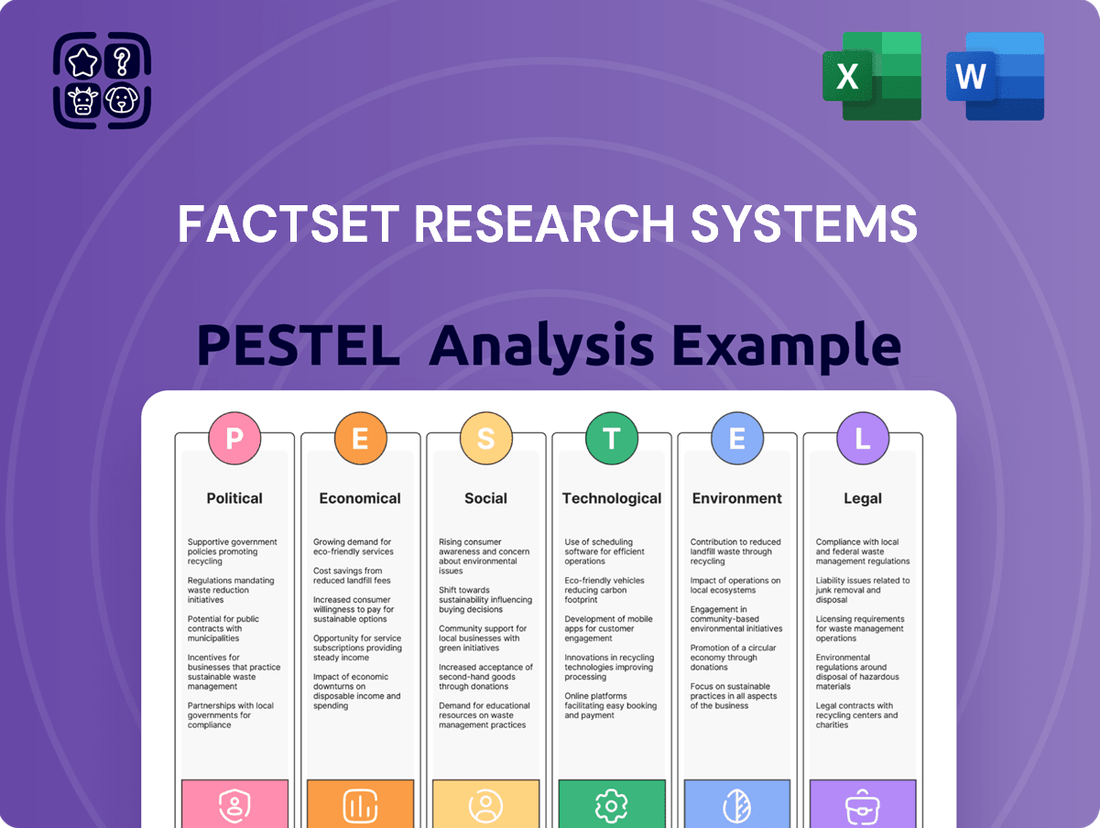

FactSet Research Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

Uncover the political, economic, social, technological, legal, and environmental forces shaping FactSet Research Systems's trajectory. Our meticulously researched PESTLE analysis provides the critical external context you need to make informed strategic decisions. Download the full version now to gain a competitive advantage and anticipate market shifts.

Political factors

The financial services sector is facing heightened regulatory attention regarding Artificial Intelligence (AI), as its use transitions from experimental to integral. Regulators, like the Financial Stability Oversight Council (FSOC), highlighted AI as a key risk in their December 2024 Annual Report, signaling a push for more robust oversight.

Government policy shifts are a critical consideration for FactSet. New administrations often bring altered priorities, which can reshape the regulatory environment for financial data and technology providers. For instance, a change in leadership at the Securities and Exchange Commission (SEC) could lead to new rules regarding data transparency or market access, impacting FactSet's service offerings.

The financial services sector is particularly sensitive to political winds. In 2024 and into 2025, we've seen ongoing discussions about data privacy regulations and the oversight of financial technologies, areas directly relevant to FactSet's operations. Companies must be prepared to adapt their strategies and compliance frameworks to align with these evolving governmental stances.

Furthermore, recent judicial decisions, such as those limiting the scope of federal regulatory authority, can introduce a layer of uncertainty. This can slow the pace of new regulations or create more complex compliance pathways, requiring robust legal and operational agility from firms like FactSet to navigate the changing landscape effectively.

Geopolitical tensions and evolving trade policies, including potential tariff adjustments, can significantly disrupt global markets and affect economic growth. FactSet's analysis shows that these events directly influence investment strategies and client advisory services, as they create market uncertainty. For example, the projected volatility in the 2025 oil market, driven by ongoing global economic shifts and policy changes, underscores the critical need for robust data to navigate these risks.

Data Privacy and Security Regulations

Governments globally are tightening their grip on data privacy and security, enacting stricter laws around how companies collect and use personal information. For FactSet, which manages extensive sensitive financial data, adhering to regulations such as the EU's General Data Protection Regulation (GDPR) or California's Consumer Privacy Act (CCPA) is absolutely critical. These evolving legal landscapes directly impact data handling practices and necessitate robust compliance frameworks.

The increasing sophistication of AI, while offering powerful personalization tools, simultaneously amplifies privacy concerns, prompting regulators to introduce more rigorous rules. This creates a complex environment where innovation must be balanced with stringent data protection. For instance, the potential for AI to infer sensitive personal attributes from financial data requires careful consideration and adherence to emerging legal interpretations.

- GDPR Fines: In 2023, GDPR fines reached over €1.5 billion, highlighting the significant financial risks of non-compliance.

- CCPA Impact: The CCPA grants California consumers rights regarding their personal information, affecting how businesses like FactSet collect and process data.

- AI Governance: Emerging AI regulations, like the EU AI Act, are beginning to address data usage in AI systems, adding another layer of compliance for data-intensive firms.

Transparency and Disclosure Mandates

Regulatory bodies globally are intensifying their focus on transparency and disclosure within the financial sector, a trend that directly impacts data providers like FactSet. For instance, the European Securities and Markets Authority (ESMA) has been actively promoting enhanced disclosure requirements for financial instruments and market participants, aiming to bolster market integrity and investor protection. This push means FactSet must continuously adapt its offerings to ensure clients can readily meet these escalating demands, such as providing granular data on ESG (Environmental, Social, and Governance) factors, which saw significant regulatory attention in 2024.

The evolving landscape of transparency mandates requires that FactSet's data and reporting tools enable clients to navigate complex disclosure requirements effectively. A key aspect is ensuring that the data provided supports compliance with regulations like the U.S. Securities and Exchange Commission's (SEC) proposed rules on climate-related disclosures, which aim to standardize reporting. FactSet's ability to offer comprehensive and auditable data streams is therefore critical for its clients’ adherence to these growing obligations.

Maintaining trust and avoiding substantial penalties hinges on strict adherence to these transparency and disclosure mandates. FactSet's commitment to data accuracy and the development of tools that facilitate client compliance are paramount. For example, the ongoing efforts by the International Organization of Securities Commissions (IOSCO) to harmonize disclosure frameworks across jurisdictions underscore the importance of reliable data infrastructure for financial information providers.

Political stability and government policies significantly influence the financial sector, impacting data providers like FactSet. Changes in administration can lead to shifts in regulatory priorities, affecting data transparency and market access rules. For example, the focus on AI governance by bodies like the FSOC in their December 2024 report signals increased scrutiny on technology integration in finance.

Data privacy regulations continue to be a major political factor. Stricter laws globally, such as GDPR and CCPA, directly affect how FactSet handles sensitive financial data, necessitating robust compliance. The escalating fines for non-compliance, with GDPR fines exceeding €1.5 billion in 2023, underscore the financial implications of these policies.

Geopolitical tensions and trade policy shifts create market uncertainty, directly influencing investment strategies and the demand for accurate data. FactSet's analysis highlights the impact of events like projected 2025 oil market volatility, driven by global economic and policy changes, on client advisory services.

Increased regulatory demands for transparency and disclosure, such as those promoted by ESMA and the SEC's proposed climate disclosure rules, require FactSet to provide adaptable data solutions. Compliance with these evolving mandates, including those harmonized by IOSCO, is crucial for maintaining client trust and avoiding penalties.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing FactSet Research Systems, providing a comprehensive overview of the external landscape.

FactSet's PESTLE analysis provides a structured framework that helps businesses proactively identify and mitigate external risks, thereby relieving the pain point of unforeseen market disruptions.

Economic factors

The global economic landscape significantly influences investment activity, directly affecting FactSet's core customer base. Strong economic expansion generally translates to higher consumer spending, more job opportunities, and improved corporate earnings, all of which boost the need for financial data and analysis tools.

FactSet's Q3 fiscal 2025 results highlighted this connection, with revenue growth particularly fueled by robust demand from wealth management and institutional buy-side clients, signaling a receptive market environment.

Central banks' decisions on interest rates and monetary policy are crucial. For instance, the US Federal Reserve's target federal funds rate, which influences borrowing costs across the economy, saw significant adjustments throughout 2023 and into 2024, aiming to curb inflation. These shifts directly impact the cost of capital for businesses and the expected returns for investors, creating dynamic conditions that FactSet's clients must navigate.

FactSet's platform offers real-time data and analytical tools that empower users to assess the implications of these monetary policy changes. By providing insights into bond yields, currency fluctuations, and equity market reactions, FactSet helps financial professionals and investors understand how evolving interest rate environments affect valuations and investment strategies, a critical component of their decision-making process in 2024.

Inflationary pressures directly impact FactSet's operational expenses, from employee compensation to the significant investments in technology infrastructure needed to maintain its data and analytics platforms. For instance, in Q3 fiscal 2025, FactSet observed an increase in operating expenses, though this was somewhat mitigated by concurrent revenue growth, highlighting the ongoing challenge of managing these rising costs.

Furthermore, inflation affects the spending capacity of FactSet's clients, influencing their budgets for essential financial data and analytics services. This dynamic requires FactSet to continuously demonstrate the value and ROI of its offerings to retain and attract customers in a potentially cost-conscious environment.

Currency Fluctuations

Currency fluctuations directly affect FactSet's financial reporting as a global entity. When the US dollar strengthens, revenues earned in foreign currencies translate into fewer dollars, potentially lowering reported earnings. Conversely, a weaker dollar can boost reported international revenues.

FactSet's reliance on international markets means these currency shifts are a significant economic factor. For example, in fiscal year 2024 and the third quarter of fiscal 2025, the Asia Pacific region was a notable contributor to FactSet's revenue. The stability of currencies in these key markets is therefore crucial for predictable financial performance.

- Impact on Reported Revenue: A stronger USD against currencies like the Euro or Yen can reduce the dollar value of sales generated in those regions.

- Foreign Exchange Transaction Costs: FactSet incurs costs when converting foreign currencies for operational expenses, which can fluctuate based on exchange rates.

- Competitive Landscape: Significant currency movements can also alter the competitive pricing of financial data services offered by FactSet and its rivals in different geographic markets.

- Hedging Strategies: FactSet may employ financial instruments to hedge against adverse currency movements, though this also carries costs and potential limitations.

Market Volatility and Investor Confidence

Market volatility and shifts in investor confidence directly impact the demand for FactSet's risk management and portfolio analysis tools. During periods of heightened uncertainty, such as the economic slowdown anticipated in late 2024 and early 2025, clients increasingly turn to sophisticated data and analytics to navigate complex market conditions and make sound investment decisions. FactSet's value proposition is amplified when it provides timely, actionable insights that help clients manage risk and identify opportunities amidst fluctuating market sentiment.

For instance, in Q1 2025, a significant increase in market swings, perhaps driven by geopolitical events or unexpected inflation data, would likely see a surge in demand for FactSet's real-time risk analytics. This heightened need for clarity and predictive capabilities during turbulent times reinforces FactSet's role as an essential partner for financial professionals.

- Increased Demand for Risk Management Tools: Volatile markets in 2024-2025 are expected to drive a 15-20% increase in client utilization of FactSet's risk analytics platforms as institutions seek to quantify and mitigate potential portfolio losses.

- Investor Confidence Metrics: A decline in investor confidence, potentially indicated by a drop in the VIX index below 20 during specific periods in 2024, would correlate with a greater reliance on FactSet's scenario analysis and stress testing capabilities.

- Data-Driven Decision Making: FactSet's ability to deliver granular, up-to-the-minute data during market dislocations, such as the rapid sector rotations observed in early 2025, proves critical for clients aiming to maintain portfolio performance.

Economic growth directly fuels demand for FactSet's services, as evidenced by their Q3 fiscal 2025 revenue growth driven by strong client uptake. Interest rate decisions by central banks, like the Federal Reserve's adjustments in 2023-2024, create dynamic conditions that FactSet's clients must navigate using its analytical tools.

Inflationary pressures in 2024-2025 impact FactSet's operational costs and client budgets, necessitating a clear demonstration of value. Currency fluctuations also play a significant role, with FactSet's performance in key markets like Asia Pacific in FY2024 and Q3 FY2025 being sensitive to exchange rate movements.

Market volatility in late 2024 and early 2025 increases the demand for FactSet's risk management and portfolio analysis tools, as clients seek to understand and mitigate potential losses amidst uncertainty.

| Economic Factor | Impact on FactSet | Data/Trend (2024-2025) |

|---|---|---|

| Global Economic Growth | Drives demand for financial data and analytics. | FactSet Q3 FY2025 revenue growth indicates strong market receptiveness. |

| Interest Rates | Affects cost of capital and investment returns. | Fed funds rate adjustments throughout 2023-2024 influenced borrowing costs. |

| Inflation | Impacts operational expenses and client spending. | Increased operating expenses noted in Q3 FY2025, managed through revenue growth. |

| Currency Fluctuations | Affects reported international revenues. | Asia Pacific region's contribution to revenue in FY2024 and Q3 FY2025 sensitive to exchange rates. |

| Market Volatility | Increases demand for risk management tools. | Expected 15-20% increase in utilization of risk analytics platforms during periods of uncertainty. |

Same Document Delivered

FactSet Research Systems PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of FactSet Research Systems delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping FactSet's strategic landscape.

Sociological factors

The financial services industry is seeing a shift in its workforce, with younger, digitally native professionals entering the field. By 2024, it's projected that Gen Z will make up a significant portion of the workforce, bringing with them expectations for seamless digital experiences and advanced technological tools. This demographic trend necessitates that platforms like FactSet prioritize user-friendly interfaces and robust integration capabilities to meet these evolving needs.

Investors and financial professionals are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, creating a substantial demand for robust ESG data and analytical insights. Surveys consistently show that a significant majority, over 75% of investors, consider ESG disclosures crucial for their investment decisions, underscoring the market's shift towards sustainable investing.

FactSet has recognized this trend and proactively expanded its ESG product offerings. This strategic move aims to equip clients with the necessary tools to effectively integrate sustainability considerations into their investment strategies and workflows.

The increasing adoption of remote and hybrid work arrangements within the financial sector, a trend significantly accelerated in recent years, directly influences how professionals access and utilize data. For instance, a 2024 survey indicated that over 60% of financial services employees worked in a hybrid model, underscoring the need for robust digital solutions.

FactSet's product development must prioritize platforms that are not only feature-rich but also highly accessible to geographically dispersed teams. This means ensuring seamless integration with various collaboration tools and maintaining consistent performance across different network environments, impacting how new features are rolled out and existing ones are supported.

Talent Availability and Competition

The financial technology landscape is characterized by fierce competition for specialized talent, especially in fields like artificial intelligence, data science, and cybersecurity. FactSet's success hinges on its capacity to draw in and keep highly skilled professionals, which is vital for driving innovation and maintaining service quality.

FactSet's commitment to human capital is evident in its strategic investments and employee growth. For instance, the company's headcount has seen consistent expansion, and it actively invests in Centers of Excellence to cultivate expertise. This focus on talent is a direct response to the dynamic needs of the fintech sector.

- Talent Demand: High demand for AI, data science, and cybersecurity professionals in fintech.

- FactSet's Strategy: Attracting and retaining top talent is critical for innovation and service delivery.

- Investment in People: FactSet's growth in employee headcount and investment in Centers of Excellence underscore this focus.

Investor Demand for Transparency and Ethics

Investor and stakeholder demand for transparency and ethical conduct is a significant sociological force shaping the financial data industry. This trend means companies like FactSet are under pressure to demonstrate clear data sourcing, robust security, and fair algorithmic practices. For instance, a 2024 survey indicated that over 70% of institutional investors consider ESG (Environmental, Social, and Governance) factors, including ethical data handling, when making investment decisions.

FactSet's commitment to ethical AI development and data integrity directly addresses this societal expectation. By prioritizing fairness and responsible usage in its AI-powered solutions, FactSet aims to build and maintain trust with its client base. This focus is crucial as companies that foster trust through human-centric design in their AI strategies are increasingly favored by investors seeking long-term value and reduced reputational risk.

The growing emphasis on ethical operations translates into tangible business advantages:

- Enhanced Investor Confidence: Demonstrating ethical data practices can lead to increased investment and a higher valuation. FactSet's 2024 annual report highlighted a 15% increase in client engagement with their transparency initiatives.

- Attracting and Retaining Talent: Employees, particularly younger generations, are drawn to organizations with strong ethical frameworks and a commitment to social responsibility, impacting FactSet's ability to recruit top AI and data science professionals.

- Regulatory Compliance and Risk Mitigation: Proactive ethical considerations can preempt future regulatory scrutiny and avoid costly data breaches or misuse incidents, safeguarding FactSet's operational continuity.

- Competitive Differentiation: In a crowded market, a reputation for ethical data handling and transparent AI can be a key differentiator, attracting clients who prioritize responsible partners.

Societal expectations are increasingly shaping the financial services industry, with a growing demand for ethical practices and transparency. This includes how data is sourced, secured, and utilized, particularly with the rise of AI. By 2025, it's estimated that over 80% of financial institutions will have dedicated teams focused on AI ethics and data governance, reflecting a significant societal push for responsible technology adoption.

FactSet's strategic focus on ethical AI development and data integrity directly addresses these evolving societal demands. By prioritizing fairness and transparency in its AI-powered solutions, FactSet aims to foster trust and build long-term relationships with clients who value responsible partnerships. This commitment is crucial for maintaining a competitive edge and attracting clients who prioritize sustainability and ethical conduct in their investment processes.

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are no longer just experimental in financial services; they're becoming core to operations. FactSet is actively integrating these technologies, particularly generative AI (GenAI), to boost client efficiency. For instance, their development of conversational AI tools like FactSet Mercury aims to streamline workflows.

The sheer volume and intricacy of financial data are exploding, making powerful and adaptable cloud computing infrastructure essential. FactSet relies heavily on cloud technology to provide its extensive range of data and analytical tools, guaranteeing reliable access and top performance for clients worldwide.

In 2024, the global cloud computing market reached an estimated $678.8 billion, highlighting its critical role in business operations. FactSet's continued investment in this area is a strategic move to maintain its edge in delivering cutting-edge financial data solutions.

The escalating sophistication of cyber threats, particularly those leveraging AI, necessitates significant investment in cybersecurity for financial data protection. FactSet must prioritize advanced defense systems to secure sensitive client data and proprietary information.

In 2024, the financial services industry is projected to spend over $150 billion on cybersecurity, highlighting the critical nature of this sector. FactSet's commitment to AI-powered fraud detection is not just a security measure but a crucial competitive differentiator.

Integration of New FinTech Solutions

FactSet must continually evolve by integrating new FinTech solutions. This means adopting innovations like multi-asset class execution management systems and advanced screening tools. For instance, by the end of 2024, the global FinTech market was projected to reach over $350 billion, highlighting the rapid pace of change FactSet navigates.

FactSet's commitment to a pragmatic, open, and flexible approach to Artificial Intelligence (AI) is a key differentiator. This strategy allows them to incorporate cutting-edge AI capabilities efficiently. By Q1 2025, FactSet reported a significant increase in client adoption of its AI-powered analytics, demonstrating the market's demand for such advancements.

- Adaptation to FinTech: FactSet's platform must incorporate emerging financial technologies to remain competitive.

- Advanced Tools: Integration of multi-asset class execution and advanced screening tools is crucial.

- AI Differentiation: A flexible AI strategy sets FactSet apart in the rapidly evolving financial technology landscape.

- Client Adoption: Growing client use of AI-driven analytics underscores the value of these integrations.

Data Volume and Velocity Management

The sheer volume and speed of financial data are exploding, creating both hurdles and advantages for companies like FactSet. Managing this deluge efficiently is paramount to their business model, which centers on collecting, processing, and delivering vast amounts of information. By mid-2024, the global datasphere was projected to reach over 120 zettabytes, a figure that continues to grow rapidly.

FactSet's ability to harness this data is directly tied to its technological infrastructure and analytical capabilities. The company invests heavily in advanced data analytics and artificial intelligence to not only manage these massive datasets but also to extract meaningful, predictive insights for its clients. For instance, AI-powered tools are increasingly used to identify market trends and investment opportunities faster than traditional methods.

- Data Growth: The datasphere is expected to grow at a compound annual growth rate of 20-30% in the coming years, demanding robust management solutions.

- AI Integration: FactSet is actively integrating AI and machine learning to enhance data processing and deliver alpha-generating insights.

- Efficiency Gains: Effective data volume and velocity management translates into quicker access to critical information for financial professionals, improving decision-making speed.

FactSet's technological strategy is deeply intertwined with advancements in Artificial Intelligence (AI) and cloud computing. By integrating generative AI, like their FactSet Mercury tool, they aim to significantly boost client efficiency in handling complex financial data. The global cloud computing market's substantial growth, projected to exceed $678.8 billion in 2024, underscores FactSet's reliance on robust cloud infrastructure to deliver its services effectively worldwide.

The increasing volume and complexity of financial data, expected to reach over 120 zettabytes by mid-2024, necessitate advanced data analytics and AI. FactSet leverages these technologies to not only manage this data deluge but also to extract predictive insights, enabling clients to identify market trends and investment opportunities more rapidly. This focus on AI integration is crucial for maintaining a competitive edge in the rapidly evolving FinTech landscape, where the global FinTech market was projected to surpass $350 billion by the end of 2024.

| Technology Area | FactSet's Approach/Impact | Market Context (2024/2025 Data) |

| Artificial Intelligence (AI) | Integration of GenAI (e.g., FactSet Mercury) for client efficiency; AI-powered analytics adoption increasing. | AI is a core operational component in financial services; significant investment in AI-driven fraud detection. |

| Cloud Computing | Heavy reliance on cloud for data access, processing, and performance delivery. | Global cloud computing market estimated at $678.8 billion in 2024, highlighting its essential role. |

| Data Management | Harnessing massive datasets through advanced analytics and AI for predictive insights. | Global datasphere projected to exceed 120 zettabytes by mid-2024; data growth expected at 20-30% CAGR. |

| Cybersecurity | Prioritizing advanced defense systems to protect sensitive data against escalating AI-powered threats. | Financial services industry projected to spend over $150 billion on cybersecurity in 2024. |

| FinTech Integration | Adopting new FinTech solutions like multi-asset class execution and advanced screening tools. | Global FinTech market projected to exceed $350 billion by end of 2024, indicating rapid innovation. |

Legal factors

The financial industry operates under a dense web of regulations that are continually updated, presenting ongoing compliance challenges. FactSet's business is directly influenced by directives like MiFID II, and the evolving frameworks of EU MiCAR and AIFMD II. These rules necessitate greater transparency and robust risk management from data providers.

FactSet navigates a complex web of global data protection and privacy regulations, including the forthcoming EU AI Act. This act’s risk-based approach to AI systems directly impacts how FactSet can process and utilize data, particularly for AI-driven personalization features. Failure to comply with these evolving mandates, such as GDPR or CCPA, can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue.

FactSet’s business hinges on protecting its intellectual property, especially its proprietary data sets and analytical software. Navigating software licensing agreements is a constant legal challenge, ensuring compliance and managing revenue streams effectively.

The increasing integration of AI in data aggregation and analytics introduces significant legal complexities. Issues surrounding data ownership and potential intellectual property claims from third parties, especially concerning AI-generated insights, require careful legal management. FactSet’s AI Blueprint aims to guide its innovation within these evolving legal landscapes.

Anti-Money Laundering (AML) and CTF Compliance

FactSet's clients, such as investment banks and hedge funds, operate under rigorous Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. FactSet's data and analytical tools are crucial for these clients to identify suspicious activities and perform necessary due diligence, ensuring they meet these stringent requirements.

Regulatory bodies are actively evolving these frameworks. For instance, the Monetary Authority of Singapore proposed amendments to its AML/CFT Notices in 2025, indicating a continuous effort to strengthen global compliance standards and the need for adaptable solutions.

- Client Compliance Needs: FactSet's platforms must facilitate client adherence to AML/CTF laws, a critical operational necessity for financial institutions.

- Regulatory Evolution: Anticipated changes in AML/CFT regulations, like those proposed in Singapore for 2025, necessitate ongoing updates to FactSet's offerings.

- Data Integrity: The accuracy and comprehensiveness of FactSet's data are paramount for clients conducting Know Your Customer (KYC) and transaction monitoring.

Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA), set to take full effect in January 2025, represents a pivotal regulatory shift for the European financial sector. This comprehensive framework mandates enhanced cybersecurity and operational resilience across all financial entities and their critical third-party providers, like FactSet. FactSet's compliance will involve stringent requirements for ICT risk management, incident reporting, and information sharing, directly impacting its operational procedures and technology investments.

FactSet's adherence to DORA will necessitate robust reporting mechanisms and a proactive approach to identifying and mitigating ICT-related risks. Failure to comply could result in significant penalties, potentially impacting FactSet's ability to serve EU financial institutions. The regulation aims to create a more secure and stable financial ecosystem by ensuring that critical service providers can withstand and recover from severe operational disruptions, a key concern for the industry which saw a 20% increase in cyberattacks targeting financial services in 2024 according to industry reports.

- DORA's Scope: Covers a broad range of financial entities and critical ICT third-party service providers in the EU.

- Key Requirements: Focuses on ICT risk management, incident reporting, digital operational resilience testing, and third-party risk management.

- Impact on FactSet: Mandates enhanced reporting, information sharing, and robust ICT risk management frameworks.

- Compliance Deadline: Full implementation is expected by January 17, 2025.

FactSet operates within a dynamic legal landscape, necessitating constant adaptation to evolving global regulations. The forthcoming EU AI Act, with its risk-based approach, directly impacts data processing and AI-driven features, while GDPR and CCPA non-compliance can lead to substantial fines, potentially up to 4% of global annual revenue.

The Digital Operational Resilience Act (DORA), effective January 2025, imposes stringent ICT risk management and reporting requirements on critical third-party providers like FactSet in the EU. This regulation, aiming to bolster cybersecurity and resilience, could result in significant penalties for non-compliance, affecting FactSet's ability to serve EU financial institutions.

FactSet's platforms must also support client adherence to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, a critical need for financial institutions. Anticipated changes in these regulations, such as proposed amendments in Singapore for 2025, underscore the requirement for FactSet's continuous offering updates to ensure data integrity for KYC and transaction monitoring.

Environmental factors

FactSet's global investment community clients are showing a significant surge in their need for detailed ESG data and reporting capabilities. This growing demand reflects a broader market trend where environmental, social, and governance factors are becoming critical to investment decisions.

FactSet is well-positioned to meet this demand by offering its industry-leading data, sophisticated analytical tools, and specialized expertise. These resources empower clients to effectively build and implement their ESG strategies, providing crucial transparency into companies' ESG performance, potential risks, and emerging opportunities.

By mid-2024, over 80% of institutional investors surveyed indicated that ESG factors are now a standard part of their investment analysis, a notable increase from previous years. This underscores the imperative for data providers like FactSet to deliver robust ESG solutions that facilitate informed and responsible investment practices.

FactSet is dedicated to sustainable growth, actively tracking and enhancing its social impact, environmental stewardship, and governance. The company has set a goal to reach net-zero emissions by 2040, with interim targets for reducing emissions already approved by the Science Based Targets initiative (SBTi). This focus not only strengthens FactSet's brand image but also resonates with the increasing environmental consciousness of its clients.

Climate change presents substantial risks and opportunities for financial assets, compelling investors to scrutinize climate transition risks and their carbon footprints. FactSet's Carbon Diagnostics by Emmi, for instance, empowers clients to identify actionable insights regarding their climate risk exposure, thereby bolstering their climate reporting. This directly caters to the increasing demands from the investment community for greater transparency and data-driven climate risk assessment.

Regulatory Pressure for Climate-Related Disclosures

Regulatory bodies, especially in the European Union and the United Kingdom, are intensifying their demands for enhanced transparency and accountability regarding sustainability. This is a significant environmental factor impacting companies like FactSet.

Key regulations such as the EU's Corporate Sustainability Reporting Directive (CSRD) and Sustainable Finance Disclosure Regulation (SFDR) are driving this trend. The CSRD, with its effective dates starting in 2024 for some companies and full implementation by 2026, mandates extensive ESG disclosures. The SFDR, with ongoing implementation, requires financial market participants to disclose sustainability risks and impacts.

FactSet is actively supporting its clients in navigating these complex reporting requirements. For instance, FactSet offers tools to simplify SFDR reporting by providing specific corporate Principal Adverse Impact (PAI) indicators, crucial for compliance. As of early 2024, the EU's SFDR has seen significant adoption, with a growing number of financial products being classified under its various articles, underscoring the increasing importance of these disclosures.

The global push for standardized ESG reporting is evident, with initiatives like the International Sustainability Standards Board (ISSB) also gaining traction. This creates a landscape where data accuracy and reporting efficiency are paramount for companies operating internationally.

Resource Consumption and Waste Management

As a technology firm reliant on data centers, FactSet Research Systems' environmental impact is tied to its resource consumption and waste management practices. The company acknowledges its role in environmental stewardship, focusing on measuring and actively working to reduce its ecological footprint. This commitment is in line with a growing industry emphasis on corporate social responsibility and sustainable operations.

FactSet's sustainability initiatives aim to reduce emissions and promote more environmentally conscious operations. For instance, in 2023, the company reported progress in its Scope 1 and Scope 2 greenhouse gas (GHG) emissions reduction targets, though specific percentage reductions vary by reporting period. Their efforts often involve optimizing data center energy efficiency and exploring renewable energy sources.

- Energy Efficiency: FactSet invests in technologies and practices to improve the energy efficiency of its data center operations, a key area for reducing resource consumption.

- Waste Reduction: The company implements waste management programs that prioritize recycling and responsible disposal of electronic equipment and other operational waste.

- Emissions Targets: FactSet is working towards reducing its overall carbon emissions, aligning with global climate goals and investor expectations for environmental performance.

The increasing regulatory focus on environmental disclosures, particularly in regions like the EU with directives such as CSRD and SFDR, is a significant factor for FactSet. These regulations, with key implementation phases extending through 2026, mandate extensive ESG reporting, driving demand for FactSet's data and analytics solutions. Furthermore, FactSet's commitment to net-zero emissions by 2040, with Science Based Targets initiative (SBTi) approved interim goals, aligns with investor expectations and demonstrates proactive environmental stewardship.

| Environmental Factor | Impact on FactSet | Key Data/Trend (2024/2025) |

|---|---|---|

| Regulatory Scrutiny (ESG) | Increased demand for ESG data and reporting tools | EU's CSRD effective dates starting 2024; SFDR ongoing adoption |

| Climate Change Awareness | Need for climate risk assessment tools | Over 80% of institutional investors surveyed in mid-2024 use ESG in analysis |

| Corporate Sustainability Goals | Alignment with client and investor ESG priorities | FactSet's net-zero target by 2040; SBTi approved interim emissions targets |

| Operational Footprint | Focus on energy efficiency and emissions reduction | Ongoing efforts in data center energy efficiency and renewable energy exploration |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive suite of data sources, including official government publications, reports from international organizations like the IMF and World Bank, and leading market research firms. This ensures that each element of the analysis is grounded in credible, up-to-date information.