EZCORP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

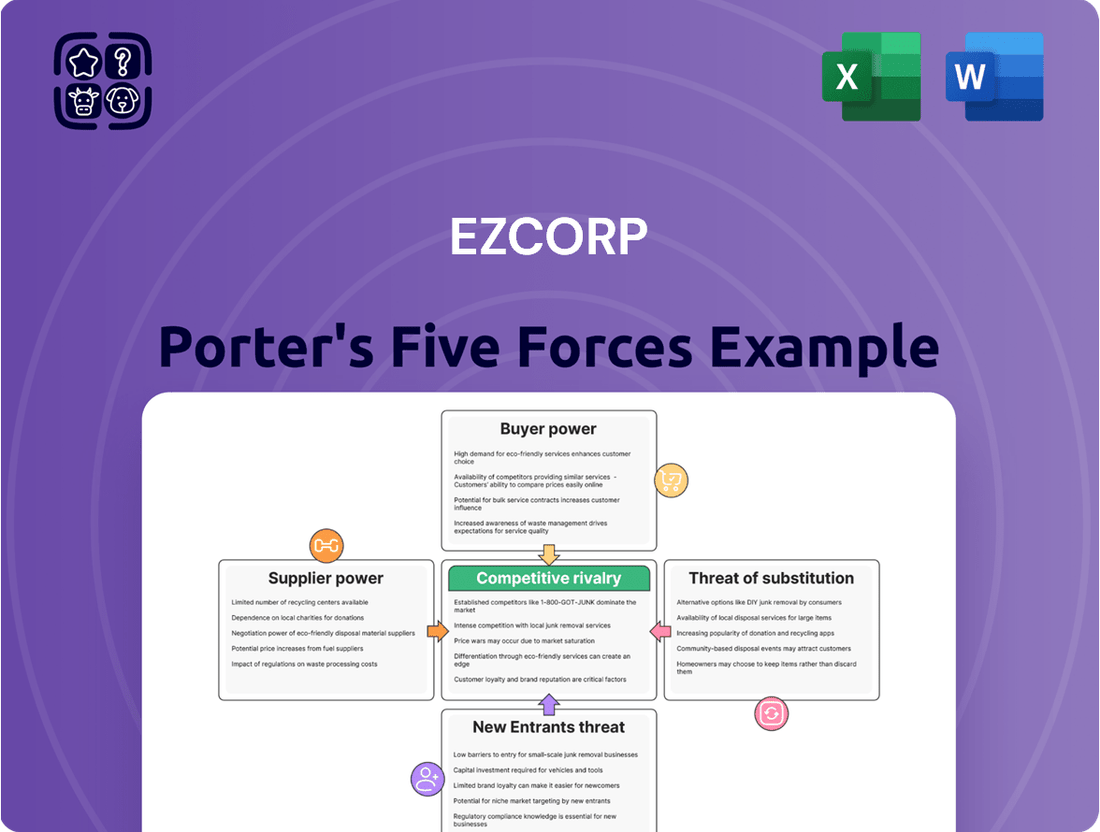

EZCORP faces moderate threats from new entrants and substitutes, as its pawn and loan services are relatively accessible but also have established alternatives. Buyer power is significant, with customers easily comparing rates and services across the industry. The intensity of rivalry among existing players is high, driving competitive pricing and service innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore EZCORP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

For EZCORP, the primary 'suppliers' are the individual customers who provide personal property as collateral for pawn loans or sell merchandise directly. These customers typically have a low bargaining power because they urgently need cash and often lack access to conventional credit, making pawn services a necessity. In 2023, EZCORP reported that its pawn loan portfolio, which represents customer-provided collateral, was a significant portion of its revenue generation.

The consistent availability of valuable personal property, like jewelry and electronics, is crucial for EZCORP's pawn lending operations. In 2024, the demand for pawn services remained robust, with many individuals leveraging their assets for short-term liquidity. The quality and current market demand for these pawned items directly impact the loan amounts EZCORP can offer and their potential resale value if the loans are not repaid.

A scarcity of desirable collateral or a downturn in the resale market for common pawned goods, such as pre-owned electronics, could significantly affect EZCORP's profitability. For instance, a decline in the resale value of used smartphones, a popular pawn item, would reduce the margin EZCORP could achieve on forfeited inventory. Therefore, effectively managing inventory and staying attuned to market trends for a diverse range of goods are vital for EZCORP's financial health.

Financial institutions offering capital to EZCORP for its lending operations can influence terms through interest rates. However, EZCORP's strong liquidity, evidenced by significant cash reserves, lessens its dependence on external capital, thereby reducing supplier bargaining power. For instance, as of Q1 2024, EZCORP reported substantial cash and cash equivalents, providing a buffer against unfavorable lending terms.

Technology and software providers for pawn management

The bargaining power of technology and software providers for pawn management is a key consideration for EZCORP. Specialized software is crucial for managing inventory, tracking loans, and ensuring regulatory compliance in the pawn industry. If these solutions are highly unique or if migrating data and retraining staff is complex and costly, these suppliers can wield significant influence.

EZCORP's strategic focus on digital advancements, including its EZ+ Rewards program and the implementation of online payment options, underscores the critical nature of these technology partnerships. The company's ongoing digital transformation efforts indicate a reliance on sophisticated software to maintain operational efficiency and enhance customer engagement. For instance, in fiscal year 2023, EZCORP reported a significant increase in digital engagement, with a notable portion of transactions facilitated through their online platforms, highlighting the dependence on their software infrastructure.

- Specialized Software: Providers offering unique pawn management functionalities can command higher prices.

- Switching Costs: High costs associated with migrating data and retraining employees can lock EZCORP into existing software agreements.

- Digital Transformation Reliance: EZCORP's investment in digital tools like EZ+ Rewards makes them dependent on reliable software partners.

- Industry Trends: The increasing demand for integrated online and in-store pawn management systems amplifies the importance of these technology providers.

Labor market for skilled appraisers and retail staff

The availability of skilled employees, especially those adept at appraising various collateral and delivering excellent customer service, directly influences EZCORP's operational efficiency and customer satisfaction. A constrained labor market or increasing wage demands can escalate operating expenses.

In 2024, the demand for skilled labor across various sectors, including retail and specialized appraisal services, remained robust. For instance, the U.S. Bureau of Labor Statistics projected continued growth in occupations requiring specialized knowledge, potentially putting upward pressure on wages for qualified personnel.

- Skilled Appraiser Demand: EZCORP relies on appraisers who can accurately value a wide range of collateral, from jewelry to electronics. The scarcity of such expertise can lead to increased recruitment costs and potentially slower transaction times.

- Retail Staff Expertise: Effective customer service from retail staff is crucial for EZCORP's business model. A shortage of well-trained retail associates can impact customer retention and the overall brand perception.

- Wage Pressures: In a competitive labor market, EZCORP may face pressure to increase wages to attract and retain skilled employees, thereby impacting its cost structure.

- EZCORP's Mitigation Strategies: The company's significant investment in employee training programs and its extensive team base are key strategies to manage the bargaining power of labor suppliers by ensuring a steady pipeline of qualified staff.

The bargaining power of EZCORP's suppliers is generally low, primarily due to the nature of its core business. Individual customers acting as suppliers of collateral for pawn loans have limited leverage as they often face urgent cash needs and lack alternative credit options. This dynamic is supported by the consistent availability of diverse personal property used as collateral, a trend observed through 2024 where demand for pawn services remained strong.

Technology and software providers can exert some influence, especially those offering specialized pawn management systems. EZCORP's increasing reliance on digital platforms, as evidenced by its 2023 digital engagement growth, means that disruptions or unfavorable terms from these critical software partners could impact operations. However, EZCORP's substantial cash reserves, reported in Q1 2024, reduce its dependence on external capital, thereby limiting the bargaining power of financial institutions.

| Supplier Type | Bargaining Power Level | Key Factors |

|---|---|---|

| Individual Customers (Collateral Providers) | Low | Urgent cash needs, limited credit access, necessity of pawn services. |

| Financial Institutions (Capital Providers) | Low | EZCORP's strong liquidity and cash reserves (e.g., substantial cash and cash equivalents in Q1 2024). |

| Technology & Software Providers | Moderate | Specialized software for pawn management, high switching costs, EZCORP's digital transformation reliance. |

| Labor (Skilled Employees) | Moderate | Demand for skilled appraisers and retail staff, potential wage pressures in a competitive market. |

What is included in the product

This analysis dissects EZCORP's competitive environment by examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand EZCORP's competitive landscape with a powerful spider/radar chart, visualizing the impact of all five forces on their business.

Customers Bargaining Power

Customers generally face low switching costs when seeking pawn loans or purchasing merchandise. They can easily visit various pawn shops to compare loan terms or merchandise prices, a significant factor in their bargaining power.

The US pawn shop market is quite extensive, offering consumers a wide array of choices. This abundance of options further strengthens the customer's position.

For EZCORP, this translates into a need to maintain competitive interest rates and service quality to retain customers. In 2023, the average loan-to-value ratio in the pawn industry remained a key competitive lever, with many shops offering around 50% of an item's appraised value.

The presence of diverse alternative lending options significantly amplifies the bargaining power of EZCORP's customers. Beyond traditional pawn shops, consumers can access personal loans from banks and credit unions, payday loans, and increasingly popular buy now, pay later (BNPL) services. This broadens customer choice and diminishes their reliance on pawn-based financing.

In 2024, the BNPL market alone saw substantial growth, with transaction volumes projected to reach hundreds of billions globally, indicating a strong consumer shift towards these flexible credit alternatives. This growing availability of substitutes means customers can more readily compare terms, interest rates, and convenience, putting pressure on EZCORP to remain competitive.

EZCORP's customer base is often characterized by individuals facing financial constraints, meaning they are particularly attuned to the cost of services. This heightened price sensitivity means that even small increases in interest rates or fees can significantly impact their decision to use EZCORP's offerings. For instance, if the average loan amount for EZCORP is around $300, a 5% increase in the APR could add a noticeable amount to the repayment burden for these customers.

This dynamic directly limits EZCORP's pricing power. If the company were to raise its prices substantially, it risks losing a significant portion of its customer base to competitors who offer more affordable alternatives or to those who simply cannot afford the higher costs. In 2024, with ongoing inflation affecting disposable incomes, this sensitivity is likely amplified, making it crucial for EZCORP to maintain competitive pricing to ensure customer retention.

Therefore, EZCORP must carefully navigate the delicate balance between generating sufficient revenue and keeping its services accessible. The company's strategy needs to focus on offering value that resonates with its target demographic, ensuring that its pricing remains attractive enough to retain existing customers and draw in new ones, despite the inherent price sensitivity of its market.

Non-recourse nature of pawn loans

The non-recourse nature of pawn loans significantly bolsters customer bargaining power. This means if a customer defaults on a pawn loan, they simply forfeit the collateral, like jewelry or electronics, without any further obligation or impact on their credit score. This lack of personal liability empowers customers to walk away if they deem the loan terms unfavorable, effectively setting a ceiling on the interest rates and fees EZCORP can charge.

EZCORP, by its business model, assumes the risk of asset forfeiture. This characteristic directly influences how EZCORP structures its loan offers and appraises collateral. For instance, in 2024, EZCORP reported that a substantial portion of its loans were indeed forfeited rather than repaid, highlighting the customer's ability to exercise this non-recourse option when terms are not met.

- Customer Leverage: The ability to forfeit collateral without credit repercussions gives customers the upper hand in negotiating loan terms.

- Risk Transfer: EZCORP bears the risk of asset depreciation or inability to resell forfeited items, which limits its ability to extract higher margins.

- Impact on Appraisals: To mitigate this risk and account for potential forfeiture, EZCORP’s initial loan-to-value ratios on collateral are conservative, reflecting the customer's ultimate control over repayment.

Digitalization and enhanced customer experience expectations

The growing digitalization of financial services has significantly amplified customer expectations for seamless convenience and efficiency. This includes readily available online payment options and a more streamlined in-store experience. For EZCORP, this translates to a heightened bargaining power as customers can easily compare and switch to providers offering superior digital integration.

EZCORP's strategic investments in digital transformation, such as the implementation of online payment capabilities and the EZ+ Rewards program, directly address these evolving customer demands. These initiatives aim to enhance customer loyalty and meet the expectation of accessible, user-friendly financial solutions.

Companies that lag in adapting to these digital shifts face a tangible risk of customer attrition. Competitors with more advanced digital offerings or alternative financial solutions can readily capture market share. For instance, in 2024, fintech adoption continued to surge, with a significant percentage of consumers expressing a preference for digital channels for managing their finances, underscoring the competitive pressure EZCORP faces.

- Digital Convenience: Customers now expect 24/7 access to services and instant transaction capabilities, increasing their leverage.

- Competitive Landscape: The rise of digital-native financial service providers intensifies competition, giving customers more choices.

- EZCORP's Response: Investments in online payments and loyalty programs are crucial for retaining customers in this evolving market.

- Market Trends: In 2024, a majority of consumers indicated they would switch providers for a better digital experience, highlighting the cost of inaction.

EZCORP's customers possess considerable bargaining power due to low switching costs and a wide array of alternative financial services, including personal loans and buy now, pay later options. This market saturation, with the BNPL sector alone seeing significant growth in 2024, forces EZCORP to maintain competitive pricing and service quality to retain its price-sensitive customer base.

The non-recourse nature of pawn loans further empowers customers, allowing them to forfeit collateral without credit repercussions, effectively capping EZCORP's pricing. In 2024, a notable portion of EZCORP's loans were forfeited, underscoring this customer leverage.

| Factor | Description | Impact on EZCORP |

|---|---|---|

| Switching Costs | Low; customers can easily compare pawn shops and alternative lenders. | Limits EZCORP's pricing power and necessitates competitive rates. |

| Availability of Substitutes | High, including banks, credit unions, payday loans, and BNPL services. | Reduces customer reliance on pawn loans, increasing negotiation leverage. |

| Price Sensitivity | High, due to customers' financial constraints. | Makes EZCORP vulnerable to price competition; inflation in 2024 amplifies this. |

| Non-Recourse Loans | Customers can forfeit collateral without further obligation. | Empowers customers to reject unfavorable terms, limiting EZCORP's margins. |

Preview Before You Purchase

EZCORP Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details EZCORP's competitive landscape through Porter's Five Forces, including an in-depth look at the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The pawn industry, especially in the United States, is notably fragmented. This means there are many independent and regional pawn operators, creating a landscape of intense local competition for companies like EZCORP. Even as a significant player, EZCORP faces rivals that are often smaller but can leverage personalized service or specialized product assortments to attract customers.

This widespread presence of smaller operators often drives price-based competition. These local businesses can be more agile in adjusting prices to suit their immediate market. Furthermore, the fragmented nature of the market emphasizes the importance of building strong, localized customer relationships, as these smaller shops often cater directly to the specific needs and preferences of their immediate communities.

EZCORP faces intense competition from a diverse range of short-term and alternative lenders. Beyond traditional pawn shops, this includes payday lenders, title loan companies, and a growing number of fintech firms offering rapid cash advances and buy-now-pay-later (BNPL) options. These entities directly target the same customer base seeking immediate financial solutions.

EZCORP's retail operations, which include selling forfeited pawn collateral and purchased merchandise, face intense competition. This segment directly contends with a broad range of players, from established discount retailers to dynamic online marketplaces like eBay and Poshmark, as well as numerous smaller resale shops. Success hinges on mastering the art of pricing and marketing pre-owned items effectively.

Emphasis on customer service and convenience as differentiators

In the highly competitive pawn shop industry, EZCORP distinguishes itself by prioritizing exceptional customer service and offering unparalleled convenience. This focus is crucial for building lasting customer relationships and driving repeat business.

EZCORP's strategy involves creating a welcoming atmosphere and streamlining operations to ensure a positive customer experience. Their EZ+ Rewards program is a prime example of incentivizing loyalty and encouraging repeat transactions.

- Customer Service Focus: EZCORP aims to build loyalty through positive interactions and efficient service, a key differentiator in the pawn industry.

- Convenience as a Strategy: Strategic store placement and accessible services are central to EZCORP's approach to attracting and retaining customers.

- Loyalty Programs: Initiatives like the EZ+ Rewards program are designed to foster customer retention and increase transaction frequency.

Regulatory environment and compliance costs impacting smaller players

The pawn industry is significantly shaped by a complex web of state and federal regulations. These rules, covering everything from interest rates to customer disclosures, create substantial compliance burdens. For smaller pawn shops, the cost of adhering to these varied requirements can be a significant hurdle, acting as a barrier to entry and expansion.

Larger entities like EZCORP, with greater resources, are often better equipped to manage these regulatory complexities. They can invest in dedicated compliance teams and sophisticated systems to ensure adherence, giving them a competitive edge. This disparity in resource allocation means that regulatory compliance can disproportionately affect smaller, independent operators.

- Regulatory Burden: Compliance costs for state and federal regulations can range from thousands to tens of thousands of dollars annually for small businesses, depending on the jurisdiction and the scope of operations.

- Competitive Advantage: Larger companies may achieve economies of scale in compliance, reducing the per-transaction cost compared to smaller players.

- Market Impact: Changes in regulations, such as the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) which impacts fee structures, or new state-level consumer protection laws, can necessitate costly system updates and retraining for all market participants, potentially impacting profitability across the board.

EZCORP faces intense rivalry from a highly fragmented pawn industry, characterized by numerous local and regional competitors. These smaller operators often compete on price and personalized service, leveraging their agility to attract customers. Additionally, EZCORP contends with a broad spectrum of alternative lenders, including payday and title loan companies, as well as fintech solutions, all vying for the same customer base seeking immediate financial relief.

SSubstitutes Threaten

For individuals with a solid credit history, traditional financial institutions like banks and credit unions present a compelling alternative to pawn loans. These institutions often provide personal loans and lines of credit with more favorable interest rates and extended repayment periods. For instance, in early 2024, the average interest rate for a personal loan from a bank could range from 6% to 15%, significantly lower than the triple-digit APRs commonly found in pawn transactions.

These traditional credit options, while requiring a credit check, act as a substantial substitute for a segment of EZCORP's customer base. The accessibility and competitive terms offered by these established lenders directly impact the demand for short-term, high-cost pawn services. If consumers can easily secure affordable credit elsewhere, they are less likely to turn to pawn shops for their immediate financial needs.

Payday loans and similar unsecured short-term credit options present a significant threat of substitution to EZCORP's pawn loan services. These products, offering rapid access to funds without requiring collateral, appeal to a similar customer base seeking immediate financial relief. For instance, the payday loan industry in the US alone is substantial, with estimates suggesting over 12 million Americans use them annually, highlighting the broad market reach of this substitute.

The rise of direct selling platforms and consignment stores presents a significant threat of substitutes for EZCORP's core pawn lending business. Instead of pawning an item for a short-term loan, consumers increasingly opt to sell their belongings directly through online marketplaces like eBay or Facebook Marketplace, or to local consignment and specialty shops. This allows individuals to potentially realize a higher return on their items if their primary goal is liquidation rather than obtaining immediate funds.

This shift directly impacts EZCORP's merchandise sales segment, which relies on selling repossessed or purchased goods. For example, in 2024, the resale market for pre-owned goods continued its robust growth, with platforms like Depop and Poshmark reporting significant transaction volumes, offering consumers a viable alternative to pawnbrokers for monetizing their possessions. This growing accessibility and profitability of alternative sales channels can divert potential customers away from EZCORP.

Buy Now, Pay Later (BNPL) services and instant cash advance apps

The proliferation of fintech solutions like Buy Now, Pay Later (BNPL) services and instant cash advance apps poses a significant threat of substitutes for EZCORP. These platforms offer consumers accessible alternatives for managing immediate financial needs, bypassing traditional lending channels.

BNPL services, for instance, allow consumers to split purchases into interest-free installments, making them attractive for budgeting. Instant cash advance apps provide quick access to small sums, often with minimal fees or credit checks. This convenience, especially for younger demographics, directly competes with EZCORP's short-term loan offerings. For example, Klarna, a major BNPL provider, reported over 150 million consumers globally by early 2024, highlighting the widespread adoption of these alternatives.

- Increased consumer preference for flexible, low-cost credit options.

- Accessibility of fintech solutions, often with minimal credit hurdles.

- Growing adoption among younger consumers who may not qualify for or prefer traditional loans.

- The ease of use and speed of approval offered by these digital alternatives.

Support from friends, family, or charitable organizations

The threat of substitutes for EZCORP's services is influenced by informal financial support systems. Many individuals facing immediate cash needs might turn to friends, family, or charitable organizations instead of utilizing pawn loans or other formal lending channels. This informal network acts as an alternative, especially for those who prefer or can access these personal or community-based resources.

While not a direct commercial competitor, the availability of support from personal networks can reduce the demand for EZCORP's services. For instance, a study might reveal that a significant percentage of individuals in lower-income brackets rely on informal loans for emergencies. In 2024, the reliance on such informal networks remains a persistent factor in the micro-lending landscape, impacting the customer base for formal providers like EZCORP.

- Informal Lending: Friends and family often provide interest-free or low-interest loans, a stark contrast to the rates charged by formal lenders.

- Charitable Assistance: Non-profit organizations and religious institutions can offer grants or no-interest loans to individuals in dire need, bypassing traditional financial institutions.

- Social Safety Nets: The strength of community and familial bonds can act as a buffer, providing immediate financial relief that substitutes for commercial borrowing.

The threat of substitutes for EZCORP's pawn services is significant, stemming from a variety of financial and non-financial alternatives. Traditional financial institutions offer lower-cost loans, while payday lenders and fintech solutions provide quick access to funds, often with less stringent requirements. Furthermore, the growing resale market and informal support networks also divert potential customers.

These substitutes directly compete for EZCORP's customer base. For example, in 2024, the average personal loan rate from banks was around 6-15%, a fraction of pawn loan APRs. The widespread use of BNPL services, with over 150 million global users by early 2024 for providers like Klarna, highlights a strong consumer shift towards more convenient and less expensive credit options.

| Substitute Type | Key Features | Impact on EZCORP | 2024 Data/Trend |

|---|---|---|---|

| Traditional Banks/Credit Unions | Lower interest rates, longer terms | Reduces demand for high-cost pawn loans | Average personal loan rates: 6-15% APR |

| Payday Loans/Cash Advances | Fast access, no collateral | Attracts similar customer base seeking immediate cash | Over 12 million US users annually |

| Fintech (BNPL, Apps) | Convenience, low/no interest, quick approval | Offers accessible alternatives, especially to younger demographics | BNPL users globally: 150M+ (early 2024) |

| Resale Market (Online/Consignment) | Potential for higher liquidation value | Diverts customers from pawning items for cash | Robust growth in pre-owned goods market |

| Informal Networks (Friends/Family) | Interest-free or low-interest loans | Reduces reliance on commercial lending for emergencies | Persistent factor in micro-lending landscape |

Entrants Threaten

The pawn industry faces substantial regulatory barriers, with EZCORP, like its peers, needing to comply with federal, state, and local laws. These regulations encompass licensing, permits, and stringent operational and reporting standards, making it difficult and costly for new companies to enter the market. For instance, obtaining the necessary permits can involve lengthy approval processes and significant upfront investment, effectively deterring potential competitors.

Establishing a pawn business demands significant upfront capital, primarily for inventory acquisition and the crucial provision of loan capital. This capital intensity acts as a substantial barrier to entry, requiring new players to secure considerable financial backing to even begin competing. For instance, in 2024, the average initial investment for a new pawn shop could range from $100,000 to $500,000, depending on location and scale, a figure that dwarfs the resources available to many aspiring entrepreneurs.

Building trust and establishing a solid reputation are significant hurdles for new entrants in the pawn industry. Customers entrust valuable personal property, making trust paramount. Newcomers require substantial time and investment to cultivate this essential reputation and customer confidence.

Established companies like EZCORP leverage years of operation and existing brand recognition, creating a formidable barrier. For instance, in 2023, the pawn industry continued to rely heavily on repeat business, underscoring the importance of established trust. This makes it challenging for new players to rapidly acquire market share.

Challenges in sourcing diverse and valuable collateral

New entrants face a significant hurdle in acquiring a consistent supply of diverse and valuable collateral, a cornerstone for pawn shop operations. Building the necessary relationships and customer trust to attract a steady stream of desirable items takes considerable time and effort. EZCORP's established network and brand recognition, cultivated over years of operation, give it a distinct advantage in sourcing inventory.

Consider these factors:

- Inventory Sourcing Difficulty: New pawn shops may struggle to attract high-quality collateral compared to established players with existing customer loyalty.

- Network Effects: EZCORP's broad store presence facilitates a wider reach for sourcing diverse merchandise, creating a barrier for newcomers.

- Reputation and Trust: A long-standing reputation for fair dealing encourages customers to bring their valuables to established businesses like EZCORP.

Economies of scale and operational efficiency of incumbents

Large players like EZCORP benefit from significant economies of scale. This is evident in their purchasing power, allowing them to negotiate better terms for inventory and services. For instance, in 2024, the average cost of goods sold as a percentage of revenue for companies in the consumer financial services sector, which EZCORP operates within, was approximately 65%, a figure that smaller entrants would struggle to achieve.

EZCORP also leverages advanced marketing strategies and technology adoption that are prohibitively expensive for newcomers. Their sophisticated management information systems and streamlined operational processes contribute to a lower cost base. This operational efficiency means they can offer services at more competitive prices, creating a substantial barrier for any new company trying to enter the market.

New entrants would face considerable difficulty in matching EZCORP's existing efficiencies and cost structures. This disparity directly impacts their ability to compete on price and profitability from the outset. For example, a startup might incur significantly higher per-transaction costs compared to an established firm like EZCORP, hindering their market penetration efforts.

- Economies of Scale: EZCORP's size allows for bulk purchasing discounts and more efficient marketing spend, reducing per-unit costs.

- Operational Efficiency: Streamlined processes and advanced technology adoption by incumbents like EZCORP lead to lower operating expenses.

- Cost Disadvantage for Newcomers: New entrants lack the established infrastructure and volume to achieve similar cost efficiencies, making it harder to compete on price.

- Marketing and Technology Investment: The capital required for effective marketing campaigns and technology upgrades presents a significant hurdle for new businesses.

The threat of new entrants for EZCORP is generally low due to significant barriers. High capital requirements for inventory and operations, coupled with stringent licensing and regulatory compliance, make market entry costly and complex. Established trust and brand recognition, built over years, also deter newcomers.

Furthermore, EZCORP benefits from economies of scale in purchasing and operations, creating a cost advantage that new entrants struggle to match. Their established networks for sourcing collateral and advanced marketing capabilities further solidify their competitive position.

In 2024, the average initial investment for a new pawn shop could range from $100,000 to $500,000, a substantial hurdle. Additionally, the pawn industry relies on repeat business, underscoring the importance of reputation, which takes time and consistent fair dealing to build.

The difficulty in securing a consistent supply of quality collateral also presents a challenge for new entrants, as established players like EZCORP have cultivated strong customer relationships over time.

Porter's Five Forces Analysis Data Sources

Our EZCORP Porter's Five Forces analysis is built upon a foundation of comprehensive data, including SEC filings, investor relations materials, industry-specific market research reports, and financial news outlets.

We leverage insights from company annual reports, competitor financial statements, and reputable industry publications to meticulously assess the competitive landscape for EZCORP.