Exide Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exide Industries Bundle

Exide Industries, a titan in the battery sector, boasts significant strengths in its established brand recognition and extensive distribution network, crucial for capturing market share. However, the company faces threats from evolving battery technologies and intense competition, necessitating strategic adaptation. Understanding these dynamics is key to navigating the future of energy storage.

Want the full story behind Exide's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Exide Industries commands a formidable market share within India's battery sector, boasting an estimated 60% in automotive batteries and a leading position in the home UPS/inverter segment. This substantial presence underscores its status as a dominant force in energy storage solutions.

The company's robust brand equity, cultivated over decades, translates into strong customer loyalty and recognition across diverse product categories. This established reputation for quality and reliability is a significant competitive advantage.

Founded in 1947, Exide's enduring legacy of over seven decades in the industry reinforces its image as a trusted and dependable brand. This long history contributes to its deep understanding of market needs and consumer preferences.

Exide Industries boasts a remarkably diverse product range, spanning automotive batteries for everything from passenger cars to heavy-duty trucks and two-wheelers. This broad offering extends to critical industrial applications, including telecommunications, railways, power utilities, and UPS systems, as well as niche markets like naval submarines. Such extensive diversification significantly reduces the company's vulnerability to downturns in any single sector.

Beyond its comprehensive product lines, Exide maintains a robust global presence, exporting its batteries to more than 45 countries worldwide. This international reach not only diversifies revenue streams but also positions Exide to capitalize on growth opportunities across various geographical markets, further solidifying its market position.

Exide Industries boasts a formidable manufacturing and distribution infrastructure, a key strength that underpins its market leadership. The company operates multiple advanced manufacturing facilities strategically located across India, enabling a robust production capacity. For instance, its manufacturing facilities inverters, batteries, and other related products are equipped with state-of-the-art technology, ensuring high-quality output and efficient production cycles. This network is crucial for meeting the substantial demand across the country.

Complementing its strong manufacturing base is an extensive distribution and service network that reaches deep into both urban and rural markets. This expansive reach ensures that Exide products are readily available to a diverse customer base, and importantly, it facilitates prompt after-sales support and service. This widespread presence is a significant competitive advantage, fostering customer loyalty and brand accessibility, which is vital in the Indian automotive and industrial sectors.

Strategic Investments in Lithium-ion Technology

Exide Industries is making substantial investments in lithium-ion cell manufacturing through its subsidiary, Exide Energy Solutions (EESL). A key development is the nearing completion of a 12-gigawatt (GWh) plant in Bengaluru. This move is a strategic pivot to capture the rapidly expanding electric vehicle (EV) and stationary energy storage sectors. By focusing on advanced battery technologies, Exide is positioning itself for long-term growth and relevance in a transforming energy landscape.

This investment in lithium-ion technology is crucial for Exide's future competitiveness. The global lithium-ion battery market is projected to reach hundreds of billions of dollars by 2030, driven by EV adoption and renewable energy integration. Exide's Bengaluru facility, with its 12 GWh capacity, is a significant step towards establishing a strong domestic manufacturing base. This allows the company to directly address the increasing demand for batteries in India's burgeoning EV ecosystem, expected to see substantial growth in the coming years, with projections suggesting millions of EVs on Indian roads by 2030.

- Strategic Investment in Lithium-ion: Exide is establishing a 12 GWh lithium-ion cell manufacturing plant through Exide Energy Solutions (EESL) in Bengaluru.

- Market Focus: This initiative targets the high-growth electric vehicle (EV) and stationary energy storage markets.

- Future Readiness: The investment secures Exide's position in advanced battery technologies, crucial for future energy solutions.

- Capacity: The 12 GWh capacity plant is a significant step in building domestic advanced battery manufacturing capabilities.

Key Partnerships and Collaborations

Exide Industries has solidified its position in the electric vehicle (EV) market through significant strategic alliances. A key development is the non-binding memorandum of understanding (MOU) with Hyundai Motor and Kia Corporation, aimed at localizing EV battery production in India. This partnership underscores Exide's growing credibility in cell technology development.

These collaborations are crucial for Exide, as they establish a robust framework for supplying batteries to prominent EV original equipment manufacturers (OEMs). This directly bolsters its market standing within the rapidly expanding Indian EV landscape, a sector projected for substantial growth in the coming years.

- Strategic Alliances: MOU with Hyundai Motor and Kia Corporation for EV battery localization in India.

- Validation of Capabilities: Partnerships confirm Exide's strengths in EV cell development.

- Market Access: Provides a strong foundation for supplying major EV OEMs.

- EV Sector Growth: Enhances Exide's competitive edge in the burgeoning EV market.

Exide Industries holds a dominant position in the Indian battery market, capturing approximately 60% of the automotive battery segment and leading in the home UPS/inverter category. Its strong brand equity, built over decades, fosters significant customer loyalty and recognition across a wide product spectrum. The company's extensive product portfolio, covering automotive, industrial, and niche applications, coupled with a global export reach to over 45 countries, mitigates sector-specific risks and diversifies revenue.

Exide's robust manufacturing capabilities, supported by multiple advanced facilities across India, ensure high-quality output and efficient production. This is complemented by an expansive distribution and service network that ensures product availability and prompt after-sales support nationwide, reinforcing customer relationships.

A key strength is Exide's significant investment in lithium-ion technology through Exide Energy Solutions (EESL), including a 12 GWh plant nearing completion in Bengaluru. This strategic move targets the rapidly growing EV and stationary energy storage markets, positioning the company for future growth in advanced battery solutions. Furthermore, strategic alliances, such as the MOU with Hyundai Motor and Kia Corporation, validate Exide's EV cell development capabilities and secure its role as a key supplier to major EV manufacturers in India.

| Metric | Value | Source/Year |

|---|---|---|

| Automotive Battery Market Share (India) | ~60% | Industry Estimates |

| Lithium-ion Plant Capacity | 12 GWh | Exide Industries (2024/2025 Projections) |

| Countries Exported To | 45+ | Exide Industries Reports |

What is included in the product

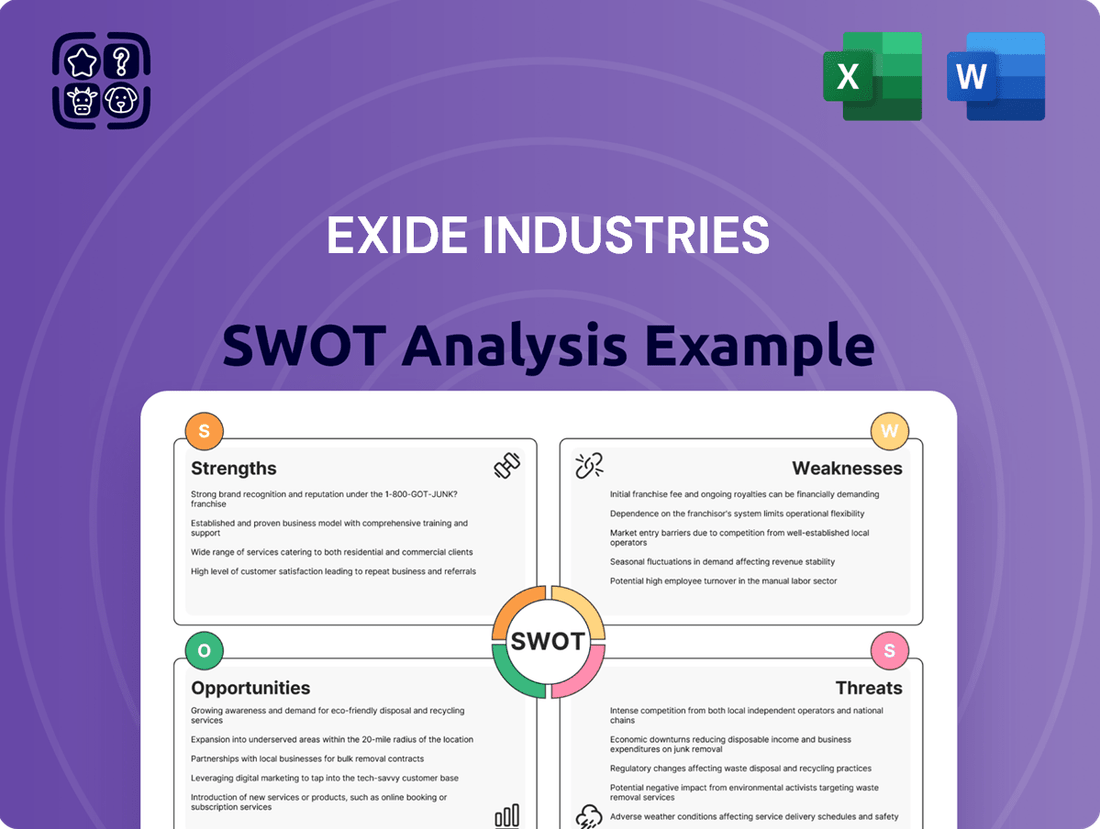

Delivers a strategic overview of Exide Industries’s internal and external business factors, highlighting its market strengths and potential growth opportunities while also identifying operational weaknesses and competitive threats.

Provides a clear, actionable SWOT analysis for Exide Industries, highlighting key strengths and mitigating weaknesses to relieve strategic uncertainty.

Weaknesses

Exide Industries' significant reliance on traditional lead-acid battery technology presents a notable weakness. While this technology remains cost-effective and highly recyclable, the global market is increasingly favoring advanced chemistries like lithium-ion, especially for electric vehicles and grid-scale energy storage solutions.

This reliance could lead to technological obsolescence as newer battery types offer superior performance characteristics, such as higher energy density and faster charging capabilities. For instance, while lead-acid batteries still hold a substantial share, the automotive sector's rapid electrification, projected to see electric vehicle sales surpass 20% of the global market by 2025, underscores this shift.

In 2024, the energy storage market, a key growth area, is heavily influenced by lithium-ion technology. Exide's established infrastructure and expertise in lead-acid might not seamlessly translate to these emerging, high-growth segments without substantial investment and technological adaptation.

Exide Industries faces a significant weakness in its vulnerability to raw material price volatility, particularly impacting its lead-acid battery segment. The profitability of this core business is directly tied to the unpredictable price swings of essential materials like lead and antimony. For instance, lead prices on the London Metal Exchange can fluctuate by 10-20% within a quarter, directly affecting Exide's cost of goods sold and squeezing profit margins, as seen in their Q4 FY2024 results where raw material costs were a significant factor.

Exide Industries navigates a fiercely competitive environment, particularly in the burgeoning battery markets. Beyond its established lead-acid segment, where it contends with both organized and unorganized domestic players, the company faces significant challenges from new entrants and global giants in the rapidly expanding lithium-ion battery sector. This dynamic intensified in 2024 as key players like Tata Chemicals, Amara Raja Batteries, and Ola Electric ramped up their investments in lithium-ion manufacturing capabilities.

High Capital Expenditure for New Technologies

Exide's move into advanced lithium-ion battery production, a necessary step for future growth, demands massive capital outlays. This significant investment, particularly in its new gigafactory, could place a strain on the company's finances in the near to medium term, potentially affecting profitability.

The financial impact is already visible, with Exide's cash flow from operations showing a dip in FY25. This decline is primarily attributed to the increased working capital required to support these ambitious expansion plans.

- Significant Capital Outlay: The transition to lithium-ion technology necessitates substantial upfront investment in manufacturing facilities and R&D.

- Gigafactory Investment: Exide is channeling considerable funds into its gigafactory project, with further capital commitments expected.

- Impact on Profitability: High initial expenditures may compress short-to-medium term profit margins as the company scales up operations.

- Cash Flow Pressures: Increased working capital needs, as seen in FY25, can temporarily reduce operational cash flow.

Slower Adoption of Advanced Technology in Legacy Segments

Exide's adoption of advanced battery technology, particularly in its established product lines, may lag behind newer, more nimble competitors. While the company is investing in innovation, the sheer scale of its legacy operations means that fully integrating cutting-edge solutions across all segments could be a gradual process.

This slower integration pace could present challenges in segments where lithium-ion technology is rapidly gaining traction. For instance, as the electric vehicle (EV) market continues its exponential growth, with projections suggesting global EV sales could exceed 20 million units in 2024, Exide's ability to quickly offer competitive lithium-ion solutions across its entire automotive battery portfolio will be crucial.

- Market Share Erosion: In fast-evolving segments like EV batteries, a slower technological rollout risks losing ground to specialized manufacturers.

- Legacy System Inertia: Existing manufacturing processes and infrastructure for lead-acid batteries can make rapid shifts to new technologies more complex and time-consuming.

- Competitive Disadvantage: Competitors focused solely on advanced battery chemistries may achieve faster product development cycles and market penetration.

- Customer Preference Shift: As demand for lithium-ion solutions grows, Exide needs to ensure its legacy product lines can either transition or coexist effectively, avoiding a perception of being technologically behind.

Exide's significant reliance on traditional lead-acid battery technology presents a weakness as the market increasingly favors advanced chemistries like lithium-ion, particularly for electric vehicles. This technological dependence could lead to obsolescence, especially as the global EV market is projected to surpass 20% of total vehicle sales by 2025, with lithium-ion dominating this growth sector.

Preview the Actual Deliverable

Exide Industries SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, showcasing Exide Industries' critical strengths like its brand recognition and extensive distribution network. You'll also gain a comprehensive understanding of its weaknesses, such as reliance on specific market segments, and the external opportunities and threats impacting its future. This detailed analysis is designed to equip you with actionable insights.

Opportunities

The burgeoning electric vehicle (EV) sector in India, fueled by supportive government policies and growing consumer interest, offers a substantial growth avenue for Exide Industries. As of early 2024, India's EV sales have seen a significant uptick, with projections indicating continued strong expansion through 2025, creating a fertile ground for battery manufacturers.

Exide is strategically positioned to capitalize on this trend with its substantial investment in a large-scale lithium-ion cell manufacturing facility. This move is designed to establish Exide as a critical component supplier within the Indian EV ecosystem.

Furthermore, Exide's existing collaborations with major automotive players like Hyundai and Kia, who are actively expanding their EV offerings in India, provide a direct pathway to secure significant orders and integrate its battery solutions into popular EV models launching in 2024 and 2025.

India's push towards renewable energy, targeting 500 GW of non-fossil fuel capacity by 2030, fuels a significant demand for robust energy storage. This presents a prime opportunity for Exide Industries to capitalize on its growing lithium-ion battery manufacturing capabilities. The company is well-positioned to offer solutions for large-scale grid stabilization and distributed energy storage in residential and commercial solar installations, directly supporting the nation's clean energy ambitions.

India's ongoing urbanization and industrial growth are significantly increasing the demand for reliable industrial batteries and uninterruptible power supply (UPS) systems. This trend is further amplified by the burgeoning data center sector and the push towards greater automation across industries.

Exide Industries is well-positioned to leverage this opportunity due to its extensive experience and broad range of industrial battery solutions. The company's established market presence allows it to effectively tap into the expanding infrastructure and technology-driven markets. For instance, in FY24, Exide reported strong performance in its industrial segment, reflecting the growing demand for its products in these critical sectors.

Potential for Global Market Expansion and Exports

Exide Industries, already a strong player in battery exports from India, has a significant chance to grow its global footprint. This expansion is particularly promising with the company's recent advancements in battery technology. By leveraging these new offerings, Exide can tap into new international markets and increase its export volumes.

The company is already making inroads with its advanced AGM batteries for the automotive sector, demonstrating a clear strategy to boost its international presence. This success with specialized products signals a broader opportunity for Exide's entire product portfolio to gain traction in overseas markets.

- Increased Exports of Advanced Batteries: Exide's move into exporting advanced AGM batteries for automotive applications highlights a strategic focus on high-value international markets.

- Diversification of Export Markets: The company can leverage its technological advancements to penetrate new geographical regions and diversify its export revenue streams beyond current established markets.

- Global Demand for Automotive Batteries: With the global automotive sector's continued growth and the increasing adoption of electric vehicles (EVs), there's a substantial demand for advanced battery solutions that Exide is poised to meet.

- Leveraging India's Manufacturing Prowess: Exide can capitalize on India's competitive manufacturing ecosystem to offer cost-effective, high-quality batteries on a global scale.

Government Support and Production-Linked Incentive (PLI) Schemes

Government initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME) II scheme and the Production-Linked Incentive (PLI) for Advanced Chemistry Cell (ACC) battery storage are creating significant tailwinds for domestic battery manufacturers. These policies, in effect through 2025 and beyond, aim to significantly boost local production and reduce reliance on imports, offering a fertile ground for companies like Exide Industries. For instance, the PLI scheme for ACC battery storage, with an outlay of ₹18,100 crore, is expected to attract substantial investment and drive technological advancements in the sector. This creates a favorable ecosystem for Exide to scale its lithium-ion battery manufacturing capabilities and secure a competitive advantage.

These government programs translate into tangible opportunities for Exide:

- Accelerated Lithium-ion Production: The PLI scheme directly incentivizes increased production volumes of advanced battery cells, allowing Exide to ramp up its output more rapidly and cost-effectively.

- Reduced Import Dependency: By fostering domestic manufacturing, these policies help mitigate supply chain risks associated with imported battery components, ensuring greater stability for Exide's operations.

- Enhanced Competitiveness: Financial incentives and a supportive policy environment enable Exide to invest in cutting-edge technology and achieve economies of scale, thereby improving its price competitiveness in the market.

- Market Expansion: The push for electric mobility, underpinned by these government schemes, is expected to drive significant demand for batteries, providing Exide with a larger addressable market for its products.

The rapidly expanding electric vehicle (EV) market in India presents a significant opportunity for Exide Industries, with government backing and rising consumer interest driving growth. Exide's investment in a large-scale lithium-ion cell manufacturing facility positions it as a key supplier within this burgeoning ecosystem, catering to the increasing demand for EV batteries in 2024 and 2025.

Exide's strategic collaborations with major automotive manufacturers like Hyundai and Kia, who are actively expanding their EV portfolios in India, provide direct access to secure orders for their battery solutions. This allows Exide to integrate its products into popular EV models slated for launch through 2024 and 2025.

India's commitment to renewable energy, aiming for 500 GW of non-fossil fuel capacity by 2030, creates a substantial demand for energy storage solutions. Exide's enhanced lithium-ion battery manufacturing capabilities are well-suited to address this need, supporting grid stabilization and distributed energy storage for solar installations.

The company also benefits from the growing demand in industrial sectors, driven by urbanization and the expansion of industries like data centers. Exide's established expertise in industrial batteries and UPS systems allows it to capitalize on this trend, as evidenced by its strong performance in the industrial segment during FY24.

Exide is also poised to increase its global presence by leveraging its advanced battery technologies, particularly in exporting high-value products like AGM batteries for automotive applications. This strategy aims to tap into new international markets and diversify its export revenue streams amidst rising global demand for automotive batteries.

Threats

The rapid evolution of battery technology, especially the move from traditional lead-acid to advanced chemistries like lithium-ion, presents a significant challenge for Exide. If the company can't pivot its entire product lineup swiftly, it risks falling behind competitors who are already at the forefront of these innovations.

While Exide is investing in lithium-ion, a sluggish adaptation in its established product lines could result in a loss of market share. For instance, the global electric vehicle (EV) battery market, a key area for lithium-ion adoption, was projected to reach over $200 billion by 2026, highlighting the urgency for companies to capture this growth.

The Indian battery market, particularly for lithium-ion technology, is experiencing a surge in investment from both domestic and international companies. This influx of new players, including established global battery manufacturers, poses a significant threat of increased price competition. For instance, companies like Ola Electric have announced substantial investments in battery manufacturing facilities in India, aiming to capture a significant market share.

This escalating competition can lead to price wars, directly impacting profit margins for existing players like Exide Industries. As more players enter the market, the pressure to offer competitive pricing will intensify, potentially eroding Exide's historically strong market position. The sheer scale of investment by global giants could also challenge Exide's ability to maintain its leadership in pricing and market share.

Exide Industries' strategic expansion into lithium-ion batteries, while promising, introduces significant exposure to the volatility of raw material prices. Key components like lithium, cobalt, and nickel, largely sourced through imports, are subject to considerable price swings. This dependence on global markets means Exide faces the risk of increased production costs and potential supply chain disruptions, impacting its competitiveness in the burgeoning EV battery sector.

Regulatory Changes and Environmental Concerns

Exide Industries faces significant threats from evolving regulatory landscapes concerning battery disposal and environmental impact. Stricter environmental regulations, particularly around lead-acid battery recycling and emissions, could increase operational costs and necessitate substantial investment in compliance technologies. For instance, the European Union's Battery Regulation, which came into effect in 2023, mandates higher collection rates and the use of recycled content, setting a precedent that could influence global standards.

Public scrutiny over the environmental footprint of lead-acid batteries is intensifying, potentially driving a faster market shift towards alternative technologies like lithium-ion. While Exide has a strong recycling infrastructure for lead-acid batteries, a rapid transition away from this core technology due to environmental pressures could pose a challenge to its established market position. The global push for sustainability, exemplified by initiatives like the Paris Agreement, puts companies heavily reliant on traditional battery chemistries under pressure to innovate or adapt.

- Increased Compliance Costs: New environmental laws may mandate advanced waste management and emission control systems, raising operational expenses for Exide.

- Accelerated Shift to Alternatives: Growing environmental awareness could hasten consumer and industrial adoption of greener battery technologies, impacting Exide's traditional product demand.

- Stricter Recycling Norms: Regulations demanding higher recycling efficiency and the incorporation of recycled materials could strain Exide's existing recycling operations.

- Reputational Risk: Failure to adequately address environmental concerns could lead to negative publicity and damage brand value in an increasingly eco-conscious market.

Disruption from Alternative Energy Storage Technologies

The energy storage landscape is rapidly evolving beyond current lithium-ion dominance. Emerging technologies like solid-state batteries, which promise higher energy density and improved safety, and advanced flow batteries, offering scalable and long-duration storage, represent significant potential disruptors. For instance, by mid-2024, several companies are reporting breakthroughs in solid-state battery development, with some aiming for commercialization by 2026-2027, potentially impacting the market share of conventional battery chemistries.

If these alternative technologies achieve commercial viability and cost-competitiveness, they could challenge Exide Industries' current and future battery offerings. Companies investing heavily in research and development for these next-generation solutions might gain a competitive edge, potentially capturing market segments that Exide currently serves or plans to enter.

The threat lies in the possibility that these new technologies could offer superior performance, safety, or cost advantages, making Exide's existing portfolio less attractive. For example, reports in late 2024 indicate that solid-state battery prototypes are achieving energy densities that could significantly outperform current lithium-ion cells, a development Exide will need to monitor closely.

Exide's strategic planning must account for this technological shift. A failure to adapt or invest in these emerging areas could lead to a decline in market position as competitors leverage these advancements. The global investment in battery R&D, projected to exceed $100 billion by 2025, underscores the intensity of this competitive technological race.

The intensifying competition, particularly from new entrants and global players in the burgeoning lithium-ion battery market, poses a significant threat to Exide's market share and pricing power. For instance, the Indian government's push for domestic EV manufacturing, with companies like Ola Electric heavily investing in battery production, creates a highly competitive landscape. This can lead to price wars, directly impacting Exide's profitability.

Exide's reliance on imported raw materials for lithium-ion batteries exposes it to price volatility and potential supply chain disruptions. Global commodity prices for lithium, cobalt, and nickel can fluctuate significantly, impacting production costs and the company's ability to maintain competitive pricing. By mid-2025, reports indicate continued volatility in these key battery metals, a trend Exide must navigate.

| Threat | Impact | Example/Data Point (as of 2024/2025) |

|---|---|---|

| Intensifying Competition | Market share erosion, price wars | Indian EV battery market attracting substantial investments from global players and domestic startups like Ola Electric. |

| Raw Material Price Volatility | Increased production costs, reduced margins | Global lithium prices saw fluctuations in early 2025, impacting battery manufacturing costs. |

| Emerging Battery Technologies | Obsolescence of current offerings | Advancements in solid-state battery technology by mid-2025 suggest potential for superior performance, challenging existing lithium-ion dominance. |

| Stricter Environmental Regulations | Higher compliance costs, need for new investments | EU Battery Regulation (effective 2023) sets precedents for stricter recycling and material usage, potentially influencing global standards by 2025. |

SWOT Analysis Data Sources

This Exide Industries SWOT analysis is built upon a foundation of credible data, including official financial reports, comprehensive market intelligence, and expert industry commentary.