Exosens Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exosens Bundle

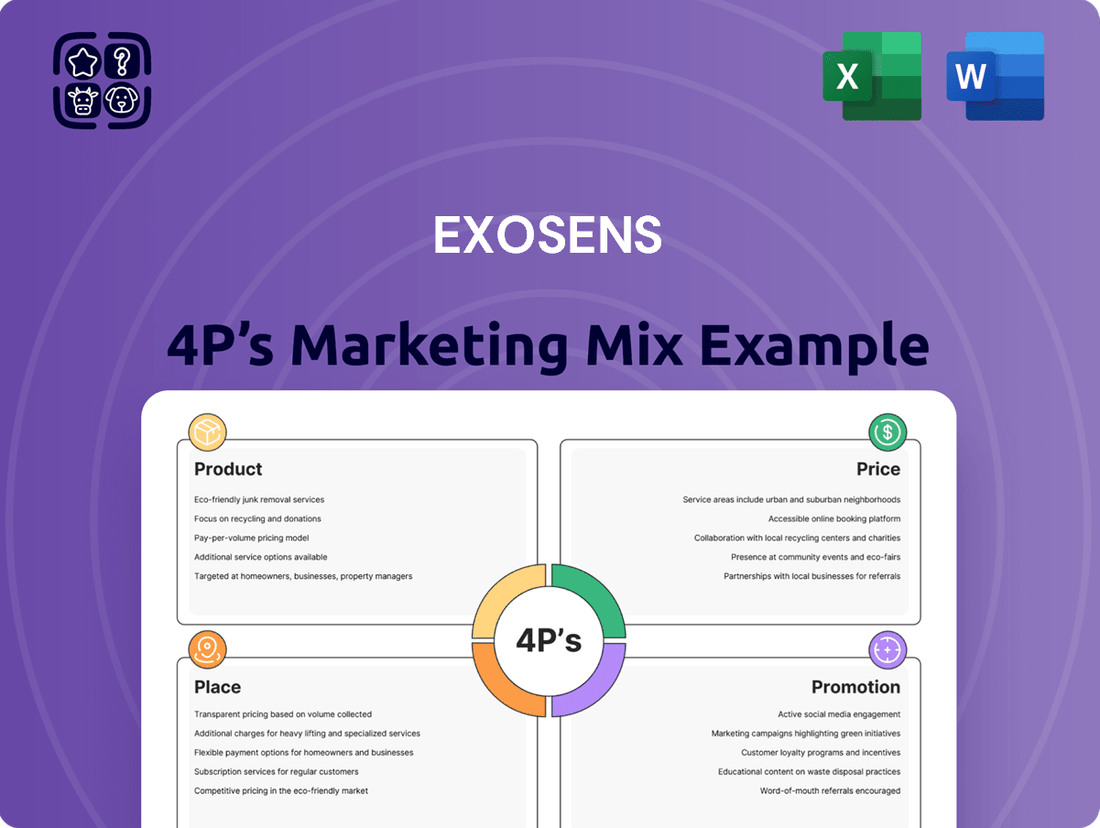

Discover how Exosens masterfully crafts its product offerings, sets competitive pricing, navigates distribution channels, and executes impactful promotions. This analysis goes beyond the surface, revealing the strategic synergy of their 4Ps.

Unlock the full picture of Exosens's marketing engine. Get immediate access to a comprehensive, editable report detailing their product innovation, pricing strategies, market placement, and promotional campaigns.

Ready to elevate your marketing strategy? This complete 4Ps analysis of Exosens provides actionable insights and a robust framework, perfect for professionals and students seeking a competitive edge.

Product

Exosens' advanced detection and imaging technologies, including photomultiplier tubes and image intensifiers, are pivotal for critical global applications. These high-end electro-optical solutions are engineered for extreme performance, supporting sectors like defense, medical imaging, and scientific research, where precision is paramount.

The company's product suite, encompassing both individual components and complete electronic systems, addresses stringent performance demands. For instance, their image intensifiers are crucial for low-light operations, a capability vital for defense applications. Exosens reported revenues of €316.4 million for the fiscal year 2023, demonstrating strong market traction for these specialized offerings.

Night vision and low-light solutions, primarily through the Photonis brand, represent a cornerstone of Exosens' product portfolio. These advanced image intensifier tubes are vital for defense and surveillance, significantly enhancing visibility in dim conditions.

These technologies are indispensable for military operations and security applications, providing critical tactical advantages. They power essential equipment like night vision goggles and are increasingly integrated into drone-based surveillance systems, demonstrating their broad utility in challenging environments.

The demand for these specialized imaging components remains robust, driven by ongoing global defense spending and the expanding use of unmanned aerial vehicles. Exosens, with its Photonis division, is positioned to capitalize on this market, contributing to enhanced operational capabilities for its clients.

Exosens' radiation detection components, including neutron, gamma ray, and X-ray detectors, are crucial for safety-critical sectors. These high-performance detectors are integral to the nuclear industry, scientific research, and industrial process control, ensuring operational integrity and regulatory adherence. The global market for radiation detection and monitoring equipment was valued at approximately USD 5.7 billion in 2023 and is projected to reach USD 8.1 billion by 2030, indicating strong demand for Exosens' specialized products.

Analytical & Life Sciences Imaging

Exosens' Analytical & Life Sciences Imaging segment offers specialized detection and imaging solutions designed for scientific instruments. Their focus is on delivering exceptional image quality and the ability to detect even the faintest signals, crucial for advanced research and diagnostics. This product line leverages core competencies in components like Microchannel Plates (MCPs), Phosphor Screens, and Resistive Glass, which are engineered to boost sensitivity and resolution in demanding applications. For instance, MCPs are vital for amplifying low-intensity light signals, a common requirement in mass spectrometry and electron microscopy, fields that saw significant investment in new instrumentation throughout 2024.

The value proposition for these imaging solutions is rooted in their ability to enhance the performance of analytical instruments. By providing components that improve signal-to-noise ratios and spatial resolution, Exosens enables scientists to achieve more precise measurements and discover subtle details. This is particularly relevant in areas like drug discovery and advanced materials analysis, where the accuracy of imaging and detection directly impacts research outcomes. The demand for such high-performance components is projected to grow, with the global scientific instrument market expected to reach over $70 billion by 2025, driven by increased R&D spending.

- High Image Quality: Exosens' components are engineered to produce clear and detailed images, essential for accurate scientific analysis.

- Low-Level Detection: The technology enables the detection of very weak signals, expanding the capabilities of analytical instruments.

- Key Components: Microchannel Plates (MCPs), Phosphor Screens, and Resistive Glass are central to their offering, enhancing sensitivity and resolution.

- Application Focus: Solutions are tailored for analytical instruments and life sciences, supporting fields like mass spectrometry and microscopy.

Microwave Amplifiers & Electronic Systems

Exosens' microwave amplifiers and electronic systems represent a key part of their product offering, catering to critical defense and aerospace applications. These systems, including hybrid power amplifiers that blend vacuum electron and solid-state technologies, are vital for modern military and communication infrastructure.

The demand for advanced electronic warfare and satellite communication capabilities continues to grow. For instance, the global electronic warfare market was valued at approximately $20 billion in 2023 and is projected to reach over $30 billion by 2028, indicating a strong market for Exosens' specialized products.

- Product: Microwave Amplifiers & Electronic Systems

- Key Features: Hybrid power amplifiers integrating vacuum electron and solid-state technologies.

- Applications: Electronic warfare, missile systems, weapon-system simulators, satellite data communications.

- Market Relevance: Essential for high-growth defense and communication sectors, with the EW market alone projected to exceed $30 billion by 2028.

Exosens offers a diverse product portfolio focused on advanced detection and imaging technologies. This includes high-performance components like image intensifiers for low-light applications, crucial for defense and surveillance, and radiation detectors vital for the nuclear and scientific sectors. Their analytical and life sciences imaging segment provides specialized solutions for scientific instruments, enhancing precision in research. Additionally, Exosens develops microwave amplifiers and electronic systems for defense and aerospace, including hybrid power amplifiers.

| Product Category | Key Technologies/Features | Primary Applications | Market Data/Growth |

| Image Intensifiers & Night Vision | Low-light detection, image amplification | Defense, surveillance, security | Global defense spending drives demand; Photonis brand is a key asset. |

| Radiation Detectors | Neutron, gamma ray, X-ray detection | Nuclear industry, scientific research, industrial control | Global market for radiation detection projected to reach USD 8.1 billion by 2030. |

| Analytical & Life Sciences Imaging | MCPs, Phosphor Screens, Resistive Glass | Mass spectrometry, electron microscopy, diagnostics | Global scientific instrument market expected to exceed $70 billion by 2025. |

| Microwave Amplifiers & Electronic Systems | Hybrid power amplifiers (vacuum electron & solid-state) | Electronic warfare, satellite communications, missile systems | Electronic warfare market projected to exceed $30 billion by 2028. |

What is included in the product

This analysis provides a comprehensive breakdown of Exosens's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for understanding their market positioning and competitive advantage.

Simplifies complex marketing strategies by clearly outlining Exosens' Product, Price, Place, and Promotion, alleviating the pain of strategic ambiguity.

Provides a clear, actionable framework for understanding Exosens' market approach, easing the burden of strategic planning and execution.

Place

Exosens leverages direct sales channels to engage with its specialized clientele across defense, scientific, and industrial markets. This strategy is crucial for delivering highly customized solutions and fostering deep customer relationships, essential for their complex, high-value technologies. For instance, in 2023, Exosens reported that its direct sales efforts contributed significantly to its revenue streams, particularly in niche defense applications where technical expertise and direct consultation are paramount.

Exosens strategically operates 12 production and R&D facilities across Europe and North America, creating a strong manufacturing base. This widespread network is crucial for maintaining efficient production processes and quickly adapting to the specific needs of regional markets.

This geographical spread is particularly vital for fulfilling sensitive defense contracts, where localized production and rapid response are paramount. For instance, Exosens' presence in key defense hubs allows for streamlined logistics and closer collaboration with defense clients throughout 2024 and into 2025.

Exosens is strategically expanding its footprint in the United States by investing in new manufacturing capabilities, aiming to solidify its presence in a key global market. This expansion includes the establishment of its inaugural U.S. manufacturing facility, specifically designed for the production of image intensifier tubes, underscoring a commitment to a 'Made in America' approach.

This significant investment is driven by the desire to tap into the substantial U.S. defense sector and adhere to local procurement mandates. The new plant is slated to commence production in early 2027, positioning Exosens to better serve American clients and potentially capture a larger market share.

Partnerships with OEMs and Integrators

Exosens strategically partners with Original Equipment Manufacturers (OEMs) and system integrators, embedding its advanced components into sophisticated systems. This collaborative approach ensures Exosens' technology is at the forefront of various applications, from defense to industrial sectors. For example, their high-performance image intensifiers are crucial for next-generation night vision systems developed by partners.

Securing long-term supply agreements underscores Exosens' commitment to these vital relationships. A prime illustration is the multi-year contract with Theon International, a leading provider of night vision devices. This agreement, valued at tens of millions of euros over its term, solidifies Exosens’ position as a key supplier for critical defense equipment, highlighting the trust and reliability of their offerings.

- OEM Integration: Exosens' components are designed for seamless integration into larger systems by partners.

- Strategic Alliances: Focus on building long-term relationships with key players in target markets.

- Theon International Agreement: A multi-year contract valued in the tens of millions of euros for night vision device components.

- Market Penetration: Partnerships enable broader market reach and adoption of Exosens' advanced technologies.

Specialized Distribution for Niche Markets

Exosens' specialized distribution strategy is crucial for its niche markets. Given the highly technical nature of its infrared detection and imaging solutions, the company likely focuses on direct sales or partnerships with highly knowledgeable distributors who understand the specific needs of demanding sectors like defense, aerospace, and scientific research. This ensures their advanced technologies reach customers requiring precise, high-performance solutions.

This targeted approach is essential because Exosens' products, such as advanced cooled and uncooled infrared detectors, are not mass-market items. They are integrated into complex systems where performance and reliability are paramount. For instance, in the defense sector, Exosens' components are vital for surveillance, targeting, and reconnaissance systems, demanding a distribution channel that can provide expert technical support and understand stringent regulatory requirements.

In 2023, Exosens reported revenue of €208 million, with a significant portion likely driven by these specialized applications. The company's focus on innovation, evidenced by its investment in R&D, supports its ability to serve these niche markets effectively. Their distribution network must therefore be equipped to handle the complex logistics and technical specifications associated with delivering these high-value components.

- Targeted Channels: Exosens likely utilizes direct sales teams for key accounts and collaborates with specialized distributors possessing deep technical expertise in sectors like defense and aerospace.

- Expertise is Key: Distribution partners must understand the intricate requirements of high-performance infrared technology to effectively serve niche applications.

- Value-Driven Sales: The focus is on delivering advanced solutions to customers who prioritize precision and reliability, justifying a more hands-on distribution approach.

- Market Reach: This strategy ensures Exosens' cutting-edge technologies reach critical industries that rely on specialized imaging and detection capabilities.

Exosens' physical presence is strategically distributed across 12 production and R&D facilities, primarily located in Europe and North America. This network supports efficient manufacturing and market responsiveness, particularly for defense contracts requiring localized production and rapid deployment. The company is further strengthening its North American presence with a new U.S. manufacturing facility, set to begin producing image intensifier tubes in early 2027 to better serve the significant U.S. defense market and comply with local sourcing requirements.

Preview the Actual Deliverable

Exosens 4P's Marketing Mix Analysis

The preview you see here is the actual Exosens 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis is ready to be implemented immediately upon download. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use to inform your strategic decisions.

Promotion

Exosens strategically leverages participation in pivotal industry events like DSEI London and the ANS Annual Conference. These gatherings are vital for showcasing cutting-edge technological advancements and fostering direct engagement with key stakeholders across defense, scientific, and nuclear industries.

In 2024, Exosens continued to highlight its expertise at these crucial forums, reinforcing its image as an innovator. Such events facilitate invaluable networking opportunities, allowing the company to directly address the needs and interests of its target markets and solidify its position as a leader.

Exosens actively manages its public image through targeted public relations, issuing regular financial reports and press releases. These communications highlight strong financial results, IPO guidance, and strategic capacity investments, fostering trust and transparency with investors and the broader market.

Exosens' digital presence centers on its official website, a comprehensive resource detailing products, advanced technologies, target markets, and investor information. This platform is crucial for engaging its technically sophisticated and financially astute audience with in-depth specifications and application insights.

The company's content marketing likely leverages this website to disseminate news, technological advancements, and market analyses. For instance, in 2023, Exosens reported a significant increase in web traffic, indicating growing interest from stakeholders seeking detailed operational and financial performance data.

Strategic Acquisitions for Portfolio Expansion and Synergies

Exosens’ strategic acquisitions are a key promotional element, showcasing their commitment to expanding technological capabilities and market presence. The acquisition of Noxant, a specialist in infrared cameras, and NVLS, a provider of night vision devices, directly enhances their product portfolio. These moves are actively communicated to investors and the market, underscoring Exosens' growth strategy and the anticipated synergies that will solidify their leadership position in the optronics sector.

These acquisitions serve as tangible proof points of Exosens' forward-looking strategy. By integrating new technologies and market access through companies like Noxant and NVLS, Exosens promotes its diversification and robust growth trajectory. The company highlights the expected synergies from these integrations, such as enhanced R&D capabilities and broader customer reach, which are crucial for reinforcing its market leadership and attracting further investment.

- Acquisition of Noxant: Strengthened infrared camera offerings, expanding technological depth.

- Acquisition of NVLS: Enhanced night vision device portfolio, broadening market access.

- Promotional Impact: Acquisitions signal diversification, growth, and synergy realization.

- Market Position: Reinforces Exosens' standing as a leader in the optronics industry.

Highlighting Innovation and R&D Investments

Exosens underscores its deep-rooted commitment to innovation, backed by substantial Research and Development investments aimed at pioneering advanced electro-optical solutions. This focus on R&D is crucial for maintaining their leadership in a rapidly evolving technological landscape.

The company actively promotes its ongoing development of next-generation products, a strategy that directly addresses complex market needs and solidifies their competitive advantage. Examples like their work on 5G image intensifier tubes and sophisticated detectors highlight their forward-thinking approach.

- Innovation Heritage: Exosens leverages decades of experience in developing cutting-edge electro-optical technologies.

- R&D Investment: Significant financial resources are allocated to research and development, fueling continuous technological advancement.

- Next-Gen Products: Development of advanced solutions like 5G image intensifier tubes and enhanced detectors demonstrates their commitment to future market demands.

- Competitive Edge: These investments and product developments are key to solving complex challenges and maintaining a leading position in the industry.

Exosens employs a multifaceted promotional strategy, heavily relying on participation in key industry trade shows like DSEI London and the ANS Annual Conference to showcase its advanced electro-optical technologies. These events are crucial for direct engagement with defense, scientific, and nuclear sector stakeholders.

The company also prioritizes its public relations efforts, issuing timely financial reports and press releases that detail strong financial performance, IPO progress, and strategic investments, thereby building transparency and trust with investors and the market.

Furthermore, Exosens' digital presence, particularly its official website, serves as a vital hub for communicating product details, technological advancements, and investor relations information to a sophisticated audience.

Strategic acquisitions, such as those of Noxant and NVLS, are actively promoted as key growth drivers, demonstrating Exosens' commitment to expanding its technological capabilities and market reach in the optronics sector.

Price

Exosens likely employs a value-based pricing strategy for its high-performance detection and imaging solutions. This approach aligns with the superior performance, precision, and critical nature of their technologies, allowing them to capture a premium reflecting the significant value delivered to customers.

In sectors like defense, scientific research, and advanced industrial applications, the reliability and enhanced capabilities offered by Exosens’ products justify a higher price point. For instance, in 2024, the global market for advanced imaging technologies, crucial for Exosens' target segments, was projected to reach over $40 billion, indicating a strong demand for specialized, high-value solutions.

Exosens strategically prices its offerings by balancing value delivery with competitor analysis in its specialized, high-tech sectors. This approach ensures they remain competitive while reflecting the advanced nature of their solutions.

The company leverages its capacity for customized solutions and robust client partnerships to support its pricing structure. This is particularly effective in justifying costs, especially within long-term agreements where reliability and bespoke features are paramount, as seen in their established presence in defense and aerospace sectors.

Exosens secures its market position through multi-year supply agreements with major clients, often incorporating firm volume commitments. This strategy provides predictable revenue streams and enhances pricing stability, crucial for long-term financial planning and investment in R&D.

These long-term contracts allow Exosens to optimize production schedules, leading to greater efficiency and cost savings. For instance, in 2024, Exosens reported that over 70% of its revenue was generated from long-term agreements, demonstrating the significant impact of this pricing strategy on its financial performance and operational predictability.

Pricing Influenced by R&D and Production Costs

Exosens' pricing strategy is directly tied to the significant capital required for its cutting-edge research and development in electro-optics. These investments are crucial for maintaining a competitive edge and developing next-generation technologies. For instance, in 2023, Exosens reported R&D expenses of €29.1 million, representing 12.1% of its revenue, underscoring the commitment to innovation that informs its pricing structure.

Furthermore, the production of highly specialized electro-optical components involves complex manufacturing processes and stringent quality control, leading to elevated production costs. These operational expenses, coupled with the need for continuous technological advancement, necessitate a pricing model that reflects the value and sophistication of Exosens’ offerings. The company's focus on high-performance, niche markets allows it to command prices that cover these substantial costs and support future growth.

- R&D Investment: Exosens' 2023 R&D expenditure was €29.1 million, a key driver of its pricing.

- Production Complexity: High costs associated with advanced manufacturing of electro-optical components.

- Quality Standards: Pricing reflects the commitment to maintaining superior product quality.

- Innovation Support: Pricing enables continued investment in developing new technologies.

Strategic Investment in Capacity to Optimize Costs

Exosens' commitment to expanding production capacity, notably with new facilities in the US, directly addresses rising market demand. This strategic build-out is designed to foster economies of scale, which are crucial for optimizing long-term production costs.

These capacity expansions are expected to significantly influence Exosens' future pricing strategies, particularly for high-volume products such as image intensifier tubes. By increasing output efficiency, the company can aim for more competitive pricing.

- US Expansion: Exosens is investing in new production facilities in the United States to bolster its manufacturing capabilities.

- Demand Fulfillment: This expansion is a direct response to growing market demand for Exosens' specialized products.

- Cost Optimization: The strategy aims to leverage economies of scale to reduce per-unit production costs over time.

- Pricing Influence: Enhanced capacity is anticipated to provide flexibility in pricing, especially for high-volume items like image intensifier tubes.

Exosens’ pricing strategy is deeply intertwined with its significant investment in research and development, as evidenced by its €29.1 million R&D expenditure in 2023, representing 12.1% of revenue. This commitment ensures the company remains at the forefront of electro-optics technology, justifying premium pricing for its advanced solutions.

The complexity of manufacturing highly specialized electro-optical components, coupled with stringent quality control, leads to elevated production costs. These operational expenses, alongside continuous innovation, necessitate a pricing model that reflects the sophistication and value of Exosens’ offerings in niche, high-performance markets.

Exosens' expansion of production capacity, including new facilities in the US, aims to achieve economies of scale. This strategic move is designed to optimize long-term production costs and potentially offer more competitive pricing, particularly for high-volume products like image intensifier tubes, thereby influencing future pricing strategies.

| Metric | 2023 Value | Significance to Pricing |

| R&D Expenditure | €29.1 million | Supports premium pricing for advanced technology. |

| R&D as % of Revenue | 12.1% | Indicates commitment to innovation driving value. |

| Long-term Agreements | >70% of Revenue | Ensures pricing stability and predictable revenue. |

4P's Marketing Mix Analysis Data Sources

Our Exosens 4P's Marketing Mix Analysis leverages a robust blend of primary and secondary data. We meticulously gather information from official company disclosures, investor relations materials, and direct observations of their product offerings, pricing structures, distribution channels, and promotional activities.