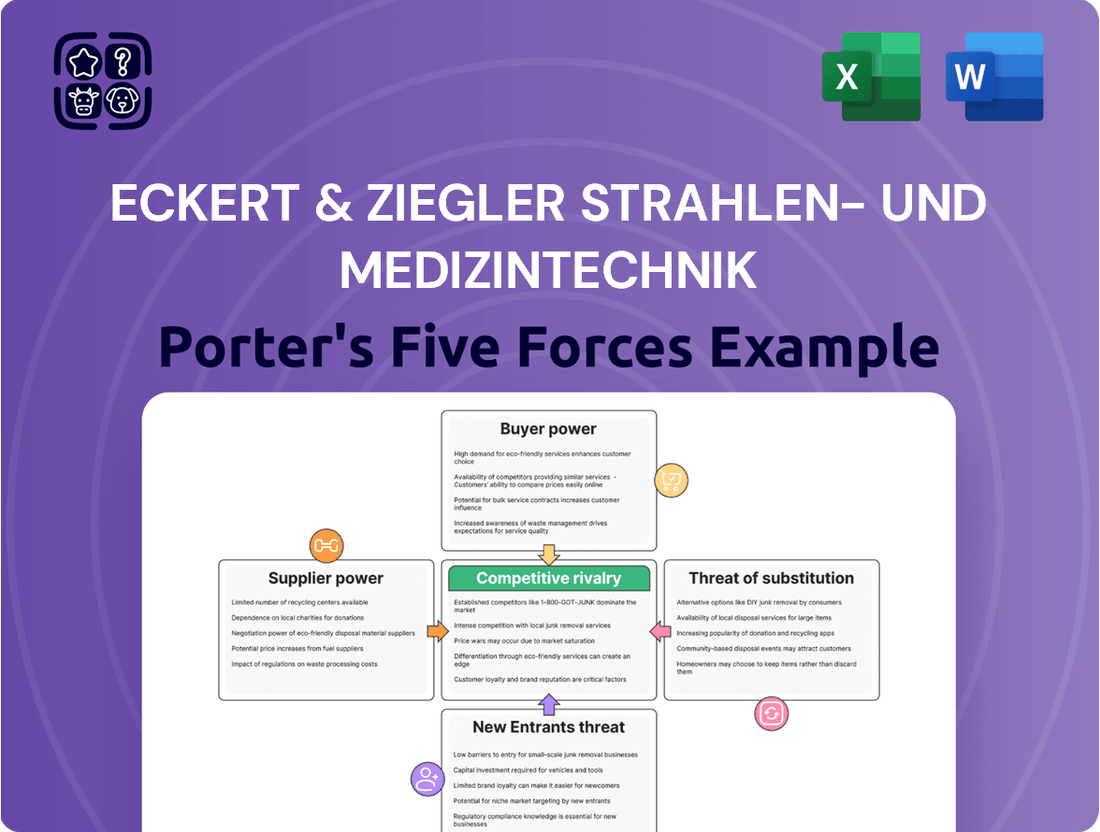

Eckert & Ziegler Strahlen- und Medizintechnik Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eckert & Ziegler Strahlen- und Medizintechnik Bundle

Eckert & Ziegler Strahlen- und Medizintechnik operates in a complex landscape shaped by robust supplier power and the intense threat of substitutes within the medical technology sector. Understanding these dynamics is crucial for navigating its competitive environment.

The full Porter's Five Forces Analysis reveals the real forces shaping Eckert & Ziegler Strahlen- und Medizintechnik’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for critical radioisotopes and specialized components Eckert & Ziegler (EZ) depends on is notably concentrated. This means only a handful of global suppliers exist, granting them substantial leverage.

This scarcity makes it difficult for EZ to quickly find alternative suppliers if disruptions occur, potentially impacting production and the entire supply chain. For instance, the February 2025 cyber-attack on a key supplier underscored the vulnerability and power these limited sources hold.

The radioactive components and isotopes Eckert & Ziegler relies on are exceptionally specialized, demanding intricate manufacturing and rigorous regulatory clearances. This inherent uniqueness severely limits the availability of direct substitutes for these vital materials, thereby amplifying the leverage held by current suppliers.

For instance, the development and approval pathways for novel isotopes, like the radiotherapeutic agent Actinium-225, often involve a very narrow, even singular, set of qualified suppliers, consolidating their bargaining power significantly.

Switching suppliers for critical radioactive materials and components presents significant hurdles for Eckert & Ziegler. The process of qualifying new vendors, navigating complex regulatory approvals, and potentially reconfiguring production lines can be both time-consuming and expensive. For instance, the stringent licensing requirements for handling radioactive isotopes mean that any change in supplier necessitates a thorough vetting and approval process, which can extend for many months and incur considerable administrative costs.

These substantial switching costs directly empower Eckert & Ziegler's suppliers. The financial and operational risks associated with transitioning to a new source for essential materials limit Eckert & Ziegler's leverage in negotiations. This dependency means suppliers can often command higher prices or more favorable terms, as the cost and disruption of finding an alternative are prohibitive for Eckert & Ziegler.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Eckert & Ziegler's business, meaning they start producing and selling the final medical products themselves, is a potential concern. While this is less common in the highly specialized and regulated nuclear medicine sector, it's not entirely out of the question. The significant technical expertise and regulatory hurdles involved in manufacturing and distributing medical devices do act as a substantial barrier, making this particular threat less potent for suppliers.

However, the broader nuclear medicine market is experiencing a trend where large pharmaceutical companies are acquiring smaller players. This can be viewed as a form of forward integration, as these larger entities gain direct access to the end-product market. For instance, in 2024, several significant M&A activities occurred within the radiopharmaceutical space, indicating a consolidation trend that could empower larger entities to bypass traditional supply chain roles.

- High barriers to entry for suppliers wanting to produce finished medical devices.

- The specialized nature of nuclear medicine manufacturing limits supplier forward integration capabilities.

- Acquisitions by major pharmaceutical companies represent a broader form of forward integration in the nuclear medicine market.

- Market consolidation in 2024 highlights the increasing influence of larger players who can directly enter the end-product market.

Importance of Eckert & Ziegler to Suppliers

Eckert & Ziegler, a major player in isotope technology, particularly in medical and isotope products, is a significant customer for its suppliers. Their substantial market presence means suppliers often have a vested interest in maintaining a relationship with them.

However, the global demand for isotopes is robust, meaning suppliers are unlikely to be overly reliant on Eckert & Ziegler alone. This broad market demand helps suppliers retain considerable bargaining power, as they can often find alternative buyers for their products.

- Global Isotope Market Growth: The worldwide isotope market is anticipated to expand, increasing the value and options for suppliers. Projections suggest continued growth driven by advancements in medical diagnostics and treatments.

- Supplier Diversification: Key isotope suppliers often serve multiple industries and geographies, reducing their dependence on any single client like Eckert & Ziegler. This diversification strengthens their negotiating position.

- Specialized Production: The production of many isotopes requires specialized facilities and expertise, limiting the number of potential suppliers. This can give established, capable suppliers more leverage in pricing and terms.

The bargaining power of suppliers to Eckert & Ziegler (EZ) is considerable due to the concentrated nature of the critical radioisotope market, where only a few global entities operate. This scarcity, combined with the highly specialized and regulated production of these materials, significantly limits EZ's ability to find alternative sources, thereby empowering existing suppliers.

The high costs and lengthy timelines associated with qualifying new suppliers for radioactive components further solidify supplier leverage, as EZ faces substantial financial and operational risks in switching. While forward integration by suppliers into EZ's business is a minor threat due to high industry barriers, broader market consolidation through acquisitions by larger pharmaceutical firms in 2024 indicates a trend where powerful entities can bypass traditional supply roles.

Despite EZ's significant customer status, robust global demand for isotopes means suppliers are not overly dependent on any single client, maintaining their strong negotiating position. The expanding global isotope market, driven by medical advancements, ensures continued value and options for these specialized producers.

| Factor | Impact on EZ | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Limited alternatives for critical isotopes | High |

| Switching Costs | Expensive and time-consuming qualification processes | High |

| Product Specialization | Few direct substitutes for radioactive materials | High |

| Market Demand | Suppliers serve multiple clients globally | Moderate to High |

What is included in the product

Analyzes the competitive intensity Eckert & Ziegler Strahlen- und Medizintechnik faces from rivals, the bargaining power of its customers and suppliers, and the threat of new entrants and substitutes.

Easily identify and mitigate competitive threats by visualizing the impact of each Porter's Five Forces on Eckert & Ziegler's market position.

Customers Bargaining Power

Eckert & Ziegler's customer base is largely comprised of hospitals, specialized clinics, and research institutions worldwide. While the sheer number of these entities is substantial, the procurement of high-value medical equipment and radioisotopes often funnels through consolidated purchasing organizations or national healthcare systems, thereby centralizing customer influence.

While individual hospitals might not buy in massive quantities, larger entities like hospital networks or government health organizations wield considerable influence due to their sheer scale. Eckert & Ziegler's robust demand for radiopharmaceuticals, a critical component in medical imaging and therapy, suggests a steady customer base, even if it's spread across many institutions.

For customers in the brachytherapy market, switching suppliers or products often entails significant costs. These can include the expense and time associated with retraining medical staff, recalibrating specialized equipment to new specifications, and the administrative burden of obtaining new regulatory approvals for different isotopes or delivery systems. These hurdles effectively raise the barrier to switching, thereby diminishing the bargaining power of individual customers.

Customer Price Sensitivity

Customer price sensitivity for Eckert & Ziegler Strahlen- und Medizintechnik's products is a key factor. This sensitivity is shaped by the financial constraints of healthcare systems, the specifics of reimbursement policies, and how crucial their offerings are for patient care, particularly in areas like cancer therapy and nuclear medicine. For instance, in 2024, many healthcare providers faced ongoing budget pressures, making them more attentive to the cost of medical equipment and supplies.

While the critical nature of their products in life-saving treatments might suggest lower price sensitivity, the competitive landscape in healthcare technology and the persistent drive for cost containment across the industry can amplify this. The ability of customers to switch to alternative solutions, even if less advanced, can also influence their willingness to pay. The reimbursement environment plays a significant role; when reimbursement rates are favorable and cover a substantial portion of the costs, customers tend to be less price-sensitive.

- Healthcare Budget Constraints: In 2024, many global healthcare systems continued to grapple with significant budget limitations, directly impacting purchasing decisions for medical technology.

- Reimbursement Policies: The extent to which governments or insurance providers cover the costs of Eckert & Ziegler's products directly influences how much end-users are willing to pay out-of-pocket or allocate from their budgets.

- Product Criticality vs. Competition: While essential for treatments like radiotherapy, the presence of multiple competitors offering similar or alternative solutions can increase price pressure.

- Cost Containment Pressures: A general trend observed throughout 2024 was an industry-wide push for cost reduction, making even critical medical supplies subject to price scrutiny.

Threat of Backward Integration by Customers

The threat of backward integration by customers, such as large hospital networks, is very low for Eckert & Ziegler Strahlen- und Medizintechnik. The production of radioisotopes and brachytherapy products requires highly specialized knowledge and significant capital outlay. For instance, setting up a cyclotron for isotope production can cost tens of millions of dollars, a prohibitive investment for most healthcare providers.

Furthermore, the industry is heavily regulated, with strict licensing and safety protocols that are difficult and costly for new entrants to navigate. In 2024, the global market for radioisotopes was valued at approximately $6.5 billion, with a complex supply chain that few individual entities could replicate independently. This high barrier to entry means customers are unlikely to develop their own production capabilities, thus limiting their bargaining power in this regard.

- Low Likelihood of Backward Integration: Customers like major hospital groups face substantial hurdles in producing their own radioisotopes.

- High Capital and Expertise Requirements: The significant investment needed for specialized equipment, such as cyclotrons, and the requisite technical expertise make self-production unfeasible for most customers.

- Stringent Regulatory Environment: Navigating the complex and costly regulatory landscape for nuclear medicine production further deters potential backward integration.

- Limited Impact on Bargaining Power: Due to these factors, customers' ability to exert pressure through the threat of backward integration is minimal.

The bargaining power of Eckert & Ziegler's customers is moderate, influenced by the critical nature of their products and the consolidation within the healthcare sector. While many customers are not large volume buyers individually, the presence of consolidated purchasing groups and national healthcare systems centralizes purchasing power, allowing for greater negotiation leverage. In 2024, budget constraints across healthcare systems intensified this effect, pushing for cost efficiencies.

Price sensitivity remains a key lever for customers, driven by healthcare budget pressures and reimbursement policies. Although Eckert & Ziegler's products are vital for treatments, the competitive landscape and ongoing cost containment efforts in healthcare mean customers are attentive to pricing. This is particularly true as many healthcare providers faced tighter financial conditions throughout 2024.

The threat of backward integration by customers is exceptionally low due to the immense capital, specialized knowledge, and stringent regulatory requirements involved in producing radioisotopes and brachytherapy devices. For example, establishing a cyclotron facility can cost tens of millions of dollars, a prohibitive investment for most healthcare institutions, thus limiting their ability to exert pressure through this channel.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Customer Concentration | Moderate | Consolidated purchasing groups and national healthcare systems centralize demand. |

| Price Sensitivity | Moderate to High | Healthcare budget constraints and reimbursement policies drive cost focus. |

| Switching Costs | Low to Moderate | Costs include retraining, equipment recalibration, and regulatory approvals. |

| Threat of Backward Integration | Very Low | High capital, expertise, and regulatory barriers deter self-production. |

Same Document Delivered

Eckert & Ziegler Strahlen- und Medizintechnik Porter's Five Forces Analysis

The document you see here is the exact, comprehensive Porter's Five Forces Analysis for Eckert & Ziegler Strahlen- und Medizintechnik that you will receive immediately after purchase. This detailed report meticulously breaks down the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You are previewing the final version—precisely the same document that will be available to you instantly after buying, ready for your strategic planning needs.

Rivalry Among Competitors

The isotope technology market, especially for nuclear medicine and brachytherapy, has a number of significant companies besides Eckert & Ziegler. Key competitors include Varian Medical Systems, which is part of Siemens Healthineers, and Elekta. These companies, along with broader medical technology giants like GE Healthcare, Cardinal Health, and Curium, are active in the medical radioisotopes sector.

Eckert & Ziegler operates in a competitive environment populated by these large, diversified medical technology firms. For instance, in 2023, Siemens Healthineers reported revenue of €21.7 billion, showcasing the scale of some of Eckert & Ziegler's rivals. This presence of major players underscores the intensity of competition within the specialized field of isotope technology.

The nuclear medicine and brachytherapy sectors are showing impressive growth. The brachytherapy market is anticipated to expand at a compound annual growth rate (CAGR) of 7.9% to 8.2% between 2024 and 2029 or 2033.

Similarly, the nuclear medicine market is projected for even more substantial growth, with an expected CAGR ranging from 11.5% to 14.2% from 2024 through 2029 or 2025. This healthy expansion can potentially ease competitive pressures, as companies have room to grow their businesses by capturing new demand rather than solely by taking market share from rivals.

Eckert & Ziegler distinguishes itself through highly specialized radioactive components crucial for advanced cancer therapies and nuclear medicine. Their portfolio includes brachytherapy seeds and vital radioisotopes such as Gallium-68 and Lutetium-177, which are key in diagnostic imaging and targeted treatments. This focus on niche, high-value products allows for significant differentiation in a market that is increasingly driven by personalized medicine.

The company's commitment to developing novel radiopharmaceuticals and pioneering targeted alpha therapies further solidifies its competitive edge. These advanced applications require specialized expertise and manufacturing capabilities, creating higher barriers to entry. For instance, the growing demand for targeted alpha emitters like Actinium-225, used in highly precise cancer treatments, highlights Eckert & Ziegler's role in cutting-edge medical innovation.

However, not all products offer the same level of differentiation. Standard radioisotopes, such as Technetium-99m, are broadly utilized across nuclear medicine, leading to more commoditized competition. In 2023, the global nuclear medicine market, which includes these isotopes, was valued at approximately $6.5 billion, with Technetium-99m being a significant contributor to diagnostic procedures, indicating a more price-sensitive competitive landscape for these particular offerings.

Exit Barriers

High exit barriers are a significant factor in the isotope technology and nuclear medicine industry, making it difficult for companies like Eckert & Ziegler to leave. These barriers stem from substantial investments in specialized assets, ongoing regulatory compliance, and entrenched long-term contracts. The sheer cost and complexity of divesting highly specialized manufacturing facilities and navigating the intricate web of nuclear safety regulations mean that exiting the market is not a simple decision.

The substantial capital expenditure required for research and development, coupled with the need for compliant manufacturing infrastructure, creates a situation where firms are often compelled to remain and compete, even in challenging market conditions. This can lead to intensified rivalry as companies are essentially locked into the industry.

Strict regulations governing nuclear safety and the handling of radioactive materials further solidify these exit barriers. Companies must maintain rigorous compliance standards, which involve continuous investment and specialized expertise, making a clean break from the industry extremely difficult and costly.

Eckert & Ziegler's own financial disclosures often highlight the long-term nature of their investments in nuclear medicine infrastructure. For instance, their 2024 reports likely detail ongoing commitments to facilities and regulatory adherence, underscoring the high costs associated with exiting such a specialized sector.

- Specialized Assets: Significant investment in nuclear-grade manufacturing and handling equipment.

- Regulatory Obligations: Continuous compliance with stringent nuclear safety and licensing requirements.

- Long-Term Contracts: Commitments to supply agreements and partnerships within the nuclear medicine supply chain.

- R&D Investment: Ongoing expenditure in developing new isotopes and medical applications.

Strategic Stakes

The stakes in the isotope technology sector are exceptionally high, particularly with its crucial role in advancing cancer therapies and diagnostics. The market is experiencing substantial growth, driving significant investment. Companies are pouring resources into research and development, expanding production capabilities, and forging strategic alliances, such as those for Actinium-225, to secure a leading position and future expansion.

- High Strategic Stakes: Isotope technology is fundamental to modern oncology, making market leadership a key objective.

- Significant Market Growth: The increasing demand for advanced cancer treatments fuels intense competition.

- R&D and Capital Investment: Companies are investing heavily in innovation and infrastructure to stay ahead.

- Partnerships for Key Isotopes: Collaborations, like those for Actinium-225, are vital for securing critical supply chains.

Competitive rivalry in the isotope technology market is intense, with major players like Siemens Healthineers and Elekta actively competing with Eckert & Ziegler. While the overall market is growing, with nuclear medicine projected to grow between 11.5% and 14.2% CAGR from 2024-2029, the competition for standard radioisotopes like Technetium-99m, which contributed to the $6.5 billion nuclear medicine market in 2023, is more commoditized and price-sensitive.

Eckert & Ziegler differentiates itself through specialized radioactive components for advanced therapies, such as Gallium-68 and Lutetium-177, and its focus on novel radiopharmaceuticals and targeted alpha therapies. This specialization creates higher barriers to entry, but the presence of large, diversified medical technology firms with substantial revenues, like Siemens Healthineers' €21.7 billion in 2023, highlights the scale of competition.

The high stakes and significant market growth, with brachytherapy expected to grow at a 7.9%-8.2% CAGR from 2024-2033, encourage heavy investment in R&D and infrastructure. Companies are forming partnerships, particularly for critical isotopes like Actinium-225, to secure market leadership and expand their capabilities in this vital sector for oncology.

High exit barriers, including substantial asset investments, regulatory compliance, and long-term contracts, compel companies to remain and compete, even in challenging conditions. This often leads to intensified rivalry as firms are essentially locked into the industry, requiring continuous investment in specialized manufacturing and adherence to stringent nuclear safety regulations.

SSubstitutes Threaten

The availability of alternative treatments presents a significant threat to Eckert & Ziegler's nuclear medicine and brachytherapy business. For cancer therapy, options like external beam radiation therapy, chemotherapy, surgery, and emerging targeted therapies provide patients and physicians with a range of choices.

While brachytherapy offers benefits such as precise radiation delivery and potentially shorter treatment times, the broader landscape of cancer care means these advantages must be weighed against the efficacy, side effects, and cost of substitute modalities. The growing sophistication and accessibility of these alternatives can divert patients away from Eckert & Ziegler's core offerings, impacting market share and revenue potential. For instance, advancements in immunotherapy and precision medicine are rapidly expanding the non-radiation treatment landscape, offering new avenues for cancer management that could reduce reliance on traditional radiation techniques.

The performance and cost-effectiveness of substitute treatments for conditions treated by brachytherapy are constantly evolving. For instance, advancements in external beam radiation therapy, such as the increasing adoption and refinement of proton therapy, present a significant competitive alternative. Proton therapy, while often more expensive upfront, can offer superior dose targeting, potentially reducing side effects compared to traditional radiation methods.

Furthermore, the development of novel chemotherapy drugs and increasingly sophisticated surgical techniques also provides viable alternatives. While brachytherapy often boasts cost-effectiveness and the advantage of localized treatment to minimize damage to surrounding healthy tissues, the ultimate choice of therapy is heavily influenced by the overall treatment plan, the specific medical condition, and individual patient factors. For example, in 2024, the global brachytherapy market was valued at approximately $2.5 billion, but the growing investment in advanced external beam technologies and targeted therapies suggests a dynamic competitive landscape.

Patient and physician preferences are significant drivers in the choice of medical treatments, directly impacting the threat of substitutes for brachytherapy and nuclear medicine. Factors such as the invasiveness of a procedure, its associated side effect profile, the overall duration of treatment, and the perceived effectiveness of a therapy all weigh heavily on decision-making. For instance, a 2024 survey indicated that 65% of oncologists consider patient preference for minimally invasive options as a primary factor in treatment selection.

The evolving landscape of healthcare increasingly favors less invasive therapeutic approaches and the growing demand for personalized medicine. This trend could either bolster brachytherapy and nuclear medicine, if innovations align with these preferences, or challenge them if alternative treatments offer superior patient experience or tailored outcomes. Data from 2023 shows a 10% year-over-year increase in patient inquiries about outpatient cancer treatment options, a segment where less invasive modalities often have an advantage.

Technological Advancements in Substitutes

Technological advancements continuously introduce new ways to treat diseases, potentially replacing existing methods. For instance, breakthroughs in non-radioactive therapies could challenge the market for industrial radioactive isotopes in specific applications. The nuclear medicine sector itself is evolving with innovations like radioimmunotherapy and hybrid imaging techniques, indicating a dynamic competitive landscape.

These advancements create a substantial threat as they offer alternative solutions that might be more effective, less invasive, or more cost-efficient. The development of more precise radiation delivery systems, novel drug therapies, and enhanced surgical procedures directly impacts the demand for traditional methods. For example, by 2024, the global cancer diagnostics market, which includes imaging and treatment technologies, was projected to reach hundreds of billions of dollars, with a significant portion driven by technological innovation.

- Technological innovation in cancer treatment presents a direct substitute threat.

- Non-radioactive technologies are emerging as potential competitors in niche markets.

- Advancements in radioimmunotherapy and hybrid imaging are reshaping the nuclear medicine landscape.

Switching Costs for Patients/Providers

Switching costs for patients and healthcare providers to alternative treatments can be significant, encompassing adjustments to clinical protocols, new equipment integration, and revised patient management strategies. For instance, adopting a new radiation therapy modality might require retraining staff and recalibrating existing linear accelerators, a process that can take months and incur substantial upfront investment.

Despite these barriers, the pursuit of superior patient outcomes, mitigation of adverse side effects, or enhanced cost-effectiveness can compel a shift towards substitute therapies. The burgeoning field of personalized medicine, for example, is increasingly enabling tailored treatment plans that may offer advantages over standardized approaches. In 2024, the global market for precision medicine solutions was valued at approximately $68.8 billion, highlighting a significant trend towards individualized care that could pressure established treatment methods.

Eckert & Ziegler Strahlen- und Medizintechnik, a key player in radiation technology, faces this dynamic. While direct patient switching is less common, healthcare institutions that utilize their equipment might consider alternatives if substitute technologies offer demonstrably better clinical results or a more favorable total cost of ownership. For example, advancements in proton therapy, while requiring substantial initial investment, are being adopted by centers seeking to minimize radiation exposure to healthy tissues, a key driver for potential shifts in equipment and treatment planning.

Key considerations for switching costs include:

- Training and Skill Development: New equipment or protocols often necessitate staff retraining, impacting operational efficiency during the transition.

- Capital Investment: Acquiring new medical devices or upgrading existing infrastructure represents a considerable financial outlay.

- Workflow Integration: Seamlessly incorporating a new treatment modality into existing patient care pathways requires careful planning and execution.

- Regulatory Approvals: Implementing novel treatments or technologies may involve navigating complex regulatory processes, adding time and cost.

The threat of substitutes for Eckert & Ziegler's nuclear medicine and brachytherapy products is substantial, driven by advancements in alternative cancer treatments and evolving patient preferences. For instance, the global brachytherapy market was valued around $2.5 billion in 2024, but this figure is under pressure from evolving alternatives.

Emerging technologies like proton therapy and sophisticated external beam radiation offer more precise targeting, potentially reducing side effects and influencing treatment choices. Additionally, the growing emphasis on personalized medicine and minimally invasive procedures, with 65% of oncologists in a 2024 survey citing patient preference for less invasive options as a key factor, further amplifies this threat.

Switching costs for healthcare providers, while a barrier, can be overcome by the pursuit of better clinical outcomes or cost-effectiveness. The global precision medicine market, valued at approximately $68.8 billion in 2024, underscores the trend towards individualized care that may favor alternative modalities.

| Substitute Treatment Category | Key Advancements/Drivers | Impact on Eckert & Ziegler | Market Data/Trends (2024) |

| External Beam Radiation Therapy (e.g., Proton Therapy) | Improved dose targeting, reduced side effects | Potential shift from brachytherapy for certain indications | Growing adoption in specialized cancer centers |

| Immunotherapy & Targeted Therapies | Non-radiation based, personalized treatment | Reduced reliance on radiation modalities | Significant growth in global oncology drug market |

| Advanced Surgical Techniques | Minimally invasive procedures | Preference for less invasive options | Increasing patient demand for outpatient treatments |

Entrants Threaten

The isotope technology and nuclear medicine sector, especially for radioactive components and radiopharmaceuticals, requires immense capital for R&D, specialized manufacturing, and distribution. For instance, establishing a radiopharmaceutical production facility can easily cost tens of millions of dollars, with ongoing investments in quality control and regulatory compliance adding to the burden. This substantial financial hurdle significantly deters potential new players from entering the market.

The medical technology sector, especially areas involving radioactive materials like those Eckert & Ziegler Strahlen- und Medizintechnik operates in, faces significant regulatory hurdles. Obtaining necessary approvals from global health authorities for new radiopharmaceuticals, such as Lutetium-177 and Actinium-225, is a lengthy, complex, and expensive undertaking. This rigorous process acts as a substantial barrier, deterring potential new entrants who may lack the resources or expertise to navigate these stringent requirements.

Eckert & Ziegler Strahlen- und Medizintechnik faces a significant threat from new entrants due to the high barriers in accessing scarce and specialized raw materials, particularly medical isotopes. These materials, crucial for their products, are not readily available and require specialized handling and sourcing.

Establishing robust and dependable supply chains for isotopes, many of which have short half-lives, presents another substantial hurdle. This necessitates deep industry knowledge and established relationships within a niche global market.

While the global isotope market is expanding, ongoing supply chain complexities continue to act as a deterrent for potential new competitors looking to enter the field. For instance, the demand for Technetium-99m, a key medical isotope, often outstrips supply due to production facility limitations.

Proprietary Technology and Expertise

Eckert & Ziegler, along with other established companies in the sector, benefits from proprietary technology and deep-seated expertise in critical areas like isotope production and handling. This specialized knowledge, often protected by patents and trade secrets, creates a substantial barrier for newcomers aiming to replicate their capabilities.

The significant investment required to develop comparable technological infrastructure and cultivate the necessary scientific and technical acumen acts as a formidable deterrent. For instance, companies in this field often hold numerous patents related to their manufacturing processes and product applications, making it difficult and costly for new entrants to compete on a technological level.

- Proprietary Technology: Eckert & Ziegler's advanced methods in isotope purification and encapsulation are key differentiators.

- Intellectual Property: A portfolio of patents protects their unique production techniques and applications.

- Deep Expertise: Years of experience in handling radioactive materials and developing medical devices are hard to replicate.

- High R&D Investment: The sector demands continuous, substantial investment in research and development, a challenge for new players.

Brand Loyalty and Established Relationships

Brand loyalty is a significant barrier for new entrants targeting Eckert & Ziegler Strahlen- und Medizintechnik. Established companies leverage strong brand recognition built over years, fostering trust with critical clients like hospitals and research institutions.

These long-standing relationships are crucial in the medical technology sector, where reliability and proven performance are paramount. Newcomers face the daunting task of displacing this entrenched loyalty and establishing credibility in a field where patient safety and scientific accuracy are non-negotiable.

- Established brand recognition: Eckert & Ziegler benefits from a well-known name in radiation technology and medical devices, making it a preferred choice for many institutions.

- Deep client relationships: Years of collaboration have solidified partnerships with key hospitals and research centers, creating a sticky customer base.

- Proven track record: The company's history of delivering high-quality, reliable products instills confidence, a difficult attribute for new entrants to replicate quickly.

- High switching costs: For medical facilities, changing suppliers for critical equipment involves significant retraining, validation, and potential disruption, further solidifying loyalty.

The threat of new entrants for Eckert & Ziegler Strahlen- und Medizintechnik is significantly mitigated by the substantial capital requirements for research, development, and specialized manufacturing in the isotope and nuclear medicine sectors. For example, establishing a radiopharmaceutical production facility can easily cost tens of millions of dollars, a substantial financial hurdle that deters many potential newcomers. Furthermore, navigating the complex and lengthy regulatory approval processes for radioactive materials, which can take years and significant investment, acts as another formidable barrier to entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, specialized manufacturing, and distribution costs (e.g., millions for a radiopharmaceutical facility). | Deters new players due to substantial financial outlay. |

| Regulatory Hurdles | Lengthy, complex, and expensive approvals from global health authorities for radioactive materials. | Acts as a significant deterrent for firms lacking resources or expertise. |

| Access to Scarce Materials | Difficulty in sourcing and handling specialized medical isotopes. | Creates a challenge for new entrants to establish reliable supply chains. |

| Proprietary Technology & IP | Patented production techniques and deep expertise in handling radioactive materials. | Makes it difficult and costly for newcomers to replicate capabilities. |

| Brand Loyalty & Switching Costs | Established trust with hospitals and research institutions, high costs for clients to switch suppliers. | Makes it challenging for new entrants to gain market share from incumbents. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eckert & Ziegler Strahlen- und Medizintechnik leverages data from their annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.