Exide Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exide Industries Bundle

Gain a crucial competitive advantage with our in-depth PESTLE analysis of Exide Industries. Understand how evolving political landscapes, economic shifts, and technological advancements are directly impacting the company's trajectory. This comprehensive report unpacks social trends, environmental regulations, and legal frameworks, offering you actionable intelligence to inform your strategic decisions. Don't be left in the dark; download the full PESTLE analysis now to unlock critical insights and secure your market position.

Political factors

The Indian government's strong backing for electric vehicles (EVs) and domestic battery production, notably through the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) Battery Storage, significantly benefits Exide Industries. This policy framework aims to curb reliance on imports and stimulate local manufacturing, fostering a supportive ecosystem for Exide's expansion into lithium-ion battery technology.

These strategic governmental policies are designed to bolster Exide's competitive edge by reducing the cost of manufacturing. For instance, import duty exemptions on critical battery components directly translate into lower production expenses, making Exide's battery products more attractive in the burgeoning Indian EV market.

Exide Industries' export strategy is significantly shaped by India's trade policies and the regulatory environments of its target markets, particularly in Southeast Asia and Europe. The company's ambition to boost its export share in the medium term, reaching approximately 25% of its total revenue by FY25, directly hinges on favorable trade agreements and the absence of prohibitive tariffs in these key regions.

For instance, any shifts in import duties or the imposition of new trade barriers in countries like Germany or Vietnam could impact the cost-competitiveness of Exide's automotive and industrial batteries. Conversely, preferential trade agreements could offer a distinct advantage, facilitating market access and enhancing Exide's global footprint.

Regulatory stability and consistency are paramount for Exide Industries, especially given the inherently hazardous nature of battery manufacturing. Fluctuations in manufacturing, environmental, and labor laws can significantly impact operational costs and strategic planning. For instance, India's battery waste management rules, which are continually updated, require substantial investment in compliant disposal and recycling processes to avoid hefty penalties and protect Exide's brand image.

Geopolitical Influences on Supply Chains

Global geopolitical tensions significantly impact supply chains for essential battery materials like lead and lithium, directly influencing Exide Industries' production costs and material availability. For instance, ongoing conflicts in Eastern Europe and the Middle East have demonstrated the fragility of global trade routes, creating price volatility for key commodities used in battery manufacturing. These disruptions can lead to increased input costs for Exide, potentially squeezing profit margins.

While India's push for self-reliance, particularly in lithium-ion battery components, is a strategic move, the broader battery industry still grapples with international market fluctuations and political events. Exide's financial year 2024-25 underscored these challenges, with observed cautiousness in capital expenditure and investments across various sectors due to the prevailing geopolitical climate and its downstream effects on economic activity. This environment necessitates robust risk management strategies for Exide to navigate potential supply disruptions and cost escalations.

- Supply Chain Vulnerability: Geopolitical instability can disrupt the supply of critical raw materials like lead and lithium, essential for Exide's product lines.

- Cost Pressures: Disruptions often lead to increased raw material prices, directly impacting Exide's manufacturing costs and profitability.

- Macroeconomic Impact: Exide's financial year 2024-25 performance reflected broader macroeconomic headwinds, including reduced capital expenditure by clients, partly driven by these geopolitical uncertainties.

- Strategic Importance of Self-Reliance: India's focus on domestic sourcing aims to mitigate reliance on foreign suppliers, though global market dynamics remain a significant factor for companies like Exide.

Policy Support for Renewable Energy Integration

The Indian government's strong emphasis on renewable energy and grid-scale storage solutions is opening up substantial new opportunities for Exide Industries' industrial battery division. These supportive policies are directly boosting demand for Exide's specialized battery products, especially those catering to solar power installations and uninterruptible power supply (UPS) systems. This strategic alignment with national green energy initiatives is a key driver for Exide's growth in the renewable energy sector.

Exide Industries has set an ambitious target, aiming to derive a significant portion of its overall revenue from renewable energy solutions by the year 2025. This reflects a clear strategic pivot towards leveraging government incentives and market trends in sustainable energy. The company is actively investing in and developing battery technologies that are crucial for the efficient integration and storage of renewable power sources.

Key policy drivers include:

- National Green Hydrogen Mission: Launched with significant financial outlay, this mission indirectly supports energy storage solutions required for intermittent renewable sources.

- Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) Battery Storage: This scheme, with an allocation of ₹18,100 crore, incentivizes domestic manufacturing of batteries, benefiting companies like Exide.

- National Solar Mission: Continued focus on solar energy deployment necessitates robust battery storage for grid stability and off-peak usage, directly benefiting Exide's offerings.

- Smart Grid initiatives: Investments in modernizing the grid infrastructure often incorporate energy storage systems, creating a market for Exide's industrial batteries.

Government policies actively promote electric vehicles (EVs) and domestic battery production, with the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) Battery Storage directly benefiting Exide. This focus aims to reduce import dependency and boost local manufacturing, creating a favorable environment for Exide's expansion into lithium-ion technology. These initiatives are expected to lower manufacturing costs through import duty exemptions on critical battery components, making Exide's products more competitive in India's growing EV market.

India's trade policies and the regulatory landscapes of export markets, particularly in Southeast Asia and Europe, significantly influence Exide's global strategy. The company's target of increasing its export revenue share to approximately 25% by FY25 is contingent upon favorable trade agreements and the absence of high tariffs in these regions. Any imposition of new trade barriers or changes in import duties in key markets could affect the cost-competitiveness of Exide's batteries, while preferential trade agreements could provide a distinct advantage.

| Policy/Initiative | Objective | Impact on Exide | Relevant Financial Year Data |

|---|---|---|---|

| PLI Scheme for ACC Battery Storage | Incentivize domestic battery manufacturing | Reduces manufacturing costs, supports Li-ion expansion | ₹18,100 crore allocation |

| National Green Hydrogen Mission | Promote green hydrogen production | Indirectly boosts demand for energy storage solutions | N/A (focus on hydrogen, but storage is key enabler) |

| National Solar Mission | Expand solar energy deployment | Increases demand for battery storage for grid stability | Continued focus on solar capacity addition |

| Smart Grid Initiatives | Modernize grid infrastructure | Creates market for industrial batteries in grid integration | Government investment in grid modernization |

What is included in the product

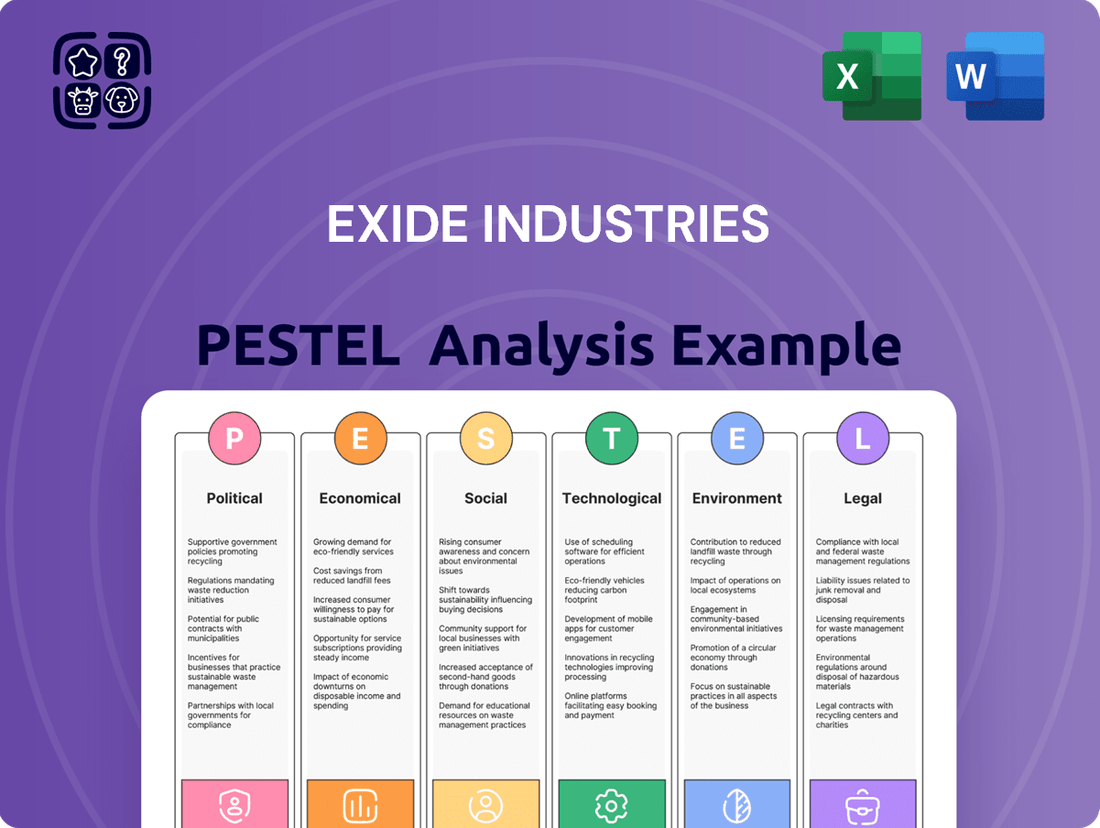

This PESTLE analysis offers a comprehensive overview of the external macro-environmental factors impacting Exide Industries, examining their influence across political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights into emerging trends and potential challenges, enabling strategic decision-making for sustained growth and competitive advantage.

A concise summary of Exide Industries' PESTLE analysis, highlighting key external factors impacting its operations, serves as a valuable tool to preemptively address market challenges and refine strategic decisions.

Economic factors

India's economy is on a strong upward trajectory, with projections indicating it will be the fastest-growing major economy in the fiscal year 2024-25. This robust growth directly translates into increased consumer and industrial demand for products like batteries. For Exide Industries, this means a healthier market for its offerings.

The strength of domestic consumption, a key driver of India's economic expansion, coupled with rising investment levels, provides a solid foundation for sectors like automotive and industrial manufacturing. These are precisely the sectors that rely heavily on battery solutions, creating a favorable environment for Exide.

This positive economic sentiment is anticipated to fuel demand across Exide's product lines. Specifically, expect a lift in sales for batteries used in two-wheelers and four-wheelers, as well as for industrial uninterruptible power supply (UPS) systems, reflecting broader economic activity and consumer spending.

Raw material price volatility, particularly for lead and antimony, directly affects Exide Industries' production expenses and profitability. Global market shifts in these essential components can impact Exide's bottom line, even with robust lead recycling initiatives. For instance, the increase in antimony prices during Q4 FY2024-25 put pressure on the company's profit margins.

Inflationary pressures and the Reserve Bank of India's (RBI) interest rate policies significantly impact Exide Industries. High inflation can increase raw material costs and operational expenses, while also potentially reducing consumer spending power on vehicles and batteries. For instance, India's retail inflation hovered around 5.1% in early 2024, a slight decrease from previous months but still a key consideration.

The RBI's monetary policy stance directly influences Exide's cost of borrowing. If interest rates rise, Exide's capital expenditure for projects like its planned lithium-ion cell manufacturing plant will become more expensive. Conversely, a stable or declining interest rate environment, such as the repo rate maintained at 6.50% through early 2024, can make these large investments more feasible and attractive.

Looking ahead, easing inflationary pressures are projected to support stable demand for Exide's products. As the cost of living stabilizes, consumers are more likely to make purchases like vehicles, which in turn drives battery sales. This economic backdrop is crucial for Exide as it expands its capacity and ventures into new technologies.

Investment in New Technologies

Exide Industries is making a substantial economic commitment to new technologies, evidenced by its planned capital expenditure of Rs. 3,500-4,000 crore for FY2025-FY2026. This significant investment is primarily directed towards establishing a lithium-ion cell manufacturing plant in Bengaluru.

This strategic investment is crucial for Exide to gain an early mover advantage in the rapidly expanding and evolving battery market. The company is leveraging a mix of funding, including debt, to finance this ambitious project, underscoring the economic importance placed on this technological shift.

- Planned Capex: Rs. 3,500-4,000 crore for FY2025-FY2026.

- Primary Focus: Lithium-ion cell manufacturing plant in Bengaluru.

- Funding Strategy: Partially debt-funded, indicating a significant financial undertaking.

- Economic Rationale: Securing an early mover advantage in the burgeoning battery sector.

Competition and Market Share

Exide Industries operates within a highly competitive landscape, contending with both established organized players and numerous unorganized manufacturers in the traditional lead-acid battery market. The burgeoning lithium-ion battery sector introduces additional competitive pressures from new domestic entrants and international imports, demanding continuous innovation and strategic positioning.

In fiscal year 2024, Exide maintained its leadership in the Indian automotive battery market, with estimates suggesting a market share of around 60-65% in the replacement segment. This dominant position, however, is under constant pressure. The company's ability to optimize its product mix, balancing volumes across different battery types and price points, is crucial for sustaining its financial performance and operating margins amidst evolving market dynamics.

Cost optimization remains a critical lever for Exide. For instance, in FY24, the company focused on improving manufacturing efficiencies and supply chain management. These efforts are essential to counter the pricing pressures from competitors and to ensure healthy operating margins, which averaged around 12-14% in recent quarters, despite fluctuating raw material costs.

- Market Dominance: Exide holds a significant share, estimated at over 60%, in India's automotive replacement battery market.

- Competitive Landscape: Faces competition from organized players like Amaron and unorganized sectors in lead-acid batteries, plus new entrants in lithium-ion.

- Product Mix Strategy: Balancing sales of higher-margin premium batteries with more volume-driven segments is key to profitability.

- Cost Management: Exide's focus on operational efficiency and supply chain improvements is vital for maintaining healthy margins in a price-sensitive market.

India's economic growth, projected to be the fastest among major economies in FY2024-25, is a significant tailwind for Exide Industries. This expansion fuels demand for automotive and industrial products, directly benefiting Exide's battery sales. The company's planned capital expenditure of Rs. 3,500-4,000 crore for FY2025-FY2026, primarily for a lithium-ion cell plant, underscores its commitment to capitalizing on this economic momentum and securing future market share.

Raw material price volatility, particularly for lead and antimony, remains a key economic factor influencing Exide's profitability. For instance, increased antimony prices in Q4 FY2024-25 put pressure on margins. Inflationary pressures, with India's retail inflation around 5.1% in early 2024, and the Reserve Bank of India's interest rate policies also directly impact Exide's costs and investment decisions, with the repo rate holding steady at 6.50% through early 2024.

Exide Industries is navigating a competitive market, holding an estimated 60-65% share in India's automotive replacement battery segment in FY2024. However, it faces competition from established players and new entrants in the lithium-ion space. The company's focus on cost optimization and manufacturing efficiencies is crucial for maintaining healthy operating margins, which have averaged around 12-14% in recent quarters, despite raw material cost fluctuations.

| Key Economic Indicators | Data Point | Impact on Exide |

| India GDP Growth (FY2024-25 Projection) | Fastest-growing major economy | Increased consumer and industrial demand for batteries |

| Planned Capex (FY2025-26) | Rs. 3,500-4,000 crore | Investment in lithium-ion cell manufacturing, capitalizing on market growth |

| Lead/Antimony Price Volatility | Q4 FY2024-25 antimony price increase | Pressure on production costs and profit margins |

| India Retail Inflation (Early 2024) | Around 5.1% | Impacts operational expenses and consumer spending power |

| RBI Repo Rate (Early 2024) | 6.50% | Influences cost of borrowing for capital expenditure |

| Automotive Replacement Battery Market Share (FY2024) | Estimated 60-65% | Dominant position, but facing evolving competition |

| Operating Margins (Recent Quarters) | Averaged 12-14% | Demonstrates focus on cost optimization amidst market pressures |

Preview Before You Purchase

Exide Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Exide Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the key drivers shaping Exide's strategic landscape, from government regulations and economic trends to evolving consumer behaviors and technological advancements. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Growing public awareness and concern for environmental sustainability are significantly shaping consumer preferences, pushing companies like Exide to prioritize eco-friendly practices. This societal shift directly impacts brand perception and market demand for greener products.

Exide's proactive approach to minimizing its environmental footprint is crucial. For instance, their focus on reducing greenhouse gas emissions aligns with global climate targets, and their battery recycling initiatives address critical waste management issues. In 2023, Exide reported a 15% reduction in its Scope 1 and 2 emissions compared to a 2020 baseline, demonstrating a tangible commitment.

Societal attitudes are rapidly shifting towards sustainability, with a growing preference for electric vehicles (EVs). This trend, fueled by heightened environmental awareness and supportive government policies, directly influences the demand for traditional automotive batteries. For instance, by the end of 2023, global EV sales surpassed 13 million units, a significant increase from previous years.

This societal embrace of EVs presents a dual impact for companies like Exide Industries. While demand for their established lead-acid battery products may see a gradual decline in the automotive sector, it simultaneously opens substantial new avenues for growth in lithium-ion battery technology. Exide's strategic investment in lithium-ion battery production, including a significant push in India, directly aligns with this evolving consumer preference and market trajectory.

The availability of skilled labor for advanced manufacturing, especially for lithium-ion battery production, is a key sociological consideration for Exide Industries. As the company expands into new technologies, ensuring a workforce with the right expertise is paramount for operational efficiency and innovation.

Exide's proactive approach to skill development is evident in its Corporate Social Responsibility (CSR) initiatives, like the 'Exide Kaushal' program. This program not only aims to bridge the skill gap but also fosters community well-being by providing vocational training and employment opportunities, particularly in regions where Exide operates.

In 2023, Exide Industries reported that its CSR activities reached over 150,000 beneficiaries, with a significant portion focused on skill development and livelihood enhancement. This commitment underscores the company's understanding of the symbiotic relationship between its workforce needs and societal development, particularly in the context of India's growing manufacturing sector.

Urbanization and Infrastructure Development

India's rapid urbanization, with an estimated 35% of its population living in urban areas as of 2023, directly translates to a heightened demand for uninterrupted power. This trend is further amplified by significant government spending on infrastructure development. For instance, the National Infrastructure Pipeline aims to invest ₹111 lakh crore ($1.3 trillion) over five years, from FY2020 to FY2025, focusing on roads, railways, and urban development. This surge in construction and modernization necessitates robust power backup solutions, a core offering for Exide Industries.

The increasing concentration of economic activity in urban centers boosts the industrial segment's growth, especially for critical applications. Sectors like banking, healthcare, and commercial offices, which are heavily reliant on continuous power, are expanding in these urban hubs. Exide's established presence in providing UPS systems and solar power storage solutions positions it to capitalize on this demand. For example, the data center industry in India is projected to grow significantly, requiring substantial power backup capacity, a market Exide is well-equipped to serve.

- Urban Population Growth: India's urban population is projected to reach 40.7% by 2030, driving demand for reliable power infrastructure.

- Infrastructure Investment: The ~₹111 lakh crore National Infrastructure Pipeline underscores a commitment to urban development, creating opportunities for power solutions.

- Critical Load Demand: The expansion of sectors like banking and healthcare in urban areas, requiring 24/7 power, directly benefits Exide's UPS and battery offerings.

- Solar Adoption: Growing urban adoption of rooftop solar, supported by government initiatives, increases the need for efficient energy storage solutions.

Changing Consumer Lifestyles and Preferences

Modern consumers increasingly prioritize convenience and longevity in their purchases. This translates to a demand for vehicle batteries that are not only reliable but also require minimal upkeep, and home energy storage systems that offer sustained performance with reduced environmental impact. Exide's product development, which includes advanced battery chemistries and extended warranty periods, directly addresses these evolving consumer desires.

The shift towards sustainability is another significant sociological trend impacting battery choices. Consumers are more aware of environmental issues and are actively seeking out eco-friendly products. Exide's investments in developing greener battery technologies and recycling initiatives align with this growing preference for responsible consumption. For instance, the automotive sector in India, a key market for Exide, saw a surge in demand for electric vehicles (EVs) in 2024, highlighting the growing consumer interest in sustainable mobility solutions, which indirectly influences the battery market.

Several key shifts are shaping consumer battery preferences:

- Demand for Durability and Efficiency: Consumers expect batteries to last longer and perform optimally under various conditions for both automotive and home backup power.

- Preference for Low Maintenance: The desire for hassle-free ownership drives demand for sealed, maintenance-free battery designs.

- Growing Environmental Consciousness: There's an increasing inclination towards batteries made with sustainable materials and those that can be recycled, reflecting a broader societal focus on eco-friendly living.

- Influence of Technology Adoption: The rise of electric vehicles and smart home energy systems necessitates advanced battery solutions with higher energy density and faster charging capabilities.

Societal attitudes are increasingly prioritizing sustainability and the adoption of electric vehicles, directly impacting demand for traditional automotive batteries. Exide's strategic investments in lithium-ion technology, a response to this evolving preference, highlight the company's adaptation to market shifts driven by environmental awareness. The global EV market surpassed 13 million units by the end of 2023, indicating a significant consumer trend towards greener transportation.

Technological factors

The global battery market is experiencing a profound technological evolution, with a clear pivot from established lead-acid technologies towards the more advanced lithium-ion chemistry. This shift is particularly pronounced in high-growth sectors like electric vehicles (EVs) and grid-scale renewable energy storage systems, where lithium-ion offers superior energy density and performance characteristics.

Exide Industries is strategically aligning itself with this technological transition, making substantial investments in developing its own lithium-ion cell manufacturing capabilities. The company's commitment is underscored by the planned completion of the first phase of its dedicated lithium-ion facility in Bengaluru by March 2025, positioning Exide to capitalize on the burgeoning demand for these next-generation battery solutions.

Exide Industries' commitment to Research and Development (R&D) is central to its strategy for staying ahead in the evolving battery market. The company is actively boosting its R&D spending to pioneer next-generation energy solutions. This includes a focus on advanced battery technologies vital for electric vehicles (EVs) and enhancing its range of Start-Stop, Lead-Acid, Absorbed Glass Mat (AGM) batteries.

A significant portion of Exide's R&D efforts are directed towards developing specialized auxiliary batteries specifically for EVs, recognizing the growing demand in this sector. Furthermore, the company is investing in creating new product lines tailored for energy storage systems, aiming to capture opportunities in the renewable energy and grid stabilization markets. This strategic R&D investment underscores Exide's ambition to be a leader in innovative battery solutions for both automotive and energy storage applications.

Exide Industries is actively embracing technological advancements to refine its manufacturing processes. Innovations in automation are key to boosting production efficiency, lowering operational expenses, and elevating the overall quality of their battery products. This focus is crucial in staying competitive within the rapidly evolving automotive and industrial sectors.

The company's commitment to operational enhancements is evident in its strategic adoption of technologies like LNG-powered trucking for green logistics. This initiative not only reduces the environmental footprint of their supply chain but also signals a forward-thinking approach to cost management and operational resilience, directly impacting their manufacturing cost structure.

Energy Storage Solutions Evolution

The landscape of energy storage is rapidly advancing, with Battery Energy Storage Systems (BESS) becoming crucial for grid stability and powering data centers. This technological shift opens substantial avenues for companies like Exide Industries.

Exide is actively participating in this evolution by developing and introducing new generations of advanced lead-acid based BESS. This demonstrates a strategic move to cater to a wider array of energy storage demands, extending beyond their traditional automotive battery focus.

The global BESS market is projected for significant growth, with estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, driven by renewable energy integration and grid modernization efforts. For instance, the market was valued at approximately USD 30 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of over 25% through 2030.

- Market Growth: The global BESS market is anticipated to surge, potentially exceeding USD 100 billion by 2030, fueled by the increasing adoption of renewable energy sources.

- Exide's Strategy: Exide's focus on new-gen advanced lead-acid BESS positions them to capitalize on this expanding market for both grid-scale and data center applications.

- Technological Advancement: The continuous improvement in battery chemistry and system integration for BESS offers opportunities for enhanced efficiency, longevity, and cost-effectiveness.

- Competitive Landscape: Key players in the energy storage sector are investing heavily in R&D, making technological innovation a critical differentiator.

Battery Recycling Technologies

Technological advancements in battery recycling are crucial for managing the growing number of discarded batteries and recovering valuable materials. This is particularly relevant for Exide Industries as the demand for electric vehicles and energy storage solutions escalates. The company's focus on recycling directly supports a more sustainable approach to battery production and disposal.

Exide's subsidiary, Chloride Metals Ltd, plays a significant role in this technological landscape. It operates advanced secondary smelting and refining processes for lead-acid batteries. This circular economy approach allows for efficient resource recovery and minimizes environmental impact.

The company's commitment to these technologies is evident in its operations. For instance, in FY23, Exide Industries recycled approximately 370,000 tonnes of lead-acid batteries. This volume highlights the scale of their recycling operations and the technological capabilities required to handle it effectively.

- Advanced Smelting: Chloride Metals employs sophisticated smelting techniques to extract lead from used batteries, optimizing material yield and purity.

- Refining Processes: Through advanced refining, Exide ensures the recovered lead meets high-quality standards for reuse in new battery manufacturing.

- Resource Recovery: These technologies enable the recovery of not only lead but also other valuable components, contributing to resource conservation.

- Environmental Compliance: Exide's recycling technologies are designed to meet stringent environmental regulations, reducing hazardous waste and emissions.

Exide Industries is navigating a significant technological shift, moving from traditional lead-acid batteries towards advanced lithium-ion technology, particularly for the burgeoning electric vehicle (EV) market. The company is investing heavily in this transition, with its first lithium-ion cell facility in Bengaluru slated for completion by March 2025.

This strategic R&D focus extends to developing specialized auxiliary batteries for EVs and new product lines for energy storage systems (ESS), aiming to capture growth in renewable energy integration. Exide is also enhancing its lead-acid offerings with technologies like Absorbed Glass Mat (AGM) batteries, crucial for Start-Stop vehicle functionality.

Technological advancements in Battery Energy Storage Systems (BESS) are a key focus, with Exide developing new generations of advanced lead-acid BESS to meet demand in grid-scale and data center applications. This aligns with the projected substantial growth in the global BESS market, which was valued at approximately USD 30 billion in 2023 and is expected to expand significantly.

Furthermore, Exide's commitment to sustainability is demonstrated through its advanced battery recycling operations, primarily managed by its subsidiary Chloride Metals Ltd. In FY23, Exide Industries recycled around 370,000 tonnes of lead-acid batteries, utilizing sophisticated smelting and refining processes to recover valuable materials and adhere to environmental standards.

Legal factors

The Battery Waste Management Rules (BWMR), updated in 2024, place a significant emphasis on the responsible handling of battery waste, including a crucial Extended Producer Responsibility (EPR) component. This means manufacturers like Exide are legally obligated to manage the collection and recycling of their products at the end of their life cycle.

Exide Industries, being a leading battery producer, must adhere to these rigorous rules, which include meeting specific collection percentages for used batteries and incorporating a minimum percentage of recycled materials into new battery production, starting in 2027. For instance, the BWMR 2022 set initial targets, and ongoing amendments will likely increase these collection and recycling mandates.

New Environmental Compensation (EC) guidelines from the Ministry of Environment, Forest, and Climate Change, effective September 2024, introduce significant financial penalties for failing to meet Extended Producer Responsibility (EPR) targets. These updated regulations, which feature distinct cost structures for lead-acid and lithium-ion batteries, directly impact companies like Exide Industries.

Exide must now allocate substantial investment towards compliant, scientific recycling processes and formal waste management infrastructure to avoid these penalties. For instance, the new guidelines could see penalties ranging from INR 5,000 to INR 10,000 per tonne of unmanaged waste, depending on the battery type, directly affecting Exide's bottom line if EPR goals are missed.

Exide Industries operates under a strict regulatory framework, necessitating adherence to rigorous product safety and quality standards across its entire battery portfolio, which spans automotive, industrial, and specialized applications. This commitment to compliance, encompassing both national and international benchmarks, is crucial for guaranteeing product dependability and safeguarding consumer well-being, thereby mitigating potential liabilities and upholding Exide's established reputation for excellence.

Labor Laws and Workforce Regulations

Exide Industries, like any major manufacturing entity, operates under a complex web of Indian labor laws. These regulations cover everything from minimum wages and working hours to employee benefits and dispute resolution mechanisms. For instance, the Industrial Disputes Act, 1947, and the Factories Act, 1948, are foundational, setting standards for workplace safety and employee relations. In 2023-24, the Indian government continued to emphasize reforms aimed at simplifying labor compliance, with the four new Labour Codes (Code on Wages, Code on Industrial Relations, Code on Social Security, and Code on Occupational Safety, Health and Working Conditions) gradually being implemented, potentially impacting Exide's operational framework.

Adherence to these labor laws is paramount for maintaining smooth operations and a positive industrial relations climate. Non-compliance can lead to significant penalties, labor strikes, and reputational damage, all of which can disrupt production and affect financial performance. Exide's commitment to fair labor practices not only ensures legal compliance but also fosters a motivated workforce. For example, the company's employee welfare initiatives are designed to align with and often exceed statutory requirements, contributing to a stable workforce. Data from FY23 indicated a continued focus on employee training and development, a key aspect of managing workforce regulations effectively.

Key labor-related factors impacting Exide include:

- Compliance with the Code on Wages, 2019: Ensuring fair and timely payment of wages and adherence to minimum wage stipulations across all its manufacturing units.

- Workplace Safety Standards: Implementing and maintaining stringent safety protocols as mandated by the Code on Occupational Safety, Health and Working Conditions, 2020, to prevent accidents and ensure employee well-being.

- Employee Benefits and Social Security: Managing contributions and benefits related to provident fund, gratuity, and other social security schemes as outlined in the Code on Social Security, 2020.

- Industrial Relations Management: Navigating regulations concerning trade unions, collective bargaining, and dispute resolution under the Code on Industrial Relations, 2020, to maintain industrial peace.

Intellectual Property Rights (IPR)

Intellectual Property Rights (IPR) are a cornerstone for Exide Industries, especially as it heavily invests in research and development for advanced battery technologies, including lithium-ion solutions. Protecting these innovations through patents and trademarks is vital for maintaining a competitive advantage in a rapidly evolving market.

Exide's commitment to safeguarding its intellectual property ensures that its significant R&D expenditures translate into sustainable market leadership. In 2023-24, Exide continued to focus on strengthening its patent portfolio, a move critical for defending its technological advancements against competitors seeking to leverage its innovations without authorization.

- Patent Filings: Exide actively pursues patents to protect its novel battery chemistries and manufacturing processes.

- Trademark Protection: Brand names and logos are crucial for market recognition and are rigorously protected.

- Licensing Opportunities: Strong IPR can create avenues for technology licensing, generating additional revenue streams.

- Competitive Defense: Robust patent protection acts as a deterrent against infringement and supports market exclusivity.

The Battery Waste Management Rules (BWMR), updated in 2024, mandate Extended Producer Responsibility (EPR), compelling manufacturers like Exide to manage the collection and recycling of their products. These regulations, which include collection targets and minimum recycled material usage, are critical for Exide's operational compliance and environmental stewardship.

New Environmental Compensation (EC) guidelines, effective September 2024, impose significant financial penalties for failing to meet EPR targets, with potential fines ranging from INR 5,000 to INR 10,000 per tonne of unmanaged waste, directly impacting Exide's profitability if not managed effectively.

Exide must invest in compliant recycling processes and waste management infrastructure to avoid these penalties and maintain its market position. The company’s adherence to stringent product safety and quality standards, across automotive and industrial sectors, is also vital for mitigating liabilities and protecting its reputation.

Exide's operations are significantly influenced by Indian labor laws, including the new Labour Codes implemented in 2023-24, which aim to simplify compliance but require careful management of wages, safety, and employee benefits to avoid penalties and operational disruptions.

Environmental factors

Exide Industries champions a circular economy, particularly through its extensive battery recycling initiatives. The company's program boasts an impressive lead recovery rate exceeding 98%, directly addressing the environmental concerns associated with lead-acid batteries. This high recovery rate is not just an operational success but a critical component of Exide's strategy to minimize environmental impact and comply with evolving regulations.

These efforts are strongly aligned with the Battery Waste Management Rules, which mandate a focus on refurbishment, reuse, and recycling for end-of-life batteries. By prioritizing these aspects, Exide not only reduces waste but also conserves valuable resources. For instance, in the fiscal year 2023-24, Exide processed a significant volume of used batteries, contributing substantially to lead recycling efforts across India.

Exide Industries is actively working to shrink its environmental impact, with a clear focus on reducing its carbon footprint. The company has set a goal to cut greenhouse gas emissions by 25% by the year 2025.

To achieve this, Exide is also making a significant push towards using more renewable energy. Their target is to source 30% of their energy needs from renewable sources by 2030, demonstrating a long-term commitment to cleaner operations.

A key initiative in this effort is the company's move towards using LNG-powered trucks for its logistics operations. This strategic shift is crucial for tackling Scope 3 emissions, which are indirect emissions generated by the company's value chain, particularly in transportation.

The environmental impact of sourcing critical raw materials like lead and lithium is a significant consideration for battery manufacturers. Exide Industries is actively addressing this by emphasizing lead recycling, which helps conserve natural resources and reduces the need for virgin lead mining. This focus on a circular economy for lead is a key aspect of their sustainable material sourcing strategy.

Furthermore, government policies play a role in facilitating sustainable material acquisition. The allowance of duty-free imports for cobalt powder and lithium-ion battery scrap directly supports Exide's efforts to source materials more responsibly. These policies encourage the use of recycled content, lessening the environmental footprint associated with new material extraction.

Water and Waste Management

Exide Industries recognizes the critical role of water and waste management in its manufacturing processes, aligning with its broader sustainability goals. Effective practices are key to reducing environmental footprint and ensuring compliance with evolving regulations. The company is committed to implementing robust waste management strategies, which directly contribute to a more circular economy within its operations.

Exide’s focus extends to minimizing energy consumption across its manufacturing sites, a crucial element in achieving a greener production cycle. This commitment is underscored by their efforts to optimize resource utilization and reduce overall waste generation. For instance, by the end of fiscal year 2024, Exide reported significant progress in its waste reduction initiatives, with a notable decrease in hazardous waste generation per unit of production compared to previous years.

Key aspects of Exide's water and waste management include:

- Resource Optimization: Implementing strategies to reduce water usage and improve water recycling rates within manufacturing plants.

- Waste Segregation and Treatment: Establishing comprehensive systems for segregating different waste streams for proper treatment and disposal, prioritizing recycling and reuse.

- Energy Efficiency in Operations: Driving down energy consumption through process improvements and technology upgrades, thereby reducing the environmental impact associated with energy generation.

- Compliance and Reporting: Adhering to all relevant environmental regulations and transparently reporting on sustainability performance, including waste management metrics.

Climate Change Adaptation and Resilience

Exide Industries is actively integrating climate change adaptation into its core business strategy, emphasizing sustainable energy solutions and advanced manufacturing. This forward-thinking approach is crucial for long-term resilience in a changing environmental landscape.

A key element of this strategy involves a significant pivot towards lithium-ion batteries, targeting the burgeoning electric vehicle (EV) and solar energy sectors. These batteries offer a lower carbon footprint during their operational life compared to traditional lead-acid batteries, directly supporting global decarbonization efforts.

Exide's commitment is evident in its substantial investments. For instance, the company announced a plan to invest approximately $400 million (around ₹3,000 crore) in a new lithium-ion cell manufacturing facility in India. This facility is expected to have a capacity of 10 GWh, underscoring their dedication to enabling cleaner energy transitions. By 2025, Exide aims to be a significant player in the green energy ecosystem, contributing to India's ambitious renewable energy targets.

- Focus on Sustainable Energy: Transitioning to lithium-ion batteries for EVs and solar energy storage.

- Investment in Advanced Manufacturing: Establishing new, high-capacity battery manufacturing facilities.

- Reduced Carbon Intensity: Offering products with lower emissions during their use phase.

- Alignment with Global Goals: Contributing to climate change mitigation and India's renewable energy objectives.

Exide Industries is heavily focused on environmental stewardship, particularly through its high lead recovery rate, exceeding 98%, which aligns with stringent battery recycling regulations. The company's commitment to sustainability is further demonstrated by its goal to reduce greenhouse gas emissions by 25% by 2025 and to source 30% of its energy from renewables by 2030. These initiatives reflect a proactive approach to minimizing environmental impact and embracing cleaner operational practices.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Exide Industries is built on a comprehensive review of data from official government publications, reputable financial news outlets, and industry-specific market research reports. We also incorporate insights from technological trend analyses and environmental sustainability assessments to ensure a well-rounded perspective.