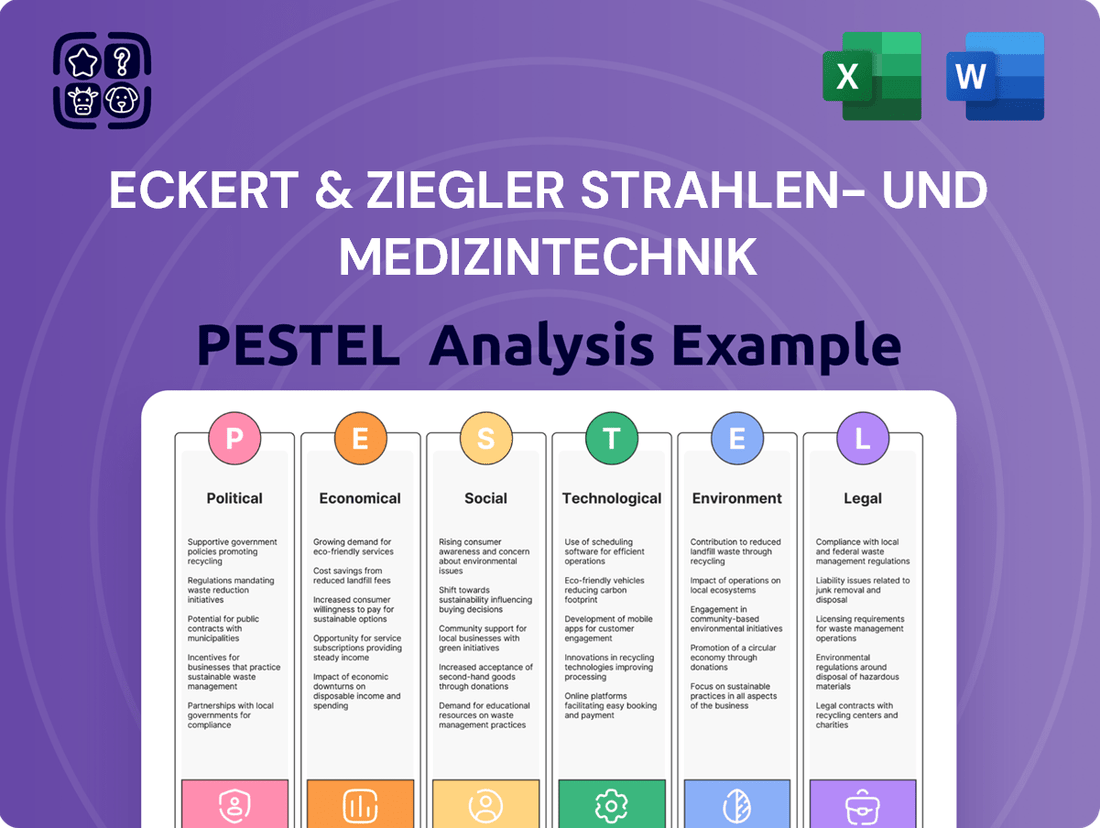

Eckert & Ziegler Strahlen- und Medizintechnik PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eckert & Ziegler Strahlen- und Medizintechnik Bundle

Navigate the complex external forces shaping Eckert & Ziegler Strahlen- und Medizintechnik's trajectory. Our PESTEL analysis dissects political stability, economic shifts, technological advancements, environmental regulations, and social trends impacting the company's operations and future growth. Gain a critical understanding of these macro-environmental factors to inform your strategic decisions and identify potential opportunities or threats. Download the full PESTEL analysis now for actionable intelligence.

Political factors

Government healthcare policies, particularly those concerning spending and reimbursement for nuclear medicine and cancer therapies, directly shape the market for Eckert & Ziegler's offerings. For instance, in 2024, many European nations are reviewing their healthcare budgets, with a focus on innovative treatments. Changes in how these advanced therapies are reimbursed can significantly impact demand for Eckert & Ziegler's isotope technology and related services.

Health technology assessments (HTAs) also play a crucial role. Governments increasingly rely on HTAs to determine the cost-effectiveness and clinical utility of new medical technologies. Positive assessments can accelerate adoption, while negative ones can create significant hurdles. Initiatives promoting early diagnosis and targeted therapies, often driven by government funding and policy, create tailwinds for companies like Eckert & Ziegler.

The stringent regulation of radioactive materials, encompassing production, transport, and disposal, is a major political consideration for Eckert & Ziegler. National and international bodies like the International Atomic Energy Agency (IAEA) set these standards. For instance, in 2024, ongoing discussions around enhancing nuclear security protocols globally, following geopolitical shifts, could lead to updated compliance demands for companies handling such materials.

As a specialist in isotope technology, Eckert & Ziegler must navigate evolving safety standards and licensing requirements for both its facilities and products. These evolving regulations can directly influence operational expenditures and the timeline for introducing new products to the market. The company's commitment to compliance is fundamental for its continued operation and market access.

Eckert & Ziegler, as a global player in specialized medical technology, navigates a complex web of international trade policies. Tariffs and export controls on radioactive components, essential for their products, directly influence operational costs and market accessibility. For instance, changes in trade agreements between major economic blocs can significantly alter the landed cost of their specialized materials.

Geopolitical instability and ongoing trade disputes pose a tangible threat to Eckert & Ziegler's supply chain. Disruptions in the sourcing of critical raw materials, such as specific isotopes, or restricted market access in regions experiencing political tension, can hinder production and distribution. The company's reliance on a stable global environment for sourcing and sales underscores the importance of international relations for its business continuity.

Political Stability and Economic Sanctions

Political stability in Germany, the United States, and China, key markets for Eckert & Ziegler, is crucial. Germany, a stable parliamentary democracy, generally offers a predictable business environment. However, geopolitical shifts, such as the ongoing conflict in Eastern Europe, can introduce supply chain uncertainties and impact energy costs, affecting operational efficiency. For example, the German government’s energy security initiatives in response to geopolitical events in 2022-2024 aim to mitigate these risks, but the long-term implications remain under observation.

Economic sanctions present a significant political risk. While Eckert & Ziegler primarily operates in stable regions, any future expansion into or sourcing from countries subject to international sanctions could severely curtail its operations. For instance, sanctions imposed on Russia in 2022 significantly impacted global trade and supply chains, demonstrating the potential ripple effects on companies with international exposure, even if direct operations in sanctioned countries are limited. The company's reliance on a global supply chain means it must continuously monitor international relations and trade policies.

- Geopolitical Stability: Eckert & Ziegler operates in Germany, a politically stable nation, but must monitor global events impacting supply chains and energy costs.

- Sanctions Impact: The company’s global operations and supply chain are vulnerable to international economic sanctions, which can restrict market access and sourcing.

- Regulatory Environment: Changes in trade policies and political relations between major economies like the US, China, and the EU can influence Eckert & Ziegler's market access and operational costs.

Public Policy on Nuclear Energy and Waste Management

Public policy regarding nuclear energy and waste management, while not directly Eckert & Ziegler's core business of medical technology, creates an indirect but significant operating environment. Stringent regulations around the handling and disposal of radioactive materials, even those used in medical applications, can impact costs and operational complexity. For instance, in 2024, many countries continued to debate and refine their long-term nuclear waste strategies, with some considering new disposal sites or advanced recycling technologies. This evolving landscape necessitates adaptability in how companies like Eckert & Ziegler manage their material lifecycles.

The perception of nuclear technology by the public and policymakers is also a crucial factor. Negative sentiment, often fueled by concerns over waste disposal, can lead to increased scrutiny and more restrictive policies, even for low-level radioactive waste generated by medical procedures. As of early 2025, discussions in the European Union and North America continue to focus on enhancing safety protocols and public communication surrounding all forms of nuclear material. Eckert & Ziegler must navigate this public opinion, ensuring their practices align with societal expectations for safety and environmental responsibility.

Key considerations for Eckert & Ziegler stemming from these policies include:

- Regulatory Compliance: Adherence to evolving national and international regulations for the transport, storage, and disposal of radioactive materials, including medical isotopes.

- Public Perception Management: Addressing public concerns about nuclear technology through transparent operations and clear communication regarding the safety of their medical applications.

- Waste Disposal Costs: Potential increases in costs associated with the disposal of even low-level radioactive waste, influenced by the availability and regulation of disposal facilities.

- Technological Advancements: The impact of new waste management technologies or stricter disposal requirements on the company's operational efficiency and cost structure.

Government healthcare funding decisions directly impact Eckert & Ziegler's market, especially concerning reimbursement for nuclear medicine and cancer therapies. For example, in 2024, many European governments are reassessing healthcare budgets, prioritizing innovative treatments, which could influence demand for the company's isotope technology.

Strict regulations govern the handling and transport of radioactive materials, a critical aspect for Eckert & Ziegler. International bodies like the IAEA set these standards, and ongoing discussions in 2024 about nuclear security could lead to updated compliance requirements for companies in this sector.

International trade policies, including tariffs and export controls on essential radioactive components, directly affect Eckert & Ziegler's operational costs and market reach. Shifts in trade agreements between major economic blocs in 2024 can significantly alter the cost of their specialized materials.

What is included in the product

This PESTLE analysis examines the external macro-environmental influences impacting Eckert & Ziegler Strahlen- und Medizintechnik across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes to inform strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Eckert & Ziegler Strahlen- und Medizintechnik a clear overview of external factors impacting their business.

Helps support discussions on external risk and market positioning during planning sessions, enabling Eckert & Ziegler Strahlen- und Medizintechnik to proactively address potential challenges and capitalize on opportunities.

Economic factors

Global healthcare expenditure is on a steady rise, a trend that directly impacts the market for nuclear medicine and cancer therapies. For instance, the Organisation for Economic Co-operation and Development (OECD) reported that average healthcare spending per capita in its member countries reached approximately $5,300 in 2023, a figure expected to continue its upward trajectory. This growth fuels demand for advanced medical technologies and treatments, creating a favorable environment for companies like Eckert & Ziegler.

Emerging economies are increasingly allocating larger portions of their budgets to healthcare, further expanding the market. In 2024, many Asian and Latin American countries are projected to see healthcare spending growth rates exceeding 7%, driven by rising incomes and a greater focus on public health infrastructure. This expansion offers significant opportunities for Eckert & Ziegler to introduce its products and services to new patient populations.

However, economic downturns and government austerity measures can pose challenges. A slowdown in global economic growth, as anticipated by the International Monetary Fund for late 2024 and early 2025, could lead to tighter healthcare budgets. Such conditions might constrain the adoption of new, often expensive, medical technologies, potentially limiting growth for Eckert & Ziegler’s offerings.

Reimbursement policies from both public and private insurers significantly influence market access and profitability for diagnostic and therapeutic procedures utilizing radioisotopes. These policies dictate the financial viability of products and services, directly impacting revenue streams for companies like Eckert & Ziegler.

In 2024, the healthcare landscape continues to see downward pressure on pricing for medical devices and radiopharmaceuticals. For instance, the Centers for Medicare & Medicaid Services (CMS) in the US regularly reviews and adjusts reimbursement rates for medical procedures and supplies, which can lead to increased cost scrutiny for manufacturers and suppliers.

Eckert & Ziegler's financial performance is therefore sensitive to shifts in these reimbursement structures. Any reduction in reimbursement rates or increased co-pays by insurers can directly compress profit margins and necessitate strategic adjustments to pricing and cost management for their radiopharmaceutical and medical technology offerings.

The economic viability of Eckert & Ziegler's operations hinges on the consistent availability and predictable pricing of essential raw materials, especially rare isotopes crucial for their medical technology segment. For instance, the supply chain for isotopes like Germanium-68, vital for PET imaging, can be influenced by geopolitical events and production capacity at key global suppliers.

As of early 2024, the cost of certain specialized isotopes has seen upward pressure due to increased demand from the expanding nuclear medicine sector and limited production facilities. This volatility directly impacts Eckert & Ziegler's production expenses and, consequently, the pricing of their finished products, requiring careful inventory management and supplier diversification.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Eckert & Ziegler Strahlen- und Medizintechnik, a global player. As of late 2024 and projected into 2025, major currency pairs like the EUR/USD and EUR/GBP continue to exhibit volatility, influenced by differing monetary policies and economic outlooks. For instance, a stronger Euro could make imported components more expensive, while a weaker Euro might boost the competitiveness of their exports.

These movements directly impact the company's financial health. Fluctuations can alter the cost of raw materials sourced internationally and affect the value of revenue generated from sales in foreign markets. When Eckert & Ziegler converts its overseas earnings back into Euros, unfavorable exchange rate shifts can lead to reduced reported profits.

Key impacts include:

- Increased Cost of Goods Sold: A weaker Euro against currencies of key suppliers can raise the cost of imported materials and components.

- Reduced International Revenue Value: Sales made in countries with weakening currencies, when translated back to Euros, will yield less revenue.

- Impact on Profit Margins: Both increased costs and reduced revenue values can compress profit margins if not effectively managed through hedging strategies.

- Unpredictable Financial Reporting: Significant currency swings can make year-over-year financial performance comparisons more complex and less predictable.

Investment in Medical Research and Development

Government funding and private investment are critical drivers for innovation in medical research, directly impacting companies like Eckert & Ziegler. In 2023, global healthcare R&D spending reached an estimated $240 billion, with a significant portion directed towards oncology and nuclear medicine. This trend is expected to continue, with projections indicating a compound annual growth rate of 7% for the radiopharmaceuticals market through 2028.

These investments translate into tangible opportunities. For instance, increased funding for early-stage research can accelerate the development of novel diagnostic tools and therapeutic agents, areas where Eckert & Ziegler has established expertise.

- Increased Funding for Oncology R&D: In 2024, the National Cancer Institute alone allocated over $7 billion to cancer research, fostering advancements in areas relevant to Eckert & Ziegler's product portfolio.

- Growth in Nuclear Medicine Market: The global nuclear medicine market was valued at approximately $5.7 billion in 2023 and is projected to reach $10.5 billion by 2028, driven by demand for diagnostic imaging agents and therapeutic radiopharmaceuticals.

- Private Sector Investment in Biotech: Venture capital funding in the biotech sector, particularly in oncology and rare diseases, remained strong in 2023, with over $30 billion invested globally, creating a fertile ground for new partnerships and product development.

Global economic growth trends significantly influence healthcare spending, a key driver for Eckert & Ziegler. The International Monetary Fund projected global GDP growth of 3.2% for 2024, a moderate but stable outlook that supports continued investment in healthcare infrastructure and advanced medical technologies.

Inflationary pressures and interest rate policies by central banks, such as the European Central Bank and the US Federal Reserve, impact operational costs and investment decisions. For instance, persistent inflation in 2024 led to higher costs for raw materials and energy, affecting production expenses.

Government fiscal policies, including healthcare budgets and tax regulations, directly shape the market environment. Changes in reimbursement rates for radiopharmaceuticals and medical devices, as reviewed by bodies like the US Centers for Medicare & Medicaid Services, can alter profitability.

The economic health of emerging markets, with their increasing healthcare expenditure, presents growth opportunities. Many Asian economies, for example, are projected to maintain healthcare spending growth above 7% in 2024, expanding the potential customer base for Eckert & Ziegler.

| Economic Factor | 2024 Projection/Data | Impact on Eckert & Ziegler |

|---|---|---|

| Global GDP Growth | 3.2% (IMF) | Supports stable healthcare spending |

| Inflation Rate (Eurozone) | ~2.5% (ECB estimate) | Increases operational costs |

| Healthcare Spending Growth (Emerging Markets) | >7% | Expands market opportunities |

| Interest Rates (Major Economies) | Varying, but generally elevated | Affects cost of capital and investment |

Full Version Awaits

Eckert & Ziegler Strahlen- und Medizintechnik PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Eckert & Ziegler Strahlen- und Medizintechnik provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the market dynamics and potential challenges and opportunities for Eckert & Ziegler, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This analysis is meticulously researched and presented, offering a clear and actionable understanding of the external forces shaping the radiation technology and medical technology sectors.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be 65 or older, up from one in 11 in 2015. This demographic shift is crucial because aging is a primary risk factor for many cancers. As more people live longer, the demand for advanced cancer treatments and diagnostic tools, like those offered by Eckert & Ziegler in brachytherapy and nuclear medicine, is expected to climb significantly.

Public perception significantly shapes the adoption of nuclear medicine. In 2024, surveys indicated a growing comfort level with diagnostic imaging, with an estimated 70% of adults expressing willingness to undergo nuclear medicine scans if recommended by their doctor. This positive trend is often fueled by successful patient outcomes and clearer communication about safety protocols.

However, historical anxieties surrounding radioactive materials persist, potentially creating barriers. Increased public awareness initiatives, perhaps highlighting the minimal radiation doses and advanced safety measures employed, are crucial for bolstering trust. For instance, a 2025 public health campaign focused on the benefits of PET scans reported a 15% increase in patient inquiries about the procedure.

Shifting lifestyle habits, including dietary patterns and physical activity levels, are contributing to a rise in chronic illnesses such as cancer and heart disease. For instance, the World Health Organization reports that non-communicable diseases, largely driven by lifestyle, accounted for an estimated 74% of all deaths globally in 2020.

This escalating disease burden creates a heightened demand for sophisticated medical technologies and treatments. Eckert & Ziegler's portfolio, focusing on areas like cancer therapy and medical imaging, is therefore well-positioned to benefit from this trend, as healthcare systems seek more effective diagnostic and therapeutic solutions.

Ethical Considerations in Medical Isotope Use

Societal discussions regarding the ethical implications of using radioactive isotopes in healthcare, especially concerning patient well-being and the long-term consequences of radiation exposure, can significantly impact public perception and regulatory frameworks. For instance, ongoing debates about the acceptable risk levels for diagnostic versus therapeutic isotopes shape public discourse and influence investment in new technologies.

The responsible management of radioactive waste generated from medical procedures is another critical ethical dimension. Public concern over safe disposal methods and potential environmental contamination can lead to stricter operational guidelines and increased costs for companies like Eckert & Ziegler. This was evident in 2024 when several European nations reviewed their nuclear waste management policies, indirectly affecting the medical isotope supply chain.

- Patient Safety: Ensuring isotopes used in diagnostics and therapies pose minimal risk to patients, with ongoing research into lower-dose alternatives.

- Long-Term Effects: Addressing public and scientific concerns about potential long-term health impacts from radiation exposure, even at diagnostic levels.

- Waste Management: Developing and implementing secure, environmentally sound methods for the disposal of radioactive medical waste, a growing challenge with increased isotope use.

- Public Trust: Maintaining transparency and open communication about the benefits and risks of medical isotopes to foster public confidence and support.

Access to Healthcare and Health Equity

Societal values emphasizing healthcare access and equity are increasingly shaping policies that aim to broaden the availability of advanced medical treatments, such as those in nuclear medicine. This trend directly impacts companies like Eckert & Ziegler, influencing their market expansion strategies as governments and healthcare systems prioritize equitable distribution of specialized technologies.

For instance, in 2024, many developed nations continued to focus on reducing healthcare disparities. In the United States, initiatives aimed at improving access to care in underserved rural areas, often through telehealth and mobile diagnostic units, gained traction. Similarly, European Union member states are exploring ways to harmonize access to cutting-edge medical technologies, which could create new opportunities for companies providing nuclear medicine equipment and isotopes.

- Growing Demand for Accessible Nuclear Medicine: Public health campaigns promoting early disease detection and treatment are driving demand for nuclear medicine services, particularly in oncology.

- Policy Focus on Health Equity: Governments are implementing policies to ensure that advanced medical technologies are not confined to affluent urban centers, encouraging investment in regional healthcare infrastructure.

- Impact on R&D and Pricing: Societal pressure for equitable access may influence research and development priorities and pricing strategies for medical technology providers.

- Geographic Market Expansion: Companies may find increased opportunities in regions previously underserved by advanced medical technologies due to policy shifts favoring broader accessibility.

Societal emphasis on preventative healthcare and early disease detection is a significant driver for Eckert & Ziegler's nuclear medicine segment. As of 2024, public health initiatives promoting regular health screenings, particularly for cancer, have increased patient engagement with diagnostic imaging services.

The aging global population, a trend projected to continue with one in six people being over 65 by 2050, directly boosts demand for cancer therapies and diagnostics, areas where Eckert & Ziegler specializes. This demographic shift underscores the growing need for advanced medical technologies to manage age-related diseases.

Public perception of nuclear medicine is increasingly positive, with studies in 2024 showing a growing acceptance of diagnostic imaging. This trend is supported by successful patient outcomes and enhanced communication regarding safety protocols, fostering greater trust in these advanced medical procedures.

Ethical considerations surrounding radiation use and waste management remain important. Societal concerns about patient well-being and environmental impact influence regulatory frameworks and operational standards for companies in this sector, as seen in policy reviews of nuclear waste management in Europe during 2024.

Technological factors

Technological leaps in producing vital medical radioisotopes like Actinium-225 and Lutetium-177 directly impact Eckert & Ziegler's capabilities. These advancements are key to securing a consistent and high-quality supply for critical therapies.

Innovations in cyclotron technology and sophisticated chemical processing are enabling higher yields and greater purity for these isotopes. This not only boosts production efficiency but also strengthens supply chains, potentially lessening dependence on external suppliers.

The ongoing innovation in radiopharmaceuticals and the rise of theranostics, which merge diagnostic imaging with targeted therapy, represent key technological advancements. Eckert & Ziegler's role in providing essential isotopes for these cutting-edge treatments, like those used in PSMA-targeted therapies for prostate cancer, places them as a crucial player in the expanding field of personalized medicine.

Technological strides in imaging, such as the growing use of SPECT and PET scans, alongside breakthroughs in brachytherapy equipment like portable electronic brachytherapy systems, are significantly shaping the market for Eckert & Ziegler's offerings. These advancements directly influence how effectively their products can be deployed and adopted by healthcare providers.

The integration of artificial intelligence and machine learning is a key technological driver, promising to refine treatment planning and enhance the interpretation of medical images. For instance, AI algorithms are showing promise in improving the precision of radiation delivery in brachytherapy, a field where Eckert & Ziegler is active.

Automation and Digitization in Production and Distribution

Eckert & Ziegler Strahlen- und Medizintechnik is leveraging automation and digitization to streamline its operations. The company's investment in advanced manufacturing processes for radioactive components directly addresses the need for enhanced precision and reduced human error in production and quality control. For instance, automated handling systems minimize radiation exposure risks for personnel, a critical factor in this industry.

Digitization plays a crucial role in Eckert & Ziegler's supply chain management. Implementing digital tracking systems for sensitive radioactive materials ensures real-time visibility and accountability throughout the distribution network. This not only improves efficiency but also bolsters security and compliance with stringent regulatory requirements for handling such materials. The company's commitment to these technological advancements is expected to yield significant improvements in operational performance and product integrity.

The impact of these technological factors is substantial:

- Improved Efficiency: Automation in production can lead to faster turnaround times and higher output volumes.

- Reduced Human Error: Digitized quality control processes minimize inconsistencies and defects in sensitive components.

- Enhanced Supply Chain Management: Real-time tracking of radioactive materials improves logistics, security, and regulatory compliance.

- Cost Optimization: Streamlined processes and reduced errors can lead to lower operational costs.

Cybersecurity and Data Protection in Medical Technology

The medical technology sector's increasing digitization makes robust cybersecurity paramount. Eckert & Ziegler Strahlen- und Medizintechnik, like many in the industry, faces significant risks from cyber threats that can disrupt operations and compromise sensitive patient data. A successful cyber-attack in early 2025 underscored the critical need for resilient IT infrastructure and stringent data protection protocols to safeguard both business continuity and regulatory compliance.

The financial implications of inadequate cybersecurity are substantial. Disruptions can lead to lost revenue, increased operational costs for recovery, and potential fines for data breaches. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, a figure that emphasizes the financial imperative for companies like Eckert & Ziegler to invest heavily in cybersecurity defenses.

- Regulatory Compliance: Adherence to data protection laws such as GDPR and HIPAA is non-negotiable, with significant penalties for non-compliance.

- Operational Continuity: Cybersecurity failures can halt production, research, and distribution, directly impacting revenue streams.

- Reputational Damage: Data breaches erode customer trust and can severely damage a company's brand reputation, affecting future sales.

- Financial Reporting Integrity: Cyber-attacks can compromise financial data, leading to inaccurate reporting and potential investor concerns.

Advancements in isotope production, such as higher yields for Lutetium-177, are critical for Eckert & Ziegler's growth in targeted radiotherapies. Innovations in automated handling systems enhance production efficiency and safety, reducing human error in the manufacturing of radioactive components. The company's investment in digitization for supply chain management improves real-time tracking and regulatory compliance for sensitive materials.

Legal factors

Eckert & Ziegler operates in a sector governed by strict medical device regulations. The EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) are critical, impacting market entry and product lifecycle. These regulations, with their evolving requirements and extended transition timelines, necessitate significant investment in compliance and quality management systems.

Eckert & Ziegler operates within a highly regulated environment shaped by stringent national and international laws concerning radiation protection. These regulations are paramount for safeguarding workers, patients, and the general public from potential harm. The company's commitment to adhering to these evolving safety standards is critical across its entire value chain, encompassing the manufacturing, handling, application, and ultimate disposal of radioactive materials.

In 2024, the global nuclear medicine market, a key sector for Eckert & Ziegler, was valued at approximately $12 billion and is projected to grow. This growth necessitates continuous adaptation to updated safety protocols, such as those from the International Atomic Energy Agency (IAEA), which regularly revises guidelines for safe use of radiation technologies. Failure to comply with these standards can result in significant penalties and operational disruptions, underscoring their importance for business continuity and reputation.

Eckert & Ziegler's competitive edge hinges on protecting its isotope technology, production processes, and radiopharmaceutical compounds through patents. These legal safeguards are vital for maintaining their market position and fostering continued innovation.

The evolving landscape of intellectual property rights directly impacts Eckert & Ziegler's capacity to develop and launch novel products. Navigating these regulations ensures they can commercialize their advancements without infringing on existing patents, a key aspect of their 2024 strategy.

Product Liability and Consumer Protection Laws

Eckert & Ziegler Strahlen- und Medizintechnik operates under stringent product liability laws. These regulations make the company accountable for any harm caused by defects in its medical technology products. In 2024, the global medical device market faced increased scrutiny regarding product safety, with regulatory bodies like the FDA issuing more recalls for devices with potential defects.

Adhering to consumer protection laws is paramount for Eckert & Ziegler. These laws ensure fair practices and safeguard customer rights. Maintaining exceptionally high product quality standards is not just about compliance; it's crucial for mitigating legal risks and fostering enduring customer trust in the competitive medical technology landscape.

- Product Liability: Manufacturers are legally responsible for damages caused by product defects.

- Consumer Protection: Regulations ensure fair treatment and safety for consumers of medical devices.

- Quality Standards: High product quality is essential for legal risk mitigation and customer confidence.

Environmental Regulations on Radioactive Waste Disposal

Environmental regulations, particularly those governing the disposal of radioactive waste, are paramount for companies like Eckert & Ziegler. These laws dictate the safe handling, storage, and long-term disposal of both low-level and high-level radioactive materials, impacting operational costs and compliance strategies.

Germany's protracted site selection process for a deep geological repository for high-level radioactive waste directly influences the infrastructure development and long-term strategic planning for entities involved in the nuclear medicine sector. This process, which aims to ensure the highest safety standards, creates a degree of uncertainty regarding future disposal availability and associated costs.

- Regulatory Framework: Strict German and EU laws govern the entire lifecycle of radioactive materials, from production to disposal, necessitating robust safety protocols and significant investment in compliance.

- Site Selection Impact: The ongoing search for a permanent repository in Germany, a process expected to continue for years, creates a dynamic regulatory landscape for waste management.

- Disposal Costs: The eventual establishment of a repository will likely involve substantial costs for waste emplacement and long-term monitoring, which companies must factor into their financial planning.

- Medical Isotopes: Even for medical applications that utilize relatively small quantities of radioactive isotopes, adherence to these stringent disposal regulations remains a critical operational requirement.

Eckert & Ziegler Strahlen- und Medizintechnik must navigate a complex web of international and national legal frameworks governing medical devices and radiation safety. The EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) continue to shape market access and product compliance, demanding significant investment in quality management systems. In 2024, the global nuclear medicine market, valued around $12 billion, saw continued emphasis on adherence to evolving safety standards from bodies like the IAEA, with non-compliance risking severe penalties.

Environmental factors

Eckert & Ziegler faces significant environmental responsibilities concerning the management and disposal of radioactive waste. This includes both low-level and high-level waste generated from their operations, such as the production of radiopharmaceuticals and isotopes. The company must adhere to strict national and international regulations to ensure safe handling and storage.

Compliance with these regulations, including Germany's radioactive waste management strategy, directly influences Eckert & Ziegler's operational costs and environmental impact. The ongoing search for permanent disposal sites, a complex and lengthy process, presents a persistent challenge. For instance, Germany's Federal Office for the Safety of Nuclear Waste Management (BASE) is actively involved in site selection, a process that can take decades and involve substantial investment.

Eckert & Ziegler Strahlen- und Medizintechnik prioritizes resource conservation and energy efficiency, even with its relatively small material volumes. This focus extends to optimizing energy usage in raw material production, a key area for environmental impact. For instance, in 2024, the company continued to invest in process improvements aimed at reducing energy consumption per unit of output.

Minimizing transportation is another crucial aspect of their environmental strategy, directly impacting carbon footprints. By streamlining logistics and exploring more localized sourcing where feasible, Eckert & Ziegler aims to reduce the environmental burden associated with its supply chain. This aligns with the growing global emphasis on sustainable logistics, with many companies reporting significant emissions reductions through optimized transport routes in 2024.

Eckert & Ziegler Strahlen- und Medizintechnik's growth plans, such as expanding production or adopting new technologies, necessitate thorough environmental impact assessments and securing specific permits. These regulatory hurdles can introduce significant delays and increase capital expenditure, directly influencing project viability and investment timing.

For instance, in Germany, the Federal Immission Control Act (Bundes-Immissionsschutzgesetz) often mandates such assessments for industrial facilities, with permitting processes that can extend over several months, impacting project schedules and requiring dedicated resources for compliance.

Climate Change and Supply Chain Resilience

While Eckert & Ziegler Strahlen- und Medizintechnik (EZAG) is not a major direct contributor to greenhouse gas emissions, the escalating impacts of climate change, particularly extreme weather events, present a significant indirect threat to its supply chain. These disruptions can impede the transportation and handling of sensitive radioactive materials, crucial for EZAG's medical and technological applications.

Ensuring the resilience of its supply chain against these environmental volatilities is therefore a critical strategic consideration for EZAG. For instance, disruptions to global shipping routes due to severe storms or floods, as experienced in various regions in 2024, could lead to delays in sourcing necessary isotopes or delivering finished products.

The company must proactively assess and mitigate risks associated with climate-induced supply chain interruptions. This includes:

- Diversifying transportation routes and modes to reduce reliance on single points of failure.

- Increasing inventory levels for critical raw materials and finished goods to buffer against potential delays.

- Developing contingency plans for alternative sourcing and distribution channels in the event of extreme weather.

- Collaborating with logistics partners to enhance visibility and preparedness for climate-related disruptions.

Sustainability Reporting and ESG Compliance

Companies face mounting pressure from regulators, investors, and the public to prove their commitment to environmental, social, and governance (ESG) principles. This trend is significantly impacting how businesses operate and report their performance.

Eckert & Ziegler's requirement to prepare a sustainability report for 2024, adhering to the European Sustainability Reporting Standards (ESRS), underscores the growing emphasis on transparent environmental accountability. For instance, the ESRS framework mandates detailed disclosures on climate-related risks and opportunities, aligning with global efforts to combat climate change.

- Regulatory Scrutiny: Increased enforcement of environmental regulations and disclosure requirements.

- Investor Demand: A growing number of investors prioritize ESG factors, influencing capital allocation.

- Public Perception: Enhanced public awareness of environmental issues drives demand for sustainable practices.

- Reporting Standards: Adoption of frameworks like ESRS necessitates robust data collection and reporting on environmental impacts.

Eckert & Ziegler's environmental strategy is heavily influenced by the stringent regulations surrounding radioactive materials, demanding meticulous waste management and disposal protocols. The company's commitment to resource conservation is evident in its 2024 investments in process improvements to reduce energy consumption, aligning with broader sustainability goals. Furthermore, the escalating impacts of climate change pose indirect supply chain risks, necessitating proactive mitigation strategies like diversifying logistics and increasing inventory for critical materials.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Eckert & Ziegler Strahlen- und Medizintechnik is built on data from official government health and safety regulations, international economic reports from organizations like the IMF and World Bank, and industry-specific market research.