FactSet Research Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

FactSet Research Systems navigates a landscape shaped by intense rivalry and significant buyer power, as clients demand sophisticated data and analytics solutions. The threat of new entrants is moderate, given high switching costs and the need for extensive data infrastructure, but substitutes pose a growing concern with the rise of alternative data providers.

The complete report reveals the real forces shaping FactSet Research Systems’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FactSet Research Systems depends heavily on a broad array of data and technology providers, who supply essential financial information, real-time market data, and the underlying technological infrastructure that powers its platforms. The influence these suppliers wield is directly tied to the distinctiveness and exclusivity of the data or technology they offer. For instance, if a provider holds unique access to a specific dataset or a proprietary analytical tool, their bargaining power increases significantly.

The bargaining power of suppliers can be significant when dealing with specialized or alternative data. For instance, if FactSet relies on a unique dataset only available from a handful of providers, those suppliers gain leverage due to the limited alternatives. This is particularly true for emerging data categories where the supplier landscape is not yet mature.

FactSet's strength lies in its capacity to aggregate and analyze these diverse data streams, making the integration itself a valuable service. However, the cost and availability of such specialized data directly impact FactSet's operational expenses and its ability to offer competitive pricing. In 2023, the global market for alternative data was estimated to be worth billions, highlighting the growing importance and potential cost of these specialized inputs.

To counteract this supplier power, FactSet actively pursues strategic partnerships and develops proprietary data solutions. These efforts not only diversify its data sourcing but also reduce reliance on any single, high-bargaining-power supplier, thereby strengthening FactSet's overall position.

FactSet's increasing reliance on cloud infrastructure, particularly for its AI and cloud-native solutions, directly impacts its bargaining power with suppliers. The cloud computing market is highly concentrated, with a few dominant players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. This concentration means these providers hold significant leverage.

In 2024, AWS, Azure, and Google Cloud continued to dominate the global cloud infrastructure market, with AWS holding an estimated 31% market share, followed by Azure at 24% and Google Cloud at 11% as of Q1 2024. This limited number of major providers gives them substantial power to dictate terms and pricing, potentially increasing costs for FactSet.

Talent Pool

The availability of skilled professionals in financial technology, data science, and AI development directly impacts FactSet's operational costs and its capacity for innovation. A limited supply of these specialized talents can significantly amplify the bargaining power of employees, potentially driving up compensation and recruitment expenses.

FactSet has been actively expanding its workforce, with a notable emphasis on bolstering its sales and technology departments. As of the first quarter of 2024, FactSet reported an increase in its global headcount, reflecting ongoing investments in talent acquisition to support its growth initiatives and product development.

- Talent Availability: The demand for expertise in AI and data analytics within the fintech sector remains high, influencing the cost of acquiring and retaining top talent for FactSet.

- Headcount Growth: FactSet's commitment to expanding its sales and technology teams, evident in its recent hiring trends, suggests a strategic effort to secure the necessary human capital for future success.

- Employee Bargaining Power: In specialized fields like AI development, where talent is scarce, employees often possess considerable leverage, impacting FactSet's ability to manage labor costs.

Acquisition Targets

FactSet's pursuit of strategic acquisitions, like LiquidityBook and Irwin, directly impacts the bargaining power of suppliers. The valuation and demand for innovative fintech companies can significantly influence the terms FactSet negotiates with these potential targets. For instance, FactSet's recent acquisition of LiquidityBook to bolster its hedge fund market capabilities highlights how acquiring specialized technology can shift power dynamics.

The bargaining power of suppliers, in the context of FactSet's acquisition targets, is amplified when these targets possess unique, in-demand technologies or customer bases that are crucial for FactSet's growth strategy. In 2024, the fintech acquisition landscape saw continued robust valuations, with many smaller firms commanding premium prices due to their proprietary solutions and early-stage market traction.

- Valuation of Fintech Targets: In 2024, the average valuation for Series A funding rounds in fintech reached approximately $25 million, indicating a high demand for innovative solutions.

- Strategic Importance: FactSet's acquisition of LiquidityBook in late 2023 aimed to enhance its offerings for hedge funds, demonstrating how specific capabilities can increase a target's bargaining leverage.

- Market Demand: The overall demand for data analytics and trading technology solutions in 2024 remained strong, giving well-positioned fintech companies more power in acquisition negotiations.

FactSet's suppliers, particularly those providing specialized financial data and cloud infrastructure, hold considerable bargaining power. This is due to the concentrated nature of cloud providers and the unique value of certain alternative datasets. For example, in Q1 2024, AWS, Azure, and Google Cloud commanded a combined 66% of the cloud infrastructure market, giving them significant pricing leverage.

The demand for specialized talent in AI and data science also empowers employees, potentially increasing FactSet's labor costs. Furthermore, fintech companies with proprietary technologies, like those FactSet acquires, can wield strong bargaining power during negotiations due to their strategic importance and market demand.

| Supplier Type | Key Factor Influencing Power | Example Impact on FactSet |

|---|---|---|

| Data Providers (Specialized) | Uniqueness/Exclusivity of Data | Higher data acquisition costs, limited alternative sourcing |

| Cloud Infrastructure Providers | Market Concentration | Increased cloud service expenses, reliance on major vendors |

| Skilled Employees (AI/Data Science) | Talent Scarcity | Higher recruitment and retention costs, potential wage inflation |

| Fintech Acquisition Targets | Proprietary Technology/Customer Base | Premium valuations, increased negotiation leverage for targets |

What is included in the product

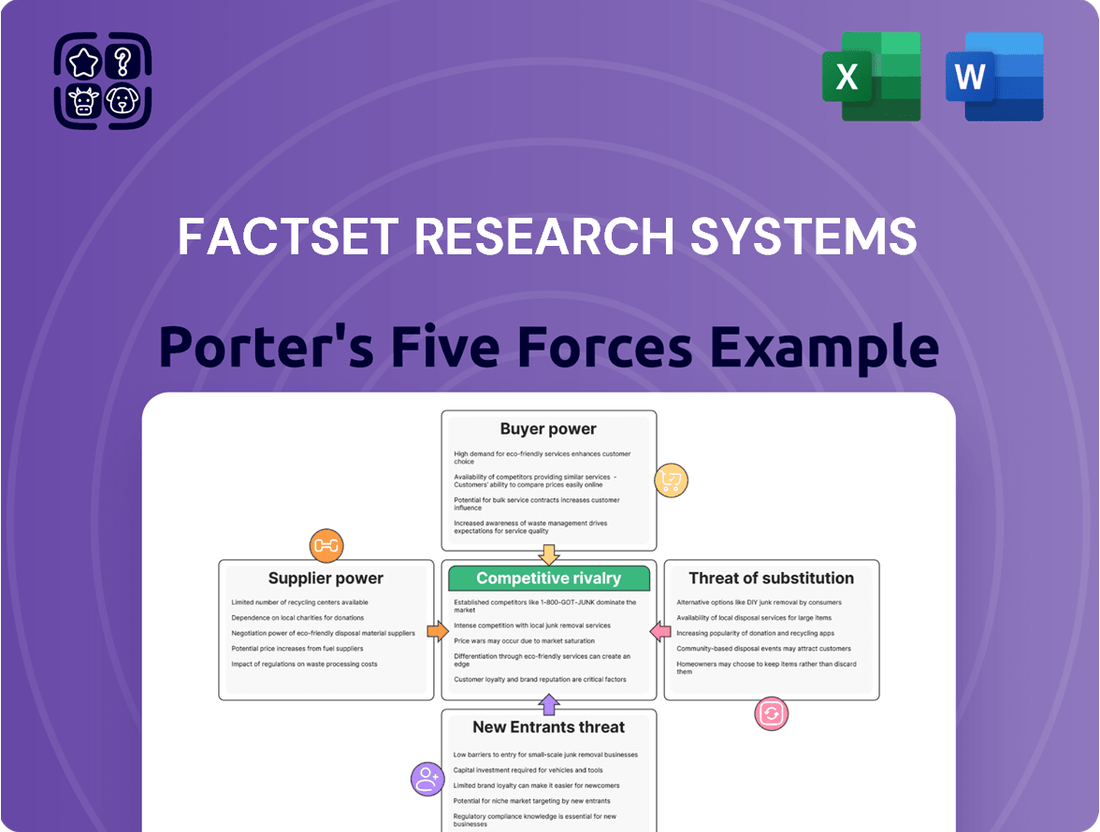

FactSet Research Systems' Porter's Five Forces analysis reveals how industry rivalry, buyer and supplier power, threat of new entrants, and substitutes shape its competitive environment and profitability.

Effortlessly assess competitive intensity with pre-built templates for each force, eliminating the need to build complex models from scratch.

Customers Bargaining Power

FactSet's primary clientele consists of large institutional investors like asset managers, hedge funds, and investment banks. These significant clients wield considerable purchasing power, enabling them to negotiate for tailored solutions or price reductions due to their substantial business volume. For instance, in the fiscal year 2023, FactSet reported that its largest clients, representing the top 25% of its customer base, accounted for a significant portion of its annual subscription revenue, underscoring their influence.

FactSet's subscription-based model fosters customer loyalty, but clients continually assess the value received. This means retention is crucial for sustained success. Demonstrating this commitment, FactSet reported an impressive annual ASV retention rate exceeding 95% as of Q3 2025.

FactSet's deep integration into client workflows, offering seamless financial data and analytical tools, creates significant switching costs. This integration makes it difficult and expensive for customers to move to a competitor, thereby diminishing their bargaining power.

In 2024, FactSet continued to emphasize its workflow embedding capabilities, a key factor in retaining its client base. This strategic focus on making its platform indispensable to daily operations significantly limits the leverage customers have to demand lower prices or better terms.

Price Sensitivity and Budget Constraints

Customers, especially financial institutions, are increasingly sensitive to pricing, particularly during economic downturns. This heightened price sensitivity directly impacts FactSet's ability to maintain its pricing power. For instance, in 2024, many financial firms were managing tighter budgets, making them more inclined to scrutinize every expense, including data and analytics subscriptions.

FactSet itself has acknowledged this trend, reporting that price realization for new business has been lower. This indicates that securing new clients in the current market often requires offering more competitive pricing structures than in previous periods. The competitive landscape is intensifying, pushing all players to be more aggressive on price.

- Price Sensitivity: Financial institutions exhibit heightened price sensitivity, especially in challenging economic climates.

- Budget Constraints: Economic pressures lead to budget constraints within financial firms, increasing scrutiny of data service costs.

- Lower Price Realization: FactSet has observed a decrease in price realization for new business acquisitions in 2024.

- Competitive Environment: The market for financial data and analytics is becoming more competitive, influencing pricing strategies.

Demand for AI-Driven Solutions

Clients are increasingly demanding AI-driven solutions to improve their decision-making processes and operational efficiency. FactSet's capacity to provide sophisticated AI features directly impacts client satisfaction and loyalty.

FactSet's commitment to innovation in generative AI was evident throughout fiscal year 2024, with several advancements enhancing their offerings.

- AI-Driven Demand: Clients are actively seeking AI capabilities to gain deeper insights and personalized solutions.

- FactSet's AI Innovation: The company made significant strides in generative AI during fiscal 2024, bolstering its competitive edge.

- Customer Influence: FactSet's AI advancements directly influence customer retention and satisfaction levels.

The bargaining power of customers for FactSet is influenced by their substantial size and the increasing demand for advanced analytics, particularly AI-driven solutions. While FactSet's deep integration creates high switching costs, clients remain sensitive to pricing, especially in tighter economic conditions observed in 2024. FactSet's ability to meet evolving client needs, such as those for generative AI, directly impacts its ability to retain customers and mitigate their price leverage.

| Metric | FY 2023/2024 Data | Significance |

|---|---|---|

| ASV Retention Rate | >95% (as of Q3 2025) | Indicates strong customer loyalty and low churn, reducing customer bargaining power. |

| Top 25% Client Revenue Contribution | Significant portion of annual subscription revenue | Highlights the considerable influence of large institutional clients. |

| Price Realization for New Business | Lowered in 2024 | Suggests increased customer price sensitivity and competitive pressure. |

Same Document Delivered

FactSet Research Systems Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details FactSet Research Systems' competitive landscape through Porter's Five Forces, offering a comprehensive analysis of threats and opportunities. Understand the industry's power dynamics, from supplier and buyer leverage to new entrant barriers and substitute product risks, all within this complete report.

Rivalry Among Competitors

The financial information and analytics market is intensely competitive, featuring numerous well-established firms offering robust data and analytical tools. FactSet's primary rivals include Bloomberg, Refinitiv (now part of LSEG), and S&P Global Market Intelligence, all of whom consistently enhance their offerings to capture market share.

These established competitors invest heavily in innovation, frequently launching new features and expanding their data sets to meet evolving client needs. For instance, Bloomberg's terminal remains a dominant force, while Refinitiv's integration into LSEG is expected to create a more formidable competitor with expanded capabilities in data and analytics.

Competitive rivalry for FactSet is intense, often centering on the sheer volume and sophistication of financial data, advanced analytical tools, and the seamlessness of the user experience. The integration of cutting-edge technologies, particularly artificial intelligence, is a key battleground.

FactSet is actively bolstering its competitive standing by making significant investments in AI capabilities and continuously broadening its extensive data catalog. This strategic focus aims to address the dynamic and evolving demands of the financial industry, ensuring they remain at the forefront of information and analytics.

FactSet faces competitive pressure from rivals employing aggressive pricing and discount tactics to capture market share, which can impact its profit margins. In 2024, the company noted that it experienced pricing pressure and a lower price realization on new business, indicating a challenging market environment.

Global Reach and Local Presence

FactSet faces intense competition where rivals battle for market share across diverse geographies. This necessitates a robust global presence complemented by tailored local solutions that resonate with regional market nuances.

FactSet serves a broad global clientele, with its user base distributed across numerous key regions. This extensive reach is a critical factor in its competitive positioning, allowing it to cater to a wide array of financial professionals worldwide.

- Global Footprint: FactSet operates in over 20 countries, demonstrating its commitment to serving clients across major financial hubs.

- Localized Offerings: The company provides data and analytics relevant to specific regional markets, enhancing its appeal to local financial institutions.

- Competitive Landscape: Key competitors like Bloomberg and Refinitiv also maintain significant global operations and localized data sets, intensifying the rivalry.

Mergers and Acquisitions

Consolidation through mergers and acquisitions significantly reshapes the competitive environment, potentially leading to the emergence of larger, more powerful competitors. FactSet actively participates in this trend, strategically acquiring companies to bolster its product suite and market position.

In 2024, the financial data and technology sector continued to see M&A activity, with companies seeking to expand their capabilities and client bases. For instance, the ongoing digital transformation across financial services drives demand for integrated solutions, making strategic acquisitions a key growth lever.

- FactSet's acquisition strategy aims to integrate new technologies and data sets, enhancing its competitive edge.

- The industry sees a trend towards consolidation, with larger players acquiring smaller, specialized firms to broaden their service offerings.

- Such M&A activity can create significant barriers to entry for new players and increase the bargaining power of established, consolidated entities.

The competitive rivalry in the financial data and analytics sector is fierce, with established players like Bloomberg and Refinitiv (now part of LSEG) constantly innovating. FactSet faces pressure from these giants who invest heavily in new features and data expansion, particularly in areas like artificial intelligence. Pricing pressure is also a significant factor, with competitors sometimes employing aggressive tactics. FactSet's own strategy involves substantial investment in AI and expanding its data catalog to maintain its competitive edge in this dynamic market.

| Competitor | Key Offerings | 2024 Focus Areas |

|---|---|---|

| Bloomberg | Terminal, News, Analytics | AI integration, expanded data sets |

| Refinitiv (LSEG) | Data, Trading platforms, Analytics | Synergies from LSEG integration, digital solutions |

| S&P Global Market Intelligence | Data, Research, Ratings | Data analytics, ESG solutions |

SSubstitutes Threaten

Large financial institutions often consider building their own proprietary data and analytics systems. This can be seen as a way to gain a competitive edge by tailoring solutions precisely to their needs. However, the significant investment in technology, talent, and ongoing maintenance for such in-house platforms is a substantial barrier.

Developing and maintaining these complex systems requires considerable capital expenditure and specialized expertise. The ongoing costs associated with data acquisition, software development, and infrastructure upkeep can easily exceed what firms might pay for subscription-based services from providers like FactSet.

While the allure of complete control is strong, the sheer complexity and cost of replicating the breadth and depth of data and analytical tools offered by established vendors make in-house solutions a less common and often less efficient choice for most. The rapid pace of technological change further exacerbates these challenges.

The rise of open-source data and analytical tools poses a potential threat by offering free or low-cost alternatives. For instance, platforms like R and Python, coupled with readily available datasets from government agencies or academic institutions, can fulfill basic analytical requirements for smaller firms or niche projects. This can reduce the perceived need for premium subscription services.

However, FactSet's value proposition lies in the depth, breadth, and curated nature of its data, which often surpasses what is easily accessible through open-source channels. In 2024, the market for financial data remains robust, with firms like FactSet differentiating through data quality, integration capabilities, and specialized analytics that are difficult to replicate with open-source solutions alone, especially for complex institutional needs.

Clients might choose traditional consulting firms or undertake manual data analysis instead of using integrated platforms like FactSet. While less efficient, these alternatives exist, especially for niche or highly customized needs.

However, the trend leans towards leveraging technology, with AI augmenting rather than replacing human expertise. For instance, in 2024, the global AI market for financial services was projected to reach over $20 billion, indicating a strong adoption of tech-enhanced solutions.

General Business Intelligence Platforms

While general business intelligence and data visualization platforms can offer some overlapping functionalities, they typically fall short when compared to FactSet's specialized financial data and deep domain expertise. These broader platforms often lack the granular, real-time financial information and the sophisticated analytical tools that are critical for investment professionals.

FactSet's platform is specifically designed to cater to the unique needs of the global investment community, providing access to a vast array of financial data, research, and analytics. For instance, as of early 2024, FactSet provides data covering over 150 million data items on over 100,000 public companies and 1 million private companies, a depth that generic platforms rarely match.

- Limited Financial Data Scope: Generic BI tools often lack the depth and breadth of specialized financial data, such as historical earnings, analyst estimates, and ownership data, which are core to FactSet's offering.

- Lack of Domain Expertise: These platforms typically do not possess the financial industry-specific knowledge and workflows that FactSet has built over decades to serve investment professionals.

- Focus on Visualization vs. Analysis: While general platforms excel at data visualization, they often lack the advanced analytical capabilities and financial modeling tools that FactSet integrates for in-depth investment research.

Emerging Technologies and AI-driven Alternatives

The threat of substitutes for financial data and analytics providers like FactSet is growing due to the rapid evolution of emerging technologies, particularly artificial intelligence (AI) and machine learning. These advancements can create entirely new ways for users to access and interpret financial information, potentially bypassing traditional data platforms.

AI-driven tools are increasingly capable of performing tasks that were once exclusive to specialized software. This means that alternative solutions, often developed by tech companies or even in-house by large financial institutions, could offer similar functionalities at a reduced cost or with greater customization. The surge in AI adoption within the financial sector underscores this trend; projections indicate that 85% of financial institutions will have implemented AI by 2025, highlighting a clear shift towards these potentially substitutive technologies.

- AI-powered analytics platforms offering automated data interpretation and insight generation.

- Open-source data libraries and tools that allow for custom data manipulation and analysis.

- Robo-advisory services that automate investment decisions, reducing reliance on traditional research platforms.

- Crowdsourced financial data and analysis from online communities and specialized forums.

The threat of substitutes for FactSet involves alternatives that can fulfill similar data and analytics needs, though often with less specialization or integration. These substitutes range from in-house development and open-source tools to broader business intelligence platforms and even manual analysis. The key differentiator for FactSet remains its depth, breadth, and curated nature of financial data, alongside specialized analytics tailored for investment professionals, which are difficult for substitutes to replicate comprehensively.

While open-source tools like Python and R, combined with public data, offer a low-cost alternative for basic analysis, they lack the depth and integration of FactSet's offerings. Similarly, generic business intelligence platforms can visualize data but typically do not provide the granular financial data or specialized analytical tools essential for investment research. The growing adoption of AI in finance, with projections of 85% of financial institutions using AI by 2025, presents a more significant emerging threat, as AI-powered platforms can automate data interpretation and insight generation, potentially offering more cost-effective or customized solutions.

FactSet's extensive data universe, covering over 150 million data items on more than 100,000 public companies as of early 2024, highlights the challenge for substitutes to match this scope. The value proposition of FactSet is further strengthened by its deep domain expertise and integrated workflows, which are difficult for generalist platforms or manual processes to replicate efficiently for complex institutional needs.

Entrants Threaten

Entering the financial data and analytics space demands significant upfront capital. Companies need to invest heavily in acquiring vast datasets, developing sophisticated technology platforms, and building robust IT infrastructure. This substantial financial hurdle acts as a strong deterrent for many aspiring competitors.

For instance, FactSet reported technology-related expenses of $655.3 million for the fiscal year 2023, highlighting the considerable investment required to maintain and advance its offerings. This level of expenditure makes it challenging for new players to establish a competitive foothold without comparable resources.

The threat of new entrants in the financial data and analytics space, particularly for a company like FactSet, is mitigated by the sheer complexity and cost of building a comparable data universe. FactSet leverages extensive, long-standing relationships with hundreds of industry-leading data partners to curate its comprehensive financial data. This robust network and the continuous effort in data validation create significant barriers to entry.

The financial services sector, including areas where FactSet operates, faces substantial regulatory scrutiny. New entrants must invest heavily in understanding and adhering to a complex web of rules, such as those from the SEC, FINRA, and global equivalents. For instance, the Dodd-Frank Act in the U.S. significantly increased compliance burdens across financial institutions, impacting operational costs and the ease with which new players can enter the market.

Brand Reputation and Trust

Established players like FactSet have cultivated deep brand reputations and trust within the financial industry over many years. New entrants face a substantial challenge in winning over clients who rely on this established credibility. FactSet's long history, spanning over 47 years, has solidified its position and contributed to a high client retention rate, demonstrating the stickiness of its services.

- Brand Loyalty: Decades of reliable service have fostered strong loyalty among FactSet's client base.

- Trust Factor: The financial community places significant trust in FactSet's data accuracy and platform stability.

- Barriers to Entry: Overcoming this ingrained trust and brand recognition represents a major hurdle for potential new competitors.

Talent Acquisition and Retention

The financial data and analytics sector faces a significant threat from new entrants, particularly concerning talent acquisition and retention. New companies struggle to attract and keep top-tier professionals in financial data, analytics, and technology, as they compete against established players like FactSet. FactSet itself has been actively expanding its workforce, notably increasing headcount in technology and sales roles to maintain its competitive edge.

This talent war intensifies the threat for newcomers. For instance, FactSet reported a notable increase in its employee base, with technology and sales departments seeing substantial growth in recent years, reflecting the demand for specialized skills in these areas. This ongoing investment in human capital by established firms makes it harder for new entrants to build a comparable team.

- Talent Scarcity: New entrants face difficulties in recruiting specialized talent in financial data science, AI, and software engineering.

- High Compensation Demands: Experienced professionals in these fields command high salaries, increasing operational costs for startups.

- FactSet's Hiring Trends: FactSet's strategic hiring in technology and sales indicates a focus on bolstering core competencies, a challenge for emerging competitors.

The threat of new entrants for FactSet is generally considered low due to significant barriers. The immense capital required for data acquisition, technology development, and regulatory compliance makes it difficult for newcomers to compete. FactSet's substantial technology expenses, like the $655.3 million reported in fiscal year 2023, underscore this financial hurdle.

| Barrier Type | Description | FactSet's Position |

|---|---|---|

| Capital Requirements | High investment needed for data, technology, and infrastructure. | FactSet's FY23 technology expenses were $655.3 million. |

| Data & Relationships | Access to comprehensive, validated financial data through established partnerships. | FactSet cultivates long-standing relationships with hundreds of data partners. |

| Brand & Trust | Established reputation and credibility built over decades. | FactSet has over 47 years of history, fostering high client loyalty and trust. |

| Regulatory Compliance | Navigating complex financial regulations requires significant investment and expertise. | Adherence to SEC, FINRA, and global regulations presents a hurdle for new entrants. |

| Talent Acquisition | Attracting and retaining specialized talent in data science and technology. | FactSet actively hires in technology and sales to maintain a competitive edge. |

Porter's Five Forces Analysis Data Sources

FactSet's Porter's Five Forces analysis is built upon a robust foundation of proprietary financial data, real-time market feeds, and extensive company filings. This includes access to earnings call transcripts, analyst reports, and regulatory disclosures, providing deep insights into industry dynamics.