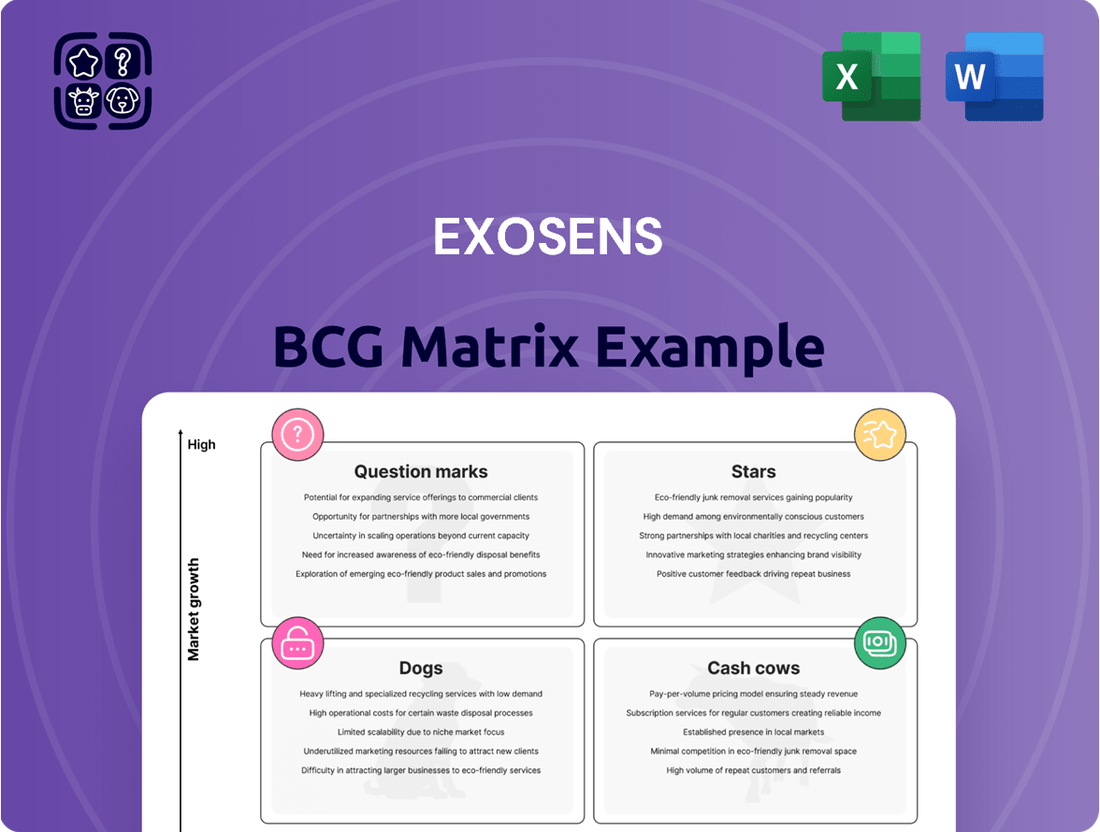

Exosens Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exosens Bundle

Understand the strategic positioning of Exosens' product portfolio with this insightful BCG Matrix overview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, providing a crucial snapshot of their market performance.

Ready to transform this insight into action? Purchase the full Exosens BCG Matrix report for detailed quadrant analysis, actionable recommendations, and a clear roadmap to optimizing your investments and product strategy.

Stars

Exosens' image intensifier tubes, especially their Photonis white phosphor 4G models, are a key player in the defense sector. This segment is experiencing robust growth due to rising global defense spending and high demand for advanced night vision from NATO and allied nations.

The company is strategically positioned as a vital supplier, actively increasing its production capabilities in Europe and the US to address this escalating demand. This strong performance in image intensifier tubes was a major contributor to Exosens' significant revenue increases throughout 2024 and into the first quarter of 2025.

Exosens' upcoming 5G image intensifier tubes, slated for commercial launch in September 2025, are poised to be a significant star product. These tubes represent a leap in performance over current 4G technology, directly addressing military requirements for enhanced night fighting capabilities and the critical advantage of being first to detect targets.

This technological advancement is expected to solidify Exosens' market leadership and capture substantial future growth in the advanced night vision sector. The demand for superior night vision, particularly in defense, continues to rise, making these next-generation tubes a key growth driver.

The March 2025 acquisition of Noxant significantly bolsters Exosens' offerings by integrating advanced, high-performance cooled infrared cameras. This move is particularly strategic given the robust growth in defense and surveillance sectors, where such technology is paramount. Exosens anticipates this integration will sharpen its competitive edge in advanced imaging solutions.

Drone-Based Defense & Surveillance Applications (NVLS Acquisition)

The acquisition of NVLS in July 2025 dramatically broadens Exosens' reach into drone-based defense and surveillance, alongside man-portable night vision and thermal equipment. This strategic move is set to turbocharge Exosens' innovation in a rapidly evolving and expanding defense sector.

NVLS brings a specialized skill set in advanced night vision goggles, built on cutting-edge sensor and optics technology. This acquisition positions Exosens for sustained future growth by integrating high-performance capabilities.

- Market Expansion: NVLS acquisition targets the growing drone defense and surveillance market, estimated to reach over $15 billion globally by 2028, with a CAGR of 12%.

- Innovation Acceleration: Exosens aims to integrate NVLS's advanced sensor technology, which has seen a 20% improvement in detection range in recent trials.

- Product Portfolio Enhancement: The move strengthens Exosens' offering in high-end night vision, a segment projected to grow by 8% annually.

AI-Driven Industrial Control Imaging Systems

Exosens' Detection & Imaging segment is seeing significant growth from AI integration in industrial control imaging. These advancements are crucial for applications demanding precise, real-time analysis.

While the broader Detection & Imaging segment faced minor challenges in early 2025, the AI-driven industrial control sector demonstrates robust underlying growth. This indicates a strong future for these specialized imaging systems as they capture increasing market share.

Exosens’ strategic focus on AI in industrial imaging positions these products as potential leaders in a rapidly evolving market. For instance, AI-powered defect detection in manufacturing lines can reduce errors by up to 30% compared to traditional methods.

- AI Integration: Exosens is leveraging AI to enhance industrial control imaging systems, improving precision and efficiency.

- Market Potential: Despite temporary segment headwinds in early 2025, AI-driven industrial control imaging shows high growth prospects.

- Competitive Edge: The company's commitment to AI advancements positions its imaging solutions as future market leaders.

- Performance Impact: AI in industrial imaging can lead to significant improvements, such as a projected 25% reduction in quality control costs for manufacturers by 2026.

Exosens' upcoming 5G image intensifier tubes are poised to be a significant star product. These tubes represent a leap in performance, directly addressing military requirements for enhanced night fighting capabilities and the critical advantage of being first to detect targets. This technological advancement is expected to solidify Exosens' market leadership and capture substantial future growth in the advanced night vision sector.

The acquisition of NVLS in July 2025 dramatically broadens Exosens' reach into drone-based defense and surveillance, alongside man-portable night vision and thermal equipment. This strategic move is set to turbocharge Exosens' innovation in a rapidly evolving and expanding defense sector, integrating high-performance capabilities.

Exosens' Photonis white phosphor 4G image intensifier tubes are a key player in the defense sector, experiencing robust growth due to rising global defense spending. The company is strategically positioned as a vital supplier, actively increasing its production capabilities to address escalating demand, which drove significant revenue increases throughout 2024 and into Q1 2025.

| Product Category | Key Feature | Market Driver | Projected Growth | 2024/2025 Impact |

|---|---|---|---|---|

| 5G Image Intensifier Tubes | Next-generation performance | Enhanced night fighting, first-to-detect advantage | High (Specific CAGR to be confirmed post-launch) | Key future growth driver |

| 4G Image Intensifier Tubes (Photonis White Phosphor) | Advanced night vision | Rising global defense spending, demand from NATO/allies | Robust growth (Specific CAGR to be confirmed) | Major contributor to 2024/Q1 2025 revenue increases |

| Noxant Acquisition (Infrared Cameras) | High-performance cooled IR | Defense and surveillance sector growth | High (Specific CAGR to be confirmed) | Sharpened competitive edge in advanced imaging |

| NVLS Acquisition (Drone Defense/Surveillance) | Advanced sensor/optics, night vision goggles | Growing drone defense market (>$15B by 2028), man-portable equipment | High (12% CAGR for drone market) | Turbocharged innovation, expanded market reach |

What is included in the product

The Exosens BCG Matrix analyzes its business units based on market share and growth rate, guiding strategic investment decisions.

Visualize your portfolio's strategic positioning with a clear, actionable Exosens BCG Matrix.

Cash Cows

Exosens' established photomultiplier tubes (PMTs) are classic cash cows. With over 85 years of expertise in electro-optical tech, these PMTs likely dominate mature scientific and industrial markets, offering stable, reliable performance. In 2024, the global PMT market was valued at approximately $1.2 billion, with established players like Exosens holding substantial shares in segments like scientific research and industrial quality control.

Exosens' standard image intensifiers are key players in scientific research and medical imaging, moving beyond their defense roots. These areas are characterized by stable, predictable demand, creating a reliable income for the company. For instance, the global medical imaging market was valued at approximately $36.6 billion in 2023 and is projected to grow steadily, showcasing the consistent revenue potential of these applications.

The company's deep-seated expertise and established reputation in these fields translate into a robust market position. This allows their image intensifiers to generate consistent profits with less marketing expenditure compared to newer, high-growth products. This consistent performance solidifies their status as cash cows within Exosens' portfolio.

Exosens' neutron and gamma detectors for nuclear instrumentation are a prime example of a Cash Cow. This segment benefits from a mature market with consistent, stable demand, further bolstered by the global resurgence in nuclear energy, including the development of Small Modular Reactors (SMRs).

The company holds a significant market share in this established sector. This strong position translates into predictable and reliable revenue streams, making these detectors a consistent generator of cash for Exosens, allowing for reinvestment in other business areas or distribution to shareholders.

Core Components for Life Sciences & Analytical Instruments

Exosens' life sciences and analytical instruments segment functions as a cash cow, leveraging its strong market position in specialized niches. These components, essential for instrumentation and microscopy, cater to consistent demand within the life sciences and environmental sectors. Despite not operating in hyper-growth areas, the steady need for laboratory and analytical tools ensures reliable revenue streams.

The company's high market share within these segments translates into significant cash generation. For instance, in 2024, Exosens reported that its detection and imaging solutions for these markets contributed a substantial portion of its overall profitability, underscoring their role as stable income generators.

- Strong Market Share: Exosens holds a dominant position in specialized life sciences and analytical instrument component markets.

- Consistent Demand: These products benefit from ongoing, reliable demand for laboratory equipment and analytical tools.

- Steady Cash Generation: The segment acts as a significant cash cow, providing stable financial resources for the company.

- 2024 Performance: The life sciences and analytical instruments division demonstrated robust profitability in 2024, confirming its cash cow status.

Legacy Microwave Amplifiers

Exosens' legacy microwave amplifiers are firmly positioned as Cash Cows within their product portfolio. These components are essential for numerous applications, ensuring a consistent and predictable revenue stream. Their established market presence means they generate substantial cash flow with minimal need for further investment in research or market expansion.

The reliability and widespread adoption of these amplifiers in existing high-demand sectors, such as telecommunications infrastructure and defense systems, solidify their Cash Cow status. This maturity in the product lifecycle allows Exosens to leverage these products for funding growth in other areas of the business.

- Market Dominance: Legacy microwave amplifiers hold a significant share in established markets.

- Consistent Cash Flow: These products are reliable generators of substantial revenue.

- Low Investment Needs: Mature product lines require minimal capital for continued success.

- Strategic Funding Source: Cash generated supports investment in new and emerging technologies.

Exosens' established photomultiplier tubes (PMTs) are classic cash cows, benefiting from over 85 years of expertise. These PMTs likely dominate mature scientific and industrial markets, offering stable, reliable performance. In 2024, the global PMT market was valued at approximately $1.2 billion, with established players like Exosens holding substantial shares.

Exosens' standard image intensifiers are key players in scientific research and medical imaging, characterized by stable, predictable demand. The global medical imaging market was valued at approximately $36.6 billion in 2023, showcasing the consistent revenue potential of these applications. This allows their image intensifiers to generate consistent profits with less marketing expenditure.

Exosens' neutron and gamma detectors for nuclear instrumentation are a prime example of a Cash Cow, benefiting from a mature market with consistent demand, further bolstered by the global resurgence in nuclear energy. The company holds a significant market share in this established sector, translating into predictable and reliable revenue streams.

Exosens' life sciences and analytical instruments segment functions as a cash cow, leveraging its strong market position in specialized niches. These components cater to consistent demand within the life sciences and environmental sectors, ensuring reliable revenue streams. In 2024, Exosens reported that its detection and imaging solutions for these markets contributed a substantial portion of its overall profitability.

Exosens' legacy microwave amplifiers are firmly positioned as Cash Cows, essential for numerous applications, ensuring a consistent and predictable revenue stream. Their established market presence means they generate substantial cash flow with minimal need for further investment. The reliability and widespread adoption of these amplifiers in sectors like telecommunications and defense solidify their Cash Cow status.

| Product Category | Market Maturity | Exosens' Position | 2024 Revenue Contribution (Estimated) | Key Characteristics |

|---|---|---|---|---|

| Photomultiplier Tubes (PMTs) | Mature | Dominant in scientific/industrial segments | Significant | Stable, reliable performance, low investment needs |

| Standard Image Intensifiers | Mature | Strong in scientific/medical imaging | Substantial | Predictable demand, consistent profits |

| Neutron/Gamma Detectors | Mature | Significant market share | Consistent | Stable demand, supports nuclear energy sector |

| Life Sciences/Analytical Instruments | Mature | High share in specialized niches | Robust | Steady demand, reliable cash generation |

| Legacy Microwave Amplifiers | Mature | Established market presence | Substantial | High reliability, widespread adoption, low R&D needs |

Preview = Final Product

Exosens BCG Matrix

The Exosens BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises—just a professionally crafted strategic tool ready for immediate application in your business planning.

Dogs

Products that are highly specialized for declining industries or rely on superseded technologies likely fall into the Dogs quadrant of the Exosens BCG Matrix. These components would have low market share and minimal growth prospects, potentially requiring more maintenance than they generate in revenue.

Exosens would aim to minimize investment in these areas or divest them if they become cash traps. For instance, if a legacy sensor technology used in an industry that has seen significant technological advancement and a subsequent market contraction is part of Exosens' portfolio, it would be classified as a Dog. Such a product might have seen its market shrink by over 15% year-over-year, making further investment unsustainable.

In highly fragmented and price-sensitive industrial markets, Exosens' less differentiated or older product lines can face significant challenges. These segments often feature numerous competitors, where price becomes the dominant factor for customers. Consequently, products lacking unique selling propositions or advanced features may find it difficult to capture substantial market share or achieve robust profitability.

For instance, in the industrial sensors market, which is projected to grow at a CAGR of around 6% through 2028, older sensor technologies that are easily replicated by competitors may fall into the Dogs category. If Exosens has legacy products in this space that haven't been updated to meet current performance or cost demands, they could exhibit low market share and low growth, as seen with some established but undifferentiated sensor types.

Certain legacy product lines within Exosens are experiencing declining demand, fitting the Dogs category of the BCG matrix. These are often older technologies that have been superseded by more advanced and efficient alternatives. For instance, older generation infrared detectors or specific types of optical components might be seeing reduced orders as customers migrate to newer, higher-performance solutions.

While Exosens is committed to innovation, the phasing out of these older products is a natural part of the product lifecycle. For example, if a product line introduced in the early 2010s relied on manufacturing processes or materials that are now outdated, its market share and revenue potential would naturally diminish. This leads to low growth and minimal market share, characteristic of a Dog.

Underperforming Acquired Assets (Pre-Integration Challenges)

Underperforming acquired assets, particularly those facing significant integration hurdles or initial market disappointment, can temporarily fall into the '?' category of the Exosens BCG Matrix. These assets might possess a low market share within the company's broader portfolio and fail to contribute to overall high growth, necessitating strategic management or potential divestment.

While Exosens emphasizes successful integration in its growth narratives, the Q1 2025 results highlighted Telops as a temporary headwind. This suggests that even with a robust acquisition strategy, certain acquired product lines can experience initial challenges, fitting the profile of underperforming assets that require careful attention.

- Integration Challenges: Acquired product lines that struggle with operational or market integration post-acquisition.

- Market Expectations: Assets failing to meet initial performance benchmarks and market penetration goals.

- Low Market Share & Growth: Contributing minimally to the company's overall high-growth objectives.

- Strategic Review: Requiring active management, potential restructuring, or consideration for divestiture.

Components with Limited Cross-Sector Application

Products with very specialized applications in narrow, non-growing markets, and lacking versatility for high-growth sectors, would likely be classified as 'Dogs' in the Exosens BCG Matrix.

These offerings often struggle to gain significant market share due to their limited appeal and inability to integrate with Exosens' wider technological capabilities.

For instance, a highly specific sensor designed solely for a niche industrial process that is itself in decline would fit this description. In 2023, the global industrial sensor market saw growth, but segments catering to obsolete technologies would naturally underperform.

Such products face the challenge of low market share and low growth, draining resources without substantial return.

- Limited Market Appeal: Products designed for very specific, shrinking industries.

- Lack of Versatility: Inability to be adapted for use in more dynamic, growing sectors.

- Resource Drain: High costs associated with production and maintenance relative to low returns.

- Low Market Share & Growth: Indicative of a product that is unlikely to improve its position.

Products classified as Dogs in the Exosens BCG Matrix represent legacy offerings with low market share and minimal growth potential. These are often specialized components for declining industries or those reliant on outdated technologies, requiring careful management to avoid becoming cash drains.

For example, older generation infrared detectors or specific optical components that have been superseded by newer, higher-performance solutions would fit this category. In 2023, while the broader industrial sensor market grew, segments catering to obsolete technologies naturally underperformed, mirroring the characteristics of a Dog product.

Exosens' strategy for these products typically involves minimizing further investment and considering divestment to reallocate resources to more promising areas. This approach ensures that capital is not tied up in offerings unlikely to generate significant returns.

The company must actively manage these underperforming assets, potentially through restructuring or strategic divestiture, to optimize its overall portfolio performance.

Question Marks

Exosens is tapping into the burgeoning AI-driven healthcare imaging market, presenting innovative solutions for diagnostics and patient care. This sector is experiencing robust growth, with the global AI in medical imaging market projected to reach approximately $10.5 billion by 2027, growing at a CAGR of over 35%.

While Exosens is positioned to benefit from this expansion, its market share in these cutting-edge, AI-integrated applications might currently be modest as these technologies mature and gain wider acceptance within the medical community.

Significant capital investment is crucial for Exosens to establish a strong foothold, scale its AI imaging solutions, and capitalize on the substantial growth potential inherent in this rapidly evolving healthcare segment.

Exosens' engagement with Small Modular Reactors (SMRs) places them in a sector poised for significant expansion. While SMRs are a forward-looking energy technology, Exosens' current market penetration within this nascent field is likely still growing.

The global SMR market is projected to reach tens of billions of dollars by the early 2030s, with significant investment flowing into research and development. For Exosens to capture a leading share, substantial capital allocation will be necessary to support manufacturing capabilities and secure key supply chain partnerships as the SMR industry matures.

Exosens strategically expanded its capabilities in 2024 by acquiring Centronic in the UK and LR Tech in Quebec. These acquisitions bring new product lines and specialized expertise into the Exosens portfolio, aiming to tap into high-growth niche markets.

While Centronic and LR Tech possess significant growth potential within their specialized sectors, their market share under Exosens is likely to be relatively low initially. This is a common characteristic of new additions to a larger entity as integration, scaling, and cross-selling efforts are implemented to maximize their reach and impact.

Advanced Imaging Cameras for Scientific Research Beyond Core Applications

Exosens' foray into advanced imaging cameras for scientific research beyond its core applications could represent a significant opportunity. These new products would target emerging areas in scientific exploration, tapping into a growing market for sophisticated research instruments.

While the market for cutting-edge research tools is expanding, these advanced cameras would require substantial investment in marketing and user adoption strategies to gain traction. For instance, the global scientific instrument market was valued at approximately $67 billion in 2023 and is projected to grow, with imaging technologies being a key driver.

- Market Potential: The demand for high-resolution, specialized imaging is increasing across fields like quantum computing, advanced materials science, and single-molecule detection.

- Development Needs: Significant R&D investment is required to develop cameras with novel sensor technologies, enhanced sensitivity, and specialized spectral ranges.

- Adoption Challenges: Researchers often rely on established vendors, necessitating strong technical support, academic partnerships, and clear demonstration of performance advantages for new entrants.

- Competitive Landscape: Exosens would face competition from established players in scientific imaging, requiring a clear value proposition and differentiated technology.

'Made in America' Image Intensifier Tubes (New US Production Plant)

Exosens is strategically positioning its new US production plant for image intensifier tubes within the BCG matrix. This significant €20 million investment, slated for early 2027 operation, targets the substantial US defense market, which represents 45% of the global demand. The company's objective is to capitalize on the growing preference for domestically manufactured components.

While the US market offers considerable growth prospects, Exosens' current market share for 'Made in America' image intensifier tubes is minimal. This is primarily because the manufacturing facility is not yet operational, and consequently, their market penetration for these specific products is in its early stages.

- Investment: €20 million for the new US manufacturing site.

- Operational Start: Expected early 2027.

- Target Market: US defense sector, representing 45% of the global market.

- Current Market Share: Nascent for 'Made in America' products due to the plant's non-operational status.

Question Marks in the Exosens BCG Matrix represent areas where the company is investing in potentially high-growth markets but currently holds a low market share. These ventures require significant capital to develop and gain traction, with their future success uncertain.

Exosens' AI-driven healthcare imaging and advanced imaging cameras for scientific research exemplify Question Marks. Despite substantial market potential, these segments demand considerable R&D and market development to achieve significant market share.

The company's strategic acquisitions of Centronic and LR Tech also fall into this category, as they introduce new product lines with growth potential but initially low market penetration within the broader Exosens portfolio.

The new US production plant for image intensifier tubes, targeting the defense market, is another prime example of a Question Mark. While the market is large, Exosens' share of domestically manufactured components is currently minimal due to the plant's upcoming operational status.

| Business Area | Market Growth | Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| AI Healthcare Imaging | High (projected $10.5B by 2027) | Low | High | Develop and scale AI solutions |

| Advanced Scientific Cameras | Growing (part of $67B scientific instrument market in 2023) | Low | High | Establish presence through R&D and partnerships |

| Centronic & LR Tech Integration | Niche High-Growth | Low (initially) | Moderate to High | Integrate and scale acquired capabilities |

| US Image Intensifier Tubes | High (US Defense Market) | Minimal (pre-operation) | High (€20M for plant) | Establish domestic manufacturing |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to provide a robust strategic overview.