Fanatics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanatics Bundle

Fanatics navigates a complex landscape, facing significant bargaining power from powerful sports leagues and demanding athletes, impacting their supplier relationships. The threat of new entrants, while potentially mitigated by high capital requirements, remains a consideration in the rapidly evolving sports merchandise market. Understanding these dynamics is crucial for Fanatics’s continued dominance.

The complete report reveals the real forces shaping Fanatics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fanatics' reliance on exclusive, long-term licensing agreements with major sports leagues like the NFL, NBA, MLB, and NHL significantly amplifies the bargaining power of these suppliers. These leagues possess the coveted intellectual property – team logos and player likenesses – that form the bedrock of Fanatics' merchandise operations. The exclusivity inherent in these contracts leaves Fanatics with few, if any, alternative sources for official league merchandise, thereby concentrating considerable leverage in the hands of the leagues.

The bargaining power of suppliers for Fanatics is significantly influenced by the concentration of key suppliers, particularly for intellectual property. The primary sources for the most critical assets, like official league and team logos and branding, are highly concentrated within the respective sports organizations themselves. This limited number of suppliers means Fanatics has very few, if any, viable alternatives for acquiring these essential licenses, which inherently bolsters the suppliers' leverage.

Fanatics' reliance on exclusive rights, such as those for trading cards acquired through the Topps integration and fan gear for major leagues, underscores this dynamic. These leagues act as powerful gatekeepers, controlling access to the content that forms the backbone of Fanatics' product offerings. In 2024, the sports licensing market continues to be dominated by these major entities, further cementing their supplier power.

Fanatics faces substantial supplier bargaining power due to the high switching costs associated with its major league and team licenses. Moving from one licensing agreement to another would mean not only losing established revenue streams from current fan bases but also navigating the intricate and costly process of negotiating entirely new, comprehensive deals with different sports organizations.

The deep integration of Fanatics' unique vertical commerce model, which encompasses everything from merchandise design to fulfillment, further entrenches this dependency. This intricate setup makes it exceptionally difficult and financially prohibitive for Fanatics to pivot away from its current key suppliers, the major sports leagues and their constituent teams, effectively strengthening the suppliers' leverage.

Supplier's Ability to Forward Integrate

The ability of suppliers to forward integrate, meaning they could potentially move into the buyer's business, presents a significant bargaining chip. While it's less typical for sports leagues to completely integrate into retail operations, they can still wield power by restricting the scope of licensing agreements or by prioritizing their own direct-to-consumer sales channels.

However, Fanatics' substantial infrastructure and dominant market position make it difficult for individual leagues to undertake full forward integration. Leagues often opt to collaborate with Fanatics because of its vast distribution network and efficient operations, which benefit both parties. For instance, Fanatics' 2023 revenue was projected to exceed $8 billion, highlighting its scale and the attractiveness of its partnerships.

- Leagues can leverage their licensing power.

- Fanatics' infrastructure deters league forward integration.

- Partnerships with Fanatics are often preferred by leagues.

- Fanatics' market dominance limits supplier integration threats.

Importance of Fanatics' Business to Suppliers

While sports leagues wield considerable influence, Fanatics' extensive distribution network and global reach offer immense value to suppliers seeking to maximize merchandise sales and fan engagement. Fanatics' significant revenue generation, projected to reach $8.1 billion in 2024, underscores its importance as a key partner for these leagues and their associated suppliers.

This symbiotic relationship means suppliers depend on Fanatics for access to a massive customer base, while Fanatics relies on suppliers for a diverse and appealing product catalog. This mutual reliance creates a balanced dynamic, where both Fanatics and its suppliers understand the strategic importance of their collaboration.

- Fanatics' global reach provides suppliers with unparalleled access to international markets.

- The company's 2024 revenue projection of $8.1 billion highlights its substantial purchasing power and market presence.

- Fanatics' established distribution channels offer suppliers a streamlined path to consumers, reducing logistical complexities.

The bargaining power of suppliers to Fanatics is substantial, primarily due to the exclusive nature of licensing agreements with major sports leagues. These leagues control essential intellectual property, such as team logos and player likenesses, which are critical for Fanatics' merchandise business. The limited availability of these assets means Fanatics has few alternatives, significantly enhancing supplier leverage.

| Supplier Type | Key Assets Controlled | Fanatics' Dependence | Supplier Bargaining Power | 2024 Impact |

| Major Sports Leagues (NFL, NBA, MLB, NHL) | Official logos, team branding, player likenesses | High; essential for core business | Very High; limited alternatives | Continued reliance on exclusive deals |

| Key Manufacturers/Distributors | Production capacity, specialized materials | Moderate to High; dependent on scale | Moderate; potential for diversification | Ongoing supply chain considerations |

What is included in the product

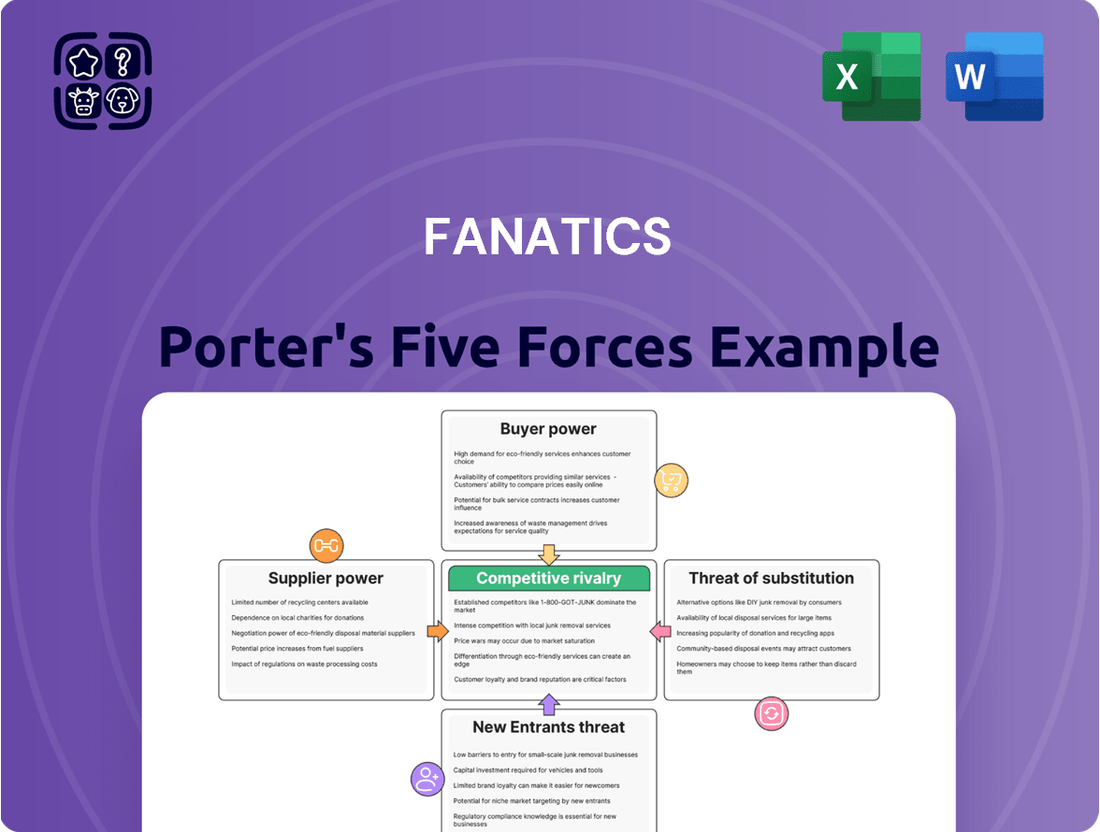

Fanatics' Porter's Five Forces analysis dissects the competitive intensity within the sports merchandise and memorabilia market, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing players.

Understand the competitive landscape at a glance with a visually intuitive breakdown of each of Fanatics' Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Individual sports fans, Fanatics' core customers, generally face minimal costs when deciding to purchase licensed merchandise from a different vendor. This ease of switching is amplified by the widespread availability of online purchasing options, allowing fans to compare prices and products across multiple retailers with just a few clicks. For example, in 2024, the global e-commerce market for sports apparel and merchandise continued its robust growth, estimated to reach over $100 billion, indicating a highly competitive landscape where customer loyalty can be fluid.

Fanatics' customers can readily opt for alternative retailers, including established sporting goods chains and even the direct-to-consumer websites of major sports brands like Nike and Adidas. This accessibility means that if a customer finds a better price or a wider selection elsewhere, the barrier to switching is very low. The convenience of digital platforms further streamlines this process, making it simple for consumers to explore and commit to purchases from competing businesses, thereby increasing the bargaining power of the customer.

Customers for licensed sports merchandise often exhibit price sensitivity, particularly for basic apparel items that don't possess unique or exclusive designs. While dedicated fans might absorb higher prices for sought-after collectibles or team-specific gear, the general consumer base is highly attuned to competitive pricing across a multitude of retail channels.

Fanatics' strategy to mitigate this involves robust promotional efforts and loyalty initiatives, such as their FanCash rewards program. This aims to build customer retention by offering tangible value, encouraging repeat purchases, and fostering a sense of loyalty that can temper extreme price sensitivity for a portion of their customer base. In 2024, the sports merchandise market continued to see a blend of premium pricing for exclusive items and a strong response to discounts on more common goods.

Customers have a wide array of choices beyond Fanatics' official offerings. Competitors such as Nike, Adidas, and Under Armour directly vie for sports apparel spending. In 2023, the global sportswear market was valued at over $200 billion, indicating significant competition for consumer dollars.

The availability of unofficial or generic sports apparel further fragments the market. Additionally, the booming athleisure trend allows consumers to embrace sports-inspired fashion without necessarily purchasing licensed team merchandise. This trend means Fanatics competes not only with other sports brands but also with general fashion retailers.

Fragmented Customer Base

Fanatics operates within a highly fragmented global customer base, comprising millions of individual sports enthusiasts. This widespread distribution of demand means that no single customer or even a small collective of customers possesses substantial leverage to dictate terms or pricing. In 2024, Fanatics' reach extends across numerous sports and leagues, further diluting any individual customer's influence.

While individual fans have limited power, aggregated consumer trends and preferences significantly shape demand for Fanatics' merchandise. Understanding these broad shifts allows the company to adapt its product offerings and marketing strategies. For instance, the growing popularity of specific sports or athletes can create substantial demand shifts that Fanatics must address.

- Fragmented Customer Base: Millions of individual sports fans globally, diminishing individual purchasing power.

- Widespread Distribution: No single customer or small group can exert significant leverage over Fanatics.

- Aggregated Trends Influence: Collective consumer preferences and demand patterns remain crucial for strategic planning.

- Reduced Bargaining Power: The sheer volume and dispersion of customers generally limit their ability to negotiate prices or terms.

Information Availability and Transparency

The rise of online platforms and sophisticated price comparison tools has dramatically increased information availability for customers. This transparency allows consumers to easily access product details, read reviews, and compare pricing across numerous retailers in real-time. For instance, by mid-2024, platforms like Google Shopping and Amazon's marketplace provided millions of product listings with detailed specifications and customer feedback, making it simple for shoppers to identify the most competitive offers.

This readily accessible information directly fuels the bargaining power of customers. Armed with knowledge of market prices and product quality, consumers are empowered to negotiate better deals or simply choose vendors offering superior value. In 2024, the e-commerce sector continued to see growth in consumer research, with studies indicating that a significant percentage of online shoppers actively utilize comparison tools before making a purchase, thereby driving down margins for businesses that cannot compete on price or perceived value.

- Increased Price Transparency: Online marketplaces and comparison sites make it effortless for consumers to see prices from multiple sellers side-by-side.

- Access to Reviews and Ratings: Customer feedback on product performance and seller service is readily available, influencing purchasing decisions.

- Empowered Purchasing Decisions: Shoppers can research alternatives and identify the best value proposition, reducing brand loyalty based on ignorance.

- Direct Impact on Retailers: Businesses face pressure to offer competitive pricing and superior customer experiences to retain customers in an informed market.

Fanatics' customers, primarily individual sports fans, possess significant bargaining power due to low switching costs and a fragmented market. The ease with which fans can access licensed merchandise from numerous online retailers and direct brand websites means that price and selection are key drivers. In 2024, the global online sports apparel market, valued at over $100 billion, highlights the intense competition for consumer attention, further empowering buyers.

Customers can easily compare prices and product offerings across various platforms, from large sporting goods chains to direct-to-consumer sites of brands like Nike and Adidas. This accessibility, amplified by digital tools, reduces customer loyalty based on convenience alone. For example, by mid-2024, comparison sites offered millions of product listings, making it simple for shoppers to find the best value.

Price sensitivity is a notable factor, especially for standard apparel items. While exclusive collectibles may command premium prices, the broader consumer base is responsive to competitive pricing across the market. The global sportswear market, exceeding $200 billion in 2023, demonstrates the need for retailers to remain competitive. Fanatics attempts to counter this with loyalty programs like FanCash, aiming to foster repeat business.

| Factor | Description | Impact on Fanatics | 2024 Data/Context |

|---|---|---|---|

| Low Switching Costs | Customers can easily buy from competitors with minimal effort or expense. | Increases customer power; pressures Fanatics on price and service. | The global e-commerce market for sports apparel is over $100 billion, showing ease of access to alternatives. |

| Fragmented Customer Base | Millions of individual fans, none with significant individual leverage. | No single customer can dictate terms, but aggregated trends are powerful. | Fanatics' global reach in 2024 means demand is widely dispersed. |

| High Information Availability | Online tools allow easy price and product comparisons. | Empowers customers to seek the best value, forcing competitive pricing. | Comparison platforms offer millions of listings, increasing price transparency. |

| Price Sensitivity | Customers are often price-conscious, especially for common items. | Requires Fanatics to balance pricing strategies with product differentiation. | The sportswear market value over $200 billion (2023) shows intense competition for consumer spending. |

What You See Is What You Get

Fanatics Porter's Five Forces Analysis

This preview showcases the comprehensive Fanatics Porter's Five Forces Analysis, detailing the competitive landscape of the sports merchandise industry. You are looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing deep insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes for Fanatics. This is the complete, ready-to-use analysis file, offering actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Fanatics operates in highly competitive markets. In licensed sports merchandise, it contends with giants like Nike and Adidas, who also have strong brand loyalty and extensive distribution networks. These three companies together hold a substantial portion of the licensed sports merchandise market, indicating a concentrated but fiercely contested space.

The sports betting arena is dominated by established players such as DraftKings and FanDuel, which have significant market share and sophisticated user bases. Fanatics is actively entering and expanding in this sector, facing established incumbents with deep pockets and proven operational models.

Even in the trading card business, where Fanatics acquired Topps, other significant competitors like Panini continue to operate. This highlights the breadth of competitive pressures Fanatics encounters, requiring it to constantly innovate and differentiate across its various ventures.

The licensed sports merchandise market is experiencing robust growth, with projections indicating a compound annual growth rate of 4.7% from 2024 through 2029. This expansion naturally fuels intense competition, as established players and new entrants vie for a larger piece of the pie.

Fanatics, a dominant force in online sports merchandise, faces a dynamic competitive landscape. While it commands a substantial market share, it consistently contends with formidable rivals such as Nike and Amazon, both of which possess extensive reach and brand loyalty.

In the rapidly evolving sports betting arena, Fanatics Sportsbook has made significant inroads. By the close of 2024, it had captured an estimated 5% of the market share, a figure that climbed to 6.7% by January 2025, directly challenging the established leadership of incumbent sportsbooks.

While Fanatics enjoys an edge through exclusive licensing deals, rivals actively differentiate themselves. Nike, for instance, commands a substantial share of the fan apparel market, fueled by its powerful brand equity and high-profile athlete endorsements. This strong brand recognition allows Nike to foster deep customer loyalty, presenting a significant competitive challenge.

Competitors are also driving differentiation through continuous product innovation and distinctive marketing. They aim to capture consumer attention beyond just team affiliation, offering unique styles and engaging campaigns. For example, in 2023, Nike's global brand value was estimated at over $50 billion, showcasing the power of its established presence.

Fanatics counters by emphasizing its direct-to-consumer model and a vast network of partnerships, cultivating loyalty through a seamless fan experience. However, this intense competition compels Fanatics to constantly innovate, perhaps by exploring personalized product offerings or exclusive digital content to maintain its market position and keep fans engaged.

High Exit Barriers

The sports merchandising industry, where Fanatics operates, is characterized by substantial capital investments. These include significant outlays for state-of-the-art manufacturing facilities, advanced e-commerce platforms, and exclusive, long-term licensing agreements with major sports leagues and teams. For instance, Fanatics has secured exclusive deals with the NFL, MLB, and NBA, requiring substantial upfront payments and ongoing commitments.

These considerable financial commitments act as high exit barriers. Companies invest heavily in specialized infrastructure and technology tailored to the sports licensing market. This deep integration makes it economically unfeasible for major players to divest or pivot away from the industry without incurring significant losses, thus encouraging sustained competition.

- High Capital Investments: Significant financial outlay is required for infrastructure, technology, and licensing, making it difficult to exit.

- Long-Term Commitments: Exclusive licensing deals, often spanning many years, lock companies into the industry.

- Specialized Assets: The industry's focus on licensed sports merchandise means assets are highly specific and not easily repurposed.

- Reduced Player Turnover: High exit barriers discourage companies from leaving, leading to a more stable, albeit competitive, market.

Strategic Acquisitions and Diversification

Fanatics' aggressive strategy of acquiring established brands like Topps and Mitchell & Ness, along with expanding into sports betting by acquiring PointsBet's U.S. business, significantly heightens competitive rivalry. These moves consolidate market share and create a more integrated sports merchandise and gaming ecosystem.

This diversification forces competitors to respond by either seeking similar consolidation or focusing on niche areas to maintain relevance. For instance, Fanatics' 2022 acquisition of Topps for approximately $500 million and its 2023 deal for Mitchell & Ness for $225 million demonstrate a clear intent to dominate multiple facets of the sports fan economy.

The expansion into sports betting, a rapidly growing market, further intensifies competition, pushing traditional sports apparel and memorabilia companies to consider similar ventures or risk being left behind. Fanatics' entry into this space, aiming to leverage its existing customer base, creates a powerful new dynamic for established sportsbooks.

- Strategic Acquisitions: Fanatics has acquired companies like Topps (2022, ~$500 million) and Mitchell & Ness (2023, $225 million) to broaden its product portfolio and customer reach.

- Diversification into Betting: The acquisition of PointsBet's U.S. operations (announced 2023) signals a major push into the competitive sports betting and gaming market.

- Market Reshaping: These moves consolidate power and force rivals to innovate or face increased competitive pressure across the sports merchandise and gaming sectors.

- Intensified Rivalry: Fanatics' aggressive growth strategy creates a high level of competitive intensity, compelling other players to adapt and expand their own offerings.

Competitive rivalry is intense across all of Fanatics' operating segments. In licensed sports merchandise, it directly battles giants like Nike and Adidas, who benefit from substantial brand equity and established distribution. Fanatics' own market share in licensed sports apparel, estimated at over 20% in 2024, underscores the fierce competition.

The sports betting market sees Fanatics Sportsbook, holding approximately 6.7% market share by January 2025, challenging established leaders like DraftKings and FanDuel. This rapid market penetration indicates a highly dynamic and aggressive competitive environment.

Fanatics' strategic acquisitions, such as Topps for around $500 million in 2022 and Mitchell & Ness for $225 million in 2023, consolidate its position but also intensify rivalry. These moves force competitors to innovate and adapt to Fanatics' expanding ecosystem.

| Competitor | Primary Market | Key Competitive Factor | Estimated 2024 Market Share (Fanatics) |

| Nike | Licensed Sports Merchandise | Brand Loyalty, Athlete Endorsements | >20% (Overall Licensed Apparel) |

| Adidas | Licensed Sports Merchandise | Brand Strength, Global Reach | N/A (Included in overall competition) |

| DraftKings | Sports Betting | First-Mover Advantage, User Base | N/A (Direct Rival) |

| FanDuel | Sports Betting | Market Dominance, Brand Recognition | N/A (Direct Rival) |

| Panini | Trading Cards | Established Player, Niche Focus | N/A (Direct Rival) |

SSubstitutes Threaten

Consumers often turn to generic or unlicensed merchandise, a significant threat of substitutes for Fanatics. These items, while lacking official team logos, provide a more affordable way to express sports fandom. For instance, a plain t-shirt in a team's colors can be a compelling alternative for a budget-conscious fan.

This threat is particularly potent for casual fans or those prioritizing price over official branding. While hard-core supporters might stick to licensed goods, a broader segment of the market can easily satisfy their needs with less expensive, non-branded apparel. This segment represents a constant challenge to the premium pricing of officially licensed products.

Fans have numerous ways to show their allegiance beyond buying physical products. For instance, in 2024, the global sports media market was projected to reach over $100 billion, indicating significant spending on content like broadcasts and digital platforms, which competes for fan attention and dollars.

Engaging with sports media, attending live games, or participating in fantasy sports leagues are all powerful expressions of fandom that don't necessarily involve purchasing merchandise. The rise of digital content and social media means fans can interact with teams and athletes through likes, shares, comments, and online communities, offering immense value without direct product purchase.

This shift towards digital engagement and experiential fandom can dilute the necessity for fans to buy physical goods. For example, while the global sports apparel market is substantial, the increasing popularity of esports and digital fan experiences suggests a potential diversion of discretionary spending away from traditional merchandise.

The emergence of digital collectibles and Non-Fungible Tokens (NFTs) poses a significant threat of substitutes for Fanatics. These unique digital assets, linked to sports teams or players, offer fans an alternative way to engage and collect, potentially diverting consumer spending from Fanatics' core physical merchandise and trading card businesses. For instance, the NFT market saw substantial activity in 2021, with sales reaching billions of dollars, indicating a growing consumer appetite for digital ownership.

Experiential Alternatives

Experiential alternatives pose a significant threat to Fanatics' merchandise sales. Consumers have a choice between purchasing team apparel and attending live sporting events, participating in fan festivals like Fanatics Fest, or even traveling to support their favorite teams. This spending on experiences directly competes for discretionary income that might otherwise be allocated to merchandise.

In 2024, the live events sector continued its robust recovery. For instance, the NFL reported record attendance figures for the 2023 season, with an average of 69,494 fans per game, indicating a strong consumer appetite for in-person experiences. Similarly, major sports leagues and individual teams are increasingly investing in fan engagement events, creating compelling alternatives to simply buying merchandise.

- Live Games: Attending professional or collegiate sporting events offers direct engagement and a memorable experience, potentially diverting funds from merchandise purchases.

- Fan Festivals and Events: Events like Fanatics Fest or team-specific celebrations provide immersive experiences that can be prioritized over buying apparel or collectibles.

- Sports Travel: For dedicated fans, traveling to away games or major tournaments represents a significant expenditure that competes directly with sports merchandise budgets.

- Broader Entertainment: Consumers may opt for other forms of entertainment, such as concerts or leisure travel, if those experiences are perceived as more valuable or enjoyable than purchasing Fanatics products.

Shift in Consumer Preferences (e.g., Athleisure)

The rise of athleisure wear presents a significant threat of substitutes for Fanatics. Consumers are increasingly drawn to comfortable, versatile athletic apparel that blends style with performance, often not tied to specific sports teams or leagues. This shift means spending on casual, high-quality activewear from brands like Lululemon, Nike, or Adidas could divert funds that might otherwise go towards traditional licensed sports merchandise, such as jerseys or fan apparel.

For instance, the global activewear market was valued at over $350 billion in 2023, with projections indicating continued strong growth. This broad market includes items that serve a similar lifestyle function as fan apparel but offer wider applicability and fashion appeal. By offering comfortable, stylish, and functional clothing, these brands provide an alternative that meets consumer needs for everyday wear, potentially reducing the perceived necessity of team-specific merchandise.

- Athleisure's Growing Market Share: The athleisure segment continues to capture a larger portion of the apparel market, indicating a fundamental change in consumer priorities towards comfort and versatility.

- Brand Power of Athleisure Giants: Major athletic brands like Nike and Adidas have successfully integrated athleisure into their core offerings, leveraging strong brand loyalty and marketing to capture consumer attention.

- Shifting Consumer Spending Habits: Consumers are increasingly willing to spend on apparel that offers both style and functionality for everyday wear, creating an opportunity for substitutes to gain traction over niche fan merchandise.

The threat of substitutes for Fanatics is substantial, encompassing a wide range of alternatives that fulfill a fan's desire to express allegiance or engage with sports. These substitutes range from generic apparel and digital content to experiential purchases and broader lifestyle choices.

For instance, in 2024, the global sports apparel market, while vast, faces competition from the booming athleisure sector, valued at over $350 billion in 2023. This highlights how consumers might opt for versatile, everyday activewear from brands like Nike or Lululemon, which offer comfort and style, over team-specific merchandise.

Furthermore, the increasing value placed on experiences, such as attending live games which saw average NFL attendance of 69,494 in the 2023 season, directly competes with merchandise spending. Digital engagement, like sports media consumption projected to exceed $100 billion globally in 2024, also diverts fan attention and discretionary income.

| Substitute Category | Examples | Key Differentiator | Impact on Fanatics |

|---|---|---|---|

| Generic/Unlicensed Merchandise | Team-colored apparel without logos | Lower price point | Appeals to budget-conscious fans, dilutes premium pricing |

| Digital Content & Engagement | Streaming services, fantasy sports, social media | Experiential, interactive | Competes for fan time and discretionary spending |

| Live Sporting Events & Experiences | Tickets, fan festivals, sports travel | Immersive, memorable | Directly competes for disposable income |

| Athleisure Wear | Comfortable, stylish activewear from non-sports brands | Versatility, everyday wearability | Captures apparel spending, shifts focus from niche fan gear |

| Digital Collectibles (NFTs) | Team or player-specific digital assets | Digital ownership, collectibility | Offers alternative fan engagement and potential spending diversion |

Entrants Threaten

Entering the licensed sports merchandise market, particularly at the scale Fanatics operates, demands significant capital. This includes funding for vast inventory, robust technology platforms, and securing exclusive, long-term licensing deals with major sports leagues and teams. For instance, the cost of securing rights alone can run into hundreds of millions of dollars, making it a formidable barrier.

Fanatics' exclusive, long-term licensing agreements, often spanning 15-20 years, create a substantial barrier to new entrants. These deals with major sports leagues and player associations mean newcomers cannot legally offer official merchandise for the most popular teams. This exclusivity is a critical differentiator in the fan merchandise market, effectively locking out competitors from a significant portion of the consumer base.

Fanatics has cultivated a powerful brand presence and a deeply loyal fan base, a direct result of its extensive digital infrastructure and direct-to-consumer approach. Building this level of trust and affinity in the passionate sports merchandise market requires substantial marketing outlays and considerable time.

New competitors face a significant hurdle in replicating Fanatics' established brand recognition and the emotional connection fans have with the company. For instance, Fanatics reported over $1 billion in revenue in 2022, showcasing the scale of its operations and market penetration.

Economies of Scale and Vertical Integration

Fanatics leverages substantial economies of scale in its vertically integrated 'V-Commerce' model, covering manufacturing, distribution, and retail. This integration facilitates swift production, streamlined supply chain operations, and pricing that is difficult for smaller, newer competitors to replicate. For instance, by controlling its supply chain, Fanatics can reduce per-unit costs significantly as production volume increases.

The company's vast customer base, exceeding 100 million sports fans, presents a formidable barrier to entry. This enormous database offers a significant advantage in customer acquisition and retention. In 2024, Fanatics continued to expand its reach through strategic partnerships, further solidifying its market presence.

- Economies of Scale: Fanatics' V-Commerce model allows for cost efficiencies through bulk purchasing and optimized production processes.

- Vertical Integration: Control over manufacturing and distribution minimizes reliance on third parties and enhances operational speed.

- Customer Database: Over 100 million registered fans provide a direct marketing channel and a significant advantage in understanding consumer behavior.

- Competitive Pricing: The combination of scale and integration enables Fanatics to offer competitive pricing, deterring new entrants.

Regulatory and Operational Complexities in Diversified Segments

For Fanatics, particularly in its newer ventures such as sports betting and gaming, the threat of new entrants is significantly mitigated by substantial regulatory and operational complexities. New players entering these highly regulated spaces must navigate a patchwork of state-by-state licensing requirements, a process that is both time-consuming and capital-intensive. For instance, obtaining a license to operate in a single US state can cost millions of dollars and involve extensive background checks and compliance audits.

These industries demand considerable legal and compliance expertise to ensure adherence to evolving regulations, which act as a formidable barrier to entry. The need for robust anti-money laundering (AML) protocols, responsible gaming measures, and data privacy compliance further elevates the operational hurdles. Consequently, the ability for new, unestablished entities to quickly gain traction and compete with established players like Fanatics, which is leveraging its existing customer base and brand recognition, is severely constrained.

- High Licensing Costs: Obtaining licenses in multiple US states can cost upwards of $10 million per state.

- Complex Compliance: Adherence to diverse state regulations and federal laws requires significant legal and operational investment.

- Operational Expertise: Managing player accounts, payment processing, and risk in real-time demands sophisticated technological infrastructure.

The threat of new entrants into the licensed sports merchandise market is low due to Fanatics' substantial barriers to entry. These include immense capital requirements for inventory and licensing, as well as exclusive, long-term deals with major sports leagues, effectively locking out competitors from official merchandise. Fanatics’ established brand loyalty, cultivated through extensive digital infrastructure and direct-to-consumer strategies, further deters newcomers.

In 2023 and continuing into 2024, Fanatics' vertically integrated model, known as V-Commerce, provides significant economies of scale. This control over manufacturing, distribution, and retail allows for cost efficiencies and competitive pricing that are difficult for smaller, new entrants to match. Their vast customer database, exceeding 100 million fans, offers a direct marketing advantage and deep consumer insights, solidifying their market position.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Securing exclusive licenses and managing inventory requires hundreds of millions of dollars. | Forms a significant financial hurdle. |

| Exclusive Licensing Agreements | Long-term deals with leagues prevent competitors from selling official merchandise. | Limits market access and product offerings for new players. |

| Brand Loyalty & Customer Base | Over 100 million registered fans and strong brand recognition. | Makes customer acquisition and retention challenging for new entrants. |

| Economies of Scale & Vertical Integration | Controlled supply chain and large-scale operations reduce costs. | Enables competitive pricing and operational efficiency difficult to replicate. |

Porter's Five Forces Analysis Data Sources

Our Fanatics Porter's Five Forces analysis leverages data from industry-specific market research reports, company investor relations disclosures, and competitive intelligence platforms to comprehensively assess industry dynamics.