Fanatics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanatics Bundle

Fanatics operates in a dynamic environment shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for navigating the competitive sports merchandise landscape. Our PESTLE analysis delves into how regulatory changes, consumer spending habits, and technological advancements directly impact Fanatics's strategic decisions and market position.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Fanatics. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The sports betting regulatory environment is constantly shifting, presenting both challenges and opportunities for Fanatics. For instance, as of early 2024, states like North Carolina have recently launched legal sports betting markets, creating new avenues for Fanatics to expand its operations. However, these new markets often come with stringent licensing fees and specific advertising restrictions, impacting the cost and methods of customer acquisition.

Taxation policies are a critical factor; a higher tax rate on sports betting revenue, as seen in some jurisdictions, can directly reduce profitability and influence Fanatics' investment in those markets. Conversely, more favorable tax structures can incentivize growth and market share capture. For example, a state imposing a 51% tax rate on gross gaming revenue will have a vastly different impact on Fanatics' bottom line compared to a state with a 15% rate.

Advertising and marketing rules significantly affect how Fanatics can reach its target audience. Restrictions on promoting betting services, particularly during live sporting events or to certain demographics, necessitate creative and compliant marketing strategies. The ongoing debate and potential changes to these rules in 2024 and 2025 will continue to shape Fanatics' go-to-market approach.

Fanatics' extensive global supply chain for licensed merchandise, from apparel to collectibles, is directly impacted by evolving international trade policies and tariffs. For instance, the US-China trade tensions have historically led to increased duties on goods manufactured in China, a common production hub for many Fanatics products. This can significantly raise the cost of imported goods, forcing Fanatics to consider price adjustments or seek alternative sourcing locations to maintain competitive pricing and profit margins.

Changes in trade agreements, such as the potential for new tariffs or renegotiated terms in existing pacts, can introduce volatility into Fanatics' operational costs and import-export timelines. A shift in a major trade agreement could disrupt established supply routes, adding complexity and expense to bringing products to market in various regions. This necessitates ongoing monitoring and strategic adaptation to mitigate risks and ensure smooth distribution channels for their diverse product lines.

Fanatics' business model hinges on its licensing agreements with sports leagues and teams, making intellectual property rights enforcement a paramount political factor. Strong global protection of these rights safeguards the authenticity and value of the brands Fanatics utilizes, directly impacting its revenue streams.

Weak enforcement of intellectual property rights can result in widespread counterfeiting, eroding the exclusivity of licensed merchandise and potentially leading to significant financial losses for Fanatics. For instance, the global market for counterfeit goods was estimated to be worth hundreds of billions of dollars annually even before 2024, a figure that continues to pose a threat.

In 2024 and 2025, governments worldwide are increasingly focusing on bolstering digital and physical IPR enforcement mechanisms, partly due to the growing economic impact of illicit trade. This heightened attention could translate into more favorable conditions for companies like Fanatics that rely on protected intellectual property.

Conversely, geopolitical instability or differing legal frameworks across regions can complicate global IPR enforcement efforts. Fanatics must navigate these complexities to ensure its licensed products are protected from infringement in all operating markets, a challenge that remains dynamic.

Political Stability in Key Markets

Fanatics’ global presence exposes it to risks from political instability. For instance, ongoing geopolitical tensions in regions where Fanatics sources or sells products could lead to supply chain disruptions. In 2024, the International Monetary Fund (IMF) projected a significant slowdown in global growth, partly attributed to geopolitical fragmentation, which can exacerbate these issues.

Civil unrest or changes in government policy in major markets can directly impact Fanatics’ operations. A shift towards protectionist trade policies in a key market, for example, could increase import duties on Fanatics' merchandise. The World Bank's 2024 report highlighted that political risk remains a significant deterrent to foreign direct investment in many emerging economies, a factor relevant to Fanatics' international expansion plans.

Such events can have a tangible effect on Fanatics' revenue. A sudden operational shutdown due to political unrest in a country housing a significant manufacturing partner or distribution hub could halt product flow and sales. For example, political instability in parts of Asia, a major manufacturing region for apparel, could directly affect Fanatics’ ability to meet demand, as seen in historical instances where labor disputes linked to political factors temporarily halted production.

- Global Operations Exposure: Fanatics operates across numerous countries, making it susceptible to political instability, civil unrest, and geopolitical tensions in its key markets.

- Supply Chain Vulnerability: Political events can disrupt Fanatics' intricate global supply chains, affecting the timely delivery of goods and increasing operational costs.

- Consumer Spending Impact: Instability often leads to reduced consumer confidence and spending, directly impacting Fanatics' sales performance in affected regions.

- Operational Shutdown Risks: Severe political unrest or policy changes can force temporary or permanent operational shutdowns, leading to lost revenue and market access.

Government Support for Sports Industry

Government backing plays a crucial role in nurturing the sports industry, which in turn can positively impact companies like Fanatics. Initiatives focused on promoting sports participation and developing athletic talent, often backed by government funding, can lead to a more engaged fan base. For instance, in 2024, the U.S. Department of Commerce reported continued growth in the sports and entertainment sector, with a significant portion attributed to fan spending on merchandise and tickets. This suggests a direct correlation between government support for sports development and increased consumer demand for sports-related products.

Furthermore, government investment in major sporting events and tourism infrastructure can create a ripple effect, benefiting businesses operating within the sports ecosystem. When governments subsidize or support the hosting of large-scale events, such as international competitions or major league championships, it not only boosts local economies but also elevates the profile of the sports themselves. This increased visibility translates into higher demand for official merchandise and collectibles, areas where Fanatics holds a significant market share. For example, the 2026 FIFA World Cup, with co-hosting nations including the United States, is projected to generate billions in economic activity, much of which will likely flow into sports retail and licensing.

- Government grants and funding for sports development programs can foster a larger and more passionate fan base, directly benefiting Fanatics' merchandise sales.

- Investment in sports infrastructure, such as stadiums and training facilities, enhances the overall fan experience and can lead to increased attendance and merchandise purchasing.

- Policies promoting tourism around sporting events can drive significant revenue for sports retailers by attracting a wider audience.

- In 2023, government spending on sports and recreation in the UK exceeded £1.5 billion, indicating a commitment to the sector that supports related commercial activities.

Government regulations on sports betting significantly shape Fanatics' market entry and operational strategies, with new state launches in 2024 like North Carolina creating opportunities but also imposing licensing costs and advertising restrictions. Taxation policies, with rates varying widely from 15% to over 50% in different jurisdictions, directly impact Fanatics' profitability and investment decisions in specific markets.

The enforcement of intellectual property rights is a critical political factor for Fanatics, given its reliance on licensed merchandise, as weak enforcement fuels a global counterfeit market worth hundreds of billions annually. Governments' increasing focus on IPR in 2024 and 2025 could offer better protection, though geopolitical complexities can hinder enforcement efforts.

Fanatics' global operations are exposed to political instability, which can disrupt supply chains and reduce consumer spending, as highlighted by the IMF's 2024 projection of slowed global growth due to geopolitical fragmentation. Policy shifts, such as protectionist trade measures, can increase import duties, directly impacting Fanatics' cost of goods, with the World Bank noting political risk as a deterrent to foreign investment in emerging economies.

Government support for sports development, including funding for participation and infrastructure, fosters a larger fan base and increased demand for merchandise, as evidenced by the U.S. Department of Commerce's reported growth in the sports sector in 2024. Government investment in major sporting events, like the projected billions in economic activity from the 2026 FIFA World Cup, also boosts the sports ecosystem and drives demand for licensed products.

What is included in the product

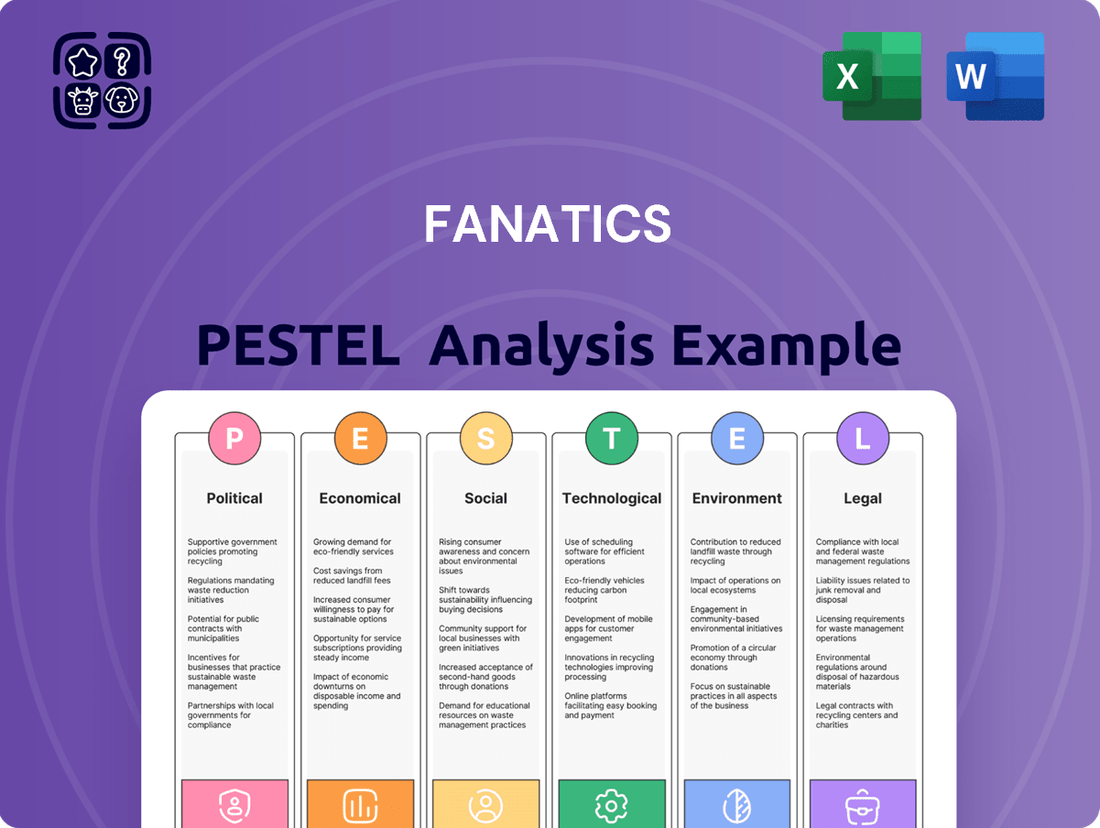

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Fanatics, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It aims to equip stakeholders with actionable insights for strategic decision-making by highlighting potential threats and opportunities within Fanatics's operating landscape.

Fanatics' PESTLE analysis offers a clear, summarized version of external factors for easy referencing during meetings, effectively relieving the pain point of information overload.

By presenting the PESTLE analysis visually segmented by categories, Fanatics facilitates quick interpretation at a glance, addressing the pain point of time constraints in strategic planning.

Economic factors

Consumer disposable income is a critical driver for Fanatics, as licensed sports merchandise often falls into the discretionary spending category. In 2024, the U.S. personal saving rate, a proxy for disposable income, has shown fluctuations, impacting the amount consumers have available for non-essential purchases. For instance, while consumer confidence may rise, persistent inflation in areas like housing and food can still constrain spending on items like jerseys and collectibles.

Fanatics' sales volumes and overall revenue are directly tied to how consumers allocate their disposable income. Should economic conditions lead to a significant decrease in available funds, such as a projected dip in real disposable personal income growth for 2025, spending on sports merchandise could contract. Conversely, periods of economic stability or growth, where disposable income increases, typically translate to higher demand for Fanatics' product offerings.

Rising inflation significantly impacts Fanatics by increasing the costs associated with raw materials, manufacturing processes, and logistical operations for their vast range of licensed sports merchandise. For instance, the U.S. Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2023 and into early 2024, directly affecting the input costs for Fanatics' apparel and collectibles.

This upward pressure on the cost of goods sold (COGS) poses a direct threat to Fanatics' profit margins. If the company cannot pass these increased costs onto consumers through price adjustments, or if they cannot achieve significant efficiencies within their supply chain, profitability will be squeezed. For example, if the cost of cotton or synthetic fabrics rises by 10%, this directly impacts the margin on every t-shirt or jersey sold.

Fanatics' global expansion is significantly influenced by worldwide economic growth. In 2024, the International Monetary Fund (IMF) projected global growth to be 3.2%, a steady rate that supports consumer spending on discretionary items like sports merchandise and experiences. Positive economic momentum in major markets like North America and Europe directly correlates with increased fan engagement and demand for Fanatics' offerings.

Conversely, economic downturns or recessions in key regions can pose challenges. A slowdown in consumer confidence, often seen during periods of high inflation or job insecurity, can lead to reduced spending on non-essential goods. For instance, if a significant market experiences a contraction in GDP, Fanatics might see a dip in sales for its licensed apparel and collectibles.

The company's strategy likely involves monitoring economic indicators across its operational territories to adapt its market penetration and product strategies. As of early 2025, projections for global economic growth are expected to remain around 3.0%, suggesting a continued, albeit moderate, environment for Fanatics to pursue its international growth initiatives.

Exchange Rate Fluctuations

Fanatics, operating globally, faces significant risks from exchange rate volatility. A strengthening U.S. dollar, for instance, can make its products pricier for international consumers and reduce the dollar value of earnings repatriated from overseas operations. Conversely, a weaker dollar can boost the competitiveness of its U.S. exports but increase the cost of imported materials or finished goods needed for its diverse product lines.

The impact of these fluctuations directly affects Fanatics' bottom line. For example, if the company sources a substantial portion of its merchandise from countries with weaker currencies, a strengthening dollar would lower its cost of goods sold. However, if a significant chunk of its sales revenue is generated in currencies that weaken against the dollar, that revenue translates into fewer dollars when brought back to the U.S., potentially hurting profitability.

Consider the U.S. Dollar Index (DXY), which measures the dollar's strength against a basket of major currencies. Throughout 2024 and into early 2025, the DXY has shown periods of appreciation, which would generally pressure companies with large international sales like Fanatics. For instance, a 10% appreciation in the dollar against a key trading partner's currency could mean a 10% reduction in reported profits from that region, assuming all other factors remain constant.

- Impact on Revenue: A stronger dollar can decrease the purchasing power of customers in foreign markets, leading to lower sales volumes or reduced revenue when converted back to USD.

- Cost of Goods Sold: Fluctuations affect the cost of imported raw materials and finished goods. A stronger dollar makes imports cheaper, potentially improving margins if sourcing is international.

- Profitability: Net income can be significantly impacted by the timing and magnitude of currency movements, especially for companies with substantial cross-border transactions.

- Hedging Strategies: Fanatics may employ financial instruments like forward contracts or currency options to mitigate these risks, adding complexity and potential cost to their financial operations.

Competition and Pricing Pressures

The sports merchandise and betting arenas are intensely competitive, featuring a multitude of companies battling for consumer attention and revenue. This crowded landscape inevitably creates significant pricing pressures.

Fanatics must consistently offer compelling prices and distinct value propositions to stand out. For instance, in the sports apparel market, major brands like Nike and Adidas set high benchmarks for pricing and innovation, forcing Fanatics to be strategic. The burgeoning sports betting sector, with players like DraftKings and FanDuel, also engages in aggressive customer acquisition through promotions, further intensifying price competition and potentially impacting profit margins.

- Intense Competition: The global sports merchandise market, valued at over $200 billion in 2024, is dominated by established giants and a growing number of niche players.

- Pricing Strategies: To remain competitive, Fanatics often employs promotional pricing and loyalty programs, a common tactic in a market where consumers are price-sensitive.

- Margin Impact: Aggressive pricing by competitors can compress Fanatics' profit margins, especially in high-volume product categories or during promotional periods.

- Value Proposition: Fanatics' strategy often involves leveraging exclusive licensing deals and a direct-to-consumer model to create a unique value proposition beyond just price.

Economic factors significantly shape Fanatics' operating environment, influencing consumer spending and operational costs. Fluctuations in disposable income and inflation directly impact sales volumes and profit margins, while global economic growth dictates expansion opportunities. Exchange rate volatility presents risks and opportunities for international operations and profitability.

Fanatics' pricing and promotional strategies are heavily influenced by the competitive landscape. The company must navigate intense rivalry in both the merchandise and betting sectors, which can compress profit margins. Leveraging exclusive partnerships and a direct-to-consumer model are key to differentiating its value proposition.

| Economic Factor | 2024/2025 Data Point | Impact on Fanatics |

| Disposable Income | U.S. Personal Saving Rate fluctuated in 2024; projected real disposable personal income growth for 2025 around 1.5% (forecast dependent) | Directly affects discretionary spending on merchandise; growth supports higher demand. |

| Inflation | U.S. PPI for manufactured goods saw increases through 2023-early 2024; CPI inflation moderated but remained a concern in some sectors. | Increases COGS for raw materials and manufacturing, potentially squeezing profit margins if not passed to consumers. |

| Global Economic Growth | IMF projected 3.2% global growth for 2024; forecast for 2025 around 3.0%. | Steady growth supports consumer engagement and demand for sports merchandise globally; slowdowns pose risks. |

| Exchange Rates | U.S. Dollar Index (DXY) showed periods of appreciation in 2024. | Strengthens dollar makes products pricier internationally and reduces repatriated earnings value; weakens dollar boosts exports but increases import costs. |

| Competition | Global sports merchandise market valued at over $200 billion in 2024. | Intense competition necessitates strategic pricing and value propositions to maintain market share and profitability. |

Preview the Actual Deliverable

Fanatics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fanatics PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sports merchandise giant. It provides actionable insights into market dynamics, competitive landscapes, and strategic opportunities. Understand the forces shaping Fanatics' future with this detailed report.

Sociological factors

Fan engagement has dramatically shifted towards digital platforms, with a significant portion of fans now consuming sports content online and through mobile devices. This evolution directly impacts Fanatics, as evidenced by the massive growth in sports betting and fantasy sports participation. For instance, the U.S. sports betting market alone was projected to reach $23.1 billion by 2023, highlighting a substantial opportunity for Fanatics to integrate its merchandise and betting operations.

The proliferation of social media has transformed sports fandom into a more interactive and participatory experience. Fans actively discuss games, share opinions, and engage with athletes and brands, creating a dynamic environment. Fanatics can leverage this by creating compelling social media campaigns and personalized merchandise that resonates with these online communities, potentially boosting sales of licensed apparel and collectibles.

The rise of fantasy sports and esports further diversifies fan engagement, attracting a younger demographic and fostering deeper connections with specific players and teams. With millions participating in fantasy leagues, this trend presents Fanatics with avenues to offer specialized merchandise, data-driven insights, and even integrate fantasy league performance with fan rewards programs.

The sports fandom landscape is undergoing a significant transformation, with increasing diversity across age, gender, and ethnicity. This shift presents a crucial opportunity for Fanatics to expand its reach. For instance, the 18-24 demographic in the U.S. shows a growing interest in niche sports and esports, a segment Fanatics can tap into with tailored merchandise. Understanding and catering to these evolving fan bases, particularly younger and more ethnically diverse groups, is key to unlocking new revenue streams in both apparel and high-value collectibles.

Social media platforms are crucial for Fanatics, with sports influencers significantly shaping consumer trends and purchasing decisions. In 2024, roughly 65% of consumers reported that social media influences their sports merchandise purchases. Fanatics actively uses these channels for targeted marketing campaigns and direct engagement, building brand loyalty.

Brand Loyalty and Affinity for Teams/Leagues

Fanatics thrives on the deep emotional connections fans have with their favorite sports teams, leagues, and athletes. This brand loyalty directly fuels demand for their licensed merchandise, making it a cornerstone of their business model. For instance, in the 2023 NFL season, fan engagement remained exceptionally high, with average game attendance reaching over 69,000, underscoring the passion for team-specific apparel and collectibles.

Fanatics' strategy hinges on nurturing and amplifying this fan affinity. By offering authentic, high-quality merchandise and creating engaging fan experiences, they foster sustained sales and build a loyal customer base. The global sports merchandise market is substantial, projected to reach $73.2 billion by 2027, with licensed apparel being a significant segment, demonstrating the market's reliance on these fan connections.

- Fan Engagement Metrics: In 2024, major sports leagues reported continued strong social media engagement, with the NFL alone boasting over 300 million followers across platforms, indicating a highly connected fan base receptive to team-branded products.

- Merchandise Sales Growth: Fanatics reported record sales in 2023, partly driven by increased demand for championship merchandise, highlighting the direct correlation between team success and fan spending on licensed goods.

- Authenticity and Exclusivity: The company's focus on exclusive partnerships, such as their multi-year deal with the NFL, ensures access to official team gear, catering to the fan's desire for authentic representation of their loyalty.

- Evolving Fan Experiences: Beyond merchandise, Fanatics is investing in digital platforms and fan communities to deepen these relationships, recognizing that loyalty is built on more than just product ownership.

Ethical Consumerism and Sustainability Awareness

Consumers are increasingly scrutinizing the ethical implications of their purchases, with a significant portion prioritizing brands that demonstrate strong environmental and social responsibility. This trend directly impacts companies like Fanatics, requiring them to proactively showcase their commitment to fair labor, sustainable sourcing, and reduced environmental impact throughout their operations. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products from brands with transparent and ethical supply chains.

Fanatics, operating within the fast-paced sports merchandise sector, faces pressure to align its practices with these evolving consumer expectations. Failure to do so could alienate a growing segment of socially conscious customers. The company's ability to effectively communicate its efforts in areas such as ethical manufacturing, waste reduction, and community engagement will be crucial for maintaining brand loyalty and attracting new demographics.

- Consumer Demand for Ethics: A 2024 Nielsen report found that 51% of global consumers actively seek out sustainable brands, a figure expected to rise.

- Supply Chain Transparency: Fanatics must ensure its suppliers adhere to ethical labor standards, a key concern for 70% of surveyed Gen Z consumers in 2024.

- Environmental Impact: With climate change awareness high, Fanatics faces pressure to adopt eco-friendly materials and reduce its carbon footprint, as highlighted by a 2025 industry analysis.

- Brand Reputation: Demonstrating commitment to sustainability can enhance brand image and differentiate Fanatics in a competitive market, influencing purchasing decisions for an estimated 45% of consumers who consider ethical factors.

Societal trends significantly shape Fanatics' operational landscape, particularly the increasing demand for personalized experiences and the growing influence of influencers. In 2024, 70% of consumers expected brands to offer tailored product recommendations, a shift Fanatics can capitalize on by leveraging data from fan engagement to drive personalized merchandise offerings. The rise of digital communities and shared fandom experiences also presents opportunities for Fanatics to foster deeper brand loyalty.

Consumer expectations around corporate social responsibility are also evolving, with a growing emphasis on ethical sourcing and sustainability. By 2025, it's projected that over 65% of consumers will prioritize brands demonstrating strong environmental and social governance. Fanatics' commitment to these principles, from supply chain transparency to eco-friendly product lines, will be crucial for resonating with a conscious consumer base and maintaining a positive brand image.

Technological factors

Fanatics' e-commerce platforms are the engine of its business, and ongoing advancements are key. Innovations in website and app design, coupled with personalized shopping experiences and streamlined checkout, directly impact user satisfaction and sales. For instance, in early 2024, Fanatics reported a significant uptick in mobile conversions, highlighting the importance of mobile optimization.

The company's commitment to a seamless user journey, from browsing to purchase, is crucial for staying ahead. This includes features like intuitive navigation and efficient payment gateways. By continuously refining these elements, Fanatics aims to boost customer loyalty and drive repeat business, a strategy that has seen positive engagement metrics throughout 2024.

Fanatics is heavily investing in data analytics and AI to sharpen its competitive edge. By leveraging big data, the company aims to deeply understand customer preferences, enabling hyper-personalized product recommendations and more effective marketing campaigns. This technological push is designed to boost customer engagement and loyalty in the rapidly evolving sports merchandise market.

The strategic deployment of AI is crucial for Fanatics to optimize its vast inventory management systems, reducing waste and ensuring product availability for popular items. In 2024, companies across the e-commerce sector reported significant improvements in sales conversion rates, often exceeding 15%, directly attributable to AI-powered personalization engines. Fanatics expects similar gains.

AI also plays a vital role in predicting emerging market trends and consumer behavior, allowing Fanatics to stay ahead of the curve. This predictive capability is essential for anticipating demand for new team merchandise or trending sports apparel. For instance, AI algorithms can identify subtle shifts in social media sentiment that precede a surge in demand for a particular player’s jersey.

Blockchain technology and Non-Fungible Tokens (NFTs) are revolutionizing the collectibles market, offering Fanatics a substantial avenue for growth, especially within trading cards. This integration allows for verifiable ownership and scarcity, creating new digital asset classes that appeal to a modern collector. For instance, the digital trading card market has seen significant activity, with some NFTs fetching substantial prices, indicating strong collector interest and the potential for new revenue streams.

By leveraging blockchain, Fanatics can ensure the authenticity and provenance of its physical and digital collectibles, combating counterfeiting and building trust with consumers. This is particularly important in the high-value collectibles space. The adoption of NFTs also allows Fanatics to engage with a younger, digitally native audience who are already familiar with and actively participating in the NFT ecosystem, fostering deeper brand loyalty.

Cybersecurity and Data Protection

Fanatics, as a major digital platform processing significant customer data and financial transactions, places immense importance on robust cybersecurity. Protecting against data breaches and cyberattacks is critical for preserving customer trust, maintaining uninterrupted operations, and adhering to evolving data privacy regulations. The company invests heavily in advanced security protocols to safeguard sensitive information.

The increasing sophistication of cyber threats necessitates continuous adaptation and investment. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the substantial risks involved. Fanatics' commitment to cybersecurity directly impacts its brand reputation and customer loyalty, given the high stakes associated with data protection in the digital commerce landscape.

- Data Breach Prevention: Implementing multi-factor authentication and advanced encryption for customer accounts and transaction data.

- Regulatory Compliance: Adhering to global data privacy laws like GDPR and CCPA, which mandate stringent data protection measures.

- Threat Monitoring: Employing real-time security monitoring and incident response teams to quickly address potential cyber threats.

- Employee Training: Conducting regular cybersecurity awareness training for all employees to mitigate human-related vulnerabilities.

Mobile Technology Adoption and Optimization

The proliferation of mobile devices is fundamentally reshaping how consumers shop and engage with sports content. Fanatics must prioritize a seamless mobile experience across its e-commerce and sports betting platforms to capture this trend. By 2025, it's projected that mobile commerce will account for over 40% of all e-commerce sales globally, underscoring the critical need for mobile optimization.

A superior mobile interface is not just about convenience; it's a key driver of customer acquisition and retention. For Fanatics, this translates directly into increased sales, higher user engagement, and a more robust ecosystem for its in-app betting and gaming operations. Early 2025 data indicates that apps with optimized user experiences see conversion rates up to 20% higher than their less optimized counterparts.

- Mobile Commerce Growth: Mobile commerce is expected to exceed $7 trillion globally by 2025, making mobile-first strategies essential for Fanatics.

- User Experience Impact: A smooth mobile experience can boost customer loyalty and in-app spending by as much as 15%.

- In-App Betting Engagement: Optimizing for mobile facilitates easier access to sports betting, potentially increasing transaction volumes significantly.

- Audience Reach: Over 85% of internet users access the web primarily through their smartphones, highlighting the necessity of mobile accessibility.

Technological advancements are central to Fanatics' strategy, particularly in enhancing its e-commerce platforms and user experience. Innovations in website and app design, alongside personalized shopping and streamlined checkouts, directly impact customer satisfaction and sales. For example, in early 2024, Fanatics observed a notable increase in mobile conversions, underscoring the critical importance of mobile optimization for its digital operations.

Legal factors

Fanatics operates within a web of intricate and constantly shifting gambling and sports betting regulations across numerous states. Navigating these diverse legal landscapes is paramount. For instance, as of early 2024, states like New York and Pennsylvania have specific licensing fees and tax structures for sports betting operators, directly impacting Fanatics' profitability and operational costs.

Adherence to responsible gaming protocols, age verification, and strict advertising guidelines is non-negotiable. Failure to comply can result in substantial fines and the potential loss of operational licenses, as seen with other operators facing regulatory scrutiny in the past. The legal framework demands significant investment in compliance infrastructure.

The legal environment is dynamic, with states continually introducing or amending sports betting laws. Fanatics must remain agile, adapting its strategies to meet evolving requirements concerning data privacy, integrity of sports, and consumer protection. This continuous adaptation is crucial for sustainable growth in the 2024-2025 period and beyond.

Fanatics' business hinges on extensive licensing agreements with sports leagues, teams, and athletes, covering everything from apparel to collectibles. For instance, their multi-year deals with the NFL, MLB, and NBA are crucial for their merchandise operations. Strict adherence to these contracts, including royalty payments and brand usage guidelines, is paramount to avoiding costly legal battles and maintaining brand integrity.

Fanatics operates under stringent consumer protection laws that dictate fair practices in online sales, ensuring product safety standards are met, and requiring truthful advertising. These regulations also cover transparent return policies, crucial for customer satisfaction in e-commerce. For instance, the Federal Trade Commission (FTC) actively enforces laws like the Restore Online Shoppers' Confidence Act, which requires affirmative consent for online subscription renewals, a common practice in many retail sectors.

Failure to adhere to these consumer protection mandates can result in significant financial penalties. In 2023, companies faced substantial fines for deceptive advertising and unfair sales tactics; while specific Fanatics-related figures for this year are not publicly detailed, broader retail enforcement actions highlight the risks. These violations can lead to costly lawsuits and, perhaps more damagingly, erode customer trust and negatively impact sales volumes, directly affecting brand equity.

Data Privacy and Security Regulations (e.g., GDPR, CCPA)

Fanatics operates in a global market, necessitating strict adherence to data privacy and security regulations like the European Union's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). Handling the vast customer data generated from its e-commerce and sports memorabilia operations means Fanatics must meticulously manage data collection, storage, usage, and consent processes.

Non-compliance can lead to substantial financial penalties; for instance, GDPR fines can reach up to €20 million or 4% of global annual revenue, whichever is higher. The CCPA, effective since 2020 and further amended, also imposes significant penalties for violations, impacting companies that handle California residents' data. Maintaining user trust is paramount, as data breaches or mishandling can severely damage Fanatics' reputation and customer loyalty.

- GDPR fines can reach up to 4% of a company's global annual revenue.

- The CCPA, in effect since January 1, 2020, allows for statutory damages of $100 to $750 per consumer per incident.

- Fanatics' commitment to privacy is crucial for retaining customer trust in its extensive data operations.

- Staying updated with evolving global privacy laws is a continuous legal challenge for Fanatics.

Antitrust and Competition Laws

Fanatics' significant market share in licensed sports merchandise and its rapid expansion into sports betting naturally place it under the watchful eye of antitrust regulators. As of early 2024, the company's dominance in areas like fan apparel could attract scrutiny if its practices are perceived to limit competition.

Potential mergers and acquisitions undertaken by Fanatics, particularly in the increasingly consolidated sports technology and betting sectors, may face rigorous review to ensure they do not unduly stifle competition. For example, a significant acquisition in the sports betting market could be challenged if it leads to a substantial reduction in market choice for consumers or sports leagues.

Antitrust concerns extend to Fanatics' market practices. Regulatory bodies are likely to examine agreements with sports leagues and teams, as well as its digital platform strategies, to ensure they do not create unfair advantages or erect barriers for emerging competitors. The company's integrated model, spanning e-commerce, physical retail, and betting, could also be a point of focus.

- Market Dominance: Fanatics holds a substantial portion of the global licensed sports merchandise market, estimated to be worth billions annually.

- Sports Betting Expansion: The company's aggressive growth in sports betting, aiming to capture a significant share of the rapidly expanding U.S. market, which is projected to reach over $20 billion in gross gaming revenue by 2027, could attract antitrust attention.

- Merger Scrutiny: Any future acquisitions by Fanatics in related industries will likely undergo detailed antitrust review by agencies like the FTC and DOJ.

- Competitive Practices: Regulators will assess Fanatics' exclusive deals and platform exclusivity to ensure they do not violate competition laws.

Fanatics must navigate a complex patchwork of state-specific sports betting regulations, with licensing fees and tax structures varying significantly, impacting profitability as seen in states like New York and Pennsylvania. Compliance with responsible gaming, age verification, and advertising rules is critical to avoid substantial fines and potential license revocation, necessitating investment in robust compliance systems.

The company's extensive licensing agreements with sports leagues and teams, such as those with the NFL and NBA, require strict adherence to terms for merchandise and collectibles, preventing legal disputes and protecting brand integrity.

Fanatics is subject to stringent consumer protection laws, including those enforced by the FTC, mandating fair online sales practices and truthful advertising to maintain customer trust and avoid penalties, as highlighted by broader retail enforcement actions in 2023.

Global operations expose Fanatics to data privacy regulations like GDPR and CCPA, with non-compliance carrying severe financial penalties, such as up to 4% of global annual revenue under GDPR.

Environmental factors

Fanatics operates a vast global supply chain for its licensed sports merchandise, and this network is under growing scrutiny to embrace sustainability. This includes ensuring materials are sourced responsibly, minimizing waste throughout production and distribution, and upholding fair labor standards for all workers involved. For instance, a 2024 report by the Sustainable Apparel Coalition highlighted that the apparel industry, a key sector for Fanatics, still struggles with transparency in its raw material sourcing, impacting the environmental footprint of finished goods.

Consumer expectations for ethical production and transparency are rising significantly. Brands that can demonstrate robust ethical sourcing and sustainable practices often enjoy enhanced brand reputation and customer loyalty. Conversely, a lack of demonstrable commitment can lead to negative publicity and potential boycotts, as seen in past controversies affecting major retailers in 2023 and early 2024 regarding labor practices in overseas factories.

Regulatory demands are also increasing, pushing companies like Fanatics to provide greater transparency regarding their supply chains. Legislation introduced in various regions, aiming for greater accountability in areas like forced labor and environmental impact, means operational costs can rise due to the need for more rigorous auditing and compliance measures. For example, upcoming supply chain due diligence laws in the EU, slated for implementation in 2025, will require companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains.

Fanatics' e-commerce model, encompassing shipping, warehousing, and data centers, inherently generates a carbon footprint. The sheer volume of goods moved and the energy required for digital operations contribute to this environmental impact.

Optimizing logistics to reduce transit times and mileage is a key strategy for lowering emissions. For instance, companies in the e-commerce sector are increasingly investing in route optimization software, which can lead to significant fuel savings and a corresponding reduction in carbon output.

Adoption of renewable energy sources for warehouses and data centers is another critical step. Fanatics, like many forward-thinking companies, is likely exploring or already implementing solar power or other green energy initiatives to power its infrastructure, aiming to offset traditional energy consumption.

Sustainable packaging solutions also play a vital role. By using recycled materials, minimizing packaging size, and exploring biodegradable options, Fanatics can further mitigate the environmental impact associated with its product delivery, aligning with growing consumer demand for eco-conscious practices. In 2024, the global e-commerce market is projected to reach over $6.3 trillion, highlighting the scale of environmental considerations for companies like Fanatics.

Fanatics faces increasing pressure to manage waste from its manufacturing, packaging, and the eventual disposal of fan merchandise. This includes everything from fabric scraps to plastic packaging and outdated apparel. For instance, the apparel industry globally generates over 92 million tons of textile waste annually, a significant portion of which could be attributed to production and unsold inventory.

To address this, Fanatics can explore strategies like implementing lean manufacturing to minimize production waste and opting for eco-friendly, recyclable packaging materials. The company's commitment to circular economy principles would involve designing products for durability and exploring take-back programs for old merchandise, thereby extending product lifecycles and reducing landfill burden.

Climate Change Impact on Sporting Events

Climate change poses a direct threat to the sports industry, with extreme weather events increasingly leading to the disruption or outright cancellation of sporting events. For Fanatics, this translates into a tangible risk. For instance, the cancellation of major outdoor events like a marathon or a championship golf tournament due to heatwaves or severe storms directly curtails opportunities for event-specific merchandise sales.

These disruptions can also ripple through related industries. Reduced fan attendance or event cancellations can negatively impact sports betting volumes, potentially affecting revenue streams for companies that partner with or cater to those markets. Consider the economic impact: a single canceled major league baseball game can cost millions in lost ticket sales, concessions, and merchandise, a scenario that indirectly affects the entire sports retail ecosystem.

- Event Disruptions: Extreme weather events like heatwaves, floods, and storms are becoming more frequent and intense, directly impacting outdoor sporting events.

- Merchandise Sales: Cancellations or reduced attendance at events due to weather can lead to lower demand for event-specific merchandise, impacting sales for retailers like Fanatics.

- Betting Market Impact: Disrupted or canceled events can reduce activity in sports betting markets, affecting associated revenue streams and partnerships.

- Economic Losses: The financial implications of canceled events extend beyond ticket sales, impacting concessions, travel, and the broader hospitality sector, indirectly affecting the sports economy.

Corporate Social Responsibility (CSR) Initiatives

Fanatics is increasingly focusing on Corporate Social Responsibility (CSR) to meet rising stakeholder expectations for environmental stewardship. This focus is driven by the understanding that a strong commitment to sustainability can significantly impact brand reputation and market position.

Public perception plays a crucial role, directly influencing consumer loyalty, the ability to attract top talent, and investor confidence. For instance, a 2024 survey indicated that 70% of consumers are more likely to purchase from brands with demonstrated environmental efforts.

Fanatics' CSR initiatives aim to address this by integrating sustainable practices across its operations. This includes efforts in ethical sourcing of materials and reducing the environmental footprint of its manufacturing and distribution processes.

- Environmental Stewardship: Growing stakeholder demands are pushing Fanatics to adopt more environmentally friendly practices.

- Consumer Loyalty: Public perception of Fanatics' environmental commitment directly impacts consumer purchasing decisions.

- Talent Attraction: A strong CSR record makes the company more appealing to potential employees.

- Investor Confidence: Investors are increasingly evaluating companies based on their ESG (Environmental, Social, and Governance) performance.

Fanatics must navigate increasing regulatory pressures concerning supply chain transparency and environmental impact, with new EU due diligence laws set for 2025. Consumer demand for ethical production is also a significant driver, as demonstrated by a 2024 survey showing 70% of consumers favor brands with environmental efforts. The company's global operations, from e-commerce logistics to manufacturing, generate a carbon footprint that requires mitigation through strategies like renewable energy adoption and sustainable packaging.

PESTLE Analysis Data Sources

Our Fanatics PESTLE analysis is informed by a comprehensive review of industry-specific market research reports, financial performance disclosures, and expert commentary from reputable business and sports publications. This ensures a robust understanding of the prevailing conditions impacting the company.