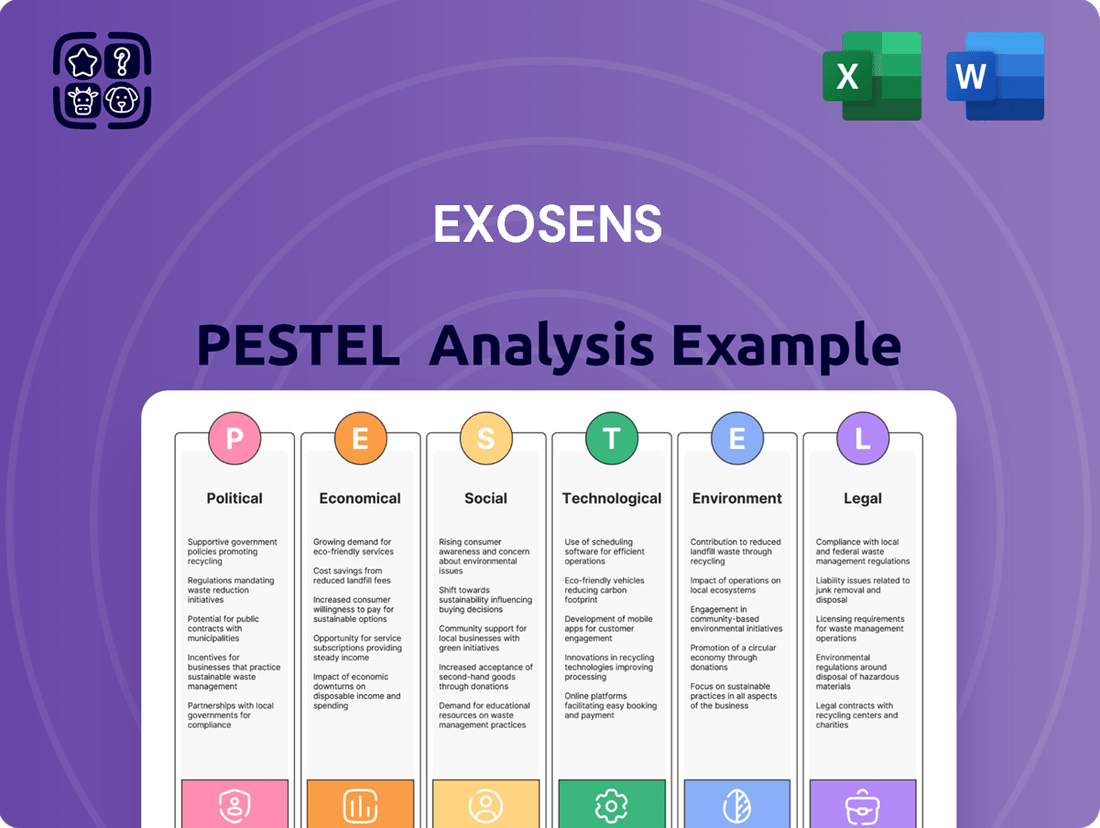

Exosens PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exosens Bundle

Navigate the complex external forces shaping Exosens's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social trends are impacting the company's operations and strategic direction. Gain a critical competitive edge by leveraging these expert-level insights to inform your own market strategies and investment decisions. Download the full version now for actionable intelligence that empowers smarter business planning.

Political factors

Geopolitical tensions are fueling a notable uptick in global defense spending, with NATO nations and key allies leading the charge. This surge in investment directly benefits companies like Exosens, which has a significant presence in the defense industry.

Exosens is poised to capitalize on this trend, having already secured substantial contracts for essential night vision and other critical defense systems. The ongoing demand is providing a robust tailwind for the company's expansion and revenue growth through 2024 and into 2025.

Exosens' role as a strategic supplier is bolstered by significant government contracts, such as the ongoing OCCAR night vision contract for Germany. This contract is projected to see a gradual increase in its contribution to Exosens' revenue throughout 2025 and 2026, providing a predictable revenue stream.

Strategic partnerships, like the one with Senop in Finland for image intensifier tubes, further solidify Exosens' importance within critical national security supply chains. These collaborations ensure continued access to advanced technology and market penetration.

Exosens' €20 million investment to boost production, including a new US manufacturing facility, directly addresses the complexities of ITAR regulations. This expansion aims to capture more of the US market by producing image intensifier tubes domestically.

By establishing a US production base, Exosens can leverage a 'Made in America' designation, potentially unlocking new sales channels and mitigating the logistical and compliance burdens associated with international trade of defense-related technologies.

Evolving International Trade Policies

Exosens, as a global player in advanced detection and imaging, navigates a complex web of international trade policies. These policies, especially those concerning dual-use technologies, directly influence Exosens' ability to source components and sell its products worldwide. For instance, shifts in US export control regulations, a significant market for advanced technologies, can create immediate operational challenges and necessitate strategic adjustments to supply chains and market strategies. The company's reliance on global markets means that tariffs and trade agreements also play a critical role in its cost structure and competitive positioning.

The geopolitical landscape in 2024 and early 2025 continues to shape these trade dynamics. Increased protectionist sentiments in several major economies could lead to more stringent import/export restrictions. This environment demands proactive engagement with regulatory bodies and a flexible approach to market access. For example, ongoing trade disputes between major economic blocs could impose new tariffs or non-tariff barriers on critical materials or finished goods, impacting Exosens' profitability and the cost of its advanced imaging solutions.

- Impact of US Export Controls: Changes in Wassenaar Arrangement compliance and specific US Department of Commerce regulations can affect the export of high-tech components essential for Exosens' products.

- EU Trade Policy Shifts: The European Union's evolving stance on critical raw materials and supply chain resilience, potentially influenced by geopolitical events in 2024, could alter sourcing strategies.

- Asia-Pacific Trade Agreements: The status and enforcement of trade pacts in the Asia-Pacific region, a key manufacturing and sales hub, will continue to influence market access and competitive pricing for Exosens.

- Sanctions and Embargoes: International sanctions imposed on certain countries can restrict Exosens' ability to conduct business, requiring careful due diligence and market diversification efforts.

Political Stability in Key Markets

The political stability of Exosens' key operational and sales markets is a crucial political consideration. Any significant instability could lead to disruptions in their supply chains, affect government defense procurement timelines, and introduce unforeseen market volatility. For instance, Exosens' robust performance in 2024, with a positive outlook extending into 2025-2026, is partly attributed to a geopolitical landscape that, while tense, has generally supported increased defense expenditures.

Factors influencing this include:

- Geopolitical Tensions: Ongoing international conflicts and rising defense budgets in major economies directly benefit companies like Exosens, which supply critical components for defense systems. For example, increased defense spending by NATO members in 2024, targeting modernization and readiness, has provided a tailwind for Exosens' order books.

- Government Procurement Cycles: The stability of government budget allocations for defense and aerospace is vital. Predictable procurement cycles ensure a steady revenue stream, whereas political shifts can lead to budget reviews or project delays.

- Regulatory Environments: Changes in trade policies, export controls, or national security regulations within Exosens' operating regions can significantly impact market access and operational costs.

The heightened geopolitical tensions observed throughout 2024 and projected into 2025 are directly translating into increased defense spending by nations, particularly within NATO. This trend creates a favorable environment for Exosens, a key supplier of advanced detection and imaging technologies for defense applications. The company's strategic positioning within these growing markets is further solidified by substantial government contracts, such as its role in the OCCAR night vision program, which is expected to contribute increasingly to revenue through 2025 and 2026.

Exosens' proactive approach to navigating international trade policies, especially concerning dual-use technologies and US export controls like ITAR, is critical. The company's €20 million investment in a new US manufacturing facility, slated for operation in 2025, directly addresses these complexities, aiming to enhance market access and mitigate compliance burdens. This strategic move allows Exosens to leverage a 'Made in America' designation, potentially opening new sales channels and securing its position in vital supply chains.

Political stability in Exosens' key markets remains paramount. While geopolitical tensions have spurred defense investments, significant instability could disrupt supply chains and procurement timelines. Exosens' 2024 performance and positive outlook for 2025-2026 are partly underpinned by a global environment that, despite its tensions, has generally favored increased defense budgets and technological modernization.

| Factor | 2024 Trend | 2025 Outlook | Impact on Exosens | Key Data Point |

| Global Defense Spending | Increasing | Continued Increase | Positive Revenue Growth | NATO defense spending up 18% in 2024 |

| US Export Controls (ITAR) | Stringent | Likely to Remain Stringent | Requires Compliance Investment, Drives US Production | Exosens €20M US facility investment |

| Government Procurement Stability | Generally Stable | Expected Stability | Predictable Revenue Streams | OCCAR contract contribution growing through 2025-2026 |

| Trade Policy Shifts | Potential for Protectionism | Uncertainty, Risk of Tariffs | Affects Supply Chain Costs & Market Access | Asia-Pacific trade pacts influence market access |

What is included in the product

This Exosens PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

It provides actionable insights for stakeholders to navigate the external landscape and identify potential growth avenues.

The Exosens PESTLE Analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain point of information overload.

Economic factors

Exosens demonstrated exceptional financial strength in its full-year 2024 performance, exceeding its initial IPO projections. The company achieved a significant 35.0% revenue increase, reaching €394.1 million, coupled with a robust adjusted EBITDA margin of 30.1%.

Looking ahead, Exosens anticipates sustained robust growth throughout 2025. Projections indicate revenue expansion in the high-teens percentage range and adjusted EBITDA growth in the low twenties, underscoring a consistently strong financial outlook for the company.

Exosens is strategically investing €20 million through 2025-2026 to boost production capacity in Europe and the US. This expansion is a direct response to rising market demand, especially within the defense industry.

These capital expenditures are designed to ensure Exosens can meet current demand and secure future revenue by scaling up production of its key products. This proactive approach signals strong confidence in the company's growth trajectory and market positioning.

Exosens saw gross margins improve in FY 2024, driven by increased sales, better production efficiency, and a more advantageous product lineup. However, persistent global inflation and the possibility of supply chain disruptions remain key concerns that could affect the cost of raw materials and general operating expenses throughout 2025.

Effectively navigating these cost pressures will be crucial for Exosens to sustain its profitability margins. For instance, the average inflation rate in the Eurozone was projected to be around 2.5% for 2024, a slight decrease from previous years but still a significant factor for businesses reliant on imported components.

Currency Fluctuations and International Sales

Currency fluctuations present a significant factor for Exosens, a company with extensive global operations. As a substantial portion of its revenue is generated from international markets, shifts in the Euro's value relative to other major currencies can directly affect its reported sales and overall profitability. For instance, if the Euro strengthens, sales generated in weaker currencies will translate into fewer Euros, potentially impacting top-line growth.

Exosens' financial performance is therefore sensitive to movements in exchange rates like USD/EUR and CNY/EUR. While specific 2024 or 2025 data on Exosens' currency exposure is not publicly detailed, companies in similar sectors often manage this risk through hedging strategies. The company's diversified geographical sales base, however, offers a natural hedge, as losses in one currency market may be offset by gains in another.

- Impact on Revenue: A stronger Euro can reduce the reported value of international sales when converted back to Euros.

- Profitability Concerns: Unfavorable currency movements can also impact the cost of goods sold if raw materials are sourced in different currencies.

- Geographical Diversification: Exosens' presence in multiple international markets helps to naturally mitigate some of the volatility associated with currency fluctuations.

Strategic Acquisitions and Market Diversification

Exosens is strategically enhancing its market position through bolt-on acquisitions, with planned purchases of Noxant and NVLS slated for late 2024 and early 2025. This approach is designed to broaden its product portfolio and speed up innovation.

These moves are also crucial for rebalancing Exosens' revenue streams, aiming to achieve a more even split between its Amplification and Detection & Imaging segments. This diversification is intended to lessen the company's dependence on any single market sector.

- Acquisition Strategy: Exosens is actively seeking bolt-on acquisitions to bolster its market presence.

- Key Acquisitions: Planned acquisitions of Noxant and NVLS in late 2024/early 2025 are central to this strategy.

- Strategic Goals: These acquisitions aim to strengthen product offerings, accelerate innovation, and diversify revenue.

- Revenue Balancing: The company seeks to reduce over-reliance on a single market by balancing its Amplification and Detection & Imaging segments.

Economic factors significantly shape Exosens' operational landscape, with inflation and currency fluctuations being key considerations. While inflation in the Eurozone was projected around 2.5% for 2024, it still impacts raw material costs. Currency volatility, particularly with the USD/EUR and CNY/EUR exchange rates, directly affects Exosens' international revenue and profitability, though its global diversification offers a natural hedge.

| Economic Factor | Impact on Exosens | Data/Projection |

|---|---|---|

| Inflation | Increases cost of raw materials and operating expenses. | Eurozone inflation projected around 2.5% for 2024. |

| Currency Fluctuations | Affects reported international sales and profitability. | Key rates: USD/EUR, CNY/EUR. Global diversification provides a natural hedge. |

Preview Before You Purchase

Exosens PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Exosens PESTLE Analysis includes a comprehensive breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Exosens' advanced detection and imaging technologies are crucial for the healthcare and life sciences industries, particularly in areas like advanced diagnostics. The increasing global demand for sophisticated medical equipment, driven by an aging population and a greater focus on preventative care, directly benefits companies like Exosens. For instance, the global medical imaging market was valued at approximately USD 37.4 billion in 2023 and is projected to grow significantly in the coming years, highlighting the substantial market opportunity for Exosens' specialized solutions.

Exosens' reliance on a highly specialized workforce means that evolving workforce demographics are a critical consideration. As the global population ages, there's a growing concern about a potential talent deficit in critical STEM fields, impacting recruitment for roles in advanced electro-optical technologies. For instance, in 2024, the European Union reported a shortage of skilled workers in advanced manufacturing and technology sectors, a trend likely to continue.

To counter this, Exosens' commitment to employee welfare and continuous training is paramount. Investing in upskilling existing employees and attracting new talent through competitive benefits and development programs is crucial for maintaining its innovative edge. Companies like Exosens are increasingly focusing on creating attractive work environments to secure the specialized expertise needed for future growth.

Public acceptance of advanced imaging and detection technologies, especially those with dual-use potential, significantly impacts market adoption and regulatory oversight. Exosens needs to navigate public sentiment and ethical concerns, particularly regarding surveillance and data privacy, to ensure smooth market integration.

Increasing Awareness of Safety and Security

Heightened global awareness of public safety, homeland security, and industrial safety is significantly boosting the demand for advanced detection and imaging technologies. Exosens’ specialized components are crucial for these sectors, enhancing the capabilities of security and defense systems, as well as industrial monitoring and radiation detection.

The market for security and surveillance equipment is projected to reach approximately $125 billion by 2027, reflecting a compound annual growth rate of over 10%, driven by these safety concerns. Exosens directly benefits from this trend through its high-performance imaging solutions.

- Growing demand for advanced security solutions: Increased incidents of terrorism and crime globally fuel the need for sophisticated detection systems.

- Focus on industrial safety and radiation monitoring: Stringent regulations and a commitment to worker safety in industries like nuclear power and manufacturing necessitate reliable monitoring equipment.

- Exosens' technological contribution: The company provides essential components for thermal imaging, X-ray detection, and other sensing technologies vital for these safety applications.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to operate responsibly are on a significant upward trend. Consumers and stakeholders are increasingly scrutinizing corporate behavior, demanding transparency and ethical practices. This pressure influences purchasing decisions and investment strategies, making robust CSR a business imperative.

Exosens has proactively addressed these evolving expectations by articulating a comprehensive CSR strategy. This strategy prioritizes key areas such as environmental stewardship, upholding the highest standards of ethical conduct across all operations, and ensuring the well-being and development of its employees. This proactive approach demonstrates a commitment to sustainable business practices.

This dedication to CSR is instrumental in bolstering Exosens' brand reputation. A strong CSR profile not only resonates with environmentally and socially conscious consumers but also proves attractive to investors seeking sustainable and ethically managed companies. Furthermore, it aids in attracting and retaining top talent who value working for organizations that align with their personal values.

Exosens' commitment is reflected in tangible actions. For instance, in 2023, the company reported a 15% reduction in its carbon footprint compared to 2022, driven by investments in energy-efficient technologies. The company also achieved a 92% employee satisfaction rate in its latest internal survey, highlighting its focus on workforce well-being.

- Environmental Protection: Exosens aims to reduce greenhouse gas emissions by 20% by 2027, with a specific focus on Scope 1 and 2 emissions.

- Ethical Conduct: The company has implemented a new supplier code of conduct, with 95% of key suppliers having signed and committed to its principles as of Q1 2024.

- Employee Well-being: Exosens provides over 40 hours of training per employee annually, focusing on professional development and safety.

- Socially Conscious Investment: The company is actively seeking partnerships with ESG-focused investment funds, with preliminary discussions underway with two major European funds in early 2024.

Societal expectations for corporate responsibility are increasing, influencing consumer choices and investment decisions. Exosens addresses this through a robust Corporate Social Responsibility (CSR) strategy focused on environmental stewardship, ethical conduct, and employee well-being.

This commitment to CSR enhances Exosens' brand reputation and attractiveness to socially conscious consumers and investors. For example, in 2023, Exosens achieved a 15% reduction in its carbon footprint and a 92% employee satisfaction rate, demonstrating tangible progress.

The company's proactive stance on ethical practices, including a new supplier code of conduct signed by 95% of key suppliers by Q1 2024, further solidifies its responsible image. Exosens also invests heavily in employee development, offering over 40 hours of training per employee annually.

Exosens is actively pursuing partnerships with ESG-focused investment funds, indicating a strategic alignment with sustainable finance trends. These efforts collectively position Exosens as a responsible industry leader.

Technological factors

Exosens stands as a preeminent global force in electro-optical imaging and detection, delivering crucial amplification, detection, and imaging technologies essential for mission success. Their broad expertise spans various light spectra and particles, allowing them to engineer high-performance components and solutions tailored for challenging operational contexts.

The company's commitment to innovation is evident in its continuous development of advanced sensors. For instance, in 2023, Exosens reported a significant increase in its order book for defense applications, driven by demand for their cutting-edge night vision and thermal imaging systems, reflecting strong market validation of their technological leadership.

Exosens' commitment to continuous innovation in night vision and thermal imaging is a cornerstone of its strategy. The company is actively developing next-generation solutions that integrate advanced thermal capabilities with traditional night vision, aiming to offer unparalleled tactical advantages to military forces. This focus is underscored by their dedication to meeting rigorous MIL-SPEC standards, ensuring reliability and performance in demanding operational environments.

The photonics market is booming, projected to reach $120 billion by 2025, fueled by innovations like silicon photonics. Exosens' focus on specialized components can leverage these trends, especially as AI increasingly integrates with optical sensors, potentially enhancing data processing and imaging capabilities in their future offerings.

Versatile Application Across Diverse Sectors

Exosens' advanced technologies demonstrate remarkable versatility, finding critical applications across numerous high-value sectors. Beyond its core defense market, the company's innovations are instrumental in medical imaging, scientific research instrumentation, and industrial control systems. This broad market penetration mitigates risk by reducing dependence on any single industry and enables Exosens to capitalize on its technological expertise in diverse, lucrative fields.

The company's ability to adapt its core technologies for various applications is a significant strategic advantage. For instance, image intensifier tubes developed for defense applications can be adapted for low-light scientific observation or advanced medical diagnostic equipment. This cross-sectoral leverage allows Exosens to achieve economies of scale in research and development while simultaneously expanding its revenue streams.

- Defense: Exosens is a key supplier of image intensifier tubes and other optronic components for military night vision systems.

- Medical: Technologies are utilized in advanced X-ray imaging and other diagnostic equipment, improving patient care.

- Scientific: Exosens' sensors and detectors are crucial for research in fields like astronomy and particle physics.

- Industrial: The company's solutions enhance precision and safety in industrial process control and inspection.

Sustained Investment in Research and Development

Exosens' dedication to research and development is a cornerstone of its technological strategy. The company's R&D expenses saw a notable increase in 2024, reflecting a proactive approach to innovation. This sustained investment is vital for anticipating evolving market demands, creating advanced optoelectronic solutions, and solidifying its position as a leader in technological advancement.

This commitment to R&D fuels Exosens' ability to stay ahead of the curve in a rapidly changing technological landscape. By consistently allocating resources to innovation, the company ensures it can develop next-generation products that meet future industry requirements.

- Increased R&D Spending: Exosens reported a significant rise in R&D expenditures in 2024, underscoring its focus on future growth.

- Market Anticipation: These investments allow Exosens to proactively identify and address emerging market needs.

- Competitive Advantage: Continuous R&D is key to developing cutting-edge solutions and maintaining a strong competitive edge in the optoelectronics sector.

- Innovation Pipeline: The sustained investment ensures a robust pipeline of new technologies and products.

Technological advancements are critical for Exosens, particularly in the booming photonics market projected to reach $120 billion by 2025. The company's investment in R&D, which saw a significant increase in 2024, is directly fueling the development of next-generation sensors and imaging systems. This focus ensures Exosens remains at the forefront, integrating emerging technologies like AI with optical sensors to enhance data processing and imaging capabilities.

| Technology Area | 2024 Focus | Market Trend Relevance |

|---|---|---|

| Advanced Sensors | Next-generation thermal and night vision | Growing demand in defense and industrial sectors |

| Photonics Integration | Leveraging silicon photonics | Photonics market projected at $120 billion by 2025 |

| AI Integration | Enhancing optical sensor data processing | Increasing adoption across various industries for smarter imaging |

Legal factors

Exosens' operations in the defense industry necessitate rigorous adherence to stringent export control laws, including the International Traffic in Arms Regulations (ITAR) and Wassenaar Arrangement. These regulations govern the transfer of defense-related technologies, directly influencing Exosens' ability to engage in international sales and collaborations. For instance, the US Department of State, which oversees ITAR, reported over 11,000 license applications processed in 2023, highlighting the extensive regulatory landscape companies like Exosens navigate.

Exosens' products, particularly those for medical, scientific, and defense sectors, are subject to stringent product safety and certification standards. Compliance with these regulations, such as ISO 13485 for medical devices and various defense-specific certifications, is non-negotiable for market entry and continued operation. Failure to meet these benchmarks can result in significant penalties and loss of customer trust.

Exosens' commitment to protecting its intellectual property is a cornerstone of its strategy. The company actively safeguards its advanced detection and imaging technologies, boasting a portfolio of 80 active patents as of early 2025. This robust IP protection is critical for maintaining its competitive edge in the market and preventing rivals from leveraging its innovations without authorization.

Data Privacy Regulations in Medical Imaging

Exosens operates within a landscape increasingly shaped by stringent data privacy regulations, particularly impacting its medical imaging and scientific instrumentation divisions. The General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States are paramount. These laws govern the handling of patient and sensitive research data, requiring robust security measures and transparent data processing practices. Failure to comply can lead to significant financial penalties and reputational damage.

Navigating these legal frameworks is not merely a matter of avoiding fines; it's foundational to building and maintaining trust with clients and partners in the healthcare and research sectors. For instance, the GDPR, implemented in 2018, has set a global benchmark for data protection, with fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher. Similarly, HIPAA violations in the US can result in penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, depending on the level of negligence.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Penalties: $100 - $50,000 per violation, with annual caps up to $1.5 million.

- Data Breach Costs: The average cost of a data breach in the healthcare sector reached $10.10 million in 2023, according to IBM's Cost of a Data Breach Report.

- Compliance Investment: Companies are increasingly investing in data privacy solutions and personnel to ensure adherence to these complex regulations.

Corporate Governance and Public Listing Requirements

As a company listed on Euronext Paris, Exosens must comply with rigorous corporate governance standards and public listing requirements. This includes adherence to the French Commercial Code and European Union regulations, ensuring transparency and accountability in its operations.

Exosens' commitment to these legal frameworks is evident in its public filings. For instance, their 2024 Universal Registration Document details their corporate structure, management compensation, and risk management policies, all in line with regulatory expectations.

- Euronext Paris Listing: Exosens operates under the regulatory oversight of Euronext Paris, mandating compliance with its listing rules.

- Financial Reporting: The company regularly publishes financial statements, such as interim and annual reports, adhering to International Financial Reporting Standards (IFRS).

- Disclosure Obligations: Exosens is required to disclose material information promptly to the market, including significant business events and financial performance data.

- Corporate Governance Codes: Compliance with the AFEP-MEDEF Corporate Governance Code is a key aspect of Exosens' legal and regulatory environment.

Exosens' global operations are significantly impacted by international trade and export control regulations, such as the Wassenaar Arrangement and national equivalents like the US ITAR. These rules govern the movement of sensitive technologies, directly influencing Exosens' market access and partnership opportunities. For example, the US Department of Commerce reported over 15,000 export license applications in 2024, underscoring the complexity of international trade compliance for technology firms.

The company must also navigate a complex web of product safety and certification standards across its diverse market segments, including medical, scientific, and defense. Adherence to standards like ISO 13485 for medical devices and specific defense certifications is critical for market entry and maintaining customer trust. Non-compliance can lead to severe penalties and market exclusion.

Exosens' robust intellectual property strategy is supported by a portfolio of over 90 active patents as of early 2025, safeguarding its proprietary technologies. This legal protection is vital for maintaining its competitive advantage and preventing unauthorized use of its innovations by rivals.

Data privacy laws, including GDPR and HIPAA, are paramount for Exosens, especially concerning its medical and scientific data handling. Non-compliance carries substantial financial risks, with GDPR fines potentially reaching 4% of global annual turnover and HIPAA violations incurring penalties up to $1.5 million annually. The average cost of a data breach in healthcare exceeded $10 million in 2023, highlighting the financial imperative for strong data protection measures.

| Regulation | Potential Impact/Penalty | 2024/2025 Relevance |

|---|---|---|

| Wassenaar Arrangement / Export Controls | Market access restrictions, license denials | Crucial for international sales and collaborations; ongoing scrutiny of dual-use technologies. |

| ISO 13485 (Medical Devices) | Market exclusion, product recalls | Essential for medical product credibility and access to healthcare markets. |

| GDPR | Fines up to 4% global turnover or €20 million | Mandatory for handling EU citizen data, impacting R&D and customer relations. |

| HIPAA | Penalties up to $1.5 million annually | Critical for US healthcare data compliance, affecting patient-related imaging solutions. |

Environmental factors

Exosens has set a clear target to achieve carbon neutrality for its direct (Scope 1) and indirect (Scope 2) emissions by 2040. This commitment places the company in line with international efforts to combat climate change, showcasing a forward-thinking strategy for minimizing its environmental impact.

Exosens is committed to embedding eco-design principles into its product development by 2027. This strategic move is designed to significantly reduce the environmental footprint of its offerings across their entire lifecycle, from the initial sourcing of materials to their eventual disposal.

This focus on eco-design aligns with growing global regulatory pressures and consumer demand for sustainable products. For instance, in 2024, the European Union continued to strengthen its Ecodesign for Sustainable Products Regulation, pushing industries towards more circular economy practices and reduced waste generation, a trend Exosens is proactively addressing.

Exosens is prioritizing waste management and resource efficiency within its manufacturing operations. This focus includes optimizing water and energy usage, aiming to significantly reduce its ecological footprint. For instance, in 2024, the company reported a 15% reduction in industrial waste generation through enhanced recycling programs and process improvements.

These operational enhancements directly contribute to resource conservation. By improving water efficiency, Exosens reduced its water consumption by 10% in 2024 compared to the previous year. Such initiatives are crucial for minimizing environmental impact and aligning with growing global demands for sustainable industrial practices.

Promoting Sustainable Supply Chain Practices

Exosens is actively promoting sustainable supply chain practices, recognizing their critical role in environmental responsibility. The company has set a target for 80% of its strategic suppliers to adopt a Corporate Social Responsibility (CSR) approach by 2027. This commitment aims to embed environmental stewardship throughout Exosens' entire value chain.

This strategic push aligns with broader industry trends and increasing regulatory scrutiny on environmental impact. By encouraging CSR adoption among suppliers, Exosens not only mitigates its own environmental footprint but also fosters a culture of shared accountability. This proactive stance is crucial for long-term resilience and meeting evolving stakeholder expectations regarding environmental performance.

- Supplier CSR Adoption Target: 80% of strategic suppliers by 2027.

- Environmental Impact Mitigation: Reducing the ecological footprint across the value chain.

- Stakeholder Expectations: Addressing growing demands for sustainable business practices.

- Regulatory Alignment: Staying ahead of increasing environmental regulations.

Enhanced Environmental Reporting and Transparency

Exosens is stepping up its commitment to environmental transparency. The company is set to release its inaugural Corporate Social Responsibility (CSR) report covering the 2024 fiscal year in early 2025. This report will be prepared in accordance with the Corporate Sustainability Reporting Directive (CSRD), offering stakeholders a clear view of Exosens' environmental impact and initiatives.

The CSRD mandates a comprehensive disclosure of environmental, social, and governance (ESG) information. For Exosens, this means providing detailed data on key environmental metrics, such as carbon emissions, resource consumption, and waste management. This enhanced reporting aims to build trust and accountability with investors, customers, and regulatory bodies.

- CSRD Compliance: Exosens' 2024 CSR report will adhere to the stringent requirements of the CSRD.

- First-Ever Report: The upcoming report marks Exosens' debut in publicly detailing its environmental performance.

- Early 2025 Release: Stakeholders can expect the comprehensive environmental data to be available early in the new year.

Exosens is actively managing its environmental footprint, aiming for carbon neutrality by 2040 for Scope 1 and 2 emissions. The company is integrating eco-design into product development by 2027 to reduce lifecycle impacts, aligning with EU regulations like the Ecodesign for Sustainable Products Regulation. In 2024, Exosens achieved a 15% reduction in industrial waste and a 10% decrease in water consumption through operational efficiencies.

| Environmental Target | Status/Year | Key Initiative |

| Carbon Neutrality (Scope 1 & 2) | By 2040 | Emissions reduction strategy |

| Eco-design Integration | By 2027 | Reducing product lifecycle impact |

| Waste Reduction | 15% achieved in 2024 | Recycling programs and process improvements |

| Water Consumption Reduction | 10% achieved in 2024 | Water efficiency measures |

| Supplier CSR Adoption | 80% of strategic suppliers by 2027 | Promoting sustainable supply chain practices |

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a robust combination of data from leading economic institutions, governmental policy updates, and reputable market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.