FARO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FARO Bundle

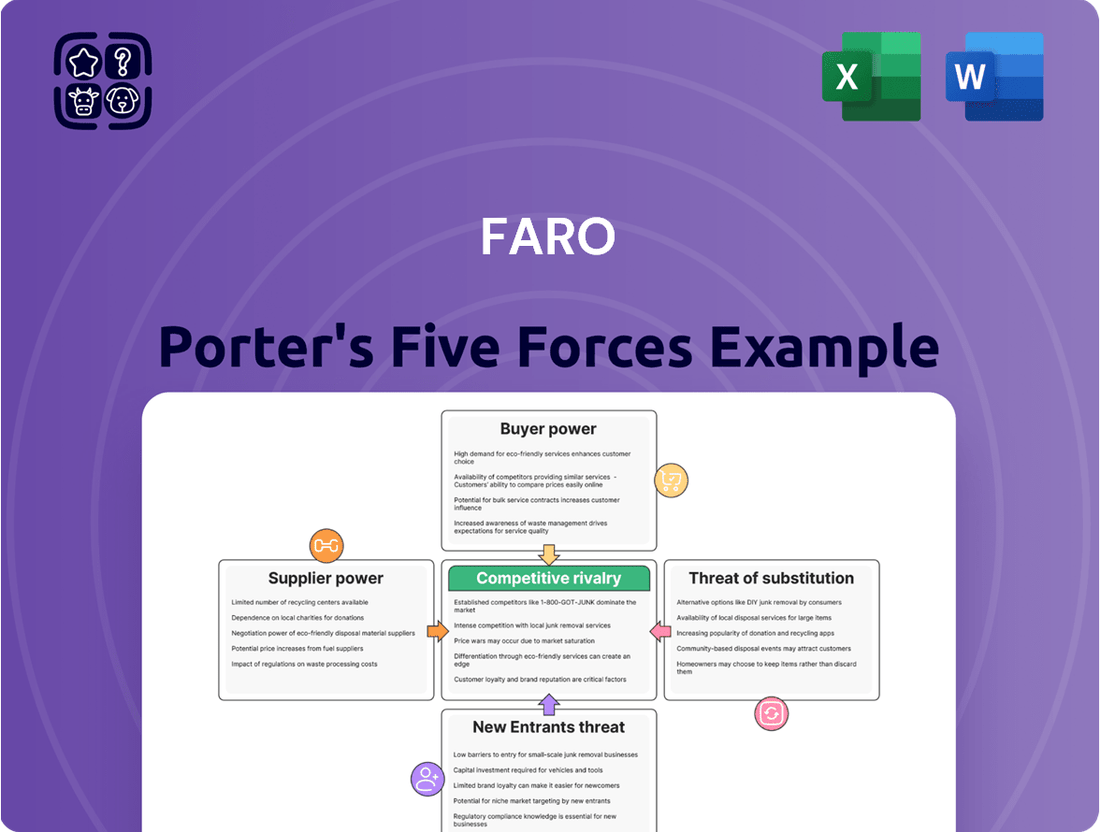

FARO's competitive landscape is shaped by intense rivalry, the threat of new entrants, and the significant bargaining power of buyers. Understanding these forces is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FARO’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

FARO Technologies' supplier landscape is shaped by the concentration of manufacturers providing its specialized components. If a significant portion of critical parts, like advanced optical sensors or precision-engineered housings, comes from a small number of vendors, these suppliers gain considerable leverage. This concentration means FARO has fewer alternatives, potentially leading to higher component costs and less favorable payment terms.

The uniqueness of the technology embedded in FARO's products further amplifies supplier power. When components are proprietary or require highly specialized manufacturing processes, suppliers can dictate pricing and supply availability. For instance, if a particular sensor technology essential for FARO's 3D scanning accuracy is only available from one or two highly specialized firms, those firms hold substantial bargaining power, impacting FARO's cost structure and production schedules.

FARO's ability to easily switch suppliers for critical components like laser scanners and measurement arms is limited by high switching costs. These costs can include significant expenses associated with redesigning products, retooling manufacturing processes, and the lengthy re-qualification of new parts, all of which disrupt production and development timelines.

For instance, integrating a new supplier for a core technology could necessitate extensive engineering changes and rigorous testing to ensure compatibility and performance standards are met. These hurdles effectively increase the bargaining power of existing suppliers, as FARO faces substantial financial and operational risks if they decide to change their supply chain for these specialized technologies.

Suppliers could threaten FARO's market position by integrating forward into the 3D measurement and imaging sector. This would mean they start producing and selling their own integrated solutions, directly competing with FARO's offerings.

However, the high complexity of FARO's combined hardware and software, coupled with deeply entrenched customer relationships, significantly mitigates this risk for most component suppliers. Only very large, diversified technology firms might possess the resources and strategic intent to overcome these barriers to entry.

Importance of Supplier Inputs to FARO's Product Quality

FARO's reliance on specialized suppliers for components that define its measurement accuracy grants these suppliers significant bargaining power. The precision and reliability of FARO's advanced metrology and 3D scanning solutions directly hinge on the quality of these critical inputs, making supplier relationships paramount.

For instance, suppliers of high-precision sensors and optical components are vital. If these suppliers face production constraints or decide to increase prices, FARO's cost of goods sold and potentially its product pricing could be directly impacted. In 2023, FARO reported Cost of Sales as $198.1 million, highlighting the substantial portion of revenue tied to its supply chain inputs.

- Component Dependency: FARO's core products, like its portable measurement arms and scanners, require highly specialized and often proprietary components to achieve their industry-leading accuracy.

- Supplier Influence: The limited number of suppliers capable of producing these high-specification parts means they can exert considerable influence on pricing and availability.

- Impact on Quality: Any compromise in the quality of these supplier inputs could directly affect FARO's product performance, potentially damaging its reputation for precision and reliability.

- Cost Implications: Increased costs from critical suppliers can squeeze FARO's profit margins, especially if these increases cannot be fully passed on to customers.

Supply Chain Consolidation and Partnerships

FARO's move to consolidate global manufacturing with Sanmina in Thailand by November 2024 signifies a concentrated reliance on a single contract manufacturer. This strategic shift could amplify Sanmina's leverage, as FARO's operational efficiency becomes closely tied to this partnership.

Conversely, FARO's February 2025 OEM agreement with Topcon, involving white-labeling, indicates a strategy to broaden market access. This diversification might mitigate the increased supplier power from the Sanmina consolidation, as it creates alternative channels and potentially strengthens FARO's overall market position.

- Supply Chain Consolidation: FARO's central manufacturing facility in Thailand, operated by Sanmina from November 2024, concentrates production.

- Supplier Leverage: This consolidation potentially increases Sanmina's bargaining power due to FARO's reliance on this single partner.

- Market Diversification: The February 2025 OEM partnership with Topcon, including white-labeling, aims to diversify market reach.

- Mitigating Supplier Power: The Topcon partnership could offset increased supplier power by creating alternative market channels and strengthening FARO's strategic options.

FARO's bargaining power with suppliers is influenced by the uniqueness of its components and the concentration of its supplier base. When specialized parts, essential for the precision of its 3D scanning and measurement equipment, are sourced from a limited number of vendors, these suppliers gain significant leverage. This situation can lead to higher costs for FARO, as seen in its 2023 Cost of Sales of $198.1 million, where supplier pricing directly impacts its expenses.

The high costs associated with switching suppliers for critical technologies, such as proprietary sensors or precision-engineered housings, further strengthen the position of existing vendors. These switching costs can involve extensive retooling and product redesign, making it operationally and financially challenging for FARO to change its supply chain. This dependency means suppliers can often dictate terms, impacting FARO's production schedules and cost structure.

FARO's strategic move to consolidate global manufacturing with Sanmina in Thailand by November 2024 centralizes its production. This concentration inherently boosts Sanmina's bargaining power, given FARO's increased reliance on this single contract manufacturer for its operational output. However, FARO's February 2025 OEM agreement with Topcon, involving white-labeling, aims to diversify its market reach, potentially offering a counter-balance to this increased supplier leverage by creating alternative strategic avenues.

| Factor | Impact on FARO's Bargaining Power with Suppliers | Example/Data Point |

|---|---|---|

| Supplier Concentration | Lowers FARO's power; increases supplier power | Reliance on few vendors for specialized components |

| Component Uniqueness/Proprietary Nature | Lowers FARO's power; increases supplier power | Sensors and optical components critical for scanning accuracy |

| Switching Costs | Lowers FARO's power; increases supplier power | High expenses for retooling and redesigning products |

| Forward Integration Threat | Lowers FARO's power (if realized) | Suppliers entering the 3D measurement market |

| Manufacturing Consolidation (Sanmina) | Lowers FARO's power; increases Sanmina's power | Centralized production in Thailand from Nov 2024 |

| Market Diversification (Topcon) | Potentially increases FARO's power | Feb 2025 OEM agreement to broaden market access |

What is included in the product

This analysis dissects the competitive forces impacting FARO, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and address competitive threats with a visual, actionable breakdown of industry forces.

Customers Bargaining Power

FARO Technologies serves a wide array of industries, from manufacturing and construction to public safety, suggesting a generally dispersed customer base. This broad reach can dilute individual customer influence.

However, significant bargaining power can emerge from large enterprise clients, particularly in high-volume sectors like automotive and aerospace. These customers often represent substantial and recurring revenue streams for FARO, making their purchasing decisions strategically important and potentially giving them leverage.

For instance, a major automotive manufacturer might negotiate favorable terms for its substantial annual purchases of FARO's advanced 3D measurement and scanning equipment, impacting FARO's pricing and service agreements.

Customers have a wide array of choices when it comes to 3D measurement and imaging solutions. Major competitors such as Hexagon AB, ZEISS Group, and Mitutoyo Corporation offer comparable technologies, providing customers with readily available alternatives.

This abundance of vendors and diverse product offerings significantly enhances customer bargaining power. When faced with multiple providers, customers can more easily switch or demand better terms, as the cost of changing suppliers is relatively low.

For instance, in the broader industrial metrology market, which includes 3D scanning, the competitive landscape is robust. In 2024, the global coordinate measuring machines market, a closely related segment, was projected to reach over $7 billion, indicating substantial vendor activity and customer choice.

Customer switching costs for FARO are a significant factor in their bargaining power. These costs can range from moderate to quite high, reflecting the substantial investment customers make in specialized hardware, which is often proprietary. Beyond the initial hardware purchase, integration with existing Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) systems is crucial, and this process can be complex and time-consuming. Furthermore, employees require training on FARO's software and hardware, and companies must adapt established operational workflows to effectively utilize the technology. This investment in technology and training creates a sticky environment, making customers less inclined to switch to a competitor due to the operational disruption and financial outlay involved.

Price Sensitivity of Customers

FARO Technologies, a company specializing in 3D measurement and imaging solutions, operates in markets where customer price sensitivity can vary significantly. In sectors like aerospace and automotive manufacturing, where precision is critical for safety and performance, customers tend to be less sensitive to price. They prioritize the accuracy, reliability, and comprehensive support offered by FARO's advanced metrology equipment. For instance, a faulty measurement in an aircraft component could have catastrophic consequences, making the cost of premium technology a secondary concern compared to ensuring absolute precision.

Conversely, in less demanding industrial applications or for customers with tighter budgets, price sensitivity can be a more dominant factor. This can increase the bargaining power of these customers. For example, a small workshop needing basic 3D scanning for less critical tasks might compare FARO's offerings against lower-cost alternatives, potentially pushing for price concessions. In 2024, the global industrial metrology market, a key segment for FARO, was valued at approximately $7.5 billion, with growth driven by automation and quality control needs, but also influenced by economic conditions that can heighten price awareness.

- High-Tech Industries: In aerospace and automotive, customers prioritize accuracy and reliability, leading to lower price sensitivity for advanced metrology solutions.

- General Applications: For less critical or capital-intensive uses, customers may exhibit higher price sensitivity, increasing their bargaining power.

- Market Context (2024): The industrial metrology market, valued around $7.5 billion in 2024, sees price sensitivity influenced by economic factors and the specific demands of the application.

Threat of Backward Integration by Customers

The threat of customers developing their own in-house 3D measurement and imaging solutions is generally low for companies like FARO. This is primarily due to the substantial capital outlay, ongoing research and development efforts, and the highly specialized technical expertise needed to create advanced 3D scanning hardware and sophisticated software.

For most clients, outsourcing these critical functions to specialized providers like FARO is a more economically sensible approach. The cost and complexity of replicating such advanced technology internally often outweigh the benefits, making it more practical to leverage the established capabilities of industry leaders.

- High Capital Investment: Developing proprietary 3D scanning technology requires significant upfront investment in manufacturing facilities, specialized equipment, and advanced materials.

- R&D Intensity: Continuous innovation in sensor technology, optics, and data processing algorithms demands substantial and ongoing research and development resources.

- Specialized Expertise: Building and maintaining a team with the necessary skills in optical engineering, software development, and metrology is a considerable challenge.

- Cost-Effectiveness: For the majority of customers, purchasing or leasing solutions from established providers like FARO presents a more cost-effective and efficient strategy than in-house development.

FARO's customers possess moderate bargaining power, influenced by the availability of alternatives and the cost of switching. While high-tech industries like aerospace show less price sensitivity, general industrial users may exert more pressure on pricing.

The threat of backward integration, where customers develop their own solutions, remains low due to the high capital, R&D, and expertise required, making outsourcing to specialists like FARO the more practical choice.

In 2024, the industrial metrology market, a key area for FARO, was valued at approximately $7.5 billion. This market's competitive nature, with players like Hexagon AB and ZEISS Group, provides customers with numerous options, thus enhancing their bargaining leverage.

| Factor | Impact on FARO's Customer Bargaining Power | Supporting Data/Observation |

| Availability of Substitutes | Increases Bargaining Power | Robust competition from Hexagon, ZEISS, Mitutoyo in the industrial metrology market. |

| Switching Costs | Decreases Bargaining Power | Significant investment in proprietary hardware, integration, and employee training creates customer stickiness. |

| Price Sensitivity | Varies; can Increase Bargaining Power | Lower in high-precision sectors (aerospace), higher in general industrial applications or during economic downturns. |

| Threat of Backward Integration | Low; Decreases Bargaining Power | High capital, R&D, and specialized expertise needed for in-house development. |

Full Version Awaits

FARO Porter's Five Forces Analysis

This is the complete, ready-to-use FARO Porter's Five Forces Analysis. What you're previewing is exactly what you'll receive, offering a comprehensive breakdown of the competitive landscape for FARO Technologies, including detailed insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate strategic planning needs.

Rivalry Among Competitors

The 3D measurement and imaging market is a crowded space, with major global players like Hexagon AB, ZEISS Group, and Mitutoyo Corporation actively competing. This intense rivalry is further amplified by the presence of many other specialized providers, creating a fragmented yet highly contested environment.

The 3D metrology and imaging market is a hotbed of activity, with impressive growth projected. We're seeing forecasts that suggest annual growth rates anywhere from 6.9% all the way up to over 23% through 2033-2035. This robust expansion is definitely good news for everyone involved, creating fertile ground for innovation and investment.

However, this rapid market expansion also acts like a magnet for intense competition. As the pie gets bigger, more companies are eager to grab a larger slice, leading to aggressive strategies and a constant drive to outperform rivals. This dynamic means that companies in this space need to be particularly sharp and adaptable to stay ahead.

FARO actively differentiates its offerings through continuous innovation, exemplified by the January 2025 launch of the FARO Leap ST handheld scanner and the integration of Blink technology, alongside ongoing CAM2 software enhancements. This commitment to new product development is crucial in a market where competitors also heavily invest in R&D.

The industry's intense focus on technological advancement, precision improvements, and expanded functionalities means that staying ahead requires constant innovation. This dynamic fuels a fierce competitive rivalry as companies strive to capture market share through superior product features and performance.

Exit Barriers

The 3D measurement industry presents considerable exit barriers due to its high fixed costs. Companies invest heavily in cutting-edge research and development, sophisticated manufacturing facilities, and specialized talent. These substantial capital outlays make it difficult for firms to cease operations without incurring significant losses.

Consequently, even companies struggling to achieve profitability often remain in the market. This persistence stems from the need to recoup their initial investments and cover ongoing fixed expenses, which prolongs competitive intensity. The pressure to cover these costs can lead to aggressive pricing or market share battles.

For instance, the capital expenditure for advanced laser scanners or coordinate measuring machines can run into millions of dollars. Companies like Hexagon Manufacturing Intelligence and Faro Technologies, major players in this space, have extensive R&D budgets. In 2023, Hexagon reported R&D expenses of approximately $1.05 billion, highlighting the continuous investment required.

- High R&D Investment: Significant ongoing spending on innovation in areas like AI-driven metrology and advanced sensor technology.

- Specialized Infrastructure: Costs associated with maintaining clean rooms, precision calibration labs, and advanced production lines.

- Skilled Workforce: The expense of employing and retaining highly trained engineers, software developers, and metrology specialists.

- Asset Specificity: Many assets are highly specialized and have limited resale value outside the 3D measurement sector, increasing exit costs.

Recent Acquisition Impact

FARO's acquisition by AMETEK, finalized on July 21, 2025, marks a significant shift in competitive rivalry. This integration places FARO within AMETEK's Ultra Precision Technologies Division, alongside established players like Creaform and Virtek.

The combined entity now boasts a more robust and diversified portfolio of 3D metrology and digital reality solutions. This expanded offering is poised to intensify competitive pressure on existing market participants, as FARO, under AMETEK's umbrella, gains enhanced market leverage and resources.

- Enhanced Portfolio: The union creates a more comprehensive suite of 3D scanning, measurement, and digital reality technologies.

- Increased Market Pressure: Competitors now face a more formidable, integrated player with broader capabilities.

- Strengthened Market Position: FARO's integration into AMETEK provides greater financial backing and market access.

The competitive rivalry in the 3D measurement and imaging market is fierce, driven by a growing market and significant investments in R&D. Companies like Hexagon AB and ZEISS Group are major players, but the landscape is also populated by numerous specialized providers, leading to intense competition. This is further amplified by the substantial exit barriers, including high fixed costs for advanced technology and specialized talent, which keep even less profitable firms engaged in the market.

The acquisition of FARO by AMETEK on July 21, 2025, has reshaped the competitive dynamics. Now part of AMETEK's Ultra Precision Technologies Division, alongside entities like Creaform, FARO benefits from enhanced resources and a more diversified portfolio. This integration is expected to increase market pressure on rivals, as the combined entity presents a more formidable competitor with greater financial backing and broader technological capabilities.

| Company | 2023 R&D Expenses (approx.) | Key Competitors | Post-Acquisition Status |

|---|---|---|---|

| Hexagon AB | $1.05 billion | ZEISS Group, Mitutoyo Corporation, FARO | Independent |

| ZEISS Group | Not publicly disclosed | Hexagon AB, Mitutoyo Corporation, FARO | Independent |

| Mitutoyo Corporation | Not publicly disclosed | Hexagon AB, ZEISS Group, FARO | Independent |

| FARO Technologies | Not publicly disclosed (prior to acquisition) | Hexagon AB, ZEISS Group, Creaform, Virtek | Acquired by AMETEK (July 2025) |

| AMETEK (Ultra Precision Technologies Division) | Not publicly disclosed | Hexagon AB, ZEISS Group, Mitutoyo Corporation | Parent Company of FARO, Creaform, Virtek |

SSubstitutes Threaten

The threat of substitutes for FARO's advanced measurement technologies primarily comes from less sophisticated, manual tools or older 2D imaging systems. While these alternatives can serve basic measurement needs, they often lack the precision, speed, and automation that FARO's 3D scanners and software offer, making them unsuitable for critical applications. For instance, traditional tape measures or calipers are still prevalent in many workshops, representing a low-cost substitute for certain routine tasks.

Customers often weigh the cost against the performance when considering alternative technologies. If simpler, cheaper options can meet the basic needs of less critical tasks, they pose a real threat. For instance, basic laser scanners might be sufficient for some architectural surveys, offering a lower entry price point compared to FARO's high-precision systems.

However, the value proposition shifts dramatically for demanding industries. In sectors like aerospace, where even minor deviations can have significant consequences, the superior accuracy and speed of FARO's 3D measurement and imaging solutions justify their premium. In 2024, the precision required in advanced manufacturing, such as producing intricate components for next-generation aircraft, makes the investment in high-fidelity technology a necessity, thereby mitigating the threat of less capable substitutes.

The emergence of new technologies like advanced photogrammetry and sophisticated AI-driven visual inspection systems presents a significant threat of substitution for traditional 3D measurement devices. These innovations can offer alternative methods for capturing and analyzing spatial data, potentially reducing reliance on FARO's core hardware offerings.

Rapid advancements in AI and machine learning are paving the way for novel 'digital reality' capture and analysis techniques. These could bypass the need for conventional hardware-centric solutions, offering a more streamlined and potentially cost-effective approach for certain applications.

For instance, while specific market share shifts are still developing, the global market for photogrammetry software alone was projected to reach over $1.5 billion by 2024, indicating a growing acceptance of alternative data capture methods.

Customer Willingness to Switch

Customer willingness to switch to substitute products for 3D metrology solutions hinges on a careful balance of perceived benefits like cost reduction or enhanced usability against the potential disruption and compromise in precision or functionality. For instance, if a substitute offers a 20% cost saving but a 5% reduction in accuracy, the decision becomes complex for high-stakes manufacturing.

In sectors with deeply embedded manufacturing processes, such as aerospace or automotive, transitioning from established 3D metrology workflows to fundamentally different substitute technologies represents a considerable undertaking. This involves not only new hardware but also retraining staff and revalidating entire quality control systems. For example, a company heavily invested in laser scanning might hesitate to switch to photogrammetry if the latter requires extensive calibration and processing time, impacting their production cycle.

- Cost Savings vs. Performance: Customers will switch if substitutes offer significant cost advantages without a substantial drop in critical performance metrics like accuracy or speed.

- Switching Costs: High costs associated with retraining, new equipment, and process integration deter switching, especially in industries with stringent quality control.

- Perceived Value: The perceived benefit of a substitute, whether it's ease of use, faster data acquisition, or better software integration, influences the likelihood of adoption.

Software-Based Solutions and Digital Twin Adoption

The increasing prevalence of software-based solutions and the growing adoption of digital twin technology present a significant threat of substitutes for traditional hardware-centric offerings in the spatial data analysis market. These digital platforms can often process and analyze existing 3D data more efficiently, potentially diminishing the perceived need for continuous investment in new scanning hardware for certain applications.

For instance, advancements in cloud-based photogrammetry and AI-driven analysis tools allow users to derive valuable insights from existing laser scan data or even drone imagery, bypassing the requirement for repeat site visits with specialized hardware. This shift means that customers might opt for enhanced software subscriptions or cloud processing services instead of purchasing the latest FARO scanners, impacting hardware sales volumes.

FARO itself acknowledges this evolving landscape, as evidenced by its strategic focus on transitioning towards a data-driven platform company. This pivot aims to leverage its expertise in data acquisition while offering integrated software solutions and analytics, thereby mitigating the threat of substitutes by becoming a provider of the very digital solutions that could otherwise replace its hardware.

The market for digital twin technology is projected for substantial growth, with estimates suggesting it could reach hundreds of billions of dollars globally in the coming years. For example, some market reports indicated the global digital twin market was valued at over $6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) exceeding 35% through 2030, highlighting the significant potential for software and platform-based solutions to capture market share.

The threat of substitutes for FARO's advanced measurement technologies is multifaceted, ranging from basic manual tools to increasingly sophisticated digital solutions. While simpler alternatives like tape measures still exist for rudimentary tasks, the more significant threat comes from emerging technologies that offer comparable or superior functionality at a lower cost or with greater ease of use.

Newer technologies, such as advanced photogrammetry and AI-powered visual inspection, are gaining traction. These can capture and analyze spatial data, potentially reducing the need for traditional hardware-based 3D scanning. For instance, the global photogrammetry software market was anticipated to exceed $1.5 billion by 2024, showcasing the growing adoption of these alternative methods.

Customer adoption of substitutes depends on a trade-off between cost savings and performance compromise. High switching costs, including retraining and process integration, can deter customers, particularly in industries like aerospace where precision is paramount. However, if substitutes offer a compelling balance, such as a 20% cost reduction with only a minor dip in accuracy, the threat becomes more pronounced.

The shift towards software-centric solutions and digital twins also poses a substitution threat. These platforms can analyze existing data, potentially reducing the demand for new scanning hardware. FARO's strategic move towards becoming a data-driven platform company aims to address this by integrating software and analytics into its offerings, mirroring the growth in the digital twin market, which was projected to reach over $6 billion in 2023 and grow significantly thereafter.

Entrants Threaten

The 3D measurement and imaging market, where FARO operates, requires significant upfront capital for cutting-edge hardware like advanced sensors and intricate software. For instance, developing next-generation laser scanners and photogrammetry solutions involves millions in specialized equipment and engineering talent.

Furthermore, continuous investment in research and development is non-negotiable to stay competitive. Companies like FARO allocate substantial portions of their revenue to R&D; in 2023, for example, many players in the industrial technology sector saw R&D spending increase by 5-10% to fuel innovation in areas like AI-driven analysis and miniaturization of hardware.

These high capital and R&D expenditures create a substantial financial barrier, deterring many potential new entrants who may lack the necessary funding and long-term commitment to establish a foothold in this technology-intensive industry.

The development of highly precise 3D measurement and imaging solutions demands deep expertise in specialized fields like engineering, optics, and advanced software development. This high barrier to entry means new companies must invest significant resources in acquiring or developing this talent.

Established companies, such as FARO Technologies, benefit from extensive intellectual property portfolios. These include numerous patents and a wealth of proprietary knowledge built over years of research and development, making it exceptionally challenging for newcomers to quickly match their sophisticated technological capabilities. For instance, in 2023, FARO reported significant R&D investments aimed at further solidifying its technological leadership.

Existing players in the 3D measurement sector, like FARO, leverage substantial economies of scale, which significantly lowers their per-unit production costs. For instance, in 2023, FARO reported revenues of approximately $317 million, allowing for greater investment in efficient manufacturing processes and technology development compared to a new, smaller entrant.

Newcomers would struggle to match the cost advantages enjoyed by established firms due to their lower production volumes. Furthermore, building and maintaining the sophisticated global sales, service, and support infrastructure that FARO offers, covering diverse industrial applications and geographical regions, represents a formidable capital and operational hurdle for any new entrant.

Brand Loyalty and Customer Relationships

In precision-critical sectors, customers often form deep loyalties to established brands, valuing consistent performance and reliable support. This makes it difficult for newcomers to gain trust and attract these established clienteles.

For instance, in the aerospace industry, a sector where FARO Technologies operates, companies typically undergo rigorous qualification processes for their metrology equipment. These processes can take years and involve significant investment, creating a strong incumbent advantage. A 2024 report indicated that over 70% of new aircraft production lines continue to utilize existing, proven metrology solutions from established vendors, highlighting the inertia in supplier relationships.

- High Switching Costs: The expense and time involved in re-qualifying new measurement equipment and retraining personnel create substantial barriers for customers considering a change.

- Established Trust and Reputation: Years of consistent product delivery and service build a reputation that new entrants struggle to replicate quickly.

- Long-Term Contracts and Support Agreements: Many precision industries operate under multi-year contracts that include ongoing service and calibration, locking in customers with their current suppliers.

Regulatory Hurdles and Industry Standards

The threat of new entrants for FARO is significantly influenced by regulatory hurdles and industry standards, particularly in sectors like aerospace and medical. These industries demand exceptional measurement accuracy and adherence to strict quality protocols. For instance, in aerospace, compliance with standards like AS9100 is often mandatory, adding substantial time and cost for new companies to establish themselves.

Navigating these complex compliance landscapes presents a formidable barrier. New entrants must invest heavily in research and development, quality control systems, and obtaining necessary certifications. This can deter potential competitors who lack the resources or expertise to meet these rigorous requirements, thereby protecting FARO's market position.

- Stringent Compliance: Industries like aerospace and medical mandate adherence to rigorous quality and accuracy standards, such as AS9100 for aerospace.

- High Entry Costs: New entrants face substantial investment in R&D, quality assurance, and certifications to meet these demanding industry requirements.

- Time-Consuming Approvals: Obtaining necessary regulatory approvals and industry certifications can be a lengthy and complex process, delaying market entry.

The threat of new entrants into FARO's 3D measurement and imaging market is generally low. This is due to the substantial capital investment required for advanced technology and R&D, coupled with the need for specialized expertise. Established players like FARO benefit from strong brand loyalty, high switching costs for customers, and significant economies of scale, all of which create formidable barriers for newcomers.

New entrants face significant challenges in matching the technological sophistication and intellectual property of established firms like FARO. The need for deep expertise in areas such as optics and advanced software development, alongside substantial R&D investments, means that only well-funded and technologically adept companies can realistically compete. For example, in 2023, many companies in the industrial technology sector increased R&D spending by 5-10% to maintain a competitive edge.

Customer loyalty and high switching costs further solidify the position of incumbents. Industries like aerospace, where FARO operates, often have rigorous qualification processes for metrology equipment that can take years, creating strong customer inertia. A 2024 report indicated that over 70% of new aircraft production lines continue to use existing, proven solutions from established vendors, underscoring this loyalty.

| Factor | Impact on New Entrants | FARO's Advantage |

| Capital Requirements | Very High (Hardware, R&D) | Established financial capacity, economies of scale |

| Technical Expertise | High (Engineering, Optics, Software) | Extensive IP portfolio, years of R&D |

| Customer Loyalty | Low initial trust, high switching costs | Strong brand reputation, long-term contracts |

| Regulatory Compliance | High (e.g., AS9100 in aerospace) | Established compliance infrastructure and certifications |

Porter's Five Forces Analysis Data Sources

Our FARO Porter's Five Forces analysis is built upon a robust foundation of data, including comprehensive industry reports, financial statements from public companies, and market intelligence from leading research firms. This blend ensures a thorough understanding of competitive dynamics.