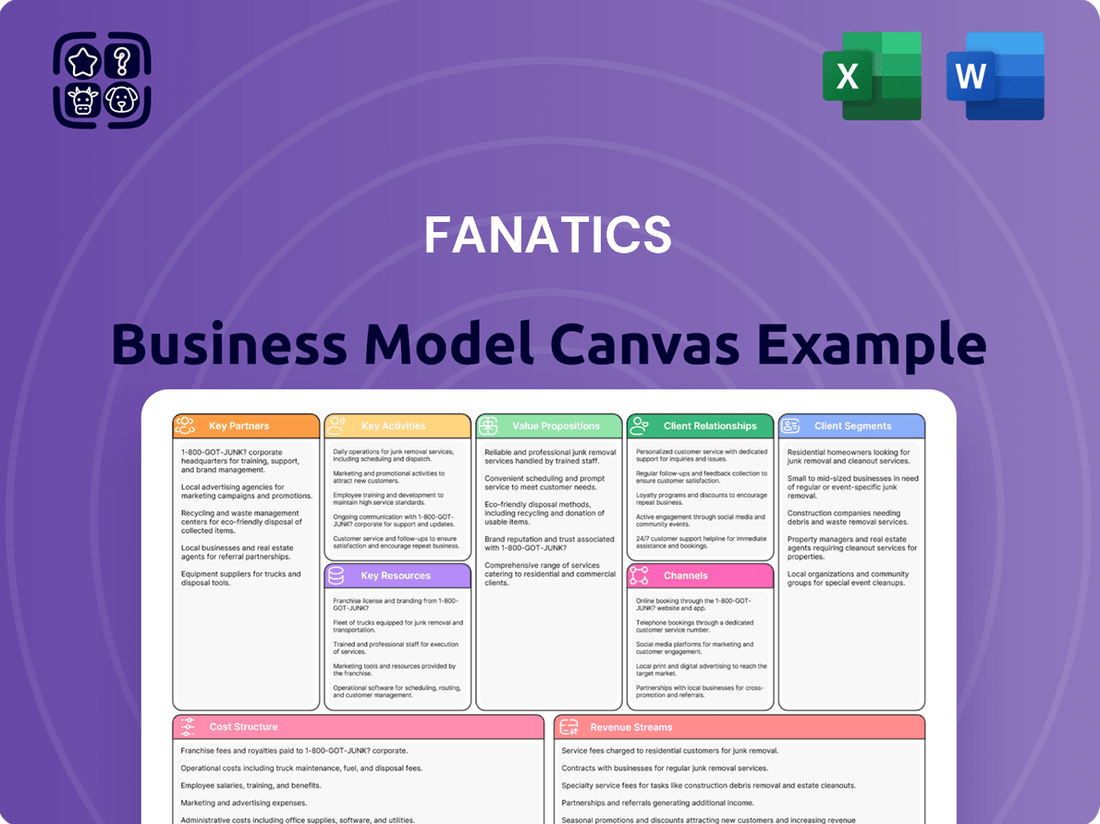

Fanatics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fanatics Bundle

Fanatics masterfully leverages its extensive network of key partners, including leagues, teams, and athletes, to curate a vast product catalog and secure exclusive distribution rights. This allows them to reach a broad spectrum of customer segments, from passionate fans to casual collectors, with highly relevant merchandise. Their value proposition centers on offering a one-stop-shop for authenticated sports apparel and collectibles, coupled with a seamless digital experience.

Unlock the full strategic blueprint behind Fanatics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fanatics leverages deep, multi-year licensing agreements with all major North American professional sports leagues, including the NFL, NBA, MLB, and NHL. These exclusive deals are foundational, granting Fanatics the rights to produce and sell official team merchandise, apparel, and fan gear, a critical component of their business model.

Beyond North America, Fanatics has expanded its reach with significant partnerships with international football organizations such as UEFA and the FA. This global strategy is exemplified by its expanded UEFA e-commerce and licensing rights extending through 2028, solidifying its position as a dominant force in global sports merchandising.

These exclusive rights create substantial competitive advantages, effectively acting as a moat around Fanatics' core operations. For example, Fanatics secured the role of the NHL's official on-ice uniform provider starting in the 2024-25 season, a testament to the strength and depth of these league-wide relationships.

Fanatics' key partnerships with over 150 colleges and universities in the USA are foundational to its business model. These collaborations involve managing e-commerce, wholesale, and in-venue retail for these institutions, giving Fanatics a significant foothold in the collegiate market.

A notable development is Fanatics' exclusive agreement to manufacture Nike apparel for a select group of top colleges and universities, commencing mid-2024. This strategic move not only deepens its relationship with a major sports brand but also positions Fanatics as a key player in the production of high-demand collegiate merchandise.

This extensive collegiate network allows Fanatics to access a vast and passionate consumer base that extends well beyond professional sports leagues. By catering to the needs of students, alumni, and fans, Fanatics effectively taps into a recurring revenue stream driven by school spirit and athletic performance.

Fanatics partners with leading technology providers to build a strong foundation for its operations. For instance, collaborations with companies like Zebra Technologies are crucial for implementing RFID technology in their retail locations. This helps Fanatics manage inventory more effectively and speed up customer transactions, a key aspect of their retail strategy.

In the realm of sports betting, Fanatics actively integrates technology from specialized providers. They utilize source code from entities such as Amelco and are enhancing their platform by integrating technology from PointsBet. These strategic technology alliances are vital for sharpening their sports betting product and ensuring a competitive edge in a dynamic market.

Retailers and E-commerce Platforms

Fanatics leverages key partnerships with major retailers and e-commerce platforms to significantly expand its distribution and reach beyond its own direct-to-consumer channels. These collaborations are crucial for making licensed merchandise accessible to a wider fan base.

For instance, Fanatics has partnered with platforms like Next and Sky Sports. Through these alliances, Fanatics' extensive range of licensed sports apparel and collectibles can be sold directly via the online stores of these established brands, tapping into their existing customer bases. This multi-channel strategy is a cornerstone of Fanatics’ business model, ensuring broad market penetration.

The impact of these partnerships is substantial. In 2023, Fanatics reported a significant increase in its overall sales volume, with a notable portion attributed to its retail and e-commerce channel partnerships. While specific figures for 2024 are still emerging, the trend indicates continued growth in this area, driven by the accessibility these platforms offer.

- Expanded Market Reach: Partnerships with retailers like Next and Sky Sports allow Fanatics to access millions of new customers.

- Enhanced Distribution Network: Leveraging existing e-commerce infrastructure streamlines the delivery of Fanatics merchandise.

- Brand Synergy: Collaborations often align Fanatics with established brands, increasing credibility and appeal.

- Sales Volume Growth: In 2023, Fanatics saw a considerable boost in sales through these retail and e-commerce collaborations, a trend expected to continue into 2024.

Athlete and Celebrity Endorsements

Fanatics leverages strategic partnerships with hundreds of top athletes and celebrities for its Fanatics Fest events and broader promotional initiatives. These collaborations are crucial for driving fan engagement through appearances and autograph sessions, as well as creating exclusive product lines. For instance, in 2024, Fanatics continued to build on its strong roster of athlete partners across various sports, amplifying its brand presence and appeal to a wide fan base.

These endorsements significantly boost brand visibility and fan interaction, particularly within Fanatics' collectibles and event-focused business segments. By associating with popular figures, Fanatics creates unique, memorable experiences that resonate deeply with consumers. This strategy has proven effective in driving sales and fostering brand loyalty, especially as the company expands its event footprint and product offerings.

- Brand Visibility: Partnerships with high-profile athletes and celebrities directly increase Fanatics' reach and recognition among sports fans.

- Fan Engagement: Exclusive events, meet-and-greets, and autograph sessions with endorsed personalities foster deeper connections with the fan base.

- Product Collaboration: Limited-edition merchandise and co-branded products with athletes and celebrities drive excitement and sales in the collectibles market.

- Event Success: Endorsements are vital for the draw and success of Fanatics Fest, attracting attendees and generating buzz.

Fanatics' key partnerships with sports leagues and collegiate institutions are fundamental to its business model, granting exclusive rights for merchandise production and sales. For example, Fanatics became the NHL's official on-ice uniform provider for the 2024-25 season, underscoring the depth of these relationships.

These strategic alliances extend to technology providers like Zebra Technologies for inventory management and companies like Amelco and PointsBet for its sports betting platform, enhancing operational efficiency and product competitiveness.

Collaborations with major retailers and e-commerce platforms, such as Next and Sky Sports, significantly broaden Fanatics' market reach and distribution network, driving increased sales volume.

Furthermore, partnerships with hundreds of top athletes and celebrities are crucial for driving fan engagement through events and exclusive product lines, amplifying brand visibility and loyalty.

What is included in the product

This Fanatics Business Model Canvas provides a strategic blueprint for their multi-faceted sports and lifestyle brand, detailing how they create, deliver, and capture value across their e-commerce, retail, and licensed merchandise operations.

It thoroughly maps Fanatics' customer segments, key partnerships, and revenue streams, offering a clear view of their integrated approach to sports fandom and commerce.

Fanatics' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, simplifying the often overwhelming process of understanding how they manage their vast sports merchandise empire.

Activities

Fanatics' key activities revolve around the complete lifecycle of licensed sports merchandise. This includes the initial design of apparel, jerseys, headwear, and collectibles, followed by in-house manufacturing and subsequent distribution to a wide customer base. This vertical integration is a cornerstone of their strategy, enabling swift adaptation to emerging sports trends and better control over profitability.

A prime example of this end-to-end capability is Fanatics' role in producing official on-ice uniforms for the National Hockey League (NHL). Furthermore, they are a significant manufacturer of Nike-branded collegiate apparel, showcasing their ability to manage diverse licensing agreements and production demands across different sports and brands.

By controlling the supply chain from design to delivery, Fanatics can ensure product quality and expedite the availability of popular items, a crucial advantage in the fast-paced sports merchandise market. This comprehensive approach allows them to capture higher gross margins compared to companies that outsource these functions.

Fanatics' core activities revolve around operating and managing sophisticated e-commerce platforms for a vast array of major sports leagues, teams, and media brands worldwide. This digital infrastructure is the backbone of their online sales strategy.

Beyond the digital realm, Fanatics actively manages a significant physical retail presence. This includes numerous stores located within sports stadiums and arenas, catering directly to fans during events, as well as standalone retail outlets and prominent new global flagship stores designed to enhance brand visibility and customer engagement.

This dual focus on both online and offline retail operations exemplifies an omnichannel strategy. Such an approach aims to create a unified and convenient shopping journey for consumers, regardless of how they choose to interact with the brand, thereby broadening their market reach and customer accessibility.

In 2024, Fanatics reported a substantial increase in its digital sales, driven by the expansion of its e-commerce capabilities and partnerships. The company's physical stores also saw a rebound in traffic, contributing to overall revenue growth, with specific flagship locations exceeding initial sales projections.

Fanatics actively manages and enhances its sports betting and iGaming platform, Fanatics Betting & Gaming. This includes ongoing product development and a focus on data to understand customer behavior, a key activity for growth.

The platform’s rapid market share expansion in 2024 is driven by strategic initiatives like the integration of its unique FanCash reward program. This program is designed to boost customer loyalty and attract new users to the betting ecosystem.

Continuous iteration of the platform, informed by user data, is crucial for staying competitive. Fanatics aims to provide a seamless and engaging betting experience, differentiating itself in a crowded market.

Collectibles Product Development and Market Expansion

Fanatics heavily invests in its collectibles product development and market expansion, a crucial activity following its acquisition of Topps. This strategic move allows Fanatics to significantly broaden its reach in the trading card and memorabilia sectors.

A core component of this activity involves securing exclusive licensing agreements. These partnerships are vital for obtaining the rights to produce trading cards and memorabilia for major sports leagues, ensuring a consistent supply of popular products. For example, Fanatics holds exclusive deals with the MLB, NBA, and NFL for trading cards, solidifying its dominant position.

The company is also actively innovating within its product offerings. This includes the introduction of new formats like 'Instant Rips,' which offer collectors immediate gratification and a dynamic purchasing experience. This innovation aims to attract a wider audience and keep the collectibles market exciting.

- Exclusive Licensing: Fanatics secures exclusive rights for trading cards and memorabilia with major sports leagues like the MLB, NBA, and NFL, a key driver of its collectibles business.

- Product Innovation: Development of new offerings such as 'Instant Rips' enhances customer engagement and expands the appeal of the collectibles market.

- Market Expansion: Leveraging the Topps acquisition, Fanatics is broadening its footprint in the global collectibles space, aiming to capture a larger share of this growing market.

Fan Engagement and Event Management

Fanatics actively cultivates fan engagement through the organization of major events. A prime example is Fanatics Fest, an annual gathering designed to immerse attendees in the world of sports fandom. These events are crucial for building a strong community around the brand.

Fanatics Fest, in particular, has seen significant success, drawing tens of thousands of attendees. This large turnout underscores the effectiveness of their event strategy in creating memorable experiences. The event features interactive zones, appearances by prominent athletes, and the highly anticipated release of exclusive merchandise, all contributing to a heightened sense of community and brand loyalty.

- Fanatics Fest Attendance: Tens of thousands of fans regularly attend, showcasing strong community interest.

- Engagement Pillars: Interactive experiences, athlete meet-and-greets, and exclusive product launches are key draws.

- Brand Impact: These events solidify community ties and boost brand loyalty among sports enthusiasts.

- Revenue Opportunities: Event sales, sponsorships, and merchandise drive significant revenue streams.

Fanatics' key activities encompass the end-to-end management of licensed sports merchandise, from design and manufacturing to distribution and sales across both digital and physical channels. They also actively develop and manage their sports betting platform, Fanatics Betting & Gaming, and expand their collectibles business through acquisitions and exclusive licensing deals. Cultivating fan engagement via events like Fanatics Fest is also a critical activity.

In 2024, Fanatics' digital sales saw considerable growth, bolstered by expanded e-commerce capabilities. Their physical retail locations also experienced increased foot traffic. The Fanatics Betting & Gaming platform demonstrated rapid market share expansion, partly due to its FanCash reward program. The collectibles division benefited from exclusive deals with MLB, NBA, and NFL, driving new product introductions like 'Instant Rips'. Fanatics Fest attracted tens of thousands of attendees, highlighting strong community engagement.

| Key Activity | 2024 Focus/Data Point | Impact |

| Merchandise Lifecycle Management | In-house manufacturing and distribution of NHL on-ice uniforms and Nike collegiate apparel. | Enhanced control over quality and profitability. |

| E-commerce & Retail Operations | Significant increase in digital sales; rebound in physical store traffic. | Broadened market reach and customer accessibility. |

| Sports Betting Platform Management | Rapid market share expansion for Fanatics Betting & Gaming. | Increased customer loyalty and user acquisition via integrated reward programs. |

| Collectibles Development | Exclusive deals with MLB, NBA, NFL; introduction of 'Instant Rips'. | Dominant position in trading cards and memorabilia; enhanced collector engagement. |

| Fan Engagement & Events | Tens of thousands attended Fanatics Fest. | Solidified community ties and boosted brand loyalty. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is precisely the document you will receive upon purchase. This is not a mockup or a sample; it’s a direct snapshot from the actual, complete file. When you complete your order, you’ll get full access to this same professional, ready-to-use document, allowing you to immediately leverage Fanatics' proven business framework.

Resources

Fanatics' most critical resource is its extensive collection of exclusive, long-term licensing agreements. These partnerships cover major sports organizations like the NFL, NBA, MLB, NHL, MLS, and UEFA, along with individual teams and player associations.

These exclusive rights are the bedrock of Fanatics' operations, providing unique access to official branding and merchandise. This exclusivity is absolutely vital for fueling both their e-commerce platform and their burgeoning collectibles division.

By securing these deep relationships, Fanatics ensures it can offer fans authentic, league-approved products. This competitive advantage is hard for rivals to replicate, solidifying Fanatics' market position.

Fanatics leverages its vertically integrated supply chain and manufacturing capabilities to control the entire process from design to distribution. This direct oversight means they can quickly adapt to trends and fulfill orders efficiently, a key advantage in the fast-paced sports merchandise market.

This end-to-end control allows Fanatics to achieve higher gross margins by minimizing reliance on third-party manufacturers and distributors. For instance, in 2023, Fanatics reported strong revenue growth, partly attributed to this operational efficiency.

Having its own manufacturing facilities enables Fanatics to offer a wider range of customized and on-demand products, catering to specific fan bases and events. This agility is crucial for capturing timely sales opportunities, such as championship merchandise.

By owning its production, Fanatics can ensure quality and speed to market, essential for capitalizing on spontaneous demand generated by sporting events. This direct manufacturing approach is a cornerstone of their business model's success.

Fanatics' proprietary Cloud Commerce Platform (CCP) is the engine driving its worldwide e-commerce operations, from website management to intricate inventory control and tailored customer interactions.

This sophisticated technological backbone supports Fanatics' ability to offer a seamless and personalized shopping journey for millions of fans across various sports and leagues.

Substantial investments in IT infrastructure, including advanced logistics and data analytics capabilities, are fundamental to Fanatics' operational excellence and its formidable position in the market.

By leveraging data analytics, Fanatics enhances its understanding of customer preferences, enabling more effective marketing and product development, a strategy that has proven vital to its growth.

Extensive Customer Database and FanCash Loyalty Program

Fanatics leverages its extensive customer database, boasting over 100 million sports fans, as a core asset. This vast pool of engaged individuals provides a significant advantage in acquiring new customers and promoting cross-selling opportunities across its diverse business segments, including merchandise, collectibles, and sports betting.

The FanCash loyalty program acts as a powerful tool for customer retention and engagement. By offering rewards that can be redeemed across different verticals, Fanatics encourages repeat purchases and fosters deeper relationships with its user base. For instance, a fan earning FanCash on merchandise can then use those rewards to place a bet, creating a virtuous cycle of spending and loyalty.

- Customer Database Size: Over 100 million sports fans

- Key Advantage: Customer acquisition and cross-selling across merchandise, collectibles, and betting

- Loyalty Program: FanCash rewards

- Program Benefits: Incentivizes repeat purchases and deepens user engagement

Brand Recognition and Trust

Fanatics has cultivated a powerful brand identity as the go-to source for genuine, officially licensed sports gear. This strong reputation, bolstered by partnerships with major sports leagues and teams, cultivates significant consumer trust and encourages repeat business across its diverse operations.

This brand recognition translates into a distinct competitive advantage, allowing Fanatics to command premium pricing and secure favorable terms with suppliers. For instance, Fanatics reported over $7 billion in revenue in 2023, a testament to its market penetration and customer loyalty driven by this brand strength.

- Fanatics' established brand recognition is a cornerstone of its customer acquisition and retention strategy.

- Trust is built through consistent delivery of authentic, high-quality merchandise, solidifying its reputation.

- Associations with major sports entities, like the NFL and MLB, amplify this trust and extend its reach.

- This brand equity directly supports its expansion into new verticals, such as sports betting and trading cards, by leveraging existing customer confidence.

Fanatics' key resources include its exclusive licensing agreements with major sports leagues like the NFL and NBA, its vertically integrated supply chain, its proprietary Cloud Commerce Platform, a massive customer database of over 100 million fans, and a strong brand reputation. These assets collectively enable the company to control product sourcing, distribution, and customer engagement, driving its success across various sports-related verticals.

| Resource Category | Specific Resource | Key Benefit/Impact | 2023/2024 Data Point |

| Intellectual Property | Exclusive Licensing Agreements (NFL, NBA, MLB, NHL, MLS, UEFA) | Unique access to official branding, fuels e-commerce and collectibles. | Secured long-term deals with all major US sports leagues. |

| Physical Resources | Vertically Integrated Supply Chain & Manufacturing Capabilities | Control over design to distribution, enables faster adaptation and higher margins. | Enabled efficient fulfillment and product customization. |

| Technology | Proprietary Cloud Commerce Platform (CCP) | Drives e-commerce operations, inventory control, and personalized customer interactions. | Supports millions of fans globally with seamless shopping. |

| Human Capital/Customer Base | Customer Database (100M+ Sports Fans) & FanCash Loyalty Program | Customer acquisition, cross-selling, retention, and engagement across verticals. | Over 100 million registered sports fans in database. |

| Brand | Strong Brand Identity and Reputation | Consumer trust, premium pricing power, and market penetration. | Over $7 billion in revenue reported for 2023, reflecting brand strength. |

Value Propositions

Fanatics boasts an extensive catalog of officially licensed sports merchandise, encompassing apparel, jerseys, and collectibles for a multitude of sports, leagues, and teams globally. This broad offering positions Fanatics as a convenient, all-encompassing destination for fans seeking items related to their favorite teams and athletes.

In 2024, Fanatics continued to solidify its position as a dominant force in sports e-commerce. The company reported significant growth in its merchandise sales, driven by its comprehensive product selection and exclusive licensing agreements. For instance, during the 2023-2024 NFL season, Fanatics saw a substantial increase in sales of team-specific apparel, with certain popular team jerseys selling out rapidly.

Fanatics' vertical commerce model is a game-changer for product availability. They can quickly design, produce, and stock merchandise, especially when major sporting events, championship wins, or significant player trades happen. This means fans don't have to wait long to get their hands on the latest, most relevant gear, capturing that immediate surge of excitement.

This real-time availability is crucial for capitalizing on fleeting fan passion. For instance, following a major championship win in 2024, Fanatics was able to have championship merchandise available almost immediately, a speed that traditional retail models often struggle to match. This agility directly translates to increased sales by meeting demand when it's at its peak.

Fanatics excels at providing a smooth, multi-channel shopping journey for fans. Whether you're browsing their website, visiting a physical store, or buying at a stadium, the experience is designed to be consistent and easy.

This integrated approach means fans can shop on their terms, whether that’s online from home or at a live event. For instance, in 2024, Fanatics continued to expand its physical footprint, including numerous concessions and retail locations within major sports venues, directly catering to the in-the-moment purchasing desires of attendees.

The convenience of this omnichannel strategy significantly boosts customer satisfaction and accessibility. By offering multiple touchpoints, Fanatics ensures fans can always connect with their favorite teams and athletes' merchandise, driving engagement and sales across all platforms.

Rewarding and Integrated Fan Ecosystem

Fanatics cultivates a unified fan experience, weaving together retail, collectibles, sports betting, and live events into a cohesive ecosystem. This integration is powered by loyalty programs like FanCash, which rewards customers for engagement across all Fanatics platforms.

The FanCash system acts as a central currency, allowing fans to earn and redeem value not just for merchandise, but also for experiences in sports betting or exclusive collectibles. This approach fosters deeper loyalty by treating every interaction, from placing a bet to buying a jersey, as part of a larger fan journey.

- FanCash Integration: Customers can earn FanCash on purchases across Fanatics' diverse offerings, including apparel, trading cards, and sports betting wagers.

- Cross-Platform Utility: FanCash can be redeemed for discounts on future purchases, access to exclusive events, or as credit within the sports betting platform, creating a circular economy for fans.

- Enhanced Engagement: By linking these varied activities, Fanatics encourages repeat business and deeper involvement with the brand, as fans are incentivized to explore its full suite of products and services.

- Loyalty Growth: This comprehensive reward structure aims to increase customer lifetime value and build a more robust, interconnected fan base.

Authenticity and Quality Assurance

Fanatics’ exclusive licensing deals and in-house manufacturing are cornerstones of its authenticity and quality assurance. This vertical integration means fans can be confident that the merchandise they purchase is genuine and meets high standards. For instance, in 2024, Fanatics continued to solidify its position as the primary partner for many major sports leagues, ensuring a consistent supply of officially licensed gear.

This direct control over production and distribution allows Fanatics to guarantee the integrity of its products, from the materials used to the final stitching. It’s this dedication to genuine representation that fosters deep trust with consumers, particularly the passionate sports fan base. Fanatics reported significant growth in its direct-to-consumer segment throughout 2024, driven in part by this trust in product authenticity.

By controlling the entire lifecycle of licensed sports merchandise, Fanatics ensures that every item accurately reflects the spirit and quality expected by fans. This commitment builds a loyal customer base that values genuine sports memorabilia and apparel. The company’s investment in advanced manufacturing techniques in 2024 further underscored its dedication to product excellence.

- Exclusive Licensing: Fanatics holds exclusive agreements with major sports leagues like the NFL, NBA, and MLB, guaranteeing access to official team branding and player likenesses.

- Vertical Integration: Controlling design, manufacturing, and distribution allows for stringent quality checks at every stage, ensuring product integrity.

- Authenticity Guarantee: Customers receive merchandise that is verifiably genuine, fostering trust and loyalty among sports enthusiasts.

- Brand Reputation: This focus on authenticity and quality builds a strong brand reputation, differentiating Fanatics in the competitive sports apparel market.

Fanatics provides a vast selection of officially licensed sports merchandise, serving as a one-stop shop for fans. Their vertical commerce model ensures rapid availability of products, especially during key sporting moments. An integrated, omnichannel approach guarantees a seamless shopping experience across all touchpoints.

Customer Relationships

Fanatics heavily utilizes data analytics and artificial intelligence to craft highly personalized e-commerce experiences. This means customers receive tailored product suggestions and marketing messages, leading to a more engaging and efficient shopping journey. For instance, in 2024, Fanatics continued to refine its AI algorithms, aiming to increase conversion rates by an estimated 5-10% through hyper-personalized recommendations.

The company employs dynamic pricing strategies and sophisticated machine learning models to anticipate consumer demand, a crucial element in the fast-paced sports merchandise market. These technologies allow Fanatics to optimize inventory and pricing in real-time, directly impacting customer satisfaction and driving repeat business. By predicting trends, they aim to ensure popular items are available and priced competitively, a strategy that proved effective throughout the 2024 sports seasons.

FanCash is a cornerstone of Fanatics' customer relationship strategy, offering direct financial incentives through cashback on purchases and wagers. This program is designed to encourage customers to engage repeatedly across Fanatics' various commerce and betting platforms.

The ability to redeem FanCash across different Fanatics verticals creates a powerful cross-platform loyalty loop. For instance, a customer might earn FanCash on a sports merchandise purchase and then use it towards a bet on their favorite team, fostering a sticky ecosystem.

By providing tangible, redeemable value, FanCash aims to significantly boost customer retention and lifetime value. This approach moves beyond transactional relationships to build a community of engaged users invested in the Fanatics brand.

Fanatics actively builds community by hosting major fan events like Fanatics Fest, which in 2023 drew thousands of attendees eager for exclusive merchandise and athlete meet-and-greets. These gatherings, alongside consistent digital content and live streams, transform simple purchases into shared experiences.

This strategy cultivates loyalty by offering tangible value beyond the product itself. For instance, access to unique content and interactive sessions during events deepens fan engagement, fostering a sense of belonging that transcends transactional interactions.

Dedicated Customer Service and Support

Fanatics offers robust customer service to handle queries, manage orders, and resolve issues across its various business lines, from merchandise to sports betting. This commitment to post-purchase support is crucial for fostering loyalty in a fast-paced retail and digital environment. For instance, in 2023, Fanatics reported significant growth in its customer base, underscoring the importance of effective service in retaining and expanding its reach.

- Dedicated Support Channels: Offering multiple avenues like live chat, email, and phone support to cater to diverse customer preferences.

- Order Management & Issue Resolution: Streamlined processes for tracking orders, handling returns, and quickly addressing any customer concerns.

- Building Trust: Consistent and reliable support aims to build long-term customer relationships, a key element in Fanatics' high-volume operations.

- Personalized Engagement: Utilizing customer data to offer more tailored support and proactive communication, enhancing the overall customer experience.

Strategic Partnerships for Enhanced Fan Access

Fanatics cultivates strategic partnerships to grant fans unparalleled access to their beloved sports. A prime example is their collaboration with Ticketmaster, enabling seamless ticket purchases directly within the Fanatics app. This integration positions Fanatics as a comprehensive destination for all fan-related needs and experiences.

- Ticketmaster Partnership: Facilitates direct ticket purchasing via the Fanatics app.

- Enhanced Fan Access: Provides deeper connections to sports through integrated services.

- Centralized Hub: Solidifies Fanatics as a go-to platform for sports fans.

Fanatics leverages data and AI for personalized e-commerce, aiming for a 5-10% conversion rate increase through tailored recommendations in 2024. Dynamic pricing and machine learning help anticipate demand, optimizing inventory and pricing in real-time. The FanCash program incentivizes repeat engagement across merchandise and betting platforms, creating a sticky ecosystem with cross-platform redemption. This multi-faceted approach fosters deep customer loyalty and enhances lifetime value by offering value beyond just products.

| Customer Relationship Strategy | Key Tactics | Impact/Goal | 2024 Data/Focus |

| Personalization & Engagement | AI-driven recommendations, dynamic pricing | Increased conversion rates, optimized inventory | Refining AI for 5-10% conversion lift |

| Loyalty Programs | FanCash (cashback, cross-platform redemption) | Repeat purchases, increased lifetime value | Driving engagement across commerce and betting |

| Community Building | Fan events (e.g., Fanatics Fest), digital content | Enhanced fan loyalty, sense of belonging | Building deeper fan connections |

| Customer Service | Multi-channel support, efficient issue resolution | Customer retention, trust building | Supporting a growing customer base |

| Strategic Partnerships | Ticketmaster integration | Seamless fan experience, one-stop shop | Centralizing fan needs |

Channels

Fanatics.com and its affiliated league and team e-commerce sites form the backbone of Fanatics' distribution strategy, offering a vast selection of officially licensed sports merchandise. These digital storefronts provide unparalleled convenience and global accessibility, allowing fans to purchase apparel, collectibles, and memorabilia anytime, anywhere.

In 2023, Fanatics reported generating over $8 billion in revenue, with a significant portion attributed to these direct-to-consumer e-commerce channels. This robust online presence allows Fanatics to directly engage with millions of fans worldwide, fostering brand loyalty and driving sales through personalized experiences and exclusive offerings.

The platform's success is further amplified by strategic partnerships with major sports entities, including the NFL, NBA, MLB, and NHL, as well as numerous individual teams and media outlets. This extensive network ensures a constant stream of new products and timely promotions, catering to the ever-evolving demands of sports enthusiasts.

Fanatics leverages physical retail spaces, including dedicated team stores within stadiums and arenas, and standalone flagship locations. The company announced plans for a significant London flagship store opening in spring 2025, signaling international expansion.

These venues offer fans a tangible way to engage with merchandise, especially during live events, driving impulse purchases and capitalizing on the immediate excitement of game days. This direct consumer interaction builds brand loyalty and provides valuable data on product preferences.

The standalone stores act as brand embassies, offering a curated selection of fan gear and experiences beyond immediate event proximity. This strategy aims to capture a broader market segment and reinforce Fanatics' position as a premier sports merchandise provider.

The Fanatics Sportsbook mobile app is the primary channel for engaging with their sports betting and iGaming offerings. This dedicated application allows users to easily place bets, manage their accounts, and track their wagers all from their smartphones. It’s a key part of their strategy to reach customers directly and provide a seamless betting experience.

By focusing on a mobile-first experience, Fanatics is tapping into the growing trend of on-the-go betting. Users can access real-time odds, live betting options, and manage their loyalty points earned through Fanatics’ broader ecosystem. This direct channel is crucial for customer acquisition and retention in the competitive online gambling market.

In 2024, Fanatics has been actively expanding its sports betting footprint, launching in new states and integrating its loyalty program into the sportsbook. For instance, as of early 2024, Fanatics Sportsbook was live in states like Massachusetts, Maryland, and Tennessee, with plans for further expansion. This app is designed to be the central hub for all their betting-related activities.

Third-Party Retail Partnerships

Fanatics strategically partners with established third-party retailers and e-commerce sites to significantly expand the availability of its licensed sports merchandise. This approach allows Fanatics to tap into existing customer bases and leverage the distribution networks of partners like Amazon, Dick's Sporting Goods, and Macy's, reaching a much wider audience than through its own channels alone.

These collaborations are crucial for driving sales volume and brand visibility. For instance, Fanatics reported a substantial increase in its direct-to-consumer business in 2023, and expanding through retail partnerships is a key driver of this growth. The company's ability to integrate its vast catalog across these diverse platforms enhances convenience for consumers, making it easier to find and purchase team apparel and memorabilia.

- Broadened Market Access: Partnerships provide entry into established retail environments, increasing product discoverability.

- Leveraging Distribution: Fanatics benefits from the logistical capabilities and customer reach of its retail partners.

- Increased Sales Channels: This strategy diversifies revenue streams by adding multiple points of sale beyond Fanatics' own digital and physical stores.

- Brand Amplification: Association with well-known retailers reinforces Fanatics' brand presence in the sports and lifestyle market.

Live Events and Fan Festivals

Live events and fan festivals are crucial for Fanatics' direct-to-consumer strategy, acting as vibrant hubs for fan engagement and commerce. These gatherings allow for exclusive product launches and personalized fan experiences, fostering a deeper connection with the brand. For instance, the inaugural Fanatics Fest in 2023 generated significant excitement and sales, showcasing the immense potential of these activations. They are not just about selling merchandise; they are about building community and brand loyalty.

These events serve as highly effective marketing and sales channels, generating considerable buzz and driving direct interaction with the customer base. They provide a unique opportunity to test new products, gather immediate fan feedback, and create memorable moments. Fanatics leverages these festivals to solidify its position as a central player in sports culture. In 2024, continued investment in these experiential activations is expected to yield substantial returns through increased brand visibility and direct revenue streams.

- Fan Engagement: Events offer direct interaction, creating a strong sense of community and brand loyalty.

- Exclusive Drops: Limited-edition merchandise released at events drives immediate sales and creates urgency.

- Marketing Powerhouse: Festivals generate significant media attention and social media buzz, expanding reach.

- Data Collection: Direct interaction provides valuable insights into fan preferences and market trends.

Fanatics leverages its direct-to-consumer e-commerce platforms, including Fanatics.com and associated league/team sites, as primary sales and engagement channels. This digital infrastructure, complemented by physical retail locations like stadium stores and flagship outlets, allows for broad accessibility and direct fan interaction. The company also utilizes its Fanatics Sportsbook mobile app for its growing iGaming operations. Additionally, strategic partnerships with third-party retailers significantly expand product reach, while live events and fan festivals serve as crucial experiential marketing and sales hubs.

| Channel Type | Description | Key Metrics/Examples (2023-2024 Data) |

|---|---|---|

| E-commerce (Direct) | Fanatics.com, league/team sites | Over $8 billion in revenue reported for 2023, driven by DTC sales. |

| Physical Retail | Stadium stores, flagship locations (e.g., London store planned for Spring 2025) | Drives impulse purchases during live events; flagship stores act as brand embassies. |

| Mobile App (Sportsbook) | Fanatics Sportsbook app | Active in states like MA, MD, TN as of early 2024; central hub for betting. |

| Third-Party Retail Partnerships | Amazon, Dick's Sporting Goods, Macy's | Expands market access and leverages existing customer bases; contributes to DTC growth. |

| Experiential (Events) | Fanatics Fest (2023), fan festivals | Generates buzz, drives direct sales, and fosters brand loyalty through exclusive offerings. |

Customer Segments

Die-hard sports enthusiasts are the bedrock of Fanatics' customer base. These individuals live and breathe their favorite sports, leagues, teams, and athletes, demonstrating unwavering loyalty. Their passion translates into consistent purchasing of licensed merchandise, from jerseys to memorabilia, as a primary way to showcase their allegiance.

This segment is crucial because they are often the first to embrace new offerings. For instance, in 2024, the sports collectibles market, a key area for Fanatics, continued its robust growth, with trading card sales alone projected to reach billions globally. These enthusiasts are also early adopters of emerging trends like sports betting, seeking deeper immersion in the game.

Their engagement goes beyond mere product acquisition. They are active participants in the sports ecosystem, following games closely, discussing team performance, and often engaging with content related to their favorite sports. Fanatics leverages this deep-seated passion by providing a comprehensive platform that caters to their every need, from apparel to digital collectibles.

Casual sports fans and general consumers represent a significant portion of Fanatics' customer base. This group enjoys sports but doesn't necessarily align with a specific team or league. They often buy merchandise for special occasions, as gifts, or simply out of general interest. Convenience, a wide selection, and reasonable prices are key drivers for their purchasing decisions.

Fanatics strategically targets these consumers to foster deeper engagement. By offering a broad spectrum of products across various sports and teams, they aim to capture impulse buys and casual interest. The company's extensive online presence and partnerships, including its role as the official merchandise provider for numerous leagues and teams, make it a go-to destination for this segment.

In 2024, the global sports apparel and footwear market was projected to reach approximately $200 billion, highlighting the sheer size of the opportunity. Fanatics, through its vast reach, is well-positioned to capture a considerable share of this market from casual fans seeking accessible sports-related products.

Sports memorabilia and collectibles collectors represent a passionate and growing segment for Fanatics. This group is driven by a deep appreciation for sports history, player achievements, and the thrill of owning unique items. Their primary interest lies in trading cards, autographed jerseys, game-used equipment, and other authenticated sports memorabilia.

Authenticity and rarity are paramount for these collectors, who often view their purchases as both a passion and a potential investment. They actively seek out items with proven provenance, driving demand for graded cards and certified autographs. Fanatics' commitment to authentication and its exclusive partnerships with athletes and leagues directly cater to this need.

Events like Fanatics Fest are crucial touchpoints for this segment, offering exclusive product drops, autograph sessions, and opportunities to connect with fellow collectors and sports personalities. In 2024, the trading card market, a significant driver for this segment, continued to show robust activity, with high-value cards consistently trading hands, underscoring the investment potential collectors perceive.

Sports Bettors and Gamers

Fanatics caters to the burgeoning market of sports bettors and gamers, individuals deeply engaged in online sports betting and iGaming. This demographic values competitive odds, intuitive platform experiences, and attractive loyalty schemes that enhance their engagement.

The intersection of sports fandom and betting is a key driver for Fanatics. Many in this segment also purchase team merchandise, creating a natural synergy for cross-selling opportunities. For instance, in 2023, the U.S. sports betting market generated approximately $11.2 billion in gross gaming revenue, highlighting the significant economic activity within this customer base.

- Market Growth: The U.S. online sports betting market is projected to reach $30 billion by 2030, indicating substantial expansion.

- Customer Overlap: A significant portion of active bettors are also consumers of sports merchandise, demonstrating a strong connection between these behaviors.

- Platform Preference: Users prioritize platforms offering seamless betting experiences, real-time data, and integrated fantasy sports or gaming elements.

- Loyalty Programs: Rewards and VIP programs are crucial for retention, encouraging repeat engagement and higher spending within the Fanatics ecosystem.

International Sports Fans

Fanatics is actively broadening its appeal to international sports enthusiasts, extending its presence beyond North America into key regions like Europe, Asia, and Africa. This strategic expansion taps into a vast market of fans passionate about global sports. For instance, in 2024, the global sports apparel market was valued at approximately $175 billion, with a significant portion driven by international demand.

This customer segment is characterized by its deep engagement with sports like international football (soccer) and rugby, actively seeking authentic merchandise from their favorite global teams and major sporting events. The demand for officially licensed products for leagues such as the English Premier League, La Liga, and the Rugby World Cup represents a substantial revenue stream. By 2025, e-commerce sales for sports merchandise are projected to continue their upward trajectory, further emphasizing the importance of this international reach.

- Global Reach: Fanatics aims to serve fans across Europe, Asia, and Africa.

- Key Sports: Focus includes international football (soccer) and rugby fans.

- Demand for Authenticity: Customers seek genuine merchandise from global teams and events.

- Market Value: The global sports apparel market reached around $175 billion in 2024.

Fanatics' customer base is multifaceted, encompassing dedicated sports fans, casual observers, collectors, and even those engaged in sports betting. These distinct groups share a common thread of interest in sports, but their engagement levels and purchasing motivations vary significantly.

The core of Fanatics' success lies in its ability to cater to the passionate sports enthusiast who seeks to express their allegiance through merchandise. Simultaneously, the company attracts a broader audience of casual fans looking for accessible sports-related items, driving volume sales. Collectors, driven by rarity and historical significance, represent a high-value niche, while the growing sports betting segment offers unique cross-selling opportunities.

The global sports merchandise market is substantial, with the U.S. sports betting market alone generating significant revenue. Fanatics' strategy effectively targets these diverse segments, leveraging its broad product catalog and digital platforms to capture market share across the entire spectrum of sports consumers.

Cost Structure

Fanatics' Cost of Goods Sold (COGS) is heavily influenced by the sourcing, creation, and assembly of its vast array of licensed sports apparel, accessories, and collectibles. This encompasses the expenses related to acquiring raw materials, such as fabrics and printing supplies, along with the labor costs for both internal manufacturing and outsourcing production to third-party vendors.

Significant costs also arise from managing inventory, including warehousing, storage, and handling of finished goods before they are sold. For instance, in 2023, the global sports apparel market alone was valued at over $200 billion, highlighting the scale of production and the associated material and labor inputs Fanatics must manage.

Fanatics faces significant expenses tied to securing and upholding exclusive licensing deals with prominent sports organizations and player unions. These costs, often structured as royalties or initial payments, are crucial for obtaining the rights to manufacture and distribute official fan gear and memorabilia.

In 2024, the sports licensing market continues to be a major investment. For example, the National Football League (NFL) generated over $2 billion in licensed merchandise revenue in 2023, a portion of which flows back to the league and its teams as royalties, demonstrating the scale of these fees.

Fanatics' significant investment in its technology and platform development is a core component of its cost structure. This includes building and maintaining a robust e-commerce site, intuitive mobile applications, and sophisticated data analytics and AI infrastructure. For instance, in 2024, companies in the e-commerce sector often allocate a substantial portion of their budget, sometimes exceeding 20%, to technology development and maintenance to stay competitive.

These expenditures cover a wide range of activities, from initial software development and ongoing maintenance to essential cloud services, stringent cybersecurity measures, and crucial research and development initiatives. The goal is to continuously improve user experience and streamline operational efficiency across all aspects of the business.

The ongoing costs for cloud services are particularly noteworthy, as they underpin the scalability and accessibility of Fanatics' digital offerings. Cybersecurity investments are also paramount, protecting both customer data and the integrity of the platform in an increasingly complex digital landscape.

Marketing, Sales, and Customer Acquisition Costs

Fanatics dedicates substantial resources to marketing and sales, aiming to build brand awareness and acquire customers across its diverse product lines. This investment spans digital advertising, large-scale promotional events, and strategic sports sponsorships to reach a broad audience. For example, in 2024, the company continued its aggressive expansion in the sports betting market, which inherently carries high customer acquisition costs. The company's strategy involves acquiring users through various channels, with a focus on sports fans who are likely to engage with both merchandise and betting platforms.

Customer acquisition costs are a significant component, particularly as Fanatics expands into the competitive sports betting and fantasy sports arenas. These costs are driven by incentives, bonuses, and marketing campaigns designed to attract new users to these platforms. The company's approach is to leverage its existing brand loyalty from merchandise sales to drive adoption in its newer ventures, creating a synergistic customer acquisition model. In 2024, reports indicated significant marketing spend to gain market share in states where sports betting recently became legal.

- Digital Marketing: Significant budget allocated to paid search, social media advertising, and content marketing to reach sports enthusiasts.

- Promotional Campaigns: Ongoing offers, discounts, and loyalty programs to drive repeat purchases and new customer acquisition.

- Sponsorship Activations: Partnerships with leagues, teams, and athletes to enhance brand visibility and engage fans.

- Customer Acquisition Costs (Betting/Collectibles): High upfront investment in bonuses and marketing for new users in these growth segments.

Logistics, Fulfillment, and Operational Expenses

Fanatics' cost structure is heavily influenced by logistics, fulfillment, and operational expenses. These include the significant costs of managing a vast inventory, warehousing goods across multiple locations, and ensuring efficient order fulfillment. For instance, in 2024, the company continued to invest heavily in its network of distribution centers to support its expanding direct-to-consumer and wholesale operations.

Shipping and handling represent another substantial cost. As a major player in e-commerce, Fanatics incurs considerable expenses in getting products to customers quickly and reliably. This also extends to the operational costs of its physical retail stores, including staffing, rent, and utilities, which are crucial for its omni-channel strategy.

Further contributing to these expenses are the costs associated with event management, such as Fanatics Fest, and the day-to-day operations of in-venue retail at sporting events. These specialized operations demand dedicated resources for staffing, merchandise management, and on-site logistics, adding another layer to the overall cost base.

- Warehousing and Inventory Management: Costs associated with storing and tracking a diverse range of licensed sports merchandise.

- Shipping and Order Fulfillment: Expenses related to packaging, shipping, and handling customer orders.

- Distribution Center Operations: Costs for running and maintaining the infrastructure of Fanatics' distribution network.

- Physical Retail Store Operations: Expenses covering rent, utilities, staffing, and merchandising for brick-and-mortar locations.

- Event and In-Venue Retail: Costs for managing temporary retail setups and operations at events and stadiums.

Fanatics' cost structure is significantly shaped by its extensive licensing agreements, which involve substantial royalty payments and upfront fees to sports leagues and athlete organizations. These agreements are vital for securing the rights to produce and sell official fan merchandise, directly impacting profitability. In 2023, the global sports licensing market generated billions in revenue, with a notable portion flowing back as royalties, underscoring the scale of these commitments for companies like Fanatics.

Operational costs, including warehousing, distribution, and fulfillment, are substantial given the company's broad product catalog and e-commerce focus. In 2024, Fanatics continued to invest in its logistics infrastructure to ensure timely delivery, a critical factor in customer satisfaction and retention. These expenses are compounded by the need for efficient inventory management across a wide range of SKUs.

Technology development and marketing expenditures form another major pillar of Fanatics' cost base. This includes maintaining and enhancing its e-commerce platforms, mobile apps, and data analytics capabilities, as well as significant investment in customer acquisition, particularly in emerging areas like sports betting. For example, in 2024, aggressive marketing campaigns were deployed to capture market share in newly legalized sports betting states.

The company's expansion into new verticals like sports betting and collectibles necessitates ongoing investment in platform development and marketing, leading to higher customer acquisition costs. These strategic investments aim to leverage Fanatics' established brand loyalty to drive growth in these competitive sectors, with significant marketing spend observed in 2024 to gain traction.

| Cost Category | Key Components | 2024 Focus/Impact | Example Impact (2023 Data) |

| Licensing & Royalties | League/Union Fees, Athlete Rights | Securing exclusive rights for new leagues/events | NFL licensed merchandise revenue exceeded $2 billion |

| Operations & Logistics | Warehousing, Fulfillment, Shipping | Expanding distribution network efficiency | Global sports apparel market value over $200 billion |

| Technology & Platform | E-commerce, Mobile Apps, Data Analytics | Enhancing user experience and data capabilities | E-commerce tech spend often exceeds 20% of budget |

| Marketing & Sales | Digital Ads, Sponsorships, Promotions | Aggressive user acquisition in sports betting | High marketing spend in new sports betting legal states |

Revenue Streams

Fanatics' core revenue engine is built on licensed merchandise sales, encompassing everything from jerseys to fan collectibles. These sales occur across its robust e-commerce sites, including the flagship Fanatics.com and various team-specific online stores, as well as through its physical retail presence. This direct-to-consumer approach is central to its business model.

In 2024, this segment, recognized as Fanatics Commerce, was the dominant contributor to the company's financial performance. Specifically, it generated a significant 77% of Fanatics' total revenue, which reached $8.1 billion for the year. This highlights the immense scale and profitability of its merchandise operations.

Fanatics generates substantial revenue from selling sports trading cards and authenticated memorabilia through its Fanatics Collectibles division, which notably includes Topps. This segment is a key driver of income, reflecting the enduring appeal of sports fandom and collecting.

In 2024, this crucial business area contributed an impressive $1.6 billion to Fanatics' overall revenue. This figure highlights not only the current financial success but also the significant growth trajectory of the collectibles market under Fanatics' stewardship.

Fanatics Betting & Gaming is a significant and expanding revenue source, primarily driven by customer wagers and transaction fees.

This segment is relatively new but shows robust growth, with projections indicating it contributed around $300 million in revenue for 2024.

Fanatics is actively increasing its market share in the competitive sports betting and iGaming landscape through strategic expansion.

Licensing and Partnership Royalties

Fanatics significantly diversifies its income beyond direct merchandise sales through licensing and partnership royalties. This strategy leverages its brand and platform to generate recurring revenue from a broad ecosystem of collaborators.

These agreements often involve revenue-sharing models with sports leagues and individual teams. Instead of a fixed profit split, partners benefit from a percentage of overall retail sales generated through Fanatics' channels. This aligns incentives and encourages active participation from all parties. For instance, Fanatics has deep-rooted deals with major sports organizations like the NFL, NBA, and MLB, which include extensive licensing rights for their respective intellectual property. While specific royalty percentages are often confidential, these partnerships are crucial to Fanatics' financial structure, contributing a substantial portion to their overall revenue. In 2024, the sports licensing industry continued to be a robust sector, with Fanatics positioned as a key player benefiting from these arrangements.

- Licensing Fees: Fanatics generates income by charging partners for the right to use its brand and platform for specific product lines or campaigns.

- Revenue Sharing: A significant portion of royalties comes from agreements where partners receive a percentage of Fanatics' retail sales, fostering mutual growth.

- League and Team Partnerships: Fanatics maintains extensive licensing and revenue-sharing agreements with major sports leagues and hundreds of teams globally.

- Intellectual Property Utilization: Royalties are earned through the authorized use of league logos, team insignia, player likenesses, and other protected intellectual property.

Event-Based Sales and Sponsorships

Fanatics taps into significant revenue through event-based sales and sponsorships, particularly at major gatherings like Fanatics Fest. This includes direct income from ticket sales, offering fans access to unique experiences and opportunities to purchase exclusive merchandise not available elsewhere. For instance, in 2024, Fanatics' ability to draw large crowds to its events directly translates into substantial ticket revenue.

Beyond ticket sales, sponsorships and brand activations represent another critical revenue stream. Companies pay to align their brands with Fanatics' high-profile events, leveraging the concentrated fan engagement for marketing purposes. This strategy capitalizes on the passionate fanbase and the captive audience present at these events, providing valuable exposure for sponsors.

- Event Ticket Sales: Direct revenue from fans purchasing entry to major Fanatics-hosted events.

- Exclusive Merchandise Sales: Income generated from selling limited-edition or event-specific merchandise.

- Corporate Sponsorships: Revenue from companies paying for brand visibility and association with events.

- Brand Activations: Fees from brands setting up interactive experiences or promotional activities at events.

Fanatics' revenue streams are diverse, with its core business in licensed sports merchandise forming the largest segment. This includes sales via e-commerce and physical retail, highlighting a strong direct-to-consumer approach.

The collectibles market, significantly bolstered by the acquisition of Topps, represents another major income generator. Fanatics Betting & Gaming is also a growing revenue contributor, driven by wagers and transaction fees.

Licensing and partnership royalties, along with revenue from event-based sales and sponsorships, further diversify Fanatics' income, solidifying its position across multiple facets of the sports industry.

| Revenue Stream | 2024 Contribution (Estimated) | Key Drivers |

|---|---|---|

| Fanatics Commerce (Merchandise) | 77% of $8.1B total revenue | E-commerce sales, physical retail, team stores |

| Fanatics Collectibles (Topps) | $1.6B | Sports trading cards, memorabilia sales |

| Fanatics Betting & Gaming | ~$300M | Customer wagers, transaction fees |

| Licensing & Royalties | Significant portion (confidential) | League/team partnerships, IP utilization |

| Event Sales & Sponsorships | Growing | Ticket sales, corporate sponsorships, brand activations |

Business Model Canvas Data Sources

The Fanatics Business Model Canvas is built using a blend of internal sales data, customer engagement metrics, and market research on sports and e-commerce trends. These sources provide a comprehensive view of Fanatics' operations and market position.