EZCORP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

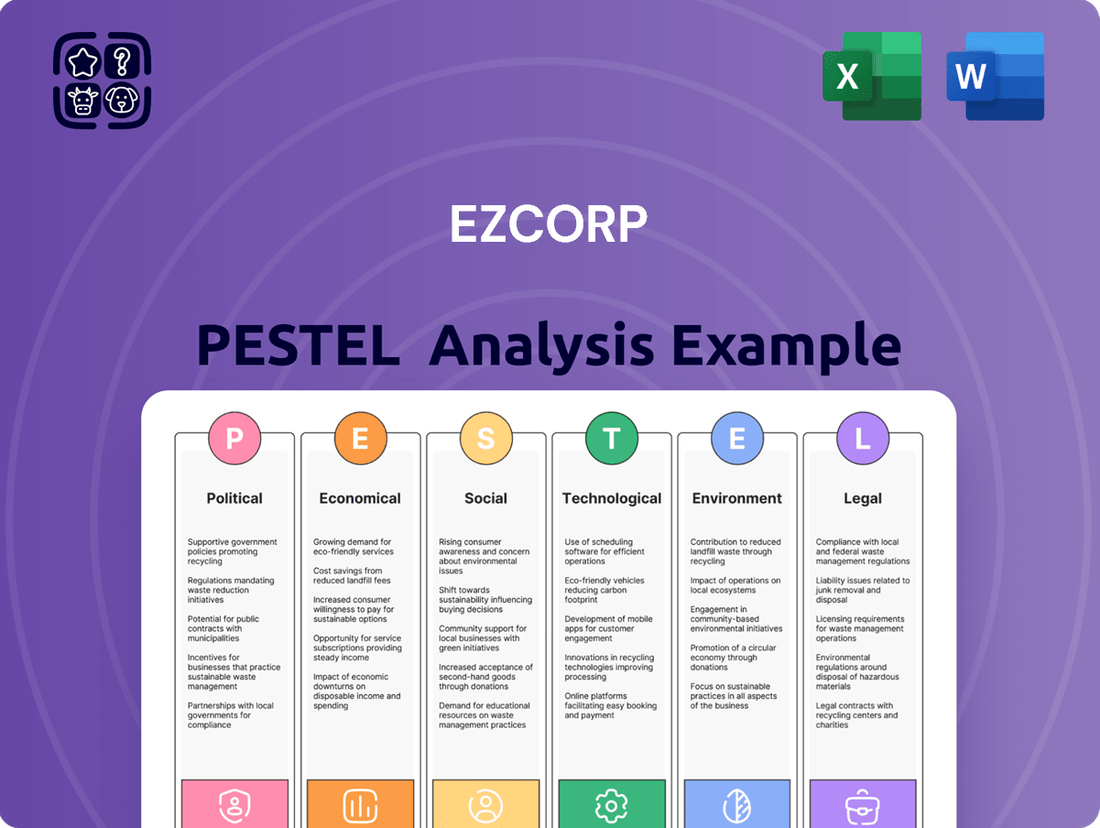

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping EZCORP's trajectory. Our meticulously researched PESTLE analysis provides the deep insights you need to anticipate market shifts and make informed strategic decisions. Download the full version now to gain a decisive advantage.

Political factors

Government policies and regulations, from federal to local levels, heavily influence EZCORP's short-term lending operations, especially concerning interest rates, loan durations, and transparency requirements for pawn loans. For instance, in 2024, many states continued to review and, in some cases, tighten regulations on payday and short-term lending, with some proposing caps on Annual Percentage Rates (APRs) that could impact EZCORP's revenue streams.

These evolving regulatory landscapes directly affect EZCORP's profitability and operational agility. A shift towards stricter consumer protection laws, such as those seen in certain states mandating clearer fee disclosures or limiting the number of rollovers allowed on short-term loans, necessitates ongoing adaptation to ensure compliance and maintain market relevance.

EZCORP's operations, particularly in Latin America, are sensitive to political stability. For instance, the region has seen varying degrees of political stability, with countries like Mexico and Colombia experiencing periods of both progress and uncertainty in recent years. These shifts can directly impact business continuity and the security of investments.

Political unrest or significant policy changes can introduce substantial risks for EZCORP. Examples include the potential for expropriation of assets, the imposition of currency controls, or the introduction of new, less favorable regulations. These factors can significantly affect EZCORP's foreign operations and, consequently, its overall financial performance, as seen in past instances across emerging markets.

Consumer protection agencies, such as the Consumer Financial Protection Bureau (CFPB) in the United States, significantly influence the operational landscape for companies like EZCORP. Their enforcement priorities, especially concerning lending practices and disclosure requirements, can directly impact business models. For instance, the CFPB's ongoing focus on fair lending and transparency in the payday loan sector, a key area for EZCORP, means that any shifts in their regulatory stance or enforcement actions could necessitate costly adjustments to EZCORP's product offerings or operational procedures. In 2024, the CFPB continued its robust enforcement, issuing significant penalties for violations, underscoring the need for EZCORP to remain highly vigilant on compliance.

Lobbying Efforts by the Pawn Industry

The pawn industry, including major players like EZCORP, actively engages in lobbying to shape regulations. Industry associations advocate for policies that support their business model, potentially influencing legislation related to interest rates, collateral valuation, and customer protections. For instance, the National Pawnbrokers Association (NPA) consistently works to educate lawmakers on the industry's role in providing access to short-term credit and the economic benefits it offers communities. Their efforts aim to prevent overly burdensome regulations that could hinder operations or increase compliance costs.

These lobbying efforts can directly impact EZCORP's financial performance by affecting operational costs and revenue potential. Favorable legislation can mean more flexibility in setting fees or less stringent reporting requirements. Conversely, restrictive laws, often proposed to protect consumers from perceived predatory practices, could limit EZCORP's ability to generate income from its core services. The effectiveness of these advocacy campaigns is crucial in maintaining a stable and profitable operating environment.

- Industry associations like the NPA represent the interests of pawn brokers, including EZCORP, in legislative arenas.

- Lobbying focuses on promoting favorable regulations and opposing restrictive measures that could impact profitability.

- Successful advocacy can lead to a more conducive business environment, potentially mitigating adverse policy changes.

- The financial impact on EZCORP hinges on the industry's ability to influence legislative outcomes regarding fees, collateral, and consumer protection.

Trade Policies Affecting Merchandise Sourcing

EZCORP's reliance on globally sourced merchandise makes it susceptible to shifts in international trade policies. For instance, the implementation or alteration of tariffs on goods imported into the United States, EZCORP's primary market, directly impacts the landed cost of its products. These duties can escalate operational expenses, forcing adjustments to pricing strategies to maintain profitability.

Changes in trade agreements, such as renegotiated terms or new pacts, can also create uncertainty. These shifts can affect the availability and cost of specific product categories that EZCORP offers. For example, if a key supplier country faces new import restrictions, it could lead to inventory shortages or necessitate finding alternative, potentially more expensive, sourcing options.

Consider the impact of potential tariffs on consumer electronics or apparel, categories often found in discount retail. An increase in import duties on these items could raise EZCORP's cost of goods sold significantly. In 2024, global trade tensions and the potential for new tariffs remain a persistent factor for retailers managing international supply chains.

- Tariff Impact: Increased import duties directly raise EZCORP's sourcing costs for globally sourced merchandise.

- Trade Agreement Volatility: Fluctuations in trade pacts can disrupt supply chains and product availability.

- Profit Margin Squeeze: Higher inventory costs necessitate careful pricing adjustments to protect profit margins.

Government policies and regulations, particularly concerning interest rates and consumer protection, directly influence EZCORP's lending operations. In 2024, several states continued to review and potentially tighten regulations on short-term lending, including proposed APR caps that could affect revenue.

Political stability in regions where EZCORP operates, such as Latin America, is crucial. Fluctuations in political climates in countries like Mexico and Colombia can impact business continuity and investment security, as seen with past instances of policy shifts in emerging markets.

Consumer protection agencies, like the CFPB, play a significant role. Their focus on fair lending and transparency in 2024, leading to substantial penalties for violations, requires EZCORP to maintain strict compliance with evolving disclosure and lending practice requirements.

Industry lobbying efforts, spearheaded by groups like the National Pawnbrokers Association, aim to shape legislation favorably for EZCORP. These efforts focus on issues like interest rate flexibility and reporting requirements, with the goal of preventing overly restrictive laws that could hinder profitability.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces influencing EZCORP, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within EZCORP's operating landscape.

Provides a clear, actionable framework that helps EZCORP identify and mitigate external threats, thereby reducing uncertainty and supporting strategic decision-making.

Economic factors

Fluctuations in benchmark interest rates, like the Federal Funds Rate, directly influence EZCORP's cost of capital and its capacity to offer competitive loan rates. For instance, the Federal Reserve maintained its target range for the federal funds rate between 5.25% and 5.50% throughout much of 2024, a historically elevated level.

While pawn loans are secured, a sustained high-interest rate environment could indirectly affect consumer demand for alternative credit options or increase the cost of financing EZCORP's operational needs, potentially impacting overall profitability.

In the United States, the unemployment rate held steady at 3.9% in April 2024, a slight uptick from 3.8% in March, indicating a potentially stable but not rapidly improving labor market. This environment can sustain demand for EZCORP's short-term loan products as individuals may still face liquidity needs despite a generally low unemployment figure.

Economic growth projections for the US in 2024 suggest a moderate expansion, with the Congressional Budget Office (CBO) forecasting 2.3% GDP growth for the year. While this indicates a healthy economy, it doesn't necessarily signal a surge in consumer confidence that would eliminate the need for quick cash solutions.

Conversely, if unemployment were to rise significantly or economic growth were to falter, EZCORP could see an increased demand for its services. For instance, a hypothetical scenario where the US unemployment rate climbed to 5% would likely correlate with a higher volume of customers seeking short-term, non-recourse loans to bridge financial gaps.

Inflation directly impacts EZCORP by affecting consumer spending and the value of collateral. As of May 2024, the U.S. Consumer Price Index (CPI) showed a 3.3% annual increase, indicating sustained inflationary pressures. This can boost demand for EZCORP's services as consumers seek short-term financial solutions, but it also raises operational expenses and could devalue pawned goods.

Changes in disposable income are crucial for EZCORP's customer base. With U.S. real disposable income growing modestly in early 2024, consumers may have slightly more capacity for loan repayment or redemption of pawned items. However, persistent inflation can still strain household budgets, potentially leading to increased default rates or a greater reliance on pawn services.

Consumer Spending and Credit Availability

Consumer spending patterns significantly influence EZCORP's business. When consumers feel financially secure and have disposable income, they are less likely to need pawn services. Conversely, economic uncertainty or a slowdown in consumer spending can increase demand for short-term, secured loans that EZCORP provides.

The availability of traditional credit from banks and other financial institutions plays a crucial role. When conventional lending tightens, making it harder or more expensive for individuals to access loans, pawn shops often see an uptick in business. For example, during periods of higher interest rates, consumers might turn to pawn services as a more accessible, albeit often more costly, alternative.

- Consumer spending in the US showed resilience through early 2024, with retail sales increasing by 0.7% in January, indicating ongoing demand for goods.

- However, credit card debt reached a record high of $1.13 trillion in Q4 2023, suggesting increasing reliance on credit and potential future strain on consumer finances.

- The Federal Reserve's benchmark interest rate remained elevated in early 2024, making traditional bank loans more expensive and potentially driving some consumers towards alternative lenders like EZCORP.

Currency Exchange Rate Fluctuations

EZCORP's significant presence in Latin America means that fluctuations in currency exchange rates, particularly between the US dollar and local currencies like the Mexican peso or Brazilian real, directly influence its reported financial results. For instance, a substantial depreciation of these local currencies against the USD in 2024 could lead to a lower reported revenue and profit when EZCORP consolidates its earnings. This directly impacts the perceived financial health and investment attractiveness of the company.

The impact is tangible; if a local currency weakens by 10% against the dollar, the dollar-denominated value of profits earned in that local currency decreases by the same proportion. This can significantly affect EZCORP's overall profitability and the return on its investments in these regions, making hedging strategies crucial for mitigating these risks.

- 2024: Mexican Peso Depreciation: The Mexican peso experienced notable volatility in early 2024, at times depreciating against the US dollar, which would have negatively impacted EZCORP's reported USD earnings from its Mexican operations.

- 2024: Brazilian Real Volatility: Similarly, the Brazilian real showed significant fluctuations throughout 2024, presenting challenges for EZCORP in translating its Brazilian revenues and profits into US dollars at a favorable rate.

- Impact on Profitability: A 5% weakening of a key Latin American currency could reduce EZCORP's consolidated net income by a measurable percentage, directly affecting earnings per share.

- Investment Returns: Currency depreciation can erode the dollar value of assets held in foreign subsidiaries, thereby lowering the effective return on EZCORP's foreign direct investments.

Elevated interest rates throughout 2024, with the Federal Funds Rate target range at 5.25%-5.50%, increase EZCORP's cost of capital and could make traditional credit less attractive, potentially boosting demand for pawn services. Despite a low unemployment rate of 3.9% in April 2024, modest GDP growth of 2.3% projected for the US in 2024 suggests continued consumer need for short-term financial solutions. Inflation, evidenced by a 3.3% CPI increase in May 2024, can drive demand for EZCORP's services but also raises operational costs and impacts collateral value.

| Economic Factor | 2024 Data Point | Impact on EZCORP |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (target range) | Increases borrowing costs, potentially drives customers to pawn services |

| US Unemployment Rate | 3.9% (April 2024) | Indicates stable demand for short-term loans |

| US GDP Growth (Projected) | 2.3% (CBO forecast) | Suggests continued need for quick cash solutions despite economic health |

| US CPI Inflation | 3.3% (May 2024) | Boosts demand but increases operational costs and affects collateral value |

Preview Before You Purchase

EZCORP PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EZCORP PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a strategic understanding of its operating landscape.

Sociological factors

Societal views on pawn shops can impact EZCORP's customer acquisition. While some see pawn services as a quick, accessible solution for short-term financial needs, others may associate them with desperation or predatory lending, creating a hurdle for broader acceptance.

EZCORP can counter negative perceptions by highlighting its role in providing essential liquidity, particularly in challenging economic times. For instance, during periods of economic uncertainty, like the inflationary pressures seen in late 2023 and early 2024, individuals often seek alternative financial avenues, and normalizing pawn services as a practical tool for managing temporary cash flow gaps is key.

Demographic shifts are significantly reshaping EZCORP's operational landscape. For instance, the increasing median age in many developed nations, projected to reach over 44 years by 2050, means a larger segment of potential customers may require accessible, short-term financial solutions. Simultaneously, immigration patterns introduce diverse customer needs that traditional banking often overlooks, creating opportunities for EZCORP to expand its reach.

These demographic changes directly influence EZCORP's target customer base. As income inequality widens, with the top 1% holding an increasing share of global wealth, a substantial portion of the population may find themselves outside the purview of conventional financial services. This presents a clear avenue for EZCORP to enhance financial inclusion by offering tailored products and services to these underserved communities.

Financial literacy is a key sociological factor influencing EZCORP's customer base. In the US, for instance, a 2023 FINRA study revealed that only 57% of Americans could answer basic financial literacy questions correctly. This means a significant portion of the population may struggle to fully grasp the terms and implications of EZCORP's financial products, necessitating simplified communication and potentially educational outreach.

Lower financial literacy can also correlate with increased vulnerability to predatory lending practices, which could indirectly impact EZCORP's reputation and regulatory scrutiny. Conversely, a more financially savvy populace might be more inclined to utilize services offering transparent terms and competitive rates, potentially benefiting EZCORP if its offerings align with these expectations.

Changing Consumer Preferences for Financial Services

Consumers increasingly demand financial services that are convenient, accessible digitally, and tailored to their specific needs. This shift is evident in the growing adoption of mobile banking and online investment platforms. For instance, by the end of 2024, it's projected that over 80% of banking customers will utilize mobile banking features, highlighting the critical need for digital integration.

EZCORP needs to actively respond to these evolving preferences to stay competitive. This means enhancing its digital footprint, possibly through a more robust mobile app or expanded online service offerings. Failing to adapt could lead to a loss of market share to more digitally agile competitors.

- Digital Adoption: Mobile banking usage is expected to reach 85% of retail banking customers in the US by the end of 2025.

- Personalization Demand: A 2024 survey indicated that 70% of consumers prefer financial institutions that offer personalized advice and product recommendations.

- Convenience Factor: Over 60% of consumers cite convenience as the primary driver when choosing a financial service provider.

Socioeconomic Inequality and Demand for Alternative Credit

Socioeconomic inequality directly fuels demand for alternative credit. In 2023, the U.S. Census Bureau reported that the median household income was $74,580, but significant disparities exist, with lower-income households often facing greater financial precarity. This gap means more individuals may turn to services like pawn loans when mainstream credit options are inaccessible or insufficient.

EZCORP’s market is particularly sensitive to these economic divides. For instance, regions with higher poverty rates, such as parts of the Deep South and Appalachia, often exhibit a greater reliance on non-traditional financial services. Data from the U.S. Department of Agriculture in 2023 indicated that food insecurity, a proxy for economic hardship, was more prevalent in these areas, underscoring the need for accessible, albeit often costly, credit solutions.

- Higher Income Inequality: In 2023, the Gini coefficient for the United States remained elevated, indicating persistent income disparities.

- Limited Banking Access: Approximately 4.5% of U.S. households were unbanked in 2022, with a higher concentration among lower-income and minority groups, creating a need for alternative financial providers.

- Emergency Financial Needs: A significant portion of the population lives paycheck to paycheck, making pawn shops a crucial resource for unexpected expenses like medical bills or car repairs.

- Demand Correlation: Pawn shop usage often increases during economic downturns or periods of high inflation, as seen in 2022-2023, when consumer prices rose significantly.

Societal perceptions of pawn shops significantly influence EZCORP's customer base, with some viewing them as essential for short-term cash needs while others perceive them negatively. EZCORP can address this by emphasizing its role in providing liquidity, especially during economic fluctuations like the inflation experienced in 2023-2024, positioning pawn services as a practical financial tool.

Demographic shifts, such as an aging population and increasing immigration, present EZCORP with opportunities to serve diverse and often underserved customer segments who may not be adequately catered to by traditional banking. This aligns with widening income inequality, where a growing number of individuals may seek alternative financial solutions outside conventional channels.

Financial literacy levels directly impact EZCORP's customer engagement; with a notable portion of the population struggling with basic financial concepts, clear communication and potentially educational initiatives are crucial. Consumers increasingly expect digital convenience and personalized services, as evidenced by the projected 85% mobile banking adoption by US retail customers by the end of 2025, requiring EZCORP to bolster its digital presence.

Socioeconomic inequality drives demand for alternative credit, with lower-income households often turning to services like pawn loans when mainstream options are unavailable. This trend is particularly pronounced in regions with higher poverty rates, where economic hardship necessitates accessible, albeit potentially costly, credit solutions.

| Sociological Factor | Impact on EZCORP | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Public Perception | Affects customer acquisition and brand image. | Mixed views: essential service vs. predatory lending. |

| Demographics | Influences target customer base and service needs. | Aging population and immigration create demand for accessible finance. |

| Financial Literacy | Impacts customer understanding and regulatory scrutiny. | Low financial literacy (57% in US in 2023) necessitates clear communication. |

| Consumer Expectations | Drives need for digital and personalized services. | 85% US mobile banking adoption by end of 2025; 70% prefer personalized advice. |

| Socioeconomic Inequality | Increases demand for alternative credit. | Elevated Gini coefficient in US (2023); 4.5% US households unbanked (2022). |

Technological factors

The ongoing digitalization of pawn services presents a significant technological factor for EZCORP. This trend allows for online appraisals, remote loan applications, and digital payment options, which directly boosts customer convenience and streamlines operations.

By embracing online platforms, EZCORP can extend its service area beyond its physical footprint, tapping into a broader, digitally engaged customer demographic. For instance, in 2024, the global online lending market was projected to reach over $1.7 trillion, highlighting the substantial opportunity for digital expansion in financial services.

EZCORP's utilization of big data analytics is a significant technological advantage, enabling more precise risk assessment in its lending operations. For instance, by analyzing vast datasets, the company can identify patterns indicative of potential default, leading to more informed lending decisions and potentially reducing charge-offs. This analytical capability is crucial in the current financial landscape, where understanding borrower behavior is paramount.

Furthermore, these advanced analytics allow EZCORP to effectively segment its diverse customer base. This segmentation facilitates highly targeted marketing campaigns, ensuring that product offerings and communication strategies resonate with specific customer needs and preferences. In 2024, many fintech companies reported increased customer acquisition and retention rates by over 15% through personalized digital outreach, a trend EZCORP can leverage.

As EZCORP's operations become more digitized, cybersecurity threats and data privacy concerns are significant technological factors. Protecting sensitive customer data from breaches and cyberattacks is crucial, especially given the increasing sophistication of these threats. In 2024, global cybersecurity spending is projected to reach $1.7 trillion, highlighting the scale of this challenge.

Maintaining customer trust through secure systems is paramount for EZCORP's reputation and legal compliance. Failure to protect data can lead to substantial financial penalties and loss of customer confidence. For instance, the average cost of a data breach in 2024 was estimated at $4.73 million globally.

Mobile App Development for Customer Engagement

Developing intuitive mobile applications is crucial for EZCORP to boost customer engagement. These apps offer seamless access to account details, real-time loan status, and convenient payment gateways, streamlining financial management for users.

A robust mobile strategy enhances customer convenience and cultivates loyalty. For instance, in 2024, a significant portion of consumers, estimated to be over 70%, preferred using mobile apps for banking and financial services, indicating a strong market preference for digital channels.

- Enhanced Accessibility: Mobile apps provide 24/7 access to EZCORP services, improving customer satisfaction.

- Streamlined Transactions: Features like in-app payments and loan applications simplify processes for users.

- Data Insights: Mobile usage generates valuable data on customer behavior, enabling personalized service offerings.

- Competitive Edge: A well-developed app can differentiate EZCORP in a crowded market, attracting tech-savvy consumers.

Inventory Management and E-commerce Platforms

Advanced inventory management and integrated e-commerce platforms are vital for EZCORP's success in handling forfeited merchandise. These technologies directly impact the efficiency of their retail operations, enabling wider customer access and dynamic pricing strategies. For instance, by mid-2024, e-commerce sales growth continued to outpace brick-and-mortar, with many specialized retailers reporting double-digit increases in online revenue streams.

These technological integrations allow EZCORP to optimize the sales velocity of its diverse inventory. By leveraging real-time data on stock levels and customer demand, the company can make quicker decisions regarding pricing and promotions, ensuring that forfeited items move efficiently through their retail channels. This digital backbone is essential for maintaining profitability in a competitive market.

- Streamlined Operations: Integrated systems reduce manual handling, minimizing errors and speeding up the sales process for forfeited goods.

- Expanded Market Reach: E-commerce platforms connect EZCORP to a national or even global customer base, increasing potential buyers for their inventory.

- Data-Driven Pricing: Real-time analytics enable dynamic pricing adjustments, maximizing revenue from each item.

- Improved Sales Velocity: Efficient inventory tracking and online visibility help to sell items faster, reducing holding costs.

The ongoing digitalization of pawn services presents a significant technological factor for EZCORP. This trend allows for online appraisals, remote loan applications, and digital payment options, which directly boosts customer convenience and streamlines operations.

By embracing online platforms, EZCORP can extend its service area beyond its physical footprint, tapping into a broader, digitally engaged customer demographic. For instance, in 2024, the global online lending market was projected to reach over $1.7 trillion, highlighting the substantial opportunity for digital expansion in financial services.

EZCORP's utilization of big data analytics is a significant technological advantage, enabling more precise risk assessment in its lending operations. For instance, by analyzing vast datasets, the company can identify patterns indicative of potential default, leading to more informed lending decisions and potentially reducing charge-offs. This analytical capability is crucial in the current financial landscape, where understanding borrower behavior is paramount.

Furthermore, these advanced analytics allow EZCORP to effectively segment its diverse customer base. This segmentation facilitates highly targeted marketing campaigns, ensuring that product offerings and communication strategies resonate with specific customer needs and preferences. In 2024, many fintech companies reported increased customer acquisition and retention rates by over 15% through personalized digital outreach, a trend EZCORP can leverage.

As EZCORP's operations become more digitized, cybersecurity threats and data privacy concerns are significant technological factors. Protecting sensitive customer data from breaches and cyberattacks is crucial, especially given the increasing sophistication of these threats. In 2024, global cybersecurity spending is projected to reach $1.7 trillion, highlighting the scale of this challenge.

Maintaining customer trust through secure systems is paramount for EZCORP's reputation and legal compliance. Failure to protect data can lead to substantial financial penalties and loss of customer confidence. For instance, the average cost of a data breach in 2024 was estimated at $4.73 million globally.

Developing intuitive mobile applications is crucial for EZCORP to boost customer engagement. These apps offer seamless access to account details, real-time loan status, and convenient payment gateways, streamlining financial management for users.

A robust mobile strategy enhances customer convenience and cultivates loyalty. For instance, in 2024, a significant portion of consumers, estimated to be over 70%, preferred using mobile apps for banking and financial services, indicating a strong market preference for digital channels.

Advanced inventory management and integrated e-commerce platforms are vital for EZCORP's success in handling forfeited merchandise. These technologies directly impact the efficiency of their retail operations, enabling wider customer access and dynamic pricing strategies. For instance, by mid-2024, e-commerce sales growth continued to outpace brick-and-mortar, with many specialized retailers reporting double-digit increases in online revenue streams.

These technological integrations allow EZCORP to optimize the sales velocity of its diverse inventory. By leveraging real-time data on stock levels and customer demand, the company can make quicker decisions regarding pricing and promotions, ensuring that forfeited items move efficiently through their retail channels. This digital backbone is essential for maintaining profitability in a competitive market.

| Key Technology Trend | Impact on EZCORP | Supporting Data (2024/2025 Estimates) |

| Digitalization of Pawn Services | Enhanced customer convenience, streamlined operations, broader market reach. | Global online lending market projected over $1.7 trillion. |

| Big Data Analytics | Improved risk assessment, targeted marketing, personalized customer experiences. | 15%+ increase in customer acquisition/retention via personalized digital outreach. |

| Mobile Application Development | Increased customer engagement, loyalty, and access to services. | Over 70% of consumers prefer mobile apps for financial services. |

| E-commerce & Inventory Management | Optimized retail operations, expanded sales channels, dynamic pricing for forfeited goods. | E-commerce sales growth outpacing brick-and-mortar, double-digit online revenue increases for specialized retailers. |

| Cybersecurity | Crucial for data protection, customer trust, and legal compliance. | Global cybersecurity spending projected at $1.7 trillion; average data breach cost $4.73 million. |

Legal factors

EZCORP navigates a complex landscape of state and federal lending laws, encompassing usury caps, truth-in-lending requirements, and specialized rules for pawn operations. For instance, the Military Lending Act (MLA) imposes strict limits on interest rates and fees for covered borrowers, a key consideration for any lender serving a broad demographic. Failure to adhere to these varied regulations across its numerous jurisdictions could result in significant penalties, costly litigation, and interruptions to its business.

As a financial service provider, EZCORP must navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to combat illicit financial activities, a crucial aspect for companies operating in the lending sector.

Compliance involves meticulous customer identification, ongoing transaction monitoring, and the mandatory reporting of any suspicious activities. For instance, in 2024, financial institutions globally invested billions in compliance technology and personnel to meet these evolving regulatory demands, impacting operational efficiency and increasing overhead costs for entities like EZCORP.

Data privacy is a growing concern, with regulations like California's Consumer Privacy Act (CCPA) and the EU's General Data Protection Regulation (GDPR) setting strict standards for how companies handle customer information. EZCORP must meticulously manage data collection, storage, and usage to avoid penalties, which can be substantial. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the critical need for compliance.

Consumer Credit Reporting Regulations

While EZCORP's core pawn loans are non-recourse, other financial services it offers, such as installment loans or rent-to-own agreements, can be subject to consumer credit reporting regulations. This means EZCORP must adhere to laws like the Fair Credit Reporting Act (FCRA) in the United States, which governs how consumer credit information is collected, used, and shared. Failure to comply can lead to significant legal penalties and reputational damage.

Compliance is crucial for maintaining accurate customer financial behavior reporting. For instance, under the FCRA, consumers have rights regarding the accuracy and privacy of their credit reports. EZCORP must ensure that the information it reports is accurate and that it has permissible purpose to access or report such data. In 2023, the Consumer Financial Protection Bureau (CFPB) continued to emphasize enforcement actions related to credit reporting, highlighting the ongoing regulatory scrutiny in this area.

- FCRA Compliance: EZCORP must ensure its reporting practices align with the FCRA's mandates for accuracy, fairness, and privacy in consumer credit information.

- Data Accuracy: Maintaining precise and up-to-date customer financial data is paramount to avoid disputes and potential legal challenges.

- Consumer Rights: Upholding consumer rights, including access to their credit reports and the ability to dispute inaccuracies, is a legal requirement.

- Regulatory Scrutiny: Continued enforcement actions by bodies like the CFPB underscore the importance of robust compliance programs for companies involved in consumer lending.

Licensing Requirements for Pawn Operations

Operating pawn shops, EZCORP's primary business, is heavily regulated, requiring specific licenses from state and local authorities in the U.S., and often national regulators in Latin American markets like Mexico. These licenses are crucial for legal operation and typically necessitate adherence to stringent financial, operational, and ethical standards. For instance, in Texas, where EZCORP has a significant presence, pawn shop operators must obtain a license from the Office of Consumer Credit Commissioner, with renewal processes ensuring ongoing compliance. Failure to maintain these licenses can result in significant penalties and operational disruptions.

EZCORP faces evolving legal frameworks impacting its lending and data handling practices. Strict adherence to consumer protection laws, such as the FCRA and MLA, is vital to prevent penalties and maintain customer trust. Ongoing compliance with AML/KYC regulations and data privacy mandates like CCPA and GDPR requires significant investment in technology and personnel, as seen by the billions spent globally in 2024 by financial institutions.

Environmental factors

EZCORP faces environmental considerations regarding the disposal or recycling of forfeited pawn collateral that doesn't sell or is deemed unsaleable. For instance, in 2023, the U.S. generated approximately 300 million tons of municipal solid waste, with a significant portion still ending up in landfills, highlighting the broader challenge of waste management across industries.

Implementing sustainable waste management practices is crucial for EZCORP. This includes exploring responsible disposal or recycling channels for diverse materials, from electronics to jewelry components. Such initiatives not only mitigate environmental impact but also bolster the company's corporate responsibility image, a factor increasingly valued by consumers and investors alike.

EZCORP's retail operations, like those of many in the sector, are significantly impacted by energy consumption. This includes the power needed for lighting, climate control systems, and the various electronic devices essential for daily business. These factors directly influence the company's environmental footprint.

Recent industry data from 2024 indicates that retail stores can account for a substantial portion of a company's overall energy usage, with lighting and HVAC systems being major contributors. For instance, a typical retail store might use upwards of 20 kilowatt-hours per square foot annually, depending on climate and store type.

By adopting energy-efficient technologies, such as LED lighting upgrades and smart thermostat systems, EZCORP has the potential to not only lower its operational expenses but also to make meaningful progress toward its sustainability objectives. Such initiatives are increasingly important for consumer perception and regulatory compliance in the 2024-2025 period.

Even though EZCORP's core business is pre-owned goods, any new merchandise or operational supplies it acquires must consider sustainable sourcing. For instance, if EZCORP were to purchase new branded packaging or cleaning supplies in 2024, it would be prudent to vet suppliers for their environmental impact. A growing consumer preference for sustainability, with 60% of consumers in a 2023 survey indicating they consider environmental impact when making purchasing decisions, means that even minor new inventory can affect brand perception.

Corporate Social Responsibility (CSR) Initiatives

EZCORP's commitment to Corporate Social Responsibility (CSR) is increasingly shaped by environmental concerns. As consumers and investors prioritize sustainability, companies are expected to demonstrate tangible efforts to mitigate their environmental impact. This includes initiatives like waste reduction and energy efficiency, which can bolster brand reputation and appeal to a growing segment of ethically minded investors. For instance, in 2024, a significant portion of global investment funds were allocated to ESG (Environmental, Social, and Governance) compliant companies, highlighting this trend.

Engaging in proactive environmental programs offers EZCORP strategic advantages. By focusing on areas such as reducing its carbon footprint or supporting local conservation efforts, the company can enhance its public image and attract socially conscious investors. This focus on sustainability is not just about compliance but also about building long-term value and resilience in a market that increasingly rewards responsible corporate behavior. Reports in early 2025 indicate a continued surge in demand for sustainable products and services, directly impacting company valuations.

- Environmental Focus: Growing consumer and investor demand for sustainable business practices.

- Brand Enhancement: CSR initiatives like recycling and carbon footprint reduction improve public perception.

- Investor Appeal: Attracting socially conscious investors who prioritize ESG factors.

- Market Trends: Alignment with the increasing market preference for environmentally responsible companies in 2024-2025.

Regulatory Pressure for Environmental Reporting and Compliance

EZCORP faces growing demands for environmental reporting and compliance, driven by both regulators and stakeholders. This means the company likely needs to enhance its systems for tracking and disclosing its environmental impact. For instance, by 2024, many jurisdictions have strengthened ESG (Environmental, Social, and Governance) disclosure requirements, pushing companies to be more transparent about their carbon footprint and resource management.

Adhering to these evolving environmental standards, such as those outlined by the Task Force on Climate-related Financial Disclosures (TCFD), is crucial. Demonstrating a commitment to sustainability not only builds trust but also helps EZCORP avoid potential fines and protect its brand reputation. Companies that proactively manage these risks are often better positioned for long-term success.

- Increased ESG Disclosure Mandates: Many governments are implementing stricter ESG reporting rules, with a significant uptick observed in requirements for publicly traded companies in 2024 and anticipated further expansion in 2025.

- Stakeholder Expectations: Investors and consumers are increasingly prioritizing companies with strong environmental track records, influencing corporate strategy and reporting practices.

- Compliance Costs: Implementing robust environmental tracking and reporting systems can involve upfront investment in technology and expertise.

- Reputational Risk Mitigation: Failure to comply with environmental regulations or meet stakeholder expectations can lead to significant reputational damage and loss of market share.

EZCORP's environmental considerations extend to waste management, energy consumption, and sustainable sourcing. The company must navigate the disposal of unsold collateral, manage energy use in its retail locations, and ensure any new inventory aligns with growing sustainability preferences. These factors directly impact its operational costs and brand perception in the 2024-2025 market.

The company is also subject to increasing environmental reporting mandates and stakeholder expectations regarding ESG performance. Proactive engagement in environmental programs can enhance EZCORP's public image and attract socially conscious investors, a trend strongly evident in 2024 and projected to continue into 2025.

| Environmental Factor | Impact on EZCORP | 2024-2025 Data/Trend |

|---|---|---|

| Waste Management | Disposal of unsold collateral | Growing consumer preference for sustainable practices; ~300 million tons of US municipal solid waste generated in 2023. |

| Energy Consumption | Retail operations (lighting, HVAC) | Retail stores can account for significant energy usage; typical store usage ~20 kWh/sq ft annually. |

| Sustainable Sourcing | New merchandise and operational supplies | 60% of consumers in a 2023 survey considered environmental impact in purchasing decisions. |

| ESG Reporting & Compliance | Stakeholder demands and regulatory requirements | Increased ESG disclosure mandates observed in 2024, with further expansion anticipated in 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for EZCORP is built on a robust foundation of data from official government publications, leading financial news outlets, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting EZCORP.