Eckert & Ziegler Strahlen- und Medizintechnik Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eckert & Ziegler Strahlen- und Medizintechnik Bundle

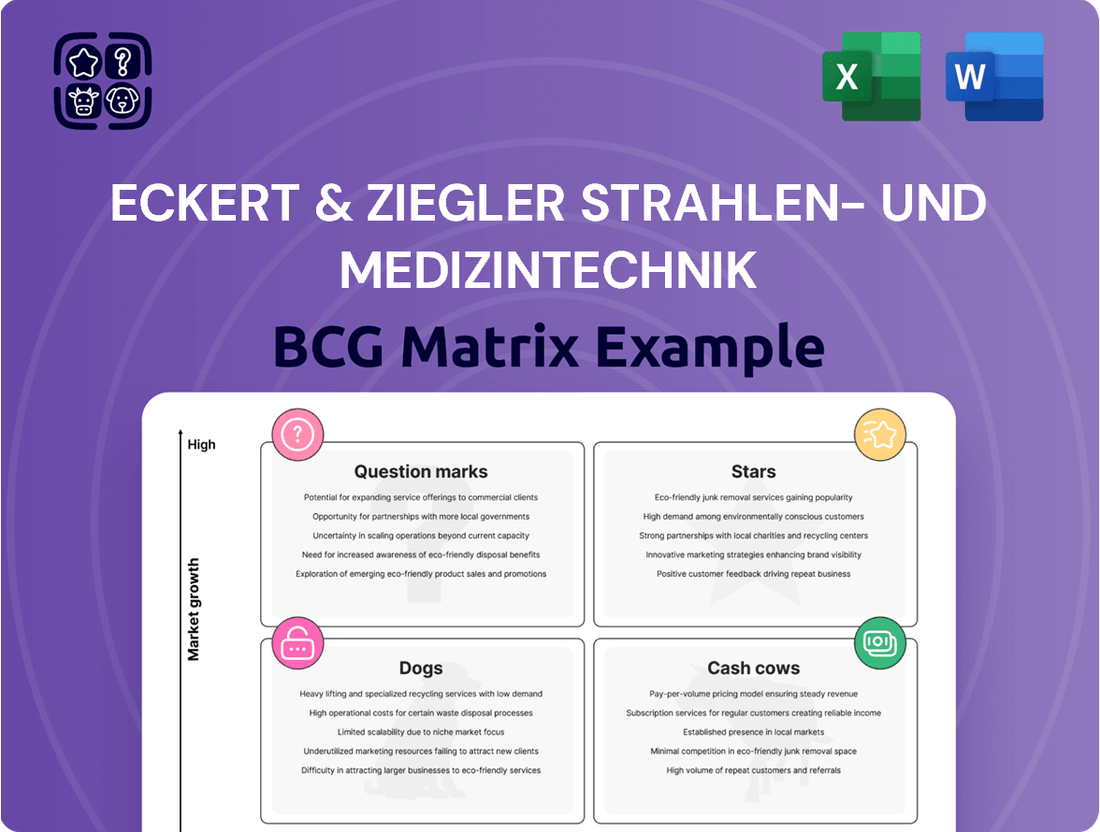

Understand Eckert & Ziegler Strahlen- und Medizintechnik's strategic positioning with a glimpse into their BCG Matrix. See how their products are categorized as Stars, Cash Cows, Dogs, or Question Marks, offering a foundational view of their portfolio's health.

This initial insight is just the start; unlock the full potential by purchasing the complete BCG Matrix report. Gain detailed quadrant analysis, data-driven recommendations, and actionable strategies to optimize your investment and product development decisions for Eckert & Ziegler.

Stars

Eckert & Ziegler's strategic focus on Actinium-225 (Ac-225) and Lutetium-177 (Lu-177) places them at the forefront of the burgeoning therapeutic radiopharmaceuticals sector. Ac-225, often hailed as the next breakthrough isotope, saw Eckert & Ziegler achieve a significant milestone with GMP-grade production commencing in Q1 2025.

Lu-177, currently a leading therapeutic isotope, gained EMA approval in Q4 2024, underscoring its widespread adoption in advanced medical treatments. The broader nuclear medicine market is projected for substantial growth, with estimates suggesting it will reach USD 7 billion in 2025 and expand to USD 11.68 billion by 2030, reflecting a compound annual growth rate of 10.78%, largely propelled by oncology demand.

The radiopharmaceutical sector is booming, driving a substantial need for specialized contract development and manufacturing organization (CDMO) services. Eckert & Ziegler is well-positioned to meet this demand, offering a comprehensive suite of services from initial development through to manufacturing and distribution. This makes them an indispensable partner for companies navigating this rapidly growing market.

Their commitment to expanding capabilities is evident in recent strategic moves. For instance, Eckert & Ziegler was chosen as the US manufacturer for Archeus' innovative radiopharmaceutical ART-101. This significant agreement underscores their robust standing and continued growth trajectory within the radiopharmaceutical CDMO space.

Eckert & Ziegler's commitment to innovation is evident in its strategic partnerships within the radiotherapeutics sector. Collaborations with companies like Actinium Pharmaceuticals, GlyTherix, Ariceum Therapeutics, and Nucleus RadioPharma highlight their role in supplying and developing crucial therapeutic radioisotopes. These alliances position Eckert & Ziegler at the forefront of novel cancer treatments, ensuring access to high-growth drug development pipelines and securing future revenue.

Advanced Radiopharmaceutical Production Equipment

The increasing need for radiopharmaceuticals, crucial for diagnostics and therapies, directly drives the demand for advanced production equipment. Eckert & Ziegler's expertise lies in supplying the specialized machinery and containment systems, often referred to as hot cells, that are fundamental to this manufacturing process. These components are vital for ensuring safety and efficiency in handling radioactive materials.

This segment operates as a key 'Facilitator & Enabler' within the broader radiopharmaceutical ecosystem. As the field of nuclear medicine continues its upward trajectory, new research, clinical trials, and commercial production facilities require state-of-the-art equipment. Eckert & Ziegler is positioned to capitalize on this expansion by providing the necessary infrastructure.

The global radiopharmaceutical market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, with an estimated compound annual growth rate (CAGR) of around 10% through 2030. This growth fuels the need for specialized production equipment.

- Market Growth Driver: The expanding applications of radiopharmaceuticals in oncology and neurology are increasing demand for production capacity.

- Equipment Specialization: Eckert & Ziegler provides highly specialized equipment, including shielded hot cells and automated synthesis modules, essential for radiopharmaceutical manufacturing.

- Regulatory Influence: Stringent regulatory requirements for radiopharmaceutical production necessitate the use of advanced, compliant equipment, benefiting suppliers like Eckert & Ziegler.

- Investment Trends: Increased investment in nuclear medicine infrastructure globally translates directly into higher demand for the production equipment Eckert & Ziegler offers.

Global Expansion in Key Medical Markets

Eckert & Ziegler has achieved robust expansion within crucial medical markets, with the United States standing out as a primary driver. The USA represents the largest global market for their medical technologies, and the company has seen substantial absolute growth there. This success highlights their effective strategy in penetrating regions with a strong and increasing demand for radiopharmaceuticals.

Their strategic focus on these high-demand areas, such as the USA, underscores Eckert & Ziegler's capability to secure and grow market share within dynamic healthcare sectors. For instance, in 2023, the company reported significant revenue contributions from its Isotope Products segment, which is heavily influenced by demand in North America.

- USA Market Dominance: The United States is the largest market for Eckert & Ziegler's medical products, contributing a significant portion of their global revenue.

- Radiopharmaceutical Demand: Growth in key markets is directly linked to the increasing global demand for radiopharmaceuticals in diagnostics and therapy.

- Strategic Penetration: Eckert & Ziegler's expansion strategy focuses on regions with high healthcare spending and advanced medical infrastructure.

- Absolute Growth Achieved: The company has demonstrated considerable absolute growth in these key geographical markets, indicating successful market share capture.

Eckert & Ziegler's specialized equipment segment, including hot cells and synthesis modules, acts as a critical enabler for the booming radiopharmaceutical market. This segment benefits directly from increased investment in nuclear medicine infrastructure, particularly in key markets like the USA, which is the largest global market for their medical technologies. The company's ability to provide essential, highly specialized production equipment positions them to capitalize on the projected growth of the radiopharmaceutical sector, estimated to reach USD 7 billion in 2025.

| Segment | Key Products | Market Role | Growth Drivers | 2025 Market Projection |

| Equipment & Services | Hot Cells, Synthesis Modules | Facilitator & Enabler | Nuclear Medicine Infrastructure Investment, Regulatory Compliance | USD 7 Billion (Broader Market) |

What is included in the product

Strategic insights for Eckert & Ziegler's product portfolio within the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Eckert & Ziegler BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying strategic decision-making.

This tool provides an export-ready design for quick PowerPoint integration, alleviating the pain of manual chart creation.

Cash Cows

Eckert & Ziegler BEBIG holds a strong position in the brachytherapy device market, especially within High-Dose Rate (HDR) brachytherapy, a segment that was a market leader in 2024. This established presence translates into reliable revenue streams and healthy profit margins for the company.

The brachytherapy market, while experiencing consistent growth with a projected compound annual growth rate of 6.8% from 2024 to 2025, is considered a more mature sector when compared to emerging radiotherapeutic innovations.

Eckert & Ziegler holds a leading position in the Gallium-68 (Ga-68) generator market. These generators are crucial for producing Ga-68, a key isotope used in diagnostic imaging for selecting patients for specific nuclear medicine therapies. The company's strong market share in this stable diagnostic imaging sector ensures a consistent and predictable revenue stream.

Eckert & Ziegler's standard isotope products for medical imaging, like Cobalt-57 flood sources, are a cornerstone of their business, acting as true cash cows. These established offerings are essential tools in hospitals worldwide, ensuring consistent demand and reliable income streams for the company.

Routine Industrial and Scientific Isotope Products

Eckert & Ziegler's routine industrial and scientific isotope products represent a significant cash cow within its portfolio. These isotopes are crucial for various applications, extending beyond healthcare into industrial gauging, precise measurement, detailed analysis, and essential environmental monitoring.

The demand in these sectors is generally stable, reflecting mature markets where Eckert & Ziegler holds a strong market share. This positions these products as a reliable and predictable source of revenue, requiring relatively modest investment to maintain their growth trajectory.

- Stable Revenue Stream: These isotopes provide a consistent and predictable income, a hallmark of cash cow businesses.

- Mature Market Dominance: Eckert & Ziegler benefits from established positions in markets with steady, ongoing demand.

- Low Investment Needs: Unlike growth-stage products, these mature offerings require less capital for expansion, freeing up resources.

- Key Industrial Applications: Their use in gauging, analysis, and environmental monitoring underscores their essential role in various industries.

Maintenance and Calibration Services

Eckert & Ziegler's maintenance and calibration services for radiation protection and analysis equipment offer a dependable and consistent source of income. These services are vital for ensuring their customers’ equipment functions correctly and meets all necessary regulatory standards.

This segment of Eckert & Ziegler's business is characterized by its stability and the recurring nature of the revenue generated. Customers rely on these essential services for the continuous operation of their radiation-related technologies. For instance, in 2024, the company continued to emphasize its service offerings, which are crucial for maintaining the integrity of their installed base of equipment and sources, thereby ensuring customer satisfaction and long-term partnerships.

- Recurring Revenue: Provides a stable income stream through ongoing service contracts.

- Customer Dependence: Essential for operational continuity and regulatory compliance for clients.

- Low Investment Needs: Requires minimal capital expenditure to maintain existing service operations.

- Market Position: Reinforces Eckert & Ziegler's role as a critical support provider in the radiation technology sector.

Eckert & Ziegler's standard isotope products, like Cobalt-57 flood sources, are foundational cash cows. These are essential tools in hospitals, ensuring consistent demand and reliable income. The company's Gallium-68 generators also fall into this category, vital for diagnostic imaging and patient selection for therapies, providing a stable revenue stream from a mature market.

Furthermore, their routine industrial and scientific isotope products, used in gauging, analysis, and environmental monitoring, are significant cash cows. These mature markets, where Eckert & Ziegler holds strong share, require minimal investment for maintenance and steady revenue generation.

The maintenance and calibration services for radiation protection and analysis equipment also act as dependable cash cows. These recurring services are critical for customer equipment functionality and regulatory compliance, reinforcing the company's supportive role in the radiation technology sector.

| Product Category | Market Characteristic | Revenue Stability | Investment Need |

| Standard Isotopes (e.g., Cobalt-57) | Mature, Essential Medical Tool | High, Consistent | Low |

| Gallium-68 Generators | Mature Diagnostic Imaging | High, Predictable | Low |

| Industrial/Scientific Isotopes | Mature, Diverse Applications | High, Stable | Low |

| Maintenance & Calibration Services | Recurring, Essential Support | High, Consistent | Low |

What You See Is What You Get

Eckert & Ziegler Strahlen- und Medizintechnik BCG Matrix

The preview you see is the complete Eckert & Ziegler Strahlen- und Medizintechnik BCG Matrix report, identical to the file you will receive after purchase. This means you're getting a fully formatted, analysis-ready document with no watermarks or demo content, ensuring immediate professional use. You can confidently use this preview as an accurate representation of the high-quality strategic tool you'll download, ready for immediate integration into your business planning. This preview guarantees no surprises, as the purchased version will be the exact, polished report you are currently viewing.

Dogs

Eckert & Ziegler's legacy products, particularly older isotope offerings catering to niche industrial uses, are likely positioned as dogs within their BCG matrix. These items face a market characterized by declining demand and minimal growth potential.

Products in this category would typically exhibit a low market share within a stagnant or shrinking market. Their continued presence might tie up valuable capital without offering significant future returns, reflecting a strategic pivot by the company away from these less dynamic segments.

Certain standard industrial radiation sources, particularly those facing significant commoditization or obsolescence due to technological advancements and evolving regulations, could be classified as underperforming. If Eckert & Ziegler possesses a limited market share in these mature, low-growth sectors, these products would likely yield low returns, potentially impacting overall profitability. However, the company's robust financial performance, as evidenced by its consistent revenue growth and strong net income in recent years, suggests that the impact of such underperforming segments is likely minimized and well-managed within their broader portfolio.

Historically, product lines or business units divested or discontinued by Eckert & Ziegler because they no longer aligned with strategic focus or showed consistently low profitability and market share would be categorized as Dogs. The company's strategy involves actively managing underperforming assets to streamline its portfolio. For example, in 2023, the company announced the divestment of its Isotope Products segment, which had been facing declining demand and profitability, to focus on its core medical technology and radiation therapy businesses.

Inefficient or Obsolete Production Processes

Inefficient or obsolete production processes can indeed fall into the 'dog' category within a BCG matrix analysis for a company like Eckert & Ziegler Strahlen- und Medizintechnik. If these older manufacturing setups are tied to products that are no longer in high demand or offer slim profit margins, they become a significant drain on resources. Think of specialized equipment for a niche medical isotope that has been superseded by newer technology, or a facility designed for a low-volume, legacy radiopharmaceutical.

These operations often struggle to achieve economies of scale, making their per-unit costs higher than more modern, streamlined facilities. This directly impacts profitability, as the cost of production eats into any potential margin. For instance, a plant running at significantly less than optimal capacity due to declining demand for its specific output would be a prime example of a resource drain without substantial contribution to growth.

In 2024, companies are increasingly scrutinizing operational costs. For Eckert & Ziegler, identifying and addressing these 'dog' processes is crucial for freeing up capital and improving overall efficiency. Consider the potential impact of a facility that requires extensive manual labor or specialized, costly maintenance for outdated machinery, directly hindering competitive pricing and profitability for its associated products.

- Outdated machinery requiring high maintenance costs.

- Low production volumes for legacy products.

- Lack of benefits from economies of scale.

- Draining financial resources without significant profit contribution.

Small-Scale, Non-Core Ventures with Limited Traction

Small-scale, non-core ventures with limited traction, often experimental or highly specialized, can fall into the "dog" category of the BCG Matrix. These ventures typically operate in niche markets that are not experiencing significant growth and, consequently, fail to achieve substantial market acceptance or scale. For example, a specialized medical device component with minimal adoption by hospitals or a niche consulting service for a rapidly declining industry would fit this description. These initiatives consume valuable resources, such as research and development funds or dedicated personnel time, without generating significant returns or demonstrating a clear path to future growth.

These "dogs" represent a drain on a company's resources. In 2024, companies are increasingly scrutinized for their portfolio efficiency. A venture that consistently underperforms and shows no signs of improvement, despite investment, needs careful evaluation. Eckert & Ziegler Strahlen- und Medizintechnik, like any diversified medical technology company, must regularly assess such ventures.

- Limited Market Share: These ventures typically hold a very small percentage of their respective markets.

- Low Growth Prospects: The markets in which they operate are often stagnant or declining.

- Resource Consumption: They require ongoing investment without commensurate returns.

- Strategic Re-evaluation: Management must decide whether to divest, harvest, or attempt a turnaround.

Eckert & Ziegler's "dog" category likely includes older, less profitable product lines or business units that have a low market share in slow-growing or declining markets. These could be legacy industrial isotope applications where demand has waned due to technological shifts or regulatory changes. For instance, certain older calibration sources might fall into this group if their market share is minimal and the overall market for such specific isotopes is shrinking.

These segments often tie up capital and resources without generating substantial returns, prompting strategic review. The company's 2023 divestment of its Isotope Products segment, which faced declining demand, exemplifies this management approach. In 2024, the focus remains on optimizing the portfolio by identifying and addressing such underperforming assets to enhance overall financial health and strategic focus.

| Potential Dog Categories | Characteristics | Example Products/Segments |

|---|---|---|

| Legacy Industrial Isotopes | Declining demand, niche applications, commoditization | Older calibration sources, specific industrial radiography isotopes |

| Obsolete Production Processes | High maintenance, low capacity utilization, outdated technology | Manufacturing equipment for superseded medical isotopes |

| Non-Core Ventures | Limited market traction, experimental, low adoption | Highly specialized medical device components with minimal market penetration |

Question Marks

Beyond Actinium-225, other alpha-emitting isotopes and early-stage radiotherapeutic drug candidates offer substantial growth potential, akin to emerging Stars in the BCG matrix. These ventures, while currently holding minimal market share, represent significant investment opportunities. Their future success hinges on positive clinical trial results and eventual market acceptance, necessitating considerable ongoing research and development funding.

For instance, Bismuth-213, another alpha emitter, is showing promise in targeted alpha therapy, with ongoing trials exploring its efficacy in various cancers. Companies developing novel alpha-conjugates, like those targeting specific cell surface receptors, are also in this early-stage category. The market for these advanced therapies is still nascent, but the potential for high returns on investment is considerable if clinical hurdles are cleared and regulatory approvals are obtained.

Eckert & Ziegler's involvement with novel radiopharmaceutical drug candidates, such as Bicycle® Radio Conjugates, places them squarely in the "Question Mark" category of the BCG matrix. These early-stage molecules are in pre-clinical or Phase 1 trials, representing a high-growth innovation sector with substantial future potential. However, their current market share is negligible, and the inherent risks associated with drug development are significant, necessitating substantial capital infusion for advancement.

Eckert & Ziegler's expansion into emerging markets, where their current footprint is minimal, represents a significant question mark within their business strategy. These regions, often characterized by rapidly growing economies and increasing healthcare demands, offer immense potential for future revenue streams.

However, realizing this potential necessitates substantial upfront capital for establishing robust distribution networks, localized marketing campaigns, and potentially adapting product offerings to meet specific market needs. For instance, in 2024, many emerging economies saw healthcare spending increase by 5-10%, presenting a clear opportunity, but the investment required for market entry can be a considerable hurdle.

Highly Specialized Diagnostic Technologies in Early Adoption

Eckert & Ziegler's investment in highly specialized diagnostic technologies, particularly in early adoption phases, aligns with the characteristics of a question mark in the BCG matrix. These ventures often involve cutting-edge isotopes or imaging advancements that, while holding immense potential to transform specific medical areas, currently possess a small market share. For instance, advancements in theranostics, combining diagnostic and therapeutic capabilities, represent a prime example of such an area, with the global theranostics market projected to reach approximately $10.5 billion by 2028, up from an estimated $3.5 billion in 2023.

The high growth potential of these technologies necessitates significant marketing and educational investment to foster market acceptance and drive adoption. Companies like Eckert & Ziegler must strategically position these innovations, highlighting their unique benefits and addressing potential barriers to entry for healthcare providers. This often involves substantial research and development funding coupled with robust go-to-market strategies.

- High Growth Potential: Emerging diagnostic tools offer significant future revenue streams as they gain traction.

- Low Market Share: Current adoption rates are minimal, reflecting the early stage of market development.

- Investment Needs: Substantial capital is required for R&D, regulatory approvals, and market education.

- Strategic Importance: These technologies represent future market leadership opportunities if successful.

Advanced Radiometric and Analytical Solutions for New Industries

Eckert & Ziegler is exploring the application of isotope technology in novel industrial sectors, aiming to capture nascent markets. This strategic pivot focuses on areas where their core competencies can address emerging needs, potentially leading to significant future revenue streams. For instance, the company might be developing specialized radiation sources for advanced materials testing or novel diagnostic tools for non-medical industrial processes.

These ventures represent a classic question mark in the BCG matrix, characterized by high potential growth but also substantial risk and uncertainty. Eckert & Ziegler's investment in research and development for these new applications is crucial. In 2024, the company's R&D expenditure saw an increase, signaling a commitment to innovation and market expansion into these less-established territories.

- Developing isotope solutions for advanced semiconductor manufacturing, a sector experiencing rapid technological evolution.

- Adapting radiometric techniques for environmental monitoring in emerging industrial zones, addressing new regulatory demands.

- Investing in research for isotope-based sensors in the burgeoning field of quantum computing hardware.

Eckert & Ziegler's foray into novel radiopharmaceutical drug candidates, such as those in early-stage clinical trials, places them in the Question Mark category. These represent high-growth potential but currently have negligible market share and significant development risks, requiring substantial capital for advancement.

The company's expansion into emerging markets, where their presence is minimal, also fits the Question Mark profile. While these regions offer growing healthcare demands, significant investment is needed for distribution and market adaptation. For example, in 2024, healthcare spending in many emerging economies rose by 5-10%, highlighting the opportunity but also the cost of entry.

Investments in specialized diagnostic technologies, particularly those in their early adoption phases, are considered Question Marks. These cutting-edge isotopes or imaging advancements have immense potential but a small current market share. The global theranostics market, for instance, was projected to grow to approximately $10.5 billion by 2028 from an estimated $3.5 billion in 2023.

Exploring isotope technology in new industrial sectors, like advanced semiconductor manufacturing or environmental monitoring, also falls into the Question Mark quadrant. These ventures offer high potential growth but carry substantial risk and uncertainty, with R&D expenditure increases in 2024 signaling commitment to these areas.

| Business Area | BCG Category | Key Characteristics | 2024 Data/Projections |

|---|---|---|---|

| Novel Radiopharmaceutical Drug Candidates | Question Mark | High growth potential, low market share, high investment needs | Ongoing clinical trials, significant R&D funding required |

| Emerging Market Expansion | Question Mark | Untapped revenue potential, high entry costs, market adaptation needs | Emerging economies' healthcare spending up 5-10% in 2024 |

| Specialized Diagnostic Technologies | Question Mark | Cutting-edge innovation, small current market share, high future potential | Theranostics market projected $10.5B by 2028 (from $3.5B in 2023) |

| New Industrial Isotope Applications | Question Mark | Nascent markets, high risk/uncertainty, strategic R&D focus | Increased R&D expenditure in 2024 |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.