EZCORP Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

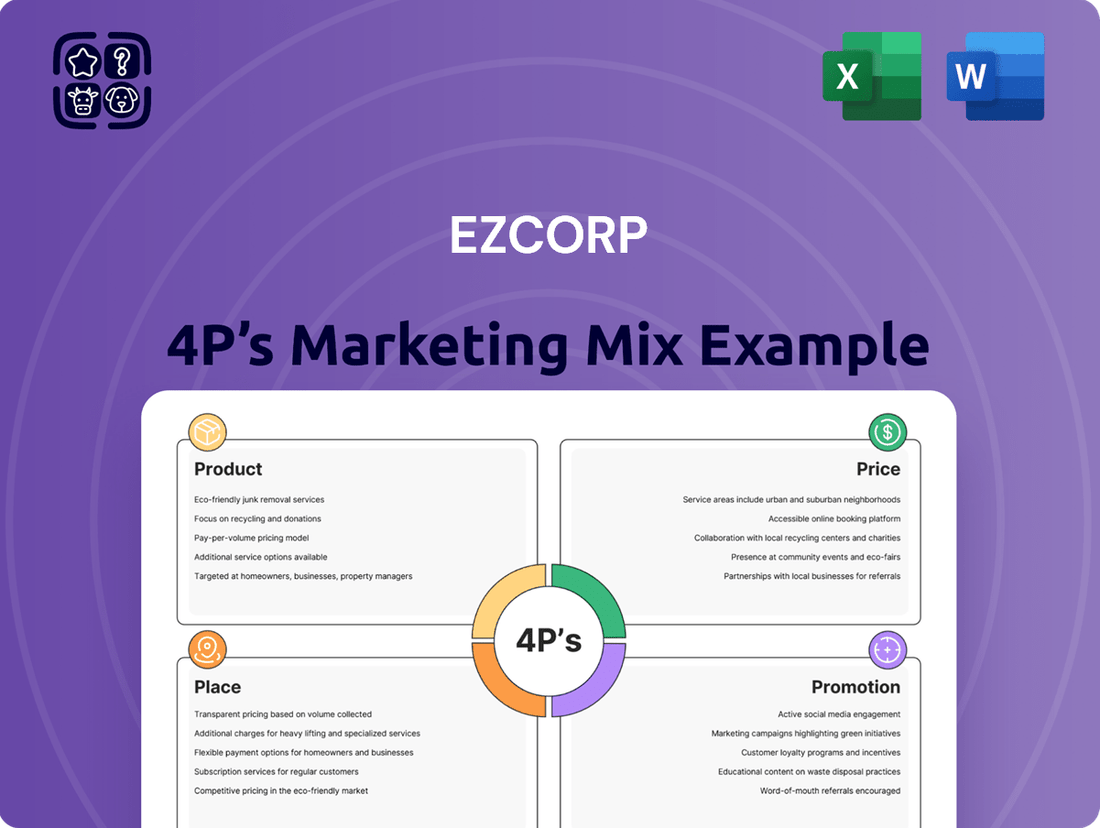

EZCORP's marketing strategy is a masterclass in leveraging its product offerings, competitive pricing, strategic placement, and targeted promotions to capture its market. Understanding how these elements synergize is key to grasping their success.

Dive deeper into EZCORP's product innovation, pricing structures, distribution networks, and promotional campaigns. Get the full, editable analysis to unlock actionable insights and strategic frameworks.

Product

EZCORP's primary offering is pawn loans, which are short-term, non-recourse loans backed by personal assets like jewelry, electronics, and tools. These loans cater to individuals needing immediate cash, providing a fast, private solution without requiring credit checks. The loan amount is determined by the collateral's value, which can fluctuate, for instance, with gold prices.

Merchandise sales are a vital component of EZCORP's offering, complementing its core lending services. The company generates revenue by selling a diverse array of pre-owned items, primarily sourced from forfeited pawn collateral and direct customer purchases.

This inventory features a strong emphasis on desirable categories such as jewelry and pre-owned luxury goods, appealing to a segment of budget-conscious consumers. In the fiscal year ending September 30, 2023, EZCORP reported that its merchandise sales segment contributed approximately 15% of its total revenue, demonstrating its significant impact on the company's financial performance.

EZCORP's jewelry scrapping sales represent a significant secondary revenue stream, leveraging forfeited collateral. This process involves extracting valuable precious metals like gold and silver from items not resold as merchandise. The profitability of this segment is directly influenced by fluctuations in commodity prices, with rising gold and silver prices in 2024 and projected for 2025 offering a strong tailwind.

Other Financial Services

While EZCORP's core business revolves around pawn loans, its "Other Financial Services" component has historically aimed to provide a broader spectrum of convenient, short-term cash solutions. Although specific past offerings like payday and auto title loans have been phased out in the U.S. market, the company's strategic approach continues to explore avenues that cater to immediate financial requirements.

This segment acknowledges EZCORP's adaptability in financial service provision. For instance, in fiscal year 2023, EZCORP reported total revenue of $784.6 million, with its pawn segment being the dominant contributor. The company's ongoing evaluation of its product mix suggests a commitment to meeting diverse customer needs beyond traditional pawn transactions.

The emphasis remains on quick, confidential, and accessible financial tools. EZCORP's strategy involves leveraging its established customer base and operational infrastructure to potentially introduce or adapt services that align with evolving market demands and regulatory landscapes. This includes a focus on digital solutions that enhance customer experience and operational efficiency.

- Historical Offerings: Previously included payday loans and auto title loans in the U.S.

- Current Focus: Emphasis on quick, convenient, and confidential short-term cash solutions.

- Strategic Adaptation: Ongoing evaluation of product mix to meet diverse customer needs and market demands.

- Revenue Context: EZCORP's total revenue reached $784.6 million in fiscal year 2023, highlighting the scale of its financial operations.

Protection Plan

EZCORP’s Protection Plan serves as a crucial element in their marketing mix, specifically addressing the 'Product' facet by bolstering customer confidence in pre-owned merchandise. This plan offers an extended layer of security for purchasers of items like computers and audio/video equipment, mitigating concerns associated with second-hand goods.

By providing this assurance, EZCORP demonstrates a strong commitment to customer satisfaction, making the purchase of pre-owned electronics a more appealing and less risky proposition. This directly tackles potential buyer hesitation, a common barrier in the resale market.

- Enhanced Value Proposition: The Protection Plan adds significant perceived value to EZCORP's pre-owned product offerings.

- Risk Mitigation for Consumers: It directly addresses the inherent risks associated with buying used electronics, offering peace of mind.

- Customer Loyalty Driver: Offering such a plan can foster greater customer loyalty and encourage repeat business.

- Competitive Differentiator: In the competitive resale market, a robust protection plan can set EZCORP apart from competitors.

EZCORP's product strategy centers on its core pawn loan service, supplemented by merchandise sales and jewelry scrapping. The company also offers a Protection Plan for pre-owned electronics, enhancing customer confidence. In fiscal year 2023, EZCORP generated $784.6 million in total revenue, with merchandise sales accounting for approximately 15%.

| Product Offering | Description | Key Financial Contribution (FY2023) | Strategic Importance |

|---|---|---|---|

| Pawn Loans | Short-term, collateral-backed loans | Dominant revenue contributor | Core business, immediate cash solution |

| Merchandise Sales | Sale of pre-owned items (jewelry, electronics) | ~15% of total revenue | Diversifies revenue, utilizes forfeited collateral |

| Jewelry Scrapping | Extraction of precious metals from collateral | Variable, dependent on commodity prices | Secondary revenue stream, leverages assets |

| Protection Plan | Extended warranty for electronics | N/A (Enhances sales of other products) | Boosts customer confidence, competitive differentiator |

What is included in the product

This analysis provides a comprehensive breakdown of EZCORP's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive landscape.

It's designed for professionals seeking a data-driven understanding of EZCORP's marketing mix, perfect for strategic planning, benchmarking, or internal reporting.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic overwhelm for EZCORP's leadership.

Provides a clear, concise overview of EZCORP's 4Ps, removing the burden of deciphering extensive marketing plans for busy executives.

Place

EZCORP's extensive physical retail network is a key component of its marketing strategy, with 1,284 stores as of Q2 fiscal 2025. This network is strategically spread across the United States (542 stores) and Latin America, including Mexico, Guatemala, El Salvador, and Honduras (742 stores). These locations serve as the primary touchpoints for customers seeking pawn loans, purchasing merchandise, and accessing other financial services, reinforcing their multi-channel engagement.

EZCORP strategically expands its retail footprint through both building new stores from scratch (de novo) and acquiring existing pawn shops. This dual approach is particularly focused on Latin America, where the company sees higher growth potential compared to the U.S. market, allowing for deeper penetration and better service to its core customer base.

This expansion drive is a key element of their growth strategy. For instance, in fiscal year 2024, EZCORP successfully added 21 new locations to its portfolio. This included the acquisition of one U.S. store and the establishment of 20 new stores primarily in Latin America, demonstrating a clear commitment to international market development.

EZCORP is prioritizing the seamless integration of its physical and digital touchpoints, a core tenet of its omnichannel strategy. This focus aims to create a unified customer journey, allowing for effortless transitions between in-store interactions and online engagement. For instance, in the first quarter of 2024, EZCORP reported a 15% increase in digital customer acquisition, highlighting the growing importance of its online presence in driving new business.

Digital Channel Enhancement

EZCORP is actively enhancing its digital channels, offering online platforms for loan applications and streamlined account management. This strategic push into digital marketing has already yielded impressive results, driving a notable increase in online transactions.

The company has set an ambitious target, aiming for 75% of all transactions to be conducted online by 2027, underscoring its commitment to digital transformation. This focus is crucial for meeting evolving customer expectations and improving operational efficiency.

- Digital Platform Development: EZCORP is investing in user-friendly online portals for loan applications and customer service.

- Online Transaction Growth: The company reports a significant uptick in transactions completed through its digital channels.

- Future Digital Goals: A key objective is to achieve 75% of total transactions online by 2027.

Inventory Management and Availability

EZCORP's inventory management is crucial for maintaining a steady supply of pre-owned merchandise, largely stemming from forfeited pawn collateral. Their strategy centers on efficient inventory turnover, especially for popular categories like jewelry, to satisfy consumer demand for affordable, quality second-hand items.

The company's focus on rapid turnover helps minimize holding costs and ensures that fresh, desirable inventory is consistently available. This approach is vital for their pawn-to-retail model, where the quick sale of collateralized goods fuels their business. For instance, in fiscal year 2023, EZCORP reported a significant number of merchandise sales, underscoring the effectiveness of their inventory flow.

- Inventory Sourcing: Primarily relies on forfeited pawn collateral, offering a unique and consistent supply of diverse goods.

- Key Product Focus: Prioritizes high-demand items like jewelry, ensuring strong sales performance and customer satisfaction.

- Turnover Strategy: Aims for rapid inventory turnover to maximize sales and minimize storage expenses.

EZCORP's physical presence is a cornerstone of its accessibility, with a robust network of 1,284 stores as of Q2 fiscal 2025. This extensive footprint spans both the United States and key Latin American markets, ensuring customers have convenient access to pawn services and merchandise.

The strategic placement of these stores, particularly the 742 locations in Latin America, underscores EZCORP's focus on high-growth regions. This physical accessibility is crucial for serving their core demographic and facilitating in-person transactions.

EZCORP actively manages its store locations through a combination of new store development and acquisitions, with a notable expansion of 21 new locations in fiscal year 2024, predominantly in Latin America. This deliberate expansion enhances market penetration and customer reach.

| Region | Number of Stores (Q2 FY2025) | New Stores Added (FY2024) |

|---|---|---|

| United States | 542 | 1 |

| Latin America | 742 | 20 |

| Total | 1,284 | 21 |

Same Document Delivered

EZCORP 4P's Marketing Mix Analysis

The preview you see here is the actual, fully completed EZCORP 4P's Marketing Mix Analysis document you’ll receive instantly after purchase. There are no hidden surprises or missing sections; what you view is precisely what you'll download. This ensures you get the complete, ready-to-use analysis without delay.

Promotion

EZCORP utilizes a comprehensive multi-channel marketing approach, blending traditional advertising with robust digital engagement to capture a wide audience. This strategy is designed to maximize reach and foster customer interaction across diverse touchpoints.

In 2024, EZCORP's digital marketing efforts, including social media campaigns and targeted online ads, contributed significantly to their customer acquisition, with online channels accounting for an estimated 60% of new customer leads. This digital focus complements their ongoing investment in traditional channels like local print and radio advertising, ensuring broad market penetration.

EZCORP's digital marketing initiatives are central to its promotional strategy, utilizing online platforms for seamless loan applications and account management. This digital-first approach has significantly boosted online transactions and new loan applications, reflecting a successful expansion of their digital presence.

The EZ+ Rewards Program serves as a cornerstone of EZCORP's customer retention strategy. This loyalty initiative demonstrably drives engagement, with a substantial portion of its transacting customer base actively participating.

Data from 2024 indicates that over 60% of EZCORP's active customers are enrolled in the EZ+ Rewards Program, a testament to its appeal and effectiveness in encouraging repeat transactions and fostering deeper customer loyalty.

Social Media Engagement

EZCORP actively engages its audience on platforms like Facebook, Instagram, and LinkedIn, leveraging these channels to highlight product advantages and share company news. This digital presence is crucial for fostering a community and amplifying their promotional efforts beyond traditional advertising.

In 2024, EZCORP's social media strategy focused on building brand loyalty and direct customer interaction. For instance, their Instagram campaigns often feature customer testimonials and behind-the-scenes content, aiming to increase engagement metrics. This approach is designed to translate into tangible interest and potential customer acquisition.

The company's social media efforts in 2025 are expected to build upon this foundation, with increased investment in targeted advertising and influencer collaborations to reach new demographics. Key performance indicators will likely include growth in follower counts, engagement rates, and website traffic originating from social channels.

- Platform Utilization: Facebook, Instagram, and LinkedIn are primary channels for customer outreach.

- Content Focus: Communication of product benefits, company updates, and community building are central themes.

- Promotional Reach: Social media extends EZCORP's promotional activities, enhancing brand visibility.

- Engagement Strategy: Interactive content and direct customer communication aim to foster loyalty and interest.

Data-Driven Marketing and Customer Segmentation

EZCORP leverages data-driven marketing to refine its customer outreach. By segmenting its customer base, the company can personalize its messaging, ensuring that the unique advantages of its offerings resonate with distinct consumer groups.

This targeted approach enhances marketing effectiveness. For instance, in fiscal year 2024, EZCORP reported a significant increase in customer engagement metrics following the implementation of new segmentation strategies across its digital platforms.

- Customer Segmentation: Identifying distinct customer groups based on behavior, demographics, and needs.

- Personalized Messaging: Tailoring marketing communications to address specific customer segments.

- Data Analytics: Utilizing customer data to inform marketing strategies and measure campaign success.

- Enhanced ROI: Aiming for improved return on investment through more efficient and effective marketing spend.

EZCORP's promotional strategy heavily relies on a dual approach of digital engagement and loyalty programs. The EZ+ Rewards Program, active in 2024, saw over 60% of its transacting customers enrolled, demonstrating its success in driving repeat business and customer loyalty. This is supported by significant digital marketing efforts, with online channels accounting for approximately 60% of new customer leads in 2024, highlighting a strong shift towards digital acquisition and interaction.

| Promotional Tactic | Key Metric (2024/2025 Focus) | Impact |

|---|---|---|

| Digital Marketing (Social Media, Online Ads) | 60% of new leads from online channels (2024) | Maximizes reach, drives online applications |

| EZ+ Rewards Program | >60% customer enrollment (2024) | Fosters loyalty, encourages repeat transactions |

| Social Media Engagement (Facebook, Instagram, LinkedIn) | Increased engagement metrics, follower growth (2025 expectation) | Builds community, amplifies brand visibility |

| Personalized Messaging (Data-driven) | Improved engagement metrics (FY2024) | Enhances marketing effectiveness, targets specific needs |

Price

EZCORP's core revenue stream is generated through pawn service charges, encompassing fees and interest on short-term, non-recourse pawn loans. These charges are central to their pricing, reflecting the value of providing instant cash without credit assessments.

For Q1 2024, EZCORP reported that its pawn segment generated approximately $109 million in revenue, with service charges being the primary driver. The average pawn loan amount in the US during this period was around $150, with typical interest rates and fees often exceeding 25% per month, a common practice in the industry to cover risk and operational costs.

EZCORP's merchandise pricing strategy focuses on offering value by selling pre-owned items, primarily forfeited pawn collateral, at substantial discounts compared to new retail prices. This approach directly targets budget-conscious consumers, making quality second-hand goods accessible and driving robust merchandise sales volume.

For instance, during the first quarter of fiscal year 2024, EZCORP reported merchandise sales of $78.7 million, a notable increase from $70.2 million in the same period of the prior year, underscoring the effectiveness of their value-driven pricing in attracting a broad customer base.

EZCORP navigates a competitive market, necessitating keen attention to rival pricing to maintain customer appeal. Their pricing strategy aims to be competitive, balancing market pressures with the intrinsic value customers perceive in EZCORP's offerings.

For instance, in the payday loan sector, average APRs can fluctuate significantly. In 2024, while specific EZCORP rates vary by state and product, industry averages for short-term loans often range from 300% to over 700% APR, reflecting the high-risk nature and short repayment terms.

EZCORP's pricing policies are therefore calibrated to align with these market realities, ensuring their services remain accessible and attractive to their target demographic while still aiming for profitability.

Dynamic Pricing based on Collateral Value

EZCORP's dynamic pricing strategy directly links pawn loan values to the worth of the collateral. This means that as the market value of items like gold and silver increases, so does the potential loan amount offered. For instance, with gold prices fluctuating around $2,300 per ounce in mid-2024, a piece of jewelry with significant gold content could command a higher loan value than it would at a lower gold price.

This approach influences revenue in two key ways: higher loan amounts can translate to greater service charges, and it also bolsters the potential resale value of any collateral that is ultimately forfeited. For example, if a customer defaults on a loan secured by jewelry worth $1,000 due to rising gold prices, EZCORP can potentially recoup more from its sale compared to a scenario where gold prices were lower.

- Collateral Value Drives Loan Amount: The price of precious metals directly impacts how much EZCORP can lend against jewelry.

- Revenue Streams Enhanced: Higher loan values can lead to increased service charges and better resale profits on forfeited items.

- Market Sensitivity: EZCORP's pricing adapts to market fluctuations, such as gold prices nearing $2,300/oz in mid-2024, to maximize its lending and resale potential.

Revenue from Jewelry Scrapping

EZCORP's revenue stream extends beyond selling merchandise to include income from scrapping jewelry. This process is directly tied to fluctuating commodity prices, serving as an additional pricing strategy.

By monetizing collateral that isn't fit for resale, EZCORP effectively leverages its inventory. For instance, in the first quarter of 2024, the price of gold averaged around $2,050 per ounce, a significant factor influencing the value extracted from scrapped jewelry.

- Jewelry Scrapping Revenue: A key component of EZCORP's pricing strategy, directly impacted by commodity markets.

- Commodity Price Influence: Gold prices, for example, can significantly affect the profitability of this revenue stream.

- Monetizing Non-Resalable Collateral: This allows EZCORP to extract value from items unsuitable for direct sale.

- Q1 2024 Gold Average: Approximately $2,050 per ounce, illustrating the market conditions influencing this revenue.

EZCORP's pricing strategy is multifaceted, driven by service charges on pawn loans, competitive merchandise pricing, and the value of collateral. For pawn loans, interest rates and fees often exceed 25% per month, reflecting the high-risk, short-term nature of the business, with average US pawn loan amounts around $150 in Q1 2024.

Merchandise sales, a significant revenue driver, offer pre-owned items at substantial discounts. Q1 FY2024 merchandise sales reached $78.7 million, up from $70.2 million the prior year, highlighting the appeal of value-driven pricing.

The company's pricing is sensitive to market fluctuations, particularly commodity prices like gold, which averaged around $2,050 per ounce in Q1 2024. This impacts both the loan amounts offered against collateral and the revenue generated from scrapping non-resalable items.

| Pricing Element | Key Feature | 2024 Data/Context |

|---|---|---|

| Pawn Loan Charges | Interest and fees on short-term loans | Often >25% per month; Avg. US loan ~$150 (Q1 2024) |

| Merchandise Sales | Discounted resale of forfeited collateral | $78.7M revenue (Q1 FY2024) vs $70.2M (Q1 FY2023) |

| Collateral Value Impact | Loan amounts & scrapping revenue tied to commodity prices | Gold avg. ~$2,050/oz (Q1 2024); affects loan value & resale profit |

4P's Marketing Mix Analysis Data Sources

Our EZCORP 4P's Marketing Mix Analysis leverages a comprehensive blend of primary and secondary data sources. We meticulously gather information from EZCORP's official investor relations materials, including annual reports and SEC filings, alongside data from industry-specific market research reports and competitive intelligence platforms.