FactSet Research Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

FactSet Research Systems boasts strong brand recognition and a robust, recurring revenue model, key strengths in a competitive financial data landscape. However, understanding the nuances of their competitive threats and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind FactSet's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FactSet boasts a substantial and diverse client roster, serving over 8,800 entities and more than 220,000 investment professionals across asset management, hedge funds, and investment banking sectors. This broad adoption underscores the essential nature of FactSet's offerings in the financial industry.

The company's ability to retain clients is exceptional, with an Annual Subscription Value (ASV) retention rate consistently exceeding 95%. This high retention signifies the deep integration of FactSet's services into clients' daily operations and investment strategies, demonstrating significant client loyalty and satisfaction.

This strong client loyalty and the inherent stickiness of FactSet's platform, due to high switching costs, create formidable barriers for new entrants. It solidifies FactSet's competitive advantage and market leadership by making it difficult for clients to transition to alternative solutions.

FactSet's strength lies in its extensive and integrated suite of financial data and analytical tools. This covers everything from detailed company financials and real-time market data to crucial economic indicators, offering a one-stop shop for investment professionals.

The platform's capabilities extend to sophisticated portfolio analysis, robust risk management features, and precise performance attribution, providing users with the insights needed to navigate complex markets. This comprehensive approach supports multi-asset class strategies and addresses a wide range of client needs throughout the investment process.

FactSet is making significant strides in AI and innovation, a key strength. They are actively investing in and integrating artificial intelligence, including generative AI, into their platform. This is designed to boost client workflows and overall productivity.

Notable initiatives include the FactSet Mercury conversational AI engine, which offers AI-powered experiences for both new and existing users. Additionally, solutions like Pitch Creator for bankers are being developed to automate and streamline various tasks, demonstrating a commitment to practical AI applications.

This strategic focus on AI-driven innovation is geared towards delivering more personalized and efficient client experiences. By leveraging AI, FactSet aims to facilitate better decision-making for its clients and unlock new avenues for growth within the financial technology sector.

Consistent Revenue Growth and Financial Resilience

FactSet exhibits remarkable financial strength, underscored by consistent revenue expansion. In the third quarter of fiscal year 2025, GAAP revenues climbed to $585.5 million, a 5.9% increase compared to the previous year. This upward trajectory is further validated by the company's organic annual subscription value (ASV), which stood at $2,296.9 million as of May 31, 2025, reflecting a solid 4.5% year-over-year growth.

This financial resilience is built upon a foundation of predictable subscription-based revenue streams and a robust balance sheet, positioning FactSet favorably for sustained performance. The company's ability to consistently grow its top line and maintain a strong financial footing highlights its inherent stability and value generation capabilities in the market.

- Consistent Revenue Growth: Q3 FY2025 GAAP revenues reached $585.5 million, up 5.9% year-over-year.

- Growing Subscription Value: Organic ASV was $2,296.9 million as of May 31, 2025, a 4.5% increase year-over-year.

- Financial Resilience: Supported by a strong balance sheet and a predictable subscription revenue model.

Strategic Acquisitions and Partnerships

FactSet consistently strengthens its capabilities through strategic acquisitions and key partnerships. A prime example is the February 2025 acquisition of LiquidityBook, which significantly bolsters FactSet's order management system (OMS) and investment book of record (IBOR) functionalities. This move directly addresses the growing demand for integrated front-to-back office solutions.

These strategic initiatives extend beyond technology upgrades. FactSet's partnership with Mosaic, for instance, enhances its public-to-private deal modeling, providing clients with more robust data and analytical tools for a rapidly evolving market landscape. Such collaborations are crucial for maintaining a competitive edge by offering comprehensive, end-to-end solutions.

- Acquisition of LiquidityBook (February 2025): Enhanced OMS and IBOR capabilities.

- Partnership with Mosaic: Strengthened public-to-private deal modeling.

- Focus on Enterprise-Wide Solutions: Ability to offer integrated client offerings.

- Market Competitiveness: Strategic moves to stay ahead in data and analytics.

FactSet's extensive client base, exceeding 8,800 entities and 220,000 professionals, highlights its indispensable role in finance. The company's impressive client retention rate, consistently above 95%, demonstrates deep service integration and loyalty, creating high switching costs that fortify its market position against competitors.

The company's comprehensive data and analytics platform offers a unified solution for financial professionals. Its advanced portfolio analysis, risk management, and performance attribution tools cater to multi-asset class strategies, providing essential insights for complex market navigation.

FactSet is aggressively investing in AI, notably with its Mercury conversational AI engine and tools like Pitch Creator. This focus on generative AI aims to enhance client workflows and productivity, signaling a commitment to innovation and personalized user experiences.

Financially, FactSet shows robust growth, with Q3 FY2025 GAAP revenues reaching $585.5 million, a 5.9% increase year-over-year. Organic ASV stood at $2,296.9 million as of May 31, 2025, up 4.5%, supported by a stable subscription model and strong financials.

Strategic acquisitions, such as LiquidityBook in February 2025, enhance FactSet's OMS and IBOR capabilities. Partnerships, like the one with Mosaic for public-to-private deal modeling, further solidify its market competitiveness by offering integrated, end-to-end solutions.

| Metric | Value (Q3 FY2025) | Year-over-Year Growth |

|---|---|---|

| GAAP Revenues | $585.5 million | 5.9% |

| Organic ASV (as of May 31, 2025) | $2,296.9 million | 4.5% |

| Client Retention Rate | > 95% | Consistent |

What is included in the product

This SWOT analysis provides a comprehensive look at FactSet Research Systems's competitive advantages and potential challenges within the financial data and analytics industry.

FactSet's SWOT analysis relieves the pain of information overload by providing a structured framework to pinpoint key strategic advantages and potential threats.

Weaknesses

FactSet faces formidable competition from giants like Bloomberg and S&P Global Market Intelligence, alongside specialized firms. This intense rivalry often translates into significant pricing pressures, forcing FactSet to justify its premium offerings through continuous innovation and unique value propositions. For instance, the financial data and analytics market is projected to grow, but intense competition means market share gains require substantial investment in R&D and client retention strategies.

FactSet's revenue is inherently linked to the performance of global financial markets. A downturn, such as the 2022 market correction which saw significant drops in equity and fixed income valuations, can directly impact its clients' assets under management. This often leads clients to re-evaluate discretionary spending, potentially reducing their investment in FactSet's data and analytics solutions.

For instance, if a significant portion of FactSet's client base, like investment banks or asset managers, experiences reduced profitability due to market volatility, they may scale back their operational expenses. This could translate to lower subscription renewals or delayed adoption of new FactSet services, directly affecting FactSet's top-line growth and profitability. FactSet's reliance on these clients means its financial health mirrors the broader financial industry's health.

Layoffs within the banking and wealth management sectors present a direct challenge to FactSet's business model, potentially reducing its user base and slowing subscription revenue growth. For instance, the significant job cuts observed in major financial institutions throughout 2024 created noticeable headwinds for companies like FactSet that depend on the employment levels within these client segments.

This inherent dependency on the headcount within financial services firms means that broader industry-wide workforce reductions can act as a significant impediment to FactSet's expansion plans. The financial sector saw considerable consolidation and cost-cutting measures in 2024, impacting numerous roles that previously would have been FactSet subscribers.

Operating Margin Pressures

FactSet faces challenges with operating margin pressures, despite robust revenue growth. In the third quarter of fiscal year 2025, the company saw its GAAP operating margin decrease by around 350 basis points compared to the previous year. Similarly, the adjusted operating margin also experienced a downturn during this period.

Several factors contribute to this margin compression. These include elevated professional fees associated with acquisitions, increased spending on technology infrastructure, and higher base salary costs. Balancing these rising expenses while continuing to invest in key strategic initiatives presents an ongoing operational hurdle for FactSet.

- Q3 FY2025 GAAP Operating Margin Decline: Approximately 350 basis points year-over-year.

- Contributing Factors: Increased acquisition-related professional fees, higher technology expenses, and rising base salaries.

- Strategic Challenge: Managing expense growth alongside strategic investment priorities.

Potential for Client In-House Solutions and AI Adoption

The increasing sophistication of artificial intelligence and the growing trend of clients building their own in-house data and analytics solutions pose a significant challenge to FactSet's established business model. Financial institutions are increasingly investing in internal AI capabilities, potentially reducing their reliance on external data and analytics providers.

This shift could impact FactSet's market share, particularly if clients find it more cost-effective or strategically advantageous to develop proprietary tools. For example, a significant portion of financial firms are reportedly increasing their AI budgets for 2024 and 2025, aiming to enhance data processing and analytical functions internally.

- AI Investment: Many financial institutions are prioritizing AI development, with some allocating over 20% of their technology budgets to AI initiatives in 2024.

- In-House Development: A growing number of firms are building internal data science teams and platforms to gain greater control and customization over their analytics.

- Potential Market Erosion: If this trend accelerates, FactSet could face reduced demand for certain subscription-based services as clients leverage their own advanced in-house solutions.

FactSet's reliance on the health of financial markets means a downturn directly impacts client spending. For instance, the market volatility experienced in 2022 led many clients to scrutinize discretionary expenses, potentially affecting FactSet's revenue streams.

The company also faces pressure from intense competition, particularly from major players like Bloomberg, which necessitates continuous investment in product development to maintain its value proposition. This competitive landscape is a constant factor influencing FactSet's market position and pricing strategies.

Rising operational costs, including technology infrastructure and salaries, are contributing to margin compression. FactSet's Q3 FY2025 GAAP operating margin saw a notable decrease of approximately 350 basis points year-over-year, highlighting the challenge of balancing growth investments with expense management.

The increasing trend of financial institutions developing in-house AI and data analytics capabilities presents a significant threat. Many firms are boosting AI budgets, with some allocating over 20% of their tech spend to these initiatives in 2024, potentially reducing reliance on external providers like FactSet.

Full Version Awaits

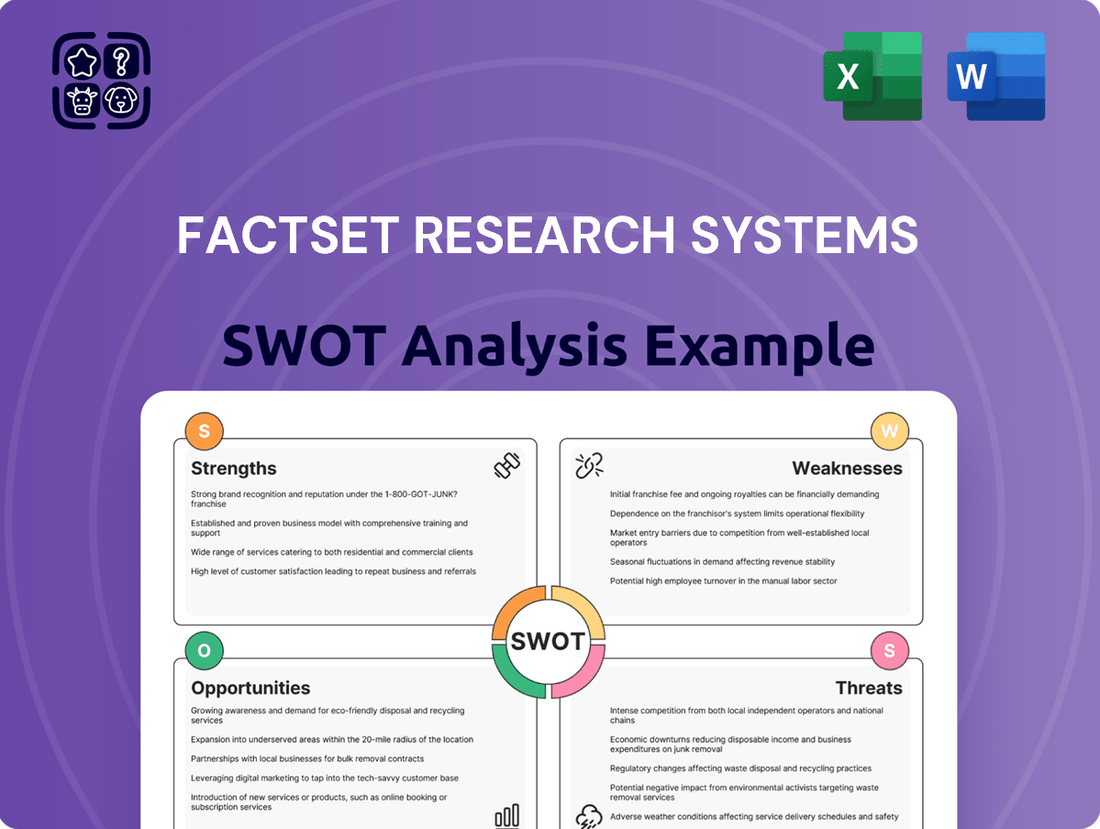

FactSet Research Systems SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details FactSet's strengths, weaknesses, opportunities, and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of FactSet's strategic position.

Opportunities

FactSet is well-positioned to capitalize on the growing demand for AI-driven financial tools. Their ongoing development of solutions like FactSet Mercury and the Conversational API allows for deeper integration into client workflows, automating tasks such as pitchbook creation and performance attribution. This focus on AI is crucial for maintaining a competitive edge and unlocking new revenue opportunities.

The company's investment in AI, as evidenced by initiatives like the Intelligent Platform, directly addresses the need for enhanced productivity and smarter decision-making in the financial sector. By streamlining complex processes through AI, FactSet can offer significant value to its diverse client base, from individual investors to large financial institutions.

For instance, the ability to automate routine tasks like data aggregation and report generation frees up valuable time for financial professionals. This not only boosts efficiency but also allows them to focus on higher-value activities like strategic analysis and client engagement, further solidifying FactSet's role as an indispensable partner.

FactSet is capitalizing on the robust expansion within wealth management and institutional buy-side sectors, identifying them as primary growth engines. The company reported strong organic ASV growth, directly attributed to successful client acquisitions in these key areas, demonstrating a clear market demand for their solutions.

The opportunity lies in further developing and integrating their offerings into the front- and middle-office operations of these clients. This strategic deepening of relationships can significantly bolster recurring revenue streams and solidify FactSet's market position, especially as the financial services industry continues to seek efficiency and advanced data analytics.

FactSet can continue to grow by acquiring companies that broaden its product range and tap into new customer bases. A prime example is their acquisition of LiquidityBook, which bolsters their trading solutions and strengthens their Order Management System (OMS) and Investment Book of Record (IBOR) offerings. This move, completed in early 2024, underscores FactSet's commitment to inorganic growth.

By targeting businesses that either enhance their current capabilities or address unmet needs in their portfolio, FactSet can unlock significant opportunities. These acquisitions not only expand their market presence but also create avenues for revenue growth through cross-selling and integration. For instance, integrating acquired data sets or technologies can offer clients more comprehensive solutions, driving deeper client engagement.

Leveraging Open Technology and APIs

FactSet's dedication to an open technology philosophy, including providing API access to its data and workflows, is a significant opportunity. This allows clients to seamlessly integrate FactSet's offerings into their existing technology infrastructure and third-party applications, enhancing overall efficiency.

By empowering developers to build custom workflows and accelerate AI initiatives with FactSet's data, the company cultivates a robust ecosystem. This not only boosts the platform's utility but also strengthens client loyalty, making it harder for them to switch providers.

For instance, FactSet's API strategy supports the growing demand for data-driven solutions in finance. In 2024, FactSet reported a 10% year-over-year increase in its annual revenue from its platform segment, which heavily relies on API integrations and open technology principles. This growth underscores the market's appetite for flexible data access and customizability.

- API Accessibility: FactSet's open API strategy facilitates deeper integration into client systems.

- Developer Empowerment: Enabling proprietary workflow development accelerates client innovation, particularly in AI.

- Ecosystem Growth: Fostering a broad ecosystem around FactSet's data increases platform stickiness and value.

- Revenue Impact: The platform segment, driven by these open principles, saw 10% YoY growth in 2024.

Global Market Expansion, particularly Asia Pacific

FactSet's strategic focus on global market expansion, particularly within the Asia Pacific region, presents a significant growth avenue. While the Americas are currently its largest revenue source, the Asia Pacific market demonstrated robust performance in fiscal year 2025. This growth is evidenced by a 6.8% organic ASV increase in the second quarter and a further 7.1% surge in the third quarter of fiscal 2025.

By continuing to strengthen its presence and adapt its product suite to meet the unique demands of clients in these dynamic markets, FactSet can unlock substantial opportunities. This geographical diversification is key to building a more resilient and expansive revenue base.

- Asia Pacific ASV Growth: FactSet reported 6.8% organic ASV growth in Q2 FY25 and 7.1% in Q3 FY25 for the Asia Pacific region.

- Geographic Diversification: Expanding in Asia Pacific offers a chance to diversify revenue streams beyond the Americas.

- Tailored Offerings: Adapting products to local market needs in emerging economies can drive deeper client engagement and adoption.

- Untapped Potential: The region represents a significant opportunity for capturing market share and increasing overall revenue.

FactSet's commitment to an open technology philosophy, including robust API access, is a significant growth opportunity. This allows clients to seamlessly integrate FactSet's data and workflows into their existing systems and third-party applications, fostering greater efficiency and customization. By empowering developers to build proprietary workflows and accelerate AI initiatives, FactSet cultivates a strong ecosystem that enhances platform stickiness and drives client loyalty.

The company is strategically expanding its global footprint, with a particular focus on the Asia Pacific region, which showed strong organic ASV growth of 6.8% in Q2 FY25 and 7.1% in Q3 FY25. This geographical diversification offers a substantial opportunity to capture market share and build a more resilient revenue base by adapting product offerings to local market demands.

Acquisitions remain a key avenue for expansion, with the purchase of LiquidityBook in early 2024 bolstering trading solutions and OMS/IBOR capabilities. By acquiring companies that enhance its product range or address unmet needs, FactSet can unlock new revenue streams through cross-selling and integration, further solidifying its market position.

| Opportunity Area | Description | Key Data/Examples |

|---|---|---|

| AI-Driven Tools | Leveraging AI to enhance productivity and decision-making for clients. | FactSet Mercury, Conversational API, Intelligent Platform initiatives. |

| Open Technology & APIs | Enabling seamless integration and custom workflow development. | 10% YoY growth in platform segment revenue (2024) due to API integrations. |

| Global Expansion (APAC) | Strengthening presence in dynamic markets to diversify revenue. | 6.8% Q2 FY25 and 7.1% Q3 FY25 organic ASV growth in Asia Pacific. |

| Strategic Acquisitions | Broadening product range and tapping into new customer bases. | Acquisition of LiquidityBook (early 2024) to enhance trading solutions. |

Threats

FactSet operates in a fiercely competitive landscape, facing formidable rivals such as Bloomberg, S&P Global with its Capital IQ platform, and LSEG, which includes Refinitiv. These established players offer a broad spectrum of financial data and analytics, making differentiation a constant challenge.

The rise of emerging players and alternative data providers further intensifies this rivalry. This competitive pressure can translate into downward pressure on pricing, demanding significant and ongoing investment in innovation to maintain a competitive edge. Failure to adapt and innovate risks market share erosion.

The growing preference for passive investing strategies presents a notable threat. This trend, where investors opt for index funds or ETFs over actively managed portfolios, often requires less intensive data and analytical support. For instance, assets in passive U.S. equity funds reached an estimated $8.5 trillion by the end of 2024, a substantial increase from previous years, highlighting the scale of this shift.

This shift could diminish the demand for FactSet's traditionally robust and sophisticated services tailored for active management. As passive strategies gain market share, the need for deep, nuanced analytics might decrease for a segment of the investment community, potentially impacting revenue streams derived from these clients.

To counter this, FactSet needs to strategically adapt its offerings. Developing and enhancing solutions that effectively support passive investment strategies, alongside its existing active management tools, is crucial. This includes providing efficient data delivery and analytical capabilities that align with the needs of passive fund managers and the broader passive investing ecosystem.

Global economic uncertainty, including the potential for recessions in major economies, presents a significant threat to FactSet. A slowdown can lead to reduced spending by financial institutions, FactSet's core clientele, impacting subscription revenues. For instance, in early 2024, many analysts revised down their global GDP growth forecasts due to persistent inflation and geopolitical tensions, a trend that could directly affect client budgets.

The ongoing consolidation within the financial services industry also poses a risk. As firms merge, they often re-evaluate existing vendor contracts, potentially leading to the cancellation or renegotiation of FactSet subscriptions as the combined entities seek cost efficiencies and streamline data providers. This trend was evident in 2023 with several large mergers announced in the asset management sector, directly impacting the number of potential clients.

Rapid Technological Disruption and AI Commoditization

The swift evolution of technology, especially generative AI, poses a significant challenge for FactSet. While the company is actively investing in AI, the rapid commoditization of these tools could diminish the unique value of FactSet's proprietary AI solutions. For instance, if clients can readily access or build comparable AI capabilities themselves, their reliance on external providers like FactSet might decrease.

This trend could lead clients to reallocate budgets away from data and analytics platforms and directly towards AI development. In 2024, the AI market saw substantial growth, with IDC projecting worldwide spending on AI systems to reach $200 billion. This increasing client investment in direct AI capabilities could potentially erode FactSet's competitive moat.

- AI Commoditization Risk: As AI technologies become more accessible and affordable, FactSet's unique AI-driven advantages could be diluted.

- Client In-House Solutions: Clients may opt to develop their own advanced AI capabilities, reducing the need for third-party data providers.

- Budget Reallocation: A shift in client spending priorities towards direct AI technology investment could negatively impact FactSet's revenue streams.

- Market Dynamics: The increasing availability of open-source AI models and talent further accelerates the commoditization trend.

Data Security and Privacy Concerns

FactSet handles a vast amount of sensitive client financial data, making it a prime target for cyber threats. A data breach could significantly erode client trust and lead to substantial financial penalties, impacting its market position.

In 2023, the financial services sector experienced a notable increase in cyberattacks, with ransomware and data breaches posing significant risks. FactSet’s commitment to robust security measures is crucial to mitigate these evolving threats.

- Reputational Damage: A security incident can severely tarnish FactSet's image.

- Client Attrition: Loss of trust may drive clients to competitors.

- Financial Penalties: Regulatory fines for data privacy violations can be substantial.

- Operational Disruption: Breaches can halt critical services, impacting revenue.

The increasing commoditization of AI presents a significant hurdle, as clients may develop in-house capabilities, potentially reducing reliance on FactSet's proprietary solutions. This trend is amplified by the growing availability of open-source AI models and talent, which could lead clients to reallocate their budgets towards direct AI investments, impacting FactSet's revenue streams.

Global economic slowdowns and industry consolidation pose further threats. Reduced client spending due to recessions, as indicated by revised GDP forecasts in early 2024, can directly affect FactSet's subscription revenues. Additionally, financial services mergers can lead to contract renegotiations and vendor streamlining, as seen with asset management consolidations in 2023.

The shift towards passive investing strategies also diminishes the demand for sophisticated analytics tailored to active management. With assets in passive U.S. equity funds reaching an estimated $8.5 trillion by the end of 2024, FactSet must adapt its offerings to cater to this growing market segment.

FactSet faces intense competition from established players like Bloomberg and S&P Global, alongside emerging alternative data providers. This rivalry necessitates continuous innovation and investment to maintain market share and pricing power, as the market demands differentiation in a crowded landscape.

SWOT Analysis Data Sources

This FactSet Research Systems SWOT analysis is built upon a robust foundation of reliable data, including FactSet's own comprehensive financial filings, extensive market intelligence, and expert evaluations from industry professionals.