FactSet Research Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

Uncover the strategic positioning of FactSet Research Systems' product portfolio with our comprehensive BCG Matrix analysis. See which offerings are market leaders (Stars), which are reliably generating cash (Cash Cows), and which require careful consideration (Question Marks or Dogs). Purchase the full report for a detailed breakdown and actionable insights to optimize your investment strategy.

Stars

FactSet's AI-powered solutions, including Pitch Creator and its Conversational API, are rapidly emerging as stars in their product portfolio. These offerings leverage generative AI to automate complex tasks, such as pitch book creation for investment bankers, significantly boosting efficiency. The Conversational API, powered by FactSet Mercury, enhances data accessibility and analysis, demonstrating a strong market demand for intelligent financial tools.

The company's substantial investment in generative AI research and development, evidenced by these recent launches, underscores their commitment to innovation. Pitch Creator, in particular, has seen rapid adoption and boasts a robust pipeline, a clear indicator of its high-growth potential and market traction. This positions FactSet as a leader in integrating cutting-edge AI into financial workflows, driving value for its clients.

FactSet's wealth management solutions are a significant growth area, evidenced by an expanding client and user base. Their fiscal year 2024 marked a milestone with the first enterprise deal in the Wealth middle office, highlighting increasing adoption of their comprehensive offerings.

The company is strategically investing in AI integration to enhance decision-making capabilities and client engagement for wealth managers. This proactive approach to innovation in a key financial sector signals a strong drive to capture greater market share.

FactSet's integrated digital platform and enterprise solutions offer a robust suite of data and analytical tools for investment professionals. This core offering is continuously enhanced with AI integration, aiming to boost client productivity and streamline workflows.

In 2024, FactSet reported that its integrated digital platform is a significant driver of its business, serving a vast array of financial clients. The company's strategic focus on AI integration within these solutions positions it favorably in a rapidly evolving market, where it holds a strong competitive advantage.

Strategic Acquisitions in Investment Tech

FactSet Research Systems is actively enhancing its position in the investment technology landscape through strategic acquisitions. These moves are designed to bolster its service portfolio and capture new market segments.

The acquisition of Irwin in October 2024, a provider of investor relations and capital markets solutions, significantly expands FactSet's reach within this critical client segment. This integration aims to streamline communication and data flow between companies and their investors.

Further strengthening its capabilities, FactSet acquired LiquidityBook in February 2025. This move brings cloud-native trading and order management technology into the FactSet ecosystem, offering clients more robust and efficient execution solutions.

- Irwin Acquisition (October 2024): Enhanced investor relations and capital markets offerings.

- LiquidityBook Acquisition (February 2025): Added cloud-native trading and order management capabilities.

- Strategic Rationale: Expansion into high-growth areas and provision of more comprehensive solutions.

ESG Solutions powered by Truvalue Labs

The Environmental, Social, and Governance (ESG) market is a rapidly expanding sector, with global ESG assets projected to reach $33.9 trillion by 2026, a substantial increase from earlier years. FactSet's ESG solutions, powered by Truvalue Labs' AI-driven data, offer a robust framework for objectively evaluating a company's ESG performance. This capability is crucial as regulatory bodies and investors increasingly prioritize sustainability, driving demand for sophisticated ESG analytics.

FactSet's integration of Truvalue Labs provides a competitive edge in this burgeoning market. Truvalue Labs utilizes artificial intelligence to analyze vast amounts of unstructured data, uncovering nuanced ESG insights that traditional methods might miss. This allows for a more comprehensive and objective assessment of corporate behavior, a key differentiator in a market where transparency and accuracy are paramount.

- Market Growth: The global ESG investing market is on a steep upward trajectory, with significant growth anticipated through 2025 and beyond.

- AI-Powered Assessment: FactSet's Truvalue Labs suite leverages AI to provide objective and data-driven evaluations of corporate ESG practices.

- Investor and Regulatory Demand: Increasing regulatory requirements and a heightened investor focus on sustainability are fueling the demand for advanced ESG data and analytics.

- Competitive Positioning: FactSet is well-positioned to capitalize on this high-growth market by offering sophisticated tools for ESG analysis.

FactSet's AI-powered solutions, including Pitch Creator and its Conversational API, are rapidly emerging as stars. These offerings automate complex tasks, boosting efficiency, and enhance data accessibility, demonstrating strong market demand for intelligent financial tools.

The company's substantial investment in generative AI, evidenced by these launches, underscores its commitment to innovation. Pitch Creator, in particular, has seen rapid adoption and boasts a robust pipeline, indicating high growth potential.

FactSet's wealth management solutions are a significant growth area, with fiscal year 2024 marking the first enterprise deal in the Wealth middle office, highlighting increasing adoption of their comprehensive offerings.

The company is strategically investing in AI integration to enhance decision-making for wealth managers, signaling a strong drive to capture greater market share in this key financial sector.

What is included in the product

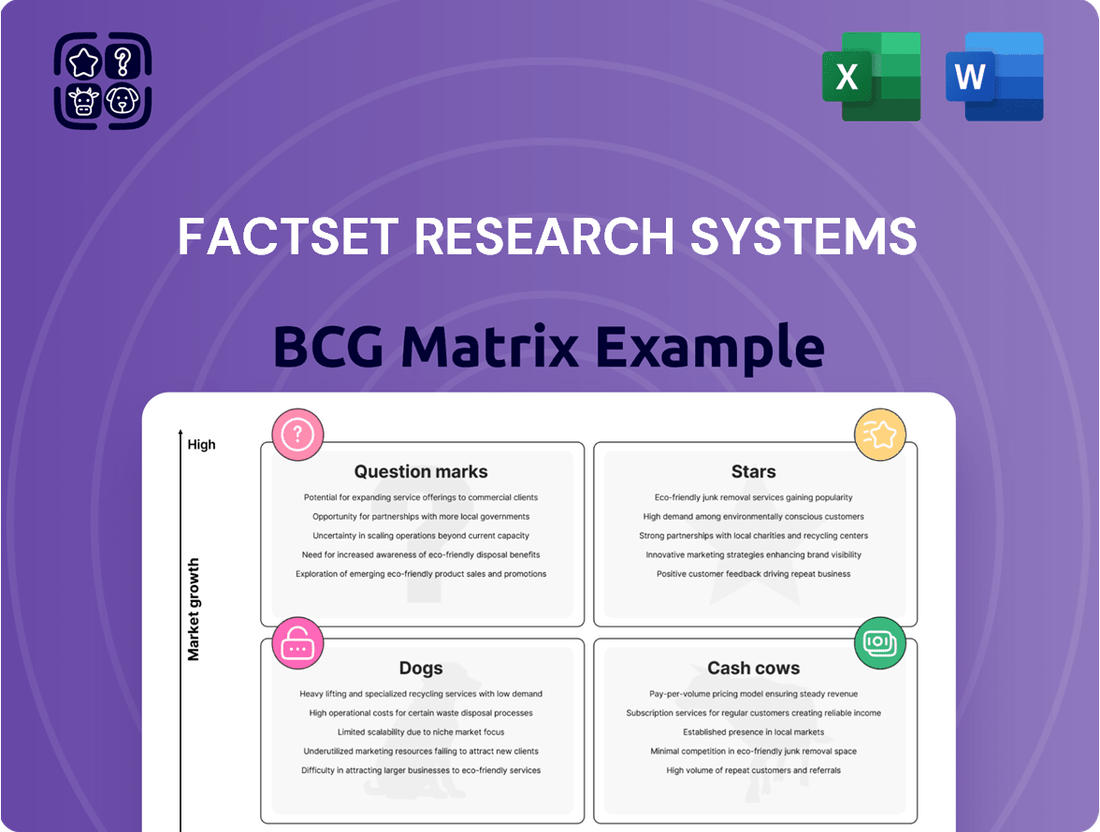

FactSet's BCG Matrix offers a strategic framework for analyzing its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which product lines to grow, maintain, or divest for optimal resource allocation.

The FactSet Research Systems BCG Matrix offers a clear visual representation of your business units, alleviating the pain of complex strategic analysis.

Cash Cows

FactSet's core business, providing extensive financial data, market insights, and economic indicators, operates within a mature yet stable market where it holds a significant market share. This foundational offering is a consistent and substantial generator of Annual Subscription Value (ASV) and overall revenue, solidifying its position as a reliable cash cow for the company.

The FactSet Workstation is a cornerstone product, boasting over 216,000 global users. This established platform is essential for in-depth company and industry analysis, portfolio evaluation, and risk management, solidifying its position in a mature market segment.

Its high market share means it requires minimal marketing spend, allowing it to consistently generate substantial cash flow for FactSet. This dependable revenue stream is characteristic of a 'cash cow' within the BCG matrix framework.

FactSet's multi-asset class portfolio analysis tools, covering performance, risk, attribution, and exposure, are industry stalwarts. These offerings are crucial for investment professionals navigating a mature market, leading to high client retention.

This segment acts as a cash cow for FactSet, generating reliable revenue streams with predictable, albeit modest, growth. The established nature of these tools means lower investment is needed for upkeep, translating to strong cash flow.

In 2023, FactSet reported that its Analytics segment, which includes these portfolio analysis tools, saw revenue grow by 7% year-over-year. This segment continues to be a bedrock of the company's financial stability.

Research Management Solutions (e.g., IRN 2.0)

FactSet's research management solutions, exemplified by advancements like IRN 2.0, are critical tools for investment professionals. These platforms streamline research workflows, allowing users to efficiently organize, access, and analyze vast amounts of data. This focus on operational efficiency is a hallmark of their value proposition.

While these solutions represent mature offerings within FactSet's portfolio, their deep integration into the daily operations of financial institutions translates to exceptionally high client retention rates. The indispensable nature of these tools in managing research processes ensures a consistent and reliable revenue stream, classifying them as strong cash cows.

For instance, FactSet reported that its annual contract value (ACV) for its content and analytics solutions, which include research management, saw continued growth. In the fiscal year ending August 2023, FactSet's total revenue reached $2.2 billion, with a significant portion attributable to these recurring revenue streams from established, integrated solutions.

- High Client Retention: Research management solutions benefit from deep integration, leading to sticky client relationships.

- Steady Revenue Generation: Their essential role in daily workflows creates predictable and consistent cash flow.

- Mature Market Dominance: FactSet's established presence in this segment solidifies its position as a reliable cash generator.

- Operational Efficiency Focus: These tools directly address the need for efficient research management in finance.

Content and Technology Groups

FactSet's Content and Technology groups are the bedrock of its operations, representing a substantial and stable segment of its workforce and investment. These teams are crucial for maintaining the integrity and timely delivery of FactSet's vast financial data and analytical tools, directly supporting its dominant market position and predictable revenue streams.

The operational efficiency of these groups directly impacts FactSet's ability to serve its diverse client base, from individual investors to large financial institutions. Their work ensures the quality and accessibility of the data that underpins critical decision-making processes across the financial industry.

- Core Functionality: These groups are responsible for the acquisition, management, and delivery of financial data, as well as the development and maintenance of the technology platforms that power FactSet's analytics and products.

- Workforce Allocation: A significant portion of FactSet's employees are dedicated to these content and technology functions, reflecting their foundational importance to the business.

- Revenue Stability: The consistent performance and reliability of FactSet's data and technology offerings, driven by these groups, contribute directly to the company's stable revenue generation and market share.

FactSet's core data and analytics offerings, including its foundational workstation and multi-asset class portfolio analysis tools, are firmly established in mature markets. These products benefit from high user adoption and deep integration into client workflows, ensuring exceptionally strong client retention.

This stability translates into predictable, substantial revenue streams with minimal need for aggressive growth investment, characteristic of cash cows. For example, FactSet's fiscal year 2023 revenue reached $2.2 billion, underscoring the consistent contribution of these established segments.

The company's research management solutions, like IRN 2.0, also fall into this category. Their critical role in streamlining financial research processes makes them indispensable, fostering loyalty and consistent Annual Subscription Value (ASV) growth.

FactSet's commitment to these reliable revenue generators is evident in its workforce allocation, with significant teams dedicated to content and technology to maintain these core services.

| Segment | Market Maturity | Revenue Contribution | Growth Potential | BCG Classification |

|---|---|---|---|---|

| Core Data & Analytics (Workstation, Portfolio Analysis) | Mature | High & Stable | Modest | Cash Cow |

| Research Management Solutions | Mature | High & Stable | Modest | Cash Cow |

What You’re Viewing Is Included

FactSet Research Systems BCG Matrix

The FactSet Research Systems BCG Matrix you are previewing is the complete, unadulterated document you will receive immediately after purchase. This means no watermarks, no demo indicators, and no altered content; just the fully formatted, professionally designed BCG Matrix report ready for your strategic analysis and decision-making. You can confidently use this preview as a direct representation of the high-quality, actionable intelligence you will gain access to, enabling you to effectively categorize and strategize your business portfolio.

Dogs

FactSet Research Systems, like any large data provider, may possess legacy or niche data feeds that fall into the 'dog' category of a BCG matrix. These could be older datasets with limited integration capabilities, catering to very specific, shrinking markets. While they might still have a small user base, their growth potential is minimal, and they likely contribute little to overall revenue or strategic advantage.

These types of offerings often require ongoing maintenance to ensure data integrity and basic functionality, but without significant investment in new features or integration, they are unlikely to attract new customers. The challenge for FactSet would be to identify these specific assets and decide whether to continue supporting them at a minimal cost or divest them if possible.

Within FactSet's diverse portfolio, certain regional product versions or localized data offerings may represent underperforming segments. If these offerings operate in slow-growing or fragmented markets with limited market share, they could be classified as 'dogs' in a BCG matrix analysis. For instance, a niche data product for a specific emerging market that has seen minimal adoption by 2024, despite significant investment, would fit this description.

Within FactSet's extensive offerings, certain older analytical models or proprietary algorithms may be experiencing reduced adoption as the financial technology sector rapidly advances. These legacy systems, if situated in a low-growth market segment and showing declining usage, could be classified as 'dogs' in a BCG matrix framework. For instance, a model developed before the widespread adoption of machine learning might struggle to compete with newer, AI-powered analytics that offer more predictive power.

Non-Core or Divested Assets

FactSet Research Systems, like many technology and data firms, may hold non-core or divested assets. These are typically product lines or acquired businesses that no longer fit the company's core strategy or have underperformed. For instance, if FactSet acquired a smaller data analytics firm in 2022 that specialized in a niche market which has since declined, that segment might be considered a potential 'dog' asset. Such assets often consume resources without generating substantial returns or contributing to market leadership, making them candidates for divestiture to streamline operations and focus on higher-growth areas.

While the BCG matrix framework suggests the possibility of 'dogs', identifying specific divested assets for FactSet requires detailed internal knowledge not publicly available. However, considering FactSet's strategic acquisitions, such as its 2021 acquisition of Ethnocharts, a provider of ESG data and analytics, it's possible that other smaller, less integrated components from prior deals could fall into this category if they haven't achieved critical mass or strategic alignment. The absence of explicit public announcements regarding divestitures of underperforming assets means this classification remains hypothetical.

- Potential 'Dogs': Hypothetical assets or acquired product lines that have low market share and low growth prospects.

- Strategic Review: Companies regularly review their portfolios for assets that do not align with strategic objectives or generate insufficient returns.

- Resource Allocation: Divesting 'dogs' frees up capital and management attention to invest in more promising business units.

- FactSet's Focus: FactSet's core business revolves around providing financial data and analytical tools for investment professionals, with a strong emphasis on data integration and workflow solutions.

Certain Customized Solutions without Scalability

Certain customized solutions, while valuable to individual clients, can be classified as 'dogs' in the BCG matrix if they lack scalability. These offerings require significant bespoke development, making them difficult and costly to replicate for a wider market. This inherent lack of replicability hinders their ability to capture substantial market share or achieve significant growth, despite their current utility.

For instance, a financial data provider might develop a highly specialized analytics tool for a single, large institutional client. While this solution might be critical for that client's operations, its unique architecture and data integration points would make it impractical to market to other firms without extensive rework. This limits its overall contribution to the company's growth trajectory.

The challenge with these 'dog' categories is their resource intensity relative to their potential for widespread adoption. While they may generate revenue, the investment in customization often outweighs the potential for scaled returns. FactSet, for example, continually evaluates its product suite to ensure resources are allocated to offerings with greater growth and market penetration potential.

- Low Scalability: Solutions requiring extensive customization are inherently difficult to replicate across a broad client base.

- Limited Market Share Growth: The inability to scale restricts the potential for these products to gain significant market traction.

- Resource Allocation Concerns: High customization costs can divert resources from more scalable and potentially profitable ventures.

- Hypothetical Classification: Identifying specific 'dog' products requires internal company analysis; this is a general framework application.

Within FactSet's vast data and analytics ecosystem, certain legacy data feeds or niche analytical tools might be categorized as 'dogs' in a BCG matrix. These are offerings with low market share and low growth prospects, often requiring ongoing maintenance without significant strategic upside. For instance, a data product catering to a rapidly shrinking industry segment or an older, less integrated analytics platform could fit this description.

By 2024, FactSet, like many data providers, likely has some offerings that fall into this 'dog' category. These might include older datasets that are no longer actively developed or specialized tools with limited client adoption due to market shifts or technological advancements. The key challenge is to identify these assets and decide on their continued support or divestiture to optimize resource allocation toward higher-potential products.

For example, a specific regional data feed that has seen minimal new client acquisition in the past few years, coupled with a declining user base, would represent a 'dog' asset. Such offerings consume resources for upkeep but contribute little to FactSet's growth or competitive positioning, necessitating a strategic review to potentially redeploy those resources.

The strategic implication for FactSet is to continually assess its portfolio. Divesting or sunsetting 'dog' assets allows the company to focus investment on its 'stars' and 'question marks,' ensuring capital is directed towards areas with the greatest potential for future growth and profitability. This proactive portfolio management is crucial for maintaining market leadership in the dynamic financial data industry.

Question Marks

FactSet's new Enterprise AI Building Blocks and Conversational API, rolling out in late 2024 and early 2025, are designed to seamlessly integrate into client technology stacks. These offerings represent a significant strategic move to empower clients in developing their own AI-driven workflows, tapping into a rapidly expanding market need.

While these initiatives possess high growth potential, their current market share is low. This is typical for new entrants, as adoption requires clients to invest in integration and workflow customization, a process that naturally takes time to gain traction.

FactSet's Pitch Creator, launched in January 2025, is currently in its early adoption phase. While it boasts a strong pipeline and has secured initial deals, its status as a new GenAI solution means its long-term market penetration and ultimate market share remain uncertain.

The solution targets the high-growth area of automating investment banking pitchbook creation, a significant pain point for financial professionals. By leveraging generative AI, Pitch Creator aims to streamline a traditionally labor-intensive process, offering a competitive edge to early adopters.

FactSet's Intelligent Platform is set to roll out new workflow solutions in early 2025, including enhanced Portfolio Commentary features. This expansion targets a rapidly growing market fueled by the increasing need for AI-driven productivity and smarter decision-making in financial analysis.

These upcoming solutions represent FactSet's move into a high-growth segment, aiming to capture market share by offering advanced tools. While the demand for such AI-powered financial productivity tools is significant, FactSet's specific offerings in this niche are new, meaning their current market penetration is nascent.

New Geographic Market Expansions

FactSet, as a global financial data and technology provider, operates across numerous established markets. However, any strategic push into nascent, high-growth geographic regions where its current penetration is minimal would be classified as a question mark within the BCG framework. These emerging markets, while promising substantial future revenue, also carry inherent risks due to low initial market share and the uncertainty of customer adoption and competitive dynamics.

While FactSet boasts a global presence with offices in key financial centers, specific details on recent aggressive expansions into entirely new, untapped geographical markets are not explicitly highlighted in readily available public information. This lack of specific data on such ventures makes it challenging to pinpoint a direct 'question mark' product or service based on recent aggressive geographic market expansions. The company's growth strategy often involves deepening its presence in existing markets and expanding its product offerings to a broader client base.

- FactSet's Global Footprint: FactSet has offices in over 20 cities worldwide, serving clients in more than 150 countries, indicating a broad existing market reach.

- Emerging Market Potential: High-growth regions in Asia-Pacific and Latin America often present opportunities for financial data providers, but also require significant investment and market understanding.

- Hypothetical Question Mark Scenario: If FactSet were to launch a major initiative in a market like Vietnam or Nigeria, with limited prior presence, this would fit the question mark profile.

- Data Limitations: Public disclosures do not typically detail specific aggressive expansions into entirely new geographic markets as discrete strategic initiatives fitting the BCG question mark category.

Partnerships with AI Firms to Enhance Solutions

FactSet is actively forging partnerships with specialized artificial intelligence firms to bolster its existing offerings and expand its reach within the financial services sector. These strategic alliances are designed to infuse FactSet's solutions with advanced AI capabilities, tapping into what are considered high-growth potential areas.

These collaborations represent significant opportunities for FactSet to leverage cutting-edge AI technology. However, it's important to note that the current market share and overall impact of these AI integrations are still in their early stages. Their ultimate success hinges on the effective execution and mutual benefit derived from these ongoing collaborations.

- AI Integration: FactSet's partnerships aim to embed advanced AI, including machine learning and natural language processing, into its data analytics and workflow solutions.

- Market Potential: The financial services industry is increasingly adopting AI for tasks like risk management, fraud detection, and personalized client advice, indicating a substantial growth runway for AI-enhanced platforms.

- Nascent Stage: While promising, the tangible market share and proven impact of these specific AI partnerships are still developing, making them a key area to monitor for future growth.

- Dependency on Success: The long-term value and market penetration of these AI-driven enhancements are directly tied to the successful integration and adoption by financial professionals.

FactSet's new AI initiatives and product launches, such as Enterprise AI Building Blocks, Conversational API, and Pitch Creator, represent significant investments in high-growth areas. These offerings are designed to enhance client workflows and automate complex financial tasks, tapping into the burgeoning demand for AI-driven solutions in financial services.

These ventures, while promising substantial future revenue, are currently in their nascent stages of market penetration. Their classification as question marks in the BCG matrix stems from their low current market share and the inherent uncertainty surrounding their future success and ability to capture significant market share, despite the high growth potential of the underlying markets they target.

The success of these question mark initiatives hinges on effective client adoption, integration into existing workflows, and FactSet's ability to differentiate its offerings in a competitive landscape. Continuous monitoring of adoption rates and market feedback will be crucial in determining their trajectory towards becoming stars or cash cows.

For instance, FactSet's Pitch Creator, launched in early 2025, targets the high-growth market of automated pitchbook creation. While it has secured initial deals, its long-term market share is still an unknown, making it a classic question mark. Similarly, new AI-powered workflow solutions like enhanced Portfolio Commentary, also rolling out in early 2025, are entering a rapidly growing market but are new entrants with nascent penetration.

BCG Matrix Data Sources

Our BCG Matrix leverages FactSet's extensive financial databases, proprietary market research, and global economic reports to provide a comprehensive view of industry dynamics and company performance.