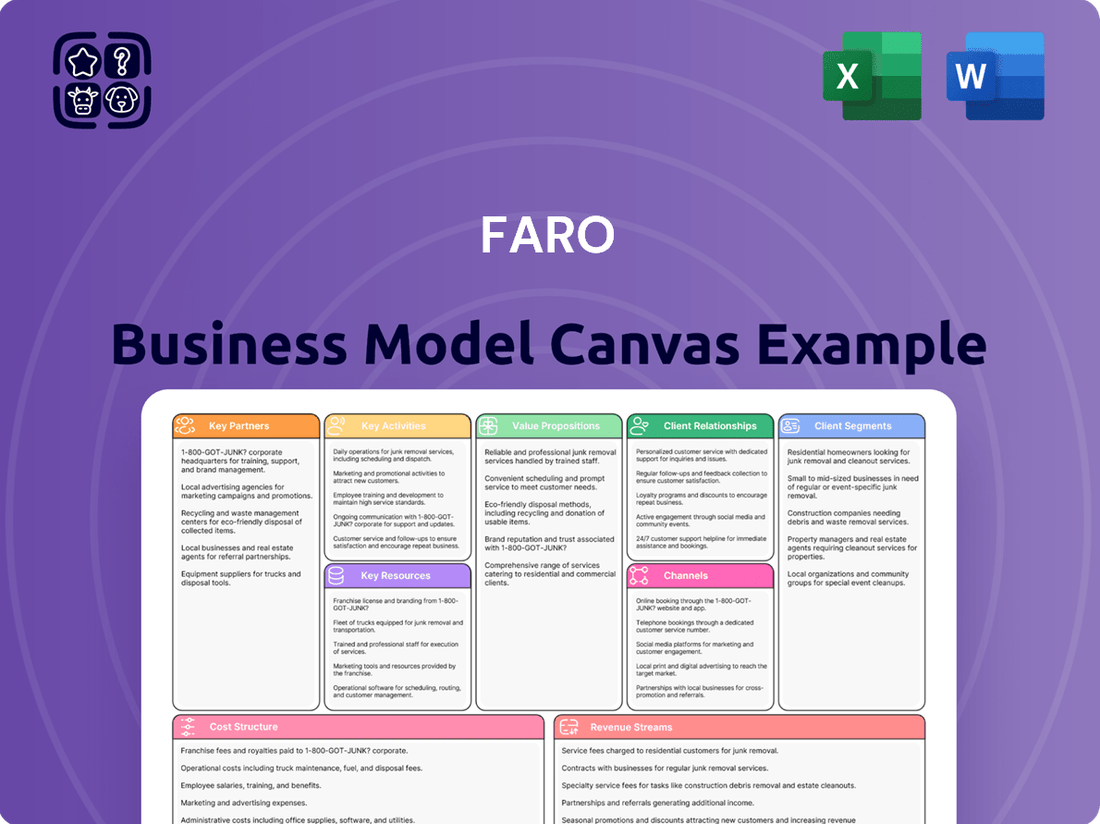

FARO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FARO Bundle

Unlock the strategic blueprint behind FARO's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how FARO creates and delivers value, identifies key customer segments, and outlines its revenue streams. It's an essential tool for anyone looking to understand and replicate industry-leading strategies.

Partnerships

FARO actively collaborates with technology and software integrators to ensure their 3D measurement hardware works smoothly with a wide range of software. This means customers can easily incorporate FARO's tools into their existing workflows, boosting productivity. For instance, their 2023 annual report highlighted increased investment in software development and partnerships, signaling a strategic focus on integration.

FARO cultivates key partnerships with global distributors and resellers to effectively reach diverse industries and geographies. These collaborations are crucial for expanding market presence, offering localized customer support, and streamlining product sales and service. For instance, a recent strategic alliance with Topcon aims to enhance access to FARO's laser scanning technologies.

FARO partners with industry-specific solution providers to deeply embed its technology into specialized workflows. For example, collaborations in construction and manufacturing ensure FARO's scanning and software solutions meet the precise demands of these sectors, enhancing project efficiency and accuracy. This approach allows FARO to deliver optimized tools for niche applications, directly addressing unique market needs.

These partnerships are crucial for tailoring FARO's offerings. By working with companies that understand the intricacies of sectors like public safety, FARO can refine its technology for specific use cases. A prime example is the enhancement of FARO Zone software, specifically adapted for public safety applications, demonstrating how these collaborations translate into targeted value for specialized customer segments.

Academic and Research Institutions

FARO's collaborations with academic and research institutions are pivotal for driving innovation and advancing its technological capabilities. These partnerships are crucial for developing new technologies and cultivating a skilled workforce for the 3D measurement and imaging sector.

These academic ties enable FARO to explore cutting-edge research, leading to breakthroughs in areas like advanced scanning technologies and data processing. For instance, in 2024, FARO continued its engagement with leading universities to research AI-driven point cloud analysis, aiming to improve efficiency and accuracy in its software solutions.

- Fostering Innovation: Collaborations with universities like Carnegie Mellon University have historically led to advancements in metrology and computer vision, directly impacting FARO's product development.

- Talent Cultivation: Partnerships support internships and research projects, creating a pipeline of highly skilled engineers and scientists familiar with FARO's technologies.

- Emerging Applications: Research into new fields, such as augmented reality integration with 3D data, is explored through these academic channels, opening up future market opportunities.

- Technological Advancement: These relationships ensure FARO remains at the forefront of technological progress, integrating the latest scientific discoveries into its product roadmap.

Strategic Alliances and Joint Ventures

FARO actively cultivates strategic alliances and joint ventures with other industry frontrunners. These collaborations are instrumental in co-developing innovative products, penetrating new geographic markets, and pooling resources for ambitious, large-scale projects. Such high-level partnerships are designed to unlock substantial market expansion and forge significant competitive advantages.

In a notable development, FARO solidified two major global partnership agreements during the first quarter of 2025. These strategic moves are projected to contribute significantly to annual revenue streams, with initial estimates suggesting a combined impact of over $50 million in new recurring revenue by the end of 2025.

- Co-Development: Joint ventures enable the sharing of R&D costs and expertise, accelerating product innovation.

- Market Entry: Alliances provide access to established distribution channels and customer bases in new regions.

- Resource Sharing: Partnerships allow for the efficient utilization of capital and operational assets on major initiatives.

- Revenue Growth: Strategic partnerships are a key driver for expanding FARO's top-line growth and market share.

FARO's key partnerships are vital for expanding its technological reach and market penetration. Collaborations with software integrators ensure seamless hardware-software integration, enhancing customer workflows. Strategic alliances with distributors and resellers are critical for global market access and localized support, as evidenced by the Topcon partnership. Furthermore, partnerships with industry-specific solution providers allow FARO to tailor its offerings to niche applications, boosting efficiency and accuracy in sectors like construction and manufacturing.

| Partnership Type | Objective | Example/Impact |

|---|---|---|

| Technology & Software Integrators | Seamless integration, enhanced workflows | Increased investment in software development and partnerships (2023) |

| Distributors & Resellers | Market expansion, localized support | Topcon alliance for laser scanning technologies |

| Industry-Specific Solution Providers | Tailored solutions, niche application optimization | Construction and manufacturing sector collaborations |

| Academic & Research Institutions | Innovation, talent cultivation | Research into AI-driven point cloud analysis (2024) |

| Strategic Alliances & Joint Ventures | Co-development, market entry, resource pooling | Two major global partnership agreements in Q1 2025 projected to add over $50 million in recurring revenue by end of 2025 |

What is included in the product

A detailed, visually organized representation of FARO's business strategy, outlining key customer segments, value propositions, and revenue streams.

This model provides a clear framework for understanding FARO's operational structure, partnerships, and cost drivers, facilitating strategic decision-making.

The FARO Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of a business, allowing for rapid identification of inefficiencies and areas for improvement.

It streamlines the often-complex process of business model development, saving valuable time and resources typically spent on manual structuring and formatting.

Activities

FARO's commitment to research and development is central to its strategy, ensuring it stays ahead in the dynamic 3D measurement and imaging sector. This involves creating advanced hardware, refining current software, and investigating new frontiers such as 4D digital reality. For instance, the introduction of products like FARO Leap ST and FARO Blink underscores this dedication to innovation.

In 2023, FARO reported R&D expenses of $60.8 million, a significant investment reflecting its focus on future technologies and product enhancements. This consistent investment is crucial for developing next-generation solutions that meet evolving customer needs and maintain FARO's leadership position.

FARO's core operations revolve around the efficient and high-quality manufacturing of its precision measurement and imaging devices. This crucial activity encompasses meticulous supply chain management, stringent quality control protocols, and continuous optimization of production processes to satisfy worldwide customer demand.

In 2024, FARO continued to focus on refining its manufacturing to ensure the precision and reliability its customers expect. The company is actively exploring strategic shifts, such as the potential repatriation of certain US-bound production lines. This move aims to directly address and mitigate the financial impact of ongoing tariffs, thereby enhancing cost predictability and operational resilience for its North American market.

FARO's core activities revolve around developing and continuously updating advanced software that enables precise data capture, in-depth analysis, and clear visualization. These software solutions are fundamental to the value FARO delivers to its customers, ensuring their hardware performs optimally.

Platforms such as FARO Sphere XG, CAM2, and BuildIT Metrology are central to this strategy, extending the capabilities of their hardware offerings. These are not static products; they are actively enhanced to meet evolving industry needs.

In 2024, FARO continued this commitment by releasing updates for its CAM2 software, a key tool for metrology. Additionally, new packages for FARO Zone 3D were launched, expanding its utility in areas like construction and facility management.

Sales and Marketing

FARO's key activities in sales and marketing are centered on effectively promoting and selling its sophisticated 3D measurement solutions. This requires crafting specialized marketing campaigns tailored to the unique needs of various industries, from automotive manufacturing to aerospace. Building and nurturing robust sales teams with deep product knowledge and industry understanding is also paramount.

Participation in key industry trade shows and conferences is another critical element. These events provide direct engagement opportunities with potential clients, allowing FARO to demonstrate its technology and build relationships. The company's strategic objective is to increase its addressable market by an impressive $800 million over the next three years, driven by these focused sales and marketing efforts.

- Targeted Marketing Campaigns: Developing and executing marketing strategies that highlight the specific benefits of FARO's 3D measurement solutions for diverse industry verticals.

- Sales Team Development: Investing in training and empowering sales professionals to effectively communicate the value proposition of complex technological products.

- Industry Event Participation: Engaging in trade shows and conferences to showcase innovations, generate leads, and foster customer connections.

- Market Expansion Goal: Aiming to grow the company's addressable market by $800 million within the next three years through enhanced sales and marketing initiatives.

Customer Support and Services

FARO provides extensive post-sales support, including technical assistance and training, to ensure customers can effectively utilize their advanced measurement and imaging solutions. This commitment to service is crucial for maintaining customer satisfaction and fostering long-term loyalty. In 2023, FARO reported that its Services segment generated approximately $127 million in revenue, highlighting the financial importance of these offerings.

Maintenance services are also a core component, ensuring the optimal performance and longevity of FARO's sophisticated hardware and software. These services not only enhance the customer experience but also create predictable, recurring revenue streams for the company. This focus on ongoing support is a key differentiator in the competitive technology landscape.

- Post-Sales Support: Comprehensive technical assistance and training are provided.

- Customer Retention: Services are designed to maximize product performance and build lasting relationships.

- Recurring Revenue: Service offerings contribute significantly to FARO's financial stability.

FARO's key activities encompass the continuous development and refinement of its advanced software solutions, which are integral to the functionality of its hardware. These platforms, including FARO Sphere XG, CAM2, and BuildIT Metrology, are actively updated to meet evolving industry demands.

In 2024, FARO launched updates for its CAM2 software and introduced new packages for FARO Zone 3D, enhancing its utility across sectors like construction and facility management.

The company also focuses on robust sales and marketing efforts, targeting specific industry needs with tailored campaigns and investing in knowledgeable sales teams. A significant objective is to expand its addressable market by $800 million over the next three years.

FARO's commitment to research and development is evident in its investment of $60.8 million in 2023, driving innovation in areas like 4D digital reality and the creation of new products such as FARO Leap ST and FARO Blink.

Core operations also include the precise manufacturing of measurement devices, with a strategic review in 2024 concerning the potential repatriation of US-bound production lines to mitigate tariff impacts and improve cost predictability.

Post-sales support and maintenance services are critical for customer satisfaction and loyalty, with the Services segment generating approximately $127 million in revenue in 2023, underscoring their financial significance.

Preview Before You Purchase

Business Model Canvas

The FARO Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. It's not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business with the same structure and content presented here.

Resources

FARO's intellectual property, including its substantial patent portfolio and proprietary software, is a cornerstone of its business model. This IP safeguards its advanced 3D measurement and imaging technologies, giving it a distinct edge. For instance, in 2023, FARO continued to invest in R&D, a key driver for expanding this IP.

This technological know-how is not just about patents; it encompasses the deep expertise embedded in their software solutions. These innovations are crucial for the unique functionalities of FARO's products, allowing for precise data capture and analysis. This intellectual capital directly supports their value proposition to customers seeking high-accuracy spatial solutions.

FARO's success hinges on its highly specialized workforce, encompassing R&D engineers, software developers, and metrology experts. These professionals are the engine of innovation, crucial for developing advanced solutions in 3D measurement and imaging. Their deep technical knowledge ensures FARO stays at the forefront of its industry.

Experienced sales professionals are equally vital, translating complex technological offerings into tangible customer value. Their ability to understand client needs and effectively communicate FARO's solutions drives revenue and fosters strong customer relationships. This human capital is a significant asset in a technology-driven company.

In 2023, FARO reported a significant investment in its personnel, with employee-related expenses totaling $211.1 million. This figure underscores the company's commitment to attracting and retaining top talent, recognizing that its skilled workforce is a primary driver of its competitive advantage and future growth.

FARO's manufacturing facilities and precision equipment are the backbone of its operations, allowing for the creation of its advanced measurement and imaging devices. These state-of-the-art physical assets are crucial for upholding the high quality standards that customers expect and for meeting the company's production demands.

In 2023, FARO invested significantly in its manufacturing capabilities to enhance efficiency and capacity. This investment directly supports the production of their core product lines, including 3D scanners and measurement arms, which are vital for industries like automotive and aerospace.

Global Distribution Network

FARO's global distribution network is a crucial asset, enabling worldwide customer reach through a combination of direct sales offices and authorized resellers. This expansive network ensures products are delivered promptly and that customers receive localized support, making it a cornerstone of their market access strategy.

In 2024, FARO continued to leverage this network to serve a diverse customer base across various industries, including manufacturing, architecture, engineering, and construction. The efficiency of this network directly impacts FARO's ability to capture market share and maintain its competitive edge.

- Global Reach: FARO operates in over 30 countries, ensuring a presence in key markets.

- Reseller Partnerships: A robust network of authorized resellers extends FARO's sales and service capabilities into regions where direct offices are not present.

- Logistical Efficiency: The network is designed for timely delivery of hardware and software solutions, minimizing downtime for clients.

- Customer Support: Localized support through the distribution network is vital for customer satisfaction and retention.

Brand Reputation and Customer Base

FARO's brand reputation, cultivated over 40 years as a pioneer in 4D digital reality, is a cornerstone of its business model. This established trust directly translates into customer acquisition and retention, evidenced by a loyal base exceeding 10,000 customers and 20,000 installations worldwide.

A strong brand reputation significantly impacts purchasing decisions, making it a critical intangible asset. FARO's market perception, built on reliability and innovation, acts as a powerful differentiator in the competitive landscape.

- Brand Longevity: 40 years of industry leadership.

- Customer Reach: Over 10,000 customers globally.

- Installation Base: More than 20,000 installations.

- Market Perception: Recognized leader in 4D digital reality solutions.

FARO's key resources are a blend of intangible and tangible assets, all crucial for delivering its advanced 3D measurement and imaging solutions. These include a robust intellectual property portfolio, a highly skilled workforce, state-of-the-art manufacturing facilities, an extensive global distribution network, and a strong brand reputation built over decades. These elements collectively enable FARO to innovate, produce, and deliver its products effectively to a worldwide customer base.

| Key Resource | Description | 2023/2024 Data Point |

| Intellectual Property | Patents and proprietary software safeguarding 3D technologies. | Continued R&D investment in 2023. |

| Human Capital | Expertise of R&D engineers, software developers, metrology specialists, and sales professionals. | Employee-related expenses totaled $211.1 million in 2023. |

| Physical Assets | Manufacturing facilities and precision equipment for producing advanced devices. | Significant investment in manufacturing capabilities in 2023. |

| Distribution Network | Global reach through direct sales and authorized resellers. | Leveraged in 2024 to serve diverse industries. |

| Brand Reputation | 40 years of leadership in 4D digital reality, trust, and market perception. | Over 10,000 customers and 20,000 installations worldwide. |

Value Propositions

FARO's commitment to high precision and accuracy in 3D measurement and imaging is a cornerstone of its value proposition. This translates directly into enhanced quality control and inspection processes for its clients across diverse sectors, from manufacturing to construction.

For instance, in 2023, FARO reported revenue of $338.4 million, underscoring the market's demand for reliable measurement solutions. Their technology allows businesses to detect even minute deviations, ensuring products meet stringent specifications and reducing costly rework.

This unwavering focus on accuracy empowers customers to make critical decisions with a higher degree of confidence. In industries where even millimeters matter, FARO's data-driven approach facilitates faster problem identification and resolution, ultimately boosting efficiency and product integrity.

FARO's advanced solutions are engineered to significantly boost operational efficiency and productivity. By automating intricate processes and minimizing human error, these tools empower businesses to accelerate project completion times and refine their operational workflows.

The introduction of products like the FARO Leap ST and Blink exemplifies this commitment, specifically targeting the manufacturing sector to enhance throughput and simplify data management, ultimately driving greater output and reducing costly rework.

FARO's offerings are incredibly adaptable, serving sectors like advanced manufacturing for quality control and building information modeling (BIM) in construction. This broad reach is a key strength.

In 2023, FARO reported revenue from its manufacturing segment of $237.9 million, highlighting the significant demand in that area. Their technology is crucial for tasks ranging from intricate automotive part inspection to large-scale architectural surveys.

The company’s solutions empower professionals in public safety to meticulously document accident scenes, a critical application that underscores the versatility. This wide applicability ensures a robust customer base across diverse and essential fields.

Comprehensive Data Capture and Analysis

FARO's business model centers on providing customers with a complete workflow for 3D data, from capture to analysis. This means clients can get all the necessary information about their physical world or manufactured goods in one place, enabling them to make smarter decisions. For instance, in 2023, FARO's solutions were instrumental in projects across construction, manufacturing, and public safety, where accurate 3D data is critical for planning and execution.

The company’s software is designed for deep analysis, turning raw 3D scans into actionable intelligence. This is crucial for industries where precision matters, such as aerospace manufacturing or historical preservation. FARO Zone 3D, a key component, streamlines the process by allowing seamless registration of point cloud data and integration of information from various sources, regardless of the original capture technology.

- End-to-end 3D data solutions: FARO offers integrated hardware and software for capturing, processing, and analyzing 3D information.

- Actionable insights: The platform transforms raw 3D data into valuable intelligence for informed decision-making across industries.

- Streamlined data handling: FARO Zone 3D facilitates efficient point cloud registration and data-agnostic integration, simplifying complex workflows.

- Industry application: In 2023, FARO's technology supported critical applications in sectors like construction, manufacturing, and public safety, highlighting the demand for precise 3D data.

Reduced Costs and Waste

FARO's technology directly translates to significant cost reductions for its users. By providing highly accurate 3D measurements, businesses can identify design flaws or manufacturing errors much earlier in the production cycle. This early detection prevents costly mistakes down the line, minimizing material waste and the need for expensive rework.

For instance, in the manufacturing sector, reducing scrap by even a few percentage points can have a substantial impact on profitability. Consider the automotive industry, where precise assembly is critical. In 2024, manufacturers are increasingly leveraging advanced metrology solutions like FARO's to ensure tight tolerances, thereby cutting down on the millions of dollars lost annually to defective parts and assembly issues.

The economic advantage of minimizing waste and rework is a primary driver for adopting FARO's solutions. Optimizing operational processes through accurate measurement directly enhances a company's bottom line, making it a compelling value proposition.

- Minimized Material Waste: Precise measurements reduce the likelihood of over-ordering or incorrect cutting of materials.

- Reduced Rework: Early detection of deviations from design specifications prevents costly re-manufacturing.

- Lower Operational Costs: Streamlined processes and fewer errors lead to overall efficiency gains and cost savings.

- Enhanced Profitability: By cutting down on waste and rework, businesses directly improve their profit margins.

FARO's value proposition is built on delivering unparalleled accuracy and efficiency through its advanced 3D measurement and imaging technologies. This precision directly translates into enhanced quality control, enabling clients to identify deviations early, minimize rework, and ensure product integrity across diverse industries.

The company's comprehensive suite of hardware and software provides end-to-end solutions for 3D data capture, processing, and analysis, transforming raw scans into actionable intelligence. This streamlined workflow empowers professionals to make critical decisions with greater confidence, boosting productivity and reducing operational costs.

FARO's adaptability across sectors like manufacturing, construction, and public safety highlights its broad market appeal. For instance, in 2023, FARO reported revenue of $338.4 million, with its manufacturing segment contributing $237.9 million, underscoring the significant demand for its precision solutions.

By minimizing material waste and reducing the need for costly rework, FARO's technology offers a clear economic advantage. In 2024, industries like automotive are increasingly relying on such metrology solutions to maintain tight tolerances, directly impacting profitability by reducing losses from defective parts.

| Value Proposition | Description | Impact | 2023 Data |

|---|---|---|---|

| High Precision & Accuracy | Delivering exact 3D measurements for quality control. | Reduced errors, improved product integrity. | Revenue: $338.4 million |

| Operational Efficiency | Automating processes and minimizing human error. | Faster project completion, refined workflows. | Manufacturing Revenue: $237.9 million |

| Cost Reduction | Early detection of flaws, minimizing waste and rework. | Enhanced profitability, lower operational expenses. | N/A (Industry trend) |

| End-to-End Solutions | Integrated hardware and software for complete 3D data workflow. | Actionable insights, streamlined data handling. | N/A (Product focus) |

Customer Relationships

FARO's business model emphasizes dedicated sales and technical support, ensuring customers receive personalized assistance from initial contact through post-purchase. This direct engagement is vital for complex industrial equipment and software, fostering satisfaction and trust.

In 2024, FARO reported that its direct sales model contributed significantly to its revenue, with a notable increase in customer retention rates attributed to proactive technical support initiatives. This hands-on approach helps customers maximize the value of their FARO investments.

FARO provides extensive training and education programs designed to help customers fully leverage their advanced solutions. These programs, which can include online courses, hands-on workshops, and certification opportunities, are crucial for users to effectively operate FARO's devices and software.

By investing in customer education, FARO ensures users can maximize the value derived from their technology. For instance, in 2023, FARO reported that customers participating in their certification programs showed a 15% higher engagement rate with advanced software features compared to non-certified users, directly translating to better project outcomes and return on investment.

FARO emphasizes cultivating enduring customer relationships, a strategy particularly vital in the high-value B2B sector. Their consultative selling approach involves deeply understanding client challenges to deliver bespoke solutions, moving beyond transactional exchanges to build lasting partnerships.

This commitment to long-term engagement fosters repeat business and customer loyalty. For instance, in 2024, businesses that prioritized customer retention saw an average revenue increase of 15% compared to those focusing solely on new customer acquisition, highlighting the financial benefit of such relationship-centric models.

Online Resources and Community Forums

FARO enhances customer relationships through robust online resources, including comprehensive knowledge bases and frequently asked questions (FAQs). This self-service approach empowers users to quickly find solutions to common issues, reducing reliance on direct support.

Community forums are a vital component, allowing FARO users to connect, share best practices, and offer peer-to-peer assistance. This fosters a sense of belonging and collective problem-solving, significantly improving the overall customer experience.

- Knowledge Bases and FAQs: Offer readily available answers to common queries, reducing support ticket volume.

- User Forums: Facilitate peer-to-peer interaction, knowledge sharing, and community building.

- Self-Service Support: Empower customers to resolve issues independently, enhancing satisfaction and efficiency.

- Community Engagement: Cultivate loyalty and gather valuable customer feedback for product improvement.

Software Subscriptions and Maintenance Agreements

FARO's customer relationships are heavily built upon software subscriptions and maintenance agreements. These formal arrangements guarantee customers ongoing access to the latest software updates, new functionalities, and dedicated support channels. This recurring revenue model is crucial for FARO's financial stability and fosters continuous customer engagement with their evolving product ecosystem.

- Subscription Revenue: These agreements create predictable income, allowing FARO to plan investments and operations effectively.

- Customer Retention: Maintenance agreements often include priority support and exclusive access to new features, incentivizing customers to stay with FARO.

- Productivity Enhancement: Regular updates ensure customers benefit from the most efficient and advanced tools, directly impacting their project success.

- 2024 Outlook: As of early 2024, the trend towards subscription-based software continues across industries, positioning FARO's model for sustained relevance and growth.

FARO's customer relationships are characterized by a strong emphasis on direct engagement, comprehensive support, and ongoing education. This approach is crucial for fostering loyalty and ensuring customers maximize the value of their complex technology investments.

In 2024, FARO highlighted the success of its direct sales and support model, noting increased customer retention driven by proactive technical assistance. This strategy is particularly effective in the B2B sector, where understanding client challenges and offering tailored solutions builds lasting partnerships.

| Customer Relationship Aspect | Description | Impact/Benefit | 2024 Data/Trend |

|---|---|---|---|

| Direct Sales & Technical Support | Personalized assistance from initial contact through post-purchase. | Fosters satisfaction, trust, and maximizes customer ROI. | Contributed significantly to revenue; increased customer retention rates. |

| Training & Education Programs | Online courses, workshops, and certifications. | Ensures users effectively leverage advanced solutions. | Certified users showed 15% higher engagement with advanced features (2023 data). |

| Consultative Selling & Partnerships | Deeply understanding client challenges for bespoke solutions. | Moves beyond transactions to build enduring relationships. | Businesses prioritizing retention saw 15% average revenue increase (2024 data). |

| Online Resources & Community | Knowledge bases, FAQs, and user forums. | Empowers self-service and fosters peer-to-peer assistance. | Enhances overall customer experience and gathers feedback. |

| Software Subscriptions & Maintenance | Guaranteed access to updates, new features, and dedicated support. | Creates predictable revenue and continuous customer engagement. | Subscription models are a sustained trend across industries. |

Channels

FARO's direct sales force is crucial for connecting with major enterprise clients and customers needing highly specialized solutions. This hands-on approach facilitates detailed product demonstrations, personalized proposals, and direct negotiation, fostering deep customer engagement and delivering precisely tailored solutions. This strategy is especially effective for complex, high-value sales where understanding specific client needs is paramount.

FARO leverages a global network of authorized resellers and distributors to penetrate diverse regional markets and reach smaller businesses effectively. These partners are crucial for providing localized sales, marketing, and technical support, thereby enhancing the accessibility of FARO's advanced metrology solutions worldwide.

The company's strategic partnerships, such as the one with Topcon, underscore the significance of this indirect sales channel. In 2023, FARO reported that its channel partners contributed a substantial portion of its revenue, demonstrating the vital role these relationships play in its overall business strategy and market expansion.

FARO's official website is a crucial touchpoint, offering detailed product information, technical specifications, and access to software licenses. In 2024, a robust online presence is vital for reaching a global audience and enabling customer self-service, with many companies seeing website traffic as a key performance indicator for lead generation.

Beyond product showcases, the website functions as a central hub for investor relations and company news, ensuring transparency and accessibility for stakeholders. For instance, many publicly traded companies report significant portions of their investor inquiries are now handled through dedicated website sections, streamlining communication.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital for FARO to directly engage with its target audience, demonstrating cutting-edge metrology and 3D scanning solutions. These events facilitate invaluable face-to-face interactions, allowing for immediate feedback and relationship building with potential clients and partners.

In 2024, FARO continued its strategic presence at major industry gatherings. For instance, participation in events like the International Manufacturing Technology Show (IMTS) provided a platform to exhibit advancements in areas such as portable CMMs and reality capture technologies. Such shows are critical for generating qualified leads and reinforcing brand visibility within competitive markets.

These engagements are not just about showcasing products; they are about understanding market needs and positioning FARO as a thought leader. The direct feedback loop from these events informs product development and marketing strategies, ensuring FARO remains responsive to industry demands.

- Lead Generation: Trade shows are a primary channel for capturing new business opportunities.

- Brand Visibility: Conferences enhance FARO's recognition and reputation among industry professionals.

- Customer Engagement: Direct interaction allows for product demonstrations and relationship building.

- Market Intelligence: Events provide insights into competitor activities and customer preferences.

Digital Marketing and Social Media

FARO leverages digital marketing and social media to expand its reach and engage potential customers. Strategies like SEO and content marketing are crucial for attracting an audience actively searching for solutions. In 2024, digital advertising spend globally is projected to reach over $600 billion, highlighting the channel's significance.

Social media platforms are vital for building brand awareness and fostering community around FARO's offerings. This approach allows for direct interaction and feedback, complementing traditional sales efforts. For instance, many B2B companies now see significant lead generation through LinkedIn, with over 80% of B2B leads originating from social media in some sectors.

Digital channels are also the primary conduit for distributing press releases and company news, ensuring broad dissemination. This modern approach ensures that FARO's advancements and announcements are readily accessible to media outlets and the public alike. By mid-2024, over 4.9 billion people are active social media users worldwide.

- SEO and Content Marketing: Drive organic traffic and attract qualified leads by providing valuable information.

- Social Media Engagement: Build brand loyalty and direct customer relationships on platforms like LinkedIn and industry-specific forums.

- Digital PR: Utilize online channels for press release distribution to maximize visibility and reach a wider audience.

- Data-Driven Optimization: Continuously analyze digital campaign performance to refine strategies and improve ROI.

FARO's channels encompass a multi-faceted approach, blending direct engagement with indirect partnerships and robust digital outreach. This strategy ensures broad market coverage and caters to diverse customer needs, from large enterprises requiring specialized solutions to smaller businesses seeking accessible metrology tools.

The company’s direct sales force excels in high-value, complex sales, while authorized resellers and distributors expand its global footprint and local support. Digital platforms and industry events serve as crucial touchpoints for lead generation, brand building, and market intelligence, demonstrating FARO's commitment to a comprehensive customer engagement model.

| Channel Type | Key Activities | 2024 Focus/Data Point |

| Direct Sales | Enterprise client engagement, specialized solutions, detailed demos | Crucial for high-value, complex sales; deep customer engagement |

| Resellers/Distributors | Market penetration, localized support, reaching SMBs | Vital for global accessibility and regional market expansion |

| Official Website | Product info, technical specs, software licenses, investor relations | Key for global reach, self-service, and lead generation; significant website traffic expected |

| Trade Shows/Conferences | Product demonstrations, direct engagement, market intelligence | Platform for showcasing advancements (e.g., IMTS); critical for lead generation and brand visibility |

| Digital Marketing/Social Media | Lead generation, brand awareness, community building, PR distribution | Leveraging SEO, content marketing, and social platforms; digital ad spend projected over $600 billion globally in 2024 |

Customer Segments

Manufacturing and industrial quality control represents a core customer segment for FARO, encompassing businesses that rely on meticulous 3D measurement for ensuring the precision of their products. These companies utilize FARO's technology for critical functions like quality assurance, detailed inspection of parts and assemblies, and reverse engineering to replicate or improve existing designs. Their primary needs revolve around achieving high levels of accuracy, accelerating production cycles, and maintaining unwavering reliability in their manufacturing processes.

The drive for precision is paramount, as even minor deviations can lead to significant production issues and costly rework. For instance, in 2024, the global industrial automation market, which heavily relies on such quality control measures, was projected to reach over $200 billion, highlighting the immense value placed on efficiency and accuracy. Companies in this segment, like RFK Racing, a prominent NASCAR team, leverage FARO's solutions to optimize their manufacturing workflows, ensuring that every component meets stringent performance standards, ultimately contributing to their competitive edge.

Professionals in Architecture, Engineering, and Construction (AEC) rely on FARO for precise 3D scanning and documentation of existing buildings and sites. This technology is crucial for tasks like verifying construction progress against plans and integrating reality capture data into Building Information Modeling (BIM) workflows. By enabling accurate site planning and clash detection, FARO's solutions help reduce costly errors and rework in complex projects.

The demand for efficient and accurate reality capture in AEC is substantial. For instance, the global BIM market size was valued at approximately $7.9 billion in 2023 and is projected to grow significantly, indicating a strong need for the tools FARO provides. AEC professionals specifically look for solutions that can rapidly and reliably capture intricate details of their environments, a need FARO addresses.

To bolster its offerings for this vital sector, FARO has strategically acquired companies like SiteScape, known for its cloud-based reality capture and collaboration platform, and GeoSLAM, a leader in mobile mapping technology. These acquisitions enhance FARO's ability to deliver end-to-end solutions for AEC, from initial site scanning to data processing and integration, further solidifying its position in the market.

Law enforcement agencies, forensic experts, and security planners rely on FARO's advanced technology for critical tasks like crime scene and accident reconstruction. This segment demands exceptionally accurate and dependable data to ensure the integrity of legal proceedings and investigations. In 2024, the global public safety software market was valued at approximately $14.5 billion, highlighting the significant investment in these solutions.

FARO's offerings are tailored to meet these stringent requirements, providing the precision needed for meticulous documentation and analysis. The FARO Zone 3D software, for instance, is specifically designed to enhance the capabilities of public safety professionals, streamlining complex reconstruction processes.

Product Design and Engineering

Product designers and engineers rely on FARO's 3D scanning technology for crucial stages like rapid prototyping and design validation. They require solutions that can swiftly capture intricate 3D data, enabling faster iteration and refinement of their product concepts. This segment prioritizes tools that enhance efficiency and seamlessly integrate with their existing CAD and design software workflows.

- Rapid Prototyping: Engineers utilize FARO scanners to create digital models of physical objects, accelerating the prototyping cycle.

- Design Validation: The technology allows for precise comparison of manufactured parts against original design specifications, identifying deviations early.

- Software Integration: FARO devices often connect directly with popular design suites, streamlining the data import and analysis process.

- Efficiency Gains: In 2024, companies adopting advanced 3D scanning reported an average reduction of 20% in design iteration time.

Geospatial and Surveying

Surveyors and geospatial professionals rely on FARO's advanced laser scanning and imaging technologies to meticulously map terrains and infrastructure, creating precise digital twins. These professionals require high-performance tools capable of efficiently capturing vast amounts of data from large-scale projects.

This segment is characterized by a need for accuracy and speed in data acquisition for applications like land surveying, construction progress monitoring, and asset management. The demand for detailed, reliable geospatial information drives the adoption of FARO's solutions.

- High-accuracy data capture: Enabling detailed topographic surveys and site analysis.

- Efficiency in large-scale projects: Streamlining data collection for infrastructure and land development.

- Integration with industry workflows: Supporting seamless integration into existing surveying and GIS software.

FARO's strategic partnership with Topcon, a leader in positioning and surveying equipment, further enhances its offerings for the geospatial and surveying market, providing integrated solutions that boost productivity and data quality for users.

FARO serves diverse customer segments, each with unique needs for precise 3D measurement and data capture. These include manufacturing firms prioritizing quality control and efficiency, AEC professionals focused on accurate site documentation and BIM integration, and public safety agencies requiring reliable forensic data. Additionally, product designers and engineers leverage FARO for rapid prototyping and design validation, while surveyors and geospatial experts depend on it for large-scale mapping and infrastructure analysis.

Cost Structure

Research and Development (R&D) represents a substantial cost for FARO, fueling the creation of cutting-edge hardware, sophisticated software, and intelligent algorithms. This investment is critical for maintaining their competitive edge in the 3D measurement and imaging solutions market.

Key expenditures within R&D include competitive salaries for their highly skilled engineering and scientific teams, alongside the costs associated with developing and rigorously testing new prototypes. For instance, in 2023, FARO reported R&D expenses of approximately $62.5 million, underscoring the significant financial commitment to innovation.

FARO's manufacturing and production costs encompass the essential elements of bringing their measurement devices to life, including the procurement of raw materials and components, the wages paid to their skilled labor force, and the various overhead expenses tied to their production facilities. In 2023, for instance, the cost of revenue, which directly reflects these manufacturing outlays, stood at $200.1 million, highlighting the significant investment required in this area.

Effectively managing these costs is paramount for FARO's profitability. This involves a continuous focus on optimizing manufacturing workflows and strengthening supply chain partnerships to secure favorable pricing and ensure timely delivery of materials. For example, any shifts in global trade policies, such as potential tariffs on imported components, could directly impact their gross margin, making proactive supply chain resilience a key strategic imperative.

FARO's cost structure is heavily influenced by its Sales, Marketing, and Distribution Expenses. These include salaries and commissions for its sales force, which are essential for driving revenue. For instance, in 2023, FARO reported $146.4 million in selling, general, and administrative expenses, a substantial portion of which is dedicated to these customer acquisition efforts.

Marketing campaigns and participation in industry trade shows also represent significant outlays. These activities are crucial for brand visibility and lead generation, especially when introducing innovative products like the Leap ST or Blink scanners. Maintaining a robust global distribution network, ensuring products reach customers worldwide, further adds to these costs.

Software Development and Maintenance Costs

Developing, updating, and maintaining sophisticated software platforms such as CAM2, BuildIT, and FARO Zone requires significant investment in skilled software engineers, essential licensing, and robust infrastructure. These ongoing expenses are critical for ensuring the compatibility and optimal performance of FARO's core technology offerings.

For example, in 2024, companies in the industrial software sector often allocate between 15-25% of their revenue to research and development, which heavily includes software development and maintenance. FARO's commitment to innovation means these costs are a fundamental part of their operational structure.

- Software Engineering Talent: High salaries for specialized developers and QA professionals.

- Licensing Fees: Costs associated with third-party software components and development tools.

- Infrastructure: Investment in cloud services, servers, and development environments.

- Continuous Updates: Resources dedicated to bug fixes, feature enhancements, and security patches.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone of any company's operational overhead. This includes costs like executive compensation, salaries for administrative staff, legal fees, accounting services, and the essential IT infrastructure that keeps everything running smoothly. Effectively managing these costs is crucial for boosting overall profitability.

For FARO Technologies, G&A expenses are a key component of their cost structure. The company's focus on operational efficiency is evident. For instance, in the first quarter of 2025, FARO reported a notable decline in its operating expenses, a positive sign for cost management.

This reduction in Q1 2025 operating expenses was attributed to specific strategic initiatives. FARO highlighted productivity improvements and the benefits realized from ongoing restructuring efforts as primary drivers for this cost optimization. Such actions directly impact the bottom line by lowering the overall expense ratio.

- Executive and Administrative Salaries: Costs associated with leadership and support staff.

- Legal and Finance: Expenses related to compliance, accounting, and financial management.

- IT Infrastructure: Investment in technology and systems necessary for operations.

- Productivity Improvements: Initiatives aimed at increasing efficiency and reducing waste in administrative functions.

FARO's cost structure is diverse, encompassing significant investments in Research and Development, manufacturing, sales and marketing, software development, and general administration. These costs are essential for innovation, production, market reach, and overall business operations.

In 2023, FARO reported R&D expenses of $62.5 million and a cost of revenue totaling $200.1 million, reflecting substantial outlays in product development and manufacturing. Selling, general, and administrative expenses were $146.4 million for the same year, indicating significant investment in customer acquisition and operational overhead.

The company's commitment to continuous software improvement and platform maintenance represents an ongoing expenditure, with industry benchmarks suggesting 15-25% of revenue allocated to R&D in the software sector. Strategic cost management, including productivity improvements and restructuring, is key to maintaining profitability, as seen in the Q1 2025 operating expense reductions.

| Cost Category | 2023 Actuals (Millions USD) | Key Components |

| Research and Development (R&D) | 62.5 | Salaries for engineers, prototype development, testing |

| Cost of Revenue (Manufacturing) | 200.1 | Raw materials, labor, production overhead |

| Selling, General & Administrative (SG&A) | 146.4 | Sales commissions, marketing, administrative salaries, IT |

| Software Development & Maintenance | (Estimated 15-25% of Revenue) | Software engineers, licensing, infrastructure, updates |

Revenue Streams

FARO's core revenue is generated through the sale of sophisticated hardware. This includes their renowned FaroArm, laser trackers, and advanced laser scanners, which are essential tools for precise measurement and imaging across numerous sectors. These represent significant capital investments for their clients.

The company's strategy relies heavily on introducing innovative new products to stimulate hardware sales. For instance, recent launches like the Leap ST and Blink are anticipated to significantly boost their hardware revenue streams in the coming periods, reflecting a commitment to technological advancement.

FARO generates revenue by licensing its specialized software, such as CAM2, BuildIT Metrology, BuildIT Projector, and FARO Zone. This is increasingly offered through a subscription model, creating a predictable, recurring income and strengthening customer ties.

These software subscriptions are a key driver for FARO's revenue expansion. For instance, in the first quarter of 2024, FARO reported that its Software & 3D Solutions segment saw a revenue increase of 4.1% year-over-year, reaching $48.5 million, highlighting the growing importance of this recurring revenue stream.

FARO's revenue model includes significant income from service and support contracts. These are often bundled with initial hardware and software sales, ensuring customers have access to ongoing maintenance, extended warranties, and crucial technical support.

These service agreements are vital for product longevity and customer retention, creating a predictable, recurring revenue stream for FARO. For instance, in 2023, FARO reported that its aftermarket business, which heavily relies on these service contracts, contributed a substantial portion to its overall financial performance, underscoring their importance.

Training and Consulting Services

FARO generates revenue by offering specialized training programs and professional consulting services. These services are designed to help customers effectively utilize FARO's advanced measurement and imaging solutions, ensuring they gain the maximum value from their technology investment. This not only drives adoption but also solidifies customer loyalty.

These offerings are crucial for customers to achieve optimal implementation and operational efficiency with FARO's technology. By providing expert guidance, FARO enhances its overall value proposition, moving beyond just hardware and software to become a comprehensive solutions partner. For instance, in 2023, FARO reported that its software and services segment, which includes training and consulting, contributed significantly to its revenue growth.

- Specialized Training Programs: Educating users on the best practices and advanced features of FARO's hardware and software.

- Professional Consulting Services: Offering tailored advice and implementation support to integrate FARO solutions into existing workflows.

- Maximizing Customer ROI: Ensuring clients achieve the full benefits and return on investment from their FARO technology.

- Enhancing Value Proposition: Supplementing product sales with ongoing support and expertise, creating a stickier customer relationship.

Parts and Accessories Sales

FARO generates revenue from selling replacement parts, essential consumables, and specialized accessories designed for their advanced metrology and 3D scanning devices. This revenue stream is crucial for supporting the continued operation, maintenance, and enhanced functionality of their installed customer base.

These sales ensure that customers can keep their FARO equipment running optimally and adapt to specific project needs. For instance, sales of calibration targets, rechargeable batteries, and various specialized probes directly contribute to this revenue segment.

- Replacement Parts: Ensuring the longevity and functionality of FARO's precision equipment.

- Consumables: Items like batteries and cleaning supplies that are regularly needed for device operation.

- Accessories: Specialized probes, tripods, and carrying cases that enhance the usability and application range of FARO devices.

FARO's revenue streams are diverse, encompassing hardware sales, software licensing, service contracts, training, and the sale of parts and accessories. This multi-faceted approach ensures consistent income and customer engagement.

The company's strategic focus on recurring revenue through software subscriptions and service agreements is a key growth driver. For example, in Q1 2024, FARO's Software & 3D Solutions segment revenue increased by 4.1% year-over-year to $48.5 million, demonstrating the success of this strategy.

Hardware sales remain a significant contributor, with new product introductions like the Leap ST and Blink expected to bolster this segment. Service and support contracts are also vital, ensuring product longevity and customer retention, with aftermarket business being a substantial revenue contributor in 2023.

| Revenue Stream | Description | Key Products/Services | 2023/2024 Data Point |

|---|---|---|---|

| Hardware Sales | Sale of precision measurement and imaging devices. | FaroArm, Laser Trackers, Laser Scanners | New product launches anticipated to boost revenue. |

| Software Licensing | Subscription-based access to specialized metrology software. | CAM2, BuildIT Metrology, FARO Zone | Q1 2024: Software & 3D Solutions revenue $48.5M (+4.1% YoY). |

| Services & Support | Ongoing maintenance, warranties, and technical assistance. | Service Contracts, Extended Warranties | Aftermarket business a substantial contributor in 2023. |

| Training & Consulting | Expert guidance for optimal use of FARO solutions. | User Training, Implementation Support | Contributed significantly to revenue growth in 2023. |

| Parts & Accessories | Replacement components and add-ons for existing equipment. | Calibration Targets, Batteries, Specialized Probes | Supports continued operation and enhances functionality. |

Business Model Canvas Data Sources

The FARO Business Model Canvas is constructed using a blend of internal financial data, customer feedback, and market intelligence. These sources provide a comprehensive view of our operations and strategic direction.