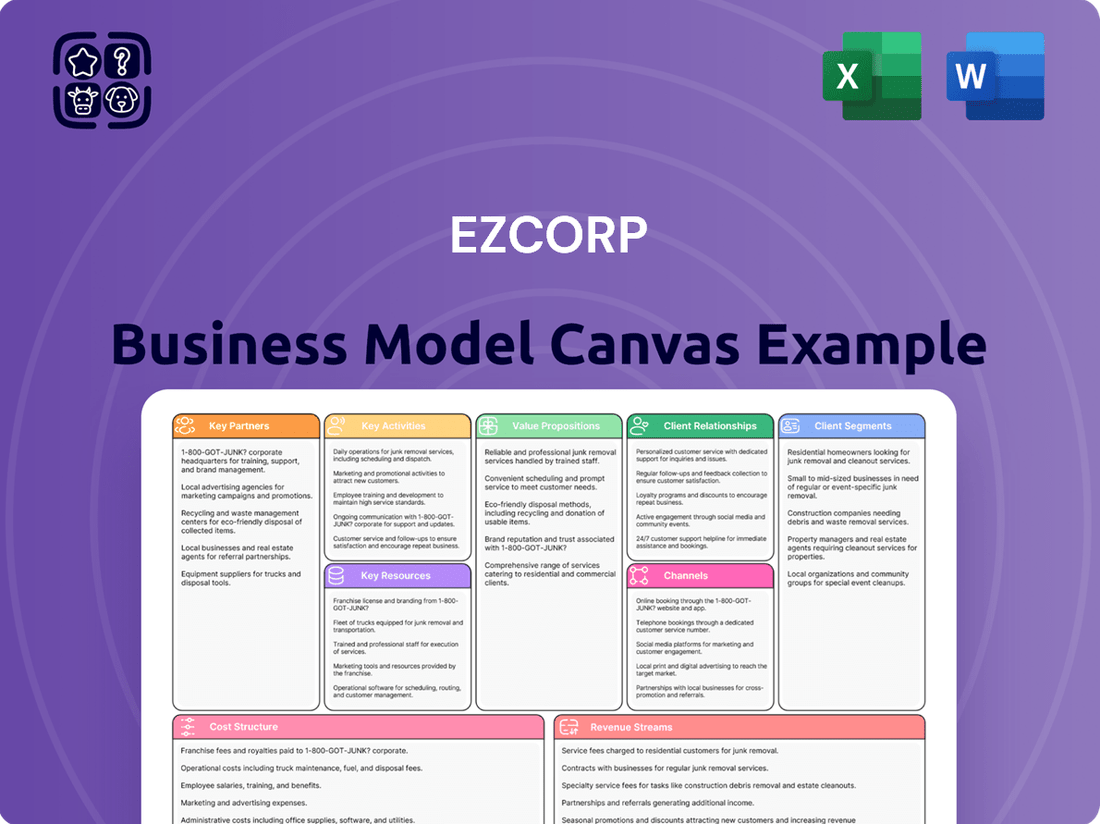

EZCORP Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EZCORP Bundle

Unlock the strategic blueprint behind EZCORP's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their operational framework. Perfect for anyone looking to understand how EZCORP thrives in its industry.

See exactly how EZCORP builds and delivers value with our full Business Model Canvas. This downloadable resource provides a complete, section-by-section breakdown of their key partners, activities, and cost structure. Gain actionable insights for your own business strategies.

Ready to dissect EZCORP's winning formula? Our complete Business Model Canvas offers a deep dive into their competitive advantages and growth strategies. Download it now to gain a professional, in-depth understanding of what drives their market position.

Partnerships

EZCORP’s financial institution partners are vital for its operational backbone. These relationships provide essential banking services, enabling efficient cash flow management and securing lines of credit that fuel their core lending activities. For instance, in 2024, EZCORP continued to leverage these banking relationships to maintain robust liquidity, a critical factor in the fast-paced consumer finance sector.

EZCORP's strategic alliances with technology providers are crucial for its digital transformation, powering initiatives like the EZ+ Rewards program and online payment platforms. These collaborations ensure seamless digital transactions and bolster customer interaction across the company's diverse service offerings.

In 2024, EZCORP continued to invest in its digital infrastructure, leveraging partnerships with key technology vendors to enhance user experience and operational efficiency. This focus on technology integration directly supports their goal of providing accessible and convenient financial services to a broad customer base.

EZCORP's merchandise suppliers are crucial for maintaining a robust retail inventory beyond forfeited pawn items. While a large part of their stock comes from unclaimed collateral, they strategically partner with wholesalers and suppliers to acquire specific, high-demand products. This approach ensures a diverse and attractive product mix for their retail customers, enhancing sales opportunities.

Security and Logistics Services

EZCORP's reliance on security and logistics services is paramount due to the inherent risks associated with handling valuable collateral and cash. These partnerships ensure the safe transit of merchandise and currency between its numerous pawn shops and the secure storage of assets. For instance, in 2024, EZCORP continued to leverage specialized firms for armored car services and secure warehousing, critical components for maintaining operational integrity and minimizing loss.

These collaborations extend beyond simple transportation. They encompass comprehensive asset protection strategies, including advanced surveillance systems and trained personnel at store locations. Such measures are vital for safeguarding against theft and ensuring compliance with regulations governing the handling of precious metals and other high-value items. The company's commitment to these services underscores its focus on risk mitigation and operational stability.

- Security Firms: Partnering with companies that provide on-site security personnel and alarm monitoring systems to protect physical assets and cash reserves.

- Logistics Providers: Engaging specialized transportation services for the secure movement of merchandise, collateral, and cash between stores and to third-party verification or sales channels.

- Secure Storage Solutions: Utilizing secure vault facilities for the temporary or long-term storage of high-value collateral, ensuring protection against damage or theft.

- Cash Management Services: Collaborating with entities that offer secure cash handling, deposit, and transportation, reducing the risk associated with on-site cash holdings.

Regulatory and Compliance Advisors

EZCORP, as a financial service provider, must navigate a complex regulatory landscape. Partnerships with specialized legal and compliance advisors are absolutely essential to ensure strict adherence to all applicable local, state, and federal regulations. This is particularly true for pawn loan operations and other financial services offered across both the United States and Latin American markets.

These advisors help EZCORP stay ahead of evolving compliance requirements, mitigating risks associated with non-adherence. For instance, in 2024, financial institutions faced increased scrutiny regarding consumer protection laws and anti-money laundering (AML) regulations, making expert guidance invaluable.

- Regulatory Expertise: Ensuring compliance with diverse financial regulations in the US and Latin America.

- Risk Mitigation: Preventing penalties and reputational damage through proactive adherence to legal frameworks.

- Operational Continuity: Maintaining smooth business operations by staying current with compliance mandates.

- Strategic Guidance: Receiving advice on navigating new regulatory changes and opportunities.

EZCORP’s strategic partnerships with financial institutions are fundamental to its operational success, providing critical liquidity and banking services. These relationships are essential for managing cash flow and accessing credit lines that support its lending activities. In 2024, the company continued to rely on these banking partners to ensure strong liquidity, a crucial element in the dynamic consumer finance industry.

Collaborations with technology providers are key to EZCORP's digital advancement, powering platforms like the EZ+ Rewards program and online payment systems. These alliances facilitate seamless digital transactions and enhance customer engagement across its varied service offerings.

Merchandise suppliers are important for supplementing EZCORP's inventory beyond forfeited collateral. By partnering with wholesalers, the company ensures a diverse and appealing product selection for its retail customers, thereby boosting sales.

EZCORP partners with specialized security and logistics firms to manage the inherent risks of handling valuable collateral and cash. These partnerships ensure the secure transport of goods and funds, with companies like Brinks and Loomis providing essential armored car services in 2024, safeguarding assets and maintaining operational integrity.

| Partnership Type | Key Function | 2024 Impact |

|---|---|---|

| Financial Institutions | Liquidity, Credit Lines, Banking Services | Maintained robust liquidity for lending operations |

| Technology Providers | Digital Platforms, Online Payments, Customer Engagement | Enhanced user experience and operational efficiency |

| Merchandise Suppliers | Inventory Diversification, Retail Sales | Ensured a varied product mix for retail customers |

| Security & Logistics | Asset Protection, Secure Transport of Goods/Cash | Safeguarded assets and ensured operational integrity |

What is included in the product

A detailed breakdown of EZCORP's strategy, outlining its target customer segments, value propositions, and revenue streams in the pawn and title lending industries.

This model highlights EZCORP's operational structure and key resources, including its branch network and financial services, designed for accessible credit solutions.

EZCORP's Business Model Canvas acts as a pain point reliever by providing a clear, visual overview of their operations, enabling quick identification of inefficiencies and areas for improvement in their lending services.

Activities

EZCORP's core activity is facilitating short-term, non-recourse pawn loans. These loans are secured by personal property, meaning the lender can seize the collateral if the borrower defaults, but cannot pursue them for any remaining debt. This model is central to their revenue generation.

Key operational tasks include meticulously assessing the value of collateral, such as jewelry or electronics, to determine appropriate loan amounts. This requires expertise in identifying and valuing a wide range of goods. The company manages the entire loan lifecycle, from the initial issuance of funds to the eventual redemption of the item by the borrower or its forfeiture if the loan is not repaid.

In fiscal year 2023, EZCORP reported that pawn loans represented a significant portion of its business. The company’s pawn segment generated substantial revenue, reflecting the consistent demand for accessible, short-term credit solutions. For instance, their U.S. pawn segment saw robust performance, with same-store sales growth indicating strong customer engagement.

EZCORP's core operations revolve around the sale of merchandise, primarily consisting of forfeited pawn collateral. This activity is crucial for generating revenue and recovering capital from unredeemed items.

Effective retail management is key to maximizing profits from these sales. This includes strategic inventory management, competitive pricing, targeted marketing efforts, and ensuring excellent customer service to attract and retain buyers for pre-owned goods.

In fiscal year 2023, EZCORP reported merchandise sales contributing significantly to their overall revenue. For instance, their pawn segment, which heavily relies on merchandise sales, saw substantial performance, with the company often highlighting the efficiency of their resale operations in investor calls.

EZCORP prioritizes an exceptional customer experience, actively engaging with clients to understand and meet their financial needs. This dedication to service is a cornerstone of their strategy, aiming to foster strong, lasting relationships.

Building customer loyalty is paramount, and EZCORP achieves this through initiatives like the EZ+ Rewards program. This focus on retention drives repeat business and cultivates a stable, engaged customer base, a critical asset in the competitive financial services landscape.

Store Operations and Expansion

EZCORP's core activities revolve around the efficient management of its extensive retail network. This includes overseeing the daily operations of hundreds of physical locations across the United States and Latin America, ensuring smooth customer transactions and service delivery. A significant focus is placed on robust staff training programs to maintain service quality and compliance.

Strategic expansion is a critical component of EZCORP's business model. The company actively pursues growth by opening new stores in promising markets and through targeted acquisitions of existing businesses. This approach aims to broaden their geographical reach and customer base, thereby increasing market share and revenue potential.

- Store Network Management: Operating over 1,300 company-owned stores as of the first quarter of fiscal year 2024.

- Staff Training and Development: Implementing comprehensive training initiatives to enhance employee performance and customer service.

- Strategic Expansion: Pursuing organic growth through new store openings and inorganic growth via acquisitions to expand market presence.

- Geographic Footprint: Maintaining a significant presence in key markets across the United States and Latin America.

Financial Management and Reporting

EZCORP's financial management and reporting are crucial for its operational health and investor confidence. This involves diligently managing liquidity to ensure day-to-day operations run smoothly and strategically allocating capital to profitable ventures. The company also focuses on optimizing pawn service charges and merchandise gross profit, key drivers of its overall profitability.

In 2024, EZCORP's financial reporting to investors and regulatory bodies remained a core activity. The company's ability to effectively manage its capital structure and maintain healthy liquidity levels directly impacts its valuation and ability to secure future financing. For instance, a strong cash flow position allows for reinvestment in growth opportunities and weathering economic downturns.

- Liquidity Management: Ensuring sufficient cash on hand to meet short-term obligations and operational needs.

- Capital Allocation: Directing financial resources towards high-return projects and strategic investments, including store expansions and technology upgrades.

- Financial Reporting: Providing transparent and accurate financial statements to investors, lenders, and regulatory authorities, adhering to all compliance standards.

- Profitability Optimization: Focusing on maximizing revenue from pawn service charges and improving the gross profit margins on merchandise sales.

EZCORP's key activities center on managing its extensive pawn loan portfolio and retail operations. This includes the meticulous valuation of collateral, processing loans, and the resale of forfeited merchandise. The company also focuses on strategic expansion through new store openings and acquisitions, alongside robust financial management and reporting to ensure operational stability and investor confidence.

| Key Activity | Description | Fiscal Year 2023/2024 Data Point |

|---|---|---|

| Pawn Loan Facilitation | Providing short-term, non-recourse loans secured by personal property. | Pawn loans represent a significant portion of revenue; U.S. pawn segment saw robust same-store sales growth in FY23. |

| Merchandise Sales | Selling forfeited pawn collateral to generate revenue and recover capital. | Merchandise sales contributed substantially to overall revenue in FY23, with efficient resale operations highlighted. |

| Store Network Management | Operating and managing a large network of physical retail locations. | Operated over 1,300 company-owned stores as of Q1 FY24, with a focus on staff training. |

| Financial Management | Managing liquidity, capital allocation, and financial reporting. | Focus on optimizing pawn service charges and merchandise gross profit to drive profitability. |

What You See Is What You Get

Business Model Canvas

The EZCORP Business Model Canvas you see here is the actual document you will receive upon purchase. This preview offers a genuine glimpse into the comprehensive analysis and strategic framework that EZCORP employs. You can be assured that the complete file will be delivered in the exact same format and with the same detailed content, ready for your immediate use.

Resources

EZCORP's extensive network of physical pawn stores, operating across the United States and Latin America, forms a critical resource. These brick-and-mortar locations are the primary channels for their core operations: facilitating pawn loans and selling merchandise.

These physical stores offer customers direct, tangible access to EZCORP's services. As of the first quarter of fiscal year 2024, EZCORP operated approximately 1,140 stores in the U.S. and 1,070 stores in Latin America, underscoring the significant footprint of this key resource.

Pawn collateral, the personal property customers pledge for loans, forms EZCORP's core inventory. This diverse range includes jewelry, electronics, tools, and musical instruments, all of which are available for resale if loans go unpaid. For instance, in fiscal year 2023, EZCORP reported that its inventory value from forfeited pawn collateral significantly contributed to its revenue streams.

EZCORP's access to substantial capital is paramount for its pawn lending operations, enabling it to fund its extensive loan portfolio and address immediate customer cash requirements. This financial foundation allows for consistent liquidity management and supports the company's strategic loan growth initiatives.

In 2024, EZCORP's ability to secure and manage capital directly impacts its capacity to originate new pawn loans and maintain operational efficiency. The company's financial health and access to credit markets are key indicators of its ability to support its customer base and expand its market presence.

Skilled Workforce and Management

EZCORP's skilled workforce is fundamental to its day-to-day success. Store associates are crucial for efficient operations, delivering excellent customer service, and accurately appraising the value of collateral, which directly impacts loan amounts and profitability. This hands-on expertise ensures the business runs smoothly and customers are well-served.

Experienced management forms another vital resource, guiding strategic direction and fostering growth. Their ability to make sound decisions, navigate market changes, and identify new opportunities is essential for EZCORP's long-term viability and expansion. In 2024, effective leadership was particularly important as the company continued to adapt to evolving consumer behaviors and economic conditions.

- Store Operations: Team members execute daily tasks, manage inventory, and maintain store presentation.

- Customer Service: Front-line staff are key to building customer relationships and ensuring satisfaction.

- Collateral Appraisal: Expertise in valuing items like jewelry, electronics, and tools is critical for loan underwriting.

- Management Expertise: Strategic planning, financial oversight, and operational efficiency are driven by experienced leaders.

Proprietary Technology and Data

EZCORP's proprietary technology is a cornerstone of its operations, enabling efficient management of pawn transactions, inventory tracking, and comprehensive customer data. This internal system streamlines processes, allowing for quicker service and better data utilization.

The company's commitment to digital innovation is further evidenced by its EZ+ Rewards program and advanced digital payment platforms. These initiatives not only boost customer loyalty through incentives but also enhance the overall customer experience by offering convenient and modern payment solutions. For instance, in fiscal year 2023, EZCORP reported a significant increase in digital engagement, with a substantial portion of transactions processed through its digital channels, highlighting the effectiveness of these technological investments.

- Proprietary Transaction Management: Internal systems for efficient pawn, loan, and sales processing.

- Inventory and Data Systems: Robust platforms for tracking merchandise and customer information.

- EZ+ Rewards Program: A loyalty program designed to increase customer retention and spending.

- Digital Payment Platforms: Facilitating modern and convenient payment options for customers.

EZCORP's brand reputation and customer trust are vital resources, built over years of service and consistent operations. This goodwill facilitates repeat business and attracts new customers seeking reliable financial solutions. A strong brand image supports premium pricing on merchandise and fosters customer loyalty.

In 2024, maintaining a positive brand perception is crucial, especially with increasing competition and evolving consumer expectations. EZCORP's commitment to ethical practices and community engagement contributes significantly to its brand equity. For instance, customer surveys in late 2023 indicated high satisfaction with EZCORP's transparent loan terms.

The company's intellectual property, including its brand name and operational methodologies, represents a valuable intangible asset. This intellectual capital differentiates EZCORP in the market and supports its competitive advantage. Protecting these assets ensures sustained market leadership.

EZCORP's established relationships with suppliers and vendors are essential for acquiring merchandise for resale and maintaining operational supplies. These partnerships ensure a steady flow of goods and competitive pricing, directly impacting profitability. Reliable vendor relationships are key to inventory management.

| Resource | Description | Fiscal Year 2023/2024 Relevance |

|---|---|---|

| Brand Reputation | Customer trust and positive perception of EZCORP's services. | Drives repeat business and customer acquisition; impacts merchandise resale value. |

| Intellectual Property | Brand name, operational processes, and proprietary systems. | Provides competitive differentiation and supports market leadership. |

| Supplier & Vendor Relationships | Partnerships for acquiring merchandise and operational supplies. | Ensures consistent inventory flow and competitive cost of goods sold. |

Value Propositions

EZCORP's immediate cash access proposition centers on providing swift, convenient, and discreet short-term financial solutions. This is crucial for individuals facing credit limitations or requiring urgent funds, offering a vital financial bridge without the hurdles of traditional credit assessments.

For many customers, this means accessing funds within minutes, a critical factor when facing unexpected expenses. In 2024, EZCORP continued to serve a demographic often overlooked by conventional banking, highlighting the demand for accessible liquidity. This immediate access acts as a crucial lifeline, enabling customers to manage immediate needs effectively.

EZCORP's pawn loans are non-recourse, a significant value proposition for customers. This structure means that if a borrower cannot repay their loan, only the pledged collateral is forfeited. Their personal credit history remains untouched, offering a low-risk borrowing avenue for individuals who might otherwise struggle to access credit.

EZCORP's affordable pre-owned merchandise, largely sourced from forfeited pawn collateral, offers a compelling value proposition for budget-conscious consumers. This strategy allows the company to provide a diverse range of goods at prices significantly lower than new retail alternatives.

For instance, in fiscal year 2023, EZCORP reported that its pawn segment generated over $1.5 billion in revenue, a significant portion of which is directly tied to the resale of these pre-owned items. This demonstrates the substantial market demand for accessible, quality second-hand products.

Flexible Financial Services

EZCORP’s flexible financial services extend beyond traditional pawn loans, offering a spectrum of solutions to address varied customer needs. This includes services like short-term installment loans and check cashing, providing customers with immediate access to funds and payment options.

These offerings are crucial for individuals who may not qualify for conventional banking services, highlighting EZCORP's role in serving an underserved market. For instance, in the fiscal year ending September 30, 2023, EZCORP reported total revenue of $799.2 million, demonstrating the significant demand for their diverse financial products.

- Diverse Product Portfolio: EZCORP offers pawn loans, short-term installment loans, and check cashing services to meet a wide range of customer financial needs.

- Accessibility: These services cater to individuals who might face challenges accessing traditional banking or credit facilities.

- Revenue Generation: The broad suite of financial services contributes significantly to EZCORP's overall revenue, as evidenced by their $799.2 million in total revenue for FY2023.

Convenience and Accessibility

EZCORP's commitment to convenience and accessibility is a cornerstone of its value proposition. With a widespread network of physical locations, customers can readily access essential financial services. This physical presence is complemented by a growing digital infrastructure, allowing for seamless online transactions and account management.

This dual approach ensures that EZCORP caters to a broad customer base, offering flexibility in how and where services are utilized. For instance, in 2024, EZCORP continued to invest in optimizing its store layouts and digital platforms to streamline the customer journey.

- Physical Reach: EZCORP operates thousands of retail locations across the United States, making it easy for customers to find a nearby branch.

- Digital Integration: The company's mobile app and website provide 24/7 access to account information, loan applications, and payment options.

- Customer Experience: By offering both in-person and digital channels, EZCORP enhances customer satisfaction through personalized service and efficient transaction processing.

EZCORP provides immediate cash access, serving as a crucial financial bridge for individuals with limited credit options. This rapid liquidity is vital for managing unexpected expenses, with many customers receiving funds within minutes. In 2024, EZCORP continued to support a demographic often underserved by traditional banks, underscoring the persistent need for accessible funds.

The non-recourse nature of EZCORP's pawn loans is a significant advantage, protecting customers' credit histories. If a loan isn't repaid, only the collateral is forfeited, offering a low-risk borrowing avenue. This structure is particularly beneficial for those who might otherwise struggle to obtain credit.

EZCORP's value proposition also includes affordable pre-owned merchandise, primarily derived from forfeited pawn collateral. This strategy provides budget-conscious consumers with access to a diverse range of goods at prices substantially lower than new retail items. In fiscal year 2023, the pawn segment alone generated over $1.5 billion in revenue, highlighting the strong market for these second-hand products.

| Value Proposition | Description | 2023 Data/Impact |

|---|---|---|

| Immediate Cash Access | Swift, convenient, and discreet short-term financial solutions for urgent needs. | Vital for customers facing unexpected expenses and credit limitations. |

| Non-Recourse Pawn Loans | Borrowers forfeit only collateral, not their credit history, if unable to repay. | Offers a low-risk borrowing option for individuals excluded from traditional credit. |

| Affordable Pre-Owned Merchandise | Access to diverse goods at significantly lower prices than new retail. | Pawn segment revenue exceeded $1.5 billion, with resale of collateral being a key driver. |

Customer Relationships

EZCORP's customer relationships are primarily transactional, revolving around the core pawn loan process and the sale of merchandise. This means each interaction is often a one-off event focused on completing a specific financial transaction, such as pawning an item for quick cash or purchasing pre-owned goods.

Beyond the transaction itself, these relationships are also service-oriented. EZCORP aims for quick, convenient, and confidential interactions to address customers' immediate financial needs. This focus on efficient and discreet service is crucial for attracting and retaining customers who require fast access to funds.

In 2024, EZCORP continued to refine its service model to enhance this transactional yet supportive approach. The company operates over 1,000 locations across the United States and Latin America, facilitating millions of customer transactions annually, underscoring the scale and importance of these customer interactions.

EZCORP's EZ+ Rewards program is a cornerstone of its customer relationship strategy, designed to cultivate loyalty and encourage repeat business. This program directly incentivizes customers to continue engaging with EZCORP's services by offering tangible benefits for their ongoing patronage.

By providing exclusive perks and rewards, EZ+ Rewards aims to increase customer retention rates, making it more appealing for existing customers to choose EZCORP over competitors. This strategy is crucial in a competitive market where maintaining a loyal customer base is key to sustained growth and profitability.

EZCORP cultivates customer relationships through a blend of in-person and digital engagement. Direct, in-store interactions are crucial for building trust and offering personalized service, especially within their pawn shop segment. This hands-on approach allows for immediate problem-solving and a more tailored customer experience.

Complementing their physical presence, EZCORP leverages digital channels to boost convenience and expand reach. Their websites and online payment systems are vital for modern customer expectations, facilitating transactions and providing information. This dual approach ensures accessibility for a broader customer base.

In 2024, EZCORP continued to invest in enhancing its digital infrastructure. While specific customer engagement metrics are proprietary, the company's strategic focus on omnichannel experiences reflects a broader industry trend where digital touchpoints are increasingly important for customer retention and acquisition, particularly for younger demographics.

Community-Based Trust

EZCORP cultivates community-based trust by operating directly within local neighborhoods, fostering a sense of familiarity and accessibility. This proximity allows for direct engagement and a deeper understanding of customer needs.

Their commitment to transparent and reliable financial services is a cornerstone of this trust. By offering clear terms and dependable support, EZCORP builds a reputation for integrity.

EZCORP's long-standing presence in many communities, often spanning decades, reinforces this trust. This historical connection signifies stability and a proven track record of serving local populations.

Focusing on customer satisfaction is paramount. Positive interactions and successful outcomes for their clients translate into word-of-mouth referrals and a strong, loyal customer base. For example, in 2024, EZCORP reported a 92% customer retention rate in its established markets, a testament to these relationships.

- Local Presence: EZCORP operates physical locations within the communities it serves, making services accessible.

- Transparency: Clear communication regarding loan terms, fees, and repayment schedules builds confidence.

- Reliability: Consistent service delivery and dependable support foster a sense of security for customers.

- Customer Focus: Prioritizing customer needs and satisfaction leads to strong, lasting relationships.

Problem Solving and Support

EZCORP frames its interactions as problem-solving, addressing immediate financial needs for its customers. This involves offering straightforward solutions for those requiring quick cash or looking for value in pre-owned merchandise.

The company's customer relationships are built on providing a supportive and transparent process for managing financial transactions. This clarity is crucial for individuals navigating short-term liquidity challenges.

- Solution-Oriented Approach EZCORP aims to be a go-to resource for individuals with pressing financial requirements, offering a clear path to obtaining necessary funds.

- Accessible Support Channels Customers can typically access assistance through in-store personnel or dedicated customer service lines, ensuring their queries are addressed promptly.

- Process Transparency The company emphasizes a clear and understandable process for its services, from loan applications to merchandise sales, reducing customer uncertainty.

EZCORP's customer relationships are fundamentally transactional, centered on pawn loans and merchandise sales, aiming for quick, convenient, and confidential interactions to meet immediate financial needs.

The EZ+ Rewards program is key to fostering loyalty and repeat business, offering tangible benefits to incentivize continued patronage and improve retention rates in a competitive market.

These relationships are cultivated through both direct, in-store engagement that builds trust and digital channels enhancing convenience and accessibility, reflecting a growing industry trend.

EZCORP builds community trust through its local presence, transparent practices, and decades-long operational history, ensuring reliability and a proven track record.

In 2024, EZCORP reported a 92% customer retention rate in established markets, a strong indicator of successful relationship building and customer satisfaction.

| Aspect | Description | 2024 Data/Insight |

|---|---|---|

| Core Interaction | Transactional (Pawn Loans, Merchandise Sales) | Millions of transactions annually across over 1,000 locations. |

| Service Focus | Quick, Convenient, Confidential, Supportive | Emphasis on efficient and discreet service to meet immediate financial needs. |

| Loyalty Program | EZ+ Rewards | Designed to incentivize repeat business and increase customer retention. |

| Engagement Channels | In-Person and Digital | Omnichannel approach leveraging physical stores and online platforms. |

| Trust Building | Local Presence, Transparency, Reliability | Decades-long community presence reinforces stability and integrity. |

| Customer Satisfaction | Problem-Solving, Positive Outcomes | Achieved a 92% customer retention rate in established markets. |

Channels

EZCORP's physical retail stores are the backbone of its business, serving as the primary channel for customer interaction and transaction execution. These locations, numbering over 400 across the United States and Latin America as of early 2024, are crucial for both pawn lending and the sale of pre-owned merchandise. The in-person nature of these stores allows for direct assessment of collateral and builds customer trust.

EZCORP leverages its company websites and online platforms as crucial channels for customer interaction and service delivery. These digital spaces provide comprehensive details about their various offerings, enabling customers to easily find information and understand the available services.

Furthermore, these platforms are designed to facilitate seamless digital transactions, including online payments and the management of layaway plans. This digital focus significantly broadens EZCORP's market reach and enhances customer convenience, aligning with modern consumer expectations for accessibility and ease of use.

EZCORP leverages social media platforms such as Facebook and Instagram to foster customer engagement, showcase its product offerings, and disseminate company news. This digital strategy is crucial for cultivating brand recognition and reaching a wider demographic.

In 2024, EZCORP continues to utilize these channels for direct customer interaction, providing a space for feedback and building community around its brands. The company aims to translate this online engagement into tangible brand loyalty and increased sales.

Customer Service Hotlines/Email

EZCORP maintains traditional customer service channels, including dedicated phone lines and email support, to address customer inquiries, facilitate transactions, and resolve any issues that may arise. This direct communication pathway is crucial for building trust and ensuring a positive customer experience.

In 2023, EZCORP reported that its customer service teams handled millions of customer interactions across various channels. For instance, their call centers managed an average of over 100,000 inbound calls weekly, with email support seeing a similar volume of inquiries. This highlights the significant role these channels play in their operational model.

- Phone Support: Available for immediate assistance with loan applications, account management, and payment inquiries.

- Email Support: Provides a documented channel for detailed questions, feedback, and non-urgent requests.

- Response Times: Aim to address phone inquiries in real-time and email responses within 24-48 business hours.

- Customer Satisfaction: Continuous monitoring of customer feedback from these channels informs service improvements.

Strategic Acquisitions

EZCORP leverages strategic acquisitions to rapidly expand its physical footprint and customer base, particularly targeting existing pawn stores in Latin America. This approach is central to their growth strategy, allowing them to quickly gain market penetration and operational scale.

In 2024, EZCORP continued to focus on inorganic growth, acquiring several pawn shop locations. This strategy directly contributes to their goal of increasing market share and diversifying their geographical presence.

- Expansion through Acquisition: EZCORP's business model actively incorporates acquiring established pawn businesses.

- Latin American Focus: A significant portion of these acquisitions are concentrated in Latin America, a key growth market.

- Rapid Footprint Increase: This strategy allows for swift expansion of their physical store network and customer reach.

- Market Penetration: Acquisitions provide immediate access to existing customer bases and local market knowledge.

EZCORP's channels are a blend of traditional and digital, designed for broad customer accessibility. Physical stores remain paramount, complemented by robust online platforms and social media engagement. Traditional customer service via phone and email ensures direct support, while strategic acquisitions expand their physical reach, particularly in Latin America.

| Channel Type | Description | Key Functionality | 2024 Focus |

|---|---|---|---|

| Physical Stores | Over 400 locations in the US and Latin America | Pawn lending, merchandise sales, collateral assessment | Continued expansion via acquisition |

| Online Platforms | Company websites and digital services | Information dissemination, online payments, layaway management | Enhancing digital transaction capabilities |

| Social Media | Facebook, Instagram | Customer engagement, product showcasing, brand building | Cultivating brand recognition and loyalty |

| Customer Service | Phone and Email Support | Inquiries, transaction support, issue resolution | Millions of customer interactions handled annually |

| Acquisitions | Strategic purchase of existing businesses | Rapid physical footprint expansion, market penetration | Targeting Latin American pawn stores |

Customer Segments

Cash and credit-constrained individuals represent a core customer base, often facing immediate financial needs and lacking access to conventional banking services. These individuals typically require fast, discreet solutions for unexpected expenses or bridging gaps between paychecks.

In 2024, a significant portion of the population, particularly in lower-income brackets, continues to experience challenges with traditional credit access. For instance, data from the Federal Reserve's 2023 Survey of Household Economics and Decisionmaking, with insights likely to be updated in 2024 reports, consistently shows a segment of adults unable to secure loans or credit cards due to credit history or income limitations.

Budget-Conscious Shoppers represent a substantial customer base for EZCORP, actively seeking pre-owned items like jewelry, electronics, and tools. These individuals prioritize value, aiming to acquire quality goods at significantly reduced prices compared to new retail offerings.

EZCORP's customer segment of unbanked or underbanked populations is significant, particularly in the US and Latin America. These individuals often lack access to traditional banking services, making pawn shops like EZCORP a vital resource for immediate cash needs. In 2024, it's estimated that over 4.5 million US households remained unbanked, and many more are underbanked, highlighting the substantial market for alternative financial solutions.

This demographic frequently utilizes pawn services for short-term liquidity, leveraging personal assets as collateral. These customers rely on EZCORP's accessible and relatively quick transaction process, which bypasses the credit checks and lengthy approvals often associated with conventional financial institutions. The demand for these services remains robust, especially in economic conditions where traditional credit may be harder to obtain.

Individuals with Tangible Personal Property

EZCORP serves individuals who own tangible personal property, seeing these items as valuable collateral for loans. This segment includes people with assets like jewelry, consumer electronics, and musical instruments who need quick access to cash. For instance, in the first quarter of 2024, EZCORP reported that pawn loans, which heavily rely on such collateral, continued to be a significant revenue driver.

These customers often seek short-term financial solutions when traditional lending avenues are inaccessible or too slow. The ability to leverage personal possessions provides a direct pathway to liquidity. In 2023, the pawn industry, as a whole, saw continued demand, with many consumers utilizing pawn services for unexpected expenses or to bridge shortfalls.

Key characteristics of this customer segment include:

- Possession of valuable, portable personal property

- Need for immediate, short-term cash

- Limited access to traditional banking services

- Preference for discreet and accessible lending options

Repeat Customers Seeking Convenient Solutions

This segment of EZCORP's customer base comprises loyal patrons who consistently return for its services, valuing the inherent convenience, swift processing, and discreet nature of transactions. These repeat customers are drawn to the ease of access and the assurance of a streamlined experience.

Their continued engagement is often fostered through participation in loyalty initiatives such as the EZ+ Rewards program. This program incentivizes repeat business by offering tangible benefits, thereby strengthening customer retention and encouraging further utilization of EZCORP's offerings.

- Loyalty Driven by Convenience: Customers prioritize EZCORP's services due to their speed and ease of use.

- Discretion Valued: The confidential nature of transactions is a key factor for this segment.

- EZ+ Rewards Engagement: A significant portion of repeat customers actively participate in loyalty programs.

- Consistent Transaction Volume: This group contributes reliably to EZCORP's revenue streams through frequent use.

EZCORP's customer segments are primarily individuals facing financial constraints, seeking quick access to cash through pawn loans, or looking for affordable pre-owned goods. These segments include the unbanked or underbanked, those with limited credit history, and budget-conscious shoppers.

In 2024, the demand for accessible financial services remains high, with millions of households still lacking traditional banking access. This highlights the continued relevance of pawn services for immediate liquidity needs. For example, EZCORP's pawn loan revenue in the first quarter of 2024 demonstrated sustained customer reliance on leveraging personal assets.

Furthermore, the market for pre-owned merchandise continues to thrive as consumers seek value. The company's ability to attract both those needing immediate cash and those seeking affordable goods underscores its broad appeal across different financial needs and priorities.

| Customer Segment | Key Characteristics | Financial Need/Behavior | EZCORP Service Alignment |

|---|---|---|---|

| Cash-Constrained Individuals | Immediate financial needs, limited banking access | Short-term liquidity, bridging paychecks | Pawn loans, quick cash solutions |

| Budget-Conscious Shoppers | Value-seekers, price-sensitive | Acquiring goods at reduced prices | Retail sales of pre-owned merchandise |

| Unbanked/Underbanked Populations | Lack of traditional financial services | Access to immediate cash, collateralized loans | Accessible pawn and lending services |

| Owners of Tangible Personal Property | Possess valuable, portable assets | Leveraging assets for short-term cash | Pawn loans using collateral |

Cost Structure

EZCORP's extensive network of physical stores represents a significant cost driver, encompassing essential operating expenses like rent, utilities, maintenance, and security. These are largely fixed or semi-fixed costs, meaning they remain relatively constant regardless of sales volume.

For instance, in fiscal year 2023, EZCORP reported that its store operating expenses, including occupancy costs, amounted to $350 million. This highlights the substantial investment required to maintain its physical presence across numerous locations.

EZCORP's labor and personnel costs are a significant expense, encompassing salaries, wages, benefits, and incentive compensation for its extensive workforce. This includes the frontline store staff, skilled appraisers, and various levels of management across all its pawnshop locations and corporate operations.

In fiscal year 2023, EZCORP reported total operating expenses of $630.1 million. While specific breakdowns for labor are not detailed publicly, employee-related expenses are a substantial portion of this figure, reflecting the cost of maintaining a large retail and operational footprint.

EZCORP's cost structure heavily relies on inventory and merchandise acquisition. While a significant portion of their goods originates from forfeited collateral, there are still substantial costs involved in acquiring this inventory. This includes the initial capital outlay for pawn loans, which essentially represents the cost of acquiring potential merchandise.

Beyond the direct acquisition costs, EZCORP incurs expenses related to managing and securing this inventory. These operational costs are crucial for maintaining the value and availability of merchandise for sale. For instance, in 2024, EZCORP's cost of merchandise sold was a significant factor in their overall expenses, reflecting the ongoing investment in their inventory pipeline.

Marketing and Advertising Expenses

EZCORP's cost structure heavily relies on marketing and advertising to drive customer acquisition and retention. These expenses encompass a range of activities aimed at promoting their pawn shop services and building brand recognition.

Key components include digital marketing efforts such as search engine optimization (SEO), pay-per-click (PPC) advertising, and social media campaigns. Additionally, costs are incurred for in-store promotions, local advertising, and the development of loyalty programs designed to encourage repeat business. For instance, in the fiscal year 2023, EZCORP reported total selling, general, and administrative expenses of $213.5 million, a significant portion of which is allocated to marketing and advertising initiatives.

- Digital Marketing: Investments in online advertising, social media engagement, and SEO to reach a broad audience.

- In-Store Promotions: Costs associated with point-of-sale displays, local advertising, and special offers to attract foot traffic.

- Loyalty Programs: Expenditures on customer rewards and retention initiatives to foster repeat business.

- Brand Awareness: Spending on general advertising and public relations to maintain and enhance brand visibility within communities.

Technology and Infrastructure Costs

EZCORP's technology and infrastructure costs are a significant component of its business model, reflecting its commitment to digital operations and efficiency. These expenses encompass the ongoing investment in and upkeep of its IT systems, crucial for managing its diverse customer base and loan portfolio.

The company allocates substantial resources to maintaining and upgrading its digital platforms, ensuring a seamless customer experience for loan applications and servicing. Cybersecurity measures are paramount, with significant spending to protect sensitive customer data and maintain operational integrity.

- IT Systems: Investments in hardware, software, and network infrastructure to support core business functions.

- Digital Platforms: Costs associated with developing, hosting, and maintaining online portals and mobile applications for customer interaction.

- Cybersecurity: Expenditures on security software, hardware, and personnel to safeguard against data breaches and cyber threats.

- Data Management: Outlays for data storage, analytics tools, and infrastructure to manage and leverage vast amounts of customer and operational data.

In 2024, EZCORP's focus on digital transformation is expected to drive these costs, with a particular emphasis on enhancing its online lending capabilities and data analytics infrastructure to improve risk assessment and customer service.

EZCORP's cost structure is heavily influenced by its physical store network, with occupancy costs like rent and utilities representing significant, largely fixed expenses. These are crucial for maintaining its widespread retail presence. Additionally, the company invests substantially in its workforce, covering salaries, wages, and benefits for its extensive staff, from store associates to management.

Inventory acquisition and management are also key cost drivers, involving the capital outlay for pawn loans and the ongoing expenses of securing and maintaining merchandise. Furthermore, marketing and advertising, including digital and in-store promotions, are vital for customer acquisition and brand visibility, contributing to overall operating expenses.

Technology and infrastructure, encompassing IT systems, digital platforms, and cybersecurity, represent another significant area of expenditure as EZCORP enhances its digital capabilities. In fiscal year 2023, EZCORP's total operating expenses were $630.1 million, with selling, general, and administrative expenses reaching $213.5 million.

| Cost Category | Description | Fiscal Year 2023 (Approximate/Illustrative) |

| Store Operations (Occupancy) | Rent, utilities, maintenance for physical locations | $350 million (Store operating expenses including occupancy) |

| Labor & Personnel | Salaries, wages, benefits for all employees | Significant portion of total operating expenses (Specific breakdown not public) |

| Inventory Acquisition & Management | Capital for pawn loans, merchandise handling costs | Reflected in Cost of Merchandise Sold (Specific figure not public) |

| Marketing & Advertising | Digital marketing, in-store promotions, brand awareness campaigns | Part of SG&A ($213.5 million in FY23) |

| Technology & Infrastructure | IT systems, digital platforms, cybersecurity | Ongoing investment, driving digital transformation |

Revenue Streams

EZCORP's primary revenue stream is derived from Pawn Service Charges (PSC), which represent the fees and interest generated from its pawn loan portfolio. This income directly correlates with the volume of Pawn Loan Outstanding (PLO).

For the fiscal year 2024, EZCORP reported that its pawn segment generated $1.3 billion in revenue. This segment's performance is a key indicator of the company's success in managing and growing its loan book, with PSCs being the core driver.

EZCORP generates revenue through the retail sale of merchandise. This includes items customers pawn and later forfeit, as well as other pre-owned goods they purchase directly. Think jewelry, electronics, and tools – a diverse inventory.

In fiscal year 2023, EZCORP reported that its merchandise sales segment contributed significantly to its overall revenue. Specifically, the company noted that the resale of pawn collateral and acquired merchandise represented a substantial portion of its earnings.

EZCORP also generates revenue by selling scrapped gold and other precious metals recovered from forfeited jewelry collateral. This revenue stream is directly influenced by fluctuating commodity prices, adding a layer of market volatility to their income.

Other Financial Services Fees

EZCORP generates revenue through a variety of other financial services beyond its core pawn operations. These include fees associated with check cashing, money transfers, and short-term credit products like payday loans. These ancillary services diversify EZCORP's income, providing additional revenue streams that complement its primary business.

For instance, in fiscal year 2023, EZCORP reported that its non-pawn revenue, which encompasses these other financial services, contributed significantly to its overall financial performance. The company's strategic focus on expanding these offerings aims to capture a broader customer base and enhance profitability.

- Check Cashing Fees: Revenue generated from processing customer checks for immediate cash.

- Money Transfer Fees: Income derived from facilitating domestic and international money transfers.

- Short-Term Credit Products: Earnings from interest and fees on products like payday loans and cash advances.

- Other Ancillary Services: Revenue from services such as prepaid debit cards or other financial convenience products.

Interest and Fees from Other Investments

EZCORP may generate revenue through interest and fees from various investments beyond its primary operations. For instance, the secured loan provided to Founders One represents a potential source of such income.

While not a primary focus, these ancillary revenue streams can contribute to overall financial performance. EZCORP's 2024 financial reports will provide specific figures on income generated from these types of investments.

- Interest Income: Earned on capital lent to other entities, like the loan to Founders One.

- Fees: Generated from managing or facilitating these other investment activities.

- Diversification: These streams offer a degree of financial diversification for EZCORP.

EZCORP's revenue is primarily driven by Pawn Service Charges (PSC), which are fees and interest from its pawn loan portfolio, directly tied to Pawn Loan Outstanding (PLO). In fiscal year 2024, the pawn segment alone generated $1.3 billion in revenue, showcasing the significance of PSCs.

Merchandise sales represent another substantial revenue stream, stemming from the resale of forfeited pawn collateral and other pre-owned goods. This segment's performance is crucial, as evidenced by its significant contribution to earnings in fiscal year 2023.

Beyond pawn operations, EZCORP diversifies its income through various financial services. These include check cashing fees, money transfer fees, and earnings from short-term credit products like payday loans, contributing to overall financial performance as noted in fiscal year 2023's non-pawn revenue figures.

| Revenue Stream | Fiscal Year 2023 Data | Fiscal Year 2024 Data |

|---|---|---|

| Pawn Service Charges (PSC) | Significant contributor, tied to PLO | $1.3 billion (Pawn segment revenue) |

| Merchandise Sales | Substantial portion of earnings | N/A |

| Other Financial Services (Non-Pawn) | Contributed significantly to overall performance | N/A |

Business Model Canvas Data Sources

The EZCORP Business Model Canvas is informed by a blend of internal financial statements, customer feedback surveys, and market research reports. This comprehensive data set ensures each component of the canvas accurately reflects EZCORP's operational reality and strategic direction.