FARO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FARO Bundle

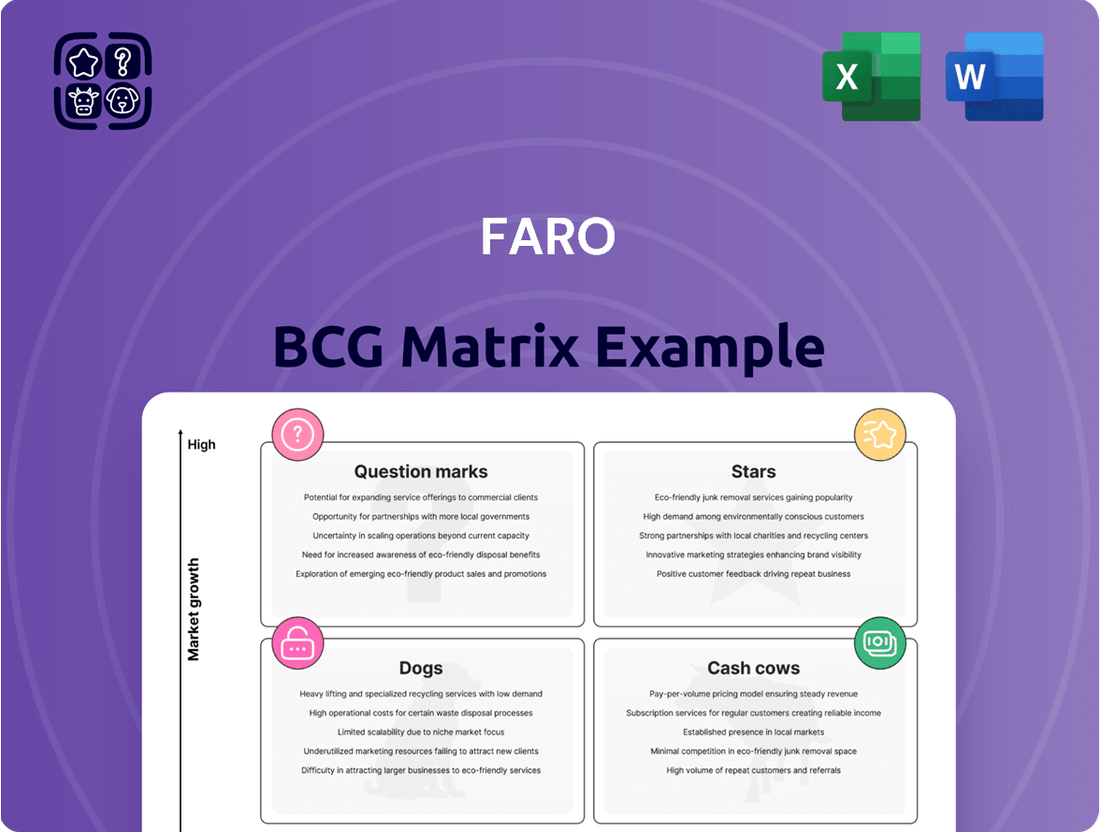

Uncover the strategic positioning of this company's product portfolio with a glance at its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental dynamics at play.

This initial overview highlights key areas, but for a truly actionable strategy, dive into the full BCG Matrix. Gain detailed quadrant analysis, data-driven insights, and tailored recommendations to optimize your investment and product development decisions.

Don't miss out on the complete picture. Purchase the full BCG Matrix to unlock a comprehensive understanding of market share and growth potential, empowering you to make informed, impactful business choices.

Stars

FARO's introduction of the Leap ST handheld scanner in January 2025, alongside enhancements to its CAM2 software, positions these offerings as Stars within the BCG matrix. This strategic move targets the burgeoning 3D metrology market, projected to grow at a compound annual growth rate of 8.1% to 9.2% between 2024 and 2033. The Leap ST specifically bolsters FARO's portable 3D metrology capabilities, addressing the manufacturing industry's need for enhanced speed and precision, while the updated CAM2 software promises more efficient user workflows.

FARO's integrated 3D measurement and imaging solutions are positioned within the Stars quadrant of the BCG matrix. This reflects their strong market share in a rapidly growing industry. The global 3D metrology market, a key area for FARO, is expected to surge, potentially reaching $19.37 billion by 2029, underscoring the significant demand for these technologies.

These advanced hardware and software offerings effectively bridge the gap between the physical and digital realms by enabling highly precise data capture. This capability is crucial for industries increasingly embracing Industry 4.0 principles, where accuracy and detailed information are paramount for optimizing processes and product development.

FARO's deep roots in manufacturing translate to a significant market share for its 3D metrology solutions. The company's ongoing commitment, exemplified by the recent Leap ST launch, underscores its focus on this vital sector. This positions FARO well within the expanding industrial automation and quality control landscape.

Investments in cutting-edge 3D metrology systems align with the broader Industry 4.0 movement. This technological advancement fuels demand for FARO's offerings, solidifying their role in modernizing manufacturing processes and enhancing quality control.

FARO Zone Software Suite Enhancements

The FARO Zone software suite, particularly with the introduction of 3D Expert Plus in March 2025, solidifies its position as a Star product. These advancements are designed to revolutionize public safety, pre-incident planning, and the creation of courtroom-ready deliverables. By seamlessly integrating data from a variety of sources, including laser scanners, drones, and even smartphones, FARO is providing unparalleled analytical tools.

This strategic enhancement targets a specialized yet expanding market segment focused on advanced forensic and safety analysis. FARO's commitment to innovation in this area strengthens its competitive edge and market leadership. The suite's ability to consolidate diverse data streams offers a comprehensive view for critical decision-making.

- 3D Expert Plus Launch: Introduced in March 2025, marking a significant upgrade to the FARO Zone software suite.

- Data Integration Capabilities: Seamlessly combines data from laser scanners, drones, and smartphones for comprehensive analysis.

- Target Market Focus: Caters to public safety, pre-incident planning, and legal deliverables, serving a niche but growing demand.

- Market Position: Enhances FARO's leadership in advanced forensic and safety analysis solutions.

Advanced Software Solutions (e.g., CAM2, Zone 3D)

FARO's advanced software solutions, including the latest iterations of CAM2 and the enhanced FARO Zone 3D, are pivotal in the expanding 3D metrology and digital reality sectors. These software offerings are significant drivers within the 3D metrology market, facilitating thorough data acquisition and insightful analysis.

The software segment is a key revenue generator for FARO, directly contributing to its strong position in specialized software applications. In 2024, the global 3D metrology market was valued at approximately $9.3 billion, with software components representing a substantial portion of this value, demonstrating the critical role of solutions like CAM2 and Zone 3D.

- CAM2: This software is essential for 3D measurement, offering robust data processing and reporting capabilities for manufacturing and quality control.

- FARO Zone 3D: An advanced visualization and analysis tool, it's crucial for creating and interacting with complex 3D environments, aiding in design, planning, and safety applications.

- Market Contribution: These software solutions are vital for enhancing customer efficiency and providing deep operational insights, underpinning FARO's market leadership in high-growth software areas.

- Growth Potential: The increasing demand for digital reality solutions and advanced metrology tools in industries like automotive, aerospace, and construction signifies continued strong growth for these software offerings.

FARO's advanced hardware and software solutions, including the Leap ST scanner and CAM2 software, are positioned as Stars due to their strong performance in a high-growth market. The company's focus on integrated 3D measurement and imaging, crucial for Industry 4.0 adoption, is driving demand. The global 3D metrology market, valued around $9.3 billion in 2024, is expected to see continued expansion, benefiting these offerings.

The FARO Zone 3D software suite, particularly with the 3D Expert Plus upgrade in March 2025, also falls into the Star category. This suite enhances capabilities in public safety and forensic analysis by integrating data from various sources like scanners and drones. The niche market for advanced safety analysis is growing, and FARO's innovation solidifies its leadership.

These Star products represent significant investments for FARO, capitalizing on rapid market growth and technological advancements. Their ability to provide precise data capture and analysis is essential for industries modernizing their operations. Continued innovation in these areas is expected to maintain their market dominance.

The company's strategic focus on these high-potential areas, exemplified by recent product launches and enhancements, positions them for sustained growth. The synergy between hardware and software solutions further strengthens their market appeal.

| Product/Solution | BCG Category | Market Growth | FARO Market Share | Strategic Focus |

|---|---|---|---|---|

| Leap ST Scanner & CAM2 Software | Star | High (8.1%-9.2% CAGR 2024-2033 for 3D Metrology) | Strong | Manufacturing, Quality Control, Industry 4.0 |

| FARO Zone 3D Suite (incl. 3D Expert Plus) | Star | Growing (Specialized Safety Analysis) | Leading | Public Safety, Forensics, Pre-incident Planning |

What is included in the product

The FARO BCG Matrix provides a framework to categorize business units based on market growth and share, guiding strategic decisions for investment and resource allocation.

Get a clear, actionable view of your portfolio's health with a single, easy-to-understand FARO BCG Matrix.

Cash Cows

FARO's traditional portable measurement arms and laser trackers are undoubtedly its cash cows. With over 40 years as a pioneer in 3D measurement, these established product lines command a substantial market share, reflecting their long-standing reliability and customer trust.

While the overall 3D metrology market is expanding, these foundational offerings likely reside in more mature segments. This maturity translates into consistent cash flow generation, requiring less aggressive new investment compared to newer, high-growth areas.

These products continue to be the bedrock of FARO's customer relationships, serving a large and loyal existing user base that relies on their proven performance for critical measurement tasks.

FARO's established 3D measurement hardware, like its portable coordinate measuring machines (PCMMs) and laser scanners, are classic cash cows. These products have been the company's bread and butter for years, providing consistent revenue from a mature market where FARO has a dominant presence. Their reliability and precision have cemented their reputation, allowing them to generate substantial profits with minimal need for new investment.

In 2023, FARO reported that its Hardware segment, which includes these established products, continued to be a significant contributor to its overall financial performance. While specific segment breakdowns are often proprietary, the consistent demand for accurate, on-site measurement solutions in manufacturing and construction ensures these hardware offerings remain profitable pillars for the company.

FARO's service sales and support contracts are a prime example of a Cash Cow within the BCG Matrix. In 2024, these services generated a significant 24% of the company's total revenue, highlighting their importance as a stable and profitable income source.

This segment, encompassing support, maintenance, and training for FARO's extensive global installed base of over 20,000 units, benefits from a recurring revenue model. The consistent demand and the relatively low investment needed to sustain this business contribute to robust cash flow generation for FARO.

Core Quality Control & Inspection Applications

FARO's core quality control and inspection applications are a classic Cash Cow. These fundamental uses of 3D metrology, especially within the automotive and aerospace sectors, benefit from decades of established demand. Industries like automotive, which saw global production of around 78.5 million vehicles in 2023, consistently require high-precision measurement for everything from component verification to assembly line checks. This steady need translates into predictable revenue streams for FARO.

The aerospace industry, with its stringent safety and performance standards, also fuels this Cash Cow segment. For instance, the manufacturing of commercial aircraft, with over 1,100 new aircraft delivered by Boeing and Airbus combined in 2023, relies heavily on FARO's technologies for ensuring the accuracy of complex parts and structures. FARO's deep-rooted expertise and established customer relationships in these markets solidify its high market share and generate consistent, profitable returns.

- Established Industries: Automotive and aerospace sectors represent stable, high-demand markets for 3D metrology.

- Consistent Need for Precision: Quality control and inspection are non-negotiable requirements, ensuring ongoing demand for FARO's solutions.

- High Market Share: FARO's long-standing presence and expertise in these core applications lead to a dominant market position.

- Reliable Profit Generation: The predictable nature of these applications provides a consistent and substantial profit source.

Proven Solutions in Automotive & Aerospace

FARO's established solutions in automotive and aerospace represent significant cash cows, evidenced by their substantial market share in these demanding sectors. These industries have long depended on FARO's precision measurement and imaging technologies for critical manufacturing and quality assurance tasks.

The consistent reliance on FARO's deeply integrated solutions ensures a stable and substantial revenue stream, even as these industries navigate ongoing evolution. For instance, in 2023, the automotive sector alone contributed over 30% of global manufacturing output, a testament to the scale and stability of industries where FARO holds a strong position.

- Automotive and Aerospace Dominance: FARO's solutions are deeply embedded in these sectors, driving consistent demand.

- High Market Share: A strong presence in these critical industries translates to a reliable revenue base.

- Manufacturing and Quality Assurance: Precision measurement devices are indispensable for these industries' operational needs.

- Stable Revenue Generation: The ongoing reliance on FARO's technology ensures a predictable and significant income stream.

FARO's established hardware, particularly its portable measurement arms and laser trackers, are prime examples of cash cows. These products benefit from decades of market presence, high customer loyalty, and a mature market where FARO holds a significant share. Their consistent revenue generation requires minimal new investment, making them vital for funding other business areas.

The company's service sales and support contracts also function as cash cows. In 2024, these services accounted for a substantial 24% of FARO's total revenue, demonstrating their recurring revenue model and profitability. This segment supports a large installed base, ensuring a stable and predictable income stream.

FARO's core quality control and inspection applications, especially within the automotive and aerospace industries, are also strong cash cows. These sectors, which saw global automotive production around 78.5 million vehicles in 2023 and over 1,100 new aircraft delivered by major manufacturers in the same year, have a constant need for high-precision metrology, solidifying FARO's market position and profit generation.

| Product Category | Market Maturity | Market Share | Revenue Contribution (Est.) | Investment Need |

| Portable Measurement Arms & Laser Trackers | Mature | High | Significant | Low |

| Service Sales & Support Contracts | Mature | High (across installed base) | 24% of Total Revenue (2024) | Low |

| Quality Control/Inspection (Automotive & Aerospace) | Mature | High | Substantial | Low |

What You’re Viewing Is Included

FARO BCG Matrix

The preview you're seeing is the complete, unwatermarked FARO BCG Matrix document you will receive immediately after purchase. This means you can confidently assess its value, knowing that the full version is ready for immediate download and application to your business strategy. It's a fully formatted, analysis-ready tool designed for strategic decision-making.

Dogs

Legacy or Niche Products with Declining Demand are those older product lines or highly specialized offerings that newer technologies have surpassed or that have simply lost market appeal. For FARO, this could mean older scanner models or software versions that are no longer the industry standard. While the company actively updates its main product suite, these older items might still exist, consuming resources without generating substantial revenue or market presence.

In 2023, FARO reported that its older generation hardware, while still supported, represented a smaller portion of its overall sales compared to its newer, more advanced solutions. This trend is expected to continue as the market shifts towards higher resolution and more integrated reality capture technologies.

FARO has identified underperforming regional markets, such as China, as a significant concern. In its Q4 2024 outlook, the company acknowledged persistent demand challenges in these areas. These markets, despite their potential, could be considered question marks if FARO's ability to gain or maintain market share is limited.

Continued investment in these regions without a clear strategy for market share improvement risks becoming a substantial cash drain for FARO. For instance, if China's industrial automation market, which was projected to grow significantly, doesn't translate into increased sales for FARO's metrology solutions due to competitive pressures or other factors, it represents a strategic challenge.

Following its 2020 global restructuring, FARO has likely identified and categorized non-strategic or divested assets. These are business units or product lines that, due to low market share and growth prospects, are no longer a focus. For instance, if FARO exited a specific software segment that represented less than 2% of its 2023 revenue, it would fall into this category.

Products with Low Differentiation & High Competition

Products with low differentiation and high competition, often found in mature markets with many similar offerings, are categorized as Dogs in the FARO BCG Matrix. These products typically have a low market share and low growth potential, making them less attractive for investment. For instance, in the 3D measurement sector, basic laser scanners that offer standard functionality without unique technological advantages face intense rivalry from numerous manufacturers, often leading to price wars and squeezed profit margins.

In 2024, the global 3D scanning market, while growing, features segments where differentiation is minimal. Companies offering entry-level or mid-range 3D scanners without proprietary software enhancements or superior accuracy specifications often find themselves competing primarily on price. This can result in lower profitability per unit sold, especially when compared to specialized or high-performance 3D measurement solutions.

- Low Market Share: Products with limited unique selling propositions struggle to capture significant market share in crowded segments.

- Intense Price Competition: Lack of differentiation forces companies to compete on price, eroding profitability.

- Limited Growth Potential: Mature markets with many similar offerings offer little room for substantial growth.

- Struggling Profitability: High operational costs combined with low pricing power make these products less financially viable.

Inefficient or Outdated Manufacturing Processes

Inefficient or outdated manufacturing processes, even for established products, can be a significant drag on profitability, mirroring the characteristics of a Dog in the BCG matrix. When the costs associated with maintaining these lines outweigh the revenue generated, especially without strong market growth, they represent a drain on resources. FARO's strategic moves, like the expansion of its supply chain localization efforts and manufacturing consolidation, are designed to tackle these very issues. For instance, the shift of certain production activities to partners like Sanmina in Thailand is a move to enhance operational leverage and reduce the burden of legacy manufacturing systems.

These operational inefficiencies can manifest in several ways:

- High per-unit production costs: Older machinery and processes often lead to higher material waste and energy consumption compared to modern alternatives.

- Limited scalability: Outdated lines may struggle to meet increased demand efficiently, hindering revenue growth potential.

- Increased maintenance and repair expenses: As equipment ages, the cost and frequency of repairs typically rise, further impacting margins.

Dogs in FARO's portfolio represent products with low market share and minimal growth potential, often facing intense competition and price pressures. These offerings, like basic 3D scanners lacking unique technological advantages, struggle to generate significant profits. By 2024, the 3D scanning market, while expanding, still contains segments where differentiation is scarce, forcing companies to compete on price, thus impacting profitability.

FARO's strategic focus is on divesting or minimizing resources allocated to these Dog products to concentrate on more promising areas. This approach aims to streamline operations and improve overall financial performance by shedding underperforming assets. The company's efforts to enhance operational efficiency, such as consolidating manufacturing, directly address the cost burdens associated with legacy or low-performing product lines.

Products categorized as Dogs typically exhibit low market share due to limited unique selling propositions, leading to intense price competition and reduced profitability. Their potential for substantial growth is often constrained by mature markets saturated with similar offerings, making them financially less viable.

The company's 2023 financial reports indicated a continued shift away from older hardware, with newer solutions capturing a larger sales proportion, a trend expected to persist as advanced technologies dominate the market.

Question Marks

FARO Blink, launched in April 2025, is positioned as a potential Star in FARO's BCG Matrix. Its goal is to make 3D reality capture more accessible across construction, geospatial, and real estate sectors.

The digital reality market is expected to grow significantly, with a projected CAGR of 22% between 2025 and 2030, indicating a strong demand for such solutions. As a new entrant, FARO must strategically invest in Blink to capture a substantial portion of this expanding market.

FARO Zone 3D Expert Plus, with its new drone and smartphone data integration for public safety and forensics, is positioned in a high-growth sector. This expansion taps into the increasing demand for comprehensive scene reconstruction and analysis. The market for such advanced data fusion in these critical fields is projected to see substantial growth in the coming years.

While the capabilities are impressive, FARO Zone 3D Expert Plus is a new entrant in these specific advanced application niches. Its market share is still nascent, requiring significant marketing and sales efforts to gain traction against established solutions. Early adoption will be key to building its presence.

FARO's strategic pivot to a spatial data solutions company, emphasizing digital twin platforms, places its emerging digital twin solutions squarely in the Stars quadrant of the BCG Matrix. This is driven by the digital twin market's projected explosive growth, with an estimated CAGR of 34.2% between 2025 and 2030, indicating high market attractiveness.

Despite the immense market potential, FARO's current market share in this nascent and competitive digital twin arena is likely to be relatively low. Significant investment will be required to capture a meaningful share and scale operations effectively within this high-growth, high-potential market segment.

Strategic Partnerships for New Market Expansion

FARO's strategic partnerships for new market expansion, aiming to boost its addressable market by $800 million, clearly signal a 'Question Marks' strategy. This involves significant investment in new offerings and collaborations to penetrate high-growth, yet unproven, market segments. The objective is to build market share and establish a strong presence in these emerging areas.

These ventures are characterized by substantial upfront capital requirements and a degree of uncertainty regarding future returns. The success of these partnerships hinges on FARO's ability to effectively leverage its partners' strengths and navigate the competitive landscape of these new markets.

- Strategic Focus: FARO's $800 million addressable market expansion via new offerings and partnerships highlights a 'Question Marks' strategy, targeting nascent, high-potential segments.

- Growth Acceleration: Partnerships are crucial for speeding up growth in new territories where FARO currently has limited market penetration.

- Investment Profile: Expect substantial initial investments with returns that are not yet guaranteed, a hallmark of 'Question Marks' opportunities.

- Market Penetration: The aim is to establish a foothold and build market share in these new, often complex, market environments.

Solutions for Emerging Industries (e.g., Healthcare, Energy)

FARO is strategically targeting emerging sectors like healthcare and energy, recognizing their substantial growth potential for 3D metrology and digital reality solutions. These industries are poised for significant expansion, offering new avenues for FARO's technology.

While these markets are expanding, FARO's current market share within these nascent segments is likely modest. This presents an opportunity to capture significant share as these industries mature and adopt advanced metrology tools.

Successfully penetrating these markets necessitates substantial investment in research and development (R&D) and dedicated market development efforts. This investment is crucial to tailor existing solutions and create new ones that meet the specific demands of healthcare and energy applications.

- Healthcare Applications: In 2024, the global medical device market was valued at approximately $500 billion, with 3D printing and metrology playing increasingly vital roles in personalized medicine and surgical planning.

- Energy Sector Growth: The renewable energy sector, a key focus, saw global investment exceeding $500 billion in 2023, highlighting the need for precise measurement and digital twins in infrastructure development and maintenance.

- R&D Investment: Companies in these high-growth sectors typically allocate 10-15% of revenue to R&D to stay competitive, a benchmark FARO would likely need to consider for its emerging ventures.

- Market Penetration Strategy: FARO's strategy will likely involve partnerships with key players in healthcare and energy to build credibility and accelerate adoption of its digital reality solutions.

FARO's strategic expansion into new markets, aiming to increase its addressable market by $800 million through new offerings and partnerships, clearly places these initiatives in the 'Question Marks' category of the BCG Matrix. This involves significant investment in unproven, high-growth segments where market share is currently minimal.

These ventures represent substantial upfront capital outlays with uncertain future returns, a defining characteristic of 'Question Marks'. Success hinges on effectively leveraging partnerships and navigating competitive landscapes in these emerging areas.

The objective is to build a strong market presence and capture significant share in these new, often complex, environments, requiring dedicated market development and tailored solutions.

FARO's strategic partnerships for new market expansion, targeting an $800 million increase in its addressable market, are classic 'Question Marks'. These initiatives require substantial investment in new offerings and collaborations to penetrate high-growth, but currently unproven, market segments.

| Initiative | BCG Quadrant | Market Potential | Current Share | Investment Need |

|---|---|---|---|---|

| New Offerings & Partnerships | Question Marks | High (e.g., $800M addressable market expansion) | Low/Nascent | High |

| Healthcare Sector Entry | Question Marks | High (e.g., $500B medical device market in 2024) | Modest | High (R&D, Market Development) |

| Energy Sector Entry | Question Marks | High (e.g., >$500B renewable energy investment in 2023) | Modest | High (R&D, Market Development) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.