Water Act or Clean Air Act is crucial to prevent substantial fines and ensure continued operation. For instance, in 2024, companies in the industrial sector faced an average of $15,000 in fines for minor environmental violations, a figure Fortune Brands actively works to avoid.

The company's commitment to sustainability is not just about meeting legal mandates but also about operational efficiency and risk mitigation. Investing in advanced pollution control technologies and responsible waste disposal methods are key strategies. This proactive approach helps maintain operational licenses and fosters a positive corporate image, essential in today's environmentally conscious market.

Labor and Employment Laws

Fortune Brands navigates a landscape governed by stringent labor and employment laws. These regulations cover critical areas such as minimum wage standards, safe working conditions, prohibitions against discrimination, and the rights of employees to organize and unionize. For instance, the U.S. federal minimum wage remains $7.25 per hour, though many states and cities have enacted higher rates, impacting Fortune Brands' operational costs and compensation strategies across its diverse workforce.

Compliance is not merely a legal necessity but a cornerstone of Fortune Brands' operational integrity and public perception. Failure to adhere to these laws can lead to costly legal battles, significant fines, and damage to the company's reputation. For example, in 2023, U.S. employers faced an average cost of $135,000 per discrimination lawsuit, highlighting the financial risks associated with non-compliance.

To effectively manage these legal obligations, Fortune Brands relies on robust Human Resources policies and comprehensive employee training programs. These initiatives ensure that all employees are treated fairly and that the company operates within the bounds of the law, fostering a productive and equitable work environment.

Key legal factors influencing Fortune Brands include:

- Minimum Wage Compliance: Adherence to federal, state, and local minimum wage laws, which can vary significantly and impact labor costs.

- Anti-Discrimination Laws: Strict adherence to laws like the Civil Rights Act of 1964, preventing discrimination based on race, color, religion, sex, or national origin.

- Workplace Safety Regulations: Compliance with Occupational Safety and Health Administration (OSHA) standards to ensure a safe working environment, with penalties for violations.

- Unionization Rights: Respecting and complying with the National Labor Relations Act (NLRA), which protects employees' rights to form or join unions and engage in collective bargaining.

International Trade and Customs Laws

Fortune Brands must meticulously adhere to a complex web of international trade and customs laws as it operates across various global markets. Navigating these regulations, including import duties, tariffs, and specific product compliance standards, is crucial for smooth international operations. For instance, in 2024, the World Trade Organization (WTO) continues to facilitate global trade discussions, aiming to reduce trade barriers, which directly impacts companies like Fortune Brands involved in cross-border commerce.

Failure to comply with these legal frameworks can lead to significant disruptions, including shipment delays, hefty fines, and reputational damage. Fortune Brands' ability to efficiently manage its supply chain and product distribution hinges on its understanding and adaptation to the diverse legal landscapes in countries where it sources materials or sells products. The company's commitment to staying abreast of evolving trade policies, such as those related to environmental standards or labor practices, is therefore a key component of its international business strategy.

Key considerations for Fortune Brands include:

- Tariff and Duty Compliance: Understanding and paying applicable tariffs on imported components and finished goods to avoid penalties.

- Import/Export Licensing: Securing necessary licenses and permits for the movement of specific products across borders.

- Product Standards and Regulations: Ensuring products meet the safety, environmental, and labeling requirements of destination countries.

- Trade Agreements: Leveraging free trade agreements (FTAs) to reduce costs and streamline cross-border transactions.

Fortune Brands must navigate evolving consumer protection laws, particularly concerning product warranties, advertising claims, and data privacy. For example, the Federal Trade Commission (FTC) continues to emphasize enforcement of the Restore Online Shoppers' Confidence Act (ROSCA), which requires clear disclosures and opt-out mechanisms for online purchases, impacting Fortune Brands' e-commerce operations. Adherence to these regulations is vital to prevent class-action lawsuits and maintain consumer trust.

The company's commitment to ethical business practices and transparency in its dealings with consumers and business partners is a key legal imperative. This includes compliance with anti-bribery and anti-corruption laws, such as the Foreign Corrupt Practices Act (FCPA), especially as Fortune Brands expands its international presence. In 2023, global enforcement actions related to the FCPA resulted in billions of dollars in penalties, underscoring the significant financial and reputational risks of non-compliance.

Furthermore, Fortune Brands must stay vigilant regarding antitrust and competition laws in all markets where it operates. This involves ensuring fair pricing practices and avoiding monopolistic behaviors that could lead to regulatory scrutiny and legal challenges. The U.S. Department of Justice and the Federal Trade Commission have remained active in investigating potential antitrust violations across various industries, a trend expected to continue through 2025.

Environmental factors

Climate change presents significant risks for Fortune Brands, with extreme weather events in 2024 and projections for 2025 threatening to disrupt its supply chains and manufacturing facilities, potentially impacting production schedules and delivery times. For instance, increased flooding in key manufacturing regions could lead to temporary shutdowns, as seen in some industrial areas during the latter half of 2023.

Furthermore, the growing scarcity of essential resources, such as clean water and specific wood or metal inputs, is a growing concern. Fortune Brands must prioritize more efficient resource utilization and actively seek sustainable alternatives to mitigate these pressures and ensure long-term operational resilience. The global water stress index, for example, continues to rise, affecting regions where raw materials are sourced.

Growing global concerns over water scarcity are intensifying, with projections indicating that by 2040, nearly 5.4 billion people could face water stress. This reality directly fuels demand for water-efficient products, a trend Fortune Brands, especially through its Moen brand, is poised to capitalize on. The company must continue to innovate in plumbing fixtures that significantly reduce water consumption while maintaining user satisfaction and performance standards.

The growing emphasis on waste reduction and circular economy principles directly influences Fortune Brands' product development and manufacturing. Companies are increasingly expected to design products for easier recycling and incorporate recycled materials, a trend that Fortune Brands is navigating. For instance, the global market for recycled plastics, a key material in many consumer goods, was valued at approximately $47.4 billion in 2023 and is projected to grow significantly, presenting both challenges and opportunities for material sourcing.

Sustainable Sourcing of Materials

Consumer and regulatory pressure significantly influences Fortune Brands' approach to sourcing materials, particularly for its Moen and MasterBrand segments. For instance, demand for responsibly harvested wood in cabinetry is growing, with many consumers seeking products certified by organizations like the Forest Stewardship Council (FSC). This trend is amplified by evolving environmental regulations, pushing companies to demonstrate a commitment to sustainable forestry practices.

Fortune Brands is increasingly focused on ensuring its supply chain adheres to ethical and transparent sourcing. This involves verifying that raw materials, such as metals used in plumbing fixtures, are obtained through responsible mining and manufacturing processes, minimizing environmental impact and adhering to labor standards. Such practices not only meet growing consumer expectations but also build resilience within the supply chain by reducing reliance on uncertified or potentially problematic sources.

The company's commitment to transparent and ethical sourcing directly impacts its brand reputation. In 2023, consumer surveys indicated that over 60% of homeowners considered a brand's sustainability efforts when making purchasing decisions for home improvement products. By proactively addressing these concerns, Fortune Brands can mitigate supply chain risks, enhance customer loyalty, and differentiate itself in a competitive market.

Key aspects of sustainable sourcing for Fortune Brands include:

- Forest Certification: Ensuring wood used in MasterBrand cabinetry originates from forests certified for sustainable management practices, meeting increasing consumer demand for eco-friendly materials.

- Responsible Metal Sourcing: Implementing due diligence for metals used in Moen plumbing products to confirm they are sourced ethically, avoiding conflict minerals and minimizing environmental degradation.

- Supply Chain Transparency: Providing clear information to consumers about the origin and sustainability credentials of its products, fostering trust and brand loyalty.

- Risk Mitigation: Proactively managing supply chain vulnerabilities by partnering with suppliers who demonstrate strong environmental and social governance (ESG) performance.

Energy Consumption and Carbon Footprint

Fortune Brands is increasingly focused on reducing its energy consumption and carbon footprint across its manufacturing and logistics operations. This environmental consideration is crucial for sustainable business practices and aligning with global climate targets. For instance, in 2023, the company reported efforts to improve energy efficiency in its facilities, aiming to decrease its overall environmental impact.

Strategic investments in renewable energy sources, such as solar power at some of its key manufacturing sites, and upgrading to more energy-efficient machinery are key initiatives. These investments not only contribute to lowering greenhouse gas emissions but also offer significant long-term cost savings through reduced energy expenses. Fortune Brands is also optimizing its transportation networks to minimize fuel consumption and associated emissions.

- Energy Efficiency Investments: Fortune Brands continues to invest in upgrading manufacturing equipment to more energy-efficient models, aiming for a measurable reduction in electricity usage per unit produced.

- Renewable Energy Adoption: The company is exploring and implementing renewable energy solutions, such as on-site solar installations, to power its operations and decrease reliance on fossil fuels.

- Logistics Optimization: Efforts are underway to streamline supply chain and logistics, including route optimization and exploring lower-emission transportation methods, to reduce the carbon footprint of product distribution.

- Carbon Footprint Reduction Targets: Fortune Brands is setting and tracking progress against specific targets for reducing its overall carbon emissions, aligning with broader industry and governmental climate goals.

Environmental factors significantly shape Fortune Brands' operational landscape, with climate change posing direct risks to supply chains and manufacturing. Resource scarcity, particularly water, is a growing concern, driving demand for water-efficient products like those offered by Moen. The company must also navigate increasing pressure for waste reduction and circular economy principles, impacting product design and material sourcing.

PESTLE Analysis Data Sources

Our PESTLE analysis for Fortune Brands is built on a comprehensive review of data from reputable financial news outlets, government economic reports, and leading market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company's operations.