Fanatics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanatics Bundle

Fanatics, a dominant force in sports e-commerce and merchandise, boasts significant strengths in its vast brand recognition and extensive distribution network. However, it also faces potential weaknesses related to its reliance on third-party manufacturers and the intense competition within the sports apparel market. Opportunities lie in expanding into new sports verticals and leveraging its data analytics capabilities, while threats could emerge from shifting consumer preferences and supply chain disruptions.

Discover the complete picture behind Fanatics’ market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to understand the full scope of their competitive advantages and potential challenges.

Strengths

Fanatics boasts an impressive array of exclusive, long-term licensing agreements with premier professional sports leagues, including the NFL, NBA, MLB, NHL, and MLS. These deep-rooted partnerships create substantial hurdles for any potential competitors aiming to enter the sports merchandise market.

This exclusive access enables Fanatics to provide an unparalleled selection of authentic sports apparel and collectibles, a significant draw for passionate fans worldwide. Their reach also extends to collegiate athletics and major international sports organizations like UEFA and the FA, reinforcing their commanding position in the industry.

By securing these extensive rights, Fanatics effectively controls a vast segment of the sports memorabilia and fan gear market, ensuring a consistent flow of high-demand products. This strategy has proven highly effective, as evidenced by Fanatics' continued growth and market penetration.

Fanatics boasts a diversified business model that extends well beyond its initial e-commerce roots in licensed sports merchandise. This strategic expansion into high-growth areas like sports betting, through Fanatics Betting & Gaming, and the burgeoning collectibles market via its acquisition of Topps, significantly strengthens its market position.

Furthermore, the company’s foray into live commerce with Fanatics Live taps into another dynamic consumer engagement channel. This multi-pronged approach diminishes dependence on any single revenue stream, creating a more resilient and robust financial structure.

By leveraging its established fan base across these varied touchpoints, Fanatics cultivates deeper customer relationships and unlocks new monetization opportunities. This diversification strategy is key to its continued growth and market penetration in the evolving sports and entertainment landscape.

Fanatics is showing impressive financial strength, with revenues expected to hit $8.1 billion in 2024, marking a solid 15% jump from the previous year. Looking ahead to 2025, the company is projected to reach $9 billion in revenue, underscoring a consistent upward trend. This robust revenue stream, especially from its high-margin collectibles business, generates substantial cash. This cash is crucial for fueling Fanatics' ambitious expansion plans and enabling strategic investments across its diverse operations.

Advanced Vertical Commerce (V-Commerce) Model

Fanatics' advanced Vertical Commerce (v-commerce) model is a significant strength, enabling just-in-time manufacturing. This agility allows them to swiftly respond to sudden surges in demand, a crucial advantage during events like championship victories or significant player trades. For instance, in the 2023 NFL season, rapid production of team merchandise following major player acquisitions demonstrated this capability, ensuring fans could purchase relevant gear almost immediately. This efficient approach boosts both product availability and customer satisfaction, directly impacting sales velocity.

The v-commerce structure translates into a highly efficient and responsive supply chain. Fanatics can pivot production quickly, minimizing inventory holding costs while maximizing the opportunity to capitalize on timely demand. This operational efficiency is a key differentiator in the competitive sports merchandise market, allowing them to capture sales that might otherwise be lost due to stockouts. Their ability to manage production in-house provides greater control over quality and delivery timelines.

- Just-in-Time Manufacturing: Enables rapid production of fan gear, especially during peak demand periods.

- Demand Responsiveness: Quickly adapts to market shifts, such as championship wins or player movement, ensuring product availability.

- Supply Chain Efficiency: Streamlined operations reduce lead times and inventory costs, enhancing profitability.

- Customer Satisfaction: Meets immediate fan demand, fostering loyalty and repeat purchases.

Large and Engaged Customer Database

Fanatics possesses an impressive customer database exceeding 100 million sports enthusiasts, providing a substantial edge in attracting new customers and effectively cross-selling a diverse range of products and services. This vast reach allows for targeted marketing campaigns and personalized offers, driving deeper customer relationships.

The company's FanCash rewards program is a key driver of loyalty and engagement. By integrating betting activities with tangible merchandise rewards, Fanatics incentivizes continued participation within its expanding ecosystem. This creates a virtuous cycle where engagement in one area directly benefits another, solidifying customer retention and increasing lifetime value.

- Over 100 million registered sports fans in their database.

- FanCash rewards program directly links betting engagement to merchandise benefits.

- Enhanced cross-selling opportunities across Fanatics' diverse product and service offerings.

- High customer loyalty fostered through integrated rewards and a comprehensive sports ecosystem.

Fanatics' exclusive, long-term licensing deals with major sports leagues like the NFL, NBA, and MLB create a formidable barrier to entry for competitors. This deep access allows them to offer a unique and extensive range of authentic fan gear and collectibles, appealing to a global fanbase. Their control over a significant portion of the sports memorabilia market ensures a consistent supply of popular items, bolstering their market dominance.

What is included in the product

Analyzes Fanatics’s competitive position through key internal and external factors, highlighting its brand strength and e-commerce dominance while acknowledging potential supply chain issues and emerging competition.

Fanatics' SWOT analysis highlights opportunities to leverage its brand strength and direct-to-consumer model to mitigate competitive threats and capitalize on emerging market trends.

Weaknesses

Fanatics' reliance on exclusive partnerships with major sports leagues, while a strength, also presents a significant weakness. A disruption or unfavorable renegotiation of these crucial licensing agreements, particularly with leagues like the NFL or NBA, could severely impact its core merchandise sales and overall revenue streams.

For instance, the expiration or termination of a key league deal could directly affect the availability and pricing of officially licensed team apparel, Fanatics' primary product category. The company's future financial performance is therefore intrinsically tied to maintaining these high-stakes relationships, a dependency that introduces considerable risk.

Despite generating substantial revenue, Fanatics has experienced fluctuations in its valuation. For instance, an employee share sale in early 2024 reportedly valued the company at $25 billion, a notable dip from its high of $31 billion reached in late 2022.

As a privately held entity, Fanatics' precise profitability figures are not publicly disclosed. This lack of transparency fuels speculation regarding its financial stability, especially considering the company's ongoing ambitious expansion initiatives across various sectors.

Fanatics is stepping into fiercely competitive markets. In sports betting, established players like DraftKings and FanDuel have significant brand recognition and existing user bases, making it tough for a newcomer to capture substantial market share. For instance, DraftKings reported over $2.2 billion in revenue for 2023, showcasing the scale of established competitors.

The collectibles space, while Fanatics has strengthened its position with the Topps acquisition, still presents challenges. Companies like Panini have a long history and strong relationships within the trading card industry. Successfully competing requires not just product but also robust distribution and marketing strategies against these entrenched businesses.

Operational Challenges of Rapid Expansion

Fanatics' aggressive expansion into sports betting across multiple US states, alongside its global commerce and live platform growth, presents significant operational hurdles. This rapid pace can strain supply chains and make it difficult to ensure uniform service quality across diverse regulatory and consumer environments. For instance, as of early 2024, Fanatics Sportsbook had launched in over a dozen states, each with unique onboarding and operational requirements.

These complexities can manifest as:

- Potential for inconsistent customer service experiences due to varying local market demands and staffing challenges.

- Supply chain disruptions affecting merchandise availability and timely delivery as demand surges in new markets.

- Integration challenges with diverse payment processors and regulatory bodies in each new jurisdiction.

Customer Service and Quality Perception

Fanatics, operating at a massive scale in e-commerce, likely encounters inherent difficulties in maintaining consistent customer service and product quality across its vast product lines. This broad reach means that isolated negative customer experiences, whether with product defects or slow response times, can disproportionately affect the brand's overall perception. For example, in 2023, many large online retailers reported increased customer service inquiries, with some struggling to maintain average response times, a challenge Fanatics would also need to navigate.

The sheer volume of transactions processed by Fanatics amplifies the potential impact of quality control lapses. A single batch of faulty merchandise or a widespread issue with order fulfillment could lead to a surge in returns and customer complaints, potentially tarnishing the brand's reputation built on sports fandom.

Managing returns efficiently and cost-effectively is another significant hurdle for large e-commerce platforms. Fanatics' extensive product catalog, ranging from apparel to collectibles, presents a complex logistical challenge in processing returns and exchanges, which directly impacts customer satisfaction and operational costs.

The perception of quality can also be tied to the authenticity and durability of licensed sports merchandise. Any perceived shortcomings in these areas, especially when dealing with high-value collectibles or performance wear, could deter discerning customers.

Fanatics' aggressive expansion into new, competitive sectors like sports betting and collectibles presents significant challenges. In sports betting, established players such as DraftKings, which reported over $2.2 billion in revenue for 2023, possess strong brand recognition and existing user bases, making market penetration difficult. Similarly, the collectibles market, despite Fanatics' acquisition of Topps, features entrenched competitors like Panini with established distribution and marketing networks.

The company's rapid growth across diverse business lines, including e-commerce, licensing, betting, and collectibles, strains its operational capacity. This broad expansion can lead to difficulties in maintaining consistent customer service and product quality across all offerings. For example, as of early 2024, Fanatics Sportsbook had launched in over a dozen states, each with unique operational requirements, highlighting the complexity of managing such diverse ventures.

Fanatics' reliance on exclusive licensing agreements with major sports leagues, while a strength, also poses a substantial weakness. A disruption or unfavorable renegotiation of these critical deals could severely impact its core merchandise sales and overall revenue. The company's valuation has also seen fluctuations, with an employee share sale in early 2024 reportedly valuing Fanatics at $25 billion, down from a high of $31 billion in late 2022, indicating market sentiment shifts.

Preview Before You Purchase

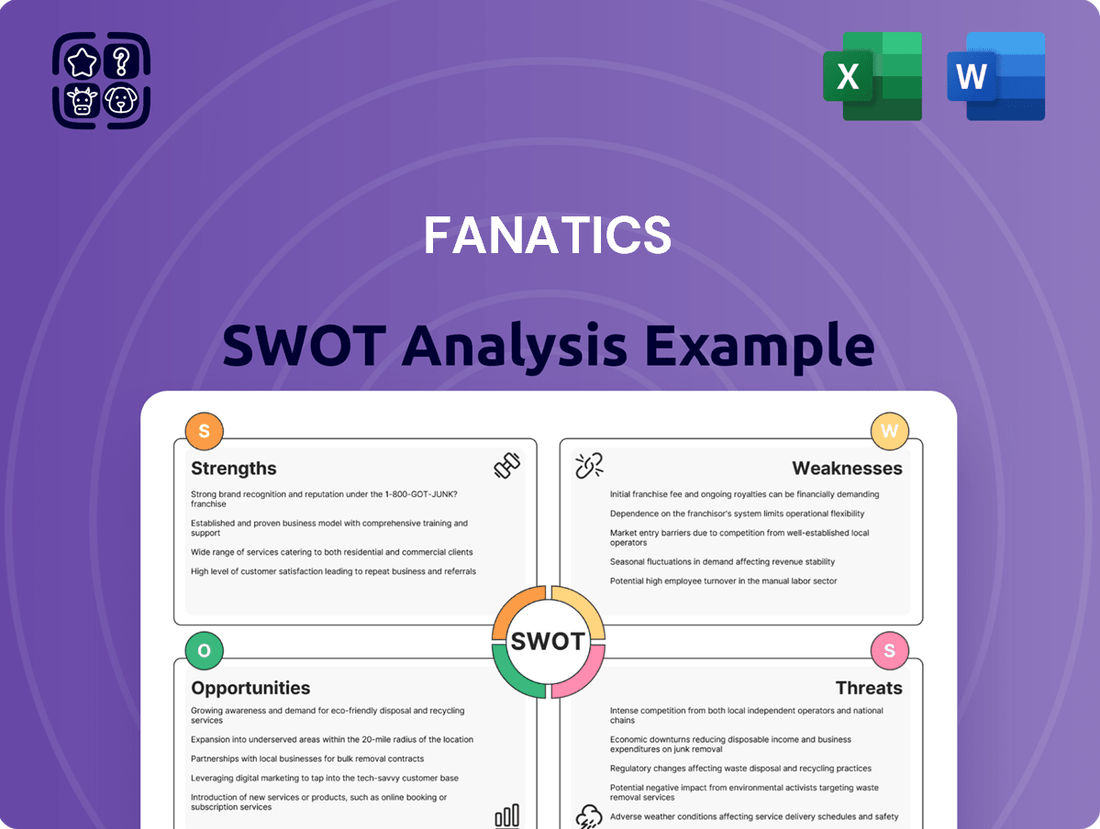

Fanatics SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll gain comprehensive insights into Fanatics' Strengths, Weaknesses, Opportunities, and Threats. This includes an examination of their strong brand recognition and extensive product catalog. Understand the challenges posed by supply chain disruptions and intense market competition. Discover potential avenues for growth through international expansion and e-commerce enhancement.

Opportunities

Fanatics Betting & Gaming has made impressive strides, covering around 95% of the U.S. online sports betting market by 2024. This rapid growth presents a clear opportunity to challenge dominant players such as FanDuel and DraftKings for a larger share of the existing market.

Beyond the U.S., significant untapped potential lies in international expansion, with Canada being a prime target for growth. Successfully entering and capturing market share in these new territories could significantly boost Fanatics' overall revenue and brand presence.

The collectibles segment, especially trading cards, is a significant profit driver for Fanatics. In 2024, this area saw a remarkable 40% revenue increase, highlighting its robust performance and potential.

Fanatics is strategically positioned to capitalize on this growth. The acquisition of Topps, a renowned name in trading cards, has significantly bolstered its presence in the market.

Furthermore, securing exclusive rights with major sports and entertainment entities like the Premier League and WWE provides a powerful advantage. These exclusive partnerships ensure a steady stream of desirable content for collectors.

This combination of strategic acquisitions and exclusive rights presents a substantial opportunity for Fanatics. The company is well-equipped to continue disrupting the collectibles market and driving further expansion in this high-margin business.

Fanatics' extensive customer database presents a prime opportunity to leverage fan data for highly personalized experiences. By analyzing purchasing history and engagement, the company can offer tailored product recommendations and exclusive content across its digital and physical touchpoints. This personalization deepens fan connections and fosters greater loyalty, ultimately driving higher lifetime value for each customer.

International Market Penetration

Fanatics is strategically leveraging its established global platform to push into new international territories. A key move is the planned opening of a flagship retail location in London during 2025, signaling a significant commitment to the European market. This expansion includes bolstering its Fanatics Live offering through strategic acquisitions, such as the purchase of Voggt, to enhance its presence and capabilities across Europe.

The company sees substantial, largely untapped opportunities for growth in international markets. This potential spans across its core merchandise business, as well as emerging sectors like sports betting and collectibles, where Fanatics is increasingly making its mark. The global sports merchandise market alone is projected to continue its upward trajectory, offering a fertile ground for Fanatics' expansion efforts.

- Global Platform Expansion: Fanatics' existing infrastructure supports international reach, with a London flagship planned for 2025.

- European Market Entry: Acquisitions like Voggt bolster Fanatics Live's presence and operational capacity in Europe.

- Untapped Market Potential: Significant growth opportunities exist in merchandise, betting, and collectibles globally.

- Market Growth Projections: The global sports merchandise sector shows strong growth potential, supporting international penetration strategies.

Potential for a Successful IPO

Fanatics is reportedly aiming for an Initial Public Offering (IPO) in 2025, a move that could unlock substantial capital. This influx of funds would be instrumental in fueling its ambitious growth strategies, including potential acquisitions and further market penetration. A successful IPO would not only bolster its financial position but also significantly elevate brand recognition on a global scale, offering a valuable exit opportunity for early investors and employees.

The anticipation surrounding Fanatics' potential IPO in 2025 is a significant opportunity. Reports suggest the company is targeting this timeframe, which could result in a substantial capital raise. This capital is crucial for accelerating expansion efforts, including strategic acquisitions and entering new markets. A successful public offering would also enhance Fanatics' brand visibility and provide essential liquidity for its stakeholders.

- Target IPO Year: 2025

- Primary Benefit: Significant capital infusion for growth and expansion.

- Secondary Benefits: Increased brand visibility and liquidity for investors and employees.

Fanatics' expansion into new international markets, particularly Canada and Europe, represents a significant growth avenue. The company's proactive approach in acquiring businesses like Voggt to bolster its Fanatics Live platform in Europe underscores this strategy.

The continued strength of the collectibles market, exemplified by a 40% revenue surge in 2024, offers a robust foundation for Fanatics. Exclusive partnerships with entities such as the Premier League and WWE further fortify its position in this high-margin segment.

Leveraging its extensive customer data for personalized experiences across its diverse offerings is a key opportunity. This data-driven approach can enhance fan engagement and loyalty, ultimately driving long-term value.

Fanatics' potential Initial Public Offering (IPO) in 2025 is poised to unlock substantial capital, enabling aggressive expansion and strategic acquisitions. This move would also significantly elevate its global brand profile.

| Opportunity | Key Fact / Data Point | Strategic Implication |

| International Expansion | Targeting Canada and Europe; London flagship planned for 2025. | Diversifies revenue streams and increases global brand presence. |

| Collectibles Market Strength | Collectibles revenue increased 40% in 2024. | Capitalizes on high-margin segment with exclusive partnerships. |

| Data Personalization | Extensive customer database. | Enhances fan engagement and lifetime value. |

| Potential IPO | Targeting 2025 for IPO. | Provides capital for growth and enhances brand visibility. |

Threats

Fanatics operates in a market dominated by established sportswear titans like Nike, Adidas, and Under Armour. These companies boast decades of brand building, significant marketing budgets, and deeply entrenched global distribution channels, making it challenging for Fanatics to gain market share. For instance, Nike's revenue for fiscal year 2023 reached $51.2 billion, highlighting the sheer scale of its operations.

The e-commerce landscape presents its own set of formidable competitors. Online marketplaces such as Amazon and eBay, with their vast customer bases and sophisticated logistics, offer alternative avenues for consumers to purchase sports merchandise. Amazon's 2023 net sales exceeded $574 billion, demonstrating its unparalleled reach.

Fanatics Betting & Gaming operates in a landscape fraught with regulatory uncertainty. The patchwork of state-by-state legal frameworks for sports betting in the US presents a complex operational challenge, with differing tax rates and compliance requirements. For instance, as of early 2024, states like New York impose a substantial 51% tax on gross gaming revenue for sportsbooks, a significantly higher burden than in many other jurisdictions.

Any shifts in these regulations, such as increased taxation or stricter advertising rules, could directly curtail Fanatics' profitability in this burgeoning market. Furthermore, ongoing legal battles, like those concerning the legality of certain advertising practices or market access, could introduce unforeseen operational disruptions and financial penalties.

The evolving legal environment means Fanatics must remain agile, constantly adapting its strategies to comply with new mandates and mitigate potential legal liabilities. Failure to navigate these challenges effectively could hinder the growth and financial success of its sports betting division.

Fanatics faces a significant threat from potential brand reputation and customer trust issues. Any missteps in product quality, such as counterfeit merchandise or poor-quality apparel, could severely impact its standing, especially since consumers connect deeply with sports memorabilia and fan gear. For instance, in 2023, reports of issues with the authenticity of certain trading cards sold through their platform, while not directly attributed to Fanatics' own manufacturing, highlighted the vulnerability of their marketplace model to third-party product integrity concerns.

Economic Downturns and Shifting Consumer Spending

Economic downturns pose a significant threat to Fanatics. A general slowdown could curb consumer spending on non-essential items like licensed sports merchandise and collectibles, impacting revenue across Fanatics' various business lines. For instance, if consumer confidence falls, spending on discretionary goods, which includes Fanatics' product categories, is often one of the first areas to be reduced.

Shifting consumer preferences also present a challenge. As tastes evolve, Fanatics might see a decline in demand for traditional merchandise, requiring continuous adaptation of its product offerings. This means staying ahead of trends in sports fandom and how consumers engage with their favorite teams and athletes, whether through apparel, digital collectibles, or other emerging formats.

- Decreased Discretionary Spending: Economic recessions, like the potential slowdown anticipated in late 2024 or early 2025, typically lead consumers to cut back on non-essential purchases. This directly affects sales of Fanatics' core products.

- Impact on Collectibles Market: The sports collectibles market, a growing segment for Fanatics, is particularly sensitive to economic conditions. Downturns can reduce the value and demand for high-end memorabilia and trading cards.

- Sports Betting Volatility: While sports betting offers growth potential, it can also be affected by economic pressures. Consumers facing financial strain may reduce their spending on betting activities.

- Adapting to Evolving Tastes: Fanatics must constantly monitor and respond to shifts in how fans engage with sports, potentially moving beyond traditional merchandise to digital goods and experiences.

Supply Chain Disruptions and Counterfeiting

Fanatics faces significant threats from global supply chain vulnerabilities. For instance, the ongoing geopolitical tensions and port congestion experienced throughout 2023 and into early 2024 have led to extended lead times and increased logistics costs for many retailers, a challenge Fanatics, with its broad product sourcing, cannot escape. These disruptions can directly impact inventory availability and the timely delivery of merchandise to consumers, especially during peak demand periods like major sporting events.

The proliferation of counterfeit goods also poses a considerable threat to Fanatics. The global market for counterfeit sports merchandise is substantial, with reports indicating billions of dollars in lost revenue annually across the apparel and accessories sector. Counterfeit products not only erode Fanatics' brand reputation and customer trust but also directly siphon sales away from legitimate channels.

- Supply Chain Vulnerabilities: Fanatics, like other global retailers, is susceptible to disruptions from manufacturing delays, transportation issues, and geopolitical instability, impacting product availability and cost.

- Counterfeiting Impact: The presence of counterfeit merchandise devalues the Fanatics brand and directly reduces sales, as consumers may unknowingly purchase imitation goods.

- Increased Logistics Costs: Global shipping challenges and port congestion, prevalent in 2023-2024, have driven up transportation expenses, affecting Fanatics' operational margins.

- Brand Dilution: The unauthorized replication of Fanatics’ licensed products can dilute brand equity and consumer perception of authenticity and quality.

Fanatics faces intense competition from established giants like Nike and Adidas, whose significant marketing budgets and global reach, exemplified by Nike's $51.2 billion revenue in FY23, present a substantial barrier to market share acquisition. Furthermore, online marketplaces such as Amazon, with its over $574 billion in net sales for 2023, offer consumers alternative and often more convenient purchasing options, intensifying the competitive pressure.

SWOT Analysis Data Sources

This Fanatics SWOT analysis is built upon a foundation of robust data, including the company's financial statements, comprehensive market research reports, and industry expert opinions to provide a well-rounded strategic perspective.